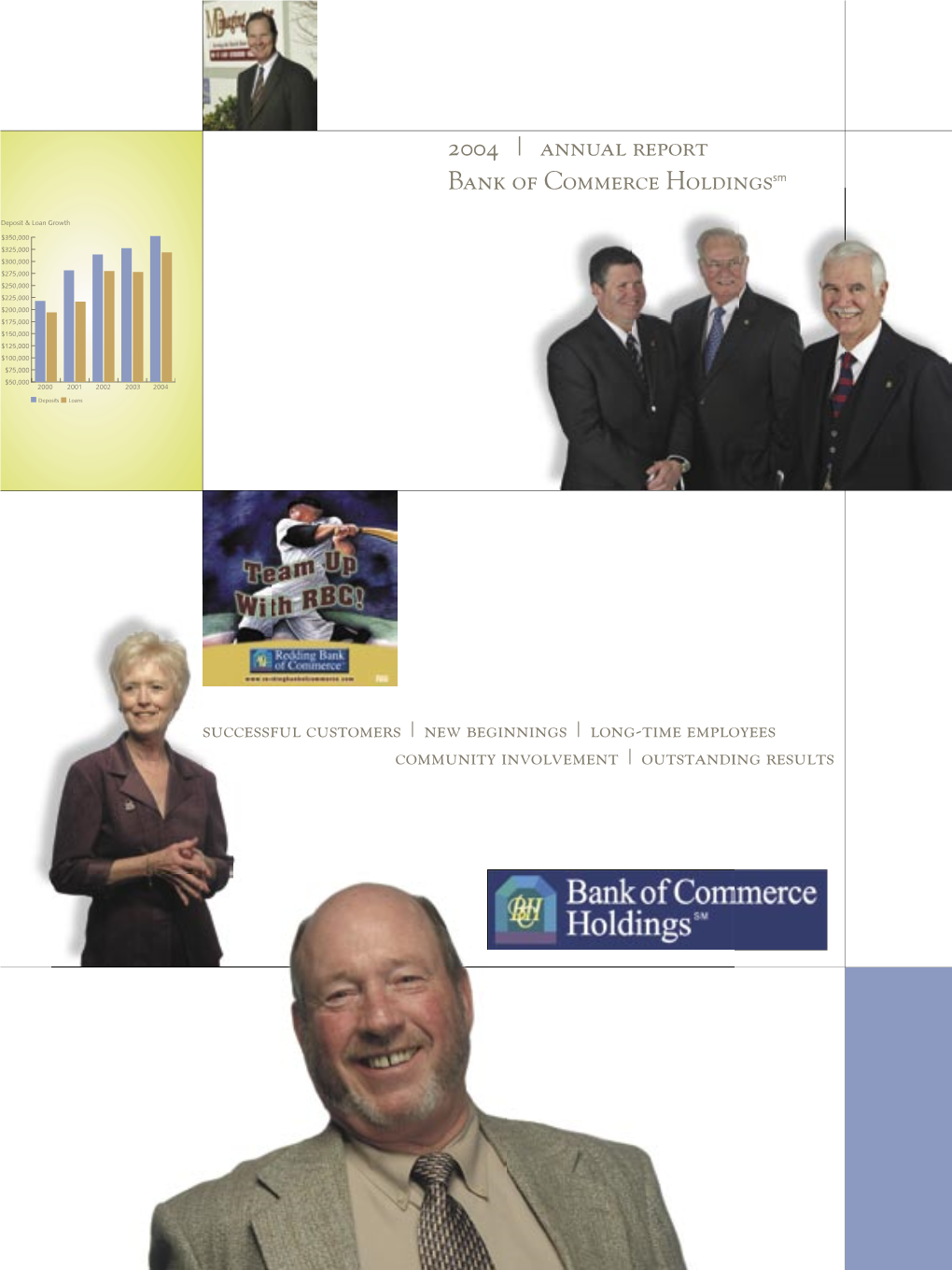

2004 | Annual Report Bank of Commerce Holdingssm

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Summer 2021 Alumni Class Notes

