Boston Borough Council 2018-19 Council Tax Explained, Budget Summary, Local Policing Summary About This Booklet

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Patient Directory – Who Can Help

Nettleham Medical Practice Who can help me? Patient Directory Contents Page What Services Do Nettleham Medical Practice Provide? Active Signposting 3 How To Book An Appointment 3 - 4 Stress When Booking Appointments 4 The Practice Team 5 - 8 PODs 8 Results Line 9 What Other Providers Can Help Me? Healthcare 111 / Urgent Care Out Of Hours 10 Dental Problems 10 Leg Wounds 10 Minor Ailments 11 - 12 Mental Health Support 13 Nursing Support at Home 14 Physiotherapy and Sports Injuries 14 Stop Smoking Services 15 Pregnancy Related Care 16 - 17 Child Health 18 - 19 Social Care Addiction Support 20 Bereavement Support 20 Benefits Queries 20 Carers Support 21 Older People’s Support 22 Voluntary Services 22 Further Useful Websites 23 What Services Do Nettleham Medical Practice Provide? Active Signposting The reception staff at Nettleham Medical Practice are trained Patient Care Advisors. This means that they are able to ask patients more questions at the point of booking of appointments to enable them to make the most appropriate appointment with the right member of clinical staff depending on the patient’s condition. This could be a GP, Nurse Practitioner, Nurse, Health Care Assistant or an alternative service provider such as a community pharmacy. This process ensures that patients are seen promptly by the correct clinical staff and has huge benefits, both to the patient and the system as whole by freeing up GP time for those who really need it. It is important for patients to understand they are not being nosy and the information being asked for is very much in their best interests. -

Lincolnshire. [Kelly's

626 WELlON·BY-L1NCOLN. LINCOLNSHIRE. [KELLY'S maintaining scholarships each of not less than £t or \VELTON RURAL DISTRICT COUNCIL. more than £2 yearly, to be awarded, as nearly as The parishes in ~he di.stlri~ are :-AiS'thorpe, Apley, possible, in equal sharez~ to boys and girls, -whose parents Bardney, Barlings, Brattleby, Broxholme, · Bullingooq. are bon&-fide resident. ill the pa~ish of Welton, and -who Buroon, Oaenby, Oammeringham, Carlton (North) .. are and have been for at least three ,·ears in the local • Oarlton (Soutlh), Cherry Wli-llingha.m, Cold Hanwolltb, -elementary school, and £4o in maintaining yearly Oouistead, Dunholme. Faldingworth, Firsby (East). exhibitions of not less than £10 or more than £2o for Firsby (West), Fiskerton, Frlest.h()rpe, Fu.lnet.by,. girls, and not less than £10 or more than £3o for boys, Goltho, Grange-de-Lings, Greetwell, Hackthorn, Hol_.. tenable for three years at any place of education, higher ton-cum-Beckering, Ingham, Nettleham, Newball" than elementary, approved by the Welton governors, to Normanby-by-Spital, Owmby, Rand, Reepham, Rise.. be awarded to scholara who are awl have been for at holme, Saxby, Saxilby-with-Ingleby, Scampton, least three years in the Welt()n elementary school. A Scothern, Snarford, Snelland, Spridlington, Stainfield, former Countess of. Watwick left £10 yearly to the Stainton-by-Langworth, Sudbrooke, Thorpe·in-the... 'Vicar of Welton for delivering a lecture in the church Fallows, Welton and Wickenby, being the parishes in every Sunday evening. The poor of t·he parish have Lincoln in the Parts of Lindsey. The area is 83,71a about £32 distributed 11mongst them yearly in clot.he8 acres; rateable value in 1912, £87,886; population in or money from Oust's, Camm's and other chaiitie.;. -

