United States Patent and Trademark Office

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Best Free Stealth Games for Windows 10 from the Microsoft Store

Best Free Stealth Games For Windows 10 From The Microsoft Store Best Free Stealth Games For Windows 10 From The Microsoft Store 1 / 4 2 / 4 There are dozens of awesome stealth games on Xbox One, but here are the best of the best. ... Here's our comprehensive round- up of the 10 best Xbox One stealth games as of 2019. Loading... Speed ... $40 at Microsoft Store .... Download now for PC + Mac, Nintendo Switch, PlayStation 4, or Xbox One. Browse our shop for merchandise. It's a lovely morning in the village, and .... It's fast, frantic and a lot of fun. You can purchase Forza Horizon 4 through the Microsoft Store. It's also available as part of the Xbox Game Pass ... Keystroke logging, often referred to as keylogging or keyboard capturing, is the action of ... Even Microsoft publicly admitted that Windows 10 operation system has a ... from the Internet or the local network, for data logs stored on the target machine. ... More stealthy implementations can be installed or built into standard .... Take PC gaming to the next level with Xbox on Windows 10. ... From the best casual games to a new generation of PC gaming. ... MSI GS75 Stealth Gaming Laptop ... SHOP XBOX ACCESSORIES. 1. ... Sitemap · Contact Microsoft · Privacy & cookies · Terms of use · Trademarks · Safety & eco · About our ads; © Microsoft 2020.. The best 50 Stealth games for PC Windows daily generated by our specialised A.I. comparing over 40 000 ... Free - Compare prices -10% .... And since its a FastData. you are backed with toll-free technical support, one _\'ear .. -

Yahoo! Games Announces Relationship with Microsoft Game Studios New Relationship Catapults Yahoo! Games on Demand Past 100 Games Mark SUNNYVALE, Calif

Yahoo! Games Announces Relationship With Microsoft Game Studios New Relationship Catapults Yahoo! Games on Demand Past 100 Games Mark SUNNYVALE, Calif. - October 2, 2003 - Yahoo! Games, the leading online games destination (Nielsen//NetRatings - August 2003), today announced Microsoft Game Studios, a leading worldwide publisher and developer of games for Windows®, XboxTM video game system and online platforms, is the newest publisher to contribute titles to Yahoo! Games on Demand (http://gamesondemand.yahoo.com). With this new relationship, more than 100 titles are available to consumers for play on Yahoo! Games on Demand. "Our relationship with Microsoft Game Studios marks another milestone in Yahoo!'s mission to deliver top quality PC games to millions of online consumers," said Dan Hart, general manager of Yahoo! Games. "This relationship gives Yahoo! Games the ability meet the growing demand for direct rental and streaming play via the Internet, and lets consumers choose from more than 100 PC game titles through Yahoo! Games on Demand." Yahoo! Games on Demand is a one-stop destination to play a diverse selection of more than 100 popular PC games from leading publishers, giving users a choice of popular new and classic games, in genres ranging from action and strategy to simulation and arcade. Players can sign up for Yahoo! Games on Demand Unlimited monthly or quarterly subscription packages, which enables them to play all subscription games with no time limits. Fifteen new titles will be added to Yahoo! Games on Demand through this relationship with Microsoft Game Studios. Available titles include: Age of Mythology®, Combat Flight SimulatorTM 3, Dungeon Siege, Microsoft Flight Simulator 2004, FreelancerTM, Rise of NationsTM, and Zoo TycoonTM. -

How Do I Download Microsoft Games on My Pc How to Reinstall a Purchased Game from Microsoft Store That Is Not Showing up in Library

how do i download microsoft games on my pc how to reinstall a purchased game from microsoft store that is not showing up in Library. Thanks for your feedback, it helps us improve the site. How satisfied are you with this reply? Thanks for your feedback. First, try signing out of the Microsoft Store. Click your Profile picture at the top right, click your account then sign out. Restart your computer, launch the Microsoft Store app, sign in again, then attempt downloading again. Click the ellipsis in the top right corner of the screen (. ) Click My Library Scroll through the list then click the Cuphead app if its listed there, then click the download button. If doesn't help, let us know and we can explore more options. Other things you can try. Start by running the Windows Store Apps troubleshooter. Open Start > Settings > Update & security > Troubleshoot Scroll down to the bottom Click Windows Store Apps. Click Run the troubleshooter. When complete try opening the Store again. Also check if the Store works in another user account. Press Windows key + R Type: wsreset.exe Hit Enter. Do this a couple times then try launching the Store again. Your Antivirus might be interfering with the Store, try disabling it 'temporarily' to see if it launches. Check Windows Update and install the latest updates. Sometimes Microsoft releases infrastructure fixes for the Store through Windows Update. You can also try resetting the store app using the following instructions: Reinstall the Store: Press Windows key + X Click Windows PowerShell (Admin) At the command prompt, type the following then hit Enter: Get-AppXPackage *WindowsStore* -AllUsers | Foreach. -

INSTRUCTION BOOKLETBOOKLET Don’T Lose This Number! This CD Key Is Required to Fully Use This Product!