NotesAlumni Alumni Notes Policy where she met and fell in love with Les Anderson. The war soon touched Terry’s life » Send alumni updates and photographs again. Les was an Army ROTC officer and the directly to Class Correspondents. Pentagon snatched him up and sent him into the infantry battles of Europe. On Les’ return in » Digital photographs should be high- 1946, Terry met him in San Francisco, they resolution jpg images (300 dpi). married and settled down in Eugene, where Les » Each class column is limited to 650 words so finished his degree at the University of Oregon. that we can accommodate eight decades of Terry focused on the care and education of classes in the Bulletin! their lively brood of four, while Les managed a successful family business and served as the » Bulletin staff reserve the right to edit, format Mayor of Eugene. and select all materials for publication. Terry’s children wrote about their vivacious, adventurous mom: “Terry loved to travel. The Class of 1937 first overseas trip she and Les took was to Europe in 1960. On that trip, they bought a VW James Case 3757 Round Top Drive, Honolulu, HI 96822 bug and drove around the continent. Trips over [email protected] | 808.949.8272 the years included England, Scotland, France, Germany, Italy, Greece, Russia, India, Japan, Hong Kong and the South Pacific. Class of 1941 “Trips to Bend, Oregon, were regular family Gregg Butler ’68 outings in the 1960s. They were a ‘skiing (son of Laurabelle Maze ’41 Butler) A fond aloha to Terry Watson ’41 Anderson, who [email protected] | 805.501.2890 family,’ so the 1968 purchase of a pole house in Sunriver allowed the family of six comfortable made it a point to make sure everyone around her A fond aloha to Terry Watson Anderson, who surroundings near Mount Bachelor and a year- was having a “roaring good time.” She passed away passed away peacefully in Portland, Oregon, round second home. -

National Pastime a REVIEW of BASEBALL HISTORY

THE National Pastime A REVIEW OF BASEBALL HISTORY CONTENTS The Chicago Cubs' College of Coaches Richard J. Puerzer ................. 3 Dizzy Dean, Brownie for a Day Ronnie Joyner. .................. .. 18 The '62 Mets Keith Olbermann ................ .. 23 Professional Baseball and Football Brian McKenna. ................ •.. 26 Wallace Goldsmith, Sports Cartoonist '.' . Ed Brackett ..................... .. 33 About the Boston Pilgrims Bill Nowlin. ..................... .. 40 Danny Gardella and the Reserve Clause David Mandell, ,................. .. 41 Bringing Home the Bacon Jacob Pomrenke ................. .. 45 "Why, They'll Bet on a Foul Ball" Warren Corbett. ................. .. 54 Clemente's Entry into Organized Baseball Stew Thornley. ................. 61 The Winning Team Rob Edelman. ................... .. 72 Fascinating Aspects About Detroit Tiger Uniform Numbers Herm Krabbenhoft. .............. .. 77 Crossing Red River: Spring Training in Texas Frank Jackson ................... .. 85 The Windowbreakers: The 1947 Giants Steve Treder. .................... .. 92 Marathon Men: Rube and Cy Go the Distance Dan O'Brien .................... .. 95 I'm a Faster Man Than You Are, Heinie Zim Richard A. Smiley. ............... .. 97 Twilight at Ebbets Field Rory Costello 104 Was Roy Cullenbine a Better Batter than Joe DiMaggio? Walter Dunn Tucker 110 The 1945 All-Star Game Bill Nowlin 111 The First Unknown Soldier Bob Bailey 115 This Is Your Sport on Cocaine Steve Beitler 119 Sound BITES Darryl Brock 123 Death in the Ohio State League Craig -

