Hong Kong Prime Office

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Standard Chartered Bank (Hong Kong)

Consumption Voucher Scheme Locations with drop-box for collection of paper registration forms Standard Chartered Bank (Hong Kong) Number Location Bank Branch Branch Address 1 HK Shek Tong Tsui Branch Shops 8-12, G/F, Dragonfair Garden, 455-485 Queen's Road West, Shek Tong Tsui, Hong Kong 2 HK 188 Des Voeux Road Shop No. 7 on G/F, whole of 1/F - 3/F Branch Golden Centre, 188 Des Voeux Road Central, Hong Kong 3 HK Central Branch G/F, 1/F, 2/F and 27/F, Two Chinachem Central, 26 Des Voeux Road Central, Hong Kong 4 HK Des Voeux Road Branch Shop G1, G/F & 1/F, Standard Chartered Bank Building, 4-4A Des Voeux Road Central, Central, Hong Kong 5 HK Exchange Square Branch The Forum, Exchange Square, 8 Connaught Place, Central, Hong Kong 6 HK Admiralty Branch Shop C, UG/F, Far East Finance Centre, 16 Harcourt Road, Admiralty, Hong Kong 7 HK Queen's Road East Branch G/F & 1/F, Pak Fook Building, 208-212 Queen's Road East, Wanchai, Hong Kong 8 HK Wanchai Southorn Branch Shop C2, G/F & 1/F to 2/F, Lee Wing Building, 156-162 Hennessy Road, Wanchai, Hong Kong 9 HK Wanchai Great Eagle Shops 113-120, 1/F, Great Eagle Centre, 23 Branch Harbour Road, Wanchai, Hong Kong 10 HK Causeway Bay Branch G/F to 2/F, Yee Wah Mansion, 38-40A Yee Wo Street, Causeway Bay, Hong Kong 11 HK Times Square Priority Whole of Third Floor & Sixth Floor, No. 8 Banking Centre Branch Russell Street, Causeway Bay, Hong Kong 12 HK Happy Valley Branch G/F, 16 King Kwong Street, Happy Valley, Hong Kong 13 HK North Point Centre Branch Shop G2, G/F, North Point Centre, 278-288 King's Road, -

Hong Kong Office Marketview Q1 2013 CBRE Global Research and Consulting

Hong Kong Office MarketView Q1 2013 CBRE Global Research and Consulting OVERALL HONG KONG CENTRAL HONG KONG ISLAND KOWLOON Rents -0.2% q-o-q Rents -1.5% q-o-q Rents -0.6% q-o-q Rents +0.8% q-o-q NEW SUPPLY ON THE HORIZON COULD BE TOO LITTLE TOO LATE Hot Topics Current tight supply persist Three of the sites to be tendered in Oct 2013 - Mar 2014 are located in Occupiers continue to seek out cost Kowloon East, providing a possible 2.3 . There are early signs that activity effective space, but options are limited. million sq ft, although other in the CBD is slowly picking up The overall vacancy rate is just 3.3%, commercial uses or hotel development compared with previous quarters. or 2.2 million sq ft of available space, may reduce the office provision. This and over 30% of this is located in the should further consolidate the area as most expensive sub-market, Central. a key office hub. However, it may not . Decentralised districts on both Only 7% of all vacant space in Hong be until 2018, at the earliest, before Hong Kong Island and Kowloon Kong is located in decentralised Hong development is completed. continue to receive stronger Kong Island and Kowloon. interest. However, this does not A platform for rental growth always translate into new lettings Given the lack of new supply feeding as vacancy remains tight in these Government action on land into the market, we do not anticipate a areas. supply significant increase in vacancy in the The government recently announced short / medium term. -

