Studies in Applied Economics

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Guide to the War of 1812 Sources

Source Guide to the War of 1812 Table of Contents I. Military Journals, Letters and Personal Accounts 2 Service Records 5 Maritime 6 Histories 10 II. Civilian Personal and Family Papers 12 Political Affairs 14 Business Papers 15 Histories 16 III. Other Broadsides 17 Maps 18 Newspapers 18 Periodicals 19 Photos and Illustrations 19 Genealogy 21 Histories of the War of 1812 23 Maryland in the War of 1812 25 This document serves as a guide to the Maryland Center for History and Culture’s library items and archival collections related to the War of 1812. It includes manuscript collections (MS), vertical files (VF), published works, maps, prints, and photographs that may support research on the military, political, civilian, social, and economic dimensions of the war, including the United States’ relations with France and Great Britain in the decade preceding the conflict. The bulk of the manuscript material relates to military operations in the Chesapeake Bay region, Maryland politics, Baltimore- based privateers, and the impact of economic sanctions and the British blockade of the Bay (1813-1814) on Maryland merchants. Many manuscript collections, however, may support research on other theaters of the war and include correspondence between Marylanders and military and political leaders from other regions. Although this inventory includes the most significant manuscript collections and published works related to the War of 1812, it is not comprehensive. Library and archival staff are continually identifying relevant sources in MCHC’s holdings and acquiring new sources that will be added to this inventory. Accordingly, researchers should use this guide as a starting point in their research and a supplement to thorough searches in MCHC’s online library catalog. -

Federalist Politics and William Marbury's Appointment As Justice of the Peace

Catholic University Law Review Volume 45 Issue 2 Winter 1996 Article 2 1996 Marbury's Travail: Federalist Politics and William Marbury's Appointment as Justice of the Peace. David F. Forte Follow this and additional works at: https://scholarship.law.edu/lawreview Recommended Citation David F. Forte, Marbury's Travail: Federalist Politics and William Marbury's Appointment as Justice of the Peace., 45 Cath. U. L. Rev. 349 (1996). Available at: https://scholarship.law.edu/lawreview/vol45/iss2/2 This Article is brought to you for free and open access by CUA Law Scholarship Repository. It has been accepted for inclusion in Catholic University Law Review by an authorized editor of CUA Law Scholarship Repository. For more information, please contact [email protected]. ARTICLES MARBURY'S TRAVAIL: FEDERALIST POLITICS AND WILLIAM MARBURY'S APPOINTMENT AS JUSTICE OF THE PEACE* David F. Forte** * The author certifies that, to the best of his ability and belief, each citation to unpublished manuscript sources accurately reflects the information or proposition asserted in the text. ** Professor of Law, Cleveland State University. A.B., Harvard University; M.A., Manchester University; Ph.D., University of Toronto; J.D., Columbia University. After four years of research in research libraries throughout the northeast and middle Atlantic states, it is difficult for me to thank the dozens of people who personally took an interest in this work and gave so much of their expertise to its completion. I apologize for the inevita- ble omissions that follow. My thanks to those who reviewed the text and gave me the benefits of their comments and advice: the late George Haskins, Forrest McDonald, Victor Rosenblum, William van Alstyne, Richard Aynes, Ronald Rotunda, James O'Fallon, Deborah Klein, Patricia Mc- Coy, and Steven Gottlieb. -

National Register of Historic Places Registration Form

NPS Form 10-900 | OMB No. 10024-0018 (Oct. 1990) United States Department of the Interior National Park Service National Register of Historic Places Registration Form This form is for use in nominating or requesting determinations for individual properties and districts. See instructions in How to Complete the National Register of Historic Places Registration Form (National Register Bulletin 16A). Complete each item by marking "x" in the appropriate box or by entering the information requested. If any item does not apply to the property being documented, enter "N/A" for "not applicable." For functions, architectural classification, materials, and areas of significance, enter only categories and subcategories from the instructions. Place additional entries and narrative items on continuation sheets (NPS Form 10-900a). Use a typewriter, word processor, or computer, to complete all items. 1. Name of Property historic name Clifton Park other names B-4608 2. Location Bounded on the northwest by Harford Road, northeast by Erdman Avenue and Clifton Park Street & number Terrace, southeast by the Baltimore Belt RR and Sinclair Lane • not for publication city or town Baltimore • vicinity state Maryland code MP county Independent city code 510 zip code 21217 3. State/Federal Agency Certification As the designated authority under the National Historic Preservation Act of 1966, as amended, I hereby certify that this E<] nomination • request for determination of eligibility meets the documentation standards for registering properties in the National Register of Historic Places and meets the procedural and professional requirements set forth in 36 CFR Part 60. In my opinion, the property ^ meets • does not meet the National Register criteria. -

