Forth 1 (Edinburgh)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

RAJAR DATA RELEASE Quarter 1, 2015 – May 21 St 2015

RAJAR DATA RELEASE Quarter 1, 2015 – May 21 st 2015 COMPARATIVE CHARTS 1. National Stations 2. Scottish Stations 3. London Stations 4. Breakfast Shows – National and London stations Source RAJAR / Ipsos MORI / RSMB RAJAR DATA RELEASE Quarter 1, 2015 – May 21 st 2015 NATIONAL STATIONS SAMPLE SIZE: TERMS WEEKLY The number in thousands of the UK/area adult population w ho listen to a station for at least 5 minutes in the Survey period - Q1 2015 REACH: course of an average w eek. SHARE OF Code Q (Quarter): 23,876 Adults 15+ The percentage of total listening time accounted for by a station in the area (TSA) in an average w eek. LISTENING: TOTAL Code H (Half year): 49,000 Adults 15+ The overall number of hours of adult listening to a station in the UK/area in an average w eek. HOURS: TOTAL HOURS (in thousands): ALL BBC Q1 14 568166 Q4 14 536759 Q1 15 553852 TOTAL HOURS (in thousands): ALL COMMERCIAL Q1 14 434769 Q4 14 450398 Q1 15 435496 STATIONS SURVEY REACH REACH REACH % CHANGE % CHANGE SHARE SHARE SHARE PERIOD '000 '000 '000 REACH Y/Y REACH Q/Q % % % Q1 14 Q4 14 Q1 15 Q1 15 vs. Q1 14 Q1 15 vs. Q4 14 Q1 14 Q4 14 Q1 15 ALL RADIO Q 48063 47851 47799 -0.5% -0.1% 100.0 100.0 100.0 ALL BBC Q 35314 34798 34872 -1.3% 0.2% 54.9 52.8 54.4 15-44 Q 15408 14840 14583 -5.4% -1.7% 40.8 38.6 40.5 45+ Q 19906 19958 20290 1.9% 1.7% 64.5 61.7 63.2 ALL BBC NETWORK RADIO Q 32262 31798 31671 -1.8% -0.4% 46.6 45.3 46.9 BBC RADIO 1 Q 10532 10433 9699 -7.9% -7.0% 6.7 6.6 6.4 BBC RADIO 2 Q 15568 15283 15087 -3.1% -1.3% 17.9 17.8 18.1 BBC RADIO 3 Q 2087 2030 2084 -0.1% -

Media Nations 2020: Scotland Report

Media Nations 2020 Scotland report Published 5 August 2020 Contents Section Overview............................................................................................................ 3 The impact of Covid-19 on audiences and broadcasters .................................... 5 TV services and devices.................................................................................... 12 Broadcast TV viewing ....................................................................................... 16 TV programming for and from Scotland ........................................................... 26 Radio and audio ............................................................................................... 34 2 Overview This Media Nations: Scotland report reviews key trends in the television and audio-visual sector as well as in the radio and audio industry in Scotland. The majority of the research relates to 2019 and early 2020 but, given the extraordinary events that surround the Covid-19 pandemic, Ofcom has undertaken research into how our viewing and news consumption habits have changed during this period. This is explored in the Impact of Covid-19 on audiences and broadcasters section. The report provides updates on several datasets, including bespoke data collected directly from licensed television and radio broadcasters (for output, spend and revenue in 2019), Ofcom’s proprietary consumer research (for audience opinions), and BARB and RAJAR (for audience consumption). In addition to this Scotland report, there are separate -

