Proposed Internal Restructuring

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Malapportionment of Parliamentary Constituencies in Johor

Malapportionment in the 2015 – 2016 Redelineation Exercises Prepared by: Penang Institute Malapportionment of Parliamentary Constituencies in Johor After 2016 Redelineation Proposal (First Display) Excessively under-represented parliamentary constituencies: No. Constituency Electorate As % of average 1 P162 Gelang Patah 112,081 176.71% 2 P159 Pasir Gudang 108,156 170.52% 3 P158 Tebrau 99,592 157.02% 4 P160 Johor Bahru 98,351 155.06% 5 P161 Pulai 95,980 151.32% 6 P163 Kulai 95,822 151.07% 5 P150 Batu Pahat 91,328 143.99% 6 P152 Kluang 88,212 139.07% Justification for excessive under-representation: None. They can have smaller electorates, if voters can be more evenly spread out across constituencies. At least one parliamentary seat should be taken from less populous areas and given to Greater Johor Bahru. Excessively over-represented parliamentary constituencies: No. Constituency Electorate As % of average 1 P143 Pagoh 36,387 57.37% 2 P142 Labis 37,569 59.23% 3 P157 Pengerang 38,338 60.44% 4 P155 Tenggara 40,670 64.12% 5 P151 Simpang Renggam 41,052 64.72% 6 P153 Sembrong 41,629 65.63% 7 P141 Sekijang 41,896 66.05% Justification for excessive over-representation: None. None of these parliamentary constituencies occupies a large landmass to qualify for over-representation as provided for by Section 2(c), the Thirteenth Schedule of the Federal Constitution. Tellingly, Mersing which has approximately twice the landmass than Pagoh has more voters than any of these. Ratio of Largest Constituency to Smallest Constituency: 3.08: 1 Changes in Malapportionment: Malapportionment is not mitigated by the redelineation proposal even though some victims of malapportionment have changed. -

Australians Into Battle : the Ambush at Gema S

CHAPTER 1 1 AUSTRALIANS INTO BATTLE : THE AMBUSH AT GEMA S ENERAL Percival had decided before the debacle at Slim River G that the most he could hope to do pending the arrival of further reinforcements at Singapore was to hold Johore. This would involve giving up three rich and well-developed areas—the State of Selangor (includin g Kuala Lumpur, capital of the Federated Malay States), the State of Negr i Sembilan, and the colony of Malacca—but he thought that Kuala Lumpu r could be held until at least the middle of January . He intended that the III Indian Corps should withdraw slowly to a line in Johore stretching from Batu Anam, north-west of Segamat, on the trunk road and railway , to Muar on the west coast, south of Malacca . It should then be respon- sible for the defence of western Johore, leaving the Australians in thei r role as defenders of eastern Johore. General Bennett, however, believing that he might soon be called upo n for assistance on the western front, had instituted on 19th December a series of reconnaissances along the line from Gemas to Muar . By 1st January a plan had formed in his mind to obtain the release of his 22nd Brigade from the Mersing-Jemaluang area and to use it to hold the enem y near Gemas while counter-attacks were made by his 27th Brigade on the Japanese flank and rear in the vicinity of Tampin, on the main road near the border of Malacca and Negri Sembilan . Although he realised tha t further coastal landings were possible, he thought of these in terms of small parties, and considered that the enemy would prefer to press forwar d as he was doing by the trunk road rather than attempt a major movement by coastal roads, despite the fact that the coastal route Malacca-Muar- Batu Pahat offered a short cut to Ayer Hitam, far to his rear . -

Menganalisis Pola Dan Arah Aliran Hujan Di Negeri Sembilan Menggunakan Kaedah GIS Poligon Thiessen Dan Kontur Isoyet

