SAIC to Acquire Engility Uniting Two Leading Technology Integrators

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Breaking News for Immediate Release

BREAKING NEWS FOR IMMEDIATE RELEASE Winners of the 4th Annual International M&A Advisor Awards Announced New York, NY, October 15, 2012 – The M&A Advisor announced the winners of the 2012 International M&A Advisor Awards at the 4th Annual International M&A Awards Gala to a festive, sold-out crowd at the New York Athletic Club on Wednesday, October 10th. Bloomberg Television Market Reporter Dominic Chu and Miss Universe China Luo Zilin hosted the event with a guest appearance by the Grammy award winning Violinist and international hip-hop/R&B star Miri Ben-Ari. "We are currently witnessing the unprecedented transformation of firms and dealmakers into Global leaders whose intimate knowledge and expertise in the cultural, financial and legal arenas are redefining our industry,” says David Fergusson, Sr. Managing Director of The M&A Advisor. “During this period of continued uncertainty, inter-country M&A activity again outperformed domestic M&A, laying testament to the claim that business truly knows no boundaries.” The International Awards Gala honored the leading deal-teams, deal-makers and firms whose activities set the standard for cross-border transactions. This year, 228 nominees representing over 400 companies were finalists for the awards. An independent judging committee of cross-border industry experts determined the ultimate recipients of the awards. In addition to the honorees, Lifetime Achievement Awards were given to the leading global M&A industry pioneers. Dr. Mario Garnero, Chairman, Brasilinvest; Rajiv K. Luthra, Co-Founder, Luthra and Luthra; Alex Rodzianko, CEO, IFC Metropol and Wang Wei, Chairman, China M&A Group were awarded for their achievements. -

18Th Annual M&A Advisor Awards Finalists I. Sector

18TH ANNUAL M&A ADVISOR AWARDS FINALISTS I. SECTOR DEAL OF THE YEAR ENERGY DEAL OF THE YEAR Acquisition of Oildex by DrillingInfo Vaquero Capital Intertek Restructuring of PetroQuest Energy FTI Consulting Heller, Draper, Patrick, Horn & Manthey, LLC. Houlihan Lokey Akin Gump Seaport Global Securities Porter Hedges LLP Dacarba Subordinated Preferred Equity Investment into Energy Distribution Partners Jordan, Knauff & Company Energy Distribution Partners Acquisition of Westinghouse Electric Company by Brookfield Business Partners Pillsbury Winthrop Shaw Pittman LLP Milbank, Tweed, Hadley & McCloy LLP Weil, Gotshal & Manges Willkie Farr & Gallagher LLP Recapitalization of kV Power by Rock Hill Capital Romanchuk & Co. Rock Hill Capital Atkins, Hollmann, Jones, Peacock, Lewis & Lyon, Inc. Restructuring of Jones Energy, Inc. Epiq Jackson Walker L.L.P Kirkland & Ellis Davis Polk & Wardwell LLP Merger of Transocean and Ocean Rig Seward & Kissel LLP King & Spalding LLP Transocean Ltd. Hamburger Ocean Rig UDW Inc. Maples and Calder Ogier Wenger & Vieli Ltd Acquisition of EQT Core Conventional Appalachia by Diversified Gas & Oil PLC Stifel RBC FINANCIALS DEAL OF THE YEAR Acquisition of First Team Resources Corporation by King Bancshares, Inc. GLC Advisors & Co. K Coe Isom Morris Laing King Bancshares, Inc. First Team Resources Corporation Stinson Merger of LourdMurray with Delphi Private Advisors, with an investment from HighTower Republic Capital Group HighTower LourdMurray Solomon Ward Seidenwurm & Smith, LLP Delphii Private Advisors 1 Acquisition of 1st Global Inc. by Blucora Inc. Haynes and Boone, LLP PJT Partners Foley & Lardner, LLP Blucora ERG Capital Merger of National Commerce Corporation with and into CenterState Bank Corporation Maynard Cooper & Gale P.C. Raymond James Nelson Mullins Riley & Scarbrough Keefe, Bruyette & Woods Inc. -