Maryland Historical Magazine, 1971, Volume 66, Issue No. 3

1814: A Dark Hour Before the Dawn Harry L. Coles National Response to the Sack of Washington Paul Woehrmann Response to Crisis: Baltimore in 1814 Frank A. Cassell Christopher Hughes, Jr. at Ghent, 1814 Chester G. Dunham ^•PIPR^$&^. "^UUI Fall, 1971 QUARTERLY PUBLISHED BY THE MARYLAND HISTORICAL SOCIETY GOVERNING COUNCIL OF THE SOCIETY GEORGE L. RADCLIFFE, Chairman of the Council SAMUEL HOPKINS, President J. GILMAN D'ARCY PAUL, Vice President C. A. PORTER HOPKINS, Vice President H. H. WALKER LEWIS, Vice President EDWARD G. HOWARD, Vice President JOHN G. EVANS, Treasurer MRS. WILLIAM D. GROFF, JR., Recording Secretary A. RUSSELL SLAGLE, Corresponding Secretary HON. FREDERICK W. BRUNE, Past President WILLIAM B. MARYE, Secretary Emeritus CHARLES P. CRANE, Membership LEONARD C. CREWE, Gallery DR. RHODA M. DORSEY, Publications LUDLOW H. BALDWIN, Darnall Young People's Museum MRS. BRYDEN B. HYDE, Women's CHARLES L. MARBURG, Athenaeum ROBERT G. MERRICK, Finance ABBOTT L. PENNIMAN, JR., Athenaeum DR. THOMAS G. PULLEN, JR., Education FREDERICK L. WEHR, Maritime DR. HUNTINGTON WILLIAMS, Library HAROLD R. MANAKEE, Director BOARD OF EDITORS JEAN BAKER Goucher College RHODA M. DORSEY, Chairman Goucher College JACK P. GREENE Johns Hopkins University FRANCIS C. HABER University of Maryland AUBREY C. LAND University of Georgia BENJAMIN QUARLES Morgan State College MORRIS L. RADOFF Maryland State Archivist A. RUSSELL SLAGLE Baltimore RICHARD WALSH Georgetown University FORMER EDITORS WILLIAM HAND BROWNE 1906-1909 LOUIS H. DIELMAN 1910-1937 JAMES W. FOSTER 1938-1949, 1950-1951 HARRY AMMON 1950 FRED SHELLEY 1951-1955 FRANCIS C. HABER 1955-1958 RICHARD WALSH 1958-1967 M6A SC 588M-^3 MARYLAND HISTORICAL MAGAZINE VOL. -

Jonathan D. Meredith Papers

Jonathan D. Meredith Papers A Finding Aid to the Collection in the Library of Congress Prepared by Theresa Salazar Manuscript Division, Library of Congress Washington, D.C. 2012 Contact information: http://hdl.loc.gov/loc.mss/mss.contact Finding aid encoded by Library of Congress Manuscript Division, 2012 Finding aid URL: http://hdl.loc.gov/loc.mss/eadmss.ms012148 Collection Summary Title: Jonathan D. Meredith Papers Span Dates: 1795-1859 Bulk Dates: (bulk 1810-1859) ID No.: MSS32664 Creator: Meredith, Jonathan, 1783-1872 Extent: 9,000 items ; 15 containers plus 1 oversize ; 6 linear feet Language: Collection material in English Repository: Manuscript Division, Library of Congress, Washington, D.C. Abstract: Lawyer, army officer, and businessman of Baltimore, Md. Family and general correspondence, legal files, financial papers, and other material relating chiefly to Meredith's associations with the Savings Bank of Baltimore and the Bank of the United States; the War of 1812; impeachment proceedings against James Hawkins Peck; shipping and trade with Europe and South America; and settlement of the estates of Charles Carroll and Robert Oliver. Selected Search Terms The following terms have been used to index the description of this collection in the Library's online catalog. They are grouped by name of person or organization, by subject or location, and by occupation and listed alphabetically therein. People Aspinwall, William Henry, 1807-1875--Correspondence. Calderón de la Barca, Ángel--Correspondence. Carroll, Charles, 1737-1832--Estate. Cogswell, Joseph Green, 1786-1871--Correspondence. Duane, William J. (William John), 1780-1865--Correspondence. Gilmor, Robert, 1748-1822--Correspondence. Graham, John, 1774-1820--Correspondence. -

