12 May 2016 ITV Plc Q1 Trading Update – 3 Months to 31 March

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Cold Feet and Prolonged Sleep-Onset Latency in Vasospastic Syndrome

RESEARCH LETTERS Outcome Result The outcomes of childhood genital surgery are substantially poorer than reported previously5 with nearly all children Anatomical assessment Clitoris requiring further treatment. All surgery was done at specialist Absent 3 (7%) units and should give the best results available. This study is Small 3 (7%) retrospective, but because of the numbers of patients involved, Normal 26 (59%) we believe it is representative. Nevertheless, despite planned Large 3 (7%) routine referrals for all relevant adolescents, these patients may Excessive 9 (20%) Vaginal Introitus be those with the poorest outcomes. Additionally these Absent 4 (9%) children had surgery between 1979 and 1995. There have Small 32 (73%)* been changes in surgical techniques, equipment, sutures, and Normal 8 (18%) antibiotics since that time. More up-to-date procedures may Vaginal length have better outcomes, although there are few data to support Absent 3 (7%) this. Short 9 (20%)† Normal 32 (73%) This study prompts a re-evaluation of cosmetic genital Labia‡ surgery in children. Most vaginal surgery can be deferred until Normal 27 (61%) after adolescence unless haematocolpos is a risk. Repeated Poor/scrotal 13 (30%) clitoral surgery may be more damaging to sexual function than Partial fusion 5 (11%) a single procedure. Clitoral regrowth occurred in 39% of Total fusion 1 (2%) patients. Children with mild clitoromegaly should have surgery Overall cosmetic result deferred until they are old enough to be involved in the Good 8 (18%) decision. Surgery should not damage genital sensitivity and Satisfactory 18 (41%) Poor 18 (41%) sexual expression should be pleasurable with the ability for orgasm undiminished; there are currently no objective data for Further treatment recommendations‡ None 1 (2%) these outcomes. -

Memorial Day 2019

The Newsletter of the Army Residence Community VolumeThe 33 Number 5 Eagle May 2019 Memorial Day 2019 Before They’re Gone: Portraits & Stories of WWII Veterans Exhibit unveiled Inside The Eagle Celebrating Jeanne Patterson’s 100th Birthday May 2019 1 Front Cover: 2 Contents 2 100th Birthday – Jeanne Patterson 3 Birthdays and Passings 3 Memorial Day Observance 4-5 A Conversation with the CEO 6 Traveling Treasures Thank You 7 ARC Golf Scramble 8 Library 8 Notice from Resident Council Chair 9 Golden Diggers 10 WW2 Veterans’ Gallery: Doris Cobb 11 Save the Date: 11 June, Dr. Tom Hatfield Our newest member of Residents who have 12-Poem by jo compton: Our Village Tree joined the Centenarian Club is Jeanne Patterson, 13 ArtsInspire Rules and Categories who resides in Lakeside Villas, and who celebrated 14 WW2 Poetry by Chuck Stout: Cold Feet this event with her family on Thursday, 25 April. 15 Films at Lakeside Theater 16 - 17 Wall Artist of the Month: ElDora Criswell 18-19 March Activities 20 Eagle Luncheon: Anne Krause, President and Executive Director of the Hemisfair Conservancy The ARCNet Eagle continues with: Full Color Photographs from April Events American Revolution, 240 Years Ago Artist of the Month, ElDora Criswell WWII: 75 Years Ago, European Theater WWII: 75 Years Ago, Pacific Theater The Front Cover: May 2019 Grace Newton created this classic cover by capturing several Residents in a relaxed moment before a group picture last year, Jeanne’s family brought a ‘Special Tribute’ Veterans Day. certificate from the State of Michigan (above). The Residents Jeanne is the widow of Colonel “Pat” Patterson, a are, left to WW2 veteran. -

Hermione Norris Talks About the Long-Awaited Return of ‘Cold Feet’ and How Her Children Now Take Centre Stage

