Form 990-PF Return of Private Foundation RECEI VE MAY 16 OGDEN T

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Return of Private Foundation CT' 10 201Z '

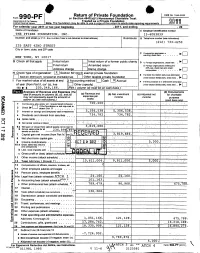

Return of Private Foundation OMB No 1545-0052 Form 990 -PF or Section 4947(a)(1) Nonexempt Charitable Trust Department of the Treasury Treated as a Private Foundation Internal Revenue Service Note. The foundation may be able to use a copy of this return to satisfy state reporting requirem M11 For calendar year 20 11 or tax year beainnina . 2011. and ending . 20 Name of foundation A Employer Identification number THE PFIZER FOUNDATION, INC. 13-6083839 Number and street (or P 0 box number If mail is not delivered to street address ) Room/suite B Telephone number (see instructions) (212) 733-4250 235 EAST 42ND STREET City or town, state, and ZIP code q C If exemption application is ► pending, check here • • • • • . NEW YORK, NY 10017 G Check all that apply Initial return Initial return of a former public charity D q 1 . Foreign organizations , check here . ► Final return Amended return 2. Foreign organizations meeting the 85% test, check here and attach Address chang e Name change computation . 10. H Check type of organization' X Section 501( exempt private foundation E If private foundation status was terminated Section 4947 ( a)( 1 ) nonexem pt charitable trust Other taxable p rivate foundation q 19 under section 507(b )( 1)(A) , check here . ► Fair market value of all assets at end J Accounting method Cash X Accrual F If the foundation is in a60-month termination of year (from Part Il, col (c), line Other ( specify ) ---- -- ------ ---------- under section 507(b)(1)(B),check here , q 205, 8, 166. 16) ► $ 04 (Part 1, column (d) must be on cash basis) Analysis of Revenue and Expenses (The (d) Disbursements total of amounts in columns (b), (c), and (d) (a) Revenue and (b) Net investment (c) Adjusted net for charitable may not necessanly equal the amounts in expenses per income income Y books purposes C^7 column (a) (see instructions) .) (cash basis only) I Contribution s odt s, grants etc. -

Springhill Suites Norfolk Virginia Beach Attractions

Attractions Nearby Outdoor Adventure • Stop and smell the roses at the Norfolk Botanical Garden • Walk along the path inside a Kangaroo exhibit at the Virginia Zoo • Stroll along the famous 3-mile boardwalk right beside the Atlantic Ocean, or stop by one of the many unique shops and variety of restaurants along the way. With Festivals, events, and outdoor concerts, there’s always something to do at the Virginia Beach Oceanfront. Entertainment and Nightlife • Try one of the many eclectic restaurants and bars in the historic Ghent District, or enjoy a drink and an appetizer along the inlet at the nearby Waterside District. • Plan a visit to the Chrysler Museum of Art • Hop on the Tide Light Rail to take you to Chrysler Hall, the official Performing Arts Center of Hampton Roads. • Learn all about maritime history, science, technology, sailing, and even discover the history behind our famous Battleship Wisconsin all in one place. Enjoy a self-guided tour, or explore the fascinating Admiral’s cabin, Combat Engagement Center, Captain’s Cabin, and more with the Guided Command & Control Tour. • Step foot into history at the Hampton Roads Naval Museum • Norfolk Premium Outlets • Stroll through streets lined with murals, join in an improv comedy show, watch live glass blowing, and more at the nearby Neon District. Sports and Recreation • In the heart of Norfolk lies the world’s largest reinforced thin-shell concrete dome, Scope Arena. Home of the MEAC Basketball Tournament, concerts, shows, and more- this arena can accommodate everyone’s style of entertainment. • Home of Old Dominion University Athletics, the Ted Constant Convocation Center hosts everything from sporting events, to concerts, comedy shows, and career fairs. -

