The Pattern of Flow and Utilisation of Funds by the Karbi Anglong Autonomous Council in Assam

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lz-^ P-,^-=O.,U-- 15 15 No

ASSAM STATE ELECTION COMMISSION ADITYA TOWER, 2}TD FI.,OO& DO\AAITO\^AI, G.S. ROAD DISPUR, GUWAHATI -781W. PTT. NO. M1263210/ 2264920 email - [email protected] NOTIFICATION Dated Dispur 17m November,2020 No.SEC.86l2020l7 : Whereas, the state Election Commission, Assam has been notified to act as the Authority to supervise, direct & conduct election of constituencies of General Councils of Tiwa Autonomous Council by the Governor of Assam in exercise of Power conferred under Rule 4 of Tiwa Autonomous Council Rules, 2005 and Section 50 (4) of Tiwa Autonomous Council Act, 1995; And, whereas, the State Election Commission, Assam notified Schedule for preparation and publication of constituency wise Photo Electoral Roll for Election to the Tiwa Autonomous Council vide Notification No. 5EC.5412020147 dated 01 .09.2020 and SEC 5 4 I 2020 I | 0 4 dated 22.1 0 .2020 ; Whereas, in exercise of powers conferred under the provision of the Rule 4 of the Tiwa Autonomous Council (Election) Rules, 2005, the final Photo Electoral Rolls in 30 (thirty) Constituencies under MorigaonA.lagaonl Hojai districts have been published on 22.10.2020 and in 6 (six) Constituencies in Kamrup (M) district have been published on t5.rr.2020; Whereas, reservation of seats for women in the Tiwa Autonomous Council has been notified vide No. TAD/BC/I5712015151 dt.21.07.2015; Now, therefore, in pursuance of Rule 17(I) and Rule 18 of the Tiwa Autonomous Council (Election) Rules 2005, the State Election Commission, Assam calls upon electors of 36 (thirfy-six) nos. of Tiwa Autonomous Council constituencies as enumerated below to elect members to the General Council of the Tiwa Autonomous Council while sfictly following the Broad Guidelines for conduct of Election dwing COVID-l9 given by Election Commission of India and adopted by State Election Commissioq Assam TABLE consistins names of Constituencies of the TAC sl. -

Golaghat ZP-F

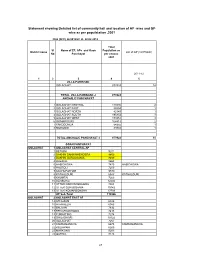

Statement showing Detailed list of community hall and location of AP -wise and GP- wise as per populatation ,2001 FEA (SFC) 26/2012/41 dt. 28.02.2012 Total Sl Name of ZP, APs and Gaon Population as District name List of GP (1st Phash) No Panchayat per census 2001 2011-12 12 3 4 5 ZILLA PARISHAD GOLAGHAT 873924 14 TOTAL ZILLA PARISHAD -I 873924 ANCHALIC PANCHAYAT 1 GOLAGHAT CENTRAL 118546 2 2 GOLAGHAT EAST 88554 1 3 GOLAGHAT NORTH 42349 1 4 GOLAGHAT SOUTH 195854 3 5 GOLAGHAT WEST 179451 3 6 GOMARIGURI 104413 2 7 KAKODONGA 54955 1 8 MORONGI 89802 1 TOTAL ANCHALIC PANCHAYAT -I 873924 14 GOAN PANCHAYAT GOLAGHAT 1 GOLAGHAT CENTRAL AP 1 BETIONI 9201 2 DAKHIN DAKHINHENGERA 9859 3 DAKHIN GURJOGANIA 8457 4 DHEKIAL 8663 5 HABICHOWA 7479 HABICHOWA 6 HAUTOLI 7200 7 KACHUPATHAR 9579 8 KATHALGURI 6543 KATHALGURI 9 KHUMTAI 7269 10 SENSOWA 12492 11 UTTER DAKHINHENGERA 7864 12 UTTER GURJOGANIA 10142 13 UTTER KOMARBONDHA 13798 AP Sub-Total 118546 GOLAGHAT 2 GOLAGHAT EAST AP 14 ATHGAON 6426 15 ATHKHELIA 6983 16 BALIJAN 7892 17 BENGENAKHOWA 7418 18 FURKATING 7274 19 GHILADHARI 10122 20 GOLAGHAT 7257 21 KAMARBANDHA 6678 KAMARBANDHA 22 KOLIAPANI 6265 23 MARKONG 5203 24 OATING 8128 23 12 3 4 5 25 PULIBOR 8908 AP Sub-Total 88554 GOLAGHAT 3 GOLAGHAT NORTH AP 26 MADHYA BRAHMAPUTRA 8091 27 MADHYA MISAMORA 7548 28 PACHIM BRAHMAPUTRA 8895 PACHIM BRAHMAPUTRA 29 PACHIM MISAMORA 8382 30 PUB MISAMORA 9433 AP Sub-Total 42349 GOLAGHAT 4 GOLAGHAT SOUTH AP 31 CHUNGAJAN 13943 32 CHUNGAJAN MAZGAON 5923 33 CHUNGAJAN MIKIR VILLAGES 7401 34 GANDHKOROI 10847 35 GELABIL 12224 36 -

