View Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Product Categorization by Company

Product Categorization by Company Campbell Soup Category #1 Category #2 Category #3 V8 Fusion Light Pace P Farm Cakes Swanson Broths Base Goldfish P Farm Cookies R&W Healthy Request Soups V8 Fusion P Farm Highly Flavored Goldfish R&W Base Soups (Chicken Noodle) P Farm 15 Grain Bread R&W Cream Soups (higher calorie) Campbell's Tomato Juice Chunky Soups Base V8 Spaghettios Campbell's Red & White P Farm White Breads Campbell's Select Healthier Version P Farm Desserts Tomato Juice V8 Splash Prego Coca-Cola Category #1 Category #2 Category #3 Diet Coke Vitaminwater Coke Coca-Cola Zero Odwalla Sprite Dasani Honest Tea All Other Regular CSDs Dannon Water PowerAde Smart Water Nestea Glaceau Essence Water Hi C Sprite Zero Mihute Maid All Diet CSDs Simply Brand Powerade Ion Zero ConAgra Category #1 Category #2 Category #3 Egg Beaters Healthy Choice Banquet Pam Low Fat Cold Cuts Marie Calendars Swiss Miss Sugar Free Guldens Chef Boyardee Move Over Butter Rosarita Peppers Hebrew National Hunt's Ketchup Kid's Cuisine LaChoy Act II Orville Reddenbacher Fleishmann's Blue Bonnet Peter Pan All Other Hunts Swiss Miss Danone Category #1 Category #2 Category #3 Evian Danimals Dannon Frusion Dannon Light & Fit Dan Active Full Fat Stonyfield Dannon Water Dannon Fruit on Bottm Activia Healthier Varieties of Stonyfield Dr. Pepper Snapple Category #1 Category #2 Category #3 Diet Dr. Pepper Mr. & Mrs. T Dr. Pepper Diet Seven Up Clamato Canada Dry Diet A&W 7-Up All Other Diet CSDs All Other Regular CSDs Snapple Diet Snapple Mott's General Mills Category #1 Category -

Corporate Responsibility Report 2017 Corporate Responsibility REPORT

CORPORATE RESPONSIBILITY 2017 Corporate Responsibility2017 Corporate Report REPORT One Strawberry Lane Orrville, Ohio 44667 330.682.3000 jmsmucker.com EXHIBIT B MANAGEMENT’S SCHEDULE OF THE SUBJECT MATTER AND CRITERIA THE J. M. SMUCKER COMPANY Schedule of Total Water Withdrawal For the Years Ended December 31, 2016 and 2014 2014 2016 Recalculated Water withdrawal (amount in megaliters) 2,800.2 3,0 07.8 OUR PURPOSE Water withdrawal Helping to bring families together to share memorable (amount in cubic meters) 2,800,200 3,007,800 meals and moments. We have always defined success by more than financial performance. We believe NOTE 1 — BASIS OF PRESENTATION: how we do things is as important as what we do. Our Purpose aims to articulate The above amounts represent the total water withdrawal of the Company for the years ended December 31, 2016 and 2014 that the Company prepared for its 2017 submittal to the CDP Water Disclosure and for presentation in the why we are in business and the impact we aspire to have on society. Company’s 2017 Report. These amounts have been prepared based on criteria as established in the World Resources Institute/World Business Council for Sustainable Development’s Greenhouse Gas Protocol: A Corporate Accounting Being together with the ones we love isn’t just a pleasant way to spend time — it’s and Reporting Standard, Revised Edition, and supported by the Global Reporting Initiative G4, EN8. vital to a healthy, happy, fulfilling life. In fact, the more family and friends spend NOTE 2 — BIG HEART ACQUISITION: Water withdrawal associated with the facilities acquired in 2015 as part of the Big Heart acquisition are not included time with each other, the richer their lives become. -

