LEG REG REVIEW 2012, 22D Issue July 16, 2012

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

USGLC's Pennsylvania Advisory Committee

Pennsylvania Advisory Committee These business, faith, military, and community leaders believe that Pennsylvania benefits when America leads in the world through investments in development and diplomacy. Hon. Mark S. Schweiker Hon. Patrick J. Murphy Co-Chairs Governor U.S. Under Secretary of the Army (2016-2017) (2001-2003) U.S. House of Representatives (D-PA) (2007-2011) Lt. Col. Joseph Albert* Gene Barr Guy Ciarrocchi Eli H. Albert Agency Pennsylvania Chamber Chester County Chamber of Business & Owner Industry Dorothy Bassett President & CEO Abraham Amorós Ardean Consulting Group Laborers International Union of North Principal Dr. Treva Clark America Lebanon Valley College Brandon Blache-Cohen Pennsylvania Legislative Director Director, International Business Programs Amizade Kim Andrews Executive Director Hon. Paige Cognetti Japan America Society of Greater City of Scranton David Briel Philadelphia Mayor Pennsylvania Department of Community Executive Director & Economic Development, International Dr. Jared L. Cohon Alex Archawski Investment, Office of International Carnegie Mellon University Greater Philadelphia Veterans Network Business Development President Emeritus Founder & Director Scott Institute for Energy Innovation Dana Brown Director Emeritus Dr. Ariel Armony Chatham University University of Pittsburgh Executive Director, Pennsylvania Center Jack Collins Vice Provost for Global Affairs for Women and Politics Wallquest Inc. Vice President Heather Arnet Kevin Busher Women & Girls Foundation of Western PA Duane Morris Government Strategies Linda Conlin CEO Government Affairs Manager World Trade Center of Greater Philadelphia John Augustine Lou Anne Caliguiri President Penn’s Northeast Chatham University President & CEO Executive Director and Dean of the Eden George Connor Hall Campus Dauphin County Office of Community & Jerad Bachar Economic Development VisitPITTSURGH Hon. James Cawley Executive Director Executive Vice President Lieutenant Governor (2011-2015) Rev. -

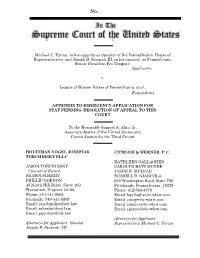

Michael C. Turzai, in His Capacity As Speaker of the Pennsylvania House of Representatives, and Joseph B

No. Michael C. Turzai, in his capacity as Speaker of the Pennsylvania House of Representatives, and Joseph B. Scarnati III, in his capacity as Pennsylvania Senate President Pro Tempore, Applicants, v. League of Women Voters of Pennsylvania, et al., Respondents. APPENDIX TO EMERGENCY APPLICATION FOR STAY PENDING RESOLUTION OF APPEAL TO THIS COURT To the Honorable Samuel A. Alito, Jr. Associate Justice of the United States and Circuit Justice for the Third Circuit HOLTZMAN VOGEL JOSEFIAK CIPRIANI & WERNER, P.C. TORCHINSKY PLLC KATHLEEN GALLAGHER JASON TORCHINSKY CAROLYN BATZ MCGEE Counsel of Record JASON R. MCLEAN SHAWN SHEEHY RUSSELL D. GIANCOLA PHILLIP GORDON 650 Washington Road, Suite 700 45 North Hill Drive, Suite 100 Pittsburgh, Pennsylvania 15228 Warrenton, Virginia 20186 Phone: 412-563-4978 Phone: 540-341-8808 Email: [email protected] Facsimile: 540-341-8809 Email: [email protected] Email: [email protected] Email: [email protected] Email: [email protected] Email: [email protected] Email: [email protected] Attorneys for Applicant Attorneys for Applicant Senator Representative Michael C. Turzai Joseph B. Scarnati, III BLANK ROME LLP BAKER & HOSTETLER LLP BRIAN S. PASZAMANT PATRICK T. LEWIS JASON A. SNYDERMAN Key Tower DANIEL S. MORRIS 127 Public Square One Logan Square Suite 2000 130 N. 18th Street Cleveland, Ohio 44144 Philadelphia, Pennsylvania 19103 Phone: 216-621-0200 Phone: 215-569-5791 Email: [email protected] Facsimile: 215-832-5791 Email: [email protected] ROBERT J. TUCKER Email: [email protected] 200 Civic Center Drive Email: [email protected] Suite 1200 Columbus, OH 43215-4138 Attorneys for Applicant Senator Phone: 614-228-1541 Joseph B. -

