IPL Brand Value Scoreboard 2010 Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

On a Sticky Wicket

ON A STICKY WICKET A Concise Report on brand values in the Indian Premier League April 2015 Prepared by: Table of Contents A Concise Report Contents Page No. on brand values in the Indian Premier Foreword: On a sticky wicket 3 League Summary of Brand Values 4 Coming of age of the IPL 5 Taking it on the chin! 7 Understanding Brand Value in the IPL 9 Valuation Approach and Methodology 12 Conclusion 13 Duff & Phelps India Private Limited 2 Preface On a sticky wicket Dear Readers, If news reports are true, IPL advertising rates are also expected It gives me great pleasure in to see a 10% - 15% increase for the welcoming you to the latest edition of current season and even higher for our annual study of brand values in the final stages of the tournament as the Indian Premier League. inventories are sought by a host of It goes without saying that it has interested takers. It is no surprise, been a tumultuous year for the IPL, then, that the overall brand value of one characterised by an almost various franchises has increased by expected bit of controversy and 6% over last year and the value of intrigue. Over the years, we have the IPL as a business has increased seen multiple instances of scandals to USD 3.5 billion from USD 3.2 surrounding the premier sporting billion last year. Clearly, the IPL is on Varun Gupta event of the country, but in almost a sticky wicket but it is still not out. Managing Director every single year, the IPL has come out stronger and more popular than As an aside, we are happy to American Appraisal India before. -

IPL 2014 Schedule

Page: 1/6 IPL 2014 Schedule Mumbai Indians vs Kolkata Knight Riders 1st IPL Sheikh Zayed Stadium, Abu Dhabi Apr 16, 2014 | 18:30 local | 14:30 GMT Delhi Daredevils vs Royal Challengers Bangalore 2nd IPL Sharjah Cricket Association Stadium, Sharjah Apr 17, 2014 | 18:30 local | 14:30 GMT Chennai Super Kings vs Kings XI Punjab 3rd IPL Sheikh Zayed Stadium, Abu Dhabi Apr 18, 2014 | 14:30 local | 10:30 GMT Sunrisers Hyderabad vs Rajasthan Royals 4th IPL Sheikh Zayed Stadium, Abu Dhabi Apr 18, 2014 | 18:30 local | 14:30 GMT Royal Challengers Bangalore vs Mumbai Indians 5th IPL Dubai International Cricket Stadium, Dubai Apr 19, 2014 | 14:30 local | 10:30 GMT Kolkata Knight Riders vs Delhi Daredevils 6th IPL Dubai International Cricket Stadium, Dubai Apr 19, 2014 | 18:30 local | 14:30 GMT Rajasthan Royals vs Kings XI Punjab 7th IPL Sharjah Cricket Association Stadium, Sharjah Apr 20, 2014 | 18:30 local | 14:30 GMT Chennai Super Kings vs Delhi Daredevils 8th IPL Sheikh Zayed Stadium, Abu Dhabi Apr 21, 2014 | 18:30 local | 14:30 GMT Kings XI Punjab vs Sunrisers Hyderabad 9th IPL Sharjah Cricket Association Stadium, Sharjah Apr 22, 2014 | 18:30 local | 14:30 GMT Rajasthan Royals vs Chennai Super Kings 10th IPL Dubai International Cricket Stadium, Dubai Apr 23, 2014 | 18:30 local | 14:30 GMT Royal Challengers Bangalore vs Kolkata Knight Riders Page: 2/6 11th IPL Sharjah Cricket Association Stadium, Sharjah Apr 24, 2014 | 18:30 local | 14:30 GMT Sunrisers Hyderabad vs Delhi Daredevils 12th IPL Dubai International Cricket Stadium, Dubai Apr 25, 2014 -

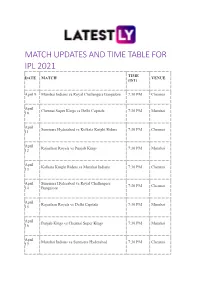

Match Updates and Time Table for Ipl 2021 Time Date Match Venue (Ist)