Branch List English

Telephone Name of Branch Address Fax No. No. Central District Branch 2A Des Voeux Road Central, Hong Kong 2160 8888 2545 0950 Des Voeux Road West Branch 111-119 Des Voeux Road West, Hong Kong 2546 1134 2549 5068 Shek Tong Tsui Branch 534 Queen's Road West, Shek Tong Tsui, Hong Kong 2819 7277 2855 0240 Happy Valley Branch 11 King Kwong Street, Happy Valley, Hong Kong 2838 6668 2573 3662 Connaught Road Central Branch 13-14 Connaught Road Central, Hong Kong 2841 0410 2525 8756 409 Hennessy Road Branch 409-415 Hennessy Road, Wan Chai, Hong Kong 2835 6118 2591 6168 Sheung Wan Branch 252 Des Voeux Road Central, Hong Kong 2541 1601 2545 4896 Wan Chai (China Overseas Building) Branch 139 Hennessy Road, Wan Chai, Hong Kong 2529 0866 2866 1550 Johnston Road Branch 152-158 Johnston Road, Wan Chai, Hong Kong 2574 8257 2838 4039 Gilman Street Branch 136 Des Voeux Road Central, Hong Kong 2135 1123 2544 8013 Wyndham Street Branch 1-3 Wyndham Street, Central, Hong Kong 2843 2888 2521 1339 Queen’s Road Central Branch 81-83 Queen’s Road Central, Hong Kong 2588 1288 2598 1081 First Street Branch 55A First Street, Sai Ying Pun, Hong Kong 2517 3399 2517 3366 United Centre Branch Shop 1021, United Centre, 95 Queensway, Hong Kong 2861 1889 2861 0828 Shun Tak Centre Branch Shop 225, 2/F, Shun Tak Centre, 200 Connaught Road Central, Hong Kong 2291 6081 2291 6306 Causeway Bay Branch 18 Percival Street, Causeway Bay, Hong Kong 2572 4273 2573 1233 Bank of China Tower Branch 1 Garden Road, Hong Kong 2826 6888 2804 6370 Harbour Road Branch Shop 4, G/F, Causeway Centre, -

1O1O Next GTM Around the Island Race 2009

for immediate release 7 November 2017 Turkish Airlines Around the Island Race Sunday 12 November Over 230 entries have been received for the 2017 edition of the Turkish Airlines Around the Island Race which will take place this Sunday 12 November. This year, the Title Sponsor is Star Alliance member, Turkish Airlines. The partnership between Royal Hong Kong Yacht Club (“Best Asian Yacht Club”) and Turkish Airlines (“The airline that flies to more countries than any other airline and the Skytrax award winner for four key categories in 2017”) will bring a lot of excitement to the Around the Island Race as the fleet flies around Hong Kong Island. Turkish Airlines is also sponsoring an Around the Island Race photography competition which will see one lucky person being chosen to win a return business class ticket from Hong Kong to any worldwide destination* operated by Turkish Airlines. Serhat Sari, General Manager of Turkish Airlines Hong Kong, said “we are very excited to be the Title Sponsor for Around the Island Race - the biggest public sailing event of the year in Hong Kong.” Mr. Sari continued, “This year is our 15th anniversary of operation in Hong Kong and we hope that through this sponsorship engagement with the sailing participants and a campaign with the public, will bring Turkish Airlines’ brand and service commitment even closer to this Asia’s World City. Anyone with the sight of the fleet from right at the waterfront in the harbor or from up on the Peak, or perhaps somewhere at the South Side stands a chance to snap that special photo and win.” This event is Hong Kong’s largest celebration of sail and will see Victoria Harbour filled to the brim with sailboats, before they set off on the 26nm circumnavigation of Hong Kong island. -

