Instituto Costarricense De Electricidad and Subsidiaries

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Central Valley & Highlands

© Lonely Planet Publications 124 lonelyplanet.com ALAJUELA & THE NORTH OF THE VALLEY 125 History exhibit, trout lake and the world’s largest butterfly Central Valley & Of the 20 or so tribes that inhabited pre- enclosure. Hispanic Costa Rica, it is thought that the Monumento National Arqueológico Guayabo Central Valley Huetar Indians were the most ( p160 ) The country’s only significant archaeological site Highlands dominant. But there is very little historical isn’t quite as impressive as anything found in Mexico or evidence from this period, save for the ar- Guatemala, but the rickety outline of forest-encompassed cheological site at Guayabo. Tropical rains villages will still spark your inner Indiana Jones. Parque Nacional Tapantí-Macizo Cerro de la The rolling verdant valleys of Costa Rica’s midlands have traditionally only been witnessed and ruthless colonization have erased most of pre-Columbian Costa Rica from the pages Muerte ( p155 ) This park receives more rainfall than during travelers’ pit stops on their way to the country’s more established destinations. The of history. any other part of the country, so it is full of life. Jaguars, area has always been famous for being one of the globe’s major coffee-growing regions, In 1561 the Spanish pitched their first ocelots and tapirs are some of the more exciting species. CENTRAL VALLEY & and every journey involves twisting and turning through lush swooping terrain with infinite permanent settlement at Garcimuñoz, in Parque Nacional Volcán Irazú ( p151 ) One of the few lookouts on earth that affords views of both the Caribbean HIGHLANDS coffee fields on either side. -

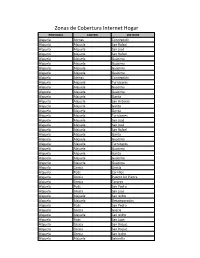

Zonas De Cobertura Internet Hogar

Zonas de Cobertura Internet Hogar PROVINCIA CANTON DISTRITO Alajuela Atenas Concepción Alajuela Alajuela San Rafael Alajuela Alajuela San José Alajuela Alajuela San Rafael Alajuela Alajuela Guácima Alajuela Alajuela Guácima Alajuela Alajuela Guácima Alajuela Alajuela Guácima Alajuela Atenas Concepción Alajuela Alajuela Turrúcares Alajuela Alajuela Guácima Alajuela Alajuela Guácima Alajuela Alajuela Garita Alajuela Alajuela San Antonio Alajuela Alajuela Garita Alajuela Alajuela Garita Alajuela Alajuela Turrúcares Alajuela Alajuela San José Alajuela Alajuela San José Alajuela Alajuela San Rafael Alajuela Alajuela Garita Alajuela Alajuela Guácima Alajuela Alajuela Turrúcares Alajuela Alajuela Guácima Alajuela Alajuela Garita Alajuela Alajuela Guácima Alajuela Alajuela Guácima Alajuela Grecia Grecia Alajuela Poás Carrillos Alajuela Grecia Puente De Piedra Alajuela Grecia Tacares Alajuela Poás San Pedro Alajuela Grecia San José Alajuela Alajuela San Isidro Alajuela Alajuela Desamparados Alajuela Poás San Pedro Alajuela Grecia Grecia Alajuela Alajuela San Isidro Alajuela Poás San Juan Alajuela Grecia San Roque Alajuela Grecia San Roque Alajuela Grecia San Isidro Alajuela Alajuela Sabanilla Alajuela Alajuela Tambor Alajuela Alajuela San Isidro Alajuela Alajuela Carrizal Alajuela Alajuela San Isidro Alajuela Alajuela Carrizal Alajuela Alajuela Tambor Alajuela Grecia Bolivar Alajuela Grecia Grecia Alajuela Alajuela San Isidro Alajuela Grecia San Jose Alajuela Alajuela San Isidro Alajuela Grecia Tacares Alajuela Poás San Pedro Alajuela Grecia Tacares -

