US$6.85 Bn T the Industry’S Digital Revenues in 2014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Soundtrack Walt Disney

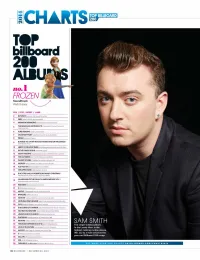

TOP BILLBOARD CHARTS200 TOP billboard 2011 ALB no.1 FROZEN Soundtrack Walt Disney POS / TITLE / ARTIST / LABEL 2 BEYONCEBeyonce Parkwood/Columbia 3 1989 TaylorSwilt Big Machine/BMW 4 MIDNIGHT MEMORIES OneOgrecuon SYCO/Columbia THE MARSHALL MAINERS LP 2 Emlnem Web/Shady/Aftermath/ Interscope/IGA 6 PURE HEROINE Lade Lava/Republic 7 CRASH MY PARTY Luke Bryan Capitol Nashville/UMGN 8 PRISM KutyPenyCapitol BLAME IT ALL ON MY ROOTS: FIVE DECADES OF INFLUENCES 9 Garth Brooks Pearl 10 HERE'S TOTHE GOODDMES RaidaGeogiaLine Republic Nastwille/BMLG 11 IN THE LONELY HOUR Sam Smith Capitol 12 NIGHT VISIONS imaginegragons KIDinaKORNER/interscope/IGA 13 THE OUTSIDERS Eric Church EMI Nashville/UPAGN 14 GHOST STORIES ColciplayParlophone/Atlantic/AG 15 NOW 50 Various Artists Sony Music/Universal/UMe 16 JUST AS I AM BrantleyGilben Valory/BMLG 17 WItAPPED IN RED KellyClarkson 19/RCA 18 DUCK THE HALLS:A ROBERTSON FAMILY CHRISIMAS TheRobertsons 4 Beards/EMI Nashville/UMGN GUARDIANS OF THE GALAXY: AWESOME MIX VOL.1 19 Soundtrack Marvel/Hollywood 20 PARTNERS Barbra Streisand Columbia 21 X EdSheeran Atlantic/AG 22 NATIVE OneRepublic Mosley/Interscope/IGA 23 BANGERZ MileyCyrus RCA 24 NOW 48Various Artists Sony Music/Universal/UMe 25 NOTHING WAS THE SAME Drake Young money/cash Money/Republic 26 GIRL Pharr,. amother/Columbia 27 5 SECONDS OF SUMMER 5Seconds MummerHey Or Hi/Capitol 28 OLD BOOTS, NEW DIRT lasonAldean Broken Bow/BBMG 29 UNORTHODOX JUKEBOX Bruno Mars Atlantic/AG 30 PLATINUM Miranda Lambert RCA Nashville/SMN 31 NOW 49 VariousArtists Sony Music/Universal/UMe SAM SMITH 32 THE 20/20 EXPERIENa (2 OF 2) Justin Timberlake RCA The singer's debut album, 33 LOVE IN THE FUTURE lohnLegend G.O.O.D./Columbia In the Lonely Hour, is the 34 ARTPOPLadyGaga Streamline/Interscope/IGA highest-ranking rookie release 35 V Maroon5222/Interscope/IGA (No. -

183 Anti-Valentine's Day Songs (2015)

183 Anti-Valentine's Day Songs (2015) 4:24 Time Artist Album Theme Knowing Me Knowing You 4:02 Abba Gold Break up Lay All Your Love On Me 5:00 Abba Gold cautionary tale S.O.S. 3:23 Abba Gold heartbreak Winner Takes it All 4:55 Abba Gold Break up Someone Like You 4:45 Adele 21 Lost Love Turning Tables 4:08 Adele 21 broken heart Rolling in the Deep 3:54 Adlele 21 broken heart All Out Of Love 4:01 Air Supply Ulitimate Air Supply Lonely You Oughta Know 4:09 Alanis Morissette Jagged Little Pill broken heart Another heart calls 4:07 All American Rejects When the World Comes Down jerk Fallin' Apart 3:26 All American Rejects When the World Comes Down broken heart Gives You Hell 3:33 All American Rejects When the World Comes Down moving on Toxic Valentine 2:52 All Time Low Jennifer's Body broken heart I'm Outta Love 4:02 Anastacia Single giving up Complicated 4:05 Avril Lavigne Let Go heartbreak Good Lovin' Gone Bad 3:36 Bad Company Straight Shooter cautionary tale Able to Love (Sfaction Mix) 3:27 Benny Benassi & The Biz No Matter What You Do / Able to Love moving on Single Ladies (Put a Ring On It) 3:13 Beyonce I Am Sasha Fierce empowered The Best Thing I Never Had 4:14 Beyonce 4 moving on Love Burns 2:25 Black Rebel Motorcycle Club B.R.M.C. cautionary tale I'm Sorry, Baby But You Can't Stand In My Light Anymore 3:11 Bob Mould Life & Times moving on I Don't Wish You Were Dead Anymore 2:45 Bowling for Soup Sorry for Partyin' broken heart Love Drunk 3:47 Boys Like Girls Love Drunk cautionary tale Stronger 3:24 Britney Spears Opps!.. -