1193Rd Minutes

Minutes of 1193rd Meeting of the Town Planning Board held on 17.1.2019 Present Permanent Secretary for Development Chairperson (Planning and Lands) Ms Bernadette H.H. Linn Professor S.C. Wong Vice-chairperson Mr Lincoln L.H. Huang Mr Sunny L.K. Ho Dr F.C. Chan Mr David Y.T. Lui Dr Frankie W.C. Yeung Mr Peter K.T. Yuen Mr Philip S.L. Kan Dr Lawrence W.C. Poon Mr Wilson Y.W. Fung Dr C.H. Hau Mr Alex T.H. Lai Professor T.S. Liu Ms Sandy H.Y. Wong Mr Franklin Yu - 2 - Mr Daniel K.S. Lau Ms Lilian S.K. Law Mr K.W. Leung Professor John C.Y. Ng Chief Traffic Engineer (Hong Kong) Transport Department Mr Eddie S.K. Leung Chief Engineer (Works) Home Affairs Department Mr Martin W.C. Kwan Deputy Director of Environmental Protection (1) Environmental Protection Department Mr. Elvis W.K. Au Assistant Director (Regional 1) Lands Department Mr. Simon S.W. Wang Director of Planning Mr Raymond K.W. Lee Deputy Director of Planning/District Secretary Ms Jacinta K.C. Woo Absent with Apologies Mr H.W. Cheung Mr Ivan C.S. Fu Mr Stephen H.B. Yau Mr K.K. Cheung Mr Thomas O.S. Ho Dr Lawrence K.C. Li Mr Stephen L.H. Liu Miss Winnie W.M. Ng Mr Stanley T.S. Choi - 3 - Mr L.T. Kwok Dr Jeanne C.Y. Ng Professor Jonathan W.C. Wong Mr Ricky W.Y. Yu In Attendance Assistant Director of Planning/Board Ms Fiona S.Y. -

LC Paper No. CB(2)740/18-19(01)

LC Paper No. CB(2)740/18-19(01) 財經事都及庫 5 局 FINANCIAL SERVICES AND THE TREASURY BUREAU (庫都科) (The Treasury Branch) 香港添馬添美道二號 24/F, Central Government Offices 2 Tim Mei Avenue, Tamar 政府總部二十四樓 Hong Kong 傳真號碼 Fax No. 25240567 電話號碼 T e l. No. 28103755 本函檔號 Our Ref. TsyB E 173/675-1011116/0 Pt.7 來函檔號 Your Ref. 29 January 2019 扎1iss Betty Ma Clerk to Panel on Security Legislative Council Complex 1 Legislative Council Road Central HongKong Dear Miss ~在a , Follow up to Panel on Security meeting held on 4 December 2018 一 Relocation of the Wan Chai Government Offices Compound (WCGOC) At the meeting of the Panel on Security (the Panel) held on 4 December 2018, the Panel requested the Government to provide information on the Govemment's plan to relocate the three office buildings at WCGOC to facilitate the consideration of the funding proposal for the Immigration Headquarters project by the Public Works Sub-commi ttee. - 2 - 1 attach the relevant supplementary information at Annex for Members' reference. Yours sincerely, (Herman So) for Secretary for Financial Services and the Treasury c.c. Secretary for Security (Fax: 2147 3165) Secretary for Commerce and Economic Development (Fax: 2918 1273) Govemment Property Administrator (Fax: 2827 1891) Director of Architectural Services (Fax: 2523 4693) Govemment ChiefInformation Officer (Fax: 2824 3208) Commissioner ofInland Revenue (Fax: 2802 7597) Director ofImmigration (Fax: 24464333) Director ofWater Supplies (Fax: 28242757) Commissioner ofCorrectional Services (Fax: 28249130) Director ofDrainage Services (Fax: 3103 0023) Judiciary Administrator (Fax No. 2413 8737) Annex Relocation of the Wan Chai Government Offices Compound This note gives an overview of the relocation exercise of the Wan Chai Government Offices Compound (WCGOC). -