The Communications Market 2008

The Communications Market 2008 4 4 Radio 233 Contents 4.1 Key market developments in radio 235 4.1.1 UK radio industry key metrics 235 4.1.2 Introduction 235 4.1.3 Commercial radio revenue grows despite audience decline… 235 4.1.4 …although listening to national commercial stations rises 3.2% 236 4.1.5 Younger listeners lead a fall in listening hours 236 4.1.6 The Hits becomes the first digital station to enter the top ten by reach... 237 4.1.7 …helped by a rise in digital listening to 18% of the total 238 4.1.8 Digital Radio Working Group publishes interim report on digital plan 241 4.1.9 RAJAR to review listening survey methodology 242 4.2 The radio industry 243 4.2.1 Radio licences 243 4.2.2 Industry revenues and expenditure 248 4.2.3 Commercial groups’ performance 251 4.2.4 Overview of the major radio operators in 2008 254 4.2.5 DAB availability and station choice 270 4.2.6 Restricted service licences 274 4.3 The radio listener 277 4.3.1 Radio reach 277 4.3.2 Listening hours 278 4.3.3 Radio ownership and listening trends 282 4.3.4 Digital listening 285 4.3.5 Listening patterns and satisfaction with radio 288 234 4.1 Key market developments in radio 4.1.1 UK radio industry key metrics UK radio industry 2002 2003 2004 2005 2006 2007 Weekly reach of radio (% of population) 90.5% 90.5% 90.3% 90.0% 89.8% 89.8% Average weekly hours per head 21.8 22.1 21.9 21.6 21.2 20.6 BBC share of listening 52.6% 52.8% 55.5% 54.5% 54.7% 55.0% Total industry revenue (£m) 1,083 1,128 1,158 1,156 1,149 1,179 Commercial revenue (£m) 509 543 551 530 512 522 BBC expenditure (£m) 574 585 607 626 637 657 Radio share of advertising spend 3.4% 3.6% 3.5% 3.3% 3.0% 2.9% Number of stations (analogue and DAB) 345 357 364 372 389 397 DAB digital radio take-up (households) 1% 2% 5% 10% 16% 22% Source: Ofcom, RAJAR (all individuals age 15+), BBC, WARC, radio operators 2007 4.1.2 Introduction Radio has maintained its audience reach in 2007 but average hours of listening have fallen. -

Fox Covert Primary School

Fox Covert Primary School School Handbook “Always curious, Always learning” A Foreword from the Director of Children and Families Session 2017-18 Dear Parents & Carers, This brochure contains a range of information about your child’s school which will be of interest to you and your child. It offers an insight into the life and ethos of the school and also offers advice and assistance which you may find helpful in supporting and getting involved in your child’s education. We are committed to working closely with parents as equal partners in your child's education, in the life of your child's school and in city-wide developments in education. Parental involvement in the decision making process and in performance monitoring are an integral part of school life. We look forward to developing that partnership with your support. I am pleased to introduce this brochure for session 2017-18 and hope that it will provide you with the information you need concerning your child’s school. If you have any queries regarding the contents of the brochure, please contact the Head Teacher of your child’s school in the first instance who will be happy to offer any clarification you may need. Alistair Gaw Executive Director of Communities and Families Children and Families Vision Our vision is for all children and young people in Edinburgh to enjoy their childhood and fulfill their potential. We believe that children and young people do best when: they are able to live safely and happily within their own families with the right kind of support as needed they attend first class, inclusive schools and Early Years settings which meet their needs We will do all we can to strengthen support for families, schools and communities to meet their children's needs. -

Global-GMG Merger Inquiry: Appendices and Glossary

APPENDIX A Terms of reference and conduct of the inquiry 1. On 11 October 2012, the OFT sent the following reference to the CC: 1. In exercise of its duty under section 22(1) of the Enterprise Act (‘the Act’) to make a reference to the Competition Commission (‘the CC’) in relation to a completed merger, the Office of Fair Trading (‘the OFT’) believes that it is or may be the case that: (a) a relevant merger situation has been created in that: (i) enterprises carried on by or under the control of Global Radio Holdings Limited have ceased to be distinct from enterprises previously carried on by or under the control of GMG Radio Holdings Limited; and (ii) as a result, the conditions specified in section 23(4) of the Act will prevail, or will prevail to a greater extent, with respect to the supply of commercial radio based on listening hours in the UK and the supply of radio advertising services in London, the West Midlands, the East Midlands, the North West, Yorkshire, the North East, Central Scotland, South Wales and North Wales; and (b) the creation of that situation has resulted or may be expected to result in a substantial lessening of competition within any market or markets in the UK for goods or services, including the supply of non-contracted radio advertising services in North Wales, the East Midlands, South Yorkshire and Cardiff. 2. Therefore, in exercise of its duty under section 22(1) of the Act, the OFT hereby refers to the CC, for investigation and report within a period ending on 27 March 2013, on the following questions in accordance with section 35(1) of the Act: (a) whether a relevant merger situation has been created; and (b) if so, whether the creation of that situation has resulted or may be expected to result in a substantial lessening of competition within any market or markets in the UK for goods and services. -

