Investment Case Study

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Metals Recycling Entities Sorted by City Location As of July 31, 2016 Total Active MRE Count = 806

Metals Recycling Entities sorted by City Location as of July 31, 2016 Total active MRE count = 806 CertID Location Name Street Address City ZIP County Contact Phone Email ExpDate 101026 A-1 CORE & METAL LLC 301 N. TREADAWAY ABILENE 79601 TAYLOR DOZIER CHAD (325) 675-5477 [email protected] 3/23/2017 101025 A-1 SALVAGE LLC 4008 PINE ST. ABILENE 79601 TAYLOR BLAKE DOZIER (325) 672-5504 [email protected] 2/5/2017 101241 JAY'Z RECYCLING 3902 PINE ST. ABILENE 79601 TAYLOR JASON HUDSON (325) 676-5299 [email protected] 8/14/2017 101110 PINE STREET SALVAGE CO. 3833 PINE ST. ABILENE 79601 TAYLOR GREG DANKWORTH (325) 677-8831 [email protected] 3/10/2017 101053 TEXAS METALS & RECYCLING CO. INC 2989 PINE ST. ABILENE 79601 TAYLOR JODIE BREWSTER (325) 672-8585 [email protected] 5/7/2017 101982 ALAMO METAL RECYCLING 219 E. FRONTAGE RAOD ALAMO 78516 HIDALGO RUBY GONZALEZ (956) 783-4709 [email protected] 4/12/2018 102193 ALVAREZ RECYCLING 1109 S. ALAMO ROAD ALAMO 78516 HIDALGO ALVAREZ BELEN (956) 638-8004 [email protected] 11/12/2017 102095 H & A METAL RECYCLERS 229 E. BUS. HWY. 83 ALAMO 78516 HIDALGO JORGE CALVILLO (956) 283-1151 [email protected] 12/22/2016 101755 MONCAS SCRAP METAL 117 S. BORDER ROAD ALAMO 78516 HIDALGO JESUS MONROY (956) 330-5406 [email protected] 1/9/2017 102075 OLD SHINE METALS LLC 1302 N. TOWER ROAD ALAMO 78516 HIDALGO HONORIO VILLARRE (956) 702-9868 [email protected] 11/10/2016 101259 WILKINSON GARY IRON & METAL INC 917 S. -

Angel: Through My Eyes - Natural Disaster Zones by Zoe Daniel Series Editor: Lyn White

BOOK PUBLISHERS Teachers’ Notes Angel: Through My Eyes - Natural Disaster Zones by Zoe Daniel Series editor: Lyn White ISBN 9781760113773 Recommended for ages 11-14 yrs These notes may be reproduced free of charge for use and study within schools but they may not be reproduced (either in whole or in part) and offered for commercial sale. Introduction ............................................ 2 Links to the curriculum ............................. 5 Background information for teachers ....... 12 Before reading activities ......................... 14 During reading activities ......................... 16 After-reading activities ........................... 20 Enrichment activities ............................. 28 Further reading ..................................... 30 Resources ............................................ 32 About the writer and series editor ............ 32 Blackline masters .................................. 33 Allen & Unwin would like to thank Heather Zubek and Sunniva Midtskogen for their assistance in creating these teachers notes. 83 Alexander Street PO Box 8500 Crows Nest, Sydney St Leonards NSW 2065 NSW 1590 ph: (61 2) 8425 0100 [email protected] Allen & Unwin PTY LTD Australia Australia fax: (61 2) 9906 2218 www.allenandunwin.com ABN 79 003 994 278 INTRODUCTION Angel is the fourth book in the Through My Eyes – Natural Disaster Zones series. This contemporary realistic fiction series aims to pay tribute to the inspiring courage and resilience of children, who are often the most vulnerable in post-disaster periods. Four inspirational stories give insight into environment, culture and identity through one child’s eyes. www.throughmyeyesbooks.com.au Advisory Note There are children in our schools for whom the themes and events depicted in Angel will be all too real. Though students may not be at risk of experiencing an immediate disaster, its long-term effects may still be traumatic. -