Level 8, 606 St. Kilda Road Melbourne, VIC 3004, Australia © 2007 THQ Inc. All manufacturers, cars, names, brands and associated imagery featured in this game are trademarks and/or copyrighted materials of their respective owners. All rights reserved. Developed by Juice Games. Juice Games, Juiced, THQ and their respective logos are trademarks and/or registered trademarks of THQ Inc. All rights reserved. All other trademarks, logos and copyrights are property of their respective owners. Windows and the Windows Vista Start button are trademarks of the Microsoft group of companies, and ‘Games for Windows’ and the Windows Vista Start button logo are used under license from Microsoft. 4005209095488 JUICED 2: HOT IMPORT NIGHTS INSTALL CODE INSTRUCTIONINSTRUCTION BOOKLETBOOKLET Don’t Lose This Number! This CD Key is required to fully use this product! 88_0_J2HIN_PC_95488_AU_MNC.indd_0_J2HIN_PC_95488_AU_MNC.indd 1 331.08.20071.08.2007 110:17:140:17:14 UhrUhr Important Health Warning About Playing Video Games Photosensitive Seizures A very small percentage of people may experience a seizure when exposed to certain visual images, including fl ashing lights or patterns that may appear in video games. Even people who have no history of seizures or epilepsy may have an undiagnosed condition that can cause these “photosensitive epileptic seizures” while watching video games. These seizures may have a variety of symptoms, including lightheadedness, altered vision, eye or face twitching, jerking or shaking of arms or legs, disorientation, confusion, or momentary loss of awareness. Seizures may also cause loss of consciousness or convulsions that can lead to injury from falling down or striking nearby objects. -

Set up Your PC for Gaming

WINDOWS® GUIDE Set Up Your PC for Gaming IN THIS GUIDE Optimizing for Graphics and Speed Page 2 Instant Messaging While Gaming Page 11 Great Games and Accessories Page 12 What You’ll Need n Windows Live™ Messenger and a Windows Live ID n A computer with Windows Vista® Windows Guides is a library of easy-to-use guides that show you how to get more from your Windows experience. Share these guides with your friends and family. © 2008 Microsoft. All rights reserved. WINDOWS GUIDE Set Up Your PC For Gaming Optimizing for Graphics and Speed With more family-friendly features, a huge catalog of games, lots of new titles, and more powerful graphics technology than ever before, Windows Vista makes gaming on your PC easier and more fun. New enhancements make it easier to access, play, and manage your computer games while also experiencing next generation gaming graphics. UPDatE SOFtwaRE AND DRIVERS You can optimize your Windows Vista PC for gaming by making sure that you’re running the latest software and drivers, and that your PC hardware meets the demands of the games you play. Update Microsoft DirectX DirectX® is a Windows® software program that enables higher performance in graphics and sound when you’re playing games on your PC. Make sure that you have the latest version of DirectX so that you can take advantage of all of the new features. On a computer running Windows Vista, you should have DirectX 10 or later. Here’s how to check which version of DirectX is on your computer: 1. -

Microsoft—Kinect for Windows

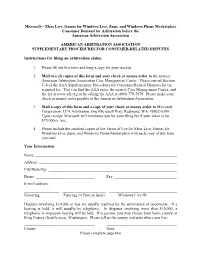

Microsoft—Xbox Live, Games for Windows Live, Zune, and Windows Phone Marketplace Consumer Demand for Arbitration before the American Arbitration Association AMERICAN ARBITRATION ASSOCIATION SUPPLEMENTARY PROCEDURES FOR CONSUMER-RELATED DISPUTES Instructions for filing an arbitration claim: 1. Please fill out this form and keep a copy for your records. 2. Mail two (2) copies of this form and your check or money order to the nearest American Arbitration Association Case Management Center. Please consult Section C-8 of the AAA Supplementary Procedures for Consumer-Related Disputes for the required fee. You can find the AAA rules, the nearest Case Management Center, and the fee at www.adr.org or by calling the AAA at (800) 778-7879. Please make your check or money order payable to the American Arbitration Association. 3. Mail a copy of this form and a copy of your check or money order to Microsoft Corporation, LCA Arbitration, One Microsoft Way, Redmond, WA 98052-6399. Upon receipt, Microsoft will reimburse you for your filing fee if your claim is for $75,000 or less. 4. Please include the attached copies of the Terms of Use for Xbox Live, Games for Windows Live, Zune, and Windows Phone Marketplace with each copy of this form you mail. Your Information: Name: Address: City/State/Zip: Phone: Fax: E-mail address: Gamertag Zune tag (if Zune at issue) Windows Live ID Disputes involving $10,000 or less are usually resolved by the submission of documents. If a hearing is held, it will usually be telephonic. In disputes involving more than $10,000, a telephonic or in-person hearing will be held. -

