Long Term Sponsored By

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SBF Overview

SECTION 02 Global Implementation of Mizu To Ikiru SBF Overview We are developing our five regional businesses by focusing on the needs of customers in each country and market. Number of employees Business overview Main products (as of December 31, 2018) Main company name (start year) Suntory Foods Limited (1972) We are strengthening the position of long-selling brands like Suntory Beverage Solution Limited (2016) Suntory Holdings Suntory Tennensui and BOSS, while offering a wide portfolio Suntory Beverage Service Limited (2013) that includes tea, juice drinks, and carbonated beverages. We JAPAN 9,682 Japan Beverage Holdings Inc. (2015) also develop integrated beverage services such as vending Suntory Foods Okinawa Limited (1997) machines, cup vending machines, and water dispensers. Suntory Products Limited (2009) Our business in Europe focuses on brands that have been Suntory Beverage & Food (SBF)* locally loved for many years. Alongside core brands like Orangina Schweppes Holding B.V. (2009) Orangina in France, and Lucozade and Ribena in the UK, EUROPE 3,798 Lucozade Ribena Suntory Limited (2014) we are also developing Schweppes carbonated beverages and a wide range of other products. Our business in Asia consists of soft drinks and health supplements. We have established joint venture companies Suntory Beverage & Food Asia Pte. Ltd. (2011) that manage the soft drink businesses in Vietnam, Thailand, BRAND’S SUNTORY INTERNATIONAL Co., Ltd. (2011) ASIA and Indonesia in a way that fits the specific needs of each 6,963 PT SUNTORY GARUDA BEVERAGE (2011) market. The health supplement business focuses on the Suntory PepsiCo Vietnam Beverage Co., Ltd. (2013) manufacture and sale of the nutritional drink, BRAND’S Suntory PepsiCo Beverage (Thailand) Co., Ltd. -

Comparison of Sports Drink Products 2017

Nutritional Comparison of Sports Drink Products; 2017 All values are per 100mL. All information obtained from nutritional panels on product and from company websites. Energy (kj) CHO (g) Sugar (g) Sodium Potassium (mg/mmol) (mg/mmol) Sports Drink Powerade Ion4 Isotonic Sports Drink Blackcurrant 104 5.8 5.8 28.0 (1.2mmol) 33 (0.9mmol) Powerade Ion4 Isotonic Sports Drink Berry Ice 104 5.8 5.8 28.0 (1.2mmol) 33 (0.9mmol) Powerade Ion4 Isotonic Sports Drink Mountain Blast 105 5.8 5.8 28.0 (1.2mmol) 33 (0.9mmol) Powerade Ion4 Isotonic Sports Drink Lemon Lime 103 5.8 5.8 28.0 (1.2mmol) 33 (0.9mmol) Powerade Ion4 Isotonic Sports Drink Gold Rush 103 5.8 5.8 28.0 (1.2mmol) 33 (0.9mmol) Powerade Ion4 Isotonic Sports Drink Silver Charge 107 5.8 5.8 28.0 (1.2mmol) 33 (0.9mmol) Powerade Ion4 Isotonic Sports Drink Pineapple Storm (+ coconut water) 97 5.5 5.5 38.0 (1.7mmol) 46 (1.2mmol) Powerade Zero Sports Drink Berry Ice 6.1 0.1 0.0 51.0 (2.2mmol) - Powerade Zero Sports Drink Mountain Blast 6.8 0.1 0.0 51.0 (2.2mmol) - Powerade Zero Sports Drink Lemon Lime 6.8 0.1 0.0 56.0 (2.2mmol) - Maximus Sports Drink Red Isotonic Sports Drink 133 7.5 6.0 31.0 - Maximus Sports Drink Big O Isotonic Sports Drink 133 7.5 6.0 31.0 - Maximus Sports Drink Green Isotonic Sports Drink 133 7.5 6.0 31.0 - Maximus Sports Drink Big Squash Isotonic Sports Drink 133 7.5 6.0 31.0 - Gatorade Sports Drink Orange Ice 103 6.0 6.0 51.0 (2.3mmol) 22.5 (0.6mmol) Gatorade Sports Drink Tropical 103 6.0 6.0 51.0 (2.3mmol) 22.5 (0.6mmol) Gatorade Sports Drink Berry Chill 103 6.0 6.0 51.0 -