Ways to Be Worse Off

WAYS TO BE WORSE OFF Ian Stoner Abstract: Does disability make a person worse off? I argue that the best answer is yes and no, because we can be worse off in two conceptually distinct ways. Disabil- ities usually make us worse off in one way (typified by facing hassles) but not in the other (typified by facing lone- liness). Acknowledging two conceptually distinct ways to be worse off has fundamental implications for philosophi- cal theories of well-being. A central question in the philosophy of disability concerns the implications of disability for well-being. The question is of obvious relevance to several controversies in bioethics; positions concerning the permissibility of pre- natal screening for the purposes of positive or negative selection and the appropriate allocation of scarce health-care resources turn, in large part, on whether disabilities are a form of value-neutral diversity (mere difference) or a regrettable, harmed condition (bad difference). Perhaps it is because the practical implications of the mere-difference/bad- difference debate are so significant that philosophers have given little atten- tion to that debate’s theoretical implications. Those implications are also significant. In fact, clarifying a conceptual confusion at the heart of the mere-difference/bad-difference debate yields a fundamental challenge to the entire project of theorizing well-being. Thus, I have two goals in this paper. First, I engage the mere-difference/ bad-difference debate by attending to the pre-theoretic concept of well- being. I argue that there is no unified concept of well-being, rather a graft of two distinct sub-concepts. -

Buffy & Angel Watching Order

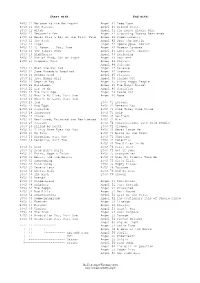

Start with: End with: BtVS 11 Welcome to the Hellmouth Angel 41 Deep Down BtVS 11 The Harvest Angel 41 Ground State BtVS 11 Witch Angel 41 The House Always Wins BtVS 11 Teacher's Pet Angel 41 Slouching Toward Bethlehem BtVS 12 Never Kill a Boy on the First Date Angel 42 Supersymmetry BtVS 12 The Pack Angel 42 Spin the Bottle BtVS 12 Angel Angel 42 Apocalypse, Nowish BtVS 12 I, Robot... You, Jane Angel 42 Habeas Corpses BtVS 13 The Puppet Show Angel 43 Long Day's Journey BtVS 13 Nightmares Angel 43 Awakening BtVS 13 Out of Mind, Out of Sight Angel 43 Soulless BtVS 13 Prophecy Girl Angel 44 Calvary Angel 44 Salvage BtVS 21 When She Was Bad Angel 44 Release BtVS 21 Some Assembly Required Angel 44 Orpheus BtVS 21 School Hard Angel 45 Players BtVS 21 Inca Mummy Girl Angel 45 Inside Out BtVS 22 Reptile Boy Angel 45 Shiny Happy People BtVS 22 Halloween Angel 45 The Magic Bullet BtVS 22 Lie to Me Angel 46 Sacrifice BtVS 22 The Dark Age Angel 46 Peace Out BtVS 23 What's My Line, Part One Angel 46 Home BtVS 23 What's My Line, Part Two BtVS 23 Ted BtVS 71 Lessons BtVS 23 Bad Eggs BtVS 71 Beneath You BtVS 24 Surprise BtVS 71 Same Time, Same Place BtVS 24 Innocence BtVS 71 Help BtVS 24 Phases BtVS 72 Selfless BtVS 24 Bewitched, Bothered and Bewildered BtVS 72 Him BtVS 25 Passion BtVS 72 Conversations with Dead People BtVS 25 Killed by Death BtVS 72 Sleeper BtVS 25 I Only Have Eyes for You BtVS 73 Never Leave Me BtVS 25 Go Fish BtVS 73 Bring on the Night BtVS 26 Becoming, Part One BtVS 73 Showtime BtVS 26 Becoming, Part Two BtVS 74 Potential BtVS 74 -

Narratives of Contamination and Mutation in Literatures of the Anthropocene Dissertation Presented in Partial