ZONA DE CONSERVACIÓN VIAL 1-3 LOS SANTOS Conavi MAPA DE

(! 22 480000 ¤£2 (! UV306 ¤£ (! O R T S I 1 1512 I O R 6 1 IQU LE V IO BRASIL SANTA ANA 2 0 SAN PEDRO H I 10 0 ! C O R V 0 102 1 ( IO C I IR 105 1 R L S 2 R L IL 121 2 8 L 0 A A 0 RIO T A A 167 10104 0 ¬ 0 1 L ¬ « « SAN RAFAEL 1 221 1 FRESES E 177 176 «¬ U 39 0 «¬ 202 7 219 R I ¤£ «¬ «¬ 1 1 ¬ 1 « ¬ C 2 CONCEPCIÓN « 0 39 O 0 I 1 1 £ ¤£ R 22 121 1 ¤ ¤£ 0 215 «¬ 1 «¬ DULCE NOMBRE 1 PASQUÍ 0 CURRIDABAT ESCAZÚ 177 ZAPOTE 8 1 311 «¬ 209 1 UV (! 110 «¬ Q POTRERO CERRADO U BELLO HORIZONTE «¬ 215 E B (! R 176 «¬ A HATILLO D O TIERRA BLANCA A ¬ R O MARIA « I CURRIDABAT 401 A D COLÓN 1 GUI H 1 LA 204 A UV O 0 R ZONA DE CONSERVACIÓN VIAL 1-3 0 214 T N 1 ! ZONA DE CONSERVACIÓ(! N VIAL 1-3 «¬ ( N D «¬ E PIEDRAS NEGRAS A V 136 SAN SEBASTIÁN 11802 E «¬ 211 SAN FRANCISCO R 252 251 218 IO 39 «¬ «¬ «¬ «¬ R I £ IB 210 ¤ TRES RÍOS BANDERILLA 175 R 1 T I ¬ 2 0 « conavi 0 1 conavi SAN FELIPE 19 ¬ 1011 IO « 4 LOS SANTOS 3 LOMAS DE AYARCO PICAGRES LOS SANTOS 211 R (! SAN ANTONIO TIRRASES 213 ¬ 0 110 207 « 3 «¬ ALAJUELITA «¬ «¬ FIERRO BEBEDERO 409 RIO UV PACAC UA (! SAN DIEGO 2 402 R I £ UV O 105 213 ¤ OR «¬ LLANO LEÓN O «¬ 105 SAN ANTONIO «¬ DESAMPARADOS SAN VICENTE ORATORIO R UASI-2019-11-013 / Actualizado a Febrero 2019 IO 210 (! D 219 214 1 A «¬ CALLE FALLAS 03 M «¬ COT PABELLÓN R «¬ 0 A S 4 I O CONCEPCIÓN R A SAN JOSECITO IO G RÍO AZUL U R R E U VILLA NUEVA C S A OCHOMOGO 230 1 0 «¬ 3 409 0 UV 1 PASO ANCHO QUEBRADA GRANDE QUEBRADA HONDA 217 214 PATARRÁ CARTAGO O 239 D «¬ «¬ «¬ A T 209 N E «¬ V RI SAN JUAN DE DIOS E 3 DESAMPARADITOS O J R 0 AR 7 IS IO 0 219 -

Codigos Para Provincia – Canton – Distrito Región Agrícola – Categoría Urbana Y Area Demográfica

CENTRO LATINOAMERICANO Y CARIBEÑO DE DEMOGRAFÍA (CELADE) CENSOS DE 1963 CENSOS DE POBLACIÓN Y VIVIENDA REPÚBLICA DE COSTA RICA Instrucciones para la Crítica y Codificación DIRECCIÓN GENERAL DE ESTADÍSTICA Y CENSOS RODRIGO BOLAÑOS SANCHEZ Director General de Estadística y Censos LIC. RENE SANCHEZ B. Sub-Director FRANCISCO AMADOR SANCHEZ Jefe Departamento de Censos FABIO VIQUEZ NUÑEZ Jefe Sección Censo de Población y Vivienda 2 INDICE Página Introducción ....................................................................................................................................... 6 PRIMERA PARTE ASPECTOS GENERALES I.- Confidencialidad de los Datos. Ley General de Estadística .......................................................... 7 II.- Adiestramiento del Personal......................................................................................................... 7 III.- Organización del Trabajo............................................................................................................ 7 IV.- Instrucciones Generales .............................................................................................................. 8 SEGUNDA PARTE CRITICA Y CODIFICACION DEL CENSO DE VIVIENDA I.- Generalidades ................................................................................................................................ 10 II.- Identificación................................................................................................................................ 10 l.- Crítica............................................................................................................................................ -