The RUNDOWN the RUNDOWN

July 2008 Edition TheThe RUNDOWNRUNDOWN Monthly newsletter of the TIDEWATER STRIDERS Running Club. One of the nation’s largest running organizations. New Membership & Newsletter Rates Start July 1st The Tidewater Striders will commence phasing in a conversion plan to email dis- tribution of the club’s newsletter. Bowing to escalating printing & bulk mail costs and the strong desire to “Go Green” your Board has approved new membership rates which reward those opting for email delivery of The Rundown and sets rates that will cover the cost of paper copies and bulk mail for those who select the postal service deliv- ery option. These will be phased in over the next few months. The new rates are effec- tive July 1st for new members and those renewing. Eventually all requiring paper deliver will need to advise the membership chairman. The new application is inside the back cover of this Rundown. Please encourage your friends and family members to join the Tidewater Striders by passing on this Run- down and application. The Summer Series is a great time to join the Striders and meet many members along with having a great time in the heat of the summer. Upcoming Striders’ Events Member of • Tuesday, July 8, 2008 - Summer Series Countdown 4 Miler • Tuesday, July 15, 2008 - Summer Series 3x2k Relay • Tuesday, July 15, 2008 - Rundown Deadline • Tuesday, July 15, 2008 - Rundown Deadline • Saturday, July 19, 2008 - Allen Stone Run-Swim-Run & 5k • Tuesday, July 29, 2008 - Memorial 5k • Thursday, July 31, 2008 - Newsletter Stuffi ng 2008 Summer Series at the Garden A Tidewater Striders fun run event Place: The Norfolk Botanical Garden, on Azalea Garden Road, near the Norfolk International Airport. -

Norfolk Theatre Festival Fall in Love with Theatre! February 14 – 17, 2019

Norfolk Announces a Theatre Celebration! Norfolk Theatre Festival Fall in love with theatre! February 14 – 17, 2019 Norfolk is one of the most theatre-rich cities in Virginia, a diverse community full of spirited audiences in venues large and small. February 14-17, the Norfolk Theatre Festival will mark Norfolk’s role as a cultural destination and celebrate the performing arts organizations that enliven the scene here. “As the arts and culture destination of Hampton Roads, Norfolk is excited to bring the highest caliber of theatrical performances to our city for residents, visitors and the community to celebrate,” said Norfolk Mayor Kenneth Cooper Alexander. Norfolk is home to a gifted performing arts community, vibrant theatre companies, multiple universities with theatre programs, and a nurturing environment for new works. Norfolk also hosts a robust touring Broadway series which draws tens of thousands of residents and regional visitors per season. In addition, the venues that house some of the liveliest performances in Norfolk are among the most beautiful and historic places in this architecturally distinguished city. Experience unforgettable shows, behind-the-scenes events, and more. Discover the riches of the Norfolk theatre scene in a whirlwind weekend in February 2019—the perfect Valentine’s getaway or staycation! Performances during Norfolk Theatre Festival include: Once On This Island presented by Norfolk State University Theatre Company Thursday, February 14, 7:30pm Saturday, February 16, 2:00pm Sunday, February 17, 2:00pm Norfolk State University's G.W.C. Brown Memorial Hall Mainstage Theater Once On This Island is the big, bold and breathtaking tale of Ti Moune, a fearless Caribbean girl who is ready to risk it all for love. -