Radiant Beings: Narratives of Contamination and Mutation in Literatures of the Anthropocene Dissertation Presented in Partial Fulfillment of the Requirements for the Degree of Doctor of Philosophy in the Graduate School of The Ohio State University By Kristin Michelle Ferebee Graduate Program in English The Ohio State University 2019 Dissertation Committee Dr. Thomas S. Davis, Advisor Dr. Jared Gardner Dr. Brian McHale Dr. Rebekah Sheldon 1 Copyrighted by Kristin Michelle Ferebee 2019 2 Abstract The Anthropocene era— a term put forward to differentiate the timespan in which human activity has left a geological mark on the Earth, and which is most often now applied to what J.R. McNeill labels the post-1945 “Great Acceleration”— has seen a proliferation of narratives that center around questions of radioactive, toxic, and other bodily contamination and this contamination’s potential effects. Across literature, memoir, comics, television, and film, these narratives play out the cultural anxieties of a world that is itself increasingly figured as contaminated. In this dissertation, I read examples of these narratives as suggesting that behind these anxieties lies a more central anxiety concerning the sustainability of Western liberal humanism and its foundational human figure. Without celebrating contamination, I argue that the very concept of what it means to be “contaminated” must be rethought, as representations of the contaminated body shape and shaped by a nervous policing of what counts as “human.” To this end, I offer a strategy of posthuman/ist reading that draws on new materialist approaches from the Environmental Humanities, and mobilize this strategy to highlight the ways in which narratives of contamination from Marvel Comics to memoir are already rejecting the problematic ideology of the human and envisioning what might come next. -

Ovarian Torsion: Time Limiting Factors for Ovarian Salvage

edicine: O M p y e c n n A e c Ghandehari et al., Emerg Med (Los Angel) 2015, g c r e e s 5:5 s m E Emergency Medicine: Open Access DOI: 10.4172/2165-7548.1000273 ISSN: 2165-7548 Research Article Open Access Ovarian Torsion: Time Limiting Factors for Ovarian Salvage Hournaz Ghandehari1, Daniel Kahn1, George Tomlinson2 and Phyllis Glanc1* 1University of Toronto, Toronto, Ontario, Canada 2Institute of Health Policy, Management and Evaluation, University of Waterloo, Waterloo, ON, Canada *Corresponding author: Phyllis Glanc, M.D., FRCPC, Department of Medical Imaging, Sunnybrook Health Sciences Centre, 2075 Bayview Ave. MG160, Toronto, ON, Canada, M4N 3M5, Canada, Tel: 416-480-6100, ext 3900; Fax: 416-480-5855; E-mail: [email protected] Received date: May 20, 2015; Accepted date: July 07, 2015; Published date: July 14, 2015 Copyright: © 2015 Ghandehar H, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited. Abstract Aim: Analysis of the timelines in the diagnosis and management of surgically treated ovarian torsion will provide novel information on significant time intervals that may be amenable to future improvement which will optimize ovarian salvage rates. Methods: A retrospective review was performed of all patients who had surgically confirmed adnexal torsion over 12 years. The following four times were extracted for each patient (1) Emergency Department (ED) Triage (2) ED physician assessment (3) Generation of ultrasound report (4) Operating room (OR) start time. -

ANGEL SKIN My Discovery and Mining of Precious, Deep-Sea

ANGEL SKIN My Discovery and Mining of Precious, Deep-Sea Corals in Hawaii Dr. George Pararas-Carayannis Introduction A Jewelry manufacturing company in Hawaii provides a free one-half hour tour to showrooms where the story on precious corals found in the islands is narrated, including a version of a "story" on the deep-sea, coral known as Pink Coral - also now known as Corrallium Secundum. In this version, the narration omits to credit or report on who, really discovered this precious deep sea coral and successfully mined it and sold it to the company - from which a new and very profitable jewelry industry begun in Hawaii and elsewhere around the world. The present account documents that I was the one who discovered this precious deep sea coral in 1965, then subsequently begun mining it and selling it to jewelry manufacturers in Hawaii, USA, Asia, Europe and Japan. The following is rather detailed account of this discovery and of the many difficulties I faced mining it from great ocean depth. The venture was an arduous and difficult enterprise that seriously endangered my life and, at that time, stretched to extremes my limited financial resources. Also, since my lure for this precious deep-sea coral awakened a desire for other quests around the world in search of other precious stones, a brief summary of such subsequent quests and misadventures is provided. My discovery of the precious coral took place in 1965 about 12 nautical miles off the southeast coast from Makapuu Point, off the island of Oahu, in Hawaii, where the depth of the ocean was about 1,200 to 1250 feet. -

