Merger Decision IV/M.1230 of 07/08/1998

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

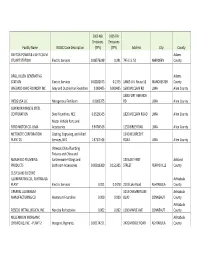

Facility Name NEISIC Code Description 2005 NEI Emissions

2005 NEI 2005 TRI Emissions Emissions Facility Name NEISIC Code Description (TPY) (TPY) Address City County DAYTON POWER & LIGHT CO JM Adams STUART STATION Electric Services 0.08576238 0.291 745 U.S. 52 ABERDEEN County DP&L, KILLEN GENERATING Adams STATION Electric Services 0.02182673 0.1375 14869 U.S. Route 52 MANCHESTER County WHEMCO‐OHIO FOUNDRY INC Gray and Ductile Iron Foundries 0.000405 0.000405 1600 MCCLAIN RD LIMA Allen County 1900 FORT AMANDA INEOS USA LLC Nitrogenous Fertilizers 0.0002375 RD LIMA Allen County SUPERIOR FORGE & STEEL CORPORATION Steel Foundries, NEC 6.0526E‐05 1820 MCCLAIN ROAD LIMA Allen County Motor Vehicle Parts and FORD MOTOR CO.‐LIMA Accessories 3.9474E‐06 1155 BIBLE ROAD LIMA Allen County METOKOTE CORPORATION Coating, Engraving, and Allied 1340 NEUBRECHT PLANT 25 Services, NEC 1.9737E‐06 ROAD LIMA Allen County Vitreous China Plumbing Fixtures and China and MANSFIELD PLUMBING Earthenware Fittings and 150 EAST FIRST Ashland PRODUCTS Bathroom Accessories 0.00019309 0.151905 STREET PERRYSVILLE County CLEVELAND ELECTRIC ILLUMINATING CO., ASHTABULA Ashtabula PLANT Electric Services 0.021 0.0178 2133 Lake Road ASHTABULA County GENERAL ALUMINUM 1043 CHAMBERLAIN Ashtabula MANUFACTURING CO Aluminum Foundries 0.009 0.009 BLVD CONNEAUT County Ashtabula FOSECO METALLURGICAL INC. Nonclay Refractories 0.002 0.002 1100 MAPLE AVE CONNEAUT County MILLENNIUM INORGANIC Ashtabula CHEMICALS, INC. ‐ PLANT 2 Inorganic Pigments 0.00174211 2426 MIDDLE ROAD ASHTABULA County 2005 NEI 2005 TRI Emissions Emissions Facility Name NEISIC Code Description (TPY) (TPY) Address City County Primary Production of Ashtabula ROCK CREEK ALUMINUM INC Aluminum 0.001 0.001 2639 E. -

Oppose the Proposed Terminatiion of Judgement in U.S. V. Association of Casualty and Surety Companies, Et

SOCIETY OF COLLISION REPAIR SPECIALISTS Toll Free Phone (877) 841-0660 • Toll Free Fax 877-851-0660 Website: www.scrs.com • E-Mail: [email protected] • Mailing: P.O. Box 3037, Mechanicsville, VA 23116 Executive Officers: Brett Bailey (816) 741-6966 Chairman Missouri August 20, 2019 Bruce Halcro (406) 442-8611 U.S. Department of Justice Vice-Chairman Montana 950 Pennsylvania Avenue, NW Amber Alley (415) 994-7913 Secretary California Washington, DC 20530-0001 Tim Ronak (949) 289-3357 Treasurer California RE: Oppose the proposed termination of judgement in U.S. v. Association of Paul Sgro (732) 222-3644 Casualty and Surety Companies, et al Director-at-Large New Jersey Kye Yeung (714) 957-1290 Immediate Past Chairman California Attorney General William Barr and the U.S. Department of Justice, National Directors: Michael Bradshaw (828) 569-1275 We write to you in opposition of the proposed termination of judgement in the U.S. v. North Carolina Association of Casualty and Surety Companies, et al, otherwise referred to as the 1963 Domenic Brusco (724) 931-3063 Pennsylvania Consent Decree. Trace Coccimiglio (801) 576-8585 Utah The Society of Collision Repair Specialists (SCRS) serves as a not-for-profit national Dave Gruskos (732) 747-1770 association representing the hardworking collision repair facilities and specialized New Jersey professionals who work to repair collision-damaged vehicles across the United States. Jeff Kallemeyn (630) 257-2277 Illinois Matthew McDonnell (406) 259-6328 There is nothing more paramount than protecting consumer safety and maintaining a fair Montana and competitive landscape that ensures consumers can count on their insurance contracts Robert Grieve (303) 761-9219 Colorado to fairly indemnify them for loss in the event of an unfortunate accident. -

