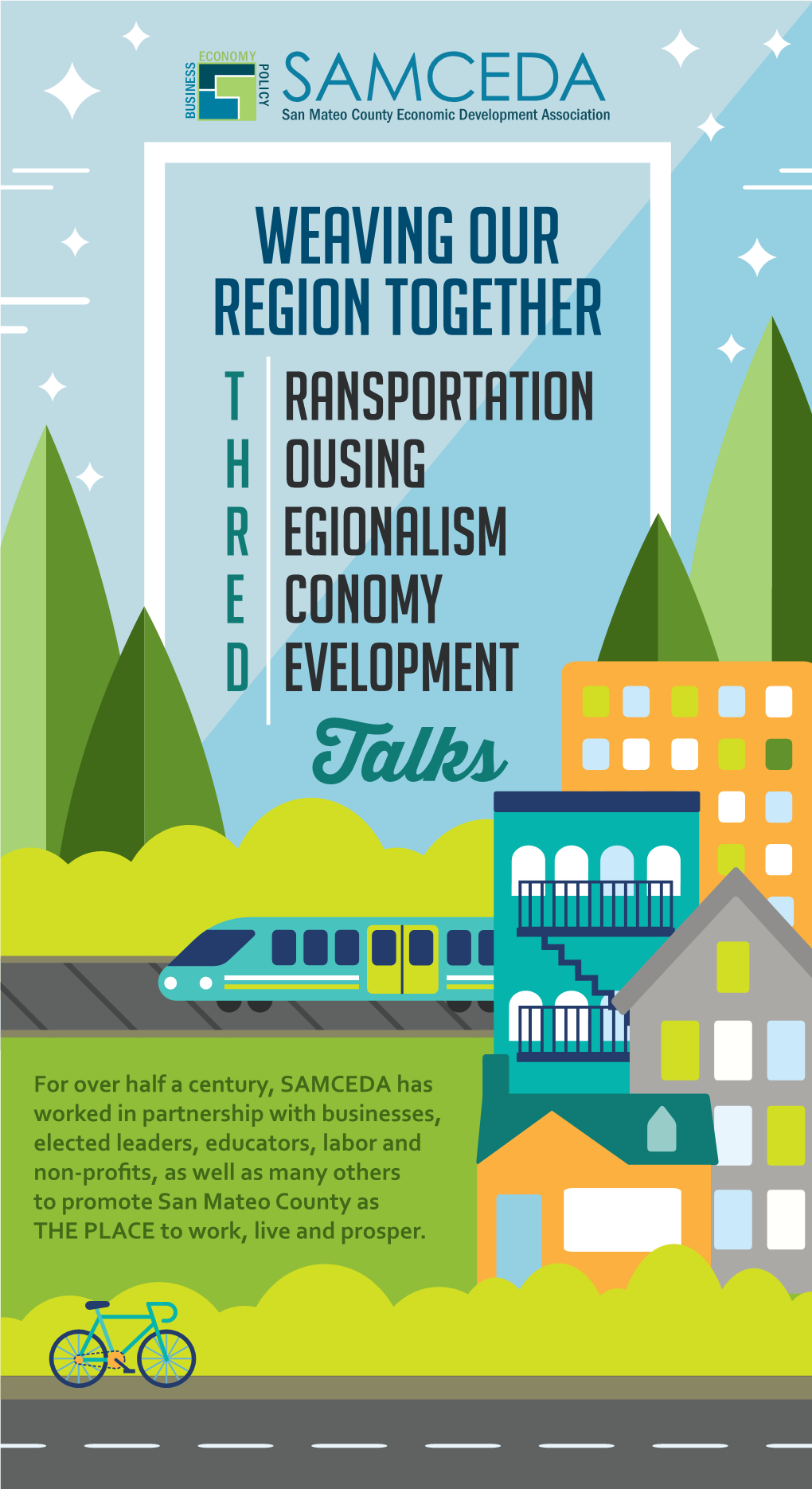

WEAVING OUR REGION TOGETHER T RANSPORTATION H OUSING R EGIONALISM E CONOMY D EVELOPMENT Talks

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

What's on Tap? San Francisco (Pdf)