MATCH UPDATES AND TIME TABLE FOR IPL 2021 TIME DATE MATCH VENUE (IST) April 9 Mumbai Indians vs Royal Challengers Bangalore 7:30 PM Chennai April Chennai Super Kings vs Delhi Capitals 7:30 PM Mumbai 10 April Sunrisers Hyderabad vs Kolkata Knight Riders 7:30 PM Chennai 11 April Rajasthan Royals vs Punjab Kings 7:30 PM Mumbai 12 April Kolkata Knight Riders vs Mumbai Indians 7:30 PM Chennai 13 April Sunrisers Hyderabad vs Royal Challengers 7:30 PM Chennai 14 Bangalore April Rajasthan Royals vs Delhi Capitals 7:30 PM Mumbai 15 April Punjab Kings vs Chennai Super Kings 7:30 PM Mumbai 16 April Mumbai Indians vs Sunrisers Hyderabad 7:30 PM Chennai 17 April Royal Challengers Bangalore vs Kolkata Knight 3:30 PM Chennai 18 Riders April Delhi Capitals vs Punjab Kings 7:30 PM Mumbai 18 April Chennai Super Kings vs Rajasthan Royals 7:30 PM Mumbai 19 April Delhi Capitals vs Mumbai Indians 7:30 PM Chennai 20 April Punjab Kings vs Sunrisers Hyderabad 3:30 PM Chennai 21 April Kolkata Knight Riders vs Chennai Super Kings 7:30 PM Mumbai 21 April Royal Challengers Bangalore vs Rajasthan Royals 7:30 PM Mumbai 22 April Punjab Kings vs Mumbai Indians 7:30 PM Chennai 23 April Rajasthan Royals vs Kolkata Knight Riders 7:30 PM Mumbai 24 April Chennai Super Kings vs Royal Challengers 3:30 PM Mumbai 25 Bangalore April Sunrisers Hyderabad vs Delhi Capitals 7:30 PM Chennai 25 April Punjab Kings vs Kolkata Knight Riders 7:30 PM Ahmedabad 26 April Delhi Capitals vs Royal Challengers Bangalore 7:30 PM Ahmedabad 27 April Chennai Super Kings vs Sunrisers Hyderabad 7:30 -

Date Match Venue Time 7 April Mumbai Indians Vs Chennai Super Kings Mumbai 8:00 PM 8 April Delhi Daredevils Vs Kings XI Punjab D

Date Match Venue Time Sportskeeda 7 April Mumbai Indians vs Chennai Super Kings Mumbai 8:00 PM 8 April Delhi Daredevils vs Kings XI Punjab Delhi 4:00 PM 8 April Kolkata Knight Riders vs Royal Challengers Bangalore Kolkata 8:00 PM 9 April Sunrisers Hyderabad vs Rajasthan Royals Hyderabad 8:00 PM 10 April Chennai Super Kings vs Kolkata Knight Riders Chennai 8:00 PM 11 April Rajasthan Royals vs Delhi Daredevils Jaipur 8:00 PM 12 April Sunrisers Hyderabad vs Mumbai Indians Hyderabad 8:00 PM 13 April Royal Challengers Bangalore vs Kings XI Punjab Bangalore 8:00 PM 14 April Mumbai Indians vs Delhi Daredevils Mumbai 4:00 PM 14 April Kolkata Knight Riders vs Sunrisers Hyderabad Kolkata 8:00 PM 15 April Royal Challengers Bangalore vs Rajasthan Royals Bangalore 4:00 PM 15 April Kings XI Punjab vs Chennai Super Kings Indore 8:00 PM 16 April Kolkata Knight Riders vs Delhi Daredevils Kolkata 8:00 PM 17 April Mumbai Indians vs Royal Challengers Bangalore Mumbai 8:00 PM 18 April Rajasthan Royals vs Kolkata Knight Riders Jaipur 8:00 PM 19 April Kings XI Punjab vs Sunrisers Hyderabad Indore 8:00 PM 20 April Chennai Super Kings vs Rajasthan Royals Chennai 8:00 PM 21 April Kolkata Knight Riders vs Kings XI Punjab Kolkata 4:00 PM 21 April Delhi Daredevils vs Royal Challengers Bangalore Delhi 8:00 PM 22 April Sunrisers Hyderabad vs Chennai Super Kings Hyderabad 4:00 PM 22 April Rajasthan Royals vs Mumbai Indians Jaipur 8:00 PM 23 April Kings XI Punjab vs Delhi Daredevils Indore 8:00 PM 24 April Mumbai Indians vs Sunrisers Hyderabad Mumbai 8:00 PM 25 April -