Cola Wars Continued: Coke Versus Pepsi in the Twenty-First Century Intro

Group 8 - Core B 08/24/2006 Session 4 - Case Notes Professor: Arvind Bhambri Case: Cola Wars Continued: Coke versus Pepsi in the Twenty-First Century Intro: Syllabus Page 16 The Soft Drink industry has been assigned as the vehicle for tackling the topic of industry analysis and competitive dynamics. The case covers developments in the soft drink industry through 1993. It describes how the industry evolved into its current structure largely following Coca-Cola’s leadership. What is particularly interesting is determining why the major competitors in the industry have been able to earn above normal returns for close to 100 years, and why the industry is organized the way it is. The case allows us to analyze how the actions and reactions of competitors over time work to create their own industry structure. The case also allows us to examine how prior strategic commitments to particular strategies create competitive positions, which in turn constrain the future competitive moves of firms. Since competitive positioning determines a firm’s long-run performance, we need to thoroughly grasp the essentials of what makes some competitive positions and competitive strategies more viable, and others not, and why. Discussion Questions: 1. Why has the soft drink industry been so profitable? a. Since 1970 consumption grew by an average of 3% b. From 1975 to 1995 both Coke and Pepsi achieve average annual growth of around 10% c. American’s drank more soda than any other beverage d. Head-to-Head Competition between both Coke and Pepsi reinforced brand recognition of each other. This assumes that marketing added to profits rather than eating them up. -

Sports Drinks: the Myths Busted August 5, 2012

Sports drinks: the myths busted August 5, 2012 The Coca-Cola and McDonald's sponsorships for the London Olympics are creating outcry from health advocates, but there's one sponsorship they may be overlooking: Powerade. Powerade, the official drink for athletes at the 2012 Olympic Games (as well as the EUFA 2012), is the sister drink of the other official Olympic drink: Coca-Cola. Is it that surprising? The most common beliefs about sports drinks are that they rehydrate athletes, that all athletes (Olympic or not) can benefit from sports drinks, and that all sports drinks are created equal. Right? Wrong. Reaching for a neon-green Gatorade after your oh-so-grueling spin class may seem like a good idea, but the truth might surprise you. Sports drinks contain electrolytes (mostly potassium and sodium) and sugars to replenish what the body has lost through sweating that water alone can’t replace. The purpose of these beverages is to bring the levels of minerals in your blood closer to their normal levels, so you can continue your workout as if you just started. Sounds great, right? But don’t go reaching for the nearest bottle just yet. Not all sports drinks are created equal, and not every sports drink works the same for every athlete. Most nutritionists agree that sports drinks only become beneficial once your workout extends past 60 minutes. For Olympians, sports drinks might actually do the trick; one study from the University of Bath found that sipping on a carbohydrate-based drink helped athletes’ performances. But that doesn’t mean that drinking water ceases to be essential. -

Strategic Analysis of the Coca-Cola Company

STRATEGIC ANALYSIS OF THE COCA-COLA COMPANY Dinesh Puravankara B Sc (Dairy Technology) Gujarat Agricultural UniversityJ 991 M Sc (Dairy Chemistry) Gujarat Agricultural University, 1994 PROJECT SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF BUSINESS ADMINISTRATION In the Faculty of Business Administration Executive MBA O Dinesh Puravankara 2007 SIMON FRASER UNIVERSITY Summer 2007 All rights reserved. This work may not be reproduced in whole or in part, by photocopy or other means, without permission of the author APPROVAL Name: Dinesh Puravankara Degree: Master of Business Administration Title of Project: Strategic Analysis of The Coca-Cola Company. Supervisory Committee: Mark Wexler Senior Supervisor Professor Neil R. Abramson Supervisor Associate Professor Date Approved: SIMON FRASER UNIVEliSITY LIBRARY Declaration of Partial Copyright Licence The author, whose copyright is declared on the title page of this work, has granted to Simon Fraser University the right to lend this thesis, project or extended essay to users of the Simon Fraser University Library, and to make partial or single copies only for such users or in response to a request from the library of any other university, or other educational institution, on its own behalf or for one of its users. The author has further granted permission to Simon Fraser University to keep or make a digital copy for use in its circulating collection (currently available to the public at the "lnstitutional Repository" link of the SFU Library website <www.lib.sfu.ca> at: ~http:llir.lib.sfu.calhandle/l8921112>)and, without changing the content, to translate the thesislproject or extended essays, if technically possible, to any medium or format for the purpose of preservation of the digital work. -