Monthly M&A Insider

A mergermArket report on globAl m&A Activity Monthly M&A InsIder mArcH 2010 CONTENTS GlobAl overvIew 01 AsiA-PAcific 05 AmericAs: LAtin AmericA 16 North AmericA 24 euroPe 34 middLe eAst & AfricA 44 mergermarket Monthly M&A InsIder Part of the mergermarket group www.mergermarket.com 80 strand 895 Broadway #4 suite 2401-3 London, Wc2r 0rL new York, nY 10003 Grand millennium Plaza united Kingdom usA 181 Queen’s road, central hong Kong t: +44 (0)20 7059 6100 t: +1 212 686-5606 t: +852 2158 9700 f: +44 (0)20 7059 6101 f: +1 212 686-2664 f: +852 2158 9701 [email protected] [email protected] [email protected] global overview global overview global large-CaP TransforMaTioNal M&a appearS To be FirMly oN the CorPoraTe agenda. reMarKably, 2010 HaS So Far witnesseD SeveN US$10bN+ Transactions, exCeeDiNg announceD activiTy iN each oF the last three yearS over the SaMe TiMeFraMe. THe UNCerTaiN eCoNoMiC oUTlooK reMaiNS aN obSTaCle To M&a, However, iT DoeS NoT SeeM To be DeTerriNg MaNy woUlD-be aCqUirerS. a number oF Cash-rich and robust CorPoraTeS Clearly DeeM “Now” a gooD TiMe To Move, with Deal Flow beiNg DriveN by a DeSire To exPand and increaSe busiNess offeriNgS iN Key HigH growth MarKets. The largest deal of the year is a case in point in this regard in comparison to corporate M&a, private equity dealmaking with UK-based Prudential moving to acquire AIA group, at the top end of the market has remained relatively subdued. the pan-asian insurance provider, from AIG group for a However, activity is slowly beginning to return with buyout consideration of US$35.5bn. -

18Th Annual M&A Advisor Awards Winners I. Sector

18TH ANNUAL M&A ADVISOR AWARDS WINNERS I. SECTOR DEAL OF THE YEAR ENERGY DEAL OF THE YEAR Acquisition of Oildex by DrillingInfo Vaquero Capital Intertek FINANCIALS DEAL OF THE YEAR Merger of LourdMurray with Delphi Private Advisors, with an investment from HighTower Republic Capital Group HighTower LourdMurray Solomon Ward Seidenwurm & Smith, LLP Delphii Private Advisors MATERIALS DEAL OF THE YEAR Sale of Robert Allen Duralee Group to RADG Holdings SSG Capital Advisors LLC Perkins Coie LLP RAS Management Advisors, LLC Winchester, Sellers, Foster & Steele, P.C. Hahn & Hessen LLP White and Williams LLP Otterbourg, P.C. TELECOMMUNICATION SERVICES DEAL OF THE YEAR Acquisition of Qualitynet by VIVA Kuwait Telecommunications Company National Bank of Kuwait (NBK) Bahrain Telecommunications Company B.S.C CONSUMER DISCRETIONARY DEAL OF THE YEAR ($10MM-$25MM) Acquisition of Legends Express Car Wash by WhiteWater Express Car Wash Holland & Knight SkyKnight Capital Barton Creek Capital WhiteWater Express Car Wash CONSUMER DISCRETIONARY DEAL OF THE YEAR ($50MM-$100MM) Sale of DFA Holding Company, Inc.to the DFA New York Employee Stock Ownership Trust CSG Partners Bradley Arant Boult Cummings DFA New York LLC Argent Financial Group Morrison Cohen CONSUMER DISCRETIONARY DEAL OF THE YEAR (OVER $100MM) Acquisition of Tonal by L Catterton L Catterton Tonal CONSUMER STAPLES DEAL OF THE YEAR Merger of Dogfish Head Brewery with the Boston Beer Company McDermott Will & Emery The Boston Beer Company Nixon Peabody Dogfish Head Brewery 1 HEALTHCARE AND LIFE SCIENCES DEAL OF THE YEAR ($10MM-$100MM) Sale of Reliant Care Management's Skilled Nursing Facilities Portfolio to Griffin-American Healthcare REIT IV, Inc. -