SAN FRANCISCO1 San Francisco earned a water quality and compliance grade of Poor for 2000 and 2001. Factors in this grade included the following: WHAT'S Although San Francisco’s source water is generally very well protected, the city had ON TAP? high levels of cancer-causing contaminants called total trihalomethanes, or TTHMs, by-products of the heavy use of chlorine for disinfection of its tap water. San Francisco Grading Drinking is one of the few large cities in the United States with TTHM levels still in excess of a Water in U.S. Cities new EPA tap water standard that went into effect in January 2002. San Francisco also EARLY RELEASE has potentially dangerous high spikes in the levels of these chemicals in its tap water. CALIFORNIA EDITION The city applied for and received a two-year extension from the EPA for bringing the system into compliance with this standard. The San Francisco Public Utilities October 2002 Commission (SFPUC) should not have allowed this problem to continue into 2002. The city says it is taking steps to reduce its TTHM levels by 2003, but its “solution,” a switch to chloramine disinfection, is a half-measure that will only moderately reduce TTHM levels and will not kill chlorine-resistant microbes. The EPA announced the reduced standard more than eight years ago, in July 1994, after extensive regulatory negotiations resulted in an agreement with the water industry—a process of which San Francisco was well aware.3 The final rule was issued in 1998.4 Under NRDC’s grading system, any water system that exceeds the new EPA standard for chemicals that cause cancer and potentially cause miscarriage and birth defects can receive a water quality grade no higher than Poor. -

Legislators of California

The Legislators of California March 2011 Compiled by Alexander C. Vassar Dedicated to Jane Vassar For everything With Special Thanks To: Shane Meyers, Webmaster of JoinCalifornia.com For a friendship, a website, and a decade of trouble-shooting. Senator Robert D. Dutton, Senate Minority Leader Greg Maw, Senate Republican Policy Director For providing gainful employment that I enjoy. Gregory P. Schmidt, Secretary of the Senate Bernadette McNulty, Chief Assistant Secretary of the Senate Holly Hummelt , Senate Amending Clerk Zach Twilla, Senate Reading Clerk For an orderly house and the lists that made this book possible. E. Dotson Wilson, Assembly Chief Clerk Brian S. Ebbert, Assembly Assistant Chief Clerk Timothy Morland, Assembly Reading Clerk For excellent ideas, intriguing questions, and guidance. Jessica Billingsley, Senate Republican Floor Manager For extraordinary patience with research projects that never end. Richard Paul, Senate Republican Policy Consultant For hospitality and good friendship. Wade Teasdale, Senate Republican Policy Consultant For understanding the importance of Bradley and Dilworth. A Note from the Author An important thing to keep in mind as you read this book is that there is information missing. In the first two decades that California’s legislature existed, we had more individuals serve as legislators than we have in the last 90 years.1 Add to the massive turnover the fact that no official biographies were kept during this time and that the state capitol moved seven times during those twenty years, and you have a recipe for missing information. As an example, we only know the birthplace for about 63% of the legislators. In spite of my best efforts, there are still hundreds of legislators about whom we know almost nothing. -