IPFW Coca Cola Product List

Brand Family Flavors Coca Cola Classic Barq’s (Root Beer & Red Crème The #1 soft drink in the world with Soda) that refreshing and uplifting cola Fanta (Orange, Grape) taste. Mello Yello Also available in Caffeine-Free Pibb Minute Maid Fruit Drinks Fruit juice drink containing real fruit Coke Zero and natural ingredients that provide No calories or carbs, but same great delicious taste and quality. taste as Coca-Cola Classic! Also available in the Zero line: Cherry FLAVORS: Lemonade, Pink Coke Zero, Sprite Zero, Vault Zero Lemonade, Orangeade, Fruit Punch (Light Cherry Limeade, Light Orangeade only available in 12oz cans) Diet Coke Nestea The #1 diet soft drink with refreshing, A combination of great taste with the authentic cola taste. The freedom to physical restoration of tea. indulge without the calories. Also available in Caffeine-Free and Lime. FLAVORS: Sweet with Lemon, Red Tea with Pomegranate & Passion Fruit Cherry Coke & Cherry Zero Dasani Water Purified water enhanced with minerals Adds a bold, exhilarating taste of for a pure, fresh taste. Cherry to Coca-Cola. (Diet Cherry only available in 12oz. cans) Dasani Flavors: Refreshing taste of Dasani Water with Lemon or Strawberry flavor. POWERade & POWERade Zero (20oz.) Thirst quenching sports drink that Sprite & Sprite Zero replenishes the active body. The leading teen brand. Clean and crisp refreshment. No caffeine. FLAVORS: Mountain Blast, Fruit Punch, Orange, Lemon-Lime, Grape, Strawberry Lemonade Powerade Zero: Mixed Berry, Grape, Fruit Punch Minute Maid 100% Juice Vault 100% Fruit Juice with a name Drinks like a soda, kicks like an consumers trust. (450mL or 10oz. -

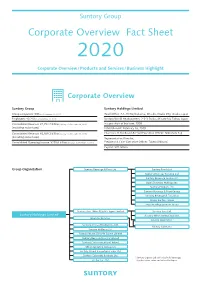

Corporate Overview Fact Sheet 2020

Suntory Group Corporate Overview Fact Sheet 2020 Corporate Overview/ Products and Services / Business Highlight Corporate Overview Suntory Group Suntory Holdings Limited Group companies: 300 (as of December 31, 2019) Head Office: 2-1-40 Dojimahama, Kita-ku, Osaka City, Osaka, Japan Employees: 40,210 (as of December 31, 2019) Suntory World Headquarters: 2-3-3 Daiba, Minato-ku, Tokyo, Japan Consolidated Revenue: ¥2,294.7 billion (January 1 to December 31, 2019) Inauguration of business: 1899 (excluding excise taxes) Establishment: February 16, 2009 Consolidated Revenue: ¥2,569.2 billion (January 1 to December 31, 2019) Chairman of the Board & Chief Executive Officer: Nobutada Saji (including excise taxes) Representative Director, Consolidated Operating Income: ¥259.6 billion (January 1 to December 31, 2019) President & Chief Executive Officer: Takeshi Niinami Capital: ¥70 billion Group Organization Suntory Beverage & Food Ltd. Suntory Foods Ltd. Suntory Beverage Solution Ltd. Suntory Beverage Service Ltd. Japan Beverage Holdings Inc. Suntory Products Ltd. Suntory Beverage & Food Europe Suntory Beverage & Food Asia Frucor Suntory Group Pepsi Bottling Ventures Group Suntory Beer, Wine & Spirits Japan Limited Suntory Beer Ltd. Suntory Holdings Limited Suntory Wine International Ltd. Beam Suntory Inc. Suntory Liquors Ltd.* Suntory (China) Holding Co., Ltd. Suntory Spirits Ltd. Suntory Wellness Ltd. Suntory MONOZUKURI Expert Limited Suntory Business Systems Limited Suntory Communications Limited Other operating companies Suntory Global Innovation Center Ltd. Suntory Corporate Business Ltd. * Suntory Liquors Ltd. sells alcoholic beverage Sunlive Co., Ltd. (spirits, beers, wine and others) in Japan. Suntory Group Corporate Overview Fact Sheet Products and Services Non-alcoholic Beverage and Food Business/Alcoholic Beverage Business Non-alcoholic Beverage and Food Business We deliver a wide range of products including mineral water, coffee, tea, carbonated drinks, sports drinks and health foods. -

