Cityrail Performance Update

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

New Nsw Rail Timetables Rail and Tram News

AUSTRALASIAN TIMETABLE NEWS No. 268, December 2014 ISSN 1038-3697 RRP $4.95 Published by the Australian Timetable Association www.austta.org.au NEW NSW RAIL TIMETABLES designated as Hamilton Yard (Hamilton Station end) and Sydney area Passenger WTT 15 Nov 2014 Hamilton Sidings (Buffer Stop end). Transport for NSW has published a new Passenger Working Timetable for the Sydney area, version 3.70. Book 2 The following sections of the Working Timetable will be re- Weekends is valid from 15 November, and Book 1 issued with effect from Saturday 3 January 2015: • Weekdays valid from 17 November. There appear to be no Section 7- Central to Hornsby-Berowra (All Routes) significant alterations other than the opening of Shellharbour • Section 8- City to Gosford-Wyong-Morisset- Junction station closing of Dunmore station. A PDF of the Broadmeadow-Hamilton new South Coast line Public timetable can be accessed from • Section 9- Hamilton to Maitland-Dungog/Scone. the Sydney trains website. Cover pages, Explanatory Notes and Section Maps will also be issued. Additionally, amendments to Section 6 will need Sydney area Freight WTT 15 Nov 2014 to be made manually to include updated run numbers and Transport for NSW has published a new Freight Working changes to Sydney Yard working as per Special Train Notice Timetable for the Sydney area, version 3.50. Book 5 0034-2015. The re-issued sections of Books 1 & 2 will be Weekends is valid from 15 November, and Book 4 designated as Version 3.92, and replace the corresponding Weekdays valid from 17 November. There appear to be no sections of Working Timetable 2013, Version 3.31, reprint significant alterations. -

Sydney Metro City & Southwest Sub-Structure

CASE STUDY SYDNEY METRO CITY & SOUTHWEST SUB-STRUCTURE WATERPROOFING SOPREMA FLAGON PVC Tunnelling System SYDNEY METRO IS AUSTRALIA’S BIGGEST PUBLIC SYDNEY METRO IS AUSTRALIA’S BIGGEST PUBLIC TRANSPORT PROJECT, REVOLUTIONIZING THE WAY AUSTRALIA’S LARGEST CITY TRAVELS From the north west, metro rail is being extended under Sydney Harbour, through new underground From the north-west, metro rail is being extended under Sydney Harbour, through new underground city stations and beyond to the south west. In 2024, its total railway network will cover more than 66 city stations and beyond to the south-west. Its total railway network will cover more than 66 km and km and serve a capacity of 40,000 customers per hour with its 31 metro stations. serve a capacity of 40,000 customers per hour with its 31 metro stations. PROJECT DETAILS PROJECT NAME CONSTRUCTION DATE Sydney Metro City & Southwest - 2018–2021 Tunnel and Station Excavation Works (TSE) OWNER NSW Government SCOPE OF WORKS Waterproofing of underground TUNNELLING CONTRACTOR works, infrastructure John Holland CPB Ghella Joint Venture (JHCPBG) LOCATION Sydney, Australia INSTALLERS Eptec Group and Advanced SITES Weather Proofing Martin Place, Victoria Cross, Pitt Street, Crows Nest and Waterloo SOPREMA WATERPROOFS THE UNDERGROUND WORKS SOPREMA FLAGON PVC tunnelling system was installed in a few of the deepest stations on the city’s metro train line, which are expected to host large buildings above the stations: Martin Place, Victoria Cross, Pitt Street, Crows Nest, and Waterloo Station sites. Thanks to its flexibility and high mechanical resistance to geological movement and high hydrological pressure, SOPREMA’s FLAGON PVC system was chosen to waterproof these challenging underground structures. -

