White Papers 08/Client Intelligence

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Wirral Landscape Character Assessment 2019 A

Wirral Metropolitan Borough Council Wirral Landscape Character Assessment Final report Prepared by LUC October 2019 Wirral Metropolitan Borough Council Wirral Landscape Character Assessment Version Status Prepared Checked Approved Date 1. Draft Final Report A Knight K Davies K Davies 07.10.2019 K Davies 2. Final Report A Knight K Davies K Davies 30.10.2019 Bristol Land Use Consultants Ltd Landscape Design Edinburgh Registered in England Strategic Planning & Assessment Glasgow Registered number 2549296 Development Planning Lancaster Registered office: Urban Design & Masterplanning London 250 Waterloo Road Environmental Impact Assessment Manchester London SE1 8RD Landscape Planning & Assessment Landscape Management landuse.co.uk 100% recycled paper Ecology Historic Environment GIS & Visualisation Contents Wirral Landscape Character Assessment October 2019 Contents 1c: Eastham Estuarine Edge 60 Chapter 1 Introduction and Landscape Context 4 Chapter 7 Structure of this report 4 LCT 2: River Floodplains 67 Background and purpose of the Landscape Character Assessment 4 2a: The Birket River Floodplain 68 The role of Landscape Character Assessment 5 Wirral in context 5 2b: The Fender River Floodplain 75 Policy context 6 Relationship to published landscape studies 9 Chapter 8 LCT 3: Sandstone Hills 82 Chapter 2 Methodology for the Landscape 3a: Bidston Sandstone Hills 83 Character Assessment 13 3b: Thurstaston and Greasby Sandstone Hills 90 3c: Irby and Pensby Sandstone Hills 98 Approach 13 3d: Heswall Dales Sandstone Hills 105 Process of assessment -

One Blackfriars in the London Borough of Southwark Planning Application No.12/AP/1784

planning report PDU/2894/01 18 July 2012 One Blackfriars in the London Borough of Southwark planning application no.12/AP/1784 Strategic planning application stage 1 referral (new powers) Town & Country Planning Act 1990 (as amended); Greater London Authority Acts 1999 and 2007; Town & Country Planning (Mayor of London) Order 2008 The proposal The erection of three buildings a tower of 50 storey (containing 274 residential units) plus basement levels, of a maximum height of 170 metres above ordnance datum (AOD), a low rise building of 6 storey “the Rennie Street building”, a low rise 4 storey building “the podium building” which together provide a mixed use development totalling 74,925 sq.m. gross external area comprising: class C1 hotel use, class C3 residential use , Class A1to A5 retail use; and 9,648 sq.m. of basement, ancillary plant, servicing and car parking with associated public open space and landscaping. The applicant The applicant is St George South London Ltd, the architect is Ian Simpson Architects and the agent is CBRE. Strategic issues Strategic issues for consideration are the principle of the proposed development; housing, affordable housing; London’s visitor infrastructure; urban design and inclusive design tall buildings and strategic views; access; Children’s and young people’s play; transport; climate change mitigation and energy; Transport and Community Infrastructure Levy. Recommendation That Southwark Council be advised that while the application is generally acceptable in strategic planning terms the application does not comply with the London Plan, for the reasons set out in paragraph 130 of this report; but that the possible remedies set out in paragraph 132 of this report could address these deficiencies. -

Property Useful Links

PROPERTY - USEFUL LINKS Property - Useful Links 1300 Home Loan 1810 Malvern Road 1Casa 1st Action 1st Choice Property 1st Property Lawyers 247 Property Letting 27 Little Collins 47 Park Street 5rise 7th Heaven Properties A Place In The Sun A Plus New Homes a2dominion AACS Abacus Abbotsley Country Homes AboutProperty ABSA Access Plastics AccessIQ Accor Accord Mortgages Achieve Adair Paxton LLP Adams & Remrs Adept PROPERTY - USEFUL LINKS ADIT Brasil ADIT Nordeste Adriatic Luxury Hotels Advanced Solutions International (ASI) Affinity Sutton Affordable Millionaire Agence 107 Promenade Agency Express Ajay Ajuha Alcazaba Hills Resort Alexander Hall Alitex All Over GEO Allan Jack + Cottier Allied Pickfords Allied Surveyors AlmaVerde Amazing Retreats American Property Agent Amsprop Andalucia Country Houses Andermatt Swiss Alps Andrew and Ashwell Anglo Pacific World Movers Aphrodite Hills Apmasphere Apparent Properties Ltd Appledore Developments Ltd Archant Life Archant Life France PROPERTY - USEFUL LINKS Architectural Association School Of Architecture AREC Aristo Developers ARUP asbec Askon Estates UK Limited Aspasia Aspect International Aspinall Group Asprey Homes Asset Agents Asset Property Brokers Assetz Assoc of Home Information Pack Providers (AHIPP) Association of Residential Letting Agents (ARLA) Assoufid Aston Lloyd Astute ATHOC Atisreal Atlas International Atum Cove Australand Australian Dream Homes Awesome Villas AXA Azure Investment Property Baan Mandala Villas And Condominiums Badge Balcony Systems PROPERTY - USEFUL LINKS Ballymore -

