KKR Is the IPL's Most Valuable Brand, Despite Missing out on Title

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Captain Cool: the MS Dhoni Story

Captain Cool The MS Dhoni Story GULU Ezekiel is one of India’s best known sports writers and authors with nearly forty years of experience in print, TV, radio and internet. He has previously been Sports Editor at Asian Age, NDTV and indya.com and is the author of over a dozen sports books on cricket, the Olympics and table tennis. Gulu has also contributed extensively to sports books published from India, England and Australia and has written for over a hundred publications worldwide since his first article was published in 1980. Based in New Delhi from 1991, in August 2001 Gulu launched GE Features, a features and syndication service which has syndicated columns by Sir Richard Hadlee and Jacques Kallis (cricket) Mahesh Bhupathi (tennis) and Ajit Pal Singh (hockey) among others. He is also a familiar face on TV where he is a guest expert on numerous Indian news channels as well as on foreign channels and radio stations. This is his first book for Westland Limited and is the fourth revised and updated edition of the book first published in September 2008 and follows the third edition released in September 2013. Website: www.guluzekiel.com Twitter: @gulu1959 First Published by Westland Publications Private Limited in 2008 61, 2nd Floor, Silverline Building, Alapakkam Main Road, Maduravoyal, Chennai 600095 Westland and the Westland logo are the trademarks of Westland Publications Private Limited, or its affiliates. Text Copyright © Gulu Ezekiel, 2008 ISBN: 9788193655641 The views and opinions expressed in this work are the author’s own and the facts are as reported by him, and the publisher is in no way liable for the same. -

Page 01 Jan 06.Indd

SATURDAY 6 JANUARY 2018 21 I’m feeling pretty good. I’m SPORT Australian tennis star hitting the ball well and I’m Today at 6.00pm. serving really well. So the first Nick Kyrgios after setting up a semi-final Men’s singles final two matches of the year, I’ve got against Grigor Dimitrov at the At Khalifa International Tennis through two tough three-setters. Brisbane International and Squash Complex Kohli earns record $2.7m Khawaja, Smith bat well after salary for 2018 IPL England post 346 at the SCG campaign AFP REUTERS our team so we don’t have to bowl at him,” Australia fast NEW DELHI: Batting star SYDNEY: Australia captain Steve bowler Pat Cummins said of his Virat Kohli will pick up the Smith continued to be England’s captain. Indian Premier League’s Ashes nemesis yesterday as he “You lose a couple of wickets largest-ever salary -- $2.7m passed 6,000 Test runs in an and he comes out to bat. He’s just -- in this year’s tournament, unbeaten knock of 44 to help his incredible, I think he’s been the with a host of big foreign team to 193 for two at close of real difference between the two names including Australian play on the second day of the sides.” captain Steve Smith also fifth Test. The tourists, 3-0 down in cashing in. The world’s top ranked the series with the urn already Kohli will stay with Royal batsman and Usman Khawaja relinquished, earlier posted a Challengers Bangalore along- batted through the final session competitive tally in the face of side South Africa’s AB de Vil- in a 107-run partnership after some fearsome pace bowling on liers, who will earn $1.7m in openers Cameron Bancroft and the back of a hard wagging tail the cash-rich event started by David Warner had departed ear- and some poor Australian the Indian cricket board in lier in Australia’s reply to Eng- catching. -

Page10sports.Qxd (Page 1)

THURSDAY, MAY 11, 2017 (PAGE 10) DAILY EXCELSIOR, JAMMU Iyer’s IPL best seals narrow Manohar set to complete his full Djokovic surives scare to start new era MADRID, May 10: champion as despite losing his However, the 14-time Grand term as ICC Chairman service in the opening game, he Slam champion has a difficult Novak Djokovic staved off a broke straight back to start a six- route to that potential matchup as win for Daredevils NEW DELHI, May 10: very recently he has had a huge upset in his first match game streak to romp through the he faces Fabio Fognini later on KANPUR, May 10: missal for Pant, who was Earlier, Finch got good sup- change of heart. since splitting with his long-time first set. Wednesday and potentially Nick already in pain after being hit port from Karthik after Lions The uncertainty looming The Nagpur lawyer now has coaching team to beat Nicolas Almagro had taken just one Kyrgios in the third round. Shreyas Iyer scripted a sen- on the thumb while collecting were reduced to 56 for three in large over Shashank Manohar's a strong ground after both the Almagro 6-1, 4-6, 7-5 in the sec- set from four previous meetings Controversial Australian sational two-wicket win for a throw from the deep in Lions the seventh over. tenure as ICC chairman ended proposed new revenue and gov- ond round of the Madrid Masters with Djokovic, but willed on by a Kyrgios cruised past American Delhi Daredevils with a classy innings. -

