From Dialogue to Scrutiny

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Italy's Divided Populists Unite Over EU Bailout Fund Reform

1/12/2019 Italy’s Divided Populists Unite Over EU Bailout Fund Reform - Bloomberg Economics Italy’s Divided Populists Unite Over EU Bailout Fund Reform By John Follain and Alessandro Speciale 1 dicembre 2019, 08:00 CET Updated on 1 dicembre 2019, 13:08 CET Bitter enemies Salvini, Di Maio find some common ground Reforms would give stabilization mechanism broader powers Explore what’s moving the global economy in the new season of the Stephanomics podcast. Subscribe via Apple Podcast, Spotify or Pocket Cast. A common Euroskeptic cause is bringing Italy’s rival populists closer and threatening the country’s coalition government. The issue at hand -- a relatively minor reform of the European Union’s bailout fund -- is usually the preserve of Brussels and treasury bureaucrats. But Matteo Salvini and Luigi Di Maio, who became bitter enemies this summer after their governing alliance fell apart, are both opposed to it. Caught in the middle are Prime Minister Giuseppe Conte and the pro-EU Democratic Party, partners in the current government with Di Maio’s Five Star Movement. Conte is due to appear in parliament on Monday to respond to suggestions he explicitly violated lawmakers’ demands when he struck a deal on the EU fund at a summit last June. https://www.bloomberg.com/news/articles/2019-12-01/italy-s-divided-populists-unite-against-eu-bailout-fund-reform 1/3 1/12/2019 Italy’s Divided Populists Unite Over EU Bailout Fund Reform - Bloomberg Are we headed for a recession? Get updates from Bloomberg's recession tracker delivered to your inbox. -

First Draft Proposal

Group of the Progressive Alliance of Socialists & Democrats in the European Parliament S&D A Union of Democracy: A Progressive Vision for the Future of Europe Friday 6 December 2013, 9:30 – 18:00 Tempio di Adriano - Piazza di Pietra, Rome Working languages EN/IT Friday 6 December: 09:30 - 10:00 Opening Remarks by Hannes SWOBODA, President of the Socialists and Democrats Group in the European Parliament, and Roberto GUALTIERI, Member of the European Parliament and S&D Co-ordinator for the Committee for Constitutional Affairs 10:00 - 11:30 Session I State of Democracy in Europe and its Challenges Chair: Jo LEINEN, MEP European Issues in National Agendas ∙ Institutional Challenges ∙ Citizens Participation ∙ European Political Parties ∙ Growing Extremism and Populism ∙ New Rights for Citizens ∙ Accession to the ECHR ∙ The Role of the Chart of Fundamental Rights Panel: Luciano BARDI, Professor, European University Institute ● Luigi BERLINGUER, MEP ● Vannino CHITI, Member of the Italian Senate - President of the European Affairs Committee ● Virgilio DASTOLI, President of European Movement Italy ● Emilio De CAPITANI, Secretary of The Fundamental Rights European Experts Group (FREE Group) ● Sandro GOZI, Vice-President of the Assembly of Council of Europe ● Enrique GUERRERO SALOM, MEP ● Zita GURMAI, MEP ● Elena PACIOTTI, President of Fondazione Basso ● Yonnec POLET, Deputy Secretary General of the Party of European Socialists 11:30 - 12:30 Debate 12:30 - 14:00 Buffet Lunch 14:00 - 15:30 Session II Developing Democratic Governance Chair: Paolo -

“La Spazzacorrotti”