Presentation Heading Subheading / Author / Date

Sydney Metro Macquarie Park briefings May 2019 1 Goodbye Station Link Opening 26 May 2019 Sydney Metro North West Services • The Sydney Metro is Australia’s first fully Every automated driverless passenger railway mins system 4 in peak • No timetables - just turn up and go: o 15 services an hour during peak o 37 minute trip between Tallawong and Chatswood Station Every o Opal enabled mins Up to 1,100 people per train. 10 o off peak Travel Calculator Travelling to Macquarie University Station from: • Rouse Hill approx. 24min to Macquarie University • Kellyville approx. 22min • Bella Vista approx. 19min • Norwest approx. 17min • Hills Showground approx. 15min Tallawong • Castle Hill approx. 13min • Cherrybrook approx. 10min • Epping approx. 4min Metro train features Sydney Metro – Accessibility First accessible railway: • Level access between platforms and trains • Wider Opal gates • Accessible toilets • Multiple elevators at stations to platforms • Kerb ramps and accessible Kiss and Ride drop-off /pick-up points • Tactile flooring • Braille on help points and audio service announcements. Sydney Metro safety and operations Parking spaces Metro phasing period • First 6 weeks, Metro trains will operate every 5 mins at peak • To complete additional works we will replace metro services with North West Night Buses over the next 6 months. North West Night Buses will provide: o Turn up and go services o 10 min frequency • North West Night Buses will commence in both directions between Tallawong and Chatswood after the last Metro service: o Tallawong approx. 9:30pm o Chatswood approx. 10:00pm. North West Night Buses frequency North West Night Buses Services every 10 mins An all stop and limited stop services will run between Chatswood and Tallawong Stations for the next 6 months. -

Operations Review

OPERATIONS REVIEW SINGAPORE PUBLIC TRANSPORT SERVICES (BUS & RAIL) • TAXI AUTOMOTIVE ENGINEERING SERVICES • INSPECTION & TESTING SERVICES DRIVING CENTRE • CAR RENTAL & LEASING • INSURANCE BROKING SERVICES OUTDOOR ADVERTISING Public Transport Services The inaugural On-Demand Public Bus ComfortDelGro Corporation Limited is Services trial, where SBS Transit operated a leading provider of land transport and five bus routes – three in the Joo Koon area related services in Singapore. and two in the Marina-Downtown area – for 2.26 the LTA ended in June 2019. Conducted REVENUE Scheduled Bus during off-peak hours on weekdays, (S$BILLION) SBS Transit Ltd entered into its fourth year commuters could book a ride with an app of operating under the Bus Contracting and request to be picked up and dropped Model (BCM) in 2019, where the provision off at any bus stop within the defined areas. of bus services and the corresponding It was concluded by the LTA that such bus standards are all determined by the Land services were not cost-effective due to Transport Authority (LTA). Under this model, the high technology costs required in the Government retains the fare revenue scaling up. and owns all infrastructure and operating assets such as depots and buses. A major highlight in 2019 was SBS Transit’s active involvement in the three-month long 17,358 Bus routes in Singapore are bundled into public trial of driverless buses on Sentosa TOTAL OPERATING 14 bus packages. Of these, SBS Transit Island with ST Engineering. Operated as an FLEET SIZE operated nine. During the year, it continued on-demand service, visitors on the island to be the biggest public bus operator with could book a shuttle ride on any of the a market share of 61.1%. -