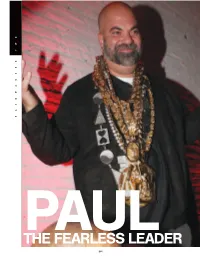

The Fearless Leader Fearless the Paul 196

TWO RAINMAKERS PAUL THE FEARLESS LEADER 196 ven back then, I was taking on far too many jobs,” Def Jam Chairman Paul Rosenberg recalls of his early career. As the longtime man- Eager of Eminem, Rosenberg has been a substantial player in the unfolding of the ‘‘ modern era and the dominance of hip-hop in the last two decades. His work in that capacity naturally positioned him to seize the reins at the major label that brought rap to the mainstream. Before he began managing the best- selling rapper of all time, Rosenberg was an attorney, hustling in Detroit and New York but always intimately connected with the Detroit rap scene. Later on, he was a boutique-label owner, film producer and, finally, major-label boss. The success he’s had thus far required savvy and finesse, no question. But it’s been Rosenberg’s fearlessness and commitment to breaking barriers that have secured him this high perch. (And given his imposing height, Rosenberg’s perch is higher than average.) “PAUL HAS Legendary exec and Interscope co-found- er Jimmy Iovine summed up Rosenberg’s INCREDIBLE unique qualifications while simultaneously INSTINCTS assessing the State of the Biz: “Bringing AND A REAL Paul in as an entrepreneur is a good idea, COMMITMENT and they should bring in more—because TO ARTISTRY. in order to get the record business really HE’S SEEN healthy, it’s going to take risks and it’s going to take thinking outside of the box,” he FIRSTHAND told us. “At its height, the business was run THE UNBELIEV- primarily by entrepreneurs who either sold ABLE RESULTS their businesses or stayed—Ahmet Ertegun, THAT COME David Geffen, Jerry Moss and Herb Alpert FROM ALLOW- were all entrepreneurs.” ING ARTISTS He grew up in the Detroit suburb of Farmington Hills, surrounded on all sides TO BE THEM- by music and the arts. -

Eminem Interview Download

Eminem interview download LINK TO DOWNLOAD UPDATE 9/14 - PART 4 OUT NOW. Eminem sat down with Sway for an exclusive interview for his tenth studio album, Kamikaze. Stream/download Kamikaze HERE.. Part 4. Download eminem-interview mp3 – Lost In London (Hosted By DJ Exclusive) of Eminem - renuzap.podarokideal.ru Eminem X-Posed: The Interview Song Download- Listen Eminem X-Posed: The Interview MP3 song online free. Play Eminem X-Posed: The Interview album song MP3 by Eminem and download Eminem X-Posed: The Interview song on renuzap.podarokideal.ru 19 rows · Eminem Interview Title: date: source: Eminem, Back Issues (Cover Story) Interview: . 09/05/ · Lil Wayne has officially launched his own radio show on Apple’s Beats 1 channel. On Friday’s (May 8) episode of Young Money Radio, Tunechi and Eminem Author: VIBE Staff. 07/12/ · EMINEM: It was about having the right to stand up to oppression. I mean, that’s exactly what the people in the military and the people who have given their lives for this country have fought for—for everybody to have a voice and to protest injustices and speak out against shit that’s wrong. Eminem interview with BBC Radio 1 () Eminem interview with MTV () NY Rock interview with Eminem - "It's lonely at the top" () Spin Magazine interview with Eminem - "Chocolate on the inside" () Brian McCollum interview with Eminem - "Fame leaves sour aftertaste" () Eminem Interview with Music - "Oh Yes, It's Shady's Night. Eminem will host a three-hour-long special, “Music To Be Quarantined By”, Apr 28th Eminem StockX Collab To Benefit COVID Solidarity Response Fund. -