Positioning of Assam As a Culturally Rich Destination: Potentialities and Prospects

International Journal of Humanities and Social Science Invention (IJHSSI) ISSN (Online): 2319 – 7722, ISSN (Print): 2319 – 7714 www.ijhssi.org ||Volume 9 Issue 3 Ser. IV || Mar, 2020 || PP 34-37 Positioning Of Assam as a Culturally Rich Destination: Potentialities and Prospects Deepjoonalee Bhuyan ----------------------------------------------------------------------------------------------------------------------------- ---------- Date of Submission: 22-03-2020 Date of Acceptance: 08-04-2020 ----------------------------------------------------------------------------------------------------------------------------- ---------- I. INTRODUCTION Cultural tourism has a special place in India because of its past civilisation. Among the various motivating factors governing travel in India, cultural tourism is undoubtedly the most important. For any foreigner, a visit to India must have a profound cultural impact and in its broader sense, tourism in India involves quite a large content of cultural content. It also plays a major role in increasing national as well as international good will and understanding. Thousands of archaeological and historical movements scattered throughout the country provide opportunites to learn about the ancient history and culture. India has been abundantly rich in its cultural heritage. Indian arts and crafts, music and dance, fairs and festivals, agriculture and forestry, astronomy and astrology, trade and transport, recreation and communication, monumental heritage, fauna and flora in wildlife and religion play a vital role in this type of tourism. Thus, it can be very well said that there remains a lot of potential for the progress of cultural tourism in India. Culturally, North East represents the Indian ethos of „unity in diversity‟ and „diversity in unity‟. It is a mini India where diverse ethnic and cultural groups of Aryans, Dravidians, Indo-Burmese, Indo Tibetan and other races have lived together since time immemorial. -