A Practitioners Guide to the Forensic Investigation of Xbox 360 Gaming Consoles

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Embry-Riddle Aeronautical University 2011 Annual ADFSL Conference on Digital Forensics, Security and Law Proceedings May 25th, 11:00 AM A Practitioners Guide to the Forensic Investigation of Xbox 360 Gaming Consoles Ashley L. Podhradsky Drexel University Rob D’Ovidio Drexel University Cindy Casey Drexel University Follow this and additional works at: https://commons.erau.edu/adfsl Part of the Computer Engineering Commons, Computer Law Commons, Electrical and Computer Engineering Commons, Forensic Science and Technology Commons, and the Information Security Commons Scholarly Commons Citation Podhradsky, Ashley L.; D’Ovidio, Rob; and Casey, Cindy, "A Practitioners Guide to the Forensic Investigation of Xbox 360 Gaming Consoles" (2011). Annual ADFSL Conference on Digital Forensics, Security and Law. 9. https://commons.erau.edu/adfsl/2011/wednesday/9 This Peer Reviewed Paper is brought to you for free and open access by the Conferences at Scholarly Commons. It has been accepted for inclusion in Annual ADFSL Conference on Digital Forensics, Security and Law by an (c)ADFSL authorized administrator of Scholarly Commons. For more information, please contact [email protected]. ADFSL Conference on Digital Forensics, Security and Law, 2011 A PRACTITIONERS GUIDE TO THE FORENSIC INVESTIGATION OF XBOX 360 GAMING CONSOLES Dr. Ashley L Podhradsky Drexel University Dr. Rob D’Ovidio Drexel University Cindy Casey Drexel University ABSTRACT Given the ubiquitous nature of computing, individuals now have nearly 24-7 access to the internet. People are not just going online through traditional means with a PC anymore, they are now frequently using nontraditional devices such as cell phones, smart phones, and gaming consoles. -

View the Manual

www.virtuatennis4.com www.sega.co.uk VIRTUA TENNIS™ 4 ACTIVATION CODE: © SEGA. SEGA, the SEGA logo and VIRTUA TENNIS are either registered trademarks or trademarks of SEGA Corporation. All rights reserved. Windows, the Windows Start button, Xbox, Xbox 360, Xbox LIVE, and the Xbox logos are trademarks of the Microsoft group of companies, and “Games for Windows” and the Windows Start button logo are used under MAN-S132-UK license from Microsoft. Important Health Warning About Playing Video Games Photosensitive Seizures A very small percentage of people may experience a seizure when exposed to certain visual images, including fl ashing lights or patterns that may appear in video games. Even people who have no history of seizures or epilepsy may have an undiagnosed condition that can cause these “photosensitive epileptic seizures” while watching video games. These seizures may have a variety of symptoms, including lightheadedness, altered vision, eye or face twitching, jerking or shaking of arms or legs, disorientation, confusion, or momentary loss of awareness. Seizures may also cause loss of consciousness or convulsions that can lead to injury from falling down or striking nearby objects. Immediately stop playing and consult a doctor if you experience any of these symptoms. Parents should watch for or ask their children about the above symptoms— children and teenagers are more likely than adults to experience these seizures. The risk of photosensitive epileptic seizures may be reduced by taking the following precautions: Sit farther from the screen; use a smaller screen; play in a well-lit room; and do not play when you are drowsy or fatigued. -