GEOGRAFIA OnlineTM Malaysian Journal of Society and Space 2 (105 - 113) 105 © 2006, ISSN 2180-2491 Menganalisis pola dan arah aliran hujan di Negeri Sembilan menggunakan kaedah GIS poligon Thiessen dan kontur Isoyet Shaharuddin Ahmad1, Noorazuan Md. Hashim1 1School of Social, Development and Environmental Studies, Faculty of Social Sciences and Humanities, Universiti Kebangsaan Malaysia Correspondence: Shaharuddin Ahmad (email: [email protected]) Abstrak Curahan hujan seringkali digunakan sebagai indeks iklim bagi menentukan perubahan dalam kajian perubahan iklim global. Frekuensi dan tempoh curahan hujan dianggap sebagai indeks penting bagi bidang geomorfologi, hidrologi dan kajian cerun. Di samping itu, maklumat tentang taburan hujan penting kepada manusia kerana boleh mempengaruhi pelbagai aktiviti manusia seperti pertanian, perikanan dan pelancongan. Oleh itu, kajian ini meneliti pola taburan dan tren hujan yang terdapat di Negeri Sembilan. Data hujan bulanan dan tahunan untuk tempoh 21 tahun (1983 – 2003) dibekalkan oleh Perkhidmatan Kajicuaca Malaysia (MMS) bagi lapan stesen kajiklim yang terdapat di seluruh negeri. Kaedah GIS Poligon Thiessen dan Kontur Isoyet digunakan bagi mengira dan menentukan pola taburan hujan manakala kaedah Ujian Mann-Kendall digunakan bagi mengesan pola perubahan tren dan variabiliti hujan. Hasil kajian menunjukkan bahawa berdasarkan kaedah Persentil dan Kontur Isoyet, pola taburan hujan di Negeri Sembilan boleh di kategorikan kepada dua jenis kawasan iaitu kawasan sederhana lembap (memanjang dari Jelebu -Kuala Pilah-Gemencheh) dan kawasan hujan lebat (sekitar kawasan pinggir pantai-Seremban- Chembong). Pola perubahan hujan didapati tidak tetap bagi kesemua stesen kajian bagi tempoh kajian ini. Berasaskan Ujian Mann-Kendall tahun 1980-an dan 1990-an menandakan tahun perubahan taburan hujan bagi kesemua stesen kajian yang boleh memberi kesan kepada kawasan tadahan dan seterusnya menentukan kadar bekalan air yang mencukupi. -

Trends in Southeast Asia

ISSN 0219-3213 2017 no. 9 Trends in Southeast Asia PARTI AMANAH NEGARA IN JOHOR: BIRTH, CHALLENGES AND PROSPECTS WAN SAIFUL WAN JAN TRS9/17s ISBN 978-981-4786-44-7 30 Heng Mui Keng Terrace Singapore 119614 http://bookshop.iseas.edu.sg 9 789814 786447 Trends in Southeast Asia 17-J02482 01 Trends_2017-09.indd 1 15/8/17 8:38 AM The ISEAS – Yusof Ishak Institute (formerly Institute of Southeast Asian Studies) is an autonomous organization established in 1968. It is a regional centre dedicated to the study of socio-political, security, and economic trends and developments in Southeast Asia and its wider geostrategic and economic environment. The Institute’s research programmes are grouped under Regional Economic Studies (RES), Regional Strategic and Political Studies (RSPS), and Regional Social and Cultural Studies (RSCS). The Institute is also home to the ASEAN Studies Centre (ASC), the Nalanda-Sriwijaya Centre (NSC) and the Singapore APEC Study Centre. ISEAS Publishing, an established academic press, has issued more than 2,000 books and journals. It is the largest scholarly publisher of research about Southeast Asia from within the region. ISEAS Publishing works with many other academic and trade publishers and distributors to disseminate important research and analyses from and about Southeast Asia to the rest of the world. 17-J02482 01 Trends_2017-09.indd 2 15/8/17 8:38 AM 2017 no. 9 Trends in Southeast Asia PARTI AMANAH NEGARA IN JOHOR: BIRTH, CHALLENGES AND PROSPECTS WAN SAIFUL WAN JAN 17-J02482 01 Trends_2017-09.indd 3 15/8/17 8:38 AM Published by: ISEAS Publishing 30 Heng Mui Keng Terrace Singapore 119614 [email protected] http://bookshop.iseas.edu.sg © 2017 ISEAS – Yusof Ishak Institute, Singapore All rights reserved. -