KKR Is the IPL's Most Valuable Brand, Despite Missing out on Title

Press Release: For Immediate Release KKR is the IPL’s Most Valuable Brand, Despite Missing Out on Title Kolkata Knight Riders is the IPL’s most valuable brand, worth US$58.6 million Mumbai Indians has the most powerful brand Royal Challengers Bangalore’s is the only brand to fall in rank The business value of the IPL system grows 9% to US$3.8 billion Since 2009, leading valuation and strategy consultancy Brand Finance has calculated both the business value of the Indian Premier League system and the brand values of each individual franchise team, providing a deep understanding of the opportunities and challenges facing the teams and the IPL system as a whole. View the ranking of the IPL's most valuable team brands here With a brand value of US$58.6 million and the fastest growth year to year of 24%, Kolkata Knight Riders (KKR) top the Brand Finance IPL league table for the second year in a row. Despite missing out on the title, KKR has continues to consistent qualify for the playoff stages. The team has displayed strong leadership skills, team bonding, and a clear approach to composition and winning tactics. This year, however, surprising player choices in the playoffs did not pay off as KKR lost to Mumbai Indians in the second qualifier. KKR has its owner Shakh Rukh Khan to thank for a larger part of its popular appeal. The Bollywood superstar attracts incredible media attention and fan following, acting as an icon for the entire franchise. Depending heavily on Khan’s personal brand equity and connections, KKR lands a host of local and national sponsorships and has been one of the first to introduce an effective merchandising strategy. -

Indian Premier League 2013

Indian Premier League 2013 Tue Apr 23 31st Match - Royal Challengers Bangalore vs Pune Warriors. 03:20 PDT M Chinnaswamy Stadium, Bangalore Tue Apr 23 32nd Match - Delhi Daredevils vs Kings XI Punjab. 07:20 PDT Feroz Shah Kotla, Delhi Wed Apr 24 33rd Match - Kolkata Knight Riders vs Mumbai Indians. 07:20 PDT Eden Gardens, Kolkata Thu Apr 25 34th Match - Chennai Super Kings vs Sunrisers Hyderabad. 07:20 PDT MA Chidambaram Stadium, Chepauk, Chennai Fri Apr 26 35th Match - Kolkata Knight Riders vs Kings XI Punjab. 07:30 PDT Eden Gardens, Kolkata Sat Apr 27 36th Match - Rajasthan Royals vs Sunrisers Hyderabad. 03:30 PDT Sawai Mansingh Stadium, Jaipur Sat Apr 27 37th Match - Mumbai Indians vs Royal Challengers Bangalore. 07:30 PDT Wankhede Stadium, Mumbai Sun Apr 28 38th Match - Chennai Super Kings vs Kolkata Knight Riders. 03:30 PDT MA Chidambaram Stadium, Chepauk, Chennai Sun Apr 28 39th Match - Delhi Daredevils vs Pune Warriors. 07:30 PDT International Cricket Stadium, Raipur Mon Apr 29 40th Match - Rajasthan Royals vs Royal Challengers Bangalore. 03:30 PDT Sawai Mansingh Stadium, Jaipur Mon Apr 29 41st Match - Mumbai Indians vs Kings XI Punjab. 07:30 PDT Wankhede Stadium, Mumbai Tue Apr 30 42nd Match - Pune Warriors vs Chennai Super Kings. 07:30 PDT Subrata Roy Sahara Stadium, Pune Wed May 1 43rd Match - Sunrisers Hyderabad vs Mumbai Indians. 03:30 PDT Rajiv Gandhi International Stadium, Uppal. Hyderabad Wed May 1 44th Match - Delhi Daredevils vs Kolkata Knight Riders. 07:30 PDT International Cricket Stadium, Raipur Thu May 2 45th Match - Chennai Super Kings vs Kings XI Punjab. -