1960 Topps Baseball Checklist+A1

1960 Topps Baseball Checklist+A1 1 Early Wynn 2 Roman Mejias 3 Joe Adcock 4 Bob Purkey 5 Wally Moon 6 Lou Berberet 7 Willie MaysMaster & Mentor Bill Rigney 8 Bud Daley 9 Faye Throneberry 10 Ernie Banks 11 Norm Siebern 12 Milt Pappas 13 Wally Post 14 Mudcat GraJim Grant on Card 15 Pete Runnels 16 Ernie Broglio 17 Johnny Callison 18 Los Angeles Dodgers Team Card 19 Felix Mantilla 20 Roy Face 21 Dutch Dotterer 22 Rocky Bridges 23 Eddie FisheRookie Card 24 Dick Gray 25 Roy Sievers 26 Wayne Terwilliger 27 Dick Drott 28 Brooks Robinson 29 Clem Labine 30 Tito Francona 31 Sammy Esposito 32 Jim O'TooleSophomore Stalwarts Vada Pinson 33 Tom Morgan 34 Sparky Anderson 35 Whitey Ford 36 Russ Nixon 37 Bill Bruton 38 Jerry Casale 39 Earl Averill 40 Joe Cunningham 41 Barry Latman 42 Hobie Landrith Compliments of BaseballCardBinders.com© 2019 1 43 Washington Senators Team Card 44 Bobby LockRookie Card 45 Roy McMillan 46 Jack Fisher Rookie Card 47 Don Zimmer 48 Hal Smith 49 Curt Raydon 50 Al Kaline 51 Jim Coates 52 Dave Philley 53 Jackie Brandt 54 Mike Fornieles 55 Bill Mazeroski 56 Steve Korcheck 57 Turk Lown Win-Savers Gerry Staley 58 Gino Cimoli 59 Juan Pizarro 60 Gus Triandos 61 Eddie Kasko 62 Roger Craig 63 George Strickland 64 Jack Meyer 65 Elston Howard 66 Bob Trowbridge 67 Jose Pagan Rookie Card 68 Dave Hillman 69 Billy Goodman 70 Lew Burdette 71 Marty Keough 72 Detroit Tigers Team Card 73 Bob Gibson 74 Walt Moryn 75 Vic Power 76 Bill Fischer 77 Hank Foiles 78 Bob Grim 79 Walt Dropo 80 Johnny Antonelli 81 Russ SnydeRookie Card 82 Ruben Gomez 83 -

1958 Topps Baseball Checklist

1958 Topps Baseball Checklist 1 Ted Williams 2 Bob Lemon 3 Alex Kellner 4 Hank Foiles 5 Willie Mays 6 George Zuverink 7 Dale Long 8 Eddie Kasko 9 Hank Bauer 10 Lew Burdette 11 Jim Rivera 12 George Crowe 13 Billy Hoeft 14 Rip Repulski 15 Jim Lemon 16 Charlie Neal 17 Felix Mantilla 18 Frank Sullivan 19 New York Giants Team Card 20 Gil McDougald 21 Curt Barclay 22 Hal Naragon 23 Bill Tuttle 24 Hobie Landrith 25 Don Drysdale 26 Ron Jackson 27 Hersh Freeman 28 Jim Busby 29 Ted Lepcio 30 Hank Aaron 31 Tex Clevenger 32 JW Porter 33 Cal Neeman 34 Bob Thurman 35 Don Mossi 36 Ted Kazanski 37 Mike McCormick 38 Dick Gernert 39 Bob Martyn 40 George Kell 41 Dave Hillman 42 Johnny Roseboro 43 Sal Maglie 44 Washington Senators Team Card Compliments of BaseballCardBinders.com© 2019 1 45 Dick Groat 46 Lou Sleater 47 Roger Maris 48 Chuck Harmon 49 Smoky Burgess 50 Billy Pierce 51 Del Rice 52 Roberto Clemente 53 Morrie Martin 54 Norm Siebern 55 Chico Carrasquel 56 Bill Fischer 57 Tim Thompson 58 Art Schult 59 Dave Sisler 60 Del Ennis 61 Darrell Johnson 62 Joe DeMaestri 63 Joe Nuxhall 64 Joe Lonnett 65 Von McDaniel 66 Lee Walls 67 Joe Ginsberg 68 Daryl Spencer 69 Wally Burnette 70 Al Kaline 71 Los Angeles Dodgers Team Card 72 Bud Byerly 73 Pete Daley 74 Roy Face 75 Gus Bell 76 Turk Farrell 77 Don Zimmer 78 Ernie Johnson 79 Dick Williams 80 Dick Drott 81 Steve Boros 82 Ron Kline 83 Bob Hazle 84 Billy O'Dell 85 Luis Aparicio 86 Valmy Thomas 87 Johnny Kucks 88 Duke Snider 89 Billy Klaus 90 Robin Roberts 91 Chuck Tanner Compliments of BaseballCardBinders.com© -