ED444608.Pdf

DOCUMENT RESUME ED 444 608 JC 000 457 AUTHOR Martinez, Katherine, Ed. TITLE FACCCTS: The Journal of the Faculty Association of California Community Colleges, 1998-1999. INSTITUTION California Community Colleges, Sacramento. Faculty Association. PUB DATE 1999-00-00 NOTE 146p.; Published four times a year. PUB TYPE Collected Works Serials (022) JOURNAL CIT FACCCTS: The Journal of California Community College Faculty; v5 n1-4 Sep 1998-May 1999 EDRS PRICE MF01/PC06 Plus Postage. DESCRIPTORS *College Faculty; *Community Colleges; Educational Finance; Educational Trends; *Governance; Legislators; Political Candidates; *Retirement Benefits; Two Year Colleges IDENTIFIERS *California Community Colleges ABSTRACT This document contains the four Faculty Association of California Community Colleges (FACCCTS) newsletters published during the 1998-99 academic year. In the September 1998 issue, faculty members talk about what shared governance means and how to improve it on individual campuses. The issue also features Gray Davis' plans forthe community colleges if he is elected governor and presents endorsements to support education-friendly candidates for the November 3 election. The December 1998 issue explains how to calculate new retirement benefits in the State Teachers' Retirement System, how the changes affect all faculties, andwho faculty should thank for the improvements. Faculty member Carolyn Russell gives a first-person account about the grassroots efforts that successfully convinced state legislators to pass the retirement package. The February 1999 issue features Assemblywomen Gloria Romero and Charlene Zettel and their commitment to helping community colleges receive the funding they need to do their jobs well. It also provides a list of legislators and their primary community college districts. -

Congressional Record United States Th of America PROCEEDINGS and DEBATES of the 110 CONGRESS, FIRST SESSION

E PL UR UM IB N U U S Congressional Record United States th of America PROCEEDINGS AND DEBATES OF THE 110 CONGRESS, FIRST SESSION Vol. 153 WASHINGTON, FRIDAY, MAY 4, 2007 No. 73 House of Representatives The House was not in session today. Its next meeting will be held on Monday, May 7, 2007, at 12:30 p.m. Senate FRIDAY, MAY 4, 2007 The Senate met at 9:30 a.m. and was U.S. SENATE, portunity to complete our budget for called to order by the Honorable PRESIDENT PRO TEMPORE, the year. I have spoken to Senator SHERROD BROWN, a Senator from the Washington, DC, May 4, 2007. CONRAD on a number of occasions. I State of Ohio. To the Senate: have spoken to the Speaker on this Under the provisions of rule I, paragraph 3, of the Standing Rules of the Senate, I hereby issue. It is very close to being in a posi- PRAYER appoint the Honorable SHERROD BROWN, a tion that we can bring it to the floor. The Chaplain, Dr. Barry C. Black, of- Senator from the State of Ohio, to perform It is my understanding the House will fered the following prayer: the duties of the Chair. appoint conferees on Monday, and we Let us pray. ROBERT C. BYRD, will do that on the next day. It is a O God, our Father, bless the United President pro tempore. privileged motion. There is 10 hours of States Senate. If anything is dark in it, Mr. BROWN thereupon assumed the debate, and there are some procedural illumine; if anything is low, raise; if chair as Acting President pro tempore. -

Judge Tosses AMO Lawsuit to Block LMSR Award

Organized 1885 Official Organ of the Sailors' Union of the Pacific Volume LXIII No. 10 SAN FRANCISCO, CALIFORNIA Friday, October 20, 2000 Sailors’ and Firemen to Judge tosses AMO lawsuit open East Coast office he Sailors’ Union of the The Norfolk locale will en- to block LMSR award Pacific and the Marine hance the ability of both Unions TFiremen’s Union (MFOW) to provide service to the crews n October 10, Judge “The impact of this ruling is that to launch a formal complaint.” agreed this month to open an of- in these ships, and to recruit William B. Bryant of we are now out from under the The judge added that “one can fice in Norfolk, Virginia, effec- qualified mariners who want to O the United States Dis- shadow of doubt and uncertainty easily presume that in the event tive November 1, 2000. work in the LMSRs and join the trict Court for the District of Co- that has been hanging over us the Plaintiff’s [AMO] contrac- lumbia decisively rejected a tor [Bay Ship Management] won The decision to open an East SUP and MFOW. since AMO challenged in the challenge by the American Mari- award in 1999.” the bid it would not have filed Coast office was deemed to be The establishment of the Nor- time Officers (AMO) to overturn the complaint.” timely and necessary by both folk office marks the first tan- If the AMO had prevailed in a Military Sealift command AMO filed the lawsuit late last Unions given that SUP and gible return to the East Coast its lawsuit, Patriot would have award to Patriot Contract Ser- year to void Patriot’s award using MFOW-contracted Patriot Con- since the SUP Branch in New been stripped of the LMSR con- vices to manage and operate 10 the argument that the Military tract Services will have six Large York was closed in 1986. -