“LA SPAZZACORROTTI” di Claudia Di Pasquale Collaborazione Giulia Sabella – Lorenzo Vendemiale Immagini Chiara D’Ambros – Francesco Di Trapani Montaggio Federico Tozzi Montaggio e grafica Giorgio Vallati CLAUDIA DI PASQUALE FUORI CAMPO È il 18 febbraio, da più di due settimane il governo ha dichiarato lo stato di emergenza per il virus. Il ministro della salute Roberto Speranza partecipa alla campagna elettorale del Ministro dell’economia Roberto Gualtieri, candidato a Roma alle elezioni suppletive del primo marzo. ROBERTO SPERANZA – MINISTRO DELLA SALUTE Mi sembrava necessario passare e dare un saluto un messaggio di sostegno veramente convinto. Io penso di poter sostenere con grande forza la candidatura di Roberto. CLAUDIA DI PASQUALE FUORI CAMPO Il ministro per la Salute Roberto Speranza oggi è anche il segretario nazionale del partito Articolo uno, fondato nel 2017 anche da D’Alema. Secondo La Stampa la sua nomina sarebbe frutto di un accordo tra D’Alema e Casaleggio. CLAUDIA DI PASQUALE Salve ministro, sono Claudia di Pasquale di Report, Rai3, possiamo fare due battute su Articolo uno, sul ruolo che può avere… ROBERTO SPERANZA - MINISTRO DELLA SALUTE Guarda sono in ritardo sto proprio in difficoltà … Ti voglio bene veramente… CLAUDIA DI PASQUALE La ringrazio che mi vuole bene. Sul vostro sito io ho letto… ROBERTO SPERANZA - MINISTRO DELLA SALUTE Sto andando alla Protezione Civile mi dispiace. CLAUDIA DI PASQUALE Allora ci vediamo un’altra volta. ROBERTO SPERANZA - MINISTRO DELLA SALUTE Venga, mi viene a trovare senza problemi, ma ora devo scappare alla Protezione Civile. CLAUDIA DI PASQUALE FUORI CAMPO Non lo abbiamo più rivisto. Il ministro Speranza fa parte inoltre del comitato di indirizzo della fondazione ItalianiEuropei. -

Alla C.A. Giuseppe Conte Presidente Del Consiglio Dei Ministri Roberto

Alla c.a. Giuseppe Conte Presidente del Consiglio dei Ministri Roberto Gualtieri Ministro dell’Economia e delle Finanze Stefano Patuanelli Ministro dello Sviluppo economico Vincenzo Amendola Ministro per gli Affari europei Paolo Gentiloni Commisario europeo per l’Economia Elena Basile Ambasciatrice d’Italia a Brussels Maurizio Massari Ambasciatore, Rappresentanza permanente d’Italia presso l’Unione europea Oggetto: Altroconsumo sostiene l’azione del Governo italiano a Bruxelles per l’adozione di strumenti finanziari straordinari nella lotta al Covid19 Egregio Presidente, On.li Ministri, VV.EE. Commissario e Ambasciatori, Altroconsumo, organizzazione indipendente di consumatori, ritiene doveroso esprimere il più fermo sostegno alle istanze poste dal Governo italiano in sede europea relative all’adozione urgente di strumenti finanziari straordinari, noti come eurobond e coronabond. In questo momento di gravissima crisi mondiale è di fondamentale importanza garantire il reperimento di tutte le risorse necessarie per fronteggiare una minaccia duplice, sanitaria e economico-finanziaria. Con riguardo a quest’ultima, in particolare, il blocco alla mobilità e alle attività produttive rischia di portare il sistema Paese al collasso, con incalcolabili conseguenze per le imprese e le famiglie, soprattutto, dei ceti più a rischio. La solidarietà europea è un architrave su cui poggia l’intero processo di integrazione che dal 1951 a oggi ha consentito all’Unione europea di nascere e prosperare dopo le macerie della Seconda guerra mondiale. Il Gruppo Euroconsumers, di cui Altrconsumo è membro insieme alle organizzazioni di consumatori Test-Achats in Belgio, OCU in Spagna e Deco Proteste in Portogallo, il 4 aprile u.s. si è rivolto con una lettera1 ai vertici delle Istituzioni europee chiedendo l’introduzione dei coronabond, lo strumento finanziario comune della zona euro, a nostro avviso la soluzione più adatta per finanziare gli interventi degli Stati membri e fronteggiare la minaccia derivante dalla pandemia in corso. -

Economic and Finance Document 2020

Economic and Finance Document 2020 Section III MINISTRY OF ECONOMIC AFFAIRS AND FINANCE National Reform ProgrammeI Economic and Finance Document 2020 Section III National Reform Programme Submitted by Prime Minister Giuseppe Conte and Minister of the Economy and Finance Roberto Gualtieri Adopted by the Cabinet on 6 July 2020 INTRODUCTION The epidemic caused by the new Coronavirus (COVID-19) has changed in a sudden and dramatic way the lives of Italian people and the economic outlook of the country. The measures to control the epidemic have led to a significant reduction in the number of new infections and intensive care units admissions. Although the tribute paid in terms of human lives remains significant and painful, it has been possible from early May to gradually restart productive activities and in June the freedom of movement of citizens between regions and European countries has also been restored. During the most acute phase of the crisis, the Government intervened with measures of large scale and economic-financial scope in order to counter, in the short term, the devastating economic effects of the COVID-19 epidemic and to minimise the long-term damage to the social and economic fabric. Interventions in favour of workers, families, businesses and sectors most affected, as well as to the strengthening of the National Health system and civil protection, implemented through the ‘Cura Italia’, ‘Liquidity’ and ‘Relaunch’ Decrees were of particular importance. It is absolutely necessary to avoid that the pandemic crisis, taking place in a context of poor economic dynamism of the country, as well as of complex geopolitical changes worldwide, is followed by a phase of economic depression. -