Sydney Metro City & Southwest Project Overview

Project update FEBRUARY 2017 SYDNEY METRO CITY & SOUTHWEST | PROJECT UPDATE 1 CONTENTS About Sydney Metro 4 Transforming Sydney 6 Sydney Metro experience 8 About City & Southwest 10 About Sydenham to Bankstown 12 Upgrading Sydenham to Bankstown 16 Sydney Metro Trains Facility 17 The stations 18 Temporary Transport Plan 29 Next steps 30 Appendix 36 ABOUT THIS PROJECT UPDATE Transport for NSW plans to extend the Sydney Metro system beyond This document outlines the second component and the proposed Chatswood through to Bankstown. upgrade and conversion of the existing Bankstown Line to metro standards. Sydney Metro City & Southwest will deliver 30 kilometres of metro rail between Chatswood and Bankstown, including a new crossing More detailed information about the Project between Sydenham beneath Sydney Harbour, new railway stations in the lower North and Bankstown is available in a State Significant Infrastructure Shore and Central Business District (CBD), and the upgrade and Application Report which was submitted to the Department of conversion of the current line between Sydenham and Bankstown Planning and Environment in January 2017. stations. It also provides an update on the entire Project and next steps in Planning approval for the Chatswood to Sydenham component was preparing detailed environmental assessments for the Project. received on 10 January 2017, construction will start shortly. Cover: Artist’s impression of Campsie Station This page: Aerial view of Sydney Harbour 2 Premier’s message Minister’s message Australia’s biggest public transport project is It’s full steam ahead as we embark on the next now well underway with tunnelling completed stage of Sydney Metro City & Southwest, the on Sydney Metro Northwest, and construction upgrade and conversion of the Bankstown Line. -

DRIVERS ROUTE KNOWLEDGE DIAGRAMS BANKSTOWN LINE SYDENHAM Effective Date: July 2021

DRIVERS ROUTE KNOWLEDGE DIAGRAMS BANKSTOWN LINE SYDENHAM Effective Date: July 2021 MARRICKVILLE Version: 4.36 DULWICH HILL Explanatory Notes: HURLSTONE PARK Navigate to your area of interest via the station index or by using links created in Adobe bookmarks. CANTERBURY This document is approved for route knowledge only. CAMPSIE Do not use these diagrams for any safety related BELMORE purpose without validating the information against a controlled source or in the field. LAKEMBA Information in these diagrams is uncontrolled. WILEY PARK Please report any updates to [email protected] PUNCHBOWL BANKSTOWN YAGOONA BIRRONG Copyright: Sydney Trains Ownership: Geospatial Services Location: TRIM Record No.D2015/586 BANKSTOWN LINE TO ST PET ERS JOINS MAP IL 04 01 R A 3 4 GRADIENT I 5 SM 602 I L SECTION : SYDENHAM TO REGENTS PARK W 2 AUTO 1 MAP SET : SYDENHAM TO MARRICKVILLE A 6 5.419 KM SYDENHAM Y PAGE: 1 OF 2 P X 4 D 0 UPDATED TO : 12 April 2021 SM 604 IL E GLESSON AV OH E OH 75 5.414 KM X U INFORMATION D N PARK LN X R W SUBURBAN LINES O H Y I A N SM 611 CO X SM 607 I W CONTROLLED FROM : RAIL OPERATIONS CENTRE 1 L S 4 I 5.415 KM A K RD 7 R 20 OH R B PA 5.430 KM R 6 I 3 D RADIO AREA CODE : 004 (SYDENHAM) 7 SM 611 IL E LN 440 IN 1 SM 609 IL G BELMOR HOME E 005 (SYDENHAM) OH 5.412 KM R 5 X 6 X3 X 5 5.418 KM D X X 0 ANY LINE FREIGHT LINE CONTROLLED FROM X4 X SM 613 BOT X 4 7 0 JUNEE NCCS " SYDNEY 1" BOARD 5 4 5.523 KM SM 612 5 0 X 5.525 KM PHONE No. -