AFL-CIO Endorsements 2010

2010 AFL-CIO Endorsements Monday, September 20 2010 ALABAMA CALIFORNIA G - Ron Sparks (D)* G - Jerry Brown (D)* LG - Jim Folsom (D)* LG - Gavin Newsom (D) AG - James Anderson (D) AG - Kamala Harris (D) SS - Scott Gilliland (D) SS - Debra Bowen (D) T - Charley Grimsley (D) CN - John Chiang (D) A - Miranda Karrine Joseph (D) T - Bill Lockyer (D) CA - Glen Zorn (D) S1 - Barbara Boxer (D) S1 - William Barnes (D)+ 01 - Mike Thompson (D) 03 - Steve Segrest (D)+ 03 - Amerish Bera (D)+ 05 - Steve Raby (D)* 04 - Clint Curtis (D)+ 07 - Terri Sewell (D)* 05 - Doris Matsui (D) 06 - Lynn Woolsey (D) ALASKA 07 - George Miller (D) G - Ethan Berkowitz (D)* 08 - Nancy Pelosi (D) S1 - Scott McAdams (D)* 09 - Barbara Lee (D) AL - Henry Crawford (D)+ 10 - John Garamendi (D) AL - Don Young (R) 11 - Jerry McNerney (D) 12 - Jackie Speier (D) ARIZONA 13 - Pete Stark (D) G - Terry Goddard (D)+ 14 - Anna Eshoo (D) AG - Felecia Rotellini (D) 15 - Mike Honda (D) SS - Chris Deschene (D) 16 - Zoe Lofgren (D) T - Andrei Cherny (D) 17 - Sam Farr (D) S1 - Rodney Glassman (D)+ 18 - Dennis Cardoza (D) 01 - Ann Kirkpatrick (D) 20 - Jim Costa (D) 02 - John Thrasher (D)+ 23 - Lois Capps (D) 03 - Jon Hulburd (D)* 24 - Tim Allison (D)+ 04 - Ed Pastor (D) 25 - Jackie Conaway (D)+ 05 - Harry Mitchell (D) 26 - Russ Warner (D)+ 06 - Rebecca Schneider (D)+ 27 - Brad Sherman (D) 07 - Raul Grijalva (D) 28 - Howard Berman (D) 08 - Gabrielle Giffords (D) 29 - Adam Schiff (D) 30 - Henry Waxman (D) ARKANSAS 31 - Xavier Becerra (D) G - Mike Beebe (D) 32 - Judy Chu (D) LG - Shane Broadway (D) 33 - Karen Bass (D)* AG - Dustin McDaniel (D) 34 - Lucille Roybal-Allard (D) T - Martha Shoffner (D) 35 - Maxine Waters (D) A - Charlie Daniels (D) 36 - Jane Harman (D) LD - L.J. -

111Th Congressional House Scorecard.Pdf

Federal NRLC Scorecard - 111th Congress, Combined Sessions U.S. House of Representatives 111th Congress, Combined Sessions 1. Foreign Relations Authorization Act (Office for Global Women's Issues) (06/10/2009, Roll Call No. 328) In testimony before the House Foreign Affairs Committee on April 22, 2009, Secretary of State Hillary Clinton made it clear that the Obama Administration will seek to promote abortion throughout the world. "We are now an administration that will protect the rights of women, including their rights to reproductive health care," Secretary Clinton said. She also said that the Obama Administration believes that "reproductive health includes access to abortion," and she told pro-life Congressman Chris Smith (R- NJ), "You are entitled to advocate . anywhere in the world, and so are we." In June 2009 the House of Representatives took up the Foreign Relations Authorization Act (H.R. 2410), a bill to authorize various State Department activities. The bill contained a section to establish an Office for Global Women's Issues, headed by an ambassador-at-large who will report directly to Secretary Clinton. Given the clear evidence that the Obama Administration State Department is determined to campaign for abortion, NRLC informed House members that NRLC opposed the bill, unless the House added an amendment proposed by Congressman Smith to prohibit the office from engaging in activities to change foreign abortion laws. However, the House Rules Committee -- which is an arm of the leadership of the Democratic majority that controls the House -- refused to allow the House to vote on the Smith Amendment, so NRLC opposed passage of the bill. -