Native Plants for Southeast Virginia, Including Hampton Roads Region

Native Plants for Southeast Virginia including Hampton Roads Region Plant Southeast Virginia Natives! This guide showcases the attractive variety of plants native to Southeast Virginia, which includes the Hampton Roads region. Native plant species have evolved within specific areas and been dispersed throughout their range without known human involvement. These plants form the primary structure of the living landscape and provide food and shelter for native animal species. Although this guide is not comprehensive, the native plants featured here were selected because they are attractive, relatively easy for the home gardener to acquire, easy to maintain, and offer Swamp Milkweed (Asclepias incarnata) and Eastern Tiger Swallowtail (Papilio glaucus) various benefits to wildlife and the environment. This guide is being provided by the Hampton Roads organizations listed below to promote the use of these plants in the urban and suburban landscapes of Southeast Virginia for their many social, cultural, and economic benefits, and to increase the availability of these native plants in retail centers throughout the region. Butterfly Society of Virginia Master Gardeners Virginia Natural Heritage Program/VA Chesapeake Bay Foundation Master Naturalists Dept of Conservation and Recreation Eco Images Meg French Design Virginia Institute of Marine Science Elizabeth River Project Norfolk Botanical Garden Virginia Living Museum Hampton Roads Planning District Sassafras Farm Virginia State Beekeepers Association Commission - HR STORM, HR WET South Hampton Roads Chapter, VNPS Virginia Tech Hampton Roads AREC Hermitage Museum and Gardens Southern Branch Nursery Wetlands Watch John Clayton Chapter, VNPS York County Wild Works of Whimsy Keep Norfolk Beautiful Virginia Coastal Zone Management Lynnhaven River Now Program/VA Dept of Environmental Quality Design and publication management by Virginia Witmer, Coastal Zone Management Program. -

Opportunity Zone Prospectus

NORFOLK ® OPPORTUNITY ZONE PROSPECTUS N O R F O L K V I R G I N I A - I N V E S T M E N T P R O S P E C T U S 1 WELCOME For more than 300 years, Norfolk has served as the cultural and economic heart of Hampton Roads, mixing ideas, connecting people, creating new experiences and new businesses, and powering the growth of a region that is home to 1.75 million people and a real GDP approaching $84 billion. One of America’s oldest global trade destinations, Norfolk has been transformed into a global center for international security and coastal resilience. We are home to Naval Station Norfolk, the world’s largest naval base, and NATO’s only headquarters in North America. We also serve as a national leader in health care, transportation, higher education, and visual and performing arts. Norfolk is investing in transformative projects that will enhance our assets, foster inclusive economic growth, and develop talented and motivated residents. In 2018, we launched the transformation of the St. Paul’s Area, which will reshape three public housing communities that encompass more than 200 acres near our thriving downtown. Investments in the people, physical infrastructure, and anchor institutions that are native to this area are helping us to attract new businesses and entrepreneurs that will drive regional productivity and growth. The neighborhoods of the St. Paul’s Area are just one example of the 16 qualified opportunity zones, the most of any city or county in the Commonwealth of Virginia, that we hope you will consider for investment. -

American Beech

Conservation Gap Analysis of American Beech August 2021 Emily Beckman1, Abby Meyer2, David Pivorunas3, Sean Hoban1 and Murphy Westwood1,4 1The Morton Arboretum 2Botanic Gardens Conservation International, U.S. 3USDA Forest Service 4Botanic Gardens Conservation International Fagus grandifolia Ehrh. (American beech) THE MORTON ARBORETUM is an internationally recognized outdoor tree museum and tree research center located in Lisle, Illinois. As the champion of trees, the Arboretum is committed to scientifically informed action, both locally and globally, and encouraging the planting and conservation of trees for a greener, healthier, more beautiful world. The Morton Arboretum welcomes more than 1.3 million visitors annually to explore its 1,700 acres with 222,000 plant specimens representing 4,650 different kinds of plants. The Arboretum’s Global Tree Conservation Program works to prevent tree extinctions around the world by generating resources, fostering cross-sector collaborations, and engaging local partners in conservation projects. The Center for Tree Science seeks to create the scientific knowledge and technical expertise necessary to sustain trees, in all their diversity, in built environments, natural landscapes, and living collections. The Arboretum also hosts and coordinates ArbNet, the interactive, collaborative, international community of arboreta and tree-focused professionals. BOTANIC GARDENS CONSERVATION INTERNATIONAL ACKNOWLEDGEMENTS (BGCI) is the world’s largest plant conservation network, comprising more than 600 botanic gardens in over 100 countries, and provides First and foremost, many thanks to the hundreds of institutions who the secretariat to the IUCN/SSC Global Tree Specialist Group. BGCI shared their ex situ accessions data and/or reported conservation was established in 1987 and is a registered charity with offices in activities. -