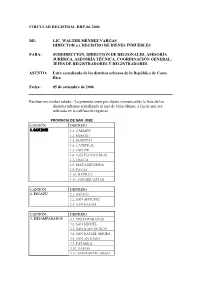

Circular Registral Drp-06-2006

CIRCULAR REGISTRAL DRP-06-2006 DE: LIC. WALTER MÉNDEZ VARGAS DIRECTOR a.i. REGISTRO DE BIENES INMUEBLES PARA: SUBDIRECCIÓN, DIRECCIÓN DE REGIONALES, ASESORÍA JURÍDICA, ASEOSRÍA TÉCNICA, COORDINACIÓN GENERAL, JEFES DE REGISTRADORES Y REGISTRADORES. ASUNTO: Lista actualizada de los distritos urbanos de la República de Costa Rica Fecha: 05 de setiembre de 2006 Reciban mi cordial saludo. La presente tiene por objeto comunicarles la lista de los distritos urbanos actualizada al mes de Julio último, a fin de que sea utilizada en la califiación registral. PROVINCIA DE SAN JOSE CANTÓN DISTRITO 1. SAN JOSE 1.1. CARMEN 1.2. MERCED 1.3. HOSPITAL 1.4. CATEDRAL 1.5. ZAPOTE 1.6. SAN FCO DOS RIOS 1.7. URUCA 1.8. MATA REDONDA 1.9. PAVAS 1.10. HATILLO 1.11. SAN SEBASTIAN CANTÓN DISTRITO 2. ESCAZU 2.1. ESCAZU 2.2. SAN ANTONIO 2.3. SAN RAFAEL CANTÓN DISTRITO 3. DESAMPARADOS 3.1. DESAMPARADOS 3.2. SAN MIGUEL 3.3. SAN JUAN DE DIOS 3.4. SAN RAFAEL ARRIBA 3.5. SAN ANTONIO 3.7. PATARRA 3.10. DAMAS 3.11. SAN RAFAEL ABAJO 3.12. GRAVILIAS CANTÓN DISTRITO 4. PURISCAL 4.1. SANTIAGO CANTÓN DISTRITO 5. TARRAZU 5.1. SAN MARCOS CANTÓN DISTRITO 6. ASERRI 6.1. ASERRI 6.2. TARBACA (PRAGA) 6.3. VUELTA JORCO 6.4. SAN GABRIEL 6.5.LEGUA 6.6. MONTERREY CANTÓN DISTRITO 7. MORA 7.1 COLON CANTÓN DISTRITO 8. GOICOECHEA 8.1.GUADALUPE 8.2. SAN FRANCISCO 8.3. CALLE BLANCOS 8.4. MATA PLATANO 8.5. IPIS 8.6. RANCHO REDONDO CANTÓN DISTRITO 9. -

Horario Y Mapa De La Línea SAN JOSÉ - FRAILES - BUSTAMANTE De Autobús

Horario y mapa de la línea SAN JOSÉ - FRAILES - BUSTAMANTE de autobús Terminal Bustamante, Plaza De Deportes SAN JOSÉ - FRAILES - BUSTAM… Bustamante →Terminal Ver En Modo Sitio Web San José, Contiguo A Minisuper Puerto Principe La línea SAN JOSÉ - FRAILES - BUSTAMANTE de autobús (Terminal Bustamante, Plaza De Deportes Bustamante →Terminal San José, Contiguo A Minisuper Puerto Principe) tiene 2 rutas. Sus horas de operación los días laborables regulares son: (1) a Terminal Bustamante, Plaza De Deportes Bustamante →Terminal San José, Contiguo A Minisuper Puerto Principe: 4:30 - 18:00 (2) a Terminal San José, Contiguo A Minisuper Puerto Principe →Terminal Bustamante, Plaza De Deportes Bustamante: 5:30 - 21:00 Usa la aplicación Moovit para encontrar la parada de la línea SAN JOSÉ - FRAILES - BUSTAMANTE de autobús más cercana y descubre cuándo llega la próxima línea SAN JOSÉ - FRAILES - BUSTAMANTE de autobús Sentido: Terminal Bustamante, Plaza De Deportes Horario de la línea SAN JOSÉ - FRAILES - BUSTAMANTE Bustamante →Terminal San José, Contiguo A Minisuper de autobús Puerto Principe Terminal Bustamante, Plaza De Deportes → 57 paradas Bustamante Terminal San José, Contiguo A Minisuper VER HORARIO DE LA LÍNEA Puerto Principe Horario de ruta: lunes 4:30 - 18:00 Terminal Bustamante, Plaza De Deportes Bustamante martes 4:30 - 18:00 Contiguo A Pulpería Quirós, Bustamante miércoles 4:30 - 18:00 Desamparados jueves 4:30 - 18:00 Figuras Bar, Bustamante Desamparados viernes 4:30 - 18:00 Finca De Apicultores Fc, Frailes Desamparados sábado 4:45 - 17:30 -