High Court Judgment Template

Neutral Citation Number: [2015] EWHC 42 (Comm) Case No: 2012 FOLIO 198 IN THE HIGH COURT OF JUSTICE QUEEN'S BENCH DIVISION COMMERCIAL COURT Rolls Building Fetter Lane, London, EC4A 1NL Date: 15/01/2015 Before: THE HONOURABLE MR JUSTICE FLAUX - - - - - - - - - - - - - - - - - - - - - Between: (1) SUEZ FORTUNE INVESTMENTS LTD Claimants (2) PIRAEUS BANK AE - and - (1) TALBOT UNDERWRITING LTD Defendants (2) HISCOX SYNDICATES LTD (3) QBE CORPORATE LTD (4) CHAUCER CORPORATE CAPITAL (NO. 2) LTD (5) MARKEL CAPITAL LTD (6) CATLIN SYNDICATE LTD (7) APRILGRANGE LTD (8) BRIT UW LTD (9) NOVAE CORPORATE UNDERWRITING LTD (10) GAI INDEMNITY LTD “M/V BRILLANTE VIRTUOSO” - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - Mr Peter Macdonald Eggers QC Mr Tim Jenns and Mr Richard Sarll (instructed by Hill Dickinson LLP for the First Claimant and by Reed Smith LLP for the Second Claimant) for the Claimants Mr David Goldstone QC & Ms Nichola Warrender (instructed by Norton Rose Fulbright LLP) for the Defendants Hearing dates: 19th, 20th Nov, 24th to 27th Nov, 1st, 2nd, 4th,10th and 11th Dec 2014 - - - - - - - - - - - - - - - - - - - - - Approved Judgment I direct that pursuant to CPR PD 39A para 6.1 no official shorthand note shall be taken of this Judgment and that copies of this version as handed down may be treated as authentic. ............................. THE HONOURABLE MR JUSTICE FLAUX THE HONOURABLE MR JUSTICE FLAUX Suez Fortune Investments v Talbot Underwriting Approved Judgment The Honourable Mr Justice Flaux: Introduction 1. In early July 2011, the tanker Brillante Virtuoso (“the vessel”) owned by the first claimant (“the owners”) was en route from Kerch in Ukraine to Qingdao in China, carrying a cargo of 141,000 metric tons of fuel oil. -

Theme Forces April 2021 Update

® APRIL 2021 Contents and Game Rules ©2001–2021 Privateer Press, Inc. All Rights Reserved. Privateer Press®, WARMACHINE®, Cephalyx, Convergence of Cyriss®, Convergence, Crucible Guard, Cryx®, Cygnar®, Khador®, Protectorate of Menoth®, Protectorate, Retribution of Scyrah®, Retribution, warcaster®, warjack®, HORDES®, Circle Orboros®, Circle, Grymkin, Grymkin: The Wicked Harvest, Legion of Everblight®, Legion, Skorne®, Trollbloods®, Trollblood, warbeast, and all associated logos and slogans are trademarks of Privateer Press, Inc. Permission is hereby granted to photocopy and retain electronic copies. Any such duplications shall be intended solely for noncommercial use and must maintain all copyrights, trademarks, or other notices contained therein or preserve all marks associated therewith. Privateer Press reserves the right to remove this permission or revise contents herein at any time for any reason. DARK LEGACY HEARTS OF DARKNESS As an ancient pact reaches its moment of reckoning, horrifying forces It is unlikely the invading Infernals would be as strong without the aid from beyond comprehension descend upon the world to collect. With of humans possessed of more selfish greed than survival instincts. As traitorous mortals as their momentary tools, Infernal Masters bring horrors move out from the shadows, people who have betrayed their their nightmares to battle for every soul they believe is their due. own kind hold the torches to light the way for evil. Perhaps they hope Though few would have suspected the terrible legacy that would follow to be spared by showing their allegiance and harvesting victims for that pact, many will pay for it as the Infernals move among them. their masters, but hope is a dying luxury now. -

Opposing Buffy

Opposing Buffy: Power, Responsibility and the Narrative Function of the Big Bad in Buffy Vampire Slayer By Joseph Lipsett B.A Film Studies, Carleton University A thesis submitted to the Faculty of Graduate Studies and Research In partial fulfillment of the requirements for the degree of Masters of Arts in Film Studies Carleton University, Ottawa, Ontario April 25, 2006 Reproduced with permission of the copyright owner. Further reproduction prohibited without permission. Library and Bibliotheque et Archives Canada Archives Canada Published Heritage Direction du Branch Patrimoine de I'edition 395 Wellington Street 395, rue Wellington Ottawa ON K1A 0N4 Ottawa ON K1A 0N4 Canada Canada Your file Votre reference ISBN: 978-0-494-16430-3 Our file Notre reference ISBN: 978-0-494-16430-3 NOTICE: AVIS: The author has granted a non L'auteur a accorde une licence non exclusive exclusive license allowing Library permettant a la Bibliotheque et Archives and Archives Canada to reproduce,Canada de reproduire, publier, archiver, publish, archive, preserve, conserve,sauvegarder, conserver, transmettre au public communicate to the public by par telecommunication ou par I'lnternet, preter, telecommunication or on the Internet,distribuer et vendre des theses partout dans loan, distribute and sell theses le monde, a des fins commerciales ou autres, worldwide, for commercial or non sur support microforme, papier, electronique commercial purposes, in microform,et/ou autres formats. paper, electronic and/or any other formats. The author retains copyright L'auteur conserve la propriete du droit d'auteur ownership and moral rights in et des droits moraux qui protege cette these. this thesis. Neither the thesis Ni la these ni des extraits substantiels de nor substantial extracts from it celle-ci ne doivent etre imprimes ou autrement may be printed or otherwise reproduits sans son autorisation. -