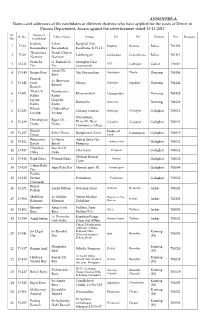

ANNEXURE-A Names and Addresses of the Candidates of Different

ANNEXURE-A Names and addresses of the candidates of different districts who have applied for the posts of Driver in Prisons Department, Assam against the advertisement dated 15-11-2017 Sl. Name of R. No. Father Name Village P.O. P.S. District Pin Remarks No. Candidate Kishore Lobin Barghuli Niz- 1 D-24 Barghuli Barama Baksa 781354 Basumatary Basumatary Kaurbaha, B.P.H.C Thaneswar Dandi Charan 2 D-20 Labdanguri Labdanguri Gobordhana Baksa 781315 Narzary Narzary Prabir Kr. Lt. Parimal Ch. Ghunghur Near 3 D-112 NIT Lakhipur Cachar 788010 Das Das Juranmandir Tarun Ch. 4 D-140 Brajen Boro Niz Shyamabari Mudoibari Dhula Darrang 784146 Boro Pranab Lt. Bireswar 5 D-145 Jyoti Ghopa Dighirpar Sipajhar Darrang 784144 Baruah Baruah Tilak Ch. Nandeswar 6 D-801 Khasramthali Chengapathar Darrang 784525 Kalita Kalita Jaynta Gopi Kt. 7 Bahmolla Bahmolla Darrang 784522 Kalita Kalita Bibash Chakradhar 8 D-236 Gulung Temera Badulipar Golaghat Golaghat 785611 Loying Loying Chandmari, Dhrubajyoti Bipul Ch. 9 D-239 W.no-10, Near Golaghat Golaghat Golaghat 785621 Dutta Dutta Commerce college Bikash Bangkowal 10 D-257 Kebel Dawo Bangkowal Gaon Kamargaon Golaghat 785619 Dawo Gaon Rituporna Lt Niron Adhar Satra Na- 11 D-821 Adhar sastra Golaghat 785621 Borah Borah Pomuwa Chandan Suresh Ch. 12 D-817 Feta Gaon Dergaon Golaghat 785614 Deka Deka Dhekial Kumar 13 D-816 Rajib Deka Primud Deka Dhekial Golaghat 785622 Gaon Uttam Robi 14 D-820 Ajoy Robi Das Numali garh TE Numali garh Golaghat 785699 Das Partha 15 D-815 Protim Podumoni Podumoni Golaghat 785621 Duwarah Bimal 16 D-271 Lakhi Pathak Dokonia Gaon Borholla Borholla Jorhat 785631 Pathak Mukibur Lt. -

District Disaster Management Plan, 2011-12 Golaghat

DISTRICT DISASTER MANAGEMENT PLAN, GOLAGHAT DISTRICT DISASTER MANAGEMENT AUTHORITY, GOLAGHAT. Ph: 03774-283282 [1] DISTRICT DISASTER MANAGEMENT PLAN, GOLAGHAT Table of Contents 1-4 Foreword 5 Chapter-I Multi Hazard Disaster Management Plan 1.1 Introduction ` 6 1.2 Why DDMP 6 1.3 Objective 6 1.4 Disasters 7 1.5 Vision 7 Chapter-II Administrative Arrangement for Disaster Management 2.1 District Disaster Management Authority, Golaghat 8 2.2 District level Crisis management Group 8 2.3 District Disaster Management Teams, Golaghat 8 2.3.1. Early Warning and Information Management Team 8 2.3.2 Quick Response Team 9-11 2.3.4 Rescue and Evacuation Team: 12 2.3.5 Emergency Health Management Team: 12 2.3.6 Shelter Management Team: 13 2.3.7 Water and Sanitation Team: 13 2.3.8 Relief and Co-ordination Team: 13 2.3.9 Damage Assessment Team: 14 2.3.10 Trauma Counselling Team: 15 2.3.11 Carcass Disposal Team: 15 2.3.12 Patrolling Team: 15 2.3.13 Incident Response Team (IRT) 16-17 Chapter-III Overview of the District 3.1 Location, Area and Administrative Division 18 3.2 Health Institutions 19 3.3 Fire Services 19 3.4 Accessibility 20 Chapter-IV Risk Assessment and Vulnerability Analysis 4.1. Risk Assessment: 21 4.2. Vulnerability of various elements to different hazards 21 4.3. Disaster Probability: 22 4.4 Flood Prone Villages in the district: 23 4.5. Embankments,Roads & Bridges likely to be affected 23-27 4.6. Agricultural Crops likely to be affected: 28 4.7. -