LA GACETA N° 92 De La Fecha 20 05 2019

La Uruca, San José, Costa Rica, lunes 20 de mayo del 2019 AÑO CXLI Nº 92 88 páginas ¡YA ESTÁ A LA VENTA! Adquiera ambos tomos por ₡6.000 Para mayor información comuníquese al 2296-9570, extensión 301 o al correo electrónico [email protected] www.imprentanacional.go.cr Pág 2 La Gaceta Nº 92 — Lunes 20 de mayo del 2019 Partes, que traerá benefcios a sus nacionales al momento de CONTENIDO presentar sus atestados académicos tanto en Costa Rica como en Brasil. Pág Finalmente, cabe destacar que el presente acuerdo constituye N° una iniciativa importante para el desarrollo económico y social PODER LEGISLATIVO de nuestro país, acorde con los principios de la política exterior Proyectos .................................................................. 2 costarricense y es el resultado de un proceso de consulta y análisis entre los organismos competentes de ambos países en esta materia, PODER EJECUTIVO y constituye la expresión de la consolidación e intensifcación de Decretos ................................................................... 3 nuestras relaciones bilaterales con la República Federativa del Brasil. Resoluciones ............................................................ 4 En virtud de lo anterior, sometemos a conocimiento de Edictos ...................................................................... 6 la Asamblea Legislativa el proyecto de ley adjunto relativo a DOCUMENTOS VARIOS........................................ 6 la Aprobación del Protocolo de Enmienda al Convenio de Intercambio Cultural entre el Gobierno -

Appendix 1. Specimens Examined

Knapp et al. – Appendix 1 – Morelloid Clade in North and Central America and the Caribbean -1 Appendix 1. Specimens examined We list here in traditional format all specimens examined for this treatment from North and Central America and the Caribbean. Countries, major divisions within them (when known), and collectors (by surname) are listed in alphabetic order. 1. Solanum americanum Mill. ANTIGUA AND BARBUDA. Antigua: SW, Blubber Valley, Blubber Valley, 26 Sep 1937, Box, H.E. 1107 (BM, MO); sin. loc. [ex Herb. Hooker], Nicholson, D. s.n. (K); Barbuda: S.E. side of The Lagoon, 16 May 1937, Box, H.E. 649 (BM). BAHAMAS. Man O'War Cay, Abaco region, 8 Dec 1904, Brace, L.J.K. 1580 (F); Great Ragged Island, 24 Dec 1907, Wilson, P. 7832 (K). Andros Island: Conch Sound, 8 May 1890, Northrop, J.I. & Northrop, A.R. 557 (K). Eleuthera: North Eleuthera Airport, Low coppice and disturbed area around terminal and landing strip, 15 Dec 1979, Wunderlin, R.P. et al. 8418 (MO). Inagua: Great Inagua, 12 Mar 1890, Hitchcock, A.S. s.n. (MO); sin. loc, 3 Dec 1890, Hitchcock, A.S. s.n. (F). New Providence: sin. loc, 18 Mar 1878, Brace, L.J.K. 518 (K); Nassau, Union St, 20 Feb 1905, Wight, A.E. 111 (K); Grantstown, 28 May 1909, Wilson, P. 8213 (K). BARBADOS. Moucrieffe (?), St John, Near boiling house, Apr 1940, Goodwing, H.B. 197 (BM). BELIZE. carretera a Belmopan, 1 May 1982, Ramamoorthy, T.P. et al. 3593 (MEXU). Belize: Belize Municipal Airstrip near St. Johns College, Belize City, 21 Feb 1970, Dieckman, L. -