In the Matter of Owens Corning

0610281 UNITED STATES OF AMERICA BEFORE FEDERAL TRADE COMMISSION COMMISSIONERS: Deborah Platt Majoras, Chairman Pamela Jones Harbour Jon Leibowitz William E. Kovacic J. Thomas Rosch ____________________________________ ) ) ) In the Matter of ) ) OWENS CORNING, ) Docket No. C- ) a corporation. ) ) ) ) ____________________________________) COMPLAINT Pursuant to the provisions of the Federal Trade Commission Act and of the Clayton Act, and by virtue of the authority vested by said Acts, the Federal Trade Commission (the “Commission”), having reason to believe that respondent Owens Corning (“Owens Corning”), a corporation, and Compagnie de Saint Gobain (“Saint Gobain”), a corporation, both subject to the jurisdiction of the Commission, have agreed to an acquisition by Owens Corning of certain fiberglass reinforcements and composite fabrics assets of Saint Gobain in violation of Section 7 of the Clayton Act, as amended, 15 U.S.C. § 18, and Section 5 of the Federal Trade Commission Act, as amended, 15 U.S.C. § 45, and it appearing to the Commission that a proceeding in respect thereof would be in the public interest, hereby issues its Complaint, stating its charges as follows: I. RESPONDENT 1. Respondent Owens Corning is a corporation organized and existing under the laws of the State of Delaware, with its principal place of business at One Owens Corning Parkway, Toledo, Ohio, 43659. Owens Corning is a global company engaged in a wide variety of businesses, including the development, manufacture, marketing, and sale of glass fiber reinforcements. 1 II. JURISDICTION 2. Owens Corning is, and at all times relevant herein has been, engaged in commerce as “commerce” is defined in Section 1 of the Clayton Act, as amended, 15 U.S.C. -

Through a Glass Darkly: the Case Against Pilkington Plc. Under the New U.S

Northwestern Journal of International Law & Business Volume 16 Issue 2 Winter Winter 1996 Through a Glass Darkly: The aC se against Pilkington plc. under the New U.S. Department of Justice International Enforcement Policy Jeffrey N. Neuman Follow this and additional works at: http://scholarlycommons.law.northwestern.edu/njilb Part of the Antitrust and Trade Regulation Commons, and the International Law Commons Recommended Citation Jeffrey N. Neuman, Through a Glass Darkly: The asC e against Pilkington plc. under the New U.S. Department of Justice International Enforcement Policy, 16 Nw. J. Int'l L. & Bus. 284 (1995-1996) This Comment is brought to you for free and open access by Northwestern University School of Law Scholarly Commons. It has been accepted for inclusion in Northwestern Journal of International Law & Business by an authorized administrator of Northwestern University School of Law Scholarly Commons. Through a Glass Darkly: The Case Against Pilkington plc. under the New U.S. Department of Justice International Enforcement Policy Jeffrey N. Neuman Trade and commerce, if they were not made of India-rubber,would never manage to bounce over the obstacles which legislatorsare continually put- ting in their way... - Henry David Thoreau, Civil Disobedience I. INTRODUCTION A complaint and consent decree filed on May 25, 1994 by the Antitrust Division of the U.S. Department of Justice against Pilk- ington plc., a British fiat glass manufacturer, is yet another indication that tough Federal Government antitrust enforcement policy is back in vogue.' The Government's complaint alleged that Pilkington's 1 United States v. Pilkington plc, 6 Trade Reg. -