Sew What? Inc. Provided Stage Drapery for Grammy Winner Sam Smith’S in the Lonely Hour Tour LOS ANGELES AREA STAGE DRAPERY MANUFACTURER, SEW WHAT? INC

Sew What? Inc. Provided Stage Drapery for Grammy Winner Sam Smith’s In the Lonely Hour Tour LOS ANGELES AREA STAGE DRAPERY MANUFACTURER, SEW WHAT? INC. RECENTLY COMPLETED WORK WITH GRAMMY WINNER SAM Rancho Dominguez, CA SMITH AND HIS TEAM ON STAGE DRAPERY FOR February 18, 2015 SMITH’S SET IN THE LONELY HOUR TOUR. It has been a meteoric rise to the top for British singer and four Grammy winner, Sam Smith. The pop singer began his first arena headlining tour in North America in 2014. By year’s end, Smith found himself nominated for six coveted Grammy Awards, including Best New Artist, Record of the Year, Song of the Year and Best Pop Vocal Album. He ended up taking home all four of the mentioned Grammys. So few would disagree that British singer and songwriter Sam Smith is the current number one tour this season. Los Angeles area stage drapery manufacturer, Sew What? Inc. is also happy to have a small part in it, having recently worked with Smith’s team on their stage drapery used already for his In the Lonely Hour North American tour. In addition, Sew What? Inc. has something of a reputation as well. Megan Duckett, principal at Sew What? reported, "Sew What? was first contacted by Creative Director, Will Potts, as we have a good reputation in the industry and most designers are aware of who we are. " The drapery manufacturer worked on a stage set that was an original design by Will Potts. "Sew What have serviced my design very well, and even performed a top quality and efficient service extending overseas for pre production which was in the UK. -

Avid Congratulates Its Many Customers Nominated for the 57Th Annual GRAMMY(R) Awards

December 10, 2014 Avid Congratulates Its Many Customers Nominated for the 57th Annual GRAMMY(R) Awards Award Nominees Created With the Company's Industry-Leading Music Solutions Include Beyonce's Beyonce, Ed Sheeran's X, and Pharrell Williams' Girl BURLINGTON, Mass., Dec. 10, 2014 (GLOBE NEWSWIRE) -- Avid® (Nasdaq:AVID) today congratulated its many customers recognized as award nominees for the 57th Annual GRAMMY® Awards for their outstanding achievements in the recording arts. The world's most prestigious ceremony for music excellence will honor numerous artists, producers and engineers who have embraced Avid EverywhereTM, using the Avid MediaCentral Platform and Avid Artist Suite creative tools for music production. The ceremony will take place on February 8, 2015 at the Staples Center in Los Angeles, California. Avid audio professionals created Record of the Year and Song of the Year nominees Stay With Me (Darkchild Version) by Sam Smith, Shake It Off by Taylor Swift, and All About That Bass by Meghan Trainor; and Album of the Year nominees Morning Phase by Beck, Beyoncé by Beyoncé, X by Ed Sheeran, In The Lonely Hour by Sam Smith, and Girl by Pharrell Williams. Producer Noah "40" Shebib scored three nominations: Album of the Year and Best Urban Contemporary Album for Beyoncé by Beyoncé, and Best Rap Song for 0 To 100 / The Catch Up by Drake. "This is my first nod for Album Of The Year, and I'm really proud to be among such elite company," he said. "I collaborated with Beyoncé at Jungle City Studios where we created her track Mine using their S5 Fusion. -

Daily Eastern News: March 28, 2003 Eastern Illinois University

Eastern Illinois University The Keep March 2003 3-28-2003 Daily Eastern News: March 28, 2003 Eastern Illinois University Follow this and additional works at: http://thekeep.eiu.edu/den_2003_mar Recommended Citation Eastern Illinois University, "Daily Eastern News: March 28, 2003" (2003). March. 14. http://thekeep.eiu.edu/den_2003_mar/14 This Article is brought to you for free and open access by the 2003 at The Keep. It has been accepted for inclusion in March by an authorized administrator of The Keep. For more information, please contact [email protected]. "Thll the troth March28,2003 + FRIDAY and don't be afraid. • VO LUME 87 . NUMBER 123 THE DA ILYEASTERN NEWS . COM THE DAILY Four for 400 Eastern baseball team has four chances this weekend to earn head coach Jim EASTERN NEWS <:rlh....,,t n his 400th career Student fees may be hiked • Fees may raise $70 next semester By Avian Carrasquillo STUDENT GOVERNMENT ED ITOR If approved students can expect to pay an extra $70.55 in fees per semester. The Student Senate Thition and Fee Review Committee met Thursday to make its final vote on student fees for next year. Following the committee's approval, the fee proposals must be approved by the Student Senate, vice president for student affairs, the President's Council and Eastern's Board of Trustees. The largest increase of the fees will come in the network fee, which will increase to $48 per semester to fund a 10-year network improvement project. The project, which could break ground as early as this summer would upgrade the campus infra structure for network upgrades, which will Tom Akers, head coach of Eastern's track and field team, watches high jumpers during practice Thursday afternoon. -