Unlocking New Opportunies

A 37 ACRE COMMERCIAL PARK ON THE A17 WITH 485,000 SQ FT OF FLEXIBLE BUSINESS UNITS UNLOCKING NEW OPPORTUNIES IN NORTH KESTEVEN SLEAFORD MOOR ENTERPRISE PARK IS A NEW STRATEGIC SITE CONNECTIVITY The site is adjacent to the A17, a strategic east It’s in walking distance of local amenities in EMPLOYMENT SITE IN SLEAFORD, THE HEART OF LINCOLNSHIRE. west road link across Lincolnshire connecting the Sleaford and access to green space including A1 with east coast ports. The road’s infrastructure the bordering woodlands. close to the site is currently undergoing The park will offer high quality units in an attractive improvements ahead of jobs and housing growth. The site will also benefit from a substantial landscaping scheme as part of the Council’s landscaped setting to serve the needs of growing businesses The site is an extension to the already aims to ensure a green environment and established industrial area in the north east resilient tree population in NK. and unlock further economic and employment growth. of Sleaford, creating potential for local supply chains, innovation and collaboration. A17 A17 WHY WORK IN NORTH KESTEVEN? LOW CRIME RATE SKILLED WORKFORCE LOW COST BASE RATE HUBS IN SLEAFORD AND NORTH HYKEHAM SPACE AVAILABLE Infrastructure work is Bespoke units can be provided on a design and programmed to complete build basis, subject to terms and conditions. in 2021 followed by phased Consideration will be given to freehold sale of SEE MORE OF THE individual plots or constructed units, including development of units, made turnkey solutions. SITE BY SCANNING available for leasehold and All units will be built with both sustainability and The site is well located with strong, frontage visibility THE QR CODE HERE ranging in size and use adaptability in mind, minimising running costs from the A17, giving easy access to the A46 and A1 (B1, B2 and B8 use classes). -

Lincolnshire GP Practice List

Lincolnshire GP Practice List NHS Lincolnshire West CCG Abbey Medical Practice Arboretum Surgery Bassingham Surgery Birchwood Medical Practice Boultham Medical Practice Caskgate Surgery Brant Road Surgery Brayford Medical Practice Burton Road Surgery Branston & Heighington Practice Hibaldstow Medical Practice Cleveland Surgery Cliff House Medical Practice Cliff Villages Surgery Crossroads Medical Practice Glebe Park Surgery Glebe Practice Hawthorn Surgery Church Walk Surgery Ingham Practice Lindum Medical Practice Metheringham Surgery Minster Medical Practice Nettleham Medical Practice Newark Road Surgery Portland Medical Practice Pottergate Surgery Richmond Medical Centre Springcliffe Surgery The Heath Surgery Trent Valley Surgery University Health Centre Washingborough Surgery Welton Family Health Centre Willingham by Stow Surgery Witham Practice Woodland Medical Practice Service provided by NHS South West Lincolnshire CCG Belvoir Vale Surgery Billinghay Medical Practice Caythorpe and Ancaster Medical Practice Colsterworth Medical Practice Glenside Country Practice Harrowby Lane Surgery Long Bennington Medical Centre Market Cross Surgery Millview Medical Centre New Springwells Medical Practice Ruskington Medical Practice Sleaford Medical Group St John’s Medical Centre St Peter’s Hill Surgery Stackyard Surgery Swingbridge Surgery Vine House Surgery Welby Practice Woolsthorpe Surgery NHS South Lincolnshire CCG Church Street Surgery Beechfield Medical Centre Gosberton Medical Centre -