2020 Form 10K FINAL.Pdf

Index UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 Form 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from ___ to ___ Commission file number: 1-3247 CORNING INCORPORATED (Exact name of registrant as specified in its charter) New York 16-0393470 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) One Riverfront Plaza, Corning, New York 14831 (Address of principal executive offices) (Zip Code) 607-974-9000 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol(s) Name of each exchange on which registered Common Stock GLW New York Stock Exchange (NYSE) Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes No Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Glazing Systems Intelligence Service

Global light vehicle OE glazing market- forecasts to 2029 April 2015 SAMPLE Usage and copyright statement A single-user licenced publication is provided for individual use only. Therefore this publication, or any part of it, may not be copied, reproduced, stored in a retrieval system, or be transmitted in any form by any means electronic, mechanical, photocopying, recording or otherwise without the prior written permission of Aroq Limited. A multi-user licence edition can be freely and legally shared with your colleagues. This agreement includes sharing electronically via your corporate intranet or the making of physical copies for your company library. Excluded from this agreement is sharing any part of this publication with, or transmitting via any means to, anybody outside of your company. This content is the product of extensive research work. It is protected by copyright under the Copyright, Designs and Patents Act 1988. The authors of Aroq Limited's research are drawn from a wide range of professional and academic disciplines. The facts within this study are believed to be correct at the time of publication but cannot be guaranteed. All information within this study has been reasonably verified to the author’s and publisher’s ability, but neither accept responsibility for loss arising from decisions based on this report. © 2015 All content copyright Aroq Limited. All rights reserved. If you would like to find out about our online multi-user services for your team or organisation, please contact: Mike Chiswell Senior QUBE Business Manager Tel: +44 (0)1527 573 608 Toll free from US: 1-866-545-5878 Email: [email protected] http://wwwS.just-auto.com/qube AMPLE April 2015 Page 2 This a sample PDF. -

Ppg Industries Inc Letter Re

PPG Industries, Inc. One PPG Place Pittsburgh, Pennsylvania 15272 USA Law Department Telecopy No,: (41:9 434-4^ (412) 434-2465 Writer's Direct l>iat No.: Dec embe r S19 91 Mr. cKStrles S. Dyas, Jr. • Dinsmor^ & Sholh 1900 Cheraed Center 255 EastI Fifth Street Cincin^ati, OH 45202-3172 RE; Skinner Landfill Superfund Site West Chester. OH Dear Mr. Dyas: terno tr No"vember'~22r7-199'l'''~^reg ar dln'g-'the'^ upcoming Skinner Landfill PRP meeting on December 12, 1991. It is PPG's corporate policy with respect to Superfund activities to cooperate voluntarily with environmental agencies and other PRPs to address adverse conditions at a site where PPG is involved. PPG has conducted a diligent search of its records to determine whether any of its facilities sent materials to the Skinner Landfill. As PPG indicated in its 104(e) responses, it does not have any internal documents or other relevant evidence linking it to this site. Upon interviewing employees at PPG's Circleville facility, it was reported that PPG Circleville employed Chemical Leaman Tank Lines, Inc. during the relevant time period to transport finished products to various PPG customers. In addition, it is believed that Circleville received raw materials from suppliers via transport fay Chemical Leaman. PPG has no evidence that PPG used Chemical Leaman to transport waste materials and has submitted two 104(e) responses to the United States Environmental Protection Agency stating same. Mr. Charles R. Dyas December 9, 1991 Page 2 Based upon our current information, PPG does not believe that; it is connected to the Skinner Landfill site and, at this time, declines participation in the PRP group. -