The Eurofi Financial Forum 2017 Tallinn | 13, 14 & 15 September

Views The EUROFI Magazine TALLINN SEPTEMBER 2017 Toomas Tõniste Financial sector regulatory initiatives are important for the Estonian Presidency The Eurofi Financial Forum 2017 Tallinn | 13, 14 & 15 September Klaus Regling Jyrki Katainen A window of opportunity Long-term and sustainable to strengthen Economic investment for jobs and and Monetary Union further economic growth in Europe And more than 160 speakers’ contributions : A. Hansson, R. Himino, V. Dombrovskis, E. Nowotny, M. Centeno, V. Goranov, B. Le Maire, P. Kažimír, V. Šapoka, K. Knot, V. Vasiliauskas, S. Bowen, C. Giancarlo, T. Nickel, M. Ferber, R. Gualtieri, Y. Mersch, M. Bayle de Jessé, E. König, S. Lautenschläger, T. Wieser, K. Braddick, K. Kessler, M. Petrova, M. Pradhan, O. Guersent, W. Hoyer, L. Holle, S. Goulard, A. Aucoin, L. Ahto, A. Magasiner, P. Bordenave, C. Clausen, A. Hachmeister, JM. González-Páramo, V. Grilli, HO. Jochumsen… The Eurofi Tallinn Forum mobile website tallinn2017.eurofi.net Answer polls Post questions during the sessions Check-out the list of speakers and contact attendees Detailed programme and logistics information HOW TO ACCESS THE TALLINN FORUM MOBILE WEBSITE? Click on the link contained in the SMS you received after registration. You can also access directly by entering tallinn2017.eurofi.net in the browser of your smartphone or by flashing the QR code. The Eurofi Financial Forum TALLINN | SEPTEMBER 2017 WHAT WAY FORWARD FOR THE EU27 AND EUROZONE? C Content 5 EDITORIAL & OPENING INTERVIEWS 16 MACRO-ECONOMIC AND POLITICAL CHALLENGES 58 GLOBAL -

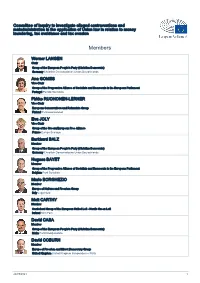

List of Members

Committee of Inquiry to investigate alleged contraventions and maladministration in the application of Union law in relation to money laundering, tax avoidance and tax evasion Members Werner LANGEN Chair Group of the European People's Party (Christian Democrats) Germany Christlich Demokratische Union Deutschlands Ana GOMES Vice-Chair Group of the Progressive Alliance of Socialists and Democrats in the European Parliament Portugal Partido Socialista Pirkko RUOHONEN-LERNER Vice-Chair European Conservatives and Reformists Group Finland Perussuomalaiset Eva JOLY Vice-Chair Group of the Greens/European Free Alliance France Europe Écologie Burkhard BALZ Member Group of the European People's Party (Christian Democrats) Germany Christlich Demokratische Union Deutschlands Hugues BAYET Member Group of the Progressive Alliance of Socialists and Democrats in the European Parliament Belgium Parti Socialiste Mario BORGHEZIO Member Europe of Nations and Freedom Group Italy Lega Nord Matt CARTHY Member Confederal Group of the European United Left - Nordic Green Left Ireland Sinn Féin David CASA Member Group of the European People's Party (Christian Democrats) Malta Partit Nazzjonalista David COBURN Member Europe of Freedom and Direct Democracy Group United Kingdom United Kingdom Independence Party 24/09/2021 1 Sergio Gaetano COFFERATI Member Group of the Progressive Alliance of Socialists and Democrats in the European Parliament Italy Social Democratic Party Pascal DURAND Member Group of the Greens/European Free Alliance France Europe Écologie Angel DZHAMBAZKI Member European Conservatives and Reformists Group Bulgaria VMRO Frank ENGEL Member Group of the European People's Party (Christian Democrats) Luxembourg Parti chrétien social luxembourgeois Markus FERBER Member Group of the European People's Party (Christian Democrats) Germany Christlich-Soziale Union in Bayern e.V. -