Lincolnshire. [ Kelly's

590 CUB LINCOLNSHIRE. [ KELLY'S Curtis Mrs. 2 Ebor villas, Casterto.n Davey Alfred James, 3 Summer villa, De Brisay Rev. Henry Lestock Delacour road, Stamford Tower road, 8kirbeck, Boston M.A.Rectory,Faldingworth,l!kt.Rasen Curtis Peter, Clinton view, Nethergate, Davey James, 83 Burton road, Lincoln De Burgh-Lawson Wormald De Lisle Westwoodside, Doncastel" DaYey John Henry, I Seathorne villas, Henry, Eastoft hall, Goole Curtis William, Bucknall, Lincoln Roman bank, Skegness De Burton Lieut.-Col. Albert D.L., J.P. Curtis William, 155 Monk's rd. Lincoln Da¥ey Joseph James, Goxhill, Hull Bnckmstr.hl.Billingborough,Flknghm Curtiss Charles, Kirkby, Market Rasen Davey Mrs. 3 Abbey drive we. Grimsby De Cerjat Mrs.The Old Place, Old Sleafrd CurtoisA. TheGrove,Nettleham rd.Lncln Davey Mrs. Mayfield ho. Goxhill, Hull Dee C. 'fhanet vil. Lincoln rd.Horncastle Curtois Frederick, 36 Sleaford rd.Boston Davey Mrs. so North street, Horncastle Deed Percy, 7 Carholme road, Lincolq Curtois L.H. Washingboro' manor,Ln!,!ln Davey Mrs. St. Aubyn's terrace, Deedes Rev. Canon Gordon .I<'rederic M.A. Curtois Miss, Washingborough, Lincoln Hundleby, Spilsby Vicarage, Haydor, Grantham Curtois Mrs. Manor house, Washing- DavidAlbt. Heckho.Augustast.Grmsby Dennis Fred Woodrow, Eastgate, Lcuth borough, Lincoln Davidson Christopher Montgomeric, IOS Dennis J. H. The Elms,Algarkirk,Boston Curtoys Rev. W.F.D.:r.r.A.Coleby,Lincoln Can wick road, Lincoln Dennis J.M. F.L.s.4sVictoria st.Grimsby Curwood Geo. 106 Stirling st. Grimsby Davidson Wm. 247 Hainton st. Grimsby Dennis John Woodrow, sen. Inglethorpe, Cusins Rev. :Frederick Teeling M.A. Oavies Jas.Hy.Holmlea,South pk.Lincln New market~ Louth Vicarage, North Hykeham, Lincoln DaviesJ.3Temple ter. -

Notice of Poll

NOTICE OF POLL West Lindsey District Council Election of District Councillors for Nettleham Ward Notice is hereby given that: 1. A poll for the election of District Councillors for Nettleham will be held on Thursday 2 May 2019, between the hours of 7:00 am and 10:00 pm. 2. The number of District Councillors to be elected is two. 3. The names, home addresses and descriptions of the Candidates remaining validly nominated for election and the names of all persons signing the Candidates nomination paper are as follows: Names of Signatories Name of Description (if Home Address Proposers(+), Seconders(++) & Candidate any) Assentors BARRETT 33 Wesley Road, Conservative Party Rouse McNeill John Stephen Cherry Willingham, Candidate Stephanie P(+) Giles P(++) Lincoln Spriggs Susan Perks Aline LN3 4GT Perks Edwin H Speer Henry Rouse Edward G McNeill McNeill Peter F Frances J McNeill Patrick J HIGHAM 11 Cliff Avenue, Liberal Democrats White Frith Christopher Nettleham, Angela M(+) Alfred H(++) Lincoln Longson Beryl M Smith Betty A LN2 2PU Herbert Jean P Marshall John J Frith Margaret Moir Ian Moir Ursula M Lawrence Sonya M MCNEILL 3 The Chestnuts, Conservative Party Rouse Spriggs Giles Patrick Nettleham, Candidate Stephanie P(+) Susan(++) Lincoln Spriggs Colin Perks Aline LN2 2NH Perks Edwin H Speer Henry Rouse Edward G McNeill McNeill Peter F Frances J McNeill Patrick J WHITE 16 North Street, Liberal Democrats Higham White Angela May Nettleham, Christopher(+) Michael A(++) Lincoln Higham Julia K Burkitt David M LN2 2PA Wallis Norma Cullen Lee John E Margaret B Shaw Brenda Lee Barbara J Turner Sheila I 4. -