1.0 Pendahuluan

Laporan Draf RANCANGAN TEMPATAN DAERAH SEGAMAT 2030 1.0 PENDAHULUAN Rancangan Tempatan Daerah Segamat 2030 ini disediakan untuk dua (2) Pihak Berkuasa Tempatan (PBT) iaitu Majlis Perbandaran Segamat (MPS) dan Majlis Daerah Labis (MDL). Sebagaimana yang diperuntukkan di bawah Seksyen 16 (1), Akta Perancangan Bandar dan Desa 1976 (Akta 172), dokumen ini merupakan dokumen rasmi yang akan mengemukakan cadangan-cadangan pembangunan, di samping menyediakan mekanisma kawalan pembangunan bagi membantu proses pembangunan di bawah pentadbiran setiap PBT di dalam Daerah Segamat. 1.1 KAWASAN RANCANGAN TEMPATAN 1.0 PENDAHULUAN Kawasan Rancangan Tempatan (RT) meliputi keseluruhan Daerah Segamat yang terletak di bahagian utara Negeri Johor. Daerah ini bersempadan dengan enam buah daerah iaitu Daerah Muar dan Kluang, Johor di bahagian selatan, Daerah Tampin, Negeri Sembilan di bahagian barat laut, Daerah Rompin, Pahang di bahagian timur laut, Daerah Batu Pahat di bahagian tenggara dan Daerah Tangkak di bahagian barat. Keseluruhan Daerah Segamat adalah seluas 286,656 hektar (Rujuk Rajah 1.1). Daerah Segamat merangkumi 11 buah mukim iaitu Buloh Kasap, Jabi, Gemas, Sermin, Sungai Segamat, Pogoh, Gemereh, Jementah, Labis, Bekok dan Chaah. Bagi kawasan pentadbiran Majlis Daerah Labis (MDL) pula hanya merangkumi 3 mukim sahaja iaitu Labis, Bekok dan Chaah. Keluasan kawasan pentadbiran MDL adalah seluas 141,008.00 hektar berdasarkan pelan warta bernombor PW3364 (Rujuk Jadual 1.1 dan Rajah 1.2). Jadual 1.1: Keluasan Kawasan Pentadbiran Majlis Daerah Labis (MDL) -

Buku Daftar Senarai Nama Jurunikah Kawasan-Kawasan Jurunikah Daerah Johor Bahru Untuk Tempoh 3 Tahun (1 Januari 2016 – 31 Disember 2018)

