Between the Lines Week 23

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

May CARG 2020.Pdf

ISSUE 30 – MAY 2020 ISSUE 30 – MAY ISSUE 29 – FEBRUARY 2020 Promoting positive mental health in teenagers and those who support them through the provision of mental health education, resilience strategies and early intervention What we offer Calm Harm is an Clear Fear is an app to Head Ed is a library stem4 offers mental stem4’s website is app to help young help children & young of mental health health conferences a comprehensive people manage the people manage the educational videos for students, parents, and clinically urge to self-harm symptoms of anxiety for use in schools education & health informed resource professionals www.stem4.org.uk Registered Charity No 1144506 Any individuals depicted in our images are models and used solely for illustrative purposes. We all know of young people, whether employees, family or friends, who are struggling in some way with mental health issues; at ARL, we are so very pleased to support the vital work of stem4: early intervention really can make a difference to young lives. Please help in any way that you can. ADVISER RANKINGS – CORPORATE ADVISERS RANKINGS GUIDE MAY 2020 | Q2 | ISSUE 30 All rights reserved. No part of this publication may be reproduced or transmitted The Corporate Advisers Rankings Guide is available to UK subscribers at £180 per in any form or by any means (including photocopying or recording) without the annum for four updated editions, including postage and packaging. A PDF version written permission of the copyright holder except in accordance with the provision is also available at £360 + VAT. of copyright Designs and Patents Act 1988 or under the terms of a licence issued by the Copyright Licensing Agency, Barnard’s Inn, 86 Fetter Lane, London, EC4A To appear in the Rankings Guide or for subscription details, please contact us 1EN. -

Report & Accounts 2018

Report & Accounts 2018 Report & Accounts Derwent London plc Report & Accounts 2018 CONTENTS STRATEGIC REPORT GOVERNANCE 2018 summary ......................................................................................... 04 Introduction from the Chairman ........................................................... 84 Chairman’s statement ............................................................................ 07 Governance at a glance .......................................................................... 86 Chief Executive’s statement .................................................................. 08 Board of Directors ................................................................................... 88 CEO succession ........................................................................................11 Senior management ............................................................................... 90 London: Open for business .....................................................................12 Corporate governance statement ........................................................ 92 Central London office market ................................................................14 Nominations Committee report ......................................................... 100 A well-placed portfolio ............................................................................16 Audit Committee report ....................................................................... 104 Our stakeholders ......................................................................................18 -

Meggitt PLC Annual Report & Accounts 2020

Meggitt PLC Annual Report & Accounts 2020 Introduction Working closely with our Customers, we deliver technologically differentiated systems and products with high certification requirements in aerospace, defence and selected energy markets. Through focusing on engineering and operational excellence, we build broad installed bases of equipment for which we provide through life services and support. Our ambitious and diverse teams act with integrity to create superior and sustainable value for all of our stakeholders. Meggitt PLC Annual Report & Accounts 2020 1 Strategic Report – 1-89 – Report Strategic Strong portfolio Focus on sustainability Strong leadership Diverse end market exposure Next-generation technologies Leading through the with four aligned divisions that create more sustainable pandemic: responding and and efficient aircraft, engines, adapting to the external power and defence systems environment See more on page 20 See more on page 68 See more on page 14 Meggitt PLC 2 Annual Report & Accounts 2020 What’s in the report Contents We deliver innovative solutions Strategic Report for the most demanding 4 Our vision 6 At a glance 8 Chairman’s statement environments. Our differentiated 10 CEO’s statement 14 Our response to COVID-19 products and technologies 16 Market review 20 Strategy 22 Business model satisfy the highest requirements 24 Innovating for the future 28 Strategy in action for product safety, performance 36 Divisional reviews 44 CFO’s review and reliability and we continue 50 Key performance indicators 54 Risk management -