ENJOYING FAMILY TIME IN SUNNY SARDINIA HERMIONE NORRIS TALKS ABOUT THE LONG-AWAITED RETURN OF ‘COLD FEET’ AND HOW HER CHILDREN NOW TAKE CENTRE STAGE Hermione, her husband Simon Wheeler and their children Wilf and Hero enjoy a scenic stroll while on holiday in Sardinia (above), a time to regroup after the actress spent six months away on projects, including the long-awaited return series of Cold Feet. “It’s lovely not to have to think about anything apart from, ‘Which pool shall we go to?’” she says of their sunshine break ermione Norris says she’s one of those people Cold Feet established Hermione’s career and put back projects in Leeds and Manchester – first on Hwho doesn’t like to look back. Yet that’s exactly her firmly on the map. But her husband, TV writer In the Club, the Kay Mellor drama about parents-to- what she found herself doing recently on the set of and producer Simon Wheeler, and their children be, then on Cold Feet. Away for months from their Cold Feet, the hit ITV series that last appeared on Wilf, 12, and Hero, eight, now take centre stage. Somerset home, this is the first decent stretch of our screens in 2003 and is due to return this autumn. “It’s all about them,” she says. “They are the most time they’ve spent together for a while. “It felt like only yesterday, but it first started 20 important people in my life.” “It’s lovely not to have to think about anything years ago, so you keep remembering where you We’re chatting in a shady spot of Forte Village, apart from, ‘Which pool shall we go to?’” Hermione were at that time,” she says of being back on set. -

MARK BROTHERHOOD Current LUDWIG Treatment and Script

MARK BROTHERHOOD Current LUDWIG Treatment and script optioned to Hat Trick. MY GENERATION Original pilot script optioned to Hare & Tortoise. CHILDREN OF THE STONES Written treatment and script commissioned by Vertigo Films. RENDLESHAM Rewrite on first episode of new series for Sly Fox/ITV. …………………………………………………………………………………………. REVENGE.COM Script for original series for Kindle Entertainment. COLD FEET IX Episode two for Big Talk/ITV. TX January 2020. THE TROUBLE WITH MAGGIE COLE Written all six episodes of original series for Genial Productions/ITV. Dawn French in title role as Maggie Cole – TX March 2020. COLD FEET VIII Episode three, hailed by viewers as “the best ever episode” following TX on 28th January 2019. Big Talk/ITV. MEET THE CROWS Pitch delivered to ITV Studios. PATIO Treatment delivered to Company Pictures. BYRON Original series treatment delivered to Balloon Entertainment. MOUNT PLEASANT FINALE Wrote the final episode of Mount Pleasant for Tiger Aspect/Sky Living. TX 30th June 2017. BENIDORM X Wrote 4 episodes of new series for Tiger Aspect/ITV. MOUNT PLEASANT VI Wrote 9 of the 10 episodes for series six having been sole writer on the fifth series, Lead Writer on the fourth series, written half of the third series, and 5 of 10 episodes of the second for Tiger Aspect/Sky Living. BENIDORM IX Wrote an episode of Benidorm for Tiger Aspect/ITV. DEATH IN PARADISE IV Completed an episode of series four for Red Planet/BBC1. THE WORST YEAR OF MY LIFE… AGAIN Wrote six half-hour episodes for his original series developed with CBBC/ACTF/ABC, TX May 2014. -