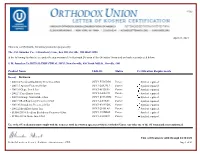

Status Certification Requirements UKD-ID Product Name

April 21, 2021 This is to certify that the following product(s) prepared by The J.M. Smucker Co., 1 Strawberry Lane, Box 280, Orrville, OH 44667-0280 at the following facilitie(s) are under the supervision of the Kashruth Division of the Orthodox Union and are kosher as indicated below. J. M. Smucker Co./RETAIL/INDUSTRIAL MFG.-New Orrville, 830 North Mill St , Orrville, OH Product Name UKD-ID Status Certification Requirements Brand: Dickinson • 200114 Seedless Blackberry Preserves 0.5oz OUV3-E71CDD1 Pareve Symbol required. • 200115 Apricot Preserves 0.5oz OUV3-20A3913 Pareve Symbol required. Symbol required. • 200116 Grape Jam 0.5oz OUV3-0813FF6 Pareve Symbol required. Symbol required. • 200117 Pure Honey 0.5oz OUV3-A84E474 Pareve Symbol required. Symbol required. • 200118 Orange Marmalade 0.5oz OUV3-6872ADB Pareve Symbol required. Symbol required. • 200119 Red Raspberry Preserves 0.5oz OUV3-47F96F5 Pareve Symbol required. Symbol required. • 200120 Strawberry Preserves 0.5oz OUV3-816F9DA Pareve Symbol required. Symbol required. • 200122 Breakfast Syrup 1oz OUV3-28101A8 Pareve Symbol required. Symbol required. • 51500-21114 Seedless Blackberry Preserves 0.5oz OUV3-359BE6F Pareve Symbol required. Symbol required. • 51500-21116 Grape Jam 0.5oz OUV3-1A80093 Pareve Symbol required. Symbol required. Use of the OU trademark must comply with the terms set forth in a written agreement with the Orthodox Union. Any other use of the OU trademark is not authorized. This certification is valid through 04/30/2022 Rabbi Menachem Genack, Rabbinic Administrator, CEO Page 1 of 24 April 21, 2021 The J.M. Smucker Co. (continued) J. M. Smucker Co./RETAIL/INDUSTRIAL MFG.-New Orrville, 830 North Mill St , Orrville, OH This is to certify that the following product(s) prepared by this company at the facilitie(s) listed above are under the supervision of the Kashruth Division of the Orthodox Union and are kosher as indicated below. -

Annual Reports

Annual Report ~2008~ Financial Highlights The J. M. Smucker Company Year Ended April 30, (Dollars in thousands, except per share data) 2008 2007 Net sales $2,524,774 $2,148,017 Net income and net income per common share: Net income $170,379 $ 157,219 Net income per common share – assuming dilution $ 3.00 $ 2.76 Income and income per common share before restructuring and merger and integration costs: (1) Income $178,881 $ 165,152 Income per common share – assuming dilution $ 3.15 $ 2.89 Common shares outstanding at year end 54,622,612 56,779,850 Number of employees 3,250 3,025 (1) Reconciliation to net income: Income before income taxes $254,788 $ 241,004 Merger and integration costs 7,967 61 Cost of products sold – restructuring 1,510 9,981 Other restructuring costs 3,237 2,120 Income before income taxes, restructuring, and merger and integration costs $267,502 $ 253,166 Income taxes 88,621 88,014 Income before restructuring and merger and integration costs $178,881 $165,152 ~ Contents ~ Letter to Shareholders 2 Business Overview 6 Recipes 11 Five-Year Summary of Selected Financial Data 14 Summary of Quarterly Results of Operations 15 Stock Price Data 15 Comparison of Five-Year Cumulative Total Shareholder Return 16 Management’s Discussion and Analysis 17 Report of Management on Internal Control Over Financial Reporting 27 Report of Independent Registered Public Accounting Firm on Internal Control Over Financial Reporting 28 Report of Independent Registered Public Accounting Firm on the Consolidated Financial Statements 29 ~ On Our Cover ~ Report of Management on Responsibility for Financial Reporting 30 “Apple Butter Season” © 2008 Will Moses Consolidated Financial Statements 31 In the painting commissioned for this year’s cover, Notes to Consolidated Financial Statements 36 artist Will Moses, great-grandson of legendary Directors, Officers, and General Managers 64 painter Grandma Moses, transports us to an earlier time at J.M.Smucker’s Orrville home, where families are Properties 64 gathered to celebrate the goodness of the harvest. -