2018 Full-Year Results Strong Organic Growth in All End Markets

26 February 2019 Meggitt PLC 2018 Full-year results Strong organic growth in all end markets Meggitt PLC (“Meggitt” or “the Group”), a leading international engineering company specialising in high performance components and sub-systems for the aerospace, defence and energy markets, today announces audited results for the year ended 31 December 2018. Group headlines % change £m 2018 20171 Reported Organic2 Orders 2,237.2 2,079.4 8 12 Revenue 2,080.6 1,994.4 4 9 Underyling Operating profit3 367.3 353.3 4 4 Earnings per share3 34.2p 32.0p 7 Statutory Operating profit 256.6 272.7 (6) Earnings per share 23.2p 37.8p (39) Free cash flow4 167.4 197.4 (15) Net debt 1,074.1 1,060.8 1 Dividend 16.65p 15.85p 5 Financial highlights • Organic order growth of 12% underpins expectations for long term revenue growth; book to bill5 of 1.08x included strong performance in civil aerospace (1.10x book to bill) • Organic revenue growth of 9% reflects strong performance in growing end-markets; with 7% growth in civil aerospace, 10% in defence and 19% in energy • Underlying operating margin maintained at 17.7%, with efficiencies from strategic initiatives and lower new product introduction costs, offset by growing free of charge (‘FoC’) content and extended learning curve costs at composites sites • Statutory operating profit reflects strong underlying performance and lower exceptional costs, offset by the year on year, non-cash impact of marking to market certain financial instruments • Free cash flow decreased by £30m to £167m, with 63% cash conversion as -

2020 Half Year Report

MidCap_HY_Cover.qxp 25/02/2021 11:25 Page FC1 JPMorgan Mid Cap Investment Trust plc Half Year Report & Financial Statements for the six months ended 31st December 2020 MidCap_HY_Cover.qxp 25/02/2021 11:25 Page IFC2 KEY FEATURES Your Company Objective JPMorgan Mid Cap Investment Trust plc (the ‘Company’) aims to achieve capital growth from investment in medium-sized UK listed companies. The Company specialises in investment in FTSE 250 companies, using long and short term borrowings to increase returns to shareholders. Investment Policies • To focus on FTSE 250 stocks that deliver strong capital growth. • To have significant exposure to the UK economy, with selective exposure to overseas earnings. • To seek out both value stocks and growth stocks, including AIM stocks, to deliver strong performance throughout the market cycle. • To use gearing to increase potential returns to shareholders. • To invest no more than 15% of gross assets in other UK listed investment companies (including investment trusts). The Company’s shares are designed for private investors in the UK, including retail investors, professionally-advised private clients and institutional investors, who seek the potential for capital growth from investment in the UK market and who understand and are willing to accept the risks of exposure to equities. Private investors may wish to consider consulting an independent financial adviser who specialises in advising on the acquisition of shares and other securities before acquiring shares in the Company. Investors should be capable of evaluating the risks and merits of such an investment and should have sufficient resources to bear any loss that may result. -