An Historiographical Overview of Early: U.S. Finance (1784

I I [An Historiographical Overview of Early: U.S. Finance (1784 -1836): Institutions, 1 ' Markets, Players, and Politics BY ROBERT E. WRIGHT AND DAVID J. COWEN II OCTOBER 1999 ' ' 999 1b-t97t TABLE OF CONTENTS TABLE OF CONTENTS 1 PART ONE: STATEMENT OF PURPOSE. IMPORTANCE. AND INTRODUCTION TO MAJOR TERMS 3 Purpose and Plan of the Study 3 · Introduction: Why Study Early U.S. Finance? 4 Introduction to Commercial Banking: What Characterized Early Commercial Banking? 5 Secondary Securities (Stock) Markets: What Were Their Structure and Functions? 12 PART TWO: HISTORIOGRAPHY OF MONEY. BANKING. AND CREDIT 15 Origins of U.S. Commercial Banking: When and Why Did Banks Form? 15 The Functioning of Early Banks: What Did Banks Do and How Did They Do It? 17 Sources of Long Term Credit: How Could Individuals Borrow Money for More Than a Year? 18 Competition, Entry, and Eiit: Was It Easy to Start a New Bank? 21 Early Bank and Securities Statistics: How Many and How Much? 22 Money Supply: How Much and What Types of Money? 23 The Mint: When, Where, and How Were U.S. Coins Produced? 25 Exchange, Domestic and Foreign: What Is It and Why Is It Important? 26 The Panics of 1792, 1819, and 1837: What Were Their Causes and Consequences? 27 The First and Second Banks of the United States: What Were Their Economic Roles? 30 Central Banking: Were the First and Second Banks Central Banks? 32 Forms of Political Economy in the Early National Period: What Did Americans Want From the Economy and Did They Get It? 34 Banks and Politics: What Was At Stake? 37 Banking -

A Different Kind of Maritime Predation South American Privateering from Baltimore, 1816-1820

A Global Forum for Naval Historical Scholarship International Journal of Naval History August 2008 Volume 7 Number 2 A Different Kind of Maritime Predation South American Privateering from Baltimore, 1816-1820 (Published in tandem with the Maryland Historical Magazine, by permission) David Head State University of New York, Buffalo In Buenos Aires on February 22, 1818, a group of American merchants, diplomats, and sea captains gathered for a celebration of George Washington’s birthday. Coming at the height of the South American republic’s revolution against Spain , the celebrants offered toasts highlighting the common cause of the United States and South America in the pursuit of independence. As Norfolk’s American Beacon reported, Captain John Dieter hailed “the Patriots of North and South America,” while Job Wheeden, a ship’s surgeon, raised a glass to “the heroes who have fought, bled, and died in their country’s cause.” These Americans, however, were more than well-wishers. Many of those gathered on the occasion—including Dieter and Wheeden, as well as the event’s organizers—were involved in privateering. By fitting out vessels and accepting commissions from a revolutionary government to attack Spanish shipping, these Americans became participants in the revolutions. However, serving the South American republics in this manner was illegal, as U.S. law prohibited any American from owning, commanding, or sailing aboard a foreign privateer that intended to attack a nation at peace with the United States . In the contest between Spain and its colonies, U.S. policy dictated neutrality.i[1] Historians have done much to uncover the organizational, operational, and legal dimensions of privateering as it evolved from the seventeenth through nineteenth centuries. -