Eminem 1 Eminem

Eminem 1 Eminem Eminem Eminem performing live at the DJ Hero Party in Los Angeles, June 1, 2009 Background information Birth name Marshall Bruce Mathers III Born October 17, 1972 Saint Joseph, Missouri, U.S. Origin Warren, Michigan, U.S. Genres Hip hop Occupations Rapper Record producer Actor Songwriter Years active 1995–present Labels Interscope, Aftermath Associated acts Dr. Dre, D12, Royce da 5'9", 50 Cent, Obie Trice Website [www.eminem.com www.eminem.com] Marshall Bruce Mathers III (born October 17, 1972),[1] better known by his stage name Eminem, is an American rapper, record producer, and actor. Eminem quickly gained popularity in 1999 with his major-label debut album, The Slim Shady LP, which won a Grammy Award for Best Rap Album. The following album, The Marshall Mathers LP, became the fastest-selling solo album in United States history.[2] It brought Eminem increased popularity, including his own record label, Shady Records, and brought his group project, D12, to mainstream recognition. The Marshall Mathers LP and his third album, The Eminem Show, also won Grammy Awards, making Eminem the first artist to win Best Rap Album for three consecutive LPs. He then won the award again in 2010 for his album Relapse and in 2011 for his album Recovery, giving him a total of 13 Grammys in his career. In 2003, he won the Academy Award for Best Original Song for "Lose Yourself" from the film, 8 Mile, in which he also played the lead. "Lose Yourself" would go on to become the longest running No. 1 hip hop single.[3] Eminem then went on hiatus after touring in 2005. -

UK's Best-Selling Albums Revealed

lifestyle MONDAY, JANUARY 5, 2015 GOSSIP UK’s best-selling albums revealed he UK’s 10 best-selling albums of 2014 album with ‘A Perfect Contradiction’. Geoff were all made by British artists for the Taylor, chief executive of the BPI and Brit Tfirst time ever. Singer/songwriter Ed awards, praised the success of the top three Sheeran topped the list with ‘X’, which sold artists for “catching fire around the world”. The 1.7m copies whilst Sam Smith’s debut LP, ‘In ‘Thinking Out Loud’ hitmaker and the ‘Stay The Lonely Hour’, claimed second spot after With Me’ singer retained their positions of selling 1.25m copies. George Ezra’s first number one and two when it came to the album, ‘Wanted on Voyage’ and Paolo Nutini’s UK’s most-streamed artists, after receiving ‘Caustic Love’ placed third and fourth respec- over one billion streams. One Direction, tively. Other artists to feature in the list Coldplay and Calvin Harris, too, all achieved included Coldplay, One Direction and Take the same feat whilst Mark Ronson and Bruno That. Pink Floyd - who released their first Mars’ track ‘Uptown Funk’ broke the record as album in 20 years in 2014 - placed ninth the most streamed track in a single week. The whilst the only female artist to make the list, number one hit achieved 2.5 million plays in Paloma Faith, had the sixth best-selling the last week of December. Artist albums chart 2014: Most streamed artists 2014: 1. Ed Sheeran, ‘X’ 1. Ed Sheeran 2. Sam Smith, ‘In the Lonely Hour’ 2. -