South East Sydney Transport Strategy

Contents 1 EXECUTIVE SUMMARY 2 1.1 Vision and objectives 4 1.2 The problem 6 1.3 The response 7 1.4 Next steps 8 2 INTRODUCTION 10 2.1 What is the plan? 10 2.2 Strategic land use and transport plans 11 2.2.1 Why South East Sydney now? 12 2.3 Working with our stakeholders 15 3 SOUTH EAST SYDNEY 2026: THE CHALLENGE 16 3.1 Overview 17 3.2 Why not business as usual? 17 3.3 Problem statement 19 4 A VISION FOR SOUTH EAST SYDNEY 2056 23 4.1 Developing a vision for South East Sydney 23 4.2 Vision 23 4.3 Objectives and indicators 24 4.3.1 Why the South East Sydney Transport Strategy approach will work 26 4.4 Integrated land use and transport scenarios 27 4.4.1 Reference Case 27 4.4.2 Compact City 28 4.4.3 Economic 29 4.4.4 Mass Transit Corridors 30 4.4.5 Mass Transit Nodes 31 4.4.6 Dispersed 32 4.5 Development of the preferred scenario 33 5 PREFERRED LAND USE AND TRANSPORT FUTURE 34 5.1 Preferred scenario 35 5.1.1 Proposed land use changes 35 5.1.2 Policy change 38 5.1.3 Freight network improvement 43 5.1.4 Place development 45 5.1.5 Principal Bicycle Network 47 5.1.6 Randwick 49 5.1.7 Green Square – Waterloo Precinct 51 5.1.8 Sydney Airport and Port Botany Precinct 53 5.2 Co-dependency of catalytic transport investment and major redevelopment and uplift 55 5.3 The delivery 55 5.3.1 The cost 55 5.3.2 The benefits and trade-offs 57 5.3.3 Innovation and Technology 58 5.3.4 How will we measure success? 58 5.3.5 Next steps 59 List of figures Figure 1 – Study Area 3 Figure 2 – Preferred scenario and major initiatives listed in proposed priority for -

Weekly Notice

1 weekly notice Monday, 28 December 2020 Sunday, 03 January 2021 Safeworking information, including Weekly Notices and SAFE Notices, is available on the RailSafe website. By accessing Weekly Notices and SAFE Notices online, you will receive safety information more quickly. Weekly Notices remain on the RailSafe website for two years; Permanent and Temporary SAFE Notices remain online as long as they are current. Anyone needing back issues of Weekly Notices and SAFE Notices should contact the Network Rules unit. If you are outside Sydney Trains, you can reach the RailSafe website via the following address: www.railsafe.org.au Other Safeworking documents, such as Network Rules, Network Procedures, Network Local Appendices, Safeworking Policies, SafeTracks flyers, and contractor information are also available online. Director Safety and Standards Sydney Trains Continued on next page 1 weekly notice CONTENTS PUBLICATION DEADLINES AND SUBMISSION OF ARTICLES 4 CAMPBELLTOWN SIGNAL BOX AND SOUTH WEST MAINTENANCE TERRITORY – TRIAL OF NON-LOCAL POSSESSION AUTHORITY TRACK ACCESS PRE-APPROVAL PROCESS 5 MERRYLANDS RATIONALISATION - STAGE 2 REMOVALS (DIAGRAM) 7 HAND OVER MAINTENANCE RESPONSIBILITY OF AUTOMATIC SELECTIVE DOOR OPERATION (ASDO) INFRASTRUCTURE ASSETS TO SYDNEY TRAINS FOR THE AREA CENTRAL TO NEWCASTLE INTERCHANGE VIA NORTH STRATHFIELD 8 NORTH SYDNEY - SPEED SIGN INSTALLATION 9 STATUS OF TOM NOTICES 10 STATUS OF PERMANENT SAFE NOTICES 11 STATUS OF NETWORK MANUALS AND FORMS 12 DISTRIBUTION OFFICERS 14 WN 1 — 28 December 2020 3 weekly notice PUBLICATION DEADLINES AND SUBMISSION OF ARTICLES Dates of the next four Weekly Notices and deadlines for articles are: Weekly Notice For Week Deadline 2 04/01/2021 – 10/01/2021 08/12/2020 3 11/01/2021 – 17/01/2021 15/12/2020 4 18/01/2021 – 24/01/2021 22/12/2020 5 25/01/2021 – 31/01/2021 29/12/2020 To meet printing and distributing schedules, articles for a Weekly Notice must be received by its deadline. -

