Notice of 2021 Annual Meeting of Stockholders

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

OBSIDIAN ENERGY LTD. Mailing Address Business Address 207 - 9TH AVENUE S.W

SECURITIES AND EXCHANGE COMMISSION FORM 40-F Annual reports filed by certain Canadian issuers pursuant to Section 15(d) and Rule 15d-4 Filing Date: 2019-03-07 | Period of Report: 2018-12-31 SEC Accession No. 0001193125-19-067079 (HTML Version on secdatabase.com) FILER OBSIDIAN ENERGY LTD. Mailing Address Business Address 207 - 9TH AVENUE S.W. 207 - 9TH AVENUE S.W. CIK:1334388| IRS No.: 000000000 | State of Incorp.:A0 | Fiscal Year End: 1231 SUITE 200 SUITE 200 Type: 40-F | Act: 34 | File No.: 001-32895 | Film No.: 19665634 CALGARY A0 T2P 1K3 CALGARY A0 T2P 1K3 SIC: 1311 Crude petroleum & natural gas (403) 777-2500 Copyright © 2019 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 40-F (Check One) ☐ Registration statement pursuant to Section 12 of the Securities Exchange Act of 1934 or ☒ Annual report pursuant to section 13(a) or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended December 31, 2018 Commission file number 1-32895 OBSIDIAN ENERGY LTD. (Exact name of registrant as specified in its charter) Alberta, Canada 1311 Not applicable (Province or other jurisdiction (Primary Standard Industrial (I.R.S. Employer of incorporation or organization) Classification Code Number (if applicable)) Identification Number (if Applicable)) Suite 200, 207 9th Avenue SW, Calgary, Alberta, Canada T2P 1K3 (403) 777-2500 (Address and Telephone Number of Registrants Principal Executive Offices) DL Services Inc., Columbia Center, 701 Fifth Avenue, Suite 6100, Seattle, Washington 98104-7043 (206) 903-5448 (Name, Address (Including Zip Code) and Telephone Number (Including Area Code) of Agent For Service in the United States) Securities registered or to be registered pursuant to Section 12(b) of the Act. -

Obsidian Energy Corporate Presentation

Obsidian Energy Corporate Presentation January 2020 Important Notice to the Readers This presentation should be read in conjunction with the Company’s unaudited consolidated financial statements, Management's Discussion and Analysis ("MD&A") for the three and nine months ended September 30, 2019. All dollar amounts contained in this presentation are expressed in millions of Canadian dollars unless otherwise indicated. Certain financial measures included in this presentation do not have a standardized meaning prescribed by International Financial Reporting Standards (“IFRS”) and therefore are considered non- generally accepted accounting practice (“Non-GAAP") measures; accordingly, they may not be comparable to similar measures provided by other issuers. This presentation also contains oil and gas disclosures, various industry terms, and forward-looking statements, including various assumptions on which such forward-looking statements are based and related risk factors. Please see the Company's disclosures located in the Appendix & Endnotes at the end of this presentation for further details regarding these matters. All slides in this presentation should be read in conjunction with “Definitions and Industry Terms”, “Non-GAAP Measure Advisory”, “Oil and Gas Information Advisory”, “Reserves Disclosure and Definitions Advisory” and “Forward-Looking Information Advisory”. All locations are considered to be Unbooked locations unless otherwise noted. 2 Corporate Overview Market Summary Ticker Symbol OBE Peace River 4,519 boe/d Q3 2019 Shares Outstanding MM 73 Cold flow heavy oil Manage base production Market Capitalization MM $80 Net Debt MM $497 Enterprise Value MM $577 Deep Basin 1,154 boe/d Q3 2019 Corporate Summary Liquids rich deeper development underlying Cardium Reserves (2P YE 2018) mmboe 125 RLI (2P YE 2018) years 13 PDP Decline (YE 2018) % 16 Tax Pools (YE 2018) MM $2,533 2019 Guidance Production boe/d 26,750 – 27,250 Capital Expenditures Cardium MM $120 incl. -