Lincoln County Couincil

LINCOLNSHIRE COUNTY COUNCIL County Election – 4 May 2017 Return of Persons Elected as County Councillors for the Lincolnshire County Council Electoral Divisions Name Electoral Division Description ADAMS, William Robert Colsterworth Rural Conservative (known as Bob) ARON, William James Horncastle & The Keals Conservative (known as Bill) ASHTON, Thomas Robert Tattershall Castle Conservative (known as Tom) AUSTIN, Alison Mary Boston South Independent BOLES, Matthew David Gainsborough Hill Liberal (known as Matt) Democrat BOWKETT, Mrs Wendy Wainfleet Conservative BRADWELL, Mrs Patricia Anne Woodhall Spa & Wragby Conservative BRAILSFORD, David Stamford West Conservative BREWIS, Christopher James Thomas The Suttons Independent Harrison (known as Chris) BRIDGES, Anthony Louth North Conservative (known as Tony) BROCKWAY, Mrs Jacqueline Nettleham & Saxilby Conservative (known as Jackie) BROOKES, Michael Boston Rural Conservative BUTROID, Richard David Gainsborough Rural Conservative South CAWREY, Lindsey Ann Washingborough Conservative CLARKE, Kevin John Boultham Labour (known as Kev) Page 25 Name Electoral Division Description COOK, Mrs Kathryn Sleaford Conservative (known as Kate) COOPER, Mrs Paula Boston West Conservative COUPLAND, Peter Ephraim Holbeach Rural Conservative CULLEN, Graham Edward Mablethorpe Labour DAVIE, Colin John Ingoldmells Rural Conservative DAVIES, Richard Graham Grantham West Conservative DOBSON, Barry Martin Deepings East Conservative DODDS, Sarah Rosemary Louth South Labour FIDO, Matthew Thomas Hartsholme Conservative -

Going to Secondary School in Lincolnshire 2022/23

Going to Secondary School in Lincolnshire 2022/23 Foreword Dear Parent or Carer As Chief Executive, I am pleased to introduce 'Going to School in Lincolnshire' to you and to thank you for considering our schools. Our standards are high and children thrive in our schools. We want every child to develop and achieve their full potential and we need your support as parents and carers to help us. This partnership is vital in helping our young people become independent and responsible citizens who can make a positive contribution to society. Please take the opportunity to visit schools, where you will find happy children with excellent staff working in a range of different ways to fulfill each child's potential. I know our teachers will be pleased to show you round their school to see the wonderful work that is being done. Debbie Barnes Chief Executive This guide is for parents of children in Year 6 who are due to transfer to secondary school. There is one school in Lincolnshire that admits children from Year 10 - Lincoln University Technical College (UTC). If your child is in Year 9 and you would like to apply for a place at this school you should contact them directly as the timescales in this guide are different for this school. Updated August 2021. 2 Contents In Lincolnshire 2022/23.......................................................................................................................... 1 Foreword ............................................................................................................................................ -

Central Lincolnshire Strategic Housing and Economic Land Availability Assessment SHELAA 2014

Central Lincolnshire Strategic Housing and Economic Land Availability Assessment SHELAA 2014 West Lindsey DC SHLAA Map CL1253 Reference Site Address Sinclairs, Ropery Road, Gainsborough Site Area (ha) 3.03 Ward Gainsborough South West Parish Gainsborough Estimated Site 120 Capacity Site Description Brownfield site located within settlement boundary of Gainsborough The inclusion of this site or any other sites in this document does not represent a decision by the Central Lincolnshire authorities and does not provide the site with any kind of planning status. Page 1 Central Lincolnshire Strategic Housing and Economic Land Availability Assessment SHELAA 2014 Map CL1253 http://aurora.central- lincs.org.uk/map/Aurora.svc/run?script=%5cShared+Services%5cJPU%5cJPUJS.AuroraScri pt%24&nocache=1206308816&resize=always Page 2 Central Lincolnshire Strategic Housing and Economic Land Availability Assessment SHELAA 2014 West Lindsey DC SHLAA Map CL1289 Reference Site Address Main Road, Grayingham, Gainsborough, Lincs DN21 Site Area (ha) 8.05 Ward Hemswell Parish West Rasen Estimated Site 147 Capacity Site Description The inclusion of this site or any other sites in this document does not represent a decision by the Central Lincolnshire authorities and does not provide the site with any kind of planning status. Page 3 Central Lincolnshire Strategic Housing and Economic Land Availability Assessment SHELAA 2014 Map CL1289 http://aurora.central- lincs.org.uk/map/Aurora.svc/run?script=%5cShared+Services%5cJPU%5cJPUJS.AuroraScri pt%24&nocache=1206308816&resize=always -