PPG Glass Brochure

PPG ARCHITECTURAL GLASS Sustainable in Every Light 1 Table of Contents 2 ➤ A Legacy of Leadership 4 ➤ Glass and Energy Management 2 6 ➤ Cradle to Cradle CertifiedTM Product Standard 8 ➤ Solarban ® Solar Control Low-E Glasses 14 ➤ Sungate ® Passive Low-E Glass 15 ➤ Starphire® Ultra-Clear Glass 16 ➤ Oceans of Color® Aqua-Tinted Performance Glasses 18 ➤ Earth & Sky Performance Tinted Glasses 20 ➤ Vistacool ® Subtly Reflective 3 Color-Enriched Glasses 21 ➤ Solarcool ® Reflective Tinted Glasses 23 ➤ PPG Certified Fabricator® Network 24 ➤ PPG Monolithic Glass Comparisons 26 ➤ PPG One-Inch Insulating Glass Unit Comparisons 29 ➤ Glass Specification Tools 4 Cover Photo Credits The Bow, Calgary, Alberta, Canada Cover Inset Photo Credits 3. San Francisco Public Utilities Product: Solarban ® z50 Glass (top to bottom) Commission Building, San Francisco, Architects: Foster + Partners; Zeidler California 1. Prudential Center, Newark, New Jersey Partnership Product: Solarban® 70XL Glass ® 60 Glass Glazing Contractor: Antamex Products: Solarban Architect: KMD Architects ® Glass Glass Fabricator: Oldcastle Starphire Glazing Contractor: Benson Architect: Morris Adjmi Architects BuildingEnvelope® Glass Fabricator: Hartung Glass Josloff Glass Owner/Developer: H&R Real Estate Glazing Contractor: Industries Glass Fabricator: JE Berkowitz, LP Investment Trust/Encana Corporation 2013 AIA COTE Winner Owner/Developer: City of Newark Photo courtesy of Tom Kessler 4. The Cirque, Dallas, Texas Photo courtesy of Tom Kessler Product: Solarban® 70XL Glass 2. Durham Transportation Center Architect of Record: Durham, North Carolina PageSoutherlandPage Product: Solarban® 70XL Glass Design Architect: Gromatzky Dupree Architect: The Freelon Group & Associates Glazing Contractor: Jacobs Glazing Contractor: Haley-Greer Trulite Glass and Glass Fabricator: Glass Dynamics Glass Fabricator: Aluminum Solutions Photo courtesy of J. -

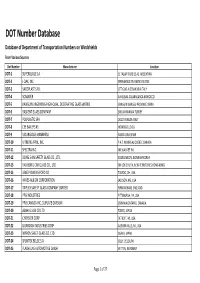

DOT Number Database Database of Department of Transportation Numbers on Windshields from Various Sources Dot Number Manufacturer Location DOT‐1 SUPERGLASS S.A

DOT Number Database Database of Department of Transportation Numbers on Windshields From Various Sources Dot Number Manufacturer Location DOT‐1 SUPERGLASS S.A. EL TALAR TIGRE BS.AS. ARGENTINA DOT‐2 J‐DAK, INC. SPRINGFIELD TN UNITED STATES DOT‐3 SACOPLAST S.R.L. OTTIGLIO ALESSANDRIA ITALY DOT‐4 SOMAVER AIN SEBAA CASABNLANCA MOROCCO DOT‐5 JIANGUIN JINGEHENG HIGH‐QUAL. DECORATING GLASS WORKS JIANGUIN JIANGSU PROVINCE CHINA DOT‐6 BASKENT GLASS COMPANY SINCAN ANKARA TURKEY DOT‐7 POLPLASTIC SPA DOLO VENEZIA ITALY DOT‐8 CEE BAILEYS #1 MONTEBELLO CA DOT‐9 VIDURGLASS MANBRESA BARCELONA SPAIN DOT‐10 VITRERIE APRIL, INC. P.A.T. MONREAL QUEBEC CANADA DOT‐11 SPECTRA INC. MILWAUKEE WI DOT‐12 DONG SHIN SAFETY GLASS CO., LTD. BOOKILMEON, JEONNAM KOREA DOT‐13 YAU BONG CAR GLASS CO., LTD. ON LOK CHUEN, NEW TERRITORIES HONG KONG DOT‐15 LIBBEY‐OWENS‐FORD CO TOLEDO, OH, USA DOT‐16 HAYES‐ALBION CORPORATION JACKSON, MS, USA DOT‐17 TRIPLEX SAFETY GLASS COMPANY LIMITED BIRMINGHAM, ENGLAND DOT‐18 PPG INDUSTRIES PITTSBURGH, PA, USA DOT‐19 PPG CANADA INC.,DUPLATE DIVISION OSHAWA,ONTARIO, CANADA DOT‐20 ASAHI GLASS CO LTD TOKYO, JAPAN DOT‐21 CHRYSLER CORP DETROIT, MI, USA DOT‐22 GUARDIAN INDUSTRIES CORP AUBURN HILLS, MI, USA DOT‐23 NIPPON SHEET GLASS CO. LTD OSAKA, JAPAN DOT‐24 SPLINTEX BELGE S.A. GILLY, BELGIUM DOT‐25 FLACHGLAS AUTOMOTIVE GmbH WITTEN, GERMANY Page 1 of 27 Dot Number Manufacturer Location DOT‐26 CORNING GLASS WORKS CORNING, NY, USA DOT‐27 SEKURIT SAINT‐GOBAIN DEUTSCHLAND GMBH GERMANY DOT‐32 GLACERIES REUNIES S.A. BELGIUM DOT‐33 LAMINATED GLASS CORPORATION DETROIT, MI, USA DOT‐35 PREMIER AUTOGLASS CORPORATION LANCASTER, OH, USA DOT‐36 SOCIETA ITALIANA VETRO S.P.A. -