17 Aerospace Quality Systems (Aqs)

AEROSPACE QUALITY SYSTEMS (AQS) The Aerospace Quality Systems Task Group conducts audits to demonstrate compliance to PRI AC7004. This quality system is required where no quality system approval exists in accordance with Nadcap Program Document PD 1100 and Operating Procedure OP 1103. PRI Staff Engineer Contacts: Task Group Leadership: Susan Frailey, +1.618.615.4478, [email protected] Chairperson: Robin Borrelli, The Boeing Company Mike Gutridge, +1.740.587.9841, [email protected] Vice Chairperson: Scott O’Connor, Honeywell Aerospace Secretary: David Day, GE Aviation Task Group Members Subscriber Voting Members (UVM) The Boeing Company Robin Borrelli Alternate: Patricia Wesemann Atlernate: Tony Marino Cessna Aircraft Company Saeed Cheema Atlernate: Jeff Robb Defense Contract Management Agency (DCMA) Michael Bess Eaton, Aerospace Group David Staten Jr. GE Aviation David Day Honeywell Aerospace Scott O’Connor Northrop Grumman Corporation Russell Cole Rockwell Collins Timothy Krumholz Spirit AeroSystems Chris Davison UTC Aerospace (Goodrich) Angelina Mendoza Supplier Voting Members (SVM) Aero Dynamics Cara Burzynski Tech Met Jim Tuminello The Young Engineers, Inc. David Eshleman AQS Liaisons CMSP Task Group David Day COMP Task Group Sally Spindor CP Task Group Michael Coleman CT Task Group Joel Mohnacky ETG Task Group Gilbert Shelby M&I Task Group Steve Rowe NDT Task Group Pete Torelli NMSE Task Group Jeff Robb WLD Task Group Saeed Cheema 17 CHEMICAL PROCESSING (CP) The Chemical Processing Task Group is conducting audits to demonstrate compliance to the AC7108 series of documents. These audits address the following types of processes: •Anodizing •Etching •Stripping •Chemical Cleaning •Laboratory Evaluation •Surface Prep Prior to Metal Bond •Chemical Milling •Paint/Dry Film Coatings •Surface Treatment/Passivation •Conversion/Phosphate Coating •Plating • Vacuum Cadmium & Aluminium IVD PRI Staff Engineer Contacts: Task Group Leadership: Ethan Akins +1.724.772.8524 [email protected] Chairperson: Mike Stolze, Northrop Grumman Corp. -

Driving Value from Motorsport Valley® the High Performance Energy-Efficient Prototype Community

Driving Value from Motorsport Valley® The high performance energy-efficient prototype community Chris Aylett - Chief Executive Motorsport Industry Association Motorsport Industry Association The only business network organisation serving the global motorsport and high–performance engineering industry • 300+ international corporate members handle £5 billion of global motorsport sales • Creates strategic alliances with government and industries, building networks and international business partnerships • Drives business growth initiatives to strengthen the motorsport industry, its profitability and success… • Delivers cross-sector business growth … Energy Efficient Motorsport… …to Automotive… to Defence…to Creative... to Aerospace… to Marine ©MIA 2019 Motorsport Valley® MIA International HQ Race Circuits Formula One Teams and Formula 1 HQ Race Car Constructors Engine Builders WRC Teams Leading Race Teams ©MIA 2019 Motorsport Valley® A World-ChampionshipTeam 8 out of 10 30% of sales turnover is Over £10bn Formula 1 teams are re-invested into R&D Estimated global sales based in the UK 10x that of road-car manufacturers turnover 4,300 45,000 staff 87% (incl. 25,000 highly skilled of UK motorsport Motorsport businesses engineers & apprentices) businesses export ©MIA 2019 Motorsport’s Continuous Innovation Rapid response delivery ALWAYS In motorsport.. DELIVER ON Changing technical Rigid time TIME every second of time, regulations constraints every sq. millimetre of CONTINUOUS --- space and INNOVATION MUST WIN every gram of weight CAPABILITY -