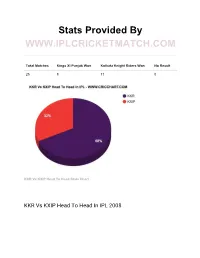

KKR Vs KXIP Head to Head Stats Chart

Stats Provided By WWW.IPLCRICKETMATCH.COM Total Matches Kings XI Punjab Won Kolkata Knight Riders Won No Result 25 8 17 0 KKR Vs KXIP Head To Head Stats Chart KKR Vs KXIP Head To Head In IPL 2008 Match Match Winner Date Type Match Venue Kings XI Punjab Won By 9 03-05-200 League Punjab Cricket Association Stadium, Runs 8 Mohali, Chandigarh Kolkata Knight Riders Won 25-05-200 League Eden Gardens, Kolkata By 3 Wickets 8 KXIP Vs KKR In IPL 2009 Winner Match Date Match Type Match Venue Kolkata Knight Riders Won By 11 21-04-2009 League Kingsmead, Durban Runs Kings XI Punjab Won By 6 Wickets 03-05-2009 League St George’s Park, Port Elizabeth IPL 2010 – Kings XI Vs Knight Riders Match Match Winner Date Type Match Venue Kolkata Knight Riders Won 27-03-201 League Punjab Cricket Association Stadium, By 39 Runs 0 Mohali, Chandigarh Kings XI Punjab Won By 8 04-04-201 League Eden Gardens, Kolkata Wickets 0 Knight Riders Vs Kings 11 In IPL 2011 Winner Match Date Match Type Match Venue Kolkata Knight Riders Won By 8 30-04-2011 League Eden Gardens, Kolkata Wickets Kings XI Punjab Vs Kolkata Knight Riders Head To Head In IPL 2012 Match Match Winner Date Type Match Venue Kings XI Punjab Won By 2 15-04-201 League Eden Gardens, Kolkata Runs 2 Kolkata Knight Riders Won 18-04-201 League Punjab Cricket Association Stadium, By 8 Wickets 2 Mohali, Chandigarh Kolkata Knight Riders Vs Kings XI Punjab In IPL 2013 Match Match Winner Date Type Match Venue Kings XI Punjab Won By 4 16-04-201 League Punjab Cricket Association Stadium, Runs 3 Mohali, Chandigarh Kolkata -

Indian Premier League 2019

VVS LAXMAN Published 3.4.19 The last ten days have reiterated just how significant a place the Indian Premier League has carved for itself on the cricke�ng landscape. Spectacular ac�on and stunning performances have brought the tournament to life right from the beginning, and I expect the next six weeks to be no less gripping. From our point of view, I am delighted at how well Hyderabad have bounced back from defeat in our opening match, against Kolkata. Even in that game, we were in control �ll the end of the 17th over of the chase, but Andre Russell took it away from us with brilliant ball-striking. Even though I was in the opposi�on dugout, I couldn’t help but marvel at how he snatched victory from the jaws of defeat. The beauty of our franchise is that the shoulders never droop, the heads never drop. There is too much experience, quality and class among the playing group for that to happen. As members of the support staff, our endeavour is to keep the players in a good mental space. But eventually, it is the players who have to deliver on the park, and that’s what they have done in the last two games. David Warner has been outstanding. There is li�le sign that he has been out of interna�onal cricket for a year. His work ethics are exemplary, and I can see the hunger and desire in his eyes. He is striking the ball as beau�fully as ever, and there is a calmness about him that is infec�ous. -

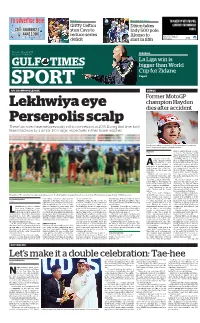

Lekhwiya Eye Dies Aft Er Accident Persepolis Scalp These Two Sides Have Met Previously in This Competition, in 2015