Jo-Anne Knowles

www.cam.co.uk Email [email protected] Address Jo-Anne 55-59 Shaftesbury Avenue London Knowles W1D 6LD Telephone +44 (0) 20 7292 0600 Television Title Role Director Production SHAKESPEARE AND HATHAWAY Polly Rattle Ella Kelly BBC CORONATION STREET Chloe Various ITV HOLBY CITY Lindsey Carroll Karl Nielson BBC DOCTORS Annie Harris (semi reg) Various BBC EMMERDALE Charlotte Various ITV HETTY FEATHER Annie Paul Walker CBBC/ CBEEBIES MOVING ON Lisa Gary Williams BBC THE MIMIC Naomi Kieron Hawkers Running Bare Productions Mina Van Helsing (Series YOUNG DRACULA Various CBBC Regular) Rosie Matthew (Semi- WATERLOO ROAD Various BBC Regular) DOCTORS Jean Alex Jacob BBC DOCTORS Phillipa Grove James Larkin BBC HOLBY CITY Kate Devis Jamie Annett BBC MOVING ON Maria Gary Williams BBC CASUALTY Fay Balch Rupert Such BBC THE BILL Mia Perry (Semi-Regular) Various ITV CAN'T BUY ME LOVE Gilly Thwaite Reza Moradi Granada Television HOLBY CITY Geraldine Flowers Paul Kousilides BBC MILE HIGH (Series 2-4) Janis Steel Various Sky 1 Lia Williams (Series DREAM TEAM Various Sky 1 Regular) EASTENDERS Paula Karl Neilson BBC MURDER IN SUBURBIA Lisa David Innes Edwards Carlton Television SWEET MEDICINE Sheena David Holroyd Carlton Television THE LAST DETECTIVE Ms Sterling Ferdinand Fairfax ITV BARBARA Wendy - Carlton Television EMMERDALE Kaye Judith Dine Yorkshire Television FAT FRIENDS Suzanne Kay Mellor Yorkshire Televison PHOENIX NIGHTS Paula (Fanny Tickler) - Channel 4 CORONATION STREET D.C. Ann Short - Granada Television HOLLYOAKS Lorraine (Series Regular) Various -

1 © 2013 Yougov Ltd. All Rights Reserved Yougov.Co.Uk Liberal

Liberal Democrat rank Have I Got News for You 1 Mock the Week 2 QI 3 Black Books 4 The IT Crowd 5 Brass Eye 6 Doctor Who 7 Red Dwarf 8 Futurama 9 Newswipe with Charlie Brooker 10 Family Guy 11 Russell Howard's Good News 12 Pride and Prejudice 13 Sherlock 14 The Thick of It 15 Being Human 16 Wallace and Gromit 17 Grand Designs 18 Elementary 19 Bremner, Bird and Fortune 20 8 Out of 10 Cats 21 Just a Minute 22 Blackadder 23 The Big Bang Theory 24 Fry's Planet Word 25 Jeeves and Wooster 26 Spaced 27 Dexter 28 Castle 29 The Armando Iannucci Shows 30 House of Cards 31 Green Wing 32 Firefly 33 That Mitchell And Webb Look 34 Buffy the Vampire Slayer 35 Parks and Recreation 36 Brainiac 37 Whose Line Is It Anyway? 38 Time Team 39 Tomorrow's World 40 Scrubs 41 Peep Show 42 Knowing Me, Knowing You... with Alan Partridge 43 BBC News 44 Campus 45 The Golden Age of Canals 46 That Was The Week That Was 47 Charlie Brooker's Screenwipe 48 1 © 2013 YouGov Ltd. All Rights Reserved yougov.co.uk Liberal Democrat rank Look Around You 49 Stand Up for the Week 50 Arrested Development 51 Dirk Gently 52 Stingray 53 The Sunday Night Project 54 Would I Lie To You? 55 Psychoville 56 The Big Fat Quiz of the Year 57 Wonders of the Universe 58 South Park 59 Vicious 60 Watson & Oliver 61 Dead Ringers 62 Absolutely Fabulous 63 Extreme Makeover 64 True Blood 65 Jack Dee Live at the Apollo 66 Nigella Bites 67 Planet Earth 68 Hancock's Half Hour 69 Friends 70 Putin, Russia and the West 71 How the Earth Was Made 72 Kath & Kim 73 Changing Rooms 74 My So-Called Life 75 Click 76 Ask Rhod Gilbert 77 Vic Reeves Big Night Out 78 Batman 79 How Clean is Your House? 80 Goodness Gracious Me 81 Supernatural 82 Walking with Dinosaurs 83 American Dad! 84 The Hitchhiker's Guide to the Galaxy 85 The Day Today 86 Not the Nine O'Clock News 87 Argumental 88 Is It Bill Bailey? 89 Russell Howard Live 90 Acorn Antiques 91 The Impressions Show with Culshaw and Stephenson 92 My Hero 93 The Office 94 House 95 New Girl 96 The Returned 97 Big Train 98 Due South 99 Destination Titan 100 2 © 2013 YouGov Ltd. -