Indiawin Sports Private Limited 1

INDIAWIN SPORTS PRIVATE LIMITED 1 Indiawin Sports Private Limited Financial Statements 2018-19 2 INDIAWIN SPORTS PRIVATE LIMITED Independent Auditor’s Report To the Members of INDIAWIN SPORTS PRIVATE LIMITED Report on the Audit of Financial Statements Opinion We have audited the accompanying financial statements of INDIAWIN SPORTS PRIVATE LIMITED (“the Company”), which comprise the Balance Sheet as at March 31, 2019, the Statement of Profit and Loss, including the statement of Other Comprehensive Income, the Cash Flow Statement and the Statement of Changes in Equity for the year then ended, and notes to the financial statements including a summary of significant accounting policies and other explanatory information (hereinafter referred to as “Financial Statements”). In our opinion and to the best of our information and according to the explanations given to us, the aforesaid financial statements give the information required by the Companies Act, 2013 (“ the Act”) in the manner so required and give a true and fair view in conformity with the Indian Accounting Standards prescribed under Section 133 of the Act read with the Companies (Indian Accounting Standards) Rules, 2015, as amended, (“Ind AS”) and other accounting principles generally accepted in India, of the state of affairs of the Company as at March 31, 2019 , its Profit including Other Comprehensive Income, its Cash Flows and the Statement of Changes in Equity for the year ended on that date. Basis for Opinion We conducted our audit in accordance with the Standards on Auditing (“SA”) specified under Section 143(10) of the Act. Our responsibilities under those Standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. -

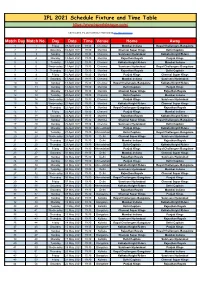

IPL 2021 Schedule Fixture and Time Table

IPL 2021 Schedule Fixture and Time Table https://www.isportsleague.com/ Check Latest IPL 2021 Schedule Now only at IPL 2021 Schedule Match Day Match No. Day Date Time Venue Home Away 1 1 Friday 09 April 2021 19:30 Chennai Mumbai Indians Royal Challengers Bangalore 2 2 Saturday 10 April 2021 19:30 Mumbai Chennai Super Kings Delhi Capitals 3 3 Sunday 11 April 2021 19:30 Chennai Sunrisers Hyderabad Kolkata Knight Riders 4 4 Monday 12 April 2021 19:30 Mumbai Rajasthan Royals Punjab Kings 5 5 Tuesday 13 April 2021 19:30 Chennai Kolkata Knight Riders Mumbai Indians 6 6 Wednesday 14 April 2021 19:30 Chennai Sunrisers Hyderabad Royal Challengers Bangalore 7 7 Thursday 15 April 2021 19:30 Mumbai Rajasthan Royals Delhi Capitals 8 8 Friday 16 April 2021 19:30 Mumbai Punjab Kings Chennai Super Kings 9 9 Saturday 17 April 2021 19:30 Chennai Mumbai Indians Sunrisers Hyderabad 10 10 Sunday 18 April 2021 15:30 Chennai Royal Challengers Bangalore Kolkata Knight Riders 10 11 Sunday 18 April 2021 19:30 Mumbai Delhi Capitals Punjab Kings 11 12 Monday 19 April 2021 19:30 Mumbai Chennai Super Kings Rajasthan Royals 12 13 Tuesday 20 April 2021 19:30 Chennai Delhi Capitals Mumbai Indians 13 14 Wednesday 21 April 2021 15:30 Chennai Punjab Kings Sunrisers Hyderabad 13 15 Wednesday 21 April 2021 19:30 Mumbai Kolkata Knight Riders Chennai Super Kings 14 16 Thursday 22 April 2021 19:30 Mumbai Royal Challengers Bangalore Rajasthan Royals 15 17 Friday 23 April 2021 19:30 Chennai Punjab Kings Mumbai Indians 16 18 Saturday 24 April 2021 19:30 Mumbai Rajasthan Royals -