Nettleham Road Site.Indd

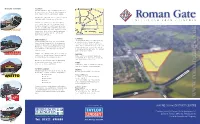

ADJACENT OCCUPIERS LOCATION A46 LINCOLN BYPASS The site extends to approximately 9 acres and is SEARBY RD A158 located to the north of Lincoln City Centre and a OUTER CIR short distance from the A46/Lincoln Bypass. CLE RISEHOLME ROAD RISEHOLME ROAD DRIVE LONGDALES ROAD BUNKERS HILL RUSKIN AVE It fronts one of the main access routes to Lincoln YARBOROUGH CR. N Cathedral and the historic core of the City. OUTER Roman Gate NETTLEHAM NEWPORT NETTLEHAM ROAD • L I N C O L N CIRCLE ROAD A Waitrose foodstore is located immediately WRAGBY ROAD WESTGATE to the south of the site. The Nettleham Road Shopping Centre is located immediately to the GREETWELL ROAD east and includes Iceland and Netto units. The HILL undeveloped land to the north and west is in the NEWLAND MONKS ROAD LINDUM ownership of the developers and has planning ST. MARYS ST River Witham permission for residential development with RAILWAY STATION approximately 240 units. PLANNING DEMOGRAPHICS The site has the benefit of outline planning 78,500 residents are within a 15 minute drive- permission for development of mixed time of Roman Gate and 192,000 reside within use district centre including retail, leisure, a 30 minute drive-time. The population around office and residential floor space. Copies of Roman Gate is generally affluent with stronger relevant documents can be made available concentrations of wealthy achievers than the to interested parties (principals and retained national average. agents only) upon request. A typical ‘core’ district centre catchment (50% of SERVICES NETTLEHAM ROAD visitors) would place Roman Gate in the top half Mains services are available. -

Walkover Habitat Survey Nettleham Beck, Lincolnshire November 2016

Walkover Habitat Survey Nettleham Beck, Lincolnshire November 2016 Contents Summary ....................................................................................................................................................... 2 Introduction .................................................................................................................................................. 4 Catchment Overview .................................................................................................................................... 4 Habitat Assessment ...................................................................................................................................... 5 Riseholme Campus to Upstream of Nettleham ........................................................................................ 5 Nettleham Village ................................................................................................................................... 15 Downstream of Nettleham ..................................................................................................................... 21 Opportunities for Habitat Improvements ................................................................................................... 33 Channel narrowing .................................................................................................................................. 36 Pool creation .......................................................................................................................................... -

Nettleham Parish Council

NETTLEHAM PARISH COUNCIL The Parish Office Scothern Road Nettleham Lincoln LN2 2TU Tel: 01522 750011 Email: [email protected] Website: www.nettleham-pc.gov.uk Re: The Green Wedge Policy – LP 22 Submission of Hearing Statement on behalf of Nettleham Parish Council Re: Day 16: Matter 15 Green Wedges Q3 Re: LP22 – We would respectfully submit that the Plan is not currently sound in regard to this policy. The Green Wedge to the NE of Lincoln shown in the Policies Map has a gap between Nettleham and the south side of Cherry Willingham. This therefore fails to achieve some of the principal objectives of Policy LP 22, namely - 1. To protect the character and identity of the villages involved, in this case Nettleham, North Greetwell & Cherry Willingham and to that aim to protect them from a potential Lincoln urban area sprawl into this area of open countryside. Throughout the 4 year period (2012 – 2015) of the promotion of the Nettleham Neighbourhood Plan (NNP) by the Parish Council, this requirement (i.e. of preventing the Village from becoming an “annex” of Lincoln) was regarded as a cornerstone of the NNP and was widely supported within the Community (but please see further below). 2. The current Green Wedge designation in this area does not provide a wildlife corridor but is in effect a cul-de-sac, since the Green Wedge stops at Greetwell Lane and then resumes to the east of Lincoln at Fiskerton Road. The Green Wedge is intended to facilitate species migration but this does not do so.