BUKU DAFTAR SENARAI NAMA JURUNIKAH KAWASAN-KAWASAN JURUNIKAH DAERAH JOHOR BAHRU UNTUK TEMPOH 3 TAHUN (1 JANUARI 2016 – 31 DISEMBER 2018) NAMA JURUNIKAH BI NO KAD PENGENALAN MUKIM KAWASAN L NO TELEFON 1 UST. HAJI MUSA BIN MUDA (710601-01-5539) 019-7545224 BANDAR -Pejabat Kadi Daerah Johor Bahru (ZON 1) 2 UST. FAKHRURAZI BIN YUSOF (791019-01-5805) 013-7270419 3 DATO’ HAJI MAHAT BIN BANDAR -Kg. Tarom -Tmn. Bkt. Saujana MD SAID (ZON 2) -Kg. Bahru -Tmn. Imigresen (360322-01-5539) -Kg. Nong Chik -Tmn. Bakti 07-2240567 -Kg. Mahmodiah -Pangsapuri Sri Murni 019-7254548 -Kg. Mohd Amin -Jln. Petri -Kg. Ngee Heng -Jln. Abd Rahman Andak -Tmn. Nong Chik -Jln. Serama -Tmn. Kolam Air -Menara Tabung Haji -Kolam Air -Dewan Jubli Intan -Jln. Straits View -Jln. Air Molek 4 UST. MOHD SHUKRI BIN BANDAR -Kg. Kurnia -Tmn. Melodies BACHOK (ZON 3) -Kg. Wadi Hana -Tmn. Kebun Teh (780825-01-5275) -Tmn. Perbadanan Islam -Tmn. Century 012-7601408 -Tmn. Suria 5 UST. AYUB BIN YUSOF BANDAR -Kg. Melayu Majidee -Flat Stulang (771228-01-6697) (ZON 4) -Kg. Stulang Baru 017-7286801 1 NAMA JURUNIKAH BI NO KAD PENGENALAN MUKIM KAWASAN L NO TELEFON 6 UST. MOHAMAD BANDAR - Kg. Dato’ Onn Jaafar -Kondo Datin Halimah IZUDDIN BIN HASSAN (ZON 5) - Kg. Aman -Flat Serantau Baru (760601-14-5339) - Kg. Sri Paya -Rumah Pangsa Larkin 013-3352230 - Kg. Kastam -Tmn. Larkin Perdana - Kg. Larkin Jaya -Tmn. Dato’ Onn - Kg. Ungku Mohsin 7 UST. HAJI ABU BAKAR BANDAR -Bandar Baru Uda -Polis Marin BIN WATAK (ZON 6) -Tmn. Skudai Kanan -Kg. -

IOI Corporation Berhad Pukin Grouping Page 2 of 48 Annual Surveillance Assessment (ASA-03) Cum Extension of Scope

IOI Corporation Berhad RSPO Membership No: 2-0002-04-000-00 PLANTATION MANAGEMENT UNIT Pukin Grouping Rompin & Maudzam Shah (Pahang), Segamat & Tangkak (Johor), Malaysia INTERTEK CERTIFICATION INTERNATIONAL SDN BHD (188296-W) Report No.: R2020/10-4 IOI Corporation Berhad Pukin Grouping Page 2 of 48 Annual Surveillance Assessment (ASA-03) cum Extension of Scope ANNUAL SURVEILLANCE ASSESSMENT (ASA-03) cum EXTENSION OF SCOPE ON RSPO CERTIFICATION ASSESSMENT REPORT IOI CORPORATION BERHAD RSPO Membership No: 2-0002-04-000-00 PLANTATION MANAGEMENT UNIT Pukin Grouping Rompin & Maudzam Shah (Pahang), Segamat & Tangkak (Johor), Malaysia Certificate No: RSPO 927888 Issued date: 13 Jun 2012 Expiry date: 12 Jun 2017 Assessment Type Assessment Dates Initial Certification (Main Assessment) 8-11 Dec 2010 Annual Surveillance Assessment (ASA-01) 5-9 Nov 2012 Annual Surveillance Assessment (ASA-02) 22 – 26 Apr 2013 Annual Surveillance Assessment (ASA-03) 08-11 Apr 2014 Annual Surveillance Assessment (ASA-04) Re-Certification Intertek Certification International Sdn Bhd (formerly known as Moody International Certification (Malaysia) Sdn Bhd) 6-L12-01, Level 12, Tower 2, Menara PGRM No. 6 & 8 Jalan Pudu Ulu, Cheras, 56100 Kuala Lumpur, Malaysia. Tel: +00 (603) 9283 9881 Fax: +00 (603) 9284 8187 Email: [email protected] Website: www.intertek.com Intertek RSPO Report: May 2014 INTERTEK CERTIFICATION INTERNATIONAL SDN BHD (188296-W) Report No.: R2020/10-4 IOI Corporation Berhad Pukin Grouping Page 3 of 48 Annual Surveillance Assessment (ASA-03) cum -

Malaya Annual Conference Methodist Episcopal Church Held in Singapore, January 1938