INVESTOR PRESENTATION Spartan Delta Corp

INVESTOR PRESENTATION Spartan Delta Corp. (SDE: TSXV) March 26, 2021 SPARTAN DELTA CORPORATE STRATEGY Building a Sustainable Energy Company for Global Investors DISCIPLINED CONSOLIDATOR Building towards >100,000 BOE/d WEST-CENTRAL ALBERTA DEEP BASIN – Liquids-Rich ALBERTA MONTNEY – Oil-Weighted ▪ Low base decline <20% with $4,000/boepd ▪ Well delineated acreage position capital efficiency (1) and IRRs (1) >200% ▪ Drill ready inventory with owned ▪ Drill ready inventory with owned infrastructure infrastructure ▪ Organic growth with top tier Montney ▪ Asset sustaining capital <18% of NOI (1)(2) economics DISCIPLINED CONSOLIDATOR MODERN ENERGY COMPANY SHAREHOLDER RETURN DRIVEN ESG ROI ▪ Strong Indigenous partnerships LEADERSHIP ▪ Strong balance sheet: $100MM undrawn bank line ▪ Gender diverse leadership and workforce ▪ Internally funded organic growth ▪ Developing a strategy & goals for emissions reduction ▪ Forecasting 2021 $38MM Free Funds Flow (1)(2) and $115MM YE Net Surplus (1)(2) ESG LEADERSHIP ROI March 26, 2021 2 1) See “Non-GAAP Measures” in Disclaimers 2) Corporate NOI estimate, based on Spartan Budget Price Deck as defined on slide 36 COMPANY OVERVIEW Spartan Delta Corp. ALBERTA MONTNEY: ▪ Oil-weighted Montney focus Capitalization (as at March 25, 2021) ▪ Additional consolidation opportunities Spartan Delta Corp. TSX-V SDE ▪ Oil and Liquids-Rich Montney drilling upside Share Price (1) $/sh 4.04 Market Capitalization (basic) (1) $MM 460.2 Common Shares Outstanding (basic) MM 113.9 Net Debt (as at Dec 31, 2020) (2) $MM 12.3 Estimated -

Obsidian Energy Ltd--Obsidian Energy Announces Year-End 2019

Obsidian Energy Announces Year-End 2019 Financial and Operational Results and 2020 Development Program Update Met or Exceeded all 2019 Guidance Metrics Achieved Significant Reduction in Undiscounted Asset Retirement Obligations During 2019 Strong Continued Operational and Development Results Year to Date CALGARY, March 30, 2020 /CNW/ - OBSIDIAN ENERGY LTD. (TSX – OBE, NYSE – OBE.BC) ("Obsidian Energy", the "Company", "we", "us" or "our") is pleased to announce our year-end 2019 financial and operational results, development program updates, and an update on our US listing. All figures are in Canadian dollars unless otherwise stated. Obsidian Energy's audited consolidated financial statements and Management's Discussion and Analysis ("MD&A") as at and for the year-ended December 31, 2019 can be found on our website at www.obsidianenergy.com. The documents will also be filed on SEDAR and EDGAR in due course. FINANCIAL AND OPERATING HIGHLIGHTS Three months ended December 31 Year ended December 31 2019 2018 2019 2018 FINANCIAL1 (millions, except per share amounts) Cash flow from Operations 49 19 77 99 Basic and Diluted ($/share) 0.67 0.26 1.06 1.36 Funds Flow from Operations2 54 (2) 160 92 Basic and Diluted ($/share) 0.74 (0.03) 2.20 1.26 Net loss (544) (113) (788) (305) Basic and Diluted ($/share) (7.45) (1.56) (10.81) (4.22) Capital expenditures 34 41 103 168 Net Debt2 495 497 495 497 Average sales price3 Light oil ($/bbl) 70.57 37.88 68.99 66.60 Heavy oil ($/bbl) 41.80 7.70 38.82 33.07 NGL ($/bbl) 31.42 24.99 20.77 36.69 Natural gas ($/mcf) -