1959 Topps Baseball Chacklist

1959 Topps Baseball Chacklist 1 Ford Frick Commissioner of Baseball 2 Eddie Yost 3 Don McMahon 4 Albie Pearson 5 Dick Donovan 6 Alex Grammas 7 Al Pilarcik 8 Philadelphia Phillies Team Card 9 Paul Giel 10 Mickey Mantle 11 Billy Hunter 12 Vern Law 13 Dick Gernert 14 Pete Whisenant 15 Dick Drott 16 Joe Pignatano 17 Danny's All-Stars 18 Jack Urban 19 Eddie Bressoud 20 Duke Snider 21 Connie Johnson 22 Al Smith 23 Murry Dickson 24 Red Wilson 25 Don Hoak 26 Chuck Stobbs 27 Andy Pafko 28 Al Worthington 29 Jim Bolger 30 Nellie Fox 31 Ken Lehman 32 Don Buddin 33 Ed Fitz Gerald 34 Al Kaline Pitchers Beware Charlie Maxwell 35 Ted Kluszewski 36 Hank Aguirre 37 Gene Green 38 Morrie Martin 39 Ed Bouchee 40 Warren Spahn 41 Bob Martyn 42 Murray Wall Compliments of BaseballCardBinders.com© 2019 1 43 Steve Bilko 44 Vito Valentinetti 45 Andy Carey 46 Bill Henry 47 Jim Finigan 48 Baltimore Orioles Team Card 49 Bill Hall 50 Willie Mays 51 Rip Coleman 52 Coot Veal 53 Stan WilliamRookie Card 54 Mel Roach 55 Tom Brewer 56 Carl Sawatski 57 Al Cicotte 58 Eddie Miksis 59 Irv Noren 60 Bob Turley 61 Dick Brown 62 Tony Taylor 63 Jim Hearn 64 Joe DeMaestri 65 Frank Torre 66 Joe Ginsberg 67 Brooks Lawrence 68 Dick Schofield 69 San Francisco Giants Team Card 70 Harvey Kuenn 71 Don Bessent 72 Bill Renna 73 Ron Jackson 74 Bob LemonDirecting The Power Cookie Lavagetto Roy Sievers 75 Sam Jones 76 Bobby Richardson 77 Johnny Goryl 78 Pedro Ramos 79 Harry Chiti 80 Minnie Minoso 81 Hal Jeffcoat 82 Bob Boyd 83 Bob Smith 84 Reno Bertoia 85 Harry Anderson 86 Bob Keegan 87 Danny O'Connell -