Brief Summary of the Project M/S M.P. Agarwalla, Near Bokakhat Chariali

Brief summary of the project M/s M.P. Agarwalla, Near Bokakhat Chariali, Bokakhat – 785612, Assam, proposes to open a stone quarry in the Balijanpi Langso Inglong chedon Anglong area against a “Lease Agreement” Near Mohang Kirong Village, P.O. Silonijan, P.S. Silonijan, Karbi Anglong District, Assam, under Northeastern Range, Silonijan of Karbi Anglong East Division, Diphu, Karbi Anglong District, Assam for production of stone to meet up the local demand of stones for PWD constructions as per the requisition letter of Executive Engineer, PWD Golaghat NH Division, Golaghat vide letter No. NH/Com/141/10 Dated 05/03/2019. This is a Mining Contract proposed to award to M/s M.P. Agarwalla for two years, as proposed by the competent authority, the Department of Environment and Forest, Government of Assam. The location of the quarry site as has been recommended by the Department of Environment and Forest, Government of Assam to issue the Mining Contract is in Balijanpi Langso Inglong chedon Anglong, Mohang Kirong Village, P.O. Silonijan, P.S. Silonijan, Karbi Anglong District, Assam, for collection of stone. The location of the quarry site is close to National Highway 39, which is about 7 KM away from the Quarry site, connected by a motorable road. The proposed quarry site is free from human habitation for a radius of more than 1 Km. The proposed quarry site is under the jurisdiction of Northeastern Range, Silonijan of Karbi Anglong East Division, Diphu, Karbi Anglong District, Assam. The area is of 3 Hectares with exposed rock formations and degraded forested area. -

Population Pressure on Natural Resources of Morigaon District, Assam

INTERNATIONAL JOURNAL OF SCIENTIFIC & TECHNOLOGY RESEARCH VOLUME 8, ISSUE 12, DECEMBER 2019 ISSN 2277-8616 Population Pressure On Natural Resources Of Morigaon District, Assam Tinku Nath Abstract: Morigaon district is marked by very high growth of its population. It is estimated that the explosion of population affect the natural resources, mainly the land use pattern of the district. The decadal growth of the population is always higher in comparison to Assam as a whole. This rapid increase of population is exerting tremendous pressure on the land use (LU) pattern of the district. As a result, areas under different land use category increase or decrease with the passing of time. For example, area under forest has been declining day by day whereas it is quite opposite in the case of area not available for cultivation. The purpose of this research work is to determine the trend population explosion and its influence on the resources of the district. Data and information so required in this study have been collected from different secondary sources. Index Terms- Population pressure, resource utilization, changing LU pattern —————————— —————————— 1. INTRODUCTION The data so acquired have been systematically arranged Growth of population is the change in the number of people and in order to analyze them qualitative/quantitative and living in a particular area between two given points of time cartographic techniques have been employed and for the (Khullar, 2000). Today one of the greatest challenges facing preparation of the map in the paper Arc GIS 10.2 and the world community is the population explosion (Maurya, Google earth pro software are used. -

House No. 216, 3 Rd Floor, Above IDBI Bank Chandmari, Post

Violation cum Show cause letter By Speed Post/ E-mail भारत सरकार /GOVERNMENT OF INDIA खान /MINISTRY OF MINES भारतीय खान ब्यूरो /INDIAN BUREAU OF MINES गुवाहाटी /GUWAHATI REGIONAL OFFICE OFFICE OF THE REGIONAL CONTROLLER OF MINES House No. 216, 3rd Floor, Above IDBI Bank दूरभाष सं. : / सं:.0361 2656184, Tel/Fax – 0361-2656184 Chandmari, Post – Bamunimaidan, Dist – E-mail –[email protected] Kamrup (M), Guwahati, Assam-781021 No:- IBM/GHY/ASM/NCH/LST-2 Dated- 10.4.2020 To, Shri. Navneet Agarwal M/s NECEM Cements Ltd., Housing Colony Road, Rukmaninagar Dispur, Guwahati – 781006, Assam e-mail: [email protected] Subject: Violation of provisions of Mineral Conservation and Development Rules, 2017, in respect of your Umrangshu limestone mine over an extent of 35 Ha. in Dima Hasao district of Assam. Sir, On the basis of scrutiny of this office records vis a vis the statements made in the final submission of review of mining plan for the period 2020-25, contravention of the below mentioned rules of Mineral Conservation & Development Rules, 2017 has been observed at your New Umrangshu limestone mine. Rule Number Nature of violations observed 45(5) The holder of a mining lease NECEM Cements Ltd. registered with IBM under rule 45(1) of MCDR shall submit online returns in respect 2017 bearing registration No. (IBM/6738/2011) is being reported to each mine to the Regional Controller have only two business activities. or any other authorised official of the IBM & The 1st being mining at its New Umrangshu limestone mine (Mine code-38ASM08003) while the 2nd being its mineral consumption at its 45(6) Any person engaged in trading end use cement plant i.e. -