, • oS ......; I ",", 0, Al J.. -I r, C~1 MINUTES OF THE MALAYA ANNUAL CONFERENCE METHODIST EPISCOPAL CHURCH HELD IN SINGAPORE, JANUARY 1938 WESLEY CHUR C H, SINGAPORE TABLE OF CONTENTS I. OFFICERS OF TEE ANNUAL CONFERENCE S II. BOARDS, COMMISSIONS AND COMMITTEES 4 Special Committees , .. 6 III. DAILY PROCEEDINGS 7 IV. DISCIPLINARY QUESTIONS 18 Certificate of Ordination 25 V. APPOINTMENTS 26 Special Appointments 34 Secretary's Certi1lcate 34 VI. REPORTS: (a) District Superintendents Singapore District-R. L. Archer 3!S Sibu District-Lee Hock Hiang 38 Central lI[alaya District-Abel Eklund 40 Central Tamil District-P. L. Peach 43 &erik! District-Wong King Hwo 46 Southern Tamil District-S. S. Pakianathan 47 Penang-Ipoh District-I Dodsworth 49 (b) Standing Committees and Boards Committee on Public Morals 55 Committee on Evangelism 55 Committee on Resolutions 56 Committee on the State of the Church 57 Committee on Home ][issions 57 Conference Board of Stewards 60 STATISTICS Summary of Kalaya Annual Conference and Malaysia Chinese Mission Conference Statistics 64 Statistical Beport of Malaya Annual Conference Inserted Statistics for Educational Institutions Inserted Statistician's Recapitulation Report Inserted Conference Treasurer's Report 66 VII. lIlISCELLANEOUS Recommendations of Committee on Christian Literature 67 General Report on Girls' Schools 67 Report of the Malaysia Commission on Beligious Education for 1937 69 VIII. ROLL OF THE DEAD 73 Memoirs 74 IX. HISTORICAL Conference Sessions 77 Chronol~gical Boll 78 Retired Ministers 79 .MINUTES OF THE FOR TY -SIXTH SESSION MALAYA ANNUAL CONFERENCE .METHODIST EPISCOPAL CHURCH HELD IN WESLEY CHURCH SINGAPORE, STRAITS SETTLEMENTS, MALAYA JANUARY 6, TO 12, I938 PUBLISHED BY SECRETARY, MALAYA ANNUAL CONFERENCE FIVE, FORT CANNING ROAD -. -

SENARAI PREMIS PENGINAPAN PELANCONG : JOHOR 1 Rumah

SENARAI PREMIS PENGINAPAN PELANCONG : JOHOR BIL. NAMA PREMIS ALAMAT POSKOD DAERAH 1 Rumah Tumpangan Lotus 23, Jln Permas Jaya 10/3,Bandar Baru Permas Jaya,Masai 81750 Johor Bahru 2 Okid Cottage 41, Jln Permas 10/7,Bandar Baru Permas Jaya 81750 Johor Bahru 3 Eastern Hotel 200-A,Jln Besar 83700 Yong Peng 4 Mersing Inn 38, Jln Ismail 86800 Mersing 5 Mersing River View Hotel 95, Jln Jemaluang 86800 Mersing 6 Lake Garden Hotel 1,Jln Kemunting 2, Tmn Kemunting 83000 Batu Pahat 7 Rest House Batu Pahat 870,Jln Tasek 83000 Batu Pahat 8 Crystal Inn 36, Jln Zabedah 83000 Batu Pahat 9 Pulai Springs Resort 20KM, Jln Pontian Lama,Pulai 81110 Johor Bahru 10 Suria Hotel No.13-15,Jln Penjaja 83000 Batu Pahat 11 Indah Inn No.47,Jln Titiwangsa 2,Tmn Tampoi Indah 81200 Johor Bahru 12 Berjaya Waterfront Hotel No 88, Jln Ibrahim Sultan, Stulang Laut 80300 Johor Bahru 13 Hotel Sri Pelangi No. 79, Jalan Sisi 84000 Muar 14 A Vista Melati No. 16, Jalan Station 80000 Johor Bahru 15 Hotel Kingdom No.158, Jln Mariam 84000 Muar 16 GBW HOTEL No.9R,Jln Bukit Meldrum 80300 Johor Bahru 17 Crystal Crown Hotel 117, Jln Harimau Tarum,Taman Abad 80250 Johor Bahru 18 Pelican Hotel 181, Jln Rogayah 80300 Batu Pahat 19 Goodhope Hotel No.1,Jln Ronggeng 5,Tmn Skudai Baru 81300 Skudai 20 Hotel New York No.22,Jln Dato' Abdullah Tahir 80300 Johor Bahru 21 THE MARION HOTEL 90A-B & 92 A-B,Jln Serampang,Tmn Pelangi 80050 Johor Bahru 22 Hotel Classic 69, Jln Ali 84000 Muar 23 Marina Lodging PKB 50, Jln Pantai, Parit Jawa 84150 Muar 24 Lok Pin Hotel LC 117, Jln Muar,Tangkak 84900 Muar 25 Hongleng Village 8-7,8-6,8-5,8-2, Jln Abdul Rahman 84000 Muar 26 Anika Inn Kluang 298, Jln Haji Manan,Tmn Lian Seng 86000 Kluang 27 Hotel Anika Kluang 1,3 & 5,Jln Dato' Rauf 86000 Kluang BIL. -