Debut Year Player Hall of Fame Item Grade 1871 Doug Allison Letter

PSA/DNA Full LOA PSA/DNA Pre-Certified Not Reviewed The Jack Smalling Collection Debut Year Player Hall of Fame Item Grade 1871 Doug Allison Letter Cap Anson HOF Letter 7 Al Reach Letter Deacon White HOF Cut 8 Nicholas Young Letter 1872 Jack Remsen Letter 1874 Billy Barnie Letter Tommy Bond Cut Morgan Bulkeley HOF Cut 9 Jack Chapman Letter 1875 Fred Goldsmith Cut 1876 Foghorn Bradley Cut 1877 Jack Gleason Cut 1878 Phil Powers Letter 1879 Hick Carpenter Cut Barney Gilligan Cut Jack Glasscock Index Horace Phillips Letter 1880 Frank Bancroft Letter Ned Hanlon HOF Letter 7 Arlie Latham Index Mickey Welch HOF Index 9 Art Whitney Cut 1882 Bill Gleason Cut Jake Seymour Letter Ren Wylie Cut 1883 Cal Broughton Cut Bob Emslie Cut John Humphries Cut Joe Mulvey Letter Jim Mutrie Cut Walter Prince Cut Dupee Shaw Cut Billy Sunday Index 1884 Ed Andrews Letter Al Atkinson Index Charley Bassett Letter Frank Foreman Index Joe Gunson Cut John Kirby Letter Tom Lynch Cut Al Maul Cut Abner Powell Index Gus Schmeltz Letter Phenomenal Smith Cut Chief Zimmer Cut 1885 John Tener Cut 1886 Dan Dugdale Letter Connie Mack HOF Index Joe Murphy Cut Wilbert Robinson HOF Cut 8 Billy Shindle Cut Mike Smith Cut Farmer Vaughn Letter 1887 Jocko Fields Cut Joseph Herr Cut Jack O'Connor Cut Frank Scheibeck Cut George Tebeau Letter Gus Weyhing Cut 1888 Hugh Duffy HOF Index Frank Dwyer Cut Dummy Hoy Index Mike Kilroy Cut Phil Knell Cut Bob Leadley Letter Pete McShannic Cut Scott Stratton Letter 1889 George Bausewine Index Jack Doyle Index Jesse Duryea Cut Hank Gastright Letter -

2021 Record Book.Indd

2018 OREGON BASEBALL 2021 OREGON BASEBALL OREGON BASEBALL 2021 QUICK FACTS UNIVERSITY FACTS Assistant Coach (Pitching) ............................................................Jake Angier (2nd Year) Location ...................................................................................................... Eugene, Ore. Alma Mater, Yr. .................................................................South Dakota State, ‘07, ‘10 Founded ...................................................................................................................1876 Assistant Coach/Recruiting Coordinator .......................................Jack Marder (2nd Year) Enrollment ........................................................................................................... 23,000 Alma Mater, Yr. ..........................................................................................Oregon, ‘16 Nickname ............................................................................................................... Ducks Assistant Coach ........................................................................ Marcus Hinkle (2nd Year) Colors .........................................................................................................Green, Yellow Alma Mater, Yr. ............................................................................Western Oregon, ‘15 Stadium (Capacity) ..................................................................................PK Park (4,000) Director of Player Development/Analytics ...................................................Brett -

Filegoenmg Jfttfsports

RADIO, Pages B-6-7—BUSINESS, Pages B-8-9 - Three Homers t ¦ : -.ijyyy I Put Demeter file goenmg jfttfSPORTS WASHINGTON, D. C., WEDNESDAY, APRIL 22, 1959 In Forefront : «¦ —. I B Fowler Comeback Helps as Dodgers •*¦ Run Streak to Four ***• by * Not <¦- Fischer Awed Task £%iv S%. v, ¦' :• th, * . *.?•* Br Aitociitfd PrMi • .xy _ j!/ J ’ ‘: ' • Don Demeter, a kid who*a fM been a long time coming, and ' Wk 4 - f! • d£%f ' i “•- * »A- “, , *-; '~'tir >; u'• • ¦ . Art Fowler, an old guy who's >iiw IS*$«»2K Jwf tfylng to come back, have the long-lost sitting Stopping Tonight Dodgers pretty Os Yanks : * the National League race. ' .'.H ... « in ¦ ***3Sjßs¦»*' h *5% , -.¦ Demeter, a lean and lanky ' 23-year-old outfielder, ripped ‘ ' his third two-run homer of the Sinking Griffs -•'-V, Q ' ; 'Ms game in the 11th inning last * <y ?.. % - E* V " ; •» night at the Coliseum for a ‘KpiP Jl te 9-7 victory over the Giants. Face Ford After • ._ JBi4h - And it was Fowler, returning Heavy * -««i8(LjBC to the majors at 38 after being* Pounding JWr cut loose by the Reds two years n • %**-¦ IMIPi ago, who collected his second By BURTON HAWKINS relief victory with the blast. •tvStaff Writer Fischer, displaying That gave the Dodgers a four- Bill brav- game winning streak, matching ery beyond the call of duty ¦jP their longest after the manner In which his *' string ,A of successes ¦ON *’» all last season, when they fin- tr JBbqP - t A Y., troops were annihilated by the ished seventh, and kept Yankees last night, says he'll them up H in second place, within .133 show at Griffith Stadium to- percentage points of first-place night and attempt to check the SHV' Milwaukee. -