The Colonial Master Gardener May

The Colonial Master Gardener May PUBLICATION OF JCC/WMASTER GARDENER ASSO C I A T I O N & 2015 VIRGINIA COOPERATIVE EXTENSION THE PRESIDENT’S MESSAGE Next Meeting: BY SUE LIDDELL Thursday, May 7 We took advantage of the warmer weather in April by offering Program: various programs, including garden symposiums, tours, and plant Ira Wallace sales. During tours of Colonial Williamsburg as part of Garden “Heirlooms, Seed Saving, and Threats from GMOs” Week, leaders talked about garden design and how participants could get ideas for their own gardens. This made me think about what kind of garden I have and, more the pizza garden we put in last year. This month we importantly, what kind of gardener I am. After I’d lived here a few will add tomatoes, peppers, and onions to the patch. years, I made a list of all the plants on my property and plotted out a rough landscape design. For a few years I kept this up, Whatever kind of gardener you are, thanks for sharing moving, adding, and subtracting plants, and recording the your knowledge and experience through our MG changes. I still move, add, and subtract plants, but I no longer organization. keep a record. As a result I have decided I am a Continually Surprised Gardener. I have had beautiful primroses one year, never to be seen again. I have enjoyed a ground cover with variegated leaves, which I believe is Lamium. This year is the first year it is covered with flowers. I have a Yucca that blooms every three to four years. -

A Clear Expression of Purpose

The Park System of Norfolk, Virginia An Analysis of its Strengths and Weaknesses By The Trust for Public Land Center for City Park Excellence Washington, D.C. February 2005 Introduction and Executive Summary A venerable city with colonial-era roots, Norfolk, Virginia, has an increasingly bright future as the center of its large metropolitan area at the mouth of the Chesapeake Bay. In 2004, with their city in the midst of an impressive civic renaissance, a group of Norfolk citizen leaders became interested in knowing the state of Norfolk’s park and recreation system and how it compares with those of other similar cities. They turned to the Trust for Public Land’s Center for City Park Excellence, which is known for its studies of urban park systems, and contracted for an overview and analysis of Norfolk. With the assistance of the Bay Oaks Park Committee, and with cooperation from city officials, TPL undertook this study of Norfolk’s park system. Data on the system’s acreage, budget, manpower, and planning process was supplemented by interviews with city leaders, park and planning staff and Norfolk’s citizens. Utilizing an extensive database of city park information Norfolk was evaluated both on its own merits and against other American cities. By dint of time and budget, TPL’s analysis is not comprehensive; it only provides an initial set of snapshot views and comparisons. Nevertheless, the findings of this study are clear enough. By almost every measure, TPL finds that while the city of Norfolk has some wonderful parks, scenic riverfronts, tree-lined boulevards and sandy beaches, it simply doesn’t have enough of them. -

Farmers Extraordinaire! Lil Sprouts at St

Farmers Extraordinaire! Lil Sprouts at St. Patrick’s Garden Club The kids grew cabbages as big as their heads. -Alice Hinsch '15 Li'l Sprouts Garden Club, sponsored by St. Patrick Catholic School, is wrapping up another season in the garden, as the school year draws to a close. With co-leaders Tom West (Thursdays) and Olena Peter- son (Tuesdays) each working with a small group of NMG volunteers, the students used square-foot gardening methods and got an impressive yield from their raised beds. MASTER GARDNENER COLLEGE REGISTRATION OPEN Master Gardener College is headed to Norfolk this fall, Thursday through Sunday, September 19-22 (classes start a day earlier for Water Steward trainees, on Wednesday, September 18). All the information about costs, classes and more can be found in the spring edition of In Seasons, the online newsletter from the state VCE-MG Programs office. The current can be found here https://www.mastergardener.ext.vt.edu/in-season-archive/ and previous issues. Ready to register? Click here! https://register.cpe.vt.edu/portal/events/reg/participantTypeSelection.do?method=load&entityId=2346624 Those attending the whole series will choose up to four breakout sessions. Banquet on Thursday night at The Main is included, but you may want to join one of the optional tours during that day, and the Sunday picnic at HRAREC. Registration is open now through July 14 for all VCE-MGs. Interested interns should check with Chris Epes about the possibility of attending. Inside This Issue 2 ASK, Plant Sale Information 5 Annoying Weeds 3 Meet Peg Fitzgerald, Three R’s in Preschool 6 Bouquets, Slightly Wilted, Butterfly House 4 Outreach at NEX. -