Brown V. Maryland and the Making of a National Economy

FOREWORD Title Interest and Irritation: Brown v. Maryland and the Making of a National Economy Author Henry P. Callegary Publication Date November, 2016 Keywords Commerce Clause, Tariff, Trade, Constitutional Law, John Marshall, Alexander Brown & Sons, Maryland, Roger Taney, William Wirt, Baltimore Abstract This paper examines the United States Supreme Court case Brown v. Maryland, 25 U.S. (12 Wheat.) 419 (1827), which struck down Maryland’s licensing fee on wholesalers of imported goods. In doing so, the Court reaffirmed its commitment to a national economic policy, instead of a state-centric system. This paper explores the context of the decision, including profiles of the parties involved, the attorneys for both sides, the lower court decisions, and the majority opinion and dissent from the United States Supreme Court. Additionally, this paper follows the lineage of the case through to the present day, examining its doctrinal impact and lingering effects on contemporary issues of taxation and commerce. Disciplines Law, constitutional history, American economic development, commerce clause analysis 1 I. Introduction The Supreme Court’s ruling in Brown v. Maryland, 25 U.S. (12 Wheat.) 419 (1827) reaffirmed one of the most significant elements of the United States Constitution: the federal government’s exclusive power to regulate international trade and interstate commerce. Additionally, this case created a new doctrine which the Court would employ for well over a century: the “Original Package” doctrine. Brown v. Maryland is significant for these two reasons alone, but as with every case, it was also a product of its times. Decided during a period of rapid territorial and economic change, this case represented a clear indication that the Court sought to unite the states under one economic banner. -

Rg 1 Baltimore Town Commissioners (1729-97)

RG 1 BALTIMORE TOWN COMMISSIONERS (1729-97) RG. 1 BALTIMORE TOWN COMMISSIONERS 1729-1797 The Baltimore Town Commissioners was created in 1729 as part of the legislative act for "erecting" Baltimore Town. The body consisted of seven commissioners, appointed for life, empowered to buy land, survey and sell lots, and settle disputes about property boundaries. The commission was the sole vestige of town government until the early 1780*s. In 1745 when Jones Town merged with Baltimore, the commissioners were given the authority to procure a three pound annual assessment from residents. In 1784 they were empowered to erect street lamps and have them lighted, to appoint constables and watchmen, to levy a tax on property, and to appoint a treasurer. Between 1784 and 1793 the commissioners were authorized justices of the peace. Occasionally special duties were assigned to them by the Maryland Legislature, including construction of market houses, maintenance of streets, and other special assessments and taxes. By the early 1780!s the commissioners shared their light administrative responsibilities with a Board of Special Commissioners and a Board of Port Wardens. The state government formed the latter two bodies in 1782 and 1783 respectively. They made up the remainder of the town's self government until its incorporation in 1796. The Special Commissioners were largely responsible for the construction and maintenance of streets and bridges. The Board of Port Wardens regulated the construction of wharves, surveyed the harbor, and supervised the collection of a duty on all vessels entering and leaving the port. Despite the three boards, essential government functions remained in Annapolis with the state government. -

Library Company of Philadelphia Mca MSS 013 BANK of COLUMBIA

Library Company of Philadelphia McA MSS 013 BANK OF COLUMBIA RECORDS 1794‐1828 1.04 linear feet, 3 boxes Series I. Correspondence (1794‐1828) Series II. Documents (1794‐1822) December 2005 McA MSS 013 2 Descriptive Summary Repository Library Company of Philadelphia 1314 Locust Street, Philadelphia, PA 19107‐5698 Call Number McA MSS 013 Creator Bank of Columbia (Georgetown, Washington, D.C.) Title Bank of Columbia Records Inclusive Dates 1794‐1828 Quantity 1.04 linear feet (3 boxes) Language of Materials Materials are in English and French. Abstract The Bank of Columbia Records has correspondence and legal and financial papers that document the history of the bank and its depositors. The collection holds letters, predominantly single letters, from many prominent citizens of Georgetown and Washington in the early nineteenth century, as well as from Treasury Department officials and officers of the Bank of the United States. Administrative Information Restrictions to Access The collection is open to researchers. It is on deposit at the Historical Society of Pennsylvania, and should be accessed through the Society’s reading room at 1300 Locust Street, Philadelphia, PA. Visit their website, http://www.hsp.org/, for reading room hours. Acquisition Information Gift of John A. McAllister; forms part of the McAllister Collection. Processing Information The Bank of Columbia Records were formerly filed within the large and chronologically‐arranged McAllister Manuscript Collection; the papers were reunited, arranged, and described as a single collection in 2005, under grants from the National Endowment for the Humanities and the William Penn Foundation. The collection was processed Edith Mulhern, a University of Pennsylvania Summer Research Intern, and Sandra Markham. -