Energy Drinks and Children

House of Commons Science and Technology Committee Energy drinks and children Thirteenth Report of Session 2017–19 Report, together with formal minutes relating to the report Ordered by the House of Commons to be printed 27 November 2018 HC 821 Published on 4 December 2018 by authority of the House of Commons Science and Technology Committee The Science and Technology Committee is appointed by the House of Commons to examine the expenditure, administration and policy of the Government Office for Science and associated public bodies. Current membership Norman Lamb MP (Liberal Democrat, North Norfolk) (Chair) Vicky Ford MP (Conservative, Chelmsford) Bill Grant MP (Conservative, Ayr, Carrick and Cumnock) Darren Jones MP (Labour, Bristol North West) Liz Kendall MP (Labour, Leicester West) Stephen Metcalfe MP (Conservative, South Basildon and East Thurrock) Carol Monaghan MP (Scottish National Party, Glasgow North West) Damien Moore MP (Conservative, Southport) Neil O’Brien MP (Conservative, Harborough) Graham Stringer MP (Labour, Blackley and Broughton) Martin Whitfield MP (Labour, East Lothian) Powers The Committee is one of the departmental select committees, the powers of which are set out in House of Commons Standing Orders, principally in SO No 152. These are available on the internet via www.parliament.uk. Publication Committee reports are published on the Committee’s website at www.parliament.uk/science and in print by Order of the House. Evidence relating to this report is published on the relevant inquiry page of the Committee’s website. Committee staff The current staff of the Committee are: Danielle Nash (Clerk), Zoë Grünewald (Second Clerk), Dr Harry Beeson (Committee Specialist), Dr Elizabeth Rough (Committee Specialist), Martin Smith (Committee Specialist), Sonia Draper (Senior Committee Assistant), Julie Storey (Committee Assistant), and Joe Williams (Media Officer). -

Knowledge of and Attitudes to Sports Drinks of Adolescents Living in South Wales, UK RM FAIRCHILD

Knowledge of and attitudes to sports drinks of adolescents living in South Wales, UK R M FAIRCHILD BSc (Hons), PhD1 D BROUGHTON BDS (Hons) 2 M Z MORGAN BSc (Hons), PGCE, MPH, MPhil, FFPH2 1Cardiff Metropolitan University, Department of Healthcare and Food, Cardiff CF5 2YB 2Applied Clinical Research and Public Health, College of Biomedical and Life Sciences, Cardiff University, School of Dentistry, Heath Park, Cardiff CF14 4XY Key words: oral health, children, sports drinks Word count including abstract 2,399 Abstract – 270 Corresponding author: Ruth M Fairchild (Dr) Cardiff School of Health Sciences Department of Healthcare and Food Cardiff Metropolitan University, Department of Healthcare and Food, Western Avenue Cardiff CF5 2YB ABSTRACT Background: The UK sports drinks market has a turnover in excess of £200M. Adolescents consume 15.6% of total energy as free sugars, much higher than the recommended 5%. Sugar sweetened beverages, including sports drinks, account for 30% of total free sugar intake for those aged 11-18 years. Objective: To investigate children’s knowledge and attitudes surrounding sports drinks. Method: 183 self-complete questionnaires were distributed to four schools in South Wales. Children aged 12 - 14 were recruited to take part. Questions focussed on knowledge of who sports drinks are aimed at; the role of sports drinks in physical activity and the possible detrimental effects to oral health. Recognition of brand logo and sports ambassadors and the relationship of knowledge to respondent’s consumption of sports drinks were assessed. Results: There was an 87% (160) response rate. 89.4% (143) claimed to drink sports drinks. 45.9% thought that sports drinks were aimed at everyone; approximately a third (50) viewed teenagers as the target group. -