Evidence on the Role of Investment Banking Syndicates in Mergers And

WORKING IN TEAMS: EVIDENCE ON THE ROLE OF INVESTMENT BANKING SYNDICATES IN MERGERS AND ACQUISITIONS HUIZHONG ZHANG Thesis submitted for the degree of Doctor of Philosophy in the Business School, The University of Adelaide, May 2016. TABLE OF CONTENTS ABSTRACT ................................................................................................................. V DECLARATION ....................................................................................................... VIII ACKNOWLEDGEMENTS ............................................................................................ IX CHAPTER 1: GENERAL INTRODUCTION ..................................................................... 1 1. Motivation and Research Objective ............................................................................ 1 2. Summary of the Major Findings ................................................................................. 5 3. Contribution ................................................................................................................ 8 4. Thesis Structure ......................................................................................................... 12 CHAPTER 2: LITERATURE REVIEW .......................................................................... 13 1. Introduction ............................................................................................................... 13 2. M&A Financial Advisors ......................................................................................... -

QINETIQ GROUP PLC (Incorporated and Registered in England and Wales No

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt as to the action you should take, you are recommended to seek your own financial advice immediately from your stockbroker, bank manager, solicitor, accountant or other independent financial adviser authorised under the Financial Services and Markets Act 2000 if you are resident in the United Kingdom or, if not, from another appropriately authorised independent financial adviser. If you have sold or otherwise transferred all your Ordinary Shares in QinetiQ, please send this document, together with the accompanying Form of Proxy, as soon as possible, to the purchaser or transferee, or to the stockbroker, bank or other agent through whom the sale or transfer was effected for delivery to the purchaser or transferee. If you have sold or otherwise transferred only part of your holding, you should retain these documents. The distribution of this document and accompanying documents in or into jurisdictions other than the United Kingdom may be restricted by local law and therefore persons into whose possession this document comes should inform themselves about and observe any such restrictions. Any failure to comply with any such restrictions may constitute a violation of the securities laws or regulations of such jurisdictions. QINETIQ GROUP PLC (Incorporated and registered in England and Wales No. 04586941) Proposed disposal of QinetiQ’s US Services division and £150 million capital return to shareholders by way of share buyback and Notice of General Meeting This document should be read as a whole. Your attention is drawn to the letter from the Chairman of QinetiQ which is set out on pages 2 to 7 of this document and recommends you to vote in favour of the resolutions to be proposed at the General Meeting referred to below. -

Investment Banks Or Boutiques: Why Are They Chosen and What Firm Type Makes the Better M&A Deals?

Investment banks or boutiques: Why are they chosen and what firm type makes the better M&A deals? An empirical investigation regarding domestic M&A deals in the USA Master Thesis Author: S.R. Faber ANR (SNR): 215677 (1275258) Program: Master of Finance Supervisor: dr. C.A.R. Schneider University: University of Tilburg, Netherlands Abstract Between 2000 and 2015 there has been an increase in the M&A advisory business for boutiques advisors. The main difference between boutique advisors and full-service investment banks is that boutique advisors generally have knowledge in a specific sector or have a specialization on M&A, whereas full-service investment banks often cover a wide variety of services. This thesis investigates whether the findings found by Song et al. (2013) are still valid using another dataset. Song et al. (2013) investigated the firms’ choice for a boutique- or full-service advisor and what consequences it has for the deal outcome. It was found that boutique advisors (mixed advisory teams) have a higher probability of getting hired, when the deal size is small (high). In addition to this, boutique advisors generate higher deal premiums on both the target and acquirer side of the deal. No statistical evidence is found to draw conclusions regarding the influence of advisors on deal duration and deal completion. Overall, no significant statement can be made regarding the performance of boutique advisors when they are compared to full-service advisors. Master Thesis – B a s F a b e r – MSc. Finance (2016 - 2017) | 2 1. Introduction Over the last years there has been an increase in mergers and acquisitions (hereafter: M&A) deals, both domestic and international. -