International Smallcap Separate Account As of July 31, 2017

International SmallCap Separate Account As of July 31, 2017 SCHEDULE OF INVESTMENTS MARKET % OF SECURITY SHARES VALUE ASSETS AUSTRALIA INVESTA OFFICE FUND 2,473,742 $ 8,969,266 0.47% DOWNER EDI LTD 1,537,965 $ 7,812,219 0.41% ALUMINA LTD 4,980,762 $ 7,549,549 0.39% BLUESCOPE STEEL LTD 677,708 $ 7,124,620 0.37% SEVEN GROUP HOLDINGS LTD 681,258 $ 6,506,423 0.34% NORTHERN STAR RESOURCES LTD 995,867 $ 3,520,779 0.18% DOWNER EDI LTD 119,088 $ 604,917 0.03% TABCORP HOLDINGS LTD 162,980 $ 543,462 0.03% CENTAMIN EGYPT LTD 240,680 $ 527,481 0.03% ORORA LTD 234,345 $ 516,380 0.03% ANSELL LTD 28,800 $ 504,978 0.03% ILUKA RESOURCES LTD 67,000 $ 482,693 0.03% NIB HOLDINGS LTD 99,941 $ 458,176 0.02% JB HI-FI LTD 21,914 $ 454,940 0.02% SPARK INFRASTRUCTURE GROUP 214,049 $ 427,642 0.02% SIMS METAL MANAGEMENT LTD 33,123 $ 410,590 0.02% DULUXGROUP LTD 77,229 $ 406,376 0.02% PRIMARY HEALTH CARE LTD 148,843 $ 402,474 0.02% METCASH LTD 191,136 $ 399,917 0.02% IOOF HOLDINGS LTD 48,732 $ 390,666 0.02% OZ MINERALS LTD 57,242 $ 381,763 0.02% WORLEYPARSON LTD 39,819 $ 375,028 0.02% LINK ADMINISTRATION HOLDINGS 60,870 $ 374,480 0.02% CARSALES.COM AU LTD 37,481 $ 369,611 0.02% ADELAIDE BRIGHTON LTD 80,460 $ 361,322 0.02% IRESS LIMITED 33,454 $ 344,683 0.02% QUBE HOLDINGS LTD 152,619 $ 323,777 0.02% GRAINCORP LTD 45,577 $ 317,565 0.02% Not FDIC or NCUA Insured PQ 1041 May Lose Value, Not a Deposit, No Bank or Credit Union Guarantee 07-17 Not Insured by any Federal Government Agency Informational data only. -

Annual Report & Accounts 2019

Annual Report & Accounts 2019 OUR STRATEGY Working closely with our customers, we deliver technologically differentiated systems and products with high certification requirements in aerospace, defence and selected energy markets. Through focusing on engineering and operational excellence, we build broad installed bases of equipment for which we provide support and services throughout their lifecycle. Our ambitious and diverse teams act with integrity to create superior and sustainable value for all of our stakeholders. 001 Strategic Report What’s in the report Contents Strategic Report Our Vision 03 Highlights 04 At a glance page 02 With innovation at the heart of Governance 06 Chairman’s statement what we do, we’ve been enabling 08 Chief Executive’s statement the extraordinary for over 160 12 Our business model years and continue to redefine 14 Our strategy our world through pioneering, 24 Market review sustainable technology for the 30 Divisional reviews page 08 38 Key performance indicators most extreme environments. 44 Risk management Financial Statements 46 Principal risks and uncertainties CEO 52 Chief Financial Officer’s review Statement 58 Corporate responsibility In 2019, we delivered Governance another year of strong 74 Chairman’s introduction organic growth and made 76 Board of Directors continued progress on our 80 Corporate governance report strategic initiatives. 86 Audit Committee report 90 Nominations Committee report 92 Directors’ remuneration report Other Information page 12 117 Directors’ report page 14 Group Financial -

Annual Report & Accounts 2018

Annual Report and Accounts 2018 Annual Report & Accounts 2018 Our Strategy Working closely with our customers, we deliver technologically differentiated systems and products with high certification requirements in aerospace, defence and selected energy markets. Through focusing on engineering and operational excellence, we build broad installed bases of equipment for which we provide support and services throughout their lifecycle. Our ambitious and diverse teams act with integrity to create superior value for all of our stakeholders. Contents Governance Strategic report Other information Financial statements What’s inside our report STRATEGIC REPORT 03 Highlights Chairman's statement 04 At a glance 2018 has proved a successful year 06 Chairman’s statement with the smooth and efficient 08 Chief Executive’s statement 12 Our business model handover of leadership to Tony 14 Our strategy Wood as Chief Executive and the 24 Market review rate of organic growth accelerating 30 Divisional reviews to 9%. 40 New organisational structure 42 Key performance indicators 46 Risk management Sir Nigel Rudd 48 Principal risks and uncertainties Chairman 54 Chief Financial Officer’s review 60 Corporate responsibility GOVERNANCE See page 06 74 Chairman’s introduction 76 Board of Directors 80 Corporate governance report 86 Audit Committee report 90 Nominations Committee report 92 Directors’ remuneration report Our business model 115 Directors’ report Differentiated technology, world‑class GROUP FINANCIAL STATEMENTS services and support and an installed base of over 71,000 aircraft provide 119 Independent auditors’ report to the members of Meggitt PLC annuity like revenues the returns from 129 Consolidated income statement which are reinvested to sustain 130 Consolidated statement market‑leading positions over of comprehensive income the long term. -