NBA | Page 5 MOTORSPORT | Page 6 Gritty Celtics Dixon takes stun Cavs to Indy 500 pole, reduce series Alonso to defi cit start in fi ft h Tuesday, May 23, 2017 FOOTBALL Sha’baan 27, 1438 AH La Liga win is GULF TIMES bigger than World Cup for Zidane SPORT Page 3 AFC CHAMPIONS LEAGUE DEMISE Former MotoGP champion Hayden Lekhwiya eye dies aft er accident Persepolis scalp These two sides have met previously in this competition, in 2015. During that time, both teams had won by a similar 3-0 margin respectively in their home matches This file photo taken on January 10, 2012 shows former Ducati rider Nicky Haiden during a press conference in Italy. Agencies rider to achieve the feat – before Rome a move to the MotoGP World Championship for 2003. He took two podiums that year, at Motegi merican former Mo- and Phillip Island, as a rookie. toGP champion Nicky More podiums followed in 2004 hayden hit by a car in before Hayden took his fi rst pole a bicycle accident in and Grand Prix victory at Laguna AItaly last week, has died of severe Seca in 2005. The following year, brain damage, the Italian hos- the “Kentucky Kid” became the pital where he was treated said MotoGP World Champion as he yesterday. beat Valentino Rossi to the pre- Hayden, 36, who won the mier class crown, securing the 2006 MotoGP world title, suf- title in the last round of the year fered severe chest and head inju- in Valencia. ries in the accident, which hap- He moved to Ducati in 2009 pened while he was training on and, later, the Aspar team, be- his bicycle in central Italy, south fore racing his last full season of the seaside resort of Rimini. -

Kohli ANI London

14 Thursday, August 12, 2021 Sports ENGLAND-INDIA 2ND TEST AT LORD’S FROM TODAY Whenever Pant thinks he can change the game, he will take chances: Kohli ANI LONDON INDIA skipper Virat Kohli on Wednesday said wicketkeep- er-batsman Rishabh Pant will always take his chances when he feels he can change the complexion of the game with his intent and skill. The first Test between In- dia and England ended in a draw after rain played spoil- sport on the final day of the Test. The visitors looked set Bianca Andreescu of Canada reacts as she wins a point during her for victory, needing 157 runs women’s singles second round match against Harriet Dart of Britain to win on the final day, with on Day Two of the National Bank Open at IGA Stadium on Tuesday in nine wickets in hand, but the Montreal, Canada. (GETTY IMagES/AFP) weather gods had something else in mind. Pant had played a quickfire cameo in the first Andreescu makes innings, but he was not able to march ahead. “That is basically how he winning return, plays. He has the capability to carry on and play a long in- nings in that manner. It nec- Muguruza and cessarily does not have to be a very defensive role, when there is demand of the situa- Mertens upset tion, he is intelligent enough to understand. If we are look- DPA lay to cruise past 2013 finalist ing to save a game, you would BERLIN Sorana Cirstea 6-2 6-2 in the not see him play those kind final match of the day. -

On a Sticky Wicket

ON A STICKY WICKET A Concise Report on brand values in the Indian Premier League April 2015 Prepared by: Table of Contents A Concise Report Contents Page No. on brand values in the Indian Premier Foreword: On a sticky wicket 3 League Summary of Brand Values 4 Coming of age of the IPL 5 Taking it on the chin! 7 Understanding Brand Value in the IPL 9 Valuation Approach and Methodology 12 Conclusion 13 Duff & Phelps India Private Limited 2 Preface On a sticky wicket Dear Readers, If news reports are true, IPL advertising rates are also expected It gives me great pleasure in to see a 10% - 15% increase for the welcoming you to the latest edition of current season and even higher for our annual study of brand values in the final stages of the tournament as the Indian Premier League. inventories are sought by a host of It goes without saying that it has interested takers. It is no surprise, been a tumultuous year for the IPL, then, that the overall brand value of one characterised by an almost various franchises has increased by expected bit of controversy and 6% over last year and the value of intrigue. Over the years, we have the IPL as a business has increased seen multiple instances of scandals to USD 3.5 billion from USD 3.2 surrounding the premier sporting billion last year. Clearly, the IPL is on Varun Gupta event of the country, but in almost a sticky wicket but it is still not out. Managing Director every single year, the IPL has come out stronger and more popular than As an aside, we are happy to American Appraisal India before. -