Save These Dates!

FALL 2014 SPONSORED BY THE COETA & DONALD BARKER FOUNDATION ANGEL VIEW INSIDE ANGEL’S VIEW PROM 5 New Ways to Serve Better PAGES 8 Spring Fun Days at Camp Forrest 6–7 HELPING 14 Toucans Party a “Well Heeled” Event CHILDREN AND ADULTS WITH DISABILITIES 16 Retail Store Chronicles MAXIMIZE THEIR POTENTIAL www.angelview.org Angel View provides compassionate Save these care to children and adults with disabilities through our 24-hour residential nursing Dates! care program, Day Program and Outreach OCTOBER 23, 2014 services. For 60 years, we’ve succeeded in Angel View’s Fall Fashion Show teaching clients skills they were once not able to perform. As a 501(c)(3) non-profit organization FEBRUARY 16, 2016 dedicated to enhancing our clients’ quality of life through innovative programs, Camp Forrest and Angel View’s 61st Annual Luncheon frequent outings, Angel View relies heavily on grants and donations. A MESSAGE FROM THE PRESIDENT Continuous improvement in every aspect of our operations is one of our daily goals, especially the delivery of medical services to our clients. Through strong partnerships, both new and old, we hope to achieve new solutions to some nagging issues caused by our geography and lack of local specialty care. • Emergency care: Our clients are frequently brought to local emergency rooms, mostly for non-emergent issues, where the wait can be very long. This is extremely hard on our clients and their caregivers. We are working to partner with local urgent care cen- ters and physicians who will guarantee rapid access and treatment. • Routine office visits: We are working to develop a weekly Palm Springs clinic with the University of California, Riverside Department of Family Medicine, devoted exclusively to those with physical and mental disabilities. -

Rosemary Lanerosemary Lane the Pentangle Magazine

Rosemary LaneRosemary Lane the pentangle magazine John Renbourn: Of Tunes and Troubadours Tour dates in the UK and US Guitar Tablature: classic Bert and a new arrangement by John Letters and Reviews Issue No 11 Winter 1996/7 Rosemary Lane Editorial... A Happy New Year to all! Rosemary Lane RL Ed 2 Rosemary Lane Contents Rosemary Lane Winter 1996/7 Issue No 11 Page Editorial 2 JacquiConcert McShee: Review: Contents/Next Month 3 Bert a& tale John at The Jolly Gardeners 21 Letters 4-6 GuitarAbout TablatureThyme 1 - Tuning Up - News 7-8 An Phis Fhlinch arr. John Renbourn 24-27 Tour Dates - Bert and Jacqui's Pentangle 9 Guitar Tablature 2 - Tour Dates - John & Archie Fisher 10 One To A Hundred by Bert Jansch 28-29 Of Tunes and Troubadours - 11-12,14-15 Album Reviews: (John Renbourn interview) & 18-19,22-23 Album News: A Frenzy of Re-Issues! 32 & 30-31 Discography: Late Pentangle - 1992-95 33 John's Tablature - the lost tunes 13 Subscription Information 34 Sir John Alot... re-appraised 16-17 Information: Concert Review: Transatlantic Re-Issues on Castle 35 John & Jacqui at the Purcell Room 20 Lost Sessions / BC COMING IN THE NEXT ISSUE! op item next time round will be news of TBert's latest album. He'll be touring the UK in April so you'll get the chance to hear some of the new songs then....Now it's a while ago since I popped a teasing question about the most recorded song from the combined Pentangle repertoire. Many thanks to all those who wrote in.