SENATE HOUSE Lydia Beyoud, Cheryl Bolen, Heather Caygle, Kenneth P

Staff and Credits TABLE of CONTENTS Obama Elected to a Second Term, Facing Fiscal Cliff and Nation Divided 2 PAUL ALBERGO Status Quo House Election Outcomes Seen Unlikely to Result in Big Changes 4 Managing Editor, Daily Report for Executives Democrats Expand Majority Status but Contentiousness Looms in January 5 CHERYL SAENZ, MICHAEL R. TRIPLETT Membership Changes to the 113th 8 Assistant Managing Editors, Daily Report for Executives 113th Congress by the Numbers 52 REPORTERS Alexei Alexis, Paul Barbagallo, Alison Bennett, SENATE HOUSE Lydia Beyoud, Cheryl Bolen, Heather Caygle, Kenneth P. Doyle, Brett Ferguson, Diane Agriculture, Nutrition & Forestry 12 Admininistration 31 Freda, Lynn Garner, Diana I. Gregg, Marc Appropriations 13 Agriculture 32 Heller, Aaron E. Lorenzo, Jonathan Nicholson, Nancy Ognanovich, Heather M. Rothman, Armed Services 15 Appropriations 33 Denise Ryan, Robert T. Zung Banking, Housing & Urban Affairs 16 Armed Services 35 EDITORS Budget 18 Budget 36 Sean Barry, Theresa A. Barry, Jane Bowling, Sue Doyle, Kathie Felix, Steve France, Commerce, Science & Transportation 18 Education & the Workforce 37 Dave Harrison, John Kirkland, Vandana Energy & Natural Resources 20 Energy & Commerce 38 Mathur, Ellen McCleskey, Isabella Perelman, Karen Saunders Environment & Public Works 22 Ethics 40 CONTRIBUTING EDITORS Ethics 23 Financial Services 41 Susan Raleigh Jenkins, Jeff Kinney, Susan J. McGolrick, John Sullivan, Joe Tinkelman Finance 26 Foreign Affairs 43 MIKE WRIGHT Foreign Relations 25 Homeland Security 44 Production Control -

LEG REG REVIEW 2012, 12Th Issue April 16, 2012

LEG REG REVIEW 2012, 12th Issue April 16, 2012 LEG REG REVIEW is a periodic newsletter produced by PHILLIPS ASSOCIATES, a professional lobbying and consultant firm located near the State Capitol. It contains news on the legislative and regulatory scene in Pennsylvania that may be of interest to the Insurance and Business Communities. It is a free member benefit for those who are members of the Pennsylvania Association of Health Underwriters (PAHU) or Manufacturers Association of South Central PA (MASCPA). Subscription information may be obtained by contacting PHILLIPS ASSOCIATES at 717/728-1217 FAX 717/728-1164 or e-mail to [email protected]. Please email [email protected] supplying both your name and e-mail address if you wish to be removed from this list. GENERAL ASSEMBLY RECESSES UNTIL APRIL 30 The PA General Assembly has recessed until month’s end. In the meantime, April 24 is Primary Day. At stake are contests for US Senator, US Congress using the NEW district lines via reapportionment and PA Senators and Representatives who are running in their OLD districts due to a court ruling against the new reapportioned district lines. In some House districts there will be two elections. One is the primary to select candidates for the fall election. The second is for legislative districts where Representatives won other elections last fall, creating vacancies in the General Assembly. Those races will decide who holds the seats this year until the fall election decides who will take their seats in the 2013-14 session of the General Assembly. Some races of interest to the insurance community are: - Licensed insurance producer Rep. -

![W]Lmz¼[ [\]Vvqvo M`Q\ Q[ Uwzm ]Xpmi^It](https://docslib.b-cdn.net/cover/0164/w-lmz%C2%BC-vvqvo-m-q-q-uwzm-xpmi-it-3680164.webp)