Indian Premier League

Indian Premier League From Wikipedia, the free encyclopedia Indian Premier League Countries India Administrator BCCI Format Twenty20 First tournament 2008 Next tournament 2013 Tournament format Double round-robin andplayoffs Number of teams 9 Current champion Kolkata Knight Riders (1st Title) Most successful Chennai Super Kings (2 Titles) Qualification Champions League Twenty20 Most runs Suresh Raina(2254,Chennai Super Kings)[1] Most wickets Lasith Malinga (83, Mumbai Indians)[2] Website iplt20.com 2013 Indian Premier League Chennai Super Kings playing against Kolkata Knight Riders at the M.A. Chidambaram Cricket Stadium in the 2008 Indian Premier League Delhi Daredevils Vs Kings XI Punjab. The Indian Premier League (IPL) is a professional league for Twenty20 cricket championship in India. It was initiated by Lalit Modi , who served as the league's first Chairman and Commissioner and Board of Control for Cricket in India (BCCI), headquartered in Mumbai, Maharashtra[3][4] and is supervised by BCCI Vice President Rajeev Shukla,[5] who serves as the league's Chairman and Commissioner. It is currently contested by nine teams, consisting of players from around the cricketing world. It was started after an altercation between the BCCI and the Indian Cricket League.[6] In 2010, IPL became the first sporting event ever to be broadcast live on YouTube.[7] Its brand value is estimated to be around US$2.99 billion in fifth season.[8] However, the league has been engulfed by series of corruption scandals where allegations of cricket betting, money laundering and spot fixing were witnessed.[9][10] The Premier League is generally considered to be the world's showcase for Twenty20 cricket, a shorter format of cricket consisting only 20 overs. -

NIGHT MATCH DAY MATCH Date Game No. Teams Venue Fri, 12Th

NIGHT MATCH DAY MATCH Date Game No. Teams Venue Fri, 12th March 1 Deccan Chargers vs Kolkata Knight Riders Hyderabad Sat, 13th March 2 Mumbai Indians vs Rajasthan Royals Mumbai Sat, 13th March 3 Kings XI Punjab vs Delhi Daredevils Mohali Sun, 14th March 4 Kolkata Knight Riders vs Royal Challengers Bangalore Kolkata Sun, 14th March 5 Chennai Super Kings vs Deccan Chargers Chennai Mon, 15th March 6 Rajasthan Royals vs Delhi Daredevils Ahmedabad Tues, 16th March 7 Royal Challengers Bangalore vs Kings XI Punjab Bengaluru Tues, 16th March 8 Kolkata Knight Riders vs Chennai Super Kings Kolkata Wed, 17th March 9 Delhi Daredevils vs Mumbai Indians Delhi Thurs, 18th March 10 Royal Challengers Bangalore vs Rajasthan Royals Bengaluru Fri, 19th March 11 Delhi Daredevils vs Chennai Super Kings Delhi Fri, 19th March 12 Deccan Chargers vs Kings XI Punjab Vizag Sat, 20th March 13 Rajasthan Royals vs Kolkata Knight Riders Ahmedabad Sat, 20th March 14 Mumbai Indians vs Royal Challengers Bangalore Mumbai Sun, 21st March 15 Deccan Chargers vs Delhi Daredevils Vizag Sun, 21st March 16 Chennai Super Kings vs Kings XI Punjab Chennai Mon, 22nd March 17 Mumbai Indians vs Kolkata Knight Riders Mumbai Tues, 23rd March 18 Royal Challengers Bangalore vs Chennai Super Kings Bengaluru Wed, 24th March 19 Kings XI Punjab vs Rajasthan Royals Mohali Thurs, 25th March 20 Mumbai Indians vs Chennai Super Kings Mumbai Fri, 26th March 21 Rajasthan Royals vs Deccan Chargers Ahmedabad Sat, 27th March 22 Kings XI Punjab vs Kolkata Knight Riders Mohali Sat, 27th March 23 Royal -