Government of Assam Environment & Forest

GOVERNMENT OF ASSAM ENVIRONMENT & FOREST DEPARTMNET DISPUR, GUWAHATI-781006 No.ENG.1/2017/334 Dated Dispur the 8th July, 2021. ADVERTISEMENT Applications are invited from eligible candidates for appointment to the post of Chairman, Member Secretary and nomination of three Members of State Pollution Control Board of Assam with headquarters at Bamunimaidam, Guwahati. The criteria for appointment/ nomination to the above posts are as under:- (a) Should possess Degree in Engineering/ Technology in Environmental Engineering or an equivalent degree thereto, Post Graduate in Environmental Engineering/ two years M.Sc in Environmental Sciences/ Environmental Management and has special knowledge and 15 years practical experience relating to Environment protection with regards to industrial pollution control, mitigation , water treatment or air pollution control devices and has rendered at least 25 years of services; or Qualification Chairperson (b) is or has been an officer under the Central and experience (1Post) Government or State Government or public sector undertaking or a University or autonomous body or statutory body, and- (i) holds or held an analogous post on regular basis in the parent cadre or department in the Pay Scale as prescribed for Commissioner and Secretary to Government of Assam, i.e., Rs. 1,30,000 (fixed) as per Assam Revision of Pay Rules, 2017; or (ii) has three years of regular service in the Grade rendered after appointment thereto on regular basis in the Pay Band-4 (Rs. 30,000 – 1,10,000 with Grade Pay of Rs. 17,500) -

Wp(C) 4716/2010

THE GAUHATI HIGH COURT (THE HIGH COURT OF ASSAM : NAGALAND : MIZORAM AND ARUNACHAL PRADESH) Writ Petition (C) No. 4716 OF 2010 1. SRI SARIF UDDIN CHOUDHURY, SON OF SRI HABIB ALI CHOUDHURY, VILLAGE – KALINAGAR, PT. V, P.O. KALINAGAR, DISTRICT – HAILAKANDI, ASSAM. 2. MD. NAZIM UDDIN LASKAR, SON OF MD. ABDUL LATIF LASKAR, VILLAGE – BAHADURPUR, P.O. BRAJAPUR, DISTRICT – HAILAKANDI, ASSAM. 3. SRI SOLBAM KALACHAND SINGHA, SON OF SRI CHIAKHU SINGHA, VILLAGE – NITYANANDAPUR PT-II, P.O. NITYANANDAPUR, DISTRICT – HAILAKANDI, ASSAM. 4. SRI ASHIT BARAN DAS, SON OF SRI ANIL CHANDRA DAS, VILLAGE & PO MOHANPUR, DISTRICT – HAILAKANDI, ASSAM. 5. SRI JOYNUL HOQUE BARBHUIYA, SON OF FORJAN ALI BARBHUIYA, VILLAGE & PO PAIKAN, DISTRICT – HAILAKANDI, ASSAM. ………… Petitioners -Versus- 1. THE STATE OF ASSAM, (REPRESENTED BY THE SECRETARY TO THE GOVT. OF ASSAM, REVENUE & DISASTER MANAGEMENT (LR) DEPARTMENT, DISPUR, GUWAHATI – 6. 2. THE COMMISSIONER AND SECRETARY TO THE GOVT. OF ASSAM, FINANCE DEPARTMENT, DISPUR, GUWAHATI -6. 3. THE DIRECTOR OF LAND RECORDS AND SURVEYS ETC., ASSAM, RUPNAGAR, GUWAHATI – 32. 4. THE DEPUTY COMMISSIONER, HAILAKANDI, P.O. AND DIST-HAILAKANDI, ASSAM. ….…… Respondents BEFORE THE HON’BLE MR. JUSTICE UJJAL BHUYAN For the Petitioner : Mr. Dr. B Ahmed, Advocate. Mr. N Hoque, Advocate. Mr. SK Deori, Advocate. For the Respondents : Mrs. VL Singh, SC, Revenue, Mr. J. Handique, GA, Assam. Mr. B. Gogoi, SC, Finance. Mr. M. Choudhury, SC, Directorate of land Records and Surveys. Date of Hearing : 01.11.2013. Date of Judgment : 03.03.2014 Judgment & Order (CAV) By way of this petition under Article 226 of the Constitution of India, petitioners seek a direction to the respondents to fill up the existing vacant post of Mandal in Hailakandi district and to consider the case of the petitioners by relaxing the upper age limit. -