Jefferies 4Th Annual ASIA EXPERT Summit Agenda & Biographies

THE GLOBAL INVESTMENT BANKING FIRM Jefferies 4th Annual ASIA EXPERT Summit Island Shangri-La, Hong Kong February 4 – 5, 2015 (Wednesday & Thursday) Agenda & Biographies Subject to change Equities | Fixed Income | Commodities | Investment Banking | Wealth & Asset Management As of Feb 5, 2015 Jefferies 4th Annual ASIA EXPERT Summit Island Shangri-La, Hong Kong, Level 39 The Atrium February 4 – 5, 2015 (Wednesday & Thursday) Wednesday, February 4, 2015 Thursday, February 5, 2015 9:00am China Unconventional Oilfield Services Update – Impact of Oil Price Drop and Future How Internet is Changing the Financial Services Industry in Asia Forecasts Alister Musgrave, MD of Moneyhero.com.hk Robert Liou, China Country Manager, PacWest Consulting Partners James Lloyd, Head of Strategy & Corporate Development, Advanced Merchant Payments (AMP) 10:00am Who Wins As China’s Cement Demand Slows? (Mandarin) Panel Debate: The Sword of Damocles: Tech IP Wars in China Zuoyi Liu, Founder of Cement Geography Panelists: IPR and Competition Partners from Bird and Bird • Hank Leung, Managing Associate, Bird & Bird • Zhaofeng Zhao, Partner, Bird & Bird • Moderator: Conor O’Mara, Asian Tech Specialist Sales 11:00am China Insurance Industry Development and Pension Fund Reform (Mandarin) How Mobile Internet is Revolutionizing The Retail Industry Jinlong Guo, Director of Insurance Division, Institute of Finance and Banking, Chinese Jason Chiu, Chief Executive Officer of Cherrypicks Academy of Social Sciences 12:30pm Keynote Presentation & Panel: Shanghai HK Stock Connect: -

When Is the Best Time to Go to Hong Kong?

Page 1 of 98 Chris’ Copyrights @ 2011 When Is The Best Time To Go To Hong Kong? Winter Season (December - March) is the most relaxing and comfortable time to go to Hong Kong but besides the weather, there's little else to do since the "Sale Season" occurs during Summer. There are some sales during Christmas & Chinese New Year but 90% of the clothes are for winter. Hong Kong can get very foggy during winter, as such, visit to the Peak is a hit-or-miss affair. A foggy bird's eye view of HK isn't really nice. Summer Season (May - October) is similar to Manila's weather, very hot but moving around in Hong Kong can get extra uncomfortable because of the high humidity which gives the "sticky" feeling. Hong Kong's rainy season also falls on their summer, July & August has the highest rainfall count and the typhoons also arrive in these months. The Sale / Shopping Festival is from the start of July to the start of September. If the sky is clear, the view from the Peak is great. Avoid going to Hong Kong when there are large-scale exhibitions or ongoing tournaments like the Hong Kong Sevens Rugby Tournament because hotel prices will be significantly higher. CUSTOMS & DUTY FREE ALLOWANCES & RESTRICTIONS • Currency - No restrictions • Tobacco - 19 cigarettes or 1 cigar or 25 grams of other manufactured tobacco • Liquor - 1 bottle of wine or spirits • Perfume - 60ml of perfume & 250 ml of eau de toilette • Cameras - No restrictions • Film - Reasonable for personal use • Gifts - Reasonable amount • Agricultural Items - Refer to consulate Note: • If arriving from Macau, duty-free imports for Macau residents are limited to half the above cigarette, cigar & tobacco allowance • Aircraft crew & passengers in direct transit via Hong Kong are limited to 20 cigarettes or 57 grams of pipe tobacco. -