The Kentucky High School Athlete, December 1969 Kentucky High School Athletic Association

Eastern Kentucky University Encompass The Athlete Kentucky High School Athletic Association 12-1-1969 The Kentucky High School Athlete, December 1969 Kentucky High School Athletic Association Follow this and additional works at: http://encompass.eku.edu/athlete Recommended Citation Kentucky High School Athletic Association, "The Kentucky High School Athlete, December 1969" (1969). The Athlete. Book 145. http://encompass.eku.edu/athlete/145 This Article is brought to you for free and open access by the Kentucky High School Athletic Association at Encompass. It has been accepted for inclusion in The Athlete by an authorized administrator of Encompass. For more information, please contact [email protected]. HighSchoolAthlete CLASS AAA STATE CHAMPION ST. XAV1ER (Left to Right) Front Row: Tom Roberts, Marty Mooney, John Lewis, Don Looney, Mark Schroer- ing, Bob Beck, Bob Andres, Bob Gruner, Bill Helm, Charles Barrett, Bill Marzian, Jack Buehner, Mike King, Dane Glass. Second Row: Carl Gammons. Rick Schmitt, Bob Riley, Mike Zoeller, Steve Hagg, Stu Eisenback, Mark Webster, Vince Millen. Mike Devine, Tom Overberg, Steve Norris, Henry Allgeier, Steve Herfel, Steve Day. Third Row: Mike Glaser, Greg McConnel, Tony King, Joe Williams, Don Har- pring, Bob Kennedy, Bert Erny, Dennis Shaw, Greg Gleis, Scott Saylor, Steve Byron, Greg Joyner, John Meyer, Fourth Row: Steve Green, Bob Fuchs, Ron Lanham, John Byrnes, Paul Buddeke, Donald Dwyer, Gil Wentzel, Ron Steele, Tim Coffey, Bob Vissman, Jim Hovey, Rick Wepler, Roger Cecil, Jack Kail. St. Xavier 34 - Thomas Jefferson 6 St. Xavier 7 - Male 6 St. Xavier 3 5 Central St. Xavier 32 - DeSales 8 St. Xavier 40 - duPont Manual 13 St. -

Chicago Cubs Were Game Opponents Start to Finish in Sandy Koufax's Career

Chicago Cubs were game opponents start to finish in Sandy Koufax’s career By George Castle, CBM Historian Posted Friday, August 28, 2015 (First of a two-part series on the 50th anniversary of Sandy Koufax’s perfect game over the Cubs on Sept. 9, 1965 in what may have been the greatest pitching duel in history with Chicago lefty Bob Hendley.) The story about Sandy Kou- Walter Alston (left) first used Sandy Koufax (right) sparingly, a tac- fax’s perfect game over the tic that upset Jackie Robinson (center) in his final season with the Cubs isn’t just about its 50th Brooklyn Dodgers. Later, Alston grossly overpitched Koufax. anniversary, the sheer mag- nificence of the Hall of Famer’s performance or the Cubs’ unparalleled streak of not be- ing no-hit since the Koufax game just ended by Cole Hamels on July 25, 2015 at Wrigley Field. Behind every all-time performance is a back story of people with emotions and desires, of standards and motivations. The Koufax saga goes back a decade from Vin Scully’s un- forgettable radio call of “Two and two on Harvey Kuenn, one strike away…” and forward two generations to the present. It is the story of individuals lifted above their middling stature in baseball to establish a special connection to Koufax, a quietly tough-guy manager who grossly mishandled Koufax, the pitcher’s resulting underlying push to prove himself and overcome constant arthritic pain, and an undermanaged, undermanned team making Koufax work espe- cially hard for a win in almost every head-to-head battle. -