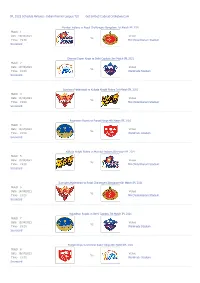

IPL 2014 Schedule

Page: 1/6 IPL 2014 Schedule Mumbai Indians vs Kolkata Knight Riders 1st IPL Sheikh Zayed Stadium, Abu Dhabi Apr 16, 2014 | 18:30 local | 14:30 GMT Delhi Daredevils vs Royal Challengers Bangalore 2nd IPL Sharjah Cricket Association Stadium, Sharjah Apr 17, 2014 | 18:30 local | 14:30 GMT Chennai Super Kings vs Kings XI Punjab 3rd IPL Sheikh Zayed Stadium, Abu Dhabi Apr 18, 2014 | 14:30 local | 10:30 GMT Sunrisers Hyderabad vs Rajasthan Royals 4th IPL Sheikh Zayed Stadium, Abu Dhabi Apr 18, 2014 | 18:30 local | 14:30 GMT Royal Challengers Bangalore vs Mumbai Indians 5th IPL Dubai International Cricket Stadium, Dubai Apr 19, 2014 | 14:30 local | 10:30 GMT Kolkata Knight Riders vs Delhi Daredevils 6th IPL Dubai International Cricket Stadium, Dubai Apr 19, 2014 | 18:30 local | 14:30 GMT Rajasthan Royals vs Kings XI Punjab 7th IPL Sharjah Cricket Association Stadium, Sharjah Apr 20, 2014 | 18:30 local | 14:30 GMT Chennai Super Kings vs Delhi Daredevils 8th IPL Sheikh Zayed Stadium, Abu Dhabi Apr 21, 2014 | 18:30 local | 14:30 GMT Kings XI Punjab vs Sunrisers Hyderabad 9th IPL Sharjah Cricket Association Stadium, Sharjah Apr 22, 2014 | 18:30 local | 14:30 GMT Rajasthan Royals vs Chennai Super Kings 10th IPL Dubai International Cricket Stadium, Dubai Apr 23, 2014 | 18:30 local | 14:30 GMT Royal Challengers Bangalore vs Kolkata Knight Riders Page: 2/6 11th IPL Sharjah Cricket Association Stadium, Sharjah Apr 24, 2014 | 18:30 local | 14:30 GMT Sunrisers Hyderabad vs Delhi Daredevils 12th IPL Dubai International Cricket Stadium, Dubai Apr 25, 2014 -

IPL 2021 Schedule Get Embed Code at Cricketwa.Com

IPL 2021 Schedule Fixtures - Indian Premier League T20 Get Embed Code at Cricketwa.Com Mumbai Indians vs Royal Challengers Bangalore 1st Match IPL 2021 Match 1 Date 09/04/2021 Venue Vs Time- 19:00 MA Chidambaram Stadium Scorecard Chennai Super Kings vs Delhi Capitals 2nd Match IPL 2021 Match 2 Date 10/04/2021 Venue Vs Time- 19:00 Wankhede Stadium Scorecard Sunrisers Hyderabad vs Kolkata Knight Riders 3rd Match IPL 2021 Match 3 Date 11/04/2021 Venue Vs Time- 19:00 MA Chidambaram Stadium Scorecard Rajasthan Royals vs Punjab Kings 4th Match IPL 2021 Match 4 Date 12/04/2021 Venue Vs Time- 19:00 Wankhede Stadium Scorecard Kolkata Knight Riders vs Mumbai Indians 5th Match IPL 2021 Match 5 Date 13/04/2021 Venue Vs Time- 19:30 MA Chidambaram Stadium Scorecard Sunrisers Hyderabad vs Royal Challengers Bangalore 6th Match IPL 2021 Match 6 Date 14/04/2021 Venue Vs Time- 19:30 MA Chidambaram Stadium Scorecard Rajasthan Royals vs Delhi Capitals 7th Match IPL 2021 Match 7 Date 15/04/2021 Venue Vs Time- 19:30 Wankhede Stadium Scorecard Punjab Kings vs Chennai Super Kings 8th Match IPL 2021 Match 8 Date 16/04/2021 Venue Vs Time- 19:30 Wankhede Stadium Scorecard Mumbai Indians vs Sunrisers Hyderabad 9th Match IPL 2021 Match 9 Date 17/04/2021 Venue Vs Time- 19:30 MA Chidambaram Stadium Scorecard Royal Challengers Bangalore vs Kolkata Knight Riders 10th Match IPL 2021 Match 10 Date 18/04/2021 Venue Vs Time- 15:30 MA Chidambaram Stadium Scorecard Delhi Capitals vs Punjab Kings 11th Match IPL 2021 Match 11 Date 18/04/2021 Venue Vs Time- 19:30 Wankhede Stadium -