Al Presidente Del Consiglio Dei Ministri Prof. Avv. Giuseppe Conte

Al Presidente del Consiglio dei Ministri Prof. Avv. Giuseppe Conte Al Ministro della Difesa On. Lorenzo Guerini Al Ministro dell’Economia e delle Finanze Prof. Roberto Gualtieri Al Ministro della Giustizia On. Alfonso Bonafede Al Ministro per la Pubblica Amministrazione On. Fabiana Dadone Oggetti: emergenza epidemiologica da COVID-19. Richieste. Signor Presidente del Consiglio, Signori Ministri, le scriventi OO.SS. in questo momento storico inaudito per tutti noi, hanno a cuore la salute dei colleghi che sono in prima linea a fronteggiare l’emergenza sanitaria che ha investito il Nostro Paese. Pertanto, in ottica della conversione del D.L. n.18/2020 “Misure di potenziamento del Servizio sanitario nazionale e di sostegno economico per famiglie, lavoratori e imprese connesse all'emergenza epidemiologica da COVID-19” e dei provvedimenti che verranno assunti nei prossimi giorni, nel condividere quanto già segnalato dai nostri colleghi, sensibilizzano all’unisono di: 1 1. consentire l’effettuazione di tamponi per i colleghi maggiormente esposti al fine di evitare contagi nelle famiglie; 2. disporre la prioritaria distribuzione al personale in servizio di DPI per evitare situazioni in cui siano gli operatori ad esserne privi con conseguenti profili penali a carico degli stessi; 3. prevedere la stipula da parte delle Amministrazioni di polizze sanitarie che coprano le eventuali spese mediche del personale a seguito di contagio; 4. sensibilizzare le Amministrazioni del Comparto all’utilizzo della dispensa temporanea del servizio ex art. 87, comma 6 del D.L. n. 18/2020 al fine di fronteggiare eventuali situazioni non prevedibili di gravi carenze di organico nei reparti, connesse alla diffusione dell’epidemia. -

At the End of 1970S, the Italian Communist Party, Under The

At the end of the 1970s, the Italian Communist Party, under the leadership of Enrico Berlinguer, seemed to be at the final stage of an uninterrupted march towards legitimacy within the Italian political system. After reaching the peak of its electoral popularity, in 1975-76, it was considered by both Italian and foreign experts to be placed, to quote the title of a well known book, ‘on the threshold of government’.1 Far from being regarded as a dangerous lair of subversives, it had acquired a reputation as the guarantor of the Italian Constitution, even in some sectors of conservative public opinion.2 This positive perception of the role of the PCI within the democratic system was mirrored by a historiography which was generally favourable to the party. It has been argued that the Marxist cultural formation of most Italian historians accounts for this.3 Although such a claim is true in some respects - the historiography of the PCI was principally compiled by scholars who were not only Marxists but also members of the party 4- the description of the PCI as a democratic force was not the consequence of a lopsided historiography, but rather rested upon historical events which were interpreted as concrete evidence of Italian communists' constant commitment to the defence of peace 1 James Ruscoe The Italian Communist Party, 1976 – 81. On the Threshold of Government (London 1982). The expression is taken from the PCI's 1978 congressional theses. The book records the failure of the PCI's attempt to get into the national Government. However, the author stressed how: ‛… the PCI is one of the most stable factors in Italian life. -