Collaboration, Christian Mission and Contextualisation: the Overseas Missionary Fellowship in West Malaysia from 1952 to 1977

Collaboration, Christian Mission and Contextualisation: The Overseas Missionary Fellowship in West Malaysia from 1952 to 1977 Allen MCCLYMONT A thesis submitted in partial fulfilment of the requirements of Kingston University for the degree of Doctor of Philosophy in History. Submitted June 2021 ABSTRACT The rise of communism in China began a chain of events which eventually led to the largest influx of Protestant missionaries into Malaya and Singapore in their history. During the Malayan Emergency (1948-1960), a key part of the British Government’s strategy to defeat communist insurgents was the relocation of more than 580,000 predominantly Chinese rural migrants into what became known as the ‘New Villages’. This thesis examines the response of the Overseas Missionary Fellowship (OMF), as a representative of the Protestant missionary enterprise, to an invitation from the Government to serve in the New Villages. It focuses on the period between their arrival in 1952 and 1977, when the majority of missionaries had left the country, and assesses how successful the OMF was in fulfilling its own expectation and those of the Government that invited them. It concludes that in seeking to fulfil Government expectation, residential missionaries were an influential presence, a presence which contributed to the ongoing viability of the New Villages after their establishment and beyond Independence. It challenges the portrayal of Protestant missionaries as cultural imperialists as an outdated paradigm with which to assess their role. By living in the New Villages under the same restrictions as everyone else, missionaries unconsciously became conduits of Western culture and ideas. At the same time, through learning local languages and supporting indigenous agency, they encouraged New Village inhabitants to adapt to Malaysian society, while also retaining their Chinese identity. -

Colgate Palmolive List of Mills As of June 2018 (H1 2018) Direct

Colgate Palmolive List of Mills as of June 2018 (H1 2018) Direct Supplier Second Refiner First Refinery/Aggregator Information Load Port/ Refinery/Aggregator Address Province/ Direct Supplier Supplier Parent Company Refinery/Aggregator Name Mill Company Name Mill Name Country Latitude Longitude Location Location State AgroAmerica Agrocaribe Guatemala Agrocaribe S.A Extractora La Francia Guatemala Extractora Agroaceite Extractora Agroaceite Finca Pensilvania Aldea Los Encuentros, Coatepeque Quetzaltenango. Coatepeque Guatemala 14°33'19.1"N 92°00'20.3"W AgroAmerica Agrocaribe Guatemala Agrocaribe S.A Extractora del Atlantico Guatemala Extractora del Atlantico Extractora del Atlantico km276.5, carretera al Atlantico,Aldea Champona, Morales, izabal Izabal Guatemala 15°35'29.70"N 88°32'40.70"O AgroAmerica Agrocaribe Guatemala Agrocaribe S.A Extractora La Francia Guatemala Extractora La Francia Extractora La Francia km. 243, carretera al Atlantico,Aldea Buena Vista, Morales, izabal Izabal Guatemala 15°28'48.42"N 88°48'6.45" O Oleofinos Oleofinos Mexico Pasternak - - ASOCIACION AGROINDUSTRIAL DE PALMICULTORES DE SABA C.V.Asociacion (ASAPALSA) Agroindustrial de Palmicutores de Saba (ASAPALSA) ALDEA DE ORICA, SABA, COLON Colon HONDURAS 15.54505 -86.180154 Oleofinos Oleofinos Mexico Pasternak - - Cooperativa Agroindustrial de Productores de Palma AceiteraCoopeagropal R.L. (Coopeagropal El Robel R.L.) EL ROBLE, LAUREL, CORREDORES, PUNTARENAS, COSTA RICA Puntarenas Costa Rica 8.4358333 -82.94469444 Oleofinos Oleofinos Mexico Pasternak - - CORPORACIÓN -