A Global Alliancewith PPG to Provide Solarban® Glass for Your

A Global Alliance with PPG to Provide Solarban® Glass for Your International Projects (Left) THE SANDCRAWLER LUCASFILM CAMPUS Location: Fusionopolis, Singapore Product: Solarban® 72 Starphire® glass ICF: AVIC Sanxin Architect: Aedas Curtainwall: Permasteelisa (Below) Seoul City Hall Location: South Korea Product: Solarban® 70XL glass Architect: iArch Architects Glass Fabricator: Jasan Glass Glazing Contractor: Jasan Glass (Above) QUEEN ALIA INTERNATIONAL AIRPORT Location: Amman, Jordan Product: Solarban® 70XL glass ICF: AVIC Sanxin Architect: Foster + Partners Curtainwall: Yuanda (Cover) RBC CENTRE Location: Toronto, Ontario - Canada Product: Solarban® 70XL glass Architect: Kohn Pedersen Fox Architects Glass Fabricator: Oldcastle BuildingEnvelope™ Glazing Contractor: Oldcastle BuildingEnvelope™ Now, through the Green City Alliance, PPG and Jinjing are bringing Solarban® solar control low-e glasses to China to meet the demands of sophisticated buildings around the world. PPG Industries set the standard for a whole new level of GCA and PPG ICFP ensure that you get energy efficiency when they introduced the innovative, energy-efficientSolarban low-e glasses that are: high-performance glass that became the Solarban family • manufactured locally of glasses in 1964. Even now, Solarban glass is still the • competitively priced most advanced low-emissivity (low-e) glass product • guaranteed to comply with PPG’s exacting available, with more than 30 million square meters quality standards installed around the globe since the 1980s. • backed by PPG’s architectural and technical support To give you greater access to Solarban solar control low-e both in the United States and locally glass products closer to your international building sites, The PPG and Jinjing Partnership PPG has teamed with local glass producers around the world to form the Green City Alliance (GCA). -

GLASTON CORPORATION Yliopistonkatu 7 - 00100 Helsinki - Finland Tel.: +358 10 500 500 / Fax: +358 10 500 6515