List of Buildings with Confirmed / Probable Cases of COVID-19

List of Buildings With Confirmed / Probable Cases of COVID-19 List of Residential Buildings in Which Confirmed / Probable Cases Have Resided (Note: The buildings will remain on the list for 14 days since the reported date.) Related Confirmed / District Building Name Probable Case(s) Yau Tsim Mong Ho On Mansion 2507 Yau Tsim Mong Sincere House 2508 Tsuen Wan Sau Shan House, Cheung Shan Estate 2509 Wong Tai Sin Tower 3, Grand View Garden 2510 Kwun Tong Kai Shing House, Kai Yip Estate 2511 Wong Tai Sin Toi Fung House, Fung Tak Estate 2512 Wong Tai Sin Block 7, Tsui Chuk Garden 2513 Kwai Tsing Shing Yat House, Kwai Shing East Estate 2514 Wan Chai Po Ming Building 2522 Kwun Tong Ying Shun House, Choi Ying Estate 2523 Kwun Tong Hotel COZi Harbour View 2524 Kwun Tong On Wah House, Lok Wa South Estate 2525 Kwun Tong Sau Lai House, Yau Lai Estate 2526 Block 6, Palm Mansions, Phase 4, Whampoa Kowloon City 2527 Garden Sha Tin Mei Mun House, Mei Tin Estate 2528 Sha Tin Tower 3, Granville Garden 2529 Wong Tai Sin Oi Ning House, Tsz Oi Estate 2530 Central & Western Central Terrace, Sai Wan Estate 2531 Central & Western Central Terrace, Sai Wan Estate 2532 Tsuen Wan Shek Lin House, Shek Wai Kok Estate 2533 Kwai Tsing Wang Yu House, Ching Wang Court 2534 Tsuen Wan L'hotel Nina et Convention Centre 2534 Holiday Inn Express Hong Kong Kowloon Sai Kung 2535 East Sai Kung Kwong Cheong House, Kwong Ming Court 2537 Yau Tsim Mong The Salisbury YMCA of Hong Kong 2538 Yuen Long Hang Tau Tsuen, Ping Shan 2539 Sha Tin Tower 2, Bayshore Towers 2540 Tuen Mun Nai Wai 2541 1 Related Confirmed / District Building Name Probable Case(s) Yuen Long Pok Wai Village 2542 No. -

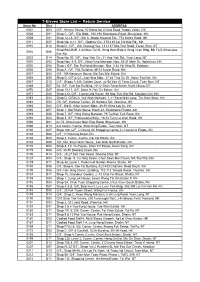

7-Eleven Store List – Return Service Store No

7-Eleven Store List – Return Service Store No. Dist ADDRESS 0001 D03 G/F., Winner House,15 Wong Nei Chung Road, Happy Valley, HK 0008 D01 Shop C, G/F., Elle Bldg., 192-198 Shaukiwan Road, Shaukiwan, HK 0009 D01 Shop 12-13, G/F., Blk C, Model Housing Est., 774 King's Road, HK 0011 D07 Shop No. 6-11, G/F., Godfrey Ctr., 175-185 Lai Chi Kok Rd., Kln 0015 D12 Shop D., G/F., Win Cheung Hse, 131-137 Sha Tsui Road, Tsuen Wan, NT Shop B2A,B2B, 2-32 Man Tai St, Wing Wah Bldg & Wing Yuen Bldg, Blk F&G,Whampoa 0016 D06 Est, Kln 0022 D14 Shop No. 57, G/F., Hop Yick Ctr., 31 Hop Yick Rd., Yuen Long, NT 0030 D02 Shop Nos. 6-9, G/F., Ning Fung Mansion, Nos. 25-31 Main St., Apleichau, HK 0035 D04 Shop J G/F, San Po Kong Mansion, Nos. 2-32 Yin Hing St, Kowloon 0036 D06 Shop A, G/F, TAL Building, 45-53 Austin Road, Kln 0037 D04 G/F, 109 Geranum House, Ma Tau Wai Estate, Kln 0058 D05 Shop D, G/F & C/L, Lap Hing Bldg., 37-43 Ting On St., Ngau Tau Kok, Kln 0067 D13 G/F., Shops A & B, Golden Court, 42-58 Yan Oi Tong Circuit, Tuen Mun, NT 0069 D07 B2, G/F, Yuet Bor Building, 10-12 Shun Fong Street, Kwai Chung, NT 0070 D07 Shop 15-17, G/F, Block 9, Pak Tin Estate, Kln 0077 D08 Shop A-D, G/F., Leung Ling House, 96 Nga Tsin Wai Rd, Kowloon City, Kln 0083 D04 Shop D, G/F&C/L Yuk Wah Mansion, 1-11 Fong Wah Lane, Tsz Wan Shan, Kln 0084 D03 G6, G/F, Harbour Centre, 25 Harbour Rd., Wanchai, HK 0085 D02 G/F., Blk B, Hiller Comm Bldg., 89-91 Wing Lok St., HK 0086 D07 Shop 1, Mei Shan House, Block 42, Shekkipmei Estate, Kln 0093 D08 Shop 7, G/F, Hing Wong Mansion, 79 Tai Kok Tsui Road, Kln 0094 D03 Shop 3, G/F, Professional Bldg., 19-23 Tung Lo Wan Road, HK 0096 D01 62-74, Shaukiwan Main East Road, Shaukiwan, HK 0098 D13 8-9 Comm. -