W]Lmz¼[ [\]Vvqvo M`Q\ Q[ Uwzm ]Xpmi^It

V15, N35 Wednesday, May 19, 2010 SouderXs stunning exit is more upheaval Half of Indiana’s U.S. Rep. Mark Souder’s affair with part-time staffer Tracy Jack- CD delegation son led to his stunning exit. (Fort Wayne Journal Gazette photo by could change in ‘10 Frank Gray) By BRIAN A. HOWEY, INDIANAPOLIS - On the brink of another “tsunami” election this November, the last of the 1994 “wave” class - U.S. Rep. Mark Souder - ignomini- ously resigned on Tuesday, ad- mitting he had an extra-marital affair with a staffer. Republican sources tell HPI that an in- cident report by the Indiana Hostettler was defeated by 22 percent in 2006 by Democrat Department of Natural Resources naming Souder may have Brad Ellsworth at the height of the dissatisfaction over the ignited what will likely be a bizarre chain of events, though U.S. war in Iraq. And now there is Souder’s stunning resig- the DNR denies such a report exists. nation - the third such event this year that has rocked the ! "#$%&'!()*!*(&+,!-.,#!#/[1&!-.!2#3&45&'!6778! Indiana congressional delegation. as part of the Gingrich Revolution. He defeated U.S. Rep. “I am so ashamed to have hurt those I love,” a Jill Long on the same night that Republican John Hostet- tearful Souder said at a press conference in Fort Wayne “I tler upset U.S. Rep. Frank McCloskey. And in the open seat am so sorry to have let so many friends down, people who vacated by U.S. Rep. Phil Sharp, David McIntosh completed have fought so hard for me.” the GOP’s sweep of three contested Democratic seats by In late April, an angst-ridden Souder told Howey defeating Secretary of State Joe Hogsett. -

![[J-1-2018] in the Supreme Court of Pennsylvania Middle District](https://docslib.b-cdn.net/cover/0798/j-1-2018-in-the-supreme-court-of-pennsylvania-middle-district-4700798.webp)

[J-1-2018] in the Supreme Court of Pennsylvania Middle District

App. 1 [J-1-2018] IN THE SUPREME COURT OF PENNSYLVANIA MIDDLE DISTRICT SAYLOR, C.J., BAER, TODD, DONOHUE, DOUGHERTY, WECHT, MUNDY, JJ. No. 159 MM 2017 On the Recommended Findings of Fact and Conclusions of Law of the Commonwealth Court of Pennsylvania entered on 12/29/18 at No. 261 MD 2017 ARGUED: January 17, 2018 LEAGUE OF WOMEN VOTERS OF PENNSYLVANIA, CARMEN FEBO SAN MIGUEL, JAMES SOLOMON, JOHN GREINER, JOHN CAPOWSKI, GRETCHEN BRANDT, THOMAS RENTSCHLER, MARY ELIZABETH LAWN, LISA ISAACS, DON LANCASTER, JORDI COMAS, ROBERT SMITH, WILLIAM MARX, RICHARD MANTELL, PRISCILLA MCNULTY, THOMAS ULRICH, ROBERT MCKINSTRY, MARK LICHTY, LORRAINE PETROSKY, Petitioners v. THE COMMONWEALTH OF PENNSYLVANIA; THE PENNSYLVANIA GENERAL ASSEMBLY; THOMAS W. App. 2 WOLF, IN HIS CAPACITY AS GOVERNOR OF PENNSYLVANIA; MICHAEL J. STACK III, IN HIS CAPACITY AS LIEUTENANT GOVERNOR OF PENNSYLVANIA AND PRESIDENT OF THE PENNSYLVANIA SENATE; MICHAEL C. TURZAI, IN HIS CAPACITY AS SPEAKER OF THE PENNSYLVANIA HOUSE OF REPRESENTATIVES; JOSEPH B. SCARNATI III, IN HIS CAPACITY AS PENNSYLVANIA SENATE PRESIDENT PRO TEMPORE; ROBERT TORRES, IN HIS CAPACITY AS ACTING SECRETARY OF THE COMMONWEALTH OF PENNSYLVANIA; JONATHAN M. MARKS, IN HIS CAPACITY AS COMMISSIONER OF THE BUREAU OF COMMISSIONS, ELECTIONS, AND LEGISLATION OF THE PENNSYLVANIA DEPARTMENT OF STATE, Respondents. App. 3 OPINION JUSTICE TODD FILED: February 7, 2018 It is a core principle of our republican form of government “that the voters should choose their representatives, not the other way around.”1 In this case, Petitioners allege that the Pennsylvania Congressional Redistricting Act of 20112 (the “2011 Plan”) does the latter, infringing upon that most central of democratic rights – the right to vote. -