England Longplay TOP 100 2019 / 31 03.08.2019

03.08.2019 England Longplay TOP 100 2019 / 31 Pos Vorwochen Woc BP T i t e l 2019 / 31 - 1 1 1 --- 21 2 No. 6 Collaborations Project . Ed Sheeran 221101 6 Divinely Uninspired To A Hellish Extent . Lewis Capaldi 3 --- --- 1N3 Freya Ridings . Freya Ridings 434171 3 When We All Fall Asleep, Where Do We Go? . Billie Eilish 5 --- 135 35 Anima . Thom Yorke 666841 28 The Greatest Showman . Motion Picture Cast Recording 7810701 1 Staying At Tamara's . George Ezra 8791251 20 ÷ [Divide] . Ed Sheeran 9107403 Bohemian Rhapsody [Soundtrack] . Queen 10 5 25 421 2 A Star Is Born [Soundtrack] . Lady Gaga & Bradley Cooper . 11 --- --- 1N11 The Great War . Sabaton 12 4 2 41 1 Step Back In Time - The Definitive . Kylie Minogue 13 11 11 895 Diamonds . Elton John 14 --- --- 1N14 Singles Party (1988 - 2019) - The Complete Remestered Singles Collection . Shakespears 15 9 5 2305 Direct Hits 2003 - 2013 . Killers 16 --- --- 1N16 Apollo - Atmospheres & Soundtracks . Brian Eno with Daniel Lanois & Roger Eno 17 13 17 365 50 Years - Don't Stop . Fleetwood Mac 18 14 16 411 1 Always In Between . Jess Glynne 19 16 22 1123 Dua Lipa . Dua Lipa 20 21 52 3820 Snacks . Jax Jones . 21 15 19 211 1 What A Time To Be Alive . Tom Walker 22 20 20 6412 Don't Smile At Me . Billie Eilish 23 22 21 5571 9 1 . The Beatles 24 12 8 61 1 Western Stars . Bruce Springsteen 25 17 33 5417 Erratic Cinematic . Gerry Cinnamon 26 24 27 241 3 Thank U, Next . Ariana Grande 27 18 41 2661 13 X . -

Album the Eminem Show

Album The Eminem Show Curtains Up (Skit) White America Business Cleanin Out My Closet Square Dance The Kiss (skit) Soldier Say Goodbye Hollywood Drips Without Me Paul Rosenberg (Skit) Sing For The Moment Superman Hailie's Song Steve Berman When The Music Stops Say What You Say Till I Collapse My Dad's Gone Crazy Curtain's Close Curtains Up (Skit) - still not avalaible White America Intro America hahaha We love you How many people are proud to be citizens of this beautiful country of ours? The stripes and the stars for the rights of men who have died for the protect? The women and men who have broke their necks for the freedem of speech the United States Government has sworn to uphold Yo, I want everyone to listen to the words of this song Or so we're told... Verse #1 I never woulda dreamed in a million years id see so many mutha fuckin people who feel like me Who share the same views And the same exact beliefs Its like a fuckin army marchin in back of me So many lives i touched So much anger aimed at no perticular direction Just sprays and sprays Straight through your radio wavs It plays and plays Till it stays stuck in your head For days and days who woulda thought standin in this mirror Bleachin my hair wit some Peroxide Reachin for a T shirt to wear That i would catipult to the fore-front of rap like this How can i predict my words And have an impact like this I musta struck a chord wit somebody up in the office Cuz congress keeps tellin me I aint causin nuttin but problems And now they sayin im in trouble wit the government Im lovin -

P36-40 Layout 1

lifestyle WEDNESDAY, NOVEMBER 4, 2015 Gossip Free music becomes top-selling album for singer Sam Hunt am Hunt may be celebrating the one-year anniversary of Hunt put seven songs from the mixtape onto his major a singer. “I felt like I finally found a direction as an artist and ... I his debut album, but most of the songs from label debut, including two songs that eventually topped started writing with a purpose or writing as myself,” he said. “I S“Montevallo” have been living online since 2013. Hunt, Billboard’s Hot Country songs chart (“Leave the Night On,” held that song and never pitched it.” who released “Montevallo” last year, first released a free mix- “House Party”). He also created three new songs - including tape in 2013. Seven of the 10 songs from “Montevallo” were another No. 1 hit “Take Your Time” - and released the 10-track Sophomore superstar originally on his 15-track free album. “I put it out on the “Montevallo” last year. The album has sold more than 810,826 Hunt has started work on his follow-up to “Montevallo,” and Internet for free and the success we had after, that was units and still sits in the Top 25 on the Billboard 200 albums he says there’s some pressure to match the success of his because of the fans,” Hunt said in a recent interview. And more chart. “One of the biggest artists right now in pop music is The debut album. He also said there’s less pressure because he has fans have continued to support the 30-year-old singer, who is Weeknd and I remember being around when his mixtapes been able to succeed in country music with a sound that one of the brightest voices in country music.