California State Archives History Program

- IHI if CALIFORNIA STATE ARCHIVES HISTORY PROGRAM INTERVIEW WITH BRUCE SAMUEL OFFICE OF MARCH FONG EU SECRETARY OF STATE University of California Berkeley CALIFORNIA SlT[ AlCII V IS California State Archives State Government Oral History Program Oral History Interview with BRUCE SAMUEL State Government Employee, 1960-1984 May 9, June 11, 1991 and April 2, 1992 Sacramento, California By Germaine LaBerge Regional Oral History Office University of California, Berkeley RESTRICTIONS ON THIS INTERVIEW None. LITERARY RIGHTS AND QUOTATIONS This manuscript is hereby made available for research purposes only. No part of the manuscript may be quoted for publication without the written permission of the California State Archivist or Regional Oral History Office, University of California at Berkeley. Requests for permission to quote for publication should be addressed to: California State Archives 1020 O Street, Room 130 Sacramento, California 95814 or Regional Oral History Office 486 Library University of California Berkeley, California 94720 The request should include information of the specific passages and identification of the user. It is recommended that this oral history be cited as follows: Bruce Samuel, Oral History Interview, Conducted 1991 and 1992 by Germaine LaBerge, Regional Oral History Office, University of California at Berkeley, for the California State Archives State Government Oral History Program. Information (916) 445-1293 California State Archives March Fong Eu Research Room (916) 445-4?.93 1020 O Street, Room 130 Exhibit Hall (916) 445-4293 of State Secretary Legislative Bill Service (916) 445-2S32 Sacramento, CA 95814 (prior years) PREFACE On September 25, 1985, Governor George Deukmejian signed into law A.B. -

Oral History Interview with Hon. Louis J. Papan

California state Archives state Government Oral History Program Oral History Interview with HON. LOUIS J. PAPAN California state Assemblyman, 1972 - 1986 March 4, 21, 29, May 31, 1988 Millbrae, California By Carole Hicke Regional Oral History Office The Bancroft Library University of California, Berkeley RESTRICI'IOOS CN THIS INI'ERVIEH None. LITERARY RIGHI'S AND QUOTATIONS This nanuscript is hereby nade available for research plrposes only. No part of the nanuscript nay be quoted for publication without the written pennission of the California State Archivist or Regional oral History Office, University of california at Berkeley. Requests for pennission to quote for publication should be addressed to: california State Archives 1020 0 Street, Roam 130 Sacramento, california 95814 or Regional Oral History Office 486 Library University of California Berkeley, California 94720 The request should include identification of the sPeCific p3.ssages and identification of the user. It is reccmnended that this oral history be cited as follows: IDuis J. Papan, oral History Interview, Conducted 1988 by carole Hicke, Regional oral History Office, University of California at Berkeley, for the california State Archives State Government Oral History Program. Information (916) 445-4293 California State Archives March Fong Eu Document Restoration (916) 445-4293 1020 a Street, Room 130 Exhibit Hall (916) 445-0748 Secretary of State Legislative Bill Service (916) 445-2832 Sacramento, CA 95814 (prior years) PREFACE On September 25, 1985, Governor George Deukmejian signed into law A.B. 2104 (Chapter 965 of the Statutes of 1985). This legislation established, under the administration of the California State Archives, a State Government Oral History Program "to provide through the use of oral history a continuing documentation of state pOlicy development as reflected in California's legislative and executive history." The following interview is one of a series of oral histories undertaken for inclusion in the state program. -