Daily Cantonese Expressions Part A: Meeting People

Daily Cantonese Expressions Part A: Meeting People Unit 1 Useful Expressions Part A: Meeting People 2 Unit 1 Useful Expressions...................................................................... 2 1. Greetings Unit 2 Introduction............................................................................... 11 1) Good morning Unit 3 Telephone.................................................................................. 15 Unit 4 Business and Visits.................................................................... 19 jóu sàhn early morning Unit 5 Repairs ...................................................................................... 21 (Hong Kong people just greet once a day in the morning, they won’t say “good Unit 6 Emergencies .............................................................................. 23 afternoon” or “good evening” except for TV presenters or telephone operators) Part B: Get around Town 24 Unit 1 Shopping ................................................................................... 25 2) Hi / Hey / Hello Unit 2 Taxi & Minibus ......................................................................... 28 (just say either one, they are English) Unit 3 Asking for Directions................................................................ 31 (Casual greeting words) (Generally speaking, Hong Kong people won’t greet their friends “How are you? Unit 4 Main Districts............................................................................ 33 néih hóuhó u ma ?” as English or Mandarin speakers do.) Unit -

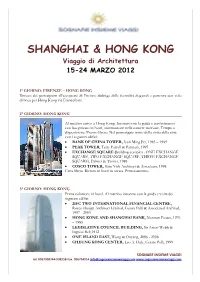

Shanghai & Hong Kong

1 SHANGHAI & HONG KONG Viaggio di Architettura 15-24 MARZO 2012 1° GIORNO: FIRENZE – HONG KONG Ritrovo dei partecipanti all’aeroporto di Firenze; disbrigo delle formalità doganali e partenza con volo di linea per Hong Kong via Francoforte. 2° GIORNO: HONG KONG Al mattino arrivo a Hong Kong. Incontro con la guida e trasferimento con bus privato in hotel, sistemazione nelle camere riservate. Tempo a disposizione. Pranzo libero. Nel pomeriggio inizio della visita della città con i seguenti edifici: • BANK OF CHINA TOWER, Ieoh Ming Pei, 1985 – 1989 • PEAK TOWER, Terry Farrell & Partners, 1995 • EXCHANGE SQUARE (building complex : ONE EXCHANGE SQUARE, TWO EXCHANGE SQUARE, THREE EXCHANGE SQUARE), Palmer & Turner, 1988 • COSCO TOWER, Hsin Yieh Architect & Associates, 1998 Cena libera. Rientro in hotel in serata. Pernottamento. 3° GIORNO: HONG KONG Prima colazione in hotel. Al mattino incontro con la guida e visita dei seguenti edifici: • 2IFC TWO INTERNATIONAL FINANCIAL CENTRE, Rocco Design Architect Limited, Cesare Pelli & Associated Archited, 1997 - 2003 • HONG KONG AND SHANGHAI BANK, Norman Foster, 1979 – 1985 • LEGISLATIVE COUNCIL BUILDING, Sir Aston Webb & Ingress Bell,1912 • ONE ISLAND EAST, Wong & Ouyang, 2006 - 2008 • CHEUNG KONG CENTER, Leo A. Daly, Cesare Pelli, 1999 SOGNARE INSIEME VIAGGI tel. 0967998744-998258-Fax. 096794914 [email protected] www.sognareinsiemeviaggi.com • HONG KONG CONVENTION & EXHIBITION CENTER, Dennis Lau and Ng Chun Man, 1995 - 1997 • MIDLEVELS ESCALATOR, ingegneri civili della Palmer & Turner Architetcts e engeneers, 1993 • SHANGRI – LA HOTEL, Wong & Ouyang (HK) Ltd., 1991 • HIGHCLIFF, Dennis Lau and Ng Chun Man, 2000 – 2003 Pranzo libero in corso d’escursione. Cena libera. Rientro in hotel in serata.