Study of Branding and Marketing in the Indian Premier League

International Journal of Humanities and Social Science Invention (IJHSSI) ISSN (Online): 2319 – 7722, ISSN (Print): 2319 – 7714 www.ijhssi.org ||Volume 9 Issue 12 Ser. I || December 2020 || PP 43-48 Criconomics: Study of Branding and Marketing in the Indian Premier League Shubhang Gopal1, Purshottam Kandhari2 1 Department of Information Technology, Delhi Technological University, Delhi, India 2 Department of Electrical Engineering, Delhi Technological University, Delhi, India ABSTRACT—Indian Premiere League, an enthralling sporting extravaganza jam-packed with glitter, glamour and entertainment quotient, has turned out to be one of the most successful advertising and branding platform for various brands. IPL, a billion-dollar business in India has created a union of commercial interest and political power to capture a viewership of audience all across the globe. The purpose of this paper is to understand the marketing strategies, branding techniques and financial model of the most eminent cricket competition – the Indian Premier League. Understanding the economics of the most successful business model that features every year and studying the feasibility from advertiser’s point of view that views IPL as a golden marketing opportunity. KEYWORDS- Cricket Branding, Financial Model, Indian Premier League, Sports Marketing, Sponsorship, Advertising --------------------------------------------------------------------------------------------------------------------------------------- Date of Submission: 08-12-2020 Date of Acceptance: 24-12-2020 -

IPL 2021 Schedule

IPL 2021 Schedule (Sydney, Melbourne EST Time zone) Date & Day Match Time Venue (EST) April 10, Saturday Mumbai Indians vs Royal Challengers Bangalore 12:00 AM Chennai April 11, Sunday Chennai Super Kings vs Delhi Capitals 12:00 AM Mumbai April 12, Monday Sunrisers Hyderabad vs Kolkata Knight Riders 12:00 AM Chennai April 13, Tuesday Rajasthan Royals vs Punjab Kings 12:00 AM Mumbai April 14, Wednesday Kolkata Knight Riders vs Mumbai Indians 12:00 AM Chennai April 15, Thursday Sunrisers Hyderabad vs Royal Challengers 12:00 AM Chennai Bangalore April 16, Friday Rajasthan Royals vs Delhi Capitals 12:00 AM Mumbai April 17, Saturday Punjab Kings vs Chennai Super Kings 12:00 AM Mumbai April 18, Sunday Mumbai Indians vs Sunrisers Hyderabad 12:00 AM Chennai April 19, Monday Royal Challengers Bangalore vs Kolkata Knight 12:00 AM Chennai Rider April 19, Monday Delhi Capitals vs Punjab Kings 12:00 AM Mumbai April 20, Tuesday Chennai Super Kings vs Rajasthan Royals 12:00 AM Mumbai April 21, Wednesday Delhi Capitals vs Mumbai Indians 12:00 AM Chennai April 21, Wednesday Punjab Kings vs Sunrisers Hyderabad 8:00 PM Chennai April 22, Thursday Kolkata Knight Riders vs Chennai Super Kings 12:00 AM Mumbai April 23, Friday Royal Challengers Bangalore vs Rajasthan Royals 12:00 AM Mumbai April 24, Saturday Punjab Kings vs Mumbai Indians 12:00 AM Chennai April 25, Sunday Rajasthan Royals vs Kolkata Knight Riders 12:00 AM Mumbai April 25, Sunday Chennai Super Kings vs Royal Challengers 8:00 PM Mumbai Bangalore April 26, Monday Sunrisers Hyderabad vs Delhi Capitals