Guerra Delle Nomine, Renzi È Tornato Sul Luogo Del Delitto

15/02/2020 Pagina 2 EAV: € 7.402 Lettori: 101.864 Argomento: Servizi pubblici Guerra delle nomine, Renzi è tornato sul luogo del delitto Giorgio Meletti e Carlo Tecce I Boiardi. Sei anni fa #enricostaisereno. L' ultima volta stravinse, ora rischia le briciole tra Fraccaro, Gualtieri e D' Alema. Brutti segnali su Privacy e Agcom Il 14 febbraio 2014, Enrico Letta salì al Quirinale per dimettersi da presidente del Consiglio. La fretta di Matteo Renzi di fargli le scarpe a colpi di #enricostaisereno, con il supporto logistico di Giorgio Napolitano , aveva un' unica spiegazione: installarsi a Palazzo Chigi in tempo per gestire la tornata di 400 nomine nelle società controllate dallo Stato, a cominciare dalle più appetibili, Eni, Enel, Poste e Leonardo. L' analisi di Riccardo Fraccaro , esponente non di primissimo piano dei Cinque Stelle, fu assai severa: "La verità è che ha fretta di gestire la prossima infornata di poltrone. Il neopremier è un cinico arrivista, un arrampicatore politico senza scrupoli. Invece di occupare militarmente le poltrone, adotti una procedura trasparente per il rinnovo dei vertici dei più importanti gruppi d' Italia". Sei anni dopo, anche ieri la festa di San Valentino è stata segnata dai venti di crisi soffiati da Renzi. Ancora una volta la vera posta in palio, nell' immediato, è la spartizione delle poltrone. Solo che stavolta è Fraccaro al tavolo principale. Spentasi la stella di Luigi Di Maio e passata la meteora Stefano Buffagni , è lui, sottosegretario alla presidenza del Consiglio, a rappresentare i Cinque Stelle al suk delle poltrone (per la verità non trasparente come Fraccaro pretendeva da giovane). -

KEY QUESTIONS the Big Six

Italy Donor Profile KEY QUESTIONS the big six Who are the main actors in Italy's development cooperation? The MAECI leads on strategy; Italy’s new develop- gust 2018 and again reappointed in September 2019. ment agency, AICS, implements bilateral programs; She supervises the MAECI’s Directorate General for embassies play a key role on the ground Development Cooperation (DGCS), which is in charge of defining the strategic direction of development pro- In August 2019, Italy formed a new government, compris- grams and is headed by Giorgio Marrapodi as the Di- ing of the Five Star Movement and the center-left Demo- rector-General since January 2018. Del Re also super- cratic Party, which forced the far-right League party into vises the work of AICS and the development bank. opposition. The new coalition was triggered by a no con- fidence motion, initiated by the right-wing League to • The Ministry of Economy and Finance (MEF), led bring down the government that it had formed with the by Roberto Gualtieri (Democratic Party-PD), is also a Five Star Movement since June 2018. Matteo Salvini (for- key player: the MEF prepares revenue and financial mer minister of the Interior and current federal secretary analysis for the MAECI, oversees and assesses the eco- of the League) hoped to trigger new elections by October, nomic and financial effects of laws and policies. In -ad however before then, the Five Star Movement and the dition, the MEF jointly with the MAECI controls the center-left Democratic Party had reached a coalition ODA budget, as well as relations with and contribu- agreement that forced the far-right League party into op- tions to multilaterals. -

Dr. Jekyll and Mr. Hyde? the Approaches of the Conte Governments to the European Union

Italian Political Science, VOLUME 16 ISSUE 1 Dr. Jekyll and Mr. Hyde? The Approaches of the Conte Governments to the European Union Andrea Capati Marco Improta LUISS GUIDO CARLI UNIVERSITY, ROME Abstract Over the past few years, interdependence and the increasing importance of external constraints on Member State governments’ domestic policies have deepened relations between the European Union (EU) and European cabinets. This article investigates the Conte I and Conte II governments’ approach to the EU. Drawing on cleav- age theory, we hypothesise that the PD exercised a ‘mitigation effect’ on M5S Euroscepticism, leading to a change in the government’s attitude towards the EU. We test this hypothesis through a small-n comparative analysis based on the two governments’ political programmes, composition, and budgetary policy in the frame- work of the European Semester. The article is structured as follows: First, we build the theoretical framework on cleavage theory and the ‘mitigation effect’ hypothesis. Second, we illustrate the transition from the Conte I to the Conte II government. Third, we discuss the method and research strategy. Finally, we examine the Conte gov- ernments’ political programmes, composition and budgetary policy with a view to testing the ‘mitigation effect’. Our analysis shows that a shift in Italy’s orientation towards the EU occurred in the transition from Conte I to Conte II, owing much to the PD’s involvement in the latter. 1. Introduction n the XVIII parliamentary term, Italy has already had three governments. Two of them were headed by Giuseppe Conte, a nonpartisan figure who previously worked as I a lawyer and academic.