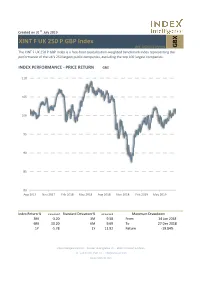

GBX XINT F UK 250 P GBP Index

Created on 31st July 2019 XINT F UK 250 P GBP Index ISIN: DE000A13PWW4 GBX The XINT F UK 250 P GBP Index is a free-float capitalization-weighted benchmark index representing the performance of the UK's 250 largest public companies, excluding the top 100 largest companies. INDEX PERFORMANCE - PRICE RETURN GBX 110 105 100 95 90 85 80 Aug 2017 Nov 2017 Feb 2018 May 2018 Aug 2018 Nov 2018 Feb 2019 May 2019 Index Return % annualised Standard Deviation % annualised Maximum Drawdown 3M -3.20 3M 9.58 From 14 Jun 2018 6M 10.20 6M 9.69 To 27 Dec 2018 1Y -5.78 1Y 11.92 Return -19.84% Index Intelligence GmbH - Grosser Hirschgraben 15 - 60311 Frankfurt am Main Tel.: +49 69 247 5583 50 - [email protected] www.index-int.com TOP 10 Largest Constituents FFMV million Weight Industry Sector Meggitt PLC 1.29% 461,944 1.29% Industrial Goods & Services F&C Investment Trust PLC 1.11% 395,614 1.11% Financial Services Cobham PLC 1.10% 395,035 1.10% Industrial Goods & Services Weir Group PLC 1.08% 387,413 1.08% Industrial Goods & Services Intermediate Capital Group PLC 1.08% 385,911 1.08% Financial Services Bellway PLC 1.02% 365,770 1.02% Personal & Household Goods Tate & Lyle PLC 0.99% 352,627 0.99% Food & Beverage John Wood Group PLC 0.98% 351,669 0.98% Oil & Gas Travis Perkins PLC 0.96% 344,429 0.96% Industrial Goods & Services GVC Holdings PLC 0.96% 342,223 0.96% Travel & Leisure Total 3,782,634 10.58% This information has been prepared by Index Intelligence GmbH (“IIG”). -

Good Anti-Corruption Practices in Defence Companies

June 2013 Raising the bar Good anti-corruption practices in defence companies Part I: Seven practices that distinguish the best “Those defence companies that do take corruption risk seriously have the chance to be seen by their government clients as better companies with which to do business. As governments toughen their attitudes towards corruption, having a reputation for zero tolerance of corruption will be a distinguishing asset for a defence company.” The Rt Hon Lord Robertson of Port Ellen KT GCMG honFRSE PC, Former Secretary General of NATO June 2013 Raising the bar Good anti-corruption practices in defence companies Part I: Seven practices that distinguish the best 2 Executive Summary Executive Summary The Defence Companies Anti-Corruption These are demanding questions. This report Index (CI) was published on 4 October 2012. looks in some detail at each topic and gives This analysis, the first of its kind, provided examples. We think that companies scoring full comparative information on the disclosure and marks on these topics represent today’s good quality of anti-corruption systems in 129 major practice. defence companies. In Part II of this report—available as a Whilst the media focused primarily on the separate online document—we have extracted banding results, the analysis also contains 104 good practice examples in relation to all of many examples of good practice by defence the 34 questions in the Index. These examples companies. Our objective is to help raise are mostly in the public domain. However, there anti-corruption standards in the defence sector were also examples of good practice from the worldwide.