Extensions of Remarks E1829 EXTENSIONS of REMARKS

December 11, 2013 CONGRESSIONAL RECORD — Extensions of Remarks E1829 EXTENSIONS OF REMARKS IN RECOGNITION OF GINA PAPAN ment program at the John F. Kennedy School kind and loving woman who inspired those of Government at Harvard University. around her, and she will be truly missed. HON. JACKIE SPEIER Her commitment and dedication to others is f unwavering. She and her sister Diane run OF CALIFORNIA HONORING SCOTT KARCZEWSKI IN THE HOUSE OF REPRESENTATIVES John’s Closet which provides free new cloth- ing to underserved children and offers them Wednesday, December 11, 2013 confidence to achieve. John Papan was HON. MICHAEL H. MICHAUD Ms. SPEIER. Mr. Speaker, I rise to honor Gina’s brother who suffered from a congenital OF MAINE Gina Papan for her eight years of service on condition that tragically and prematurely ended IN THE HOUSE OF REPRESENTATIVES the Millbrae City Council, two of them as his life at age 21. In response and to continue Wednesday, December 11, 2013 mayor, one as vice mayor. its advocacy for disabled children, the Papan In her role as mayor this past year and family set up John’s Closet. Gina also is the Mr. MICHAUD. Mr. Speaker, I rise today to throughout her tenure on the council, Gina has co-director of the John Papan Memorial Schol- recognize Scott Karczewski on the occasion of focused on sustainable finances and revenue arship Fund which was founded by the family his retirement from the Department of Vet- enhancement in Millbrae. She has played an to help special education students and late erans’ Affairs after 36 years of dedicated serv- instrumental role in the adoption of the Eco- bloomers, kids who overcome early learning ice. -

Oral History Interview with Leo T. Mccarthy

California State Archives State Government Oral History Program Oral History Interview with LEO T. McCARTHY California Assemblyman, 1968-1982 California Lieutenant Governor, 1983-1995 December 18, 1995 February 1, 15, and 22, 1996 March 7 and 27, 1996 April 11, 1996 August 7, 25, and 28, 1996 San Francisco, California By Carole Hicke Regional Oral History Office University of California, Berkeley RESTRICTIONS ON THIS INTERVIEW None. LITERARY RIGHTS AND QUOTATIONS This manuscript is hereby made available for research purposes only. No part of the manuscript may be quoted for publication without written permission of the California State Archivist or Regional Oral History Office, University of California at Berkeley. Requests for permission to quote for publication should be addressed to: California State Archives 10200 Street, Room 130 Sacramento, California 95814 or Regional Oral History Office 486 Library University of California Berkeley, California 94720 The request should include information of the specific passages and identification of the user. It is recommended that this oral history be cited as follows: Leo T. McCarthy, Oral History Interview, Conducted 1995 and 1996 by Carole Hicke, Regional Oral History Office, University of California at Berkeley, for the California State Archives State Government Oral History Program. INTERVIEW HISTORY InterviewerlEditor Carole Hicke Director, University of California at Berkeley State Archives State Government Oral History Program Director, Pillsbury, Madison & Sutro History Project Director, -

Bulletin Is 44 ��������Recent Contributors Published When We Are Able

CALIFORNIA S T A T E LIBRARY FOUNDATION Number 118 2017 DR. KEVIN STARR MEMORIAL ISSUE CALIFORNIA S T A T E LIBRARY FOUNDATION Number 118 2017 EDITOR 2 . .Kevin Starr Will Never Be Replaced: A Remembrance of the Gary F. Kurutz Historian and Author By Dr. William Deverell EDITORIAL ASSISTANTS Kathleen Correia & Marta Knight 6 . .Reminiscences, Recollections, and Remembrances of Dr. Kevin O. Starr, 15th State Librarian of California COPY EDITOR M. Patricia Morris By Cameron Robertson BOARD OF DIRECTORS 12 ����������“A Letter to Dr. Kevin Starr, a.k.a. Dr. Feelgood” By Andrew St. Mary Kenneth B. Noack, Jr. SIDEBAR: A Letter from Dr. Starr to Taylor St. Mary President Donald J. Hagerty 16 ����������A Tribute to Dr. Kevin Starr Delivered at the 2017 Annual Vice-President Meeting of the Society of California Archivists By Mattie Taormina Thomas E. Vinson Treasurer 17 ����������California: An Elegy By Arthur Imperatore III Marilyn Snider 19 ����������Recollections of Kevin Starr By Marianne deVere Hinckle Secretary Greg Lucas 27 ����������When Kevin Starr Ran for the San Francisco State Librarian of California Board of Supervisors: 1984 By Michael S. Bernick JoAnn Levy Marilyn Snider 29 . .Celebrating Dr. Starr’s Genius, Generous Spirit and Phillip L. Isenberg Thomas W. Stallard Astonishing Vision By Dr. C. L. Max Nikias Mead B. Kibbey Phyllis Smith Gary Noy Angelo A. Williams 30 . .Eulogy of Dr. Kevin Starr Highlighting His Ten Years as Jeff Volberg State Librarian of California, 1994—2004 By Gary F. Kurutz Gary F. Kurutz Marta Knight 34 ����������The Sutro Library: Mirror for Global California, March 13, 2013 Executive Director Foundation By Dr. -