Executive, Management and Board Changes in Canada's Oil & Gas

March 2019 Executive, Management and Board Changes in Canada's Oil & Gas Market Top Moves Sherri Brillon (left), who Michael J. Faust (left) was has served as Encana named interim president Corporation’s chief and chief executive officer financial officer since 2009, of Obsidian Energy Ltd. for will retire at the end of May. 12 months with an optional Corey Code has been six-month extension. Aaron named executive vice- Smith will assume the president and chief financial officer of Encana, position of senior vice-president of development effective May 1. With Encana since 1999, Code and operations with Obsidian. In related news, most recently served as vice-president, investor David French has stepped down as president relations and strategy. and chief executive officer of Obsidian. French will join Rosehill Resources Inc. as director, president and chief executive, on or before April 30. He succeeds Gary Hanna, who will remain Jason Jaskela (left) will chairman of the company’s board of directors. assume the role of executive vice-president and chief operating officer of Baytex Energy Corp., succeeding Rick Ramsay, who plans to retire on April 5. Jaskela was previously chief operating officer of Raging River Exploration Inc. David Cornhill (left), founder and chairperson of AltaGas Ltd., is stepping down on April 1 as board chair. As of April 2, Pentti Karkkainen will assume the role of chairperson. Karkkainen has more than 30 years of investment management, energy sector research and investment banking experience. Cornhill will remain on the board. On the Move – March 2019 Published on April 4, 2019 1 Management Changes • Alan Withey has been appointed interim vice- • Eileen Marikar has been named vice-president, president, finance and chief financial officer at finance at Keyera Corp. -

OBSIDIAN ENERGY LTD. Form 6-K Current Event Report Filed 2021-04

SECURITIES AND EXCHANGE COMMISSION FORM 6-K Current report of foreign issuer pursuant to Rules 13a-16 and 15d-16 Amendments Filing Date: 2021-04-27 | Period of Report: 2021-04-27 SEC Accession No. 0001193125-21-134439 (HTML Version on secdatabase.com) FILER OBSIDIAN ENERGY LTD. Mailing Address Business Address 207 - 9TH AVENUE S.W. 207 - 9TH AVENUE S.W. CIK:1334388| IRS No.: 000000000 | State of Incorp.:A0 | Fiscal Year End: 1231 SUITE 200 SUITE 200 Type: 6-K | Act: 34 | File No.: 001-32895 | Film No.: 21859918 CALGARY A0 T2P 1K3 CALGARY A0 T2P 1K3 SIC: 1311 Crude petroleum & natural gas (403) 777-2500 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 6-K REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 OF THE SECURITIES EXCHANGE ACT OF 1934 For the month of April 2021 Commission File Number 1-32895 Obsidian Energy Ltd. (Translation of registrants name into English) Suite 200, 207 9th Avenue SW Calgary, Alberta T2P 1K3 Canada (Address of principal executive offices) Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.) Form 20-F ☐ Form 40-F ☑ Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1) ☐ Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7) ☐ Copyright © 2021 www.secdatabase.com. -

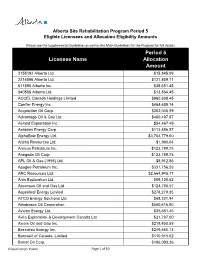

Alberta Site Rehabilitation Program Period 5 Eligible Licensees and Allocation Eligibility Amounts