Old Oak Common, London

OPDC December 2016 V Old Oak Common, London Savills comments on OPDC Car Parking Policy Private & Confidential savills.co.uk Old Oak Common Contents 1. Overview 1 1.1. Site Context .......................................................................................................................................................... 1 1.2. Summary of Our Views ......................................................................................................................................... 1 1.3. The Proposals ...................................................................................................................................................... 1 2. Policy Context 2 2.1. Residential ............................................................................................................................................................ 2 2.2. Retail .................................................................................................................................................................... 2 2.3. Offices .................................................................................................................................................................. 2 2.4. Industrial ............................................................................................................................................................... 2 2.5. Hotel .................................................................................................................................................................... -

![[Wirral] Seacombe Ferry Terminal](https://docslib.b-cdn.net/cover/6648/wirral-seacombe-ferry-terminal-206648.webp)

[Wirral] Seacombe Ferry Terminal

Pier Head Ferry Terminal [Liverpool] Mersey Ferries, Pier Head, Georges Parade, Liverpool L3 1DR Telephone: 0151 227 2660 Fax: 0151 236 2298 By Car Leave the M6 at Junction 21a, and take the M62 towards Liverpool. Follow the M62 to the end, keeping directly ahead for the A5080. Continue on this road until it merges into the A5047, following signs to Liverpool City Centre, Albert Dock and Central Tourist Attractions. Pier Head Ferry Terminal is signposted from the city centre. Parking Pay and display parking is available in the Albert Dock and Kings Dock car parks. Pier Head Ferry Terminal is approximately 5-10 minutes walk along the river. By Public Transport Using Merseyrail’s underground rail service, alight at James Street Station. Pier Head Ferry Terminal is a 5- minute walk from James Street. For further information about bus or rail links contact Merseytravel on: 0870 608 2 608 or log onto: www.merseytravel.gov.uk By National Rail Lime Street Station is Liverpool’s main national rail terminus, with main line trains to and from Manchester, London, Scotland and the rest of the UK. Pier Head Ferry Terminal is a 20-minute walk from Lime Street [see tourist information signs]. Enquire at Queen Square Tourist Information Centre for details of bus services to Pier Head. Woodside Ferry Terminal [Wirral] Mersey Ferries, Woodside, Birkenhead, Merseyside L41 6DU Telephone: 0151 330 1472 Fax: 0151 666 2448 By Car From the M56 westbound, turn right onto the M53 at Junction 11. Follow the M53 motorway to Junction 1, and then take the A5139 [Docks Link/ Dock Road]. -

Middle East Property & Construction Handbook 2010/2011

MIDDLE EAST PROPERTY & CONSTRUCTION HANDBOOK 2010/2011 1 2 MIDDLE EAST PROPERTY & CONSTRUCTION HANDBOOK 2010/2011 Middle East Offices Abu Dhabi, UAE [email protected] +971 2 444 2040 Beirut, Lebanon [email protected] +961 1 780 111 Doha, Qatar [email protected] +974 4458 0150 Dubai, UAE [email protected] +971 4 423 3690 Manama, Bahrain [email protected] +973 17 588 796 Riyadh, KSA [email protected] +966 1 463 2625 Cairo, Egypt (North Africa) [email protected] +974 5581 7035 / +44 7740 922 931 1 1 DAVIS LANGDON An AECOM company 3 Global presence 3 Rich Middle East history 4 Industry awards 4 2 GLOBAL CONSTRUCTION CONSULTANTS The bigger picture 7 Sector specialists 7 Cohesive solutions 7 Thought leaders 8 3 ECONOMIC ROUND UP Country statistics 2009 11 Economic trends and outlook 12 Construction inflation trends and outlook 17 4 ARTICLES Spotlight on Syria 23 Grand Prix racing – on track in the Middle East 27 Property service charges and the Dubai Strata law 31 High speed rail – high risk, high cost, high rewards 35 Adding value through sustainability management 40 Case study – King Abdulaziz Centre for World Culture 45 Regional integration and potential for religious 50 tourism sector Building information modelling – cost and value 55 drivers for integrated working Bridging the gap – the demand for social infrastucture 58 2 Public private partnership (PPP’s) 61 Development management – creating a viable scheme 66 5 REFERENCE ARTICLES Procurement routes 73 -