V O T E R G U I

VOTERGUIDE 2006 School bonds, state races top local ballots y the end of the day June 6, south San Mateo County BY MARION SOFTKY Bvoters will have marked ALMANAC STAFF WRITER their ballots for as many as 30 offices — from U.S. senator to Arnold Schwarzenegger does not county controller — and voted face serious opposition. yes or no on two, important state State Sen. Jackie Speier, who ballot measures. If they live in served as a San Mateo County the Menlo Park School District, supervisor after being wounded voters will also decide whether to in Guyana at the Jonestown issue $91.1 million in bonds for massacre, is running in a tight school construction. race for lieutenant governor The results from this June 6 pri- with fellow-Democrats John mary will, of course, determine Garamendi, the state insurance the lineup of candidates that commissioner, and state Sen. Liz will face voters in November. Figueroa of Fremont. None is a With more than 50 choices on resident of the Almanac circula- a typical ballot, voters can have tion area, and therefore this race a hard time deciding who will is not included in this guide. best represent them. One of the hottest and nastiest In addition to the sample ballot races in the state is to replace The Almanac/Marjan Sardoughi with the official voter information Sen. Speier in the 8th state Sen- Cars line up to pick up students at Oak Knoll School. The district plans to use funds from the bond measure pamphlet that you get in the mail ate district, which runs from San to help reduce crowding and improve traffic circulation. -

ADVOCATE an Update on Legislative, Regulatory, and Political Issues Affecting Commercial Real Estate

The BOMA San Francisco ADVOCATE An Update on Legislative, Regulatory, and Political Issues Affecting Commercial Real Estate Route to >> ______________ ______________ ______________ ______________ ______________ July 15, 2002 Volume 8, Number 3 This Issue of the BOMA-San Francisco Advocate Is Brought To You By Farella Braun + Martel, LLP Inquiries about the Advocate? Call Government and Public Affairs Director Ken Cleaveland (415)362-2662x11or email <[email protected]> BOMA Urges Board of Supervisors to Consider City Budget Reductions…Not New Taxes on Business The San Francisco Board of Supervisors is reviewing efforts to balance the city’s budget, and is considering adding new taxes on real estate interests throughout the city. Included in the proposal by Supervisor Aaron Peskin is the addition of a 3/10 of 1% gross receipts tax on all rent revenues generated by properties located within the city, and a payroll tax of 1.5% on 90% of all distributions from limited partnerships, including commissions, property transfers, etc. This action, along with new taxes on taxi companies, construction contractors, and car rental companies will, long term, further push businesses out of the city, and, in the end, hurt the city budget deficit more rather than help it. BOMA, in conjunction with the San Francisco Chamber of Commerce and the Committee on Jobs, will be addressing the actual impacts from the current proposal alternatives, and will produce alternatives we can present to City Hall. If you have tax expertise, and wish to help BOMA and the business community craft a position paper on this urgent matter, please call Ken Cleaveland, the BOMA San Francisco Director of Government and Public Affairs at 415-362-2662, ext 11.