Provincia Nombre Provincia Cantón Nombre Cantón Distrito Nombre

Provincia Nombre Provincia Cantón Nombre Cantón Distrito Nombre Distrito Barrio Nombre Barrio 1 San José 1 San José 1 CARMEN 1 Amón 1 San José 1 San José 1 CARMEN 2 Aranjuez 1 San José 1 San José 1 CARMEN 3 California (parte) 1 San José 1 San José 1 CARMEN 4 Carmen 1 San José 1 San José 1 CARMEN 5 Empalme 1 San José 1 San José 1 CARMEN 6 Escalante 1 San José 1 San José 1 CARMEN 7 Otoya. 1 San José 1 San José 2 MERCED 1 Bajos de la Unión 1 San José 1 San José 2 MERCED 2 Claret 1 San José 1 San José 2 MERCED 3 Cocacola 1 San José 1 San José 2 MERCED 4 Iglesias Flores 1 San José 1 San José 2 MERCED 5 Mantica 1 San José 1 San José 2 MERCED 6 México 1 San José 1 San José 2 MERCED 7 Paso de la Vaca 1 San José 1 San José 2 MERCED 8 Pitahaya. 1 San José 1 San José 3 HOSPITAL 1 Almendares 1 San José 1 San José 3 HOSPITAL 2 Ángeles 1 San José 1 San José 3 HOSPITAL 3 Bolívar 1 San José 1 San José 3 HOSPITAL 4 Carit 1 San José 1 San José 3 HOSPITAL 5 Colón (parte) 1 San José 1 San José 3 HOSPITAL 6 Corazón de Jesús 1 San José 1 San José 3 HOSPITAL 7 Cristo Rey 1 San José 1 San José 3 HOSPITAL 8 Cuba 1 San José 1 San José 3 HOSPITAL 9 Dolorosa (parte) 1 San José 1 San José 3 HOSPITAL 10 Merced 1 San José 1 San José 3 HOSPITAL 11 Pacífico (parte) 1 San José 1 San José 3 HOSPITAL 12 Pinos 1 San José 1 San José 3 HOSPITAL 13 Salubridad 1 San José 1 San José 3 HOSPITAL 14 San Bosco 1 San José 1 San José 3 HOSPITAL 15 San Francisco 1 San José 1 San José 3 HOSPITAL 16 Santa Lucía 1 San José 1 San José 3 HOSPITAL 17 Silos. -

Codigos Geograficos

División del Territorio de Costa Rica Por: Provincia, Cantón y Distrito Según: Código 2007 Código Provincia, Cantón y Distrito COSTA RICA 1 PROVINCIA SAN JOSE 101 CANTON SAN JOSE 10101 Carmen 10102 Merced 10103 Hospital 10104 Catedral 10105 Zapote 10106 San Francisco de Dos Ríos 10107 Uruca 10108 Mata Redonda 10109 Pavas 10110 Hatillo 10111 San Sebastián 102 CANTON ESCAZU 10201 Escazú 10202 San Antonio 10203 San Rafael 103 CANTON DESAMPARADOS 10301 Desamparados 10302 San Miguel 10303 San Juan de Dios 10304 San Rafael Arriba 10305 San Antonio 10306 Frailes 10307 Patarrá 10308 San Cristóbal 10309 Rosario 10310 Damas 10311 San Rafael Abajo 10312 Gravilias 10313 Los Guido 104 CANTON PURISCAL 10401 Santiago 10402 Mercedes Sur 10403 Barbacoas 10404 Grifo Alto 10405 San Rafael 10406 Candelaria 10407 Desamparaditos 10408 San Antonio 10409 Chires 105 CANTON TARRAZU 10501 San Marcos 10502 San Lorenzo 10503 San Carlos 106 CANTON ASERRI 10601 Aserrí 10602 Tarbaca o Praga 10603 Vuelta de Jorco 10604 San Gabriel 10605 La Legua 10606 Monterrey 10607 Salitrillos 107 CANTON MORA 10701 Colón 10702 Guayabo 10703 Tabarcia 10704 Piedras Negras 10705 Picagres 108 CANTON GOICOECHEA 10801 Guadalupe 10802 San Francisco 10803 Calle Blancos 10804 Mata de Plátano 10805 Ipís 10806 Rancho Redondo 10807 Purral 109 CANTON SANTA ANA 10901 Santa Ana 10902 Salitral 10903 Pozos o Concepción 10904 Uruca o San Joaquín 10905 Piedades 10906 Brasil 110 CANTON ALAJUELITA 11001 Alajuelita 11002 San Josecito 11003 San Antonio 11004 Concepción 11005 San Felipe 111 CANTON CORONADO -