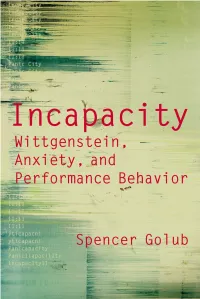

Wittgenstein, Anxiety, and Performance Behavior

Incapacity Incapacity Wittgenstein, Anxiety, and Performance Behavior Spencer Golub northwestern university press evanston, illinois Northwestern University Press www.nupress.northwestern.edu Copyright © 2014 by Spencer Golub. Published 2014 by Northwestern University Press. All rights reserved. Printed in the United States of America 10 9 8 7 6 5 4 3 2 1 Library of Congress Cataloging-in-Publication Data Golub, Spencer, author. Incapacity : Wittgenstein, anxiety, and performance behavior / Spencer Golub. pages cm Includes bibliographical references and index. ISBN 978-0-8101-2992-4 (cloth : alk. paper) 1. Wittgenstein, Ludwig, 1889–1951. 2. Language and languages—Philosophy. 3. Performance—Philosophy. 4. Literature, Modern—20th century—History and criticism. 5. Literature—Philosophy. I. Title. B3376.W564G655 2014 121.68—dc23 2014011601 Except where otherwise noted, this book is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License. To view a copy of this license, visit http://creativecommons.org/licenses/by-nc-nd/4.0/. In all cases attribution should include the following information: Golub, Spencer. Incapacity: Wittgenstein, Anxiety, and Performance Behavior. Evanston: Northwestern University Press, 2014. For permissions beyond the scope of this license, visit http://www.nupress .northwestern.edu/. An electronic version of this book is freely available, thanks to the support of libraries working with Knowledge Unlatched. KU is a collaborative initiative designed to make high-quality books open access for the public good. More information about the initiative and links to the open-access version can be found at www.knowledgeunlatched.org. For my mother We go towards the thing we mean. —Wittgenstein, Philosophical Investigations, §455 . -

Mark Davies Editor

Mark Davies Editor Agents Alice Dunne Assistant +44 (0) 20 3214 0949 Flora Line [email protected] Credits Film Production Company Notes HOME ALONE 20th Century Studios / Dir: Dan Mazer 2021 Disney+ Prod: Hutch Parker, Jeremiah Samuels, Dan Wilson with Rob Delaney, Aisling Bea, Kenan Thompson THE EXCHANGE Who's On First Films Dir: Dan Mazer 2021 Prod: Simon Horsman, Jeffrey Soros, Dan Hine (with Ed Oxenbould) BORAT SUBSEQUENT Four by Two Films / Amazon Dir: Jason Woliner MOVIEFILM Prod: Sacha Baron Cohen, Monica 2020 Levinson, Anthony Hines EVERYBODY'S TALKING Warp / Film 4 / New Regency / Additonal editing ABOUT JAMIE 20th Century Studios Dir: Jonathan Butterell 2020 Prod: Barry Ryan, Mark Herbert, Peter Carlton (with Max Harwood, Lauren Patel, Richard E. Grant, Sharon Horgan, Sarah Lancashire) United Agents | 12-26 Lexington Street London W1F OLE | T +44 (0) 20 3214 0800 | F +44 (0) 20 3214 0801 | E [email protected] Production Company Notes SUPERVIZED Merlin Films Dir: Steve Barron 2019 Prods: Steve Barron & Kieran Corrigan (with Hiran Abeysekera, Elya Baskin & Tom Berenger) DORA AND THE LOST Paramount Pictures Additional editing CITY OF GOLD Dir: James Bobin Prod: Kristin Burr (with 2019 Isabela Moner, Benicio Del Toro, Michael Peña, Eva Longoria) LONDON FIELDS Muse Films / Hero Films As Consultant Editor 2015 Dir: Matthew Cullen Prods:Jordan Gertner & Chris Hanley (with Billy Bob Thornton, Amber Heard and Johnny Depp) MAY THE BEST MAN What If It Barks Dir:Andrew O’Connor WIN Films/MGM/Orion Pictures Prods:Lee Hupfield, Ray Marshall, 2014 Andrew O'Connor and Matthew Robinson (with Rosa Salazar, Whitmer Thomas and Drew Tarver) **Official Selection SXSW Film Festival Austin Tx** ALAN PARTRIDGE: Baby Cow Films Additional editing ALPHA PAPA Dir: Declan Lowney 2013 Prods: Kevin Loader and Henry Normal (with Steve Coogan, Nigel Lindsay, Colm Meaney and Karl Theobald) Television Production Company Notes MAN VS. -