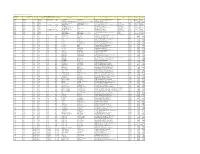

Senarai Bilangan Pemilih Mengikut Dm Sebelum Persempadanan 2016 Johor

SURUHANJAYA PILIHAN RAYA MALAYSIA SENARAI BILANGAN PEMILIH MENGIKUT DAERAH MENGUNDI SEBELUM PERSEMPADANAN 2016 NEGERI : JOHOR SENARAI BILANGAN PEMILIH MENGIKUT DAERAH MENGUNDI SEBELUM PERSEMPADANAN 2016 NEGERI : JOHOR BAHAGIAN PILIHAN RAYA PERSEKUTUAN : SEGAMAT BAHAGIAN PILIHAN RAYA NEGERI : BULOH KASAP KOD BAHAGIAN PILIHAN RAYA NEGERI : 140/01 SENARAI DAERAH MENGUNDI DAERAH MENGUNDI BILANGAN PEMILIH 140/01/01 MENSUDOT LAMA 398 140/01/02 BALAI BADANG 598 140/01/03 PALONG TIMOR 3,793 140/01/04 SEPANG LOI 722 140/01/05 MENSUDOT PINDAH 478 140/01/06 AWAT 425 140/01/07 PEKAN GEMAS BAHRU 2,391 140/01/08 GOMALI 392 140/01/09 TAMBANG 317 140/01/10 PAYA LANG 892 140/01/11 LADANG SUNGAI MUAR 452 140/01/12 KUALA PAYA 807 140/01/13 BANDAR BULOH KASAP UTARA 844 140/01/14 BANDAR BULOH KASAP SELATAN 1,879 140/01/15 BULOH KASAP 3,453 140/01/16 GELANG CHINCHIN 671 140/01/17 SEPINANG 560 JUMLAH PEMILIH 19,072 SENARAI BILANGAN PEMILIH MENGIKUT DAERAH MENGUNDI SEBELUM PERSEMPADANAN 2016 NEGERI : JOHOR BAHAGIAN PILIHAN RAYA PERSEKUTUAN : SEGAMAT BAHAGIAN PILIHAN RAYA NEGERI : JEMENTAH KOD BAHAGIAN PILIHAN RAYA NEGERI : 140/02 SENARAI DAERAH MENGUNDI DAERAH MENGUNDI BILANGAN PEMILIH 140/02/01 GEMAS BARU 248 140/02/02 FORTROSE 143 140/02/03 SUNGAI SENARUT 584 140/02/04 BANDAR BATU ANAM 2,743 140/02/05 BATU ANAM 1,437 140/02/06 BANDAN 421 140/02/07 WELCH 388 140/02/08 PAYA JAKAS 472 140/02/09 BANDAR JEMENTAH BARAT 3,486 140/02/10 BANDAR JEMENTAH TIMOR 2,719 140/02/11 BANDAR JEMENTAH TENGAH 414 140/02/12 BANDAR JEMENTAH SELATAN 865 140/02/13 JEMENTAH 365 140/02/14