Cornwall South West Drinks Brochure 2016 Contents

LWC LWC Cornwall Depot South West Depot (Jolly’s Drinks) King Charles Business Park Wilson Way Old Newton Road Pool Industrial Estate Heathfield Redruth | Cornwall Newton Abbot | Devon TR15 3JD TQ12 6UT 0845 345 1076 0844 811 7399 [email protected] [email protected] ER SE SUMM ASON CORNWALL SOUTH WEST DRINKS BROCHURE 2016 CONTENTS Local Brands ���������������������������������������2-18 National Brands ������������������������������ 19-42 LWC ARE THE LARGEST INDEPENDENT WHOLESALER IN THE UK We currently carry over 6000 product lines But are you competitively priced? including: 127 different draught products of The last three years has seen us grow our sales beers, lagers and ciders from £110 million to £180 million this year� 1,212 different spirit lines We have only done this because we offer the best 740 soft drink lines balance of service, product range and price anywhere 1,035 different wines in the UK today� We are totally committed to 131 cider lines helping our customers grow their sales and 97 RTD’s margins through competitive pricing and a wide Over 1,000 different cask ales and varied product range� Are LWC backed and supported by Sounds good how do I get in touch? all national suppliers? Simple, for Cornwall call Naomi Mankee on LWC are partner wholesaler status with Coors, 0845 345 1076 or email cornwall@lwc-drinks�co�uk InBev and Heineken UK� We also work in for South West call Lucy Tucker on conjunction with ALL regional brewers in the UK� 0844 811 7399 or email southwest@lwc-drinks�co�uk This means that -

SPORTS DRINKS TABLE of CONTENTS Sports Drinks Table of Contents

SPORTS DRINKS TABLE OF CONTENTS Sports drinks Table of Contents Sports nutrition market overview 06 Global sports nutrition market 2018-2023 07 Global sports nutrition market volume 2013-2020 08 Global sports food and drink sales in 2013, by category Sports drinks 10 Brand value of the most valuable soft drink brands worldwide 2018 11 Market share of leading sports/energy drinks companies worldwide 2015 12 Market share of the leading non-aseptic sport drink brands in the U.S. 2018 13 Global volume sales of liquid refreshment beverages (LRB) 2017, by category 14 Global volume sales share of liquid refreshment beverages (LRB) 2017, by category 15 U.S. market share of sports drinks 2012-2017, based on retail sales 16 U.S. market share of sports drinks 2012-2017, based on volume sales Retail facts 18 U.S. sports and energy drink retail sales 2009-2014 19 U.S. dollar sales of sports drinks 2012-2017 20 Volume sales of sports drinks in the U.S. 2012-2017 Table of Contents 21 U.S. retail price of sports drinks 2012-2017 22 U.S. supermarkets: sports drink dollar sales 2014-2015 23 U.S. supermarkets: sports drink unit sales 2014-2015 24 Sales of the leading non-aseptic sport drink brands in the U.S. 2017/18 25 Market share of the leading non-aseptic sport drink brands in the U.S. 2018 26 U.S. C-store sales of sports drinks 2017, by brand 27 U.S. C-store unit sales of sports drinks 2017, by brand 28 U.S. -

A Comparison of the Consumption of Sugar-Sweetened Beverages by College Students in Body Mass Index Groups

A COMPARISON OF THE CONSUMPTION OF SUGAR-SWEETENED BEVERAGES BY COLLEGE STUDENTS IN BODY MASS INDEX GROUPS A master’s thesis submitted to the Kent State University College of Education, Health, and Human Services in partial fulfillment of the requirements for the degree of Master of Nutrition By Rahaf Al Hamad May 2021 © Copyright, 2021 by Rahaf M. Al Hamad All Rights Reserved ii Thesis written by Rahaf M. Al Hamad B.S.Ed., University of Dayton, 2018 M.S., Kent State University, 2021 Approved by __________________________, Director, Master’s Thesis Committee Eun-Jeong (Angie) Ha __________________________, Member, Master’s Thesis Committee Natalie Caine-Bish __________________________, Member, Master’s Thesis Committee Tanya Falcone Accepted by __________________________, Director, School of Health Sciences Ellen L. Glickman __________________________, Dean, College of Education, Health, and Human James C. Hannon Services iii AL HAMAD, RAHAF M., M.S., May 2021 Nutrition and Dietetics A COMPARISON OF THE CONSUMPTION OF SUGAR-SWEETENED BEVERAGES BY COLLEGE STUDENTS IN BODY MASS INDEX GROUPS (149 pp.) Thesis Director: Eun-Jeong (Angie) Ha, Ph.D. The purpose of this retrospective, nonexperimental study was to compare the consumption of sugar-sweetened beverages (SSBs) by college students in BMI groups (N=209). Data were collected from students enrolled in Science of Human Nutrition at a Midwestern public university. More than half the students were women (73.2%) and freshmen (55.2%). The study involved a demographic survey, a three-day dietary log, and anthropometric measurements for data analysis. Descriptive statistics were used to examine demographics and types of SSBs. Analysis of covariance was used to analyze the association of SSB intake, calories derived from SSBs, and sugar derived from SSBs in students whose body mass index (BMI) classified them as underweight‒normal, overweight, and obese.