Choosing the Right Myzone Ticket

Choosing the right MyZone ticket PensionerExcursionTicket Unlimited daily travel ZA03659 Sydney and outer metropolitan areas GST incl. Valid on day of fi rst use only. Unlimited travel on all Sydney Buses, Newcastle Buses and Ferries, Sydney Ferries and CityRail services. Transport info: Excludes premium services. Ticket not transferable. www.131500.info Magnetic Strip Must be made available for inspection or processing by an authorised offi cer. Issued subject to the Transport Administration Act 1988, its Regulations and Orders. Fares effective 2 January 2012 Contents What’s MyZone? ______________ 2 Choosing your ticket ___________ 2 MyBus tickets _______________ 3-5 MyMulti tickets ______________ 6-7 MyMulti travel map ___________ 8-9 MyFerry tickets ____________ 10-11 MyTrain tickets ____________ 12-13 Pensioner Excursion tickets ______ 14 Family Funday Sunday tickets ____ 15 Metro Light Rail and Sydney Ferries network maps __ 16-17 MyMulti MyBus MyFerry tickets sold here Ticket resellers can be The information in this brochure is correct at easily identified by the the time of printing and is subject to change Save time MyZone/PrePay flag. without notice. What’s MyZone? MyBus tickets (bus-only travel) MyZone is the name of the public transport fare How do I know which is the right bus ticket? system encompassing travel by train, bus (government Select a MyBus1, MyBus2 or MyBus3 ticket according and private), government ferry and light rail. MyZone to how many sections you need to travel through on tickets are used across greater Sydney, the Blue your trip (a section is approximately 1.6 km). Mountains, Central Coast, the Illawarra, the Southern Highlands and the Hunter (excluding Newcastle Ferries and Newcastle Buses time-based fares). -

Tracking the Value of Rail Time Over Time Neil J

Institute of Transport Studies, Monash University World Transit Research World Transit Research 9-1-2011 Tracking the value of rail time over time Neil J. Douglas George Karpouzis Follow this and additional works at: http://www.worldtransitresearch.info/research Recommended Citation Douglas, N.J. & Karpouzis, G. (2011). Tracking the value of rail time over time. Conference paper delivered at the 34th Australasian Transport Research Forum (ATRF) Proceedings held on 28 - 30 September 2011 in Adelaide, Australia. This Conference Paper is brought to you for free and open access by World Transit Research. It has been accepted for inclusion in World Transit Research by an authorized administrator of World Transit Research. For more information, please contact [email protected]. Australasian Transport Research Forum 2011 Proceedings 28 - 30 September 2011, Adelaide, Australia Publication website: http://www.patrec.org/atrf.aspx Tracking the value of rail time over time By Douglas N.J.1 and Karpouzis G.2 Neil Douglas is manager of Douglas Economics. George Karpouzis was chief economist at RailCorp and is now a consultant economist Abstract The value of rail time is an important economic parameter in the evaluation of many rail infrastructure projects, translating travel time savings into dollars to compare against project costs. For Sydney, the value of onboard train travel time has been estimated through Stated Preference market research. Three surveys have been undertaken over the last two decades. The first was undertaken in 1992; the second in 2003 and the third in 2010. Between 1992 and 2010, the value of time has been updated by reference to movements in fare and latterly by reference to wage rate indices. -