North Carolina State University Year-By-Year Baseball Records

NORTH CAROLINA STATE UNIVERSITY 197 SAM ESPOSITO Head Baseball Coach A former major leaguer, Sam Esposito was handed the North Carolina State baseball reins in 1967 following the retirement of veteran Vic Sorrell, and the Wolfpack has not experienced a losing season under his direction. After an 11-11 break-even season in his first campaign, the Wolfpack has been menacingly on the prowl and twice posted 21 or more victories. The apex of his five-year State career came in 1968 when he steered the Wolfpack to the Atlantic Coast Con- ference championship, the NCAA Dis- trict III title and a third-place finish in the collegiate World Series as the team finished with an overall record of 25-9, the best in State’s history. Esposito, who also serves as a f?- basketball assistant, has seen his teams etch an imposing 92-52-1 record, an average of more than 18 wins per season, and against ACC competi- tion, his clubs stand 50-33. Last season, State went 18-11-1 and was in contention for the conference title untilkthe final week of the race, ending with a 9-5 league mar . Esposito, for 10 years an American League infielder, mostly with the Chicago White Sox, has already been cited twice for his coaching ability: he was voted NCAA District Coach of the Year in 1968, when State was 13-4 in the league and 25-9 overall, and he was co-winner of the 1968 Will Wynne Award, presented annually to the man adjudged to have contributed the most to baseball in North Carolina. -

Baseball Single Season/Career Pitching Records

FORDHAM UNIVERSITY BASEBALL ALL-TIME CAREER PITCHING RECORDS (compiled with available materials) (as of 5/25/2021) Appearances Wins Strikeouts 1. Rich Anastasi (2010-13) 93 1. Jim Dwyer (1924-26) 26 1. Matt Mikulski (2018-21) 272 2. Kyle Martin (2017-19) 83 2. Tom Davis (2005-08) 24 2. Javier Martinez (2004-07) 264 3. Bill Conkling (1990-93) 79 3. Bob Cooney (1926-29) 23 3. Brett Kennedy (2013-15) 218 Charlie Cucchiara (1992-95) 79 Hank Borowy (1938-39) 23 Reiss Knehr (2016-18) 218 5. Andrew Paolillo (2001-04) 76 Javier Martinez (2004-07) 23 4. Pete Harnisch (1985-87) 213 James Sammut (2005-07) 76 5. Pete Harnisch (1985-87) 21 5. Donny Tracey (1978-81) 212 7. Jay Hutchinson (1989-92) 75 Ed Estwanick (1933-35) 21 Anthony DiMeglio (2016-19) 212 8. Jimmy Murphy (2013-17) 71 Cory Riordan (2005-07) 21 7. Ed Alex (1940-42) 207 9. Bobby Aylmer (1987-90) 69 Matt Mikulski (2018-21) 21 8. Tom Davis (2005-08) 205 10. Paul Darrigo (1986-89) 68 10. Paul LoGiudice (1988-91) 20 9. Cory Riordan (2005-08) 201 Javier Martinez (2004-07) 68 Joe Maniscalco (1989-92) 20 10. Paul Darrigo (1986-89) 199 Anthony DiMeglio (2016-19) 68 12. Paul Darrigo (1986-89) 19 11. Chris Pike (2011-13) 198 13. Craig Tscherednikov (2003-06) 67 Henry Toolan (1993-96) 19 12. Scott Gleckel (1975-78) 195 14. J.C. Porter (2011-14) 64 14. Ed Alex (1940-42) 18 13. Jimmy Murphy (2013-17) 191 15.