Dennis Yablonsky, CEO, Allegheny Conference On

April 24, 2012 The Honorable Mary Schapiro Chair Securities and Exchange Commission 100 F Street, NE Washington, DC 20549-1090 Dear Chairwoman Schapiro, On behalf of the Allegheny Conference on Community Development and the Greater Pittsburgh Chamber of Commerce, we are writing to express our concerns over the changes being proposed to the structure of money market funds. The Allegheny Conference on Community Development and its affiliates – the Greater Pittsburgh Chamber of Commerce, the Pennsylvania Economy League of Greater Pittsburgh, and the Pittsburgh Regional Alliance – work in collaboration with public and private sector partners to stimulate economic growth and enhance the quality of life in southwestern Pennsylvania. In order to move our agenda forward, we need to ensure that good policies are in place for both business development and government stability. It is our belief that the rule changes being proposed to money market funds would greatly jeopardize the financial health and stability of our business community and our local governments, and as such, we would encourage you to not move forward with them. As you well know, money market funds are attractive because they have a stable $1.00 per-share net asset value (NAV). The ability to access 100% of the money invested in the fund is also an important element. Changing policies to force money market funds to “float” their NAVs or restrict the ability of investors to retrieve all of their invested money would have enormous negative impacts on the funds, as well as businesses and local governments. Both businesses and local governments use money market funds to hold excess cash for short periods of time. -

2011-2012 PAC Candidate Contributions

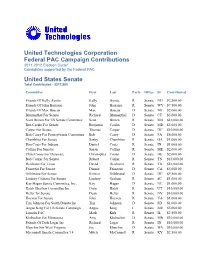

United Technologies Corporation Federal PAC Campaign Contributions 2011-2012 Election Cycle* Candidates supported by the Federal PAC United States Senate Total Contributed - $217,500 Committee First Last Party Office St Contributed Friends Of Kelly Ayotte Kelly Ayotte R Senate NH $2,500.00 Friends Of John Barrasso John Barrasso R Senate WY $7,500.00 Friends Of Max Baucus Max Baucus D Senate MT $2,000.00 Blumenthal For Senate Richard Blumenthal D Senate CT $5,000.00 Scott Brown For US Senate Committee Scott Brown R Senate MA $10,000.00 Ben Cardin For Senate Benjamin Cardin D Senate MD $5,000.00 Carper For Senate Thomas Carper D Senate DC $10,000.00 Bob Casey For Pennsylvania Committee Bob Casey D Senate PA $6,000.00 Chambliss For Senate Saxby Chambliss R Senate GA $1,000.00 Dan Coats For Indiana Daniel Coats R Senate IN $1,000.00 Collins For Senator Susan Collins R Senate ME $2,000.00 Chris Coons For Delaware Christopher Coons D Senate DE $2,000.00 Bob Corker For Senate Robert Corker R Senate TN $10,000.00 Dewhurst For Texas David Dewhurst R Senate TX $10,000.00 Feinstein For Senate Dianne Feinstein D Senate CA $5,000.00 Gillibrand For Senate Kirsten Gillibrand D Senate DC $9,500.00 Lindsey Graham For Senate Lindsey Graham R Senate SC $1,000.00 Kay Hagan Senate Committee, Inc. Kay Hagan D Senate NC $1,000.00 Hatch Election Committee Inc Orrin Hatch R Senate UT $10,000.00 Heller for Senate Dean Heller R Senate NV $10,000.00 Hoeven For Senate John Hoeven R Senate VA $1,000.00 Tim Johnson For South Dakota Inc Tim Johnson D Senate SD $1,000.00 -

Union Calendar No. 433 111Th Congress, 2D Session – – – – – – – – – – – – House Report 111–710