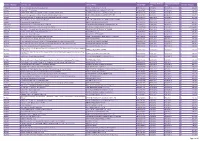

2012 Contracts (PDF, 498.96

Contract Awarded Contract Expiration Contract Number Contract Title Vendor Name VendorABN Contract Amount Date Date CW22831 V Line - Miscellaneous Services Agreement V/LINE PASSENGER PTY LTD 29087425269 1/01/2012 31/12/2012 $ 422,290 AL5913 Labour Hire - Test Analyst HCI PROFESSIONAL SERVICES PTY LTD 52108307955 5/01/2012 27/06/2016 $ 334,710 AL6212 General Solid Waste For Disposal Contract For Spent Railway Spoil COMPACTION & SOIL TESTING SERVICES PTY LTD 44106976738 6/01/2012 31/05/2013 $ 179,559 AL6696 Concrete Or Aggregates Or Stone Products Manufacturing Services BORAL RESOURCES (COUNTRY) PTY LTD 51000187002 9/01/2012 30/05/2013 $ 148,872 AL7090 Maintenance Works For Outdoor Advertising Billboards At Seven Locations SFS 22703705163 10/01/2012 21/05/2012 $ 217,100 AL7099 Oracle Software License Update And Support. ORACLE CORPORATION AUSTRALIA PTY LIMITED 80003074468 10/01/2012 23/01/2012 $ 1,293,796 AL8049 Procurement Of Legal Services HENRY DAVIS YORK LAWYERS 94516079651 12/01/2012 16/01/2012 $ 282,939 CW21625 Supply And Implement Waratah Train Set Qa Db INTEGRUM MANAGEMENT SYSTEMS PTY LTD 73125273494 13/01/2012 30/06/2016 $ 542,551 CW34115 Supply Of On-Board Catering Services For Nsw Trains APEX PACIFIC SERVICES PTY. LTD. 16102856440 14/01/2012 15/07/2016 $ 25,682,400 CW34571 Nsw Trains - Country Regional Network (Crn) Access Agreement CRN COUNTRY REGIONAL NETWORK 61009252653 15/01/2012 14/01/2015 $ 3,700,000 BL0124 Climate Change Vulnerability Assessment Fees ADVISIAN PTY LTD 50098008818 16/01/2012 26/07/2012 $ 149,285 BL0358 Labour Hire - Project Manager PROVINCIAL PERSONNEL 11002921468 16/01/2012 19/09/2013 $ 237,827 BL1229 Asset Taggingaffix Railcorp Supplied Barcode Label ADNET TECHNOLOGY AUSTRALIA PTY LIMITED 52071304213 18/01/2012 29/03/2012 $ 186,816 BL1343 Greta & Branxton Footbridge Balustrade Upgrade RKR ENGINEERING 74052053031 18/01/2012 5/07/2012 $ 198,000 BL1218 Planned Bus Services From Central To Wollongong/Dapto On 4 And 5 February 2012. -

Digital Starting Blocks: the Sydney Metro Experience Samantha Mcwilliam1, Damien Cutcliffe2 1&2WSP, Sydney, AUSTRALIA Corresponding Author: [email protected]

Digital starting blocks: The Sydney Metro experience Samantha McWilliam1, Damien Cutcliffe2 1&2WSP, Sydney, AUSTRALIA Corresponding Author: [email protected] SUMMARY Sydney Metro is currently Australia’s biggest public transport project. Stage 1 and 2 of this new standalone railway will ultimately deliver 31 metro stations and more than 66 kilometres of new metro rail, revolutionising the way Australia’s biggest city travels. Once it is extended into the central business district (CBD) and beyond in 2024, metro rail will run from Sydney’s booming North West region under Sydney Harbour, through new underground stations in the CBD and beyond to the south west. Sydney Metro City and Southwest (Stage 2) features twin 15.5km tunnels along with 7 new underground stations between Chatswood and Sydenham. The line is extended beyond Sydenham with an upgrade of the existing Sydney Trains heavy rail line to Bankstown. The adoption of a digital engineering approach on the Sydney Metro City and Southwest project resulted in an unprecedented level of collaboration and engagement between designers, clients and stakeholders. The use of tools such as WSP’s bespoke web based GIS spatial data portal Sitemap allowed geographically mapped data to be made securely available to all stakeholders involved on the project, enabling the team to work off a common data set while simultaneously controlling/restricting access to sensitive data. Over the course of the project this portal was enhanced to act as a gateway to all other digital content developed for such as live digital design models, virtual reality and augmented reality content. This portal was the prototype for what is now called ‘WSP Create’.