SAN GABRIEL DE ASERRÍ De Autobús

Horario y mapa de la línea SAN JOSE - SAN GABRIEL DE ASERRÍ de autobús San Jose - SAN JOSE - SAN GABRIEL DE AS… San Gabriel Ver En Modo Sitio Web de Aserrí (R:157) La línea SAN JOSE - SAN GABRIEL DE ASERRÍ de autobús (San Jose - San Gabriel de Aserrí (R:157)) tiene 2 rutas. Sus horas de operación los días laborables regulares son: (1) a Terminal Los Mangos Aserrí, Plaza De Deportes Los Mangos →Terminal San José, Frente A Instituto Cosvic: 3:45 - 19:45 (2) a Terminal San José, Frente A Instituto Cosvic →Terminal Los Mangos Aserrí, Frente A Plaza De Deportes Los Mangos: 5:30 - 22:30 Usa la aplicación Moovit para encontrar la parada de la línea SAN JOSE - SAN GABRIEL DE ASERRÍ de autobús más cercana y descubre cuándo llega la próxima línea SAN JOSE - SAN GABRIEL DE ASERRÍ de autobús Sentido: Terminal Los Mangos Aserrí, Plaza De Horario de la línea SAN JOSE - SAN GABRIEL DE Deportes Los Mangos →Terminal San José, Frente ASERRÍ de autobús A Instituto Cosvic Terminal Los Mangos Aserrí, Plaza De Deportes Los → 47 paradas Mangos Terminal San José, Frente A Instituto VER HORARIO DE LA LÍNEA Cosvic Horario de ruta: lunes 3:45 - 19:45 Terminal Los Mangos Aserrí, Plaza De Deportes martes 3:45 - 19:45 Los Mangos miércoles 3:45 - 19:45 Cercanías Escuela María García Araya, Los Mangos Aserrí jueves 3:45 - 19:45 viernes 3:45 - 19:45 Salitral, Aserrí sábado 4:15 - 20:15 Cercanías Balneario Reina Del Sol, San Gabriel Aserrí domingo 4:15 - 19:45 Plantel Buses San Gabriel, Aserrí Costado Posterior Iglesia San Gabriel Arcángel, Información de la línea SAN -

Costa Rica Las Palomas Washed.Indd

Costa Rica Tarbaca LAS PALOMAS Profile Country Costa Rica Province San José Canton Aserrí Town Tarbaca Farm Las Palomas Altitude 1400 - 1700 masl Varieties Bourbon, Caturra, Catuai, San Ramon, Typica Harvest December - April Process Washed Costa Rica Las Palomas Tarbaca is one of the fi ve original districts of the Canton Aserrí and has the highest Costa Rica altitude therein. Characterized as an extremely green area due to the large number of trees and the small population. It also contains the Cerro El Cedral in which there Las Palomas is a large number of water springs as well as being crossed by several rivers of the canton. This is where we fi nd Familia Monge Garcia’s Las Palomas farm. Don Jorge Monge Garbanzo inherited Las Palomas from his parents and took over management of the farm in 1993. He now runs it with his wife, Flor Mayela Garcia Valverde and their children. Jorge Monge Garbanzo himself is one of eleven children, all of whom continue to be connected to coffee in some way. Las Palomas spans six hectares and produces around 250 fanegas (a fenega is approx. 46kg) of coffee annually. The farm is named Las Palomas because of the various birds that can be found in the region, his Don Jorge employs two full-time farm workers, and a group of 25 collectors visit the farm during the harvest season, moving between Las Palomas and the neighbouring farms. Coffee is delivered to the nearby Association of Agricultural Producers of the Communities of Acosta and Aserrí (ASOPROAAA), who process coffee and citrus in the areas of Acosta, Jorco and Palmichal, as well as offering fi nancial, commercial and technical support to its members.