View Annual Report

WHY WE ARE, WHO WE ARE... OUR CULTURE A culture of dotting the i’s and crossing the t’s… Of doing the right things and doing things right… A culture of growth – individual and as a company. It’s who we are. It’s because of who we are. It’s a result of living our Basic Beliefs… Our Commitment to Each Other. To our consumers and to our customers. As we look to the future of unlimited possibilities, we recognize the principles that are instrumental to our success… A culture deeply rooted in our Basic Beliefs… Guideposts for decisions at every level… Why we are who we are. A culture that encourages commitment to each other… Clear communication and collaboration… Vision…A culture of appreciation. A family-sense of sharing in a job well done… Where every person makes a difference. OUR BRANDS For more than 115 years, The J. M. Smucker Company has been committed to offering consumers quality products that help bring families together to share memorable meals and moments. Knott’s Buff Black PMS 871 OUR PURPOSE Helping to bring families together to share memorable meals and moments. CONTENTS U.S. Retail Coffee 6 | U.S. Retail Consumer Foods 10 | International, Foodservice, and Natural Foods 14 | Sustainability at Smucker 18 | Financial Review 21 Management’s Discussion and Analysis 24 | Consolidated Financial Statements 41 Notes to Consolidated Financial Statements 46 OUR FAMILY OF BRANDS We are honored to own and market trusted iconic food brands and greatly appreciate consumers including our portfolio of products as part of their family meals. -

Page 1 of 3 for IMMEDIATE RELEASE Contact: Shae Sneed

Page 1 of 3 FOR IMMEDIATE RELEASE Contact: Shae Sneed Cohn & Wolfe (212) 798-9789 HOLY MOLE! NINE YEAR-OLD CHEF TAKES HOME A $25,000 COLLEGE FUND AS WINNER OF THE JIF ® MOST CREATIVE SANDWICH CONTEST ™ Jacob C. from Morganton, NC Impresses America with His Magnificent Mole Chicken Torta Recipe ORRVILLE, Ohio (March 25, 2013) – Jif®, the number one choice of choosy moms, announced today that 9-year-old Jacob C. from Morganton, NC is the Grand Prize Winner of the 11th Annual Jif Most Creative Sandwich Contest ™ at an event in New York City. The aspiring chef received a $25,000 college fund for his one-of-a-kind recipe, the Magnificent Mole Chicken Torta , while four runners-up each received a $2,500 college scholarship fund for their delicious sandwich recipes. Jacob’s award-winning recipe features Jif Chocolate Flavored Hazelnut Spread as the base for a delicious mole sauce for pulled rotisserie chicken, and topped with Monterey jack cheese, avocado, lettuce and tomato served on a bolillo roll. “This has been such a positive experience for us from beginning to end, “said Suzanne C., Jacob’s mom. “ It has not only created a college fund for Jacob, but has also created some memories for our family that we’re never going to forget.” The four runner-up recipes paired either the peanutty taste of Jif Peanut Butter or the creamy, chocolaty flavor of Jif Hazelnut Spread with a unique mix of ingredients including pears, carrots, granola, bananas and bacon. Runner-Up Recipes • Apple Fries Peanut Butter Surprise! : A flour tortilla filled with apple “fries,” granola, mini chocolate chips and Jif Creamy Peanut Butter. -

The J. M. Smucker Company 2020 Annual Report

FISCAL YEAR 2020 LOOKING BACK ON A YEAR OF SHARED SUCCESS As we reflect on the results that represent the continued growth of our business in fiscal year 2020, it is important to take a moment to appreciate the significant accomplishments that were achieved together with our employees, our partners and our communities. These accomplishments demonstrate our commitment to ensuring we are continuing to grow our business and the impact we make on all constituents. Thank you to everyone who supported our success in fiscal year 2020! Ensured a steady Implemented a supply of food for people new, strategic executive and pets during the leadership structure COVID-19 pandemic Opened Longmont, CO, Introduced new manufacturing facility parental leave benefits to meet Uncrustables ® demand for employees Launched culturally Increased our relevant marketing campaigns dividend for the 18th for 10 of our largest brands consecutive year Grew Dunkin’ ® to the Drove the #3 brand in retail sales in Uncrustables ® brand the at-home coffee category to double-digit Source: IRI Consumption Data growth each quarter Invested in the Meow Mix ® brand, Achieved two milestone achieving the #1 position in dry cat sustainability commitments food household penetration ahead of schedule Source: IRI Panel Data FISCAL YEAR 2020 ANNUAL REPORT 1 DEAR FELLOW SHAREHOLDERS, Fiscal year 2020 was an unprecedented one for many A critical aspect of delivering value to our constituents reasons, most notably the significant impact of COVID-19 is how we execute against our long-term growth across the world. While this crisis presented considerable imperatives. We are pleased to share that we took challenges, we could not be prouder of how our entire several meaningful steps during fiscal year 2020 directly organization rose to the occasion. -