22 Bishopsgate London EC2N 4BQ Construction of A

Committee: Date: Planning and Transportation 28 February 2017 Subject: Public 22 Bishopsgate London EC2N 4BQ Construction of a building arranged on three basement floors, ground and 58 upper floors plus mezzanines and plant comprising floorspace for use within Classes A and B1 of the Use Classes Order and a publicly accessible viewing gallery and facilities (sui generis); hard and soft landscaping works; the provision of ancillary servicing and other works incidental to the development. (201,449sq.m. GEA) Ward: Lime Street For Decision Registered No: 16/01150/FULEIA Registered on: 24 November 2016 Conservation Area: St Helen's Place Listed Building: No Summary The planning application relates to the site of the 62 storey tower (294.94m AOD) granted planning permission in June 2016 and which is presently being constructed. The current scheme is for a tower comprising 59 storeys at ground and above (272.32m AOD) with an amended design to the top. The tapering of the upper storeys previously approved has been omitted and replaced by a flat topped lower tower. In other respects the design of the elevations remains as before. The applicants advise that the lowering of the tower in the new proposal is in response to construction management constraints in relation to aviation safeguarding issues. The planning application also incorporates amendments to the base of the building, the public realm and to cycle space provision which were proposed in a S73 amendment application and which your Committee resolved to grant on 28 November 2016, subject to a legal agreement but not yet issued. The building would provide offices, retail at ground level, a viewing gallery with free public access at levels 55 and 56 and a public restaurant and bar at levels 57 and 58. -

Trafford Park Masterplan Baseline Assessment

Trafford Park Masterplan Baseline Assessment A Report for the Trafford Economic Alliance By EKOS, CBRE, URBED and WSP August 2008 EKOS Consulting (UK) Ltd 2 Mount Street Manchester M2 5WQ TABLE OF CONTENTS LIST OF FIGURES AND TABLES............................................................................................ 6 EXECUTIVE SUMMARY......................................................................................................... 12 2 INTRODUCTION AND STUDY CONTEXT ..................................................................... 23 INTRODUCTION ....................................................................................................................... 23 STUDY CONTEXT.................................................................................................................... 23 HISTORICAL CONTEXT ............................................................................................................ 24 STUDY CONTEXT AND MASTERPLAN OBJECTIVES .................................................................... 29 STUDY AREA.......................................................................................................................... 31 BASELINE REPORT OBJECTIVES AND STRUCTURE.................................................................... 31 3 REGENERATION AND PLANNING POLICY REVIEW.................................................. 33 INTRODUCTION ....................................................................................................................... 33 NATIONAL POLICY -

Barton Upon Irwell Conservation Area Appraisal SPD5.6A

TRAFFORD COUNCIL SPD5.6: Barton Upon Irwell Conservation Area Appraisal SPD5.6a: Barton Upon Irwell Conservation Area Management Plan Consultation Statement March 2016 Conservation Area Appraisal and Management Plan Consultation Statement Trafford Council Contents 1. Introduction ................................................................................................................... 1 2. Statement of Community Involvement Review .............................................................. 1 3. Public Consultation ........................................................................................................ 1 4. Consultation Responses and Main Issues .................................................................... 3 5. Main Changes to the SPD ............................................................................................. 4 Appendix 1 – List of Consultees ........................................................................................ 13 Appendix 2 – Local Advertisement – Conservation Management Plan ............................. 17 Appendix 2 – Local Advertisement – Conservation Area Appraisal ................................... 18 Supplementary Planning Document Conservation Area Appraisal Consultation Statement Trafford Council 1. Introduction 1.1. In preparing Supplementary Planning Documents (SPDs), the Council is required to follow the procedures laid down in the Town and Country Planning (Local Planning) (England) Regulations 2012, and its adopted Statement of Community Involvement -

Why Build a New Home?