P25-26 Layout 1

SUNDAY, AUGUST 20, 2017 TV PROGRAMS 18:10 Impractical Jokers 00:55 Hollywood Medium With Tyler 11:50 Duck Dynasty 12:12 The Loud House 18:35 Key And Peele Henry 12:15 Duck Dynasty 12:36 Breadwinners 18:59 Lip Sync Battle 01:50 E! News 12:40 Counting Cars 13:00 School Of Rock 19:22 Lip Sync Battle 02:50 Celebrity Style Story 13:05 Counting Cars 13:24 Hunter Street 19:46 Disaster Date 03:20 Celebrity Style Story 13:30 Ax Men 13:48 Nicky, Ricky, Dicky & Dawn 00:15 Outback 01:15 Ladder 49 00:00 Henry Hugglemonster 20:09 Ridiculousness Arabia 03:50 Rob & Chyna 14:20 Mountain Men 14:12 Henry Danger 01:45 Bonta 03:10 Jurassic World 00:15 Calimero 20:33 Comedy Central Presents Comedy 04:40 Rob & Chyna 15:10 Big Easy Motors 14:36 The Thundermans 03:10 The Adventures Of Don Quixote 05:15 Black Rose 00:30 Art Attack 3alwagef 05:30 Celebrity Style Story 16:00 Storage Wars: Best Of 15:00 100 Things To Do Before High 04:50 Two Buddies And A Badger 06:45 The Throwaways 00:55 Zou 21:00 The Daily Show With Trevor Noah 06:00 EJ NYC 16:25 Storage Wars: Best Of School 06:10 Hotel For Dogs 08:20 Ladder 49 01:05 Loopdidoo 21:30 The Half Hour 07:00 Just Jillian 16:50 Pawn Stars 15:24 Rabbids Invasion 07:55 Quest For A Heart 10:15 The Lovers 01:20 Henry Hugglemonster 22:00 The Half Hour 08:00 E! News 17:15 Pawn Stars 15:48 SpongeBob SquarePants 09:25 Vickie And The Treasure Of Gods 12:05 Jurassic World 01:35 Calimero 22:25 Chappelle's Show 08:55 Botched 17:40 Billion Dollar Wreck 16:12 Teenage Mutant Ninja Turtles 11:05 Cher Ami 14:10 The Throwaways 01:50 Zou -

Un Bore Mercher Series 2 Airs on Sunday Nights at 9Pm on S4c

UN BORE MERCHER SERIES 2 AIRS ON SUNDAY NIGHTS AT 9PM ON S4C The hotly-anticipated second series of Vox Pictures’ record-breaking drama Un Bore Mercher (6 x 60’) is currently airing on Sunday nights at 9pm on S4C before Keeping Faith has its BBC network outing in the summer. The first series was broadcast in Welsh as Un Bore Mercher and then in English in Wales on BBC One Wales and then nationally on BBC One as Keeping Faith. The series received outstanding ratings and went on to break BBC iPlayer records. Starring Eve Myles (Cold Feet, A Very English Scandal, Victoria, Broadchurch) the 8-part thriller tells the story of lawyer, wife and mother Faith Howells (Myles) as she fights to find the truth behind the sudden disappearance of her husband. Series two - written by Matthew Hall and Pip Broughton – joins her as she attempts to pick up the pieces of her life and marriage. Eve Myles says: “I’m thrilled that this brilliantly written drama found such a place in the audience’s heart and I’m so excited to be back in the beautiful west Wales landscape working with a terrifically creative and talented team - it’s a joy.” Adrian Bate, Executive Producer for Vox Pictures says: "After the phenomenal multi-platform success of the first season, Vox are delighted to be working again with the BBC, S4C and Nevision to bring Un Bore Mercher / Keeping Faith back for what promises to be another series full of emotional intrigue for Faith and her family.” Originally developed by S4C as Un Bore Mercher and as Keeping Faith for BBC Wales, the series is produced by Vox Pictures in association with APC / Nevision and with support from Welsh Business Finance. -