Norfolk Architectural Survey Update Work Plan, City of Norfolk, Virginia

NORFOLK ARCHITECTURAL SURVEY UPDATE WORK PLAN, CITY OF NORFOLK, VIRGINIA by Adriana T. Moss with contributions from Peggie Haile McPhillips Prepared for Virginia Department of Historic Resources Prepared by DOVETAIL CULTURAL RESOURCE GROUP August 2020 Norfolk Architectural Survey Update Work Plan, City of Norfolk, Virginia by Adriana T. Moss with contributions from Peggie Haile McPhillips Prepared for Virginia Department of Historic Resources Capital Region Office 2801 Kensington Avenue Richmond, Virginia 23221 Prepared by Dovetail Cultural Resource Group 11905 Bowman Drive, Suite 502 Fredericksburg, Virginia 22408 Dovetail Job #19-074 August 2020 August 26, 2020 Adriana T. Moss, Principal Investigator Date Dovetail Cultural Resource Group This page intentionally left blank ABSTRACT Dovetail Cultural Resource Group (Dovetail) conducted a background review and windshield study associated with the preparation of a multi-phased work plan to update architectural documentation within the City of Norfolk, Virginia; the study was done between December 2019 and January 2020. The project was completed at the request of the City of Norfolk’s (the City) Department of City Planning in partnership with the Virginia Department of Historic Resources (DHR) Cost Share Survey and Planning Program (Cost Share Program). The study comprised a desktop review of past survey records, reports, and associated materials in DHR’s archives and a citywide windshield survey to identify potential areas in need of resurvey or new survey, including opportunities for thematic or resource-specific survey efforts. Particular attention was paid to resources that have reached 50 years of age since the last citywide survey conducted in 1997 by Hanbury Evans Newill Vlattas & Company (HENV), as well as resources in areas targeted for redevelopment as denoted by the Norfolk Department of Economic Development or susceptible to storm surge and sea level rise flooding as outlined by the Federal Emergency Management Agency (FEMA) and National Oceanic and Atmospheric Administration (NOAA) maps (HENV 1997). -

COMMUNITY ASSET MAPPING DATASET 4Th Community Asset Mapping Meeting Eastern Neighborhoods – Norview Community Center Saturday, 2/27, 9:00 Am – 10:30 Am

COMMUNITY ASSET MAPPING DATASET 4th Community Asset Mapping Meeting Eastern Neighborhoods – Norview Community Center Saturday, 2/27, 9:00 am – 10:30 am This summary provides a compilation of answers to the following question: What are the most important assets in your neighborhood and in the city as a whole that make your community strong and a great place to live? Please name at least three top priorities. By assets we mean: a. Places b. People c. Events d. Things Residents Count: 30 Places [208 data points] Interaction with Natural Elements [33 data points] Community parks and gardens, particularly the Norfolk Botanical Garden and the Norfolk ZOO, were identified as major assets. DATA: City and Neighborhood Parks (33) Norfolk Zoo (9) – elephant/butterfly public art at entrance Town Point Park (4) Norfolk Botanical Gardens (9) Stockley Gardens (2) Farmers Market (2) – green hill farms sections in Norview, aesthetics Parks and Greenspace (7) – Streetscapes, historical trees Interaction with Water [11 data points] The water and its interactions along the beaches was considered one of the greatest assets. DATA: Waterways (1) Deep water Ports (1) Waterfront (10) Beaches (5) – 7 miles of Beach in Ocean View Water (5) – greatest asset, change minds from water/bridges separate us to connect us, biggest economic asset and challenge Neighborhoods [34 data points] Norview and the many different activities it provides is a major asset. Downtown was also recognized as a valued asset. DATA: Downtown (6) – Waterside Street, walkability, revival Arts/NEON