1 Union Calendar No. 433 111th Congress, 2d Session – – – – – – – – – – – – House Report 111–710 REPORT OF THE ACTIVITIES OF THE COMMITTEE ON ARMED SERVICES FOR THE ONE HUNDRED ELEVENTH CONGRESS JANUARY 3, 2011.—Committed to the Committee of the Whole House on the State of the Union and ordered to be printed U.S. GOVERNMENT PRINTING OFFICE 99–006 WASHINGTON : 2011 VerDate Mar 15 2010 04:21 Jan 11, 2011 Jkt 099006 PO 00000 Frm 00001 Fmt 4012 Sfmt 4012 E:\HR\OC\HR710.XXX HR710 sroberts on DSK3CLS3C1PROD with REPORTS E:\Seals\Congress.#13 HOUSE COMMITTEE ON ARMED SERVICES ONE HUNDRED ELEVENTH CONGRESS IKE SKELTON, Missouri, Chairman JOHN SPRATT, South Carolina JOHN M. MCHUGH, New York, Ranking SOLOMON P. ORTIZ, Texas Member 1 GENE TAYLOR, Mississippi HOWARD P. ‘‘BUCK’’ MCKEON, California NEIL ABERCROMBIE, Hawaii 3 Ranking Member 2 SILVESTRE REYES, Texas ROSCOE G. BARTLETT, Maryland VIC SNYDER, Arkansas MAC THORNBERRY, Texas ADAM SMITH, Washington WALTER B. JONES, North Carolina LORETTA SANCHEZ, California W. TODD AKIN, Missouri MIKE MCINTYRE, North Carolina J. RANDY FORBES, Virginia ELLEN O. TAUSCHER, California 4 JEFF MILLER, Florida ROBERT A. BRADY, Pennsylvania JOE WILSON, South Carolina ROBERT E. ANDREWS, New Jersey FRANK A. LOBIONDO, New Jersey SUSAN A. DAVIS, California ROB BISHOP, Utah JAMES R. LANGEVIN, Rhode Island MICHAEL R. TURNER, Ohio RICK LARSEN, Washington JOHN KLINE, Minnesota JIM COOPER, Tennessee MIKE ROGERS, Alabama JIM MARSHALL, Georgia TRENT FRANKS, Arizona MADELEINE Z. BORDALLO, Guam BILL SHUSTER, Pennsylvania 5 BRAD ELLSWORTH, Indiana CATHY MCMORRIS RODGERS, Washington PATRICK J. MURPHY, Pennsylvania 6 K. MICHAEL CONAWAY, Texas CAROL SHEA-PORTER, New Hampshire DOUG LAMBORN, Colorado JOE COURTNEY, Connecticut ROB WITTMAN, Virginia DAVID LOEBSACK, Iowa MARY FALLIN, Oklahoma KIRSTEN E. -

General Aviation Caucus 112Th Congress

General Aviation Caucus 112th Congress House Co-Chairmen ILLINOIS MONTANA PENNSYLVANIA Rep. John Barrow (D-12-GA) Rep. Jerry Costello (D-12-IL) Rep. Denny Rehberg (R-At Large-MT) Rep. Jason Altmire (D-4-PA) Rep. Sam Graves (R-6-MO) Rep. Robert Dold (R-10-IL) Sen. Max Baucus (D-MT) Rep. Lou Barletta (R-11-PA) Senate Co-Chairmen Rep. Randy Hultgren (R-14-IL) Sen. John Tester (D-MT) Rep. Mark Critz (D-12-PA) Sen. Mark Begich (D-AK) Rep. Adam Kinzinger (R-11-IL) NEBRASKA Rep. Charlie Dent (R-15-PA) Sen. Mike Johanns (R-NE) Rep. Dan Lipinski (D-3-IL) Rep. Jeff Fortenberry (R-1-NE) Rep. Michael Doyle (D-14-PA) Rep. Donald Manzullo (R-16-IL) Rep. Adrian Smith (R-3-NE) Rep. Michael Fitzpatrick (R-8-PA) ALABAMA Rep. Jan Schakowsky (D-9-IL) Sen. Ben Nelson (D-NE) Rep. Jim Gerlach (R-6-PA) Rep. Jo Bonner (R-1-AL) Rep. Bobby Schilling (R-17-IL) NEVADA Rep. Tim Holden (D-17-PA) Rep. Mo Brooks (R-5-AL) Rep. Aaron Schock (R-18-IL) Rep. Shelley Berkley (D-1-NV) Rep. Tom Marino (R-10-PA) ALASKA Rep. John Shimkus (R-19-IL) Sen. Dean Heller (R-NV) Rep. Todd Russell Platts (R-19-PA) Rep Don Young (R-At Large-AK) Rep. Joe Walsh (R-8-IL) NEW HAMPSHIRE Rep. Bill Shuster (R-9-PA) Sen. Lisa Murkowski (R-AK) Sen. Mark Kirk (R-IL) Rep. Charles Bass (R-2-NH) SOUTH CAROLINA ARIZONA INDIANA Rep.