From TV Screen to Movie Screen Actor Richard Armitage Makes a Great Impression, Not Just in British Series

From TV screen to movie screen Actor Richard Armitage makes a great impression, not just in British series First he played heroes only on TV, but now, in “The Hobbit,” Richard Armitage has the chance to shine in the movies, too. In “Inspector Lynley” (on ZDF today) the Brit proves his expertise in playing shady characters as well. London. When Richard Armitage auditioned for the first time for the role that was to make him suddenly famous throughout the whole world, he was recovering from an injury he’d incurred while shooting the spy series, “Spooks.” “I had taken so many painkillers that all I could do was limp into the room and sit on my hands while the meeting passed me by. I think all I showed there was my ability to act in pain,” the tall thespian recalls. “Lord of the Rings” director and Oscar winner Peter Jackson must have liked Armitage’s performance anyway; in the end, he gave Armitage the role of Thorin Oakenshield in his three-part of film adaptation of “The Hobbit.” Even if the first piece of the trilogy, which appeared in cinemas in 2012, does not quite reach the level of “Lord of the Rings,” the part of the heroic prince Thorin Oakenshield catapulted Armitage into the Hollywood spotlight. But even before his international breakthrough into the dream factory, the Brit, born in 1971 in Leicestershire as Richard Crispin Armitage, was hardly an unknown. In 2011 he could be seen in the blockbuster, “Captain America.” But Armitage, who made his TV debut in the series “Boon” in 1992, made his name mostly in British series such as “Cold Feet,” “Between the Sheets,” or “Inspector Lynley.” Before that the actor, educated at the London Academy of Music and Dramatic Art, had also stood on stage with the Royal Shakespeare Company. -

Matt Gray BSC Director of Photography

Matt Gray BSC Director of Photography www.mattgraybsc.com Film & Television Director Production Co Producers SHOWTRIAL Zara Holmes World Productions Chris Hall BBC1 VIGIL James Strong World Productions Eric Coulter ITV THE NEST Andy de Emmony Studio Lambert Clare Kerr BBC1 Simon Lewis LIAR 2 James Strong Two Brothers James Dean GENTLEMAN JACK Sally Wainwright Lookout Point Phil Collinson KIRI Euros Lyn The Forge Toby Bentley Channel 4 Nomination: GTC Award Excellence 2018 LIAR James Strong Two Brothers Pictures Eliza Mellor Sam Donovan THREE GIRLS Philippa Lowthorpe BBC Simon Lewis Winner: Best Photography Drama & Comedy, RTS Craft & Design Awards, 2017 APPLE TREE YARD Jessica Hobbs Kudos Film & TV Chris Carey THE LIVING AND THE DEAD Alice Troughton BBC Eliza Mellor Sam Donovan MIDWINTER OF THE SPIRIT Richard Clark ITV Studios Phil Collinson CODE OF A KILLER James Strong World Productions Priscilla Parish ONE CHILD John Alexander BBC Grainne Marmion THE SECRET Dominic Savage Working Title TV Guy Heeley THE CRIMSON FIELD David Evans BBC Annie Tricklebank THE 7.39 John Alexander Carnival Film & TV Lynn Horsford BBC THE LAST WITCH Robin Sheppard Red Productions Karen Lewis Pilot BROADCHURCH James Strong Kudos Film & TV Richard Stokes Euros Lyn BEST OF MEN Tim Whitby Whitby Davison Harriet Davison BBC2 THE SCAPEGOAT Charles Sturridge Island Pictures Sarah Beardsall WHITE HEAT John Alexander ITV Elinor Day BBC - 1 - EXILE John Alexander Red Productions Karen Lewis THE SUSPICIONS OF MR James Hawes Hat Trick Productions Nigel Marchant WHICHER