Self-Registration Service for Unidentified Unpaid Carers

Scottish Government Self-registration Service for unidentified unpaid carers Strategic Communications, Vaccines Strategy Division 3-1-2021 Contents Overview – Self-registration for unidentified unpaid carers ......................................... 2 Process for unpaid carers to be offered an appointment online following self- registration ONLINE .......................................................................................................... 3 Process for unpaid carers to be offered an appointment off-line because they are not able to complete the process of self-registration ONLINE ..................................... 5 Process flow diagram ....................................................................................................... 6 Communications Plan: ..................................................................................................... 7 ANNEX 1 – Sample of creative campaign ....................................................................... 9 Overview – Self-registration for unidentified unpaid carers The self-registration process for unidentified unpaid carers will open on 15 March and take a once for Scotland approach. The NVSS will be used by all Boards for this group in cohort 6. People who self-identify as unpaid carers will be able to access self-registration either online (at https://register.vacs.nhs.scot) or via the Covid vaccination helpline. Carers are eligible for vaccination at this stage and should register if all of the following statements apply to them: You are 16 to 64 -

“Reaching 79% of Commercial Radio's Weekly Listeners…” National Coverage

2019 GTN UK is the British division of Global Traffic Network; the leading provider of custom traffic reports to commercial radio and television stations. GTN has similar operations in Australia, Brazil and Canada. GTN is the largest Independent radio network in the UK We offer advertisers access to over 240 radio stations across the country, covering every major conurbation with a solus opportunity enabling your brand to stand out with up to 48% higher ad recall than that of a standard ad break. With both a Traffic & Travel offering, as well as an Entertainment News package, we reach over 28 million adults each week, 80% of all commercial radio’s listeners, during peak listening times only, 0530- 0000. Are your brands global? So are we. Talk to us about a global partnership. Source: Clark Chapman research 2017 RADIO “REACHING 79% OF COMMERCIAL RADIO’S WEEKLY LISTENERS…” NATIONAL COVERAGE 240 radio stations across the UK covering all major conurbations REACH & FREQUENCY Reaching 28 million adults each week, 620 ratings. That’s 79% of commercial radio’s weekly listening. HIGHER ENGAGEMENT With 48% higher ad recall this is the stand-out your brand needs, directly next to “appointment-to-listen” content. BREAKFAST, MORNING, AFTERNOON, DRIVE All advertising is positioned within key radio listening times for maximum reach. 48% HIGHER AD RECALL THAN THAT OF A STANDARD AD BREAK Source: Clark Chapman research NATIONAL/DIGITAL LONDON NORTH EAST Absolute Radio Absolute Radio Capital North East Absolute Radio 70s Kiss Classic FM (North) Absolute -

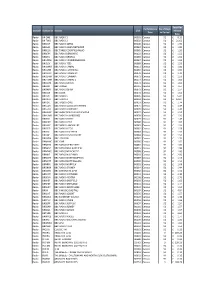

Domain Station ID Station UDC Performance Date

Total Per Performance No of Days DomainStation IDStation UDC Minute Date in Period Rate Radio BR ONE BBC RADIO 1 B0001Census 91£ 8.15 Radio BR TWO BBC RADIO 2 B0002Census 91£ 21.62 Radio BR1EXT BBC RADIO 1XTRA B0106Census 91£ 1.90 Radio BRASIA BBC RADIO ASIAN NETWORK B0064Census 91£ 1.80 Radio BRBEDS BBC THREE COUNTIES RADIO B0065Census 91£ 1.59 Radio BRBERK BBC RADIO BERKSHIRE B0103Census 91£ 1.52 Radio BRBRIS BBC RADIO BRISTOL B0066Census 91£ 1.52 Radio BRCAMB BBC RADIO CAMBRIDGESHIRE B0067Census 91£ 1.55 Radio BRCLEV BBC RADIO TEES B0068Census 91£ 1.53 Radio BRCMRUBBC RADIO CYMRU B0011Census 91£ 1.60 Radio BRCORN BBC RADIO CORNWALL B0069Census 91£ 1.59 Radio BRCOVN BBC RADIO COVENTRY B0070Census 91£ 1.49 Radio BRCUMB BBC RADIO CUMBRIA B0071Census 91£ 1.53 Radio BRCYMMBBC RADIO CYMRU 2 B0114Census 91£ 1.60 Radio BRDEVN BBC RADIO DEVON B0072Census 91£ 1.65 Radio BRDOR BBC DORSET B0115Census 91£ 1.57 Radio BRDRBY BBC RADIO DERBY B0073Census 91£ 1.57 Radio BRESSX BBC ESSEX B0074Census 91£ 1.61 Radio BRFIVE BBC RADIO 5 B0005Census 91£ 5.07 Radio BRFOUR BBC RADIO 4 B0004Census 91£ 14.87 Radio BRFOYL BBC RADIO FOYLE B0019Census 91£ 1.74 Radio BRGLOS BBC RADIO GLOUCESTERSHIRE B0075Census 91£ 1.49 Radio BRGUER BBC RADIO GUERNSEY B0076Census 91£ 1.45 Radio BRHRWC BBC HEREFORD AND WORCESTER B0077Census 91£ 1.52 Radio BRHUMB BBC RADIO HUMBERSIDE B0078Census 91£ 1.56 Radio BRJERS BBC RADIO JERSEY B0079Census 91£ 1.47 Radio BRKENT BBC RADIO KENT B0080Census 91£ 1.63 Radio BRLANC BBC RADIO LANCASHIRE B0081Census 91£ 1.56 Radio BRLEED BBC RADIO LEEDS -