delivered to your door propertyYour paper, local London & Southern Edition March/April 2016 PROPERTY OF THE MONTH P8 MORTGAGES P23 BUDGET P41 INTERIORS P42 GARDENING P46 Why build a The first step new home? P3 – six great starter homes P6 One of the most exclusive addresses in Mill Hill. Computer generated illustration indicative only. Final elegantly appointed apartments now released Completions from March 2016 Available to view Information Centre and Showhomes open daily 10am - 5pm 2 and 3 bedroom apartments from £875,000 - £1,850,000 For further information telephone 01753 336594, email [email protected] or visit www.stjosephsgate.co.uk St Joseph’s Gate, Lawrence Street, Mill Hill, London, NW7 4JZ London, Kent, Sussex, Surrey, Hampshire, Isle of Wight – Find your new home at Whathouse.com The Halebourne Group Find your new home at whathouse.com/new-homes new home 3 Open March 2016 Welcome! Show Home Why buy a new his March’s Budget speech merely confirmed one or two of the changes to the property market previously Tintroduced, with the Lifetime ISA the only brand new announcement with effect on potential homebuyers – and even that is a very similar build home? product to the Help to Buy What are the reasons why house-hunters should consider buying a new build home? ISA he brought to the market last November. rand new is special. Many Some of us will certainly be THE LATEST disappointed that the Chancellor house-hunters simply love the STANDARDS The Ridge ‘blank canvas’ of a brand new did not clarify – or modify – last New-build homes are built to high year’s stamp duty changes for buy- RIDGEMOUNT ROAD SUNNINGDALE SL5 9JQ home. -

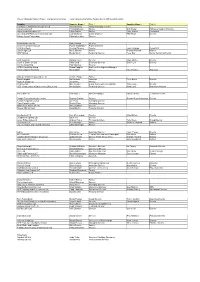

Schedule of Consultants 190511

CROSSRAIL - CRL RETAINED MAIN AND SECONDARY DESIGNERS 15 MARCH 2011 FDC SubConsultant FDC Consultant FDC Design Package C272 PIP C300/C410 C305 C310 C315 C330 C340 C350 C405 C411 Bond C412 C421 C422 C430 C435 C501 C502 C503 C510 C511 C512 C520 C610 C620 C625 C630 C631 C644 C650 C660 C670 C680 C807 Tunnels Tunnels Thames Connaught ROP VDP PML Padd Main St Adv Wks Bond St TCR Adv TCR Main Farringdon Farringdon Liverpool St Liverpool St Liverpool St Station Whitechapel Whitechapel Custom Track, Signalling Route Tunnel M&E Platform Traction Non- Station Control / Radio Data Marine West East Tunnel Tunnel Wks Main Wks Wks Wks Adv Wks Main Wks Adv Wks Main Wk Adv Wk Tunnels Adv Wks Main Wks House OHLE & Control Screen Power traction Comms SCADA Transport West Logistics Centre Doors Power GiaEquation Atkins C100 - Architectural Components Design Grimshaw Atkins C100 - Architectural Components Design Schulmann Smith Mott MacDonald C102 - Material and Workmanship Specifications Corderoy Mott MacDonald C121 - Sprayed Concrete Linings (SCL) Design Main Main Secondary Secondary Secondary Secondary Secondary Secondary Secondary Secondary Secondary Main Secondary Secondary Gall Zeidler Mott MacDonald C121 - Sprayed Concrete Linings (SCL) Design Main Main Secondary Secondary Secondary Secondary Secondary Secondary Secondary Secondary Secondary Main Secondary Secondary London Bridge Associates Mott MacDonald C121 - Sprayed Concrete Linings (SCL) Design Main Main Secondary Secondary Secondary Secondary Secondary Secondary Secondary Secondary Secondary -

List of Attendees to Market Testing Event 10Th December 2012

Project: Strategic Partner Project - Consultancy Services List of attendees to Market Testing Event 10th December 2012 Supplier Supplier Name: 1 Title: 1 Supplier Name: 2 Title: 2 Frankham Consultancy Group Limited Richard Chitty Group Managing Director Carter Jonas LLP Richard Meeson Partner Nick Taylor Partner & Head of Planning Haverstock Associates LLP Claire Barton Partner John Jenkins Consultant Ove Arup and Partners International Ltd Lisa Matthews Senior Engineer Phil Wood Director Selway Joyce Partnership Christopher Hore Director Aedas Architects Ltd Karle Burford Director Churches Engineering Ltd Patrick Saddington Projects Director HLM Architects Richard Parsons Director John Richards Consultant Ubu Design LLP Mark Johnson Partner Richard Willmott Partner WSP UK Ltd Martin Smith Technical Director Peter Day Senior Technical Director AKS Ward Ltd David Perkins Director Brian Ritchie Director Currie & Brown UK Ltd Chris Boyd Divisional Director Simon Lee Director Curtins Consulting Paul Menzies Director DPDS Consulting Group Susan Cupples Business Development Manager Perkins Ogden Architects Mark Ogden Director Paul Pearson Associate AMA Alexi Marmot Associates Ltd Jennifer Singer Partner Davis Langdon Ian Harrison Associate Peter Boote Director Hydrock Group Ltd Jerry King Director Pick Everard Mike Reader Senior Framework Co-ordinator Allan Cowie Director URS Infrastructure & Environment UK Limited Martin Baker Technical Director Mark Lima Associate Architect Amey OW Ltd Will Warner Account Manager David Gillham Technical Director