Financing U.S. Economic Development, 1788-‐1860

Financing U.S. Economic Development, 1788-1860 By Robert E. Wright, Nef Family Chair of Political Economy, Augustana College SD National income statisticians and econometricians will continue to study precisely when, where, and why real per capita income grew in the antebellum U.S., but nobody doubts that it was about two and a half to three times higher on the eve of the Civil War than it had been at the new nation’s founding just a lifetime before (Lindert and Williamson 2013; Williamson 2014). Economic historians also generally agree on how real income growth occurred: post-Revolution political stability enabled relatively rapid development of (‘revolutions in’ or, more accurately in these cases, ‘evolutions in’) the agricultural and transportation sectors that freed up sufficient resources (people and land) to allow growth in the higher value-added manufacturing sector, the so-called Industrial “Revolution.” What pre-Sylla scholars1 generally misconstrued or missed entirely is the role of the financial system in early and antebellum America’s political, agricultural, transportation, and industrial evolutions.2 With the partial exception of Perkins (1994),3 pre-Sylla scholars ignored, downplayed, or generally underestimated the complexity, modernity, and size of America’s early financial system, i.e., banks, insurers, and securities markets and their interactions (e.g., Nettels 1962). Krooss and Blyn (1971:37) actually apologized for the “failure” of financial intermediaries to make “a substantial contribution to the total economy,” arguing that banks and insurers were “in the early stages of experiment.” Even in the late antebellum period, they argued, new technologies, like telegraphs and railroads, drove financial development rather than the reverse. -

Reminiscences of Baltimore,: a Machine

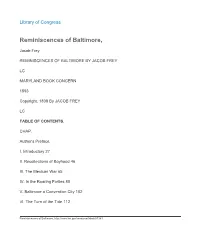

Library of Congress Reminiscences of Baltimore, Jacob Frey REMINISCENCES OF BALTIMORE BY JACOB FREY LC MARYLAND BOOK CONCERN 1893 Copyright, 1808 By JACOB FREY LC TABLE OF CONTENTS. CHAP. Author's Preface. I. Introductory 27 II. Recollections of Boyhood 46 III. The Mexican War 65 IV. In the Roaring Forties 80 V. Baltimore a Convention City 102 VI. The Turn of the Tide 112 Reminiscences of Baltimore, http://www.loc.gov/resource/lhbcb.01361 Library of Congress VII. The War Cloud 125 VIII. After the Storm 139 IX. Charity and Reorganization 146 X. The Constitution of '64 and '67 162 XI. Commotions and Alarms 177 XII. Grove, the Photographer 197 XIII. Baltimore's Military Defenders 211 XIV. Banking Extraordinary 221 XV. “ “ Continued 235 XVI. The Sequence of a Crime 252 XVII. The Wharton-Ketchum Case and Others 266 XVIII. A Chapter of Chat 280 XIX. The Story of a Reformation 293 XX. The Story of Emily Brown 301 XXI. In Recent Years 311 XXII. The Marshal's Office 320 XXIII. The Press of Baltimore 332 Reminiscences of Baltimore, http://www.loc.gov/resource/lhbcb.01361 Library of Congress XXIV. The Stage in Baltimore 346 XXV. Educational Institutions and Public Works 364 XXVI. Baltimore Markets 389 XXVII. The Harbor of Baltimore 402 XXVIII. Industrial Baltimore 417 XXIX. Street Railways and Their Relation to Urban Development 434 XXX. Busy Men and Fair Women 443 XXXI. Public and Recent Buildings 456 LIST OF ILLUSTRATIONS. Portrait of Jacob Frey Frontispiece Pratt Street Opposite Page, 30 Washington Monument “ “ 41 Charles Street at Franklin—Looking North “ “ 52 Portrait of C.