Independent Radio (Alphabetical Order) Frequency Finder

Independent Radio (Alphabetical order) Frequency Finder Commercial and community radio stations are listed together in alphabetical order. National, local and multi-city stations A ABSOLUTE RADIO CLASSIC ROCK are listed together as there is no longer a clear distinction Format: Classic Rock Hits Broadcaster: Bauer between them. ABBEY 104 London area, Surrey, W Kent, Herts, Luton (Mx 3) DABm 11B For maps and transmitter details see: Mixed Format Community Swansea, Neath Port Talbot and Carmarthenshire DABm 12A • Digital Multiplexes Sherborne, Dorset FM 104.7 Shropshire, Wolverhampton, Black Country b DABm 11B • FM Transmitters by Region Birmingham area, West Midlands, SE Staffs a DABm 11C • AM Transmitters by Region ABC Coventry and Warwickshire DABm 12D FM and AM transmitter details are also included in the Mixed Format Community Stoke-on-Trent, West Staffordshire, South Cheshire DABm 12D frequency-order lists. Portadown, County Down FM 100.2 South Yorkshire, North Notts, Chesterfield DABm 11C Leeds and Wakefield Districts DABm 12D Most stations broadcast 24 hours. Bradford, Calderdale and Kirklees Districts DABm 11B Stations will often put separate adverts, and sometimes news ABSOLUTE RADIO East Yorkshire and North Lincolnshire DABm 10D and information, on different DAB multiplexes or FM/AM Format: Rock Music Tees Valley and County Durham DABm 11B transmitters carrying the same programmes. These are not Broadcaster: Bauer Tyne and Wear, North Durham, Northumberland DABm 11C listed separately. England, Wales and Northern Ireland (D1 Mux) DABm 11D Greater Manchester and North East Cheshire DABm 12C Local stations owned by the same broadcaster often share Scotland (D1 Mux) DABm 12A Central and East Lancashire DABm 12A overnight, evening and weekend, programming. -

Bauer Radio Total Portfolio

1 2 BAUER RADIO TOTAL PORTFOLIO RAJAR Q4 2012 3 BAUER RADIO TOTAL PORTFOLIO ■ 13.3m listeners ■ Our Place Portfolio stations are No.1 in 21 out of 21 markets ■ Smash Hits, The Hits & Heat are all in the top 10 digital stations ■ Average age 38 Source: RAJAR, Bauer Radio Total Portfolio TSA, 6 Months PE Dec 12 4 LISTENER PROFILE 4 ■ 46% of listeners are male, 54% are female BAUER RADIO TOTAL PORTFOLIO REACHES ■ 51% of listeners are ABC1, 49% C2DE 13,279,000 ADULTS 15+ EVERY WEEK ■ 76% of listeners are Main Shoppers ■ Has a commercial Share of 25.0% Source: RAJAR, Bauer Radio Total Portfolio TSA, 6 Months PE Dec 12 5 REACH BY AGE BREAK 5 WEEKLY REACH (000) 3,488 2,965 2,345 2,383 2,098 15-24 25-34 35-44 45-54 55+ Source: RAJAR, Bauer Radio Total Portfolio TSA, 6 Months PE Dec 12 6 THIS IS A FULLSCREEN PICTURE CHART 7 THIS IS A FULLSCREEN PICTURE CHART 8 THIS IS A FULLSCREEN PICTURE CHART 9 THE BAUER PLACE PORTFOLIO ■ 8.7m listeners ■ No.1 in 21 out of 21 markets ■ 18% higher reach than our nearest competitor ■ 41% more listening hours ■ Average age 42 Source: RAJAR, Bauer Place Portfolio TSA, 6 Months PE Dec 12 10 BAUER PLACE PORTFOLIO REACH Bauer Place Portfolio reaches 8.7 million adults across the UK ■ Heart FM (UK): 7.4 million ■ Capital FM (UK): 6.8 Million ■ Classic FM: 5.4 Million ■ Total Smooth Radio UK: 3.8 Million ■ talkSPORT: 3.0 Million ■ Total Absolute Radio Network: 3.1 Million Source: RAJAR, Bauer Place Portfolio TSA, 6 Months PE Dec 12 11 AND WE CONNECT WITH THEM FOR 11 LONGER Bauer Place Portfolio has average hours of 8.3 ■ Heart FM (UK): 6.9 hours ■ Capital FM (UK): 5.9 hours ■ Classic FM: 6.7 hours ■ Total Smooth Radio UK: 8.0 hours ■ talkSPORT: 6.4 hours ■ Total Absolute Radio Network: 6.9 hours Source: RAJAR, Bauer Place Portfolio TSA, 6 Months PE Ded 12 12 MADE UP OF THE BEST LOCAL BRANDS 12 13 13 FEEL INFORMED BAUER PLACE PORTFOLIO + 40% FEEL INVOLVED BAUER PLACE PORTFOLIO + 30% FEEL CONNECTED BAUER PLACE PORTFOLIO + 32% VS. -