Alberta Site Rehabilitation Program Period 5 Eligible Licensees and Allocation Eligibility Amounts Please see the Supplemental Guidelines as well as the Main Guidelines for the Program for full details Period 5 Licensee Name Allocation Amount 2155192 Alberta Ltd. $15,845.09 2214896 Alberta Ltd. $121,809.11 611890 Alberta Inc. $35,651.45 840586 Alberta Ltd. $13,864.45 ACCEL Canada Holdings Limited $960,608.45 Conifer Energy Inc. $464,459.14 Acquisition Oil Corp. $302,046.99 Advantage Oil & Gas Ltd. $460,497.87 Aeneid Exploration Inc. $54,467.49 Aeraden Energy Corp. $113,886.57 AlphaBow Energy Ltd. $3,704,779.60 Altima Resources Ltd. $1,980.64 Amicus Petroleum Inc. $123,789.75 Anegada Oil Corp. $123,789.75 APL Oil & Gas (1998) Ltd. $8,912.86 Apogee Petroleum Inc. $331,756.53 ARC Resources Ltd. $2,664,945.71 Artis Exploration Ltd. $89,128.62 Ascensun Oil and Gas Ltd. $124,780.07 Aspenleaf Energy Limited $278,279.35 ATCO Energy Solutions Ltd. $68,331.94 Athabasca Oil Corporation $550,616.80 Avalon Energy Ltd. $35,651.45 Avila Exploration & Development Canada Ltd $21,787.00 Axiom Oil and Gas Inc. $219,850.59 Baccalieu Energy Inc. $249,560.13 Barnwell of Canada, Limited $110,915.62 Barrel Oil Corp. $196,083.36 #Classification: Public Page 1 of 10 Alberta Site Rehabilitation Program Period 5 Eligible Licensees and Allocation Eligibility Amounts Please see the Supplemental Guidelines as well as the Main Guidelines for the Program for full details Period 5 Licensee Name Allocation Amount Battle River Energy Ltd. -

Symbol Company Market Maker Listing Market Market Maker Type Effective Date NDM NORTHERN DYNASTY MINERALS LTD

Symbol Company Market Maker Listing Market Market Maker Type Effective Date NDM NORTHERN DYNASTY MINERALS LTD. J Citadel Securities Canada ULC (#005) XTSE Full 12/9/2016 PLI PROMETIC LIFE SCIENCES INC. J Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 TV TREVALI MINING CORPORATION J Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 PGF PENGROWTH ENERGY CORPORATION Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 CS CAPSTONE MINING CORP. J Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 OBE Obsidian Energy Ltd. Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 ALO Alio Gold Inc. Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 BBD.B BOMBARDIER INC. CL 'B' SV Citadel Securities Canada ULC (#005) XTSE Full 10/5/2015 AAV ADVANTAGE OIL & GAS LTD. Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 ASR ALACER GOLD CORP. J Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 CFW CALFRAC WELL SERVICES LTD. Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 ECA ENCANA CORPORATION Citadel Securities Canada ULC (#005) XTSE Full 10/5/2015 ERF ENERPLUS CORPORATION Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 K KINROSS GOLD CORPORATION Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 LUN LUNDIN MINING CORPORATION Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 NGD NEW GOLD INC. Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 PD PRECISION DRILLING CORPORATION Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 S SHERRITT INTERNATIONAL CORPORATION Citadel Securities Canada ULC (#005) XTSE Full 4/19/2016 SVM SILVERCORP METALS INC. -

2021 Notice of Annual Meeting and 2020 Information Circular & Proxy

NOTICE OF ANNUAL MEETING AND INFORMATION CIRCULAR AND PROXY STATEMENT With Respect to the Annual Meeting of Shareholders to be held on May 6, 2021 To be conducted via live audio webcast at: https://web.lumiagm.com/179912272 March 16, 2021 Table of Contents Notice of Annual Meeting ...................................1 Director Compensation Philosophy .................................................... 36 Shareholder and Voting Information Fees and Retainers ...................................... 36 General Meeting Information ........................2 Share-Based Awards .................................. 37 Voting Information ..........................................4 Director Compensation Tables ................... 37 Director Equity Ownership Requirements .. 39 Business of the Meeting Financial Statements ...................................11 Executive Compensation Appointment of Auditors .............................11 Letter to Shareholders ................................. 40 Annual Election of Directors .......................11 Named Executive Officers ......................... 43 Advisory Vote on Executive Named Executive Officer Profiles .............. 43 Compensation ..............................................23 Compensation & Human Resources Board Recommendations for Shareholder Committee Governance ............................ 46 Voting .............................................................24 Aligning Executive Compensation and Shareholder Interests .................................. 47 Corporate Governance Compensation -