2015 world directory 2 - Copia omaggio € ââÊ`ÊV«iÀÌ>Ê > Suppliers’ THAT’S WHY THIS WILL BE Profiles YOUR NEXT LAMINATING LINE ZERO DEFECTS ZERO WASTE ZERO DOWNTIME > Suppliers’ ZERO DISPERSION Products & ÊÊ°ÊÓÇÉäÓÉÓää{ÊcÊ{È®Ê>ÀÌ°Ê£]ÊV>Ê£ÊÊ Ê>ÊÊÊUÊÊÊ*Ài Yellow Pages > Glassworks’ Addresses ÌÌ]Ê*ÃÌiÊÌ>>iÊ-«>ÊÊ-«i`°ÊÊ>°Ê«°ÊÊ °°ÊÎxÎÉÓääÎÊVÛ° Powerlam FLAT GLASS LAMINATING LINE WITH EVA & PVB AVAILABLE IN ABSOLUTE PERFORMANCE AND RELIABILITY INTERACTIVE VERSIONS TOO }ÞÊÌiÀ>Ì>]Ê->ÀÌiiÀ}ÞÊ-°À°°]Ê À°Ê,ië°Ê>ÀVÊ*i DESKTOP DISCOVER MORE www.rcnengineering.it IPAD/IPHONE RCN ENGINEERING S.R.L. Via Marcatutto, 7 - 20080 Albairate (MI) Italy Tel +39 02 94602434 - [email protected] www.rcnengineering.it -Õ««iiÌÊÊ>Ê°Ê£{{ÊÊ>ÀV É«ÀÊÊ°ÊÓÉÓä£xÊ`Ê>ÃÃ/iV ANDROID DEVICES www.glassonline.com Multi-roller coating machine for the enamelling and design printing of float glass sheets. ROLLMAC a division of GEMATA - Via Postale Vecchia, 77 - 36070 Trissino (VI) Italy Tel. +39.0445.490618 - Fax +39.0445.490639 - E-mail: [email protected] - www.rollmac.it Because we care Revolutionary. Also our technologies. INSULATING GLASS MANUFACTURING Bystronic glass symbolises innovation with machinery, HANDLING EQUIPMENT systems and services for the processing of architectural AUTOMOTIVE GLASS PREPROCESSING and automotive glass focused on tomorrow’s market. From basic requirements through to entire, customised installations Bystronic glass provides pioneering solutions – naturally, all in the highest quality. www.bystronic-glass.com IR medium wave twin tubes emitters for: iÃÊÌ>µÕ>ÀÌâÊ>ÃÊ«À`ÕViÃÊ } ÞÊ Ê UÊ >>Ì}Êià >««ÀiV>Ìi`Ê iµÕ«iÌÊ vÀÊ Ì iÊ }>ÃÃÊ Ê UÊ ÀÀÀ}Êià industry such as manual and au- Ê UÊ `ÀÞÊÃVÀiiÊ«ÀÌ}Êià tomatic tin side detectors and UV polymerization units. -

Matching Gift Programs

Plexus Technology Group,$50 SPX Corp,d,$100 TPG Capital,$100 U.S. Venture,$25 Maximize the Impact of Your Gift Plum Creek Timber Co Inc.,$25 SPX FLOW,d,$100 TSI Solutions,$25 U.S.A. Motor Lines,$1 Pohlad Family Fdn,$25 SSL Space Systems/Loral,$100 Tableau Software,$25 UBM Point72 Asset Mgt, L.P. STARR Companies,$100 Taconic Fdn, Inc.,$25 UBS Investment Bank/Global Asset Mgt,$50 Polk Brothers Fdn Sabre Holdings Campaign (October 2017),$1 Taft Communications,$1 Umpqua Bank,$1 Polycom Inc.,$20 Safety INS Group, Inc.,$250 Takeda Pharma NA,$25 Unilever North America (HQ),s,d Portfolio Recovery Associates,$25 Sage Publications, Inc.,$25 Talent Music,$5 Union Pacific Corp MoneyPLUS,d Match Your Gift PotashCorp,d,$25 Salesforce.com,$50 Tallan Union Pacific Corp TimePLUS,$25 Potenza,$50 Sallie Mae Dollars for Doers,d Talyst,$25 United States Cellular Corp,$25 when you donate to Power Integrations,$25 Saltchuk,$25 Tampa Bay Times Fund,r,$25 United Technologies Corp - UTC,d,$25 Praxair,d,$25 Samaxx,$5 TargetCW,$1 UnitedHealth Group Precor,$25 Samuel Roberts Noble Fdn Inc.,d,$100 Teagle Fdn, Inc.,d UnitedHealth Group (Volunteer) Preferred Personnel Solutions SanMar Technology Sciences Group,$10 Universal Leaf Tobacco Corp,$25 Preformed Line Products Co,r,d,$25 Sandmeyer Steel Co,r,$50 Teichert, Inc. Unum Corp,2:1,d,$50 Premier, Inc.,$50 Sanofi,$50 Teknicks,$1 Premier, Inc. Volunteer,$25 Schneider Electric Co (Cash & Volunteer),d,$25 Tektronix, Inc.,d,$20 Principal Financial Group,r,$50 Scripps Networks Interactive,r,$25 Teleflex,r,d,$50 V/W/X/Y/Z VISA Intl ProLogis,d,$50 Scripps Networks Volunteer,d,$250 Teradata Campaign (October),$25 VMware Inc.,$31 ProQuest LLC,$25 Securian Financial Group,r,d,$35 Terex Corp,$50 Vanderbilt Ventures, Inc.