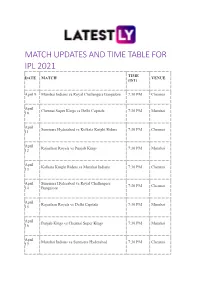

Match Updates and Time Table for Ipl 2021 Time Date Match Venue (Ist)

MATCH UPDATES AND TIME TABLE FOR IPL 2021 TIME DATE MATCH VENUE (IST) April 9 Mumbai Indians vs Royal Challengers Bangalore 7:30 PM Chennai April Chennai Super Kings vs Delhi Capitals 7:30 PM Mumbai 10 April Sunrisers Hyderabad vs Kolkata Knight Riders 7:30 PM Chennai 11 April Rajasthan Royals vs Punjab Kings 7:30 PM Mumbai 12 April Kolkata Knight Riders vs Mumbai Indians 7:30 PM Chennai 13 April Sunrisers Hyderabad vs Royal Challengers 7:30 PM Chennai 14 Bangalore April Rajasthan Royals vs Delhi Capitals 7:30 PM Mumbai 15 April Punjab Kings vs Chennai Super Kings 7:30 PM Mumbai 16 April Mumbai Indians vs Sunrisers Hyderabad 7:30 PM Chennai 17 April Royal Challengers Bangalore vs Kolkata Knight 3:30 PM Chennai 18 Riders April Delhi Capitals vs Punjab Kings 7:30 PM Mumbai 18 April Chennai Super Kings vs Rajasthan Royals 7:30 PM Mumbai 19 April Delhi Capitals vs Mumbai Indians 7:30 PM Chennai 20 April Punjab Kings vs Sunrisers Hyderabad 3:30 PM Chennai 21 April Kolkata Knight Riders vs Chennai Super Kings 7:30 PM Mumbai 21 April Royal Challengers Bangalore vs Rajasthan Royals 7:30 PM Mumbai 22 April Punjab Kings vs Mumbai Indians 7:30 PM Chennai 23 April Rajasthan Royals vs Kolkata Knight Riders 7:30 PM Mumbai 24 April Chennai Super Kings vs Royal Challengers 3:30 PM Mumbai 25 Bangalore April Sunrisers Hyderabad vs Delhi Capitals 7:30 PM Chennai 25 April Punjab Kings vs Kolkata Knight Riders 7:30 PM Ahmedabad 26 April Delhi Capitals vs Royal Challengers Bangalore 7:30 PM Ahmedabad 27 April Chennai Super Kings vs Sunrisers Hyderabad 7:30 -

Page10finals.Qxd (Page 1)

TUESDAY, JULY 2, 2019 (PAGE 10) DAILY EXCELSIOR, JAMMU Fernando trumps Pooran in Sri Lanka’s Vijay Shankar out of World Cup with toe injury, 'Bangla Test': Changes on cards as Mayank Agarwal named replacement 23-run win over West Indies BIRMINGHAM, July 1: Council has confirmed that the no end to India's middle-order woes CHESTER-LE-STREET, July 1: Indian all-rounder Vijay Event Technical Committee of the BIRMINGHAM, July 1: ing Ravindra Jadeja's case for in the playing XI against Shankar was Monday ruled out of ICC Men's Cricket World Cup inclusion stronger by the day. Bangladesh, it will definitely Nicholas Pooran's sensa- the ongoing World Cup due to a toe 2019 has approved Mayank Kedar Jadhav and Yuzvendra The primary logic could possi- bolster the lower-order bat- tional century went in vain as injury and will be replaced by bats- Agarwal as a replacement player Chahal could find their names bly be Jadeja being better at big- ting. Avishka Fernando set up Sri man Mayank Agarwal, who is yet for Vijay Shankar in the India struck off the final XI as India aim hitting compared to Jadhav, when For India, the important thing Lanka's thrilling 23-run win to make his ODI debut. squad for the remainder of the tour- for a quick turnaround in their batting at Nos.6 or 7. His wicket- will be that Bangladesh's bowling over West Indies with a maid- Shankar is the second Indian nament," said the ICC in a release. penultimate World Cup group to-wicket left-arm spin is a restric- won't have the same potency as en hundred in an inconsequen- player to be ruled out of the tourna- Karnataka opener Agarwal, league game against a battle-hard- tive option and to top it all, his out- England and they will heavily tial World Cup match here ment after senior opener Shikhar who made his Test debut against ened Bangladesh, which is trying standing ability to field at any depend on Shakib's all-round to stay relevant in a fight for the position.