Financial Post GEOFFREY MORGAN September 4, 2020

Financial Post GEOFFREY MORGAN September 4, 2020 Endangered species: Canadian small oil and gas companies under pressure to merge or die (Financial Post) – Banks and creditors are running out of patience with a now six-year downturn in the Canadian oil industry. Small- and mid-sized oil and gas companies in Canada are going the way of the dodo bird. “The 20,000-barrel-per-day producer in Western Canada is an endangered species. We don’t see that changing for some time,” said Adam Waterous, CEO of the Waterous Energy Fund, which has been deploying private equity capital in recent years to buy up small oil companies, including the $750-million purchase of Pengrowth Energy Corp. in Nov. 2019. If the small oil producer is an endangered species, Waterous is the trophy hunter. In six transactions he has built a company now called Strathcona Resources Ltd. into one of the largest private-equity owned producers in North America with production of more than 60,000 bpd. Now, Strathcona is eyeing more underpriced assets in the Canadian oilpatch. Investors and analysts expect a mergers and acquisition wave as the oil price depression since last March and COVID-19 were just the latest in a series of crises that has squeezed the life out of many companies. It has come to a stage where banks and creditors are, in some cases, running out of patience with a now six-year downturn in the Canadian oil industry. Exasperated by paltry returns, they are cutting off funding in some cases and pushing companies to either restructure or sell out to larger companies. -

Obsidian Energy Corporate Presentation

Obsidian Energy Corporate Presentation February 2019 Important Notice to the Readers This presentation should be read in conjunction with the Company’s unaudited consolidated financial statements, Management's Discussion and Analysis ("MD&A") for the three and nine months ended September 30, 2018. All dollar amounts contained in this presentation are expressed in millions of Canadian dollars unless otherwise indicated. Certain financial measures included in this presentation do not have a standardized meaning prescribed by International Financial Reporting Standards (“IFRS”) and therefore are considered non- generally accepted accounting practice ("non-GAAP") measures; accordingly, they may not be comparable to similar measures provided by other issuers. This presentation also contains oil and gas disclosures, various industry terms, and forward-looking statements, including various assumptions on which such forward-looking statements are based and related risk factors. Please see the Company's disclosures located in the Appendix & Endnotes at the end of this presentation for further details regarding these matters. All slides in this presentation should be read in conjunction with “Definitions and Industry Terms”, “Non-GAAP Measure Advisory”, “Oil and Gas Information Advisory”, “Reserves Disclosure and Definitions Advisory” and “Forward-Looking Advisory”. Unless noted otherwise, the pricing assumption for slide 3 are applicable for all the of the slides. All locations are considered to be Unbooked locations unless otherwise noted. 2 Corporate -

Application (Approval of Proposal) Filed April 19, 2021

B201 718482 COURT FILE NUMBER 25-2718482 COURT COURT OF QUEEN’S BENCH OF ALBERTA JUDICIAL CENTRE CALGARY $50 COM IN THE MATTER OF THE NOTICE OF April 27 2021 INTENTION TO MAKE A PROPOSAL Justice Neufeld OF PROPOSAL OF GAIN ENERGY LTD. DOCUMENT APPLICATION (Approval of Proposal) ADDRESS FOR SERVICE AND MLT AIKINS LLP CONTACT INFORMATION OF 2100, 222 - 3rd Ave SW PARTY FILING THIS DOCUMENT Calgary, Alberta T2P 0B4 Phone: 403.693.5420/4347 Fax: 403.508.4349 Attention: Ryan Zahara/Catrina Webster File: 0026391.00013 NOTICE TO RESPONDENTS, This application is made against you. You are a respondent. You have the right to state your side of this matter before the master. To do so, you must be in Court when the application is heard as shown below: Date: April 27, 2021 Time: 2:00 pm Where: VIA WEBEX Before Whom: The Honourable Justice R.A. Neufeld Go to the end of this document to see what else you can do and when you must do it. Remedy claimed or sought: 1. KPMG Inc. (the "Proposal Trustee" or "KPMG"), is seeking an Order substantially in the form attached hereto as Schedule "A" for the following: (a) abridging the time for, and validating service of, this Application on the parties set out in the Service List attached hereto as Schedule "B" and the materials filed in support of this Application, if necessary, and dispensing with service on any party not served; (b) approving and sanctioning (the “Proposal Approval Order”) a proposal dated March 8, 2021 (the “Proposal”) to the creditors of Gain Energy Ltd.