Microsoft Studios

Live time ■ Microsoft Studio’s global live conference at E3 in Los Angeles is a key opportunity for it to reach its global gaming audience – looking for the latest on games for its Xbox, Xbox 360, Xbox One, Games for Windows, Steam, Windows Store and Windows Phone platforms – and it wanted to reach this audience with all the news ■ Redmond, Washington company needed a production partner that would ensure seamless video and Ethernet transmission to support critical live feeds from the conference to its global audience Always there ■ The Switch connected Microsoft Studios onto its global network by connecting diverse 10 Gbps fiber optic cables between Microsoft Studios’ headquarters in Redmond and The Switch’s local PoP ■ Transmission services allowed Microsoft to send and receive video programming from the conference in a variety of video formats, including 4K, 3G, HD, ASI, J2K as well as selectable bandwidths of Ethernet and DIA ■ Through the use of The Switch’s fiber trailers, ensured permanent connectivity for both on-site and off-site locations Always on Microsoft Studios ■ Result was ES 2019 conference syndicated to the broadcast media at the highest quality available The Switch hits global gaming audience for Xbox ■ Capability to deliver coverage of event to a pool of broadcasters ready to and other MS platforms by hooking them into E3 “pull” the feed (via The Switch network) or encode for non-linear distribution conference news to OTT or social media ■ Through The Switch, Microsoft Studios delivered faultless coverage to developers and the Microsoft community across the world, announcing a staggering 50 games – including 18 Xbox exclusives and 15 world premieres theswitch.tv. -

Writing HOT Games for Microsoft Windows

Writing HOT Games for Microsoft ® Windows™ The Microsoft Game Developers’ Handbook Microsoft Windows™ Multimedia 10/94 TABLE OF CONTENTS Table of Contents.............................................................................................................................3 Microsoft Windows Multimedia ......................................................................................................5 We’re serious about games .............................................................................................................. 5 Millions of new 32-bit game machines on the way!........................................................................ 5 It ain’t over yet.................................................................................................................................. 5 The Windows Market .......................................................................................................................7 Windows 95 as a Game Platform....................................................................................................9 1 Fast, Flexible Graphics.........................................................................................................9 WinG overview: ................................................................................................................................ 9 Other graphic enhancements ......................................................................................................... 10 2 Easy to Support...................................................................................................................10 -

2014-07 EFF Gaming Exempiton Comment

Before the U.S. COPYRIGHT OFFICE, LIBRARY OF CONGRESS In the Matter of Exemption to Prohibition on Circumvention of Copyright Protection Systems for Access Control Technologies Docket No. 2014-07 Comments of the Electronic Frontier Foundation 1. Commenter Information Electronic Frontier Foundation Kendra Albert Mitch Stoltz (203) 424-0382 Corynne McSherry [email protected] Kit Walsh 815 Eddy St San Francisco, CA 94109 (415) 436-9333 [email protected] The Electronic Frontier Foundation (EFF) is a member-supported, nonprofit public interest organization devoted to maintaining the traditional balance that copyright law strikes between the interests of copyright owners and the interests of the public. Founded in 1990, EFF represents over 25,000 dues-paying members, including consumers, hobbyists, artists, writers, computer programmers, entrepreneurs, students, teachers, and researchers, who are united in their reliance on a balanced copyright system that ensures adequate incentives for creative work while facilitating innovation and broad access to information in the digital age. In filing these comments, EFF represents the interests of gaming communities, archivists, and researchers who seek to preserve the functionality of video games abandoned by their manufacturer. 2. Proposed Class Addressed Proposed Class 23: Abandoned Software—video games requiring server communication Literary works in the form of computer programs, where circumvention is undertaken for the purpose of restoring access to single-player or multiplayer video gaming on consoles, personal computers or personal handheld gaming devices when the developer and its agents have ceased to support such gaming. We ask the Librarian to grant an exemption to the ban on circumventing access controls applied to copyrighted works, 17 U.S.C. -

Casual Games on Windows

WINDOWS® GUIDE Casual Games on Windows IN THIS GUIDE See What You Already Have in Windows Vista Page 2 Connecting With Others: Playing Casual Games Online Page 15 MSN Games Page 19 What You’ll Need n Windows Live™ Messenger and a Windows Live ID n Internet Explorer®, version 6 or later n A computer with Windows Vista® Windows Guides is a library of easy-to-use guides that show you how to get more from your Windows experience. Share these guides with your friends and family. © 2008 Microsoft. All rights reserved. WINDOWS GUIDE Casual Games on Windows See What You Already Have in Windows Vista Windows Vista comes with a great selection of games that you can play anytime. 1. To open the Games folder, click the Windows logo in the bottom left corner of your display, then click Games in the right pane. 2. To open one of the games in the folder, double-click its icon. Windows games are not installed by default in Windows Vista Business and Windows Vista Enterprise. To install them, click the Windows logo in the bottom left corner of your display, click Control Panel, click Programs, and then click Turn Windows features on or off. In the Windows Features dialog box, select the Games check box, and then click OK. If you are prompted for an administrator password or confirmation, type the password or provide confirmation. If you don’t see the option or it’s grayed out, and you’re part of a network, your options may be being governed by your network’s Group Policy, and you may be prevented from doing so.