Merrill Corporation

An Acuris Company An Acuris report on global M&A activity March 2018 Monthly M&A Insider mergermarket.com Mergermarket Monthly M&A Insider March 2018 2 Contents An Acuris report on global M&A activity Contents Global Overview 4 US & Canada 12 Central & South America 19 Europe 26 Middle East and Africa 33 Asia-Pacific (excluding Japan) 40 Japan 47 mergermarket.com Mergermarket Monthly M&A Insider March 2018 3 Welcome Welcome from Merrill Corporation The Monthly M&A Insider explores the global takeover offer for TDC Group, a Denmark- in value and 24.3% in volume compared to M&A market with respect to the numbers, based and listed telecom provider. This was the same period last year. Backed by an movements, and trends, as well as revealing followed by aerospace and defense company exceptionally strong performance in 2017, the top financial and legal advisors – globally General Dynamics acquiring US IT services these early indications, with large deals such and across six regions (North America, Central company CSRA Inc. for US$9.5bn. as Blackstone’s US$20bn buyout of a 55% Donald Davis and South America, Europe, Middle East and stake in Thomson Reuters’ Financial and Risk By region, North America achieved the largest Vice President, Advisor Sales Africa, Asia-Pacific, and Japan). Unit, suggest another boom year may be in market share by value (45.3%), with 311 deals Merrill Corporation store for PE. February’s M&A activity saw value totals worth US$80.1bn. Europe contributed 28.2% comparable to the same month last year, but to market share by value with 306 deals at Sincerely, from far fewer deals. -

67. WALL STREET ANALYSTS, BANKERS & INVESTORS (76X)

67. WALL STREET ANALYSTS, BANKERS & INVESTORS (76x) Normally, when defense spending drops, so does the stock value of military contractors. But defense stock values have defied financial gravity as firms have continued aggressive efforts to shed personnel and facilities and cut internal costs, including R&D spending to underwrite share buyback programs and generous dividends to retain investor interest. It’s worked, but analysts debate how much longer companies can continue the same tactics. Although bankers are laying the groundwork for future deals, until there’s greater budgetary certainty, the expected wave of mergers and acquisitions that will accompany US and European spending cuts will remain stalled. Joe Nadol of JPMorgan Chase, Doug Harned of Sanford Bernstein and Ron Epstein of Bank of America are the top sell-side analysts, according to Institutional Investor, and Wall Street veteran Byron Callan at Capital Alpha Partners remains the leading independent financial analyst covering the sector. Bankers to watch in this cycle include the venerable duo of Denis Bovin and Mike Urfirer of Stone Key Partners, Credit Suisse veteran Craig Oxman, mid-cap expert Anita Antenucci of Houlihan Lokey, Evercore’s Les Fabuss and Citigroup’s Kevin Cox. Investors who other investors watch include Steve Binder of Adage Capital Management, Steve Roorda of Ameriprise, Jason Toner of Capital Group, Matt Simon of Citadel Investment Group, Douglas Scott of Fidelity, Claude Staehly of Wellington Management and Frank Finelli at The Carlyle Group. James McAleese of McAleese & Associates is a bridge between Washington and Wall Street. The complete report follows… . -

Finalists Announced for the 4Th Annual International M&A Advisor

BREAKING NEWS FOR IMMEDIATE RELEASE Finalists Announced for the 4th Annual International M&A Advisor Awards Top Cross-Border Transactions, Restructuring, Deal Financing, Product/Service, Firms and Dealmakers to be honored October 10th at the New York Athletic Club in New York, NY. New York, NY, August 31, 2012 – The M&A Advisor is pleased to announce 228 nominations, representing over 350 companies, are being evaluated for the 4th Annual International M&A Advisor Awards. The Finalist companies have been selected from the nominees in the first stage of evaluation and the independent panel of judges will now focus their attention on the challenging task of selecting the ultimate award winners. The winners for the M&A Deal of the Year, Sector Deal of the Year, Corporate/Strategic Acquisition of the Year, Restructuring of the Year, Deal Financing of the Year, Firms of the Year, M&A Product/Services of the Year and International Dealmaker of the Year categories will be announced at the 4th Annual International M&A Advisor Awards Gala on Wednesday, October 10th at the New York Athletic Club in New York, New York. "We are currently witnessing the transformation of firms and dealmakers into Global leaders whose intimate knowledge and expertise in the cultural, financial and legal arenas are redefining our industry,” says Roger Aguinaldo, CEO of The M&A Advisor. “The increasing volume of cross border M&A is testament to the claim that business truly knows no boundaries.” This year’s finalists represent the industry’s leading firms, including: -