Radio – Preparing for the Future

Radio – Preparing for the future Phase 1 developing a new framework Issued: 15 December 2004 Closing date for responses: 7 March 2005 Radio – Preparing for the future 2 Contents Section Page Foreword 2 1 Introduction 4 2 Executive summary 9 3 An overview of radio in the UK 23 4 Why do we intervene in the market for radio? 34 5 Towards a strategic framework for the regulation of 51 radio 6 The regulation of formats and local material on 59 analogue commercial radio 7 Facilitating the growth of digital radio 88 8 Future licensing 150 9 Questions for consultation 156 10 Glossary of terms and definitions 161 Appendices (published online at www.ofcom.org.uk) A The regulation of commercial radio in the UK B Results of audience research C Summary of representations made during the review of digital radio D The economic and social policy arguments for intervention in the radio market E Regulatory impact assessments F Ofcom’s consultation procedures 2 Radio – Preparing for the future Foreword The senior broadcaster – radio - is a vibrant and increasingly popular medium. Audiences are listening both to a wider range of stations and for longer in total than they were five years ago. Radio is also at the cutting edge of convergence. Audiences listen to radio not just over conventional sets but, increasingly, via digital television, mobile phones and the internet; and there is a growing range of data and multi-media services available over digital radio sets. Since Ofcom inherited regulation of commercial radio from the Radio Authority, we have taken a number of specific steps to help the industry develop and increase choice for audiences. -

Radio - Preparing for the Future Phase 2: Implementing the Framework

Radio - Preparing for the Future Phase 2: Implementing the Framework Consultation Publication date: 19 October 2005 Closing Date for Responses: 11 January 2006 Radio – Preparing for the Future Contents Section Page Foreword 1 Executive Summary 1 2 Introduction 7 3 The radio industry today 8 4 The Public Purposes of radio 17 5 Ofcom’s overall strategic framework for radio 25 6 Licensing policy 38 7 The regulation of Formats and Localness on commercial radio 57 Annexes 1 Responding to this Consultation 75 2 Ofcom’s Consultation Principles 77 3 Consultation Response Cover Sheet 78 4 Consultation Questions 80 Appendices (Published online at www.ofcom.org.uk) A Results of audience research B Summary of consultation responses to phase 1 of Radio – preparing for the future C The move from input to output regulation for commercial local radio D Options for DAB replanning – A report to the DRDB Analogue Radio Switchover Group E Impact assessments F Glossary of terms and definitions Radio – Preparing for the Future Foreword This phase of Ofcom’s review of the UK radio industry, Radio - Preparing for the Future, which sets out the regulatory framework for the years ahead. As such, it sits alongside the Strategic Framework documents for other key parts of the wider communications sector (the Telecommunications Strategic Review, the Spectrum Framework Review and the Statutory Review of Public Service Television Broadcasting) which Ofcom has published over the past year. Radio as a medium is increasing everywhere, ubiquitous in its reach and its power to inform and entertain locally, nationally and immediately. Listeners love their local station; they participate in their community station; and they regularly tune into their favourite stations.