Socio-Economic Significances of the Festivals of the Tiwas and the the Assamese Hindus of Middle Assam

www.ijcrt.org © 2020 IJCRT | Volume 8, Issue 5 May 2020 | ISSN: 2320-28820 SOCIO-ECONOMIC SIGNIFICANCES OF THE FESTIVALS OF THE TIWAS AND THE THE ASSAMESE HINDUS OF MIDDLE ASSAM Abstract:- The Tiwas of Mongoloid group migrated to Assam and scattered into different parts of Nagaon, Morigaon and Karbi Anglong districts and settled with the Assamese Hindus as an inseparable part of their society. The Festivals observed by the Tiwas and the Assamese caste Hindus have their distinct identity and tradition. The festivals celebrated by these communities are both of seasonal and calenderic and some festivals celebrated time to time. Bihu is the greatest festival of the region and the Tiwas celebrate it with a slight variation. The Gosain Uliuwa Mela, Jonbeel Mela and the Barat festival are some specific festivals. Influence of Neo-Vaisnative culture is diffusively and widely seen in the festivals of the plain Tiwas and the other Assamese caste Hindus. The Committee Bhaona festival of Ankiya drama performance celebrated in Charaibahi area is a unique one. This paper is an attempt to look into the socio-economic significances of the festivals of the Tiwas and Assamese Hindus of Middle Assam. Key Words:- Bihu, Gosain Uliuwn, Bhaona. 1. Introduction : In the valley of the mighty river Brahmaputra in Assam, different groups of people of different ethnicity, culture, religion and following various customs and traditions began to live from the very ancient times. Some of them were autochthonous while others came across the Northern or the Eastern hill from the plains on the west as traders or pilgrims. -

1 F.No.3/3/2009-PP-I GOVERNMENT of INDIA MINISTRY of MINORITY

F.No.3/3/2009-PP-I GOVERNMENT OF INDIA MINISTRY OF MINORITY AFFAIRS MINUTES OF THE 14th MEETING OF THE EMPOWERED COMMITTEE TO CONSIDER AND APPROVE THE MULTI-SECTORAL DEVELOPMENT PLANS FOR MINORITY CONCENTRATION DISTRICTS HELD AT 10.30 A.M. ON 8TH JUNE, 2009 UNDER THE CHAIRMANSHIP OF SECRETARY, MINISTRY OF MINORITY AFFAIRS A list of members and officials present in the meeting is annexed. 2. The Chairman of the Empowered Committee explained the background for identification of minority concentration districts (MCDs) and the scheme of a multi-sectoral development programme (MsDP) designed to address the development deficits of such districts. The Chairman pointed out that the baseline survey not only brought out the updated position in respect of the relevant parameters used for identification of such districts, but also ranked the deficits in order of the extent of deprivation in the districts. It was expected that the plans submitted by the State Governments would address the deficits in order of priority. In case a deficit, ranked higher in the order of deprivation, was not proposed to be addressed by the plan, it would be incumbent on the part of the District Level Committee and the State Level Committee to bring out the reasons for not doing so. The Chairman stressed that the primary objective of this programme was to address the identified development deficits, so that the various interventions would result in the improvement of the backwardness parameters of a minority concentration district and bring it at par with the national average. 3. The Chairman stated that the fact that these districts were not just MCDs, having a substantial minority population, but were also districts comprising of other communities who suffer from the same backwardness and deprivation should not be lost sight of.