Monthly M&A Insider

A mergermArket report on globAl m&A Activity MONTHLY M&A INSIDER FebruAry 2010 CONTENTS GLOBAL OVERVIEW 01 AsiA-PaciFic 05 AmericAs: Latin AmericA 14 North AmericA 20 europe 28 middle eAst & AFricA 36 mergermarket MONTHLY M&A INSIDER Part of the mergermarket group www.mergermarket.com 80 strand 895 broadway #4 suite 2401-3 london, Wc2r 0rl new york, ny 10003 grand millennium plaza united kingdom usA 181 Queen’s road, central hong kong t: +44 (0)20 7059 6100 t: +1 212 686-5606 t: +852 2158 9700 f: +44 (0)20 7059 6101 f: +1 212 686-2664 f: +852 2158 9701 [email protected] [email protected] [email protected] GLOBAL OVERVIEW 01 GIVen the scALE And scope of the WORst economIC doWntuRN IN decAdes, IT IS of LIttLE SURPRISE THAT THE GLOBAL M&A MARKET SUFFERED BADLY IN 2009. A totAL OF 9,493 DEALS WORTH US$1.76TN CAME to THE MARKET OVER THE COURSE OF THE YEAR, REPRESENTING A DECLINE OF MORE THAN 25% IN TERMS OF Both DEAL VOLUME AND VALUE COMPARED to 2008 NUMBERS. Furthermore, global deal volume fell to the lowest level seen Elsewhere, private equity players have continued to be since 2003 while the average deal size of US$185m is way largely absent from the top end of the market with buyout down on the US$233m witnessed during the height of the activity generally retrenching to the mid and low-cap space. M&A boom in 2007. Understandably, large leveraged buyouts - along the lines of the mega deals that dominated the private equity driven Despite this, there are a number of encouraging signs M&A landscape in the years running up to the financial that the M&A market has reached inflection point with crisis - have been largely put on hold since the acute onset dealmaking conditions and market confidence slowly of the financial crisis.W hile private equity equity-related deal improving. -

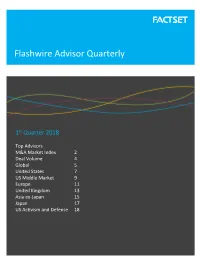

Flashwire Advisor Quarterly

FLSHWIRE US MONTHLY Flashwire Advisor Quarterly 1st Quarter 2018 Top Advisors M&A Market Index 2 Deal Volume 4 Global 5 United States 7 US Middle Market 9 Europe 11 United Kingdom 13 Asia ex-Japan 15 Japan 17 US Activism and Defense 18 FactSet.com Copyright © 2018 FactSet Research Systems Inc. All rights reserved. 1 Flashwire Advisor Quarterly 1st Quarter 2018 The Global Mergers & Acquisitions Market Index $450.0 4,000 $394.1 $400.0 $383.0 3,500 $350.0 3,000 $305.1 $300.0 $304.7 2,500 $251.6 $250.0 $270.3 2,000 $198.8 $241.6 $236.1 $224.4 $200.0 $215.4 $219.1 $204.0 $211.3 $196.2 1,500 $150.0 $157.0 1,000 $100.0 $50.0 500 3,395 3,077 2,518 3,044 2,631 2,880 3,052 2,986 2,587 2,802 2,980 3,034 3,120 2,928 2,559 2,710 $0.0 0 Dec-16 Jan-17 Feb-17 Mar-17 Apr-17 May-17 Jun-17 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Deal Volume Aggregate Deal Value The US Mergers & Acquisitions Market Index $300.0 1,400 1,200 $250.0 $245.0 $196.8 1,000 $200.0 $195.0 800 $155.5 $149.1 $178.8 $150.0 $147.5 $113.0 $141.7 600 $129.4 $122.0 $119.9 $100.0 $113.6 $114.5 $114.9 $103.9 400 $50.0 200 1,063 1,193 965 1,072 937 1,054 1,032 978 961 885 1,035 1,012 876 1,025 866 887 $0.0 0 Dec-16 Jan-17 Feb-17 Mar-17 Apr-17 May-17 Jun-17 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Deal Volume Aggregate Deal Value FactSet.com Copyright © 2018 FactSet Research Systems Inc.