2012 Annual Report

2012 ANNU A L REPO R T 2012 ANNUAL REPORT One Strawberry Lane / Orrville, Ohio 44667 / (330) 682-3000 smuckers.com A The J. M. Smucker Company 2012 Annual Report 36560_Cover.indd 1 6/25/12 9:46 AM ShAREHOLDER INFORMATION CONTENTS CORPORATE OFFICE INDEPENDENT REGISTERED PUBLIC The J. M. Smucker Company AccOUNTING FIRM One Strawberry Lane Ernst & Young LLP 1 Orrville, Ohio 44667 Akron, Ohio Why We Are, Who We Are Telephone: (330) 682-3000 DIVIDENDS STOCK LISTING The Company’s Board of Directors typically declares a cash dividend 4 The J. M. Smucker Company’s common shares are listed on the New York each quarter. Dividends are generally payable on the first business FINANCIAL HIGHLIGHTS Letter to Shareholders Stock Exchange – ticker symbol SJM. day of March, June, September, and December. The record date is Year Ended April 30, approximately two weeks before the payment date. The Company’s (Dollars in thousands, except per share data) 2012 2011 CORPORATE WEBSITE dividend disbursement agent is Computershare Investor Services, LLC. Net sales $ 5,525,782 $ 4,825,743 8 To learn more about The J. M. Smucker Company, visit smuckers.com. Net income and net income per common share: U.S. Retail Coffee SHAREHOLDER SERVICES Net income $ 459,744 $ 479,482 ANNUAL MEETING The transfer agent and registrar for the Company, Computershare Net income per common share – assuming dilution $ 4.06 $ 4.05 The annual meeting will be held at 11:00 a.m. Eastern Time, Wednesday, Investor Services, LLC, is responsible for assisting registered Income and income per common share excluding special project costs:(1) 12 August 15, 2012, in the Fisher Auditorium at the Ohio Agricultural Research shareholders with a variety of matters, including: Income $ 535,579 $ 555,133 U.S. -

View Annual Report

ANNUAL REPORT — 2004— FINANCIAL HIGHLIGHTS — The J. M. Smucker Company — Year Ended April 30, (Dollars in thousands, except per share data) 2004 2003 Net sales $1,417,011 $1,311,744 Net income and net income per common share: Net income $ 111,350 $ 96,342 Net income per common share – assuming dilution $ 2.21 $ 2.02 Income and income per common share before restructuring and merger and integration costs: (1) Income $ 121,993 $ 104,432 Income per common share – assuming dilution $ 2.42 $ 2.19 Common shares outstanding at year end 50,174,707 49,767,540 Number of employees 2,950 2,775 (1)Reconciliation to net income: Income before income taxes $ 178,819 $ 155,390 Merger and integration costs 1,266 10,511 Cost of products sold – restructuring 8,464 1,256 Other restructuring costs 7,362 1,281 Income before income taxes, restructuring, and merger and integration costs $ 195,911 $ 168,438 Income taxes 73,918 64,006 Income before restructuring and merger and integration costs $ 121,993 $ 104,432 CONTENTS ON OUR COVER Letter to Shareholders 1 “Freedom from Want,” by Norman Rockwell Five-Year Summary of Selected Financial Data 10 Created for the March 6, 1943, issue of Summary of Quarterly Results of Operations 11 the Saturday Evening Post Stock Price Data 11 In honoring us as America’s best place to work, Fortune Management’s Discussion and Analysis 12 magazine observed that The J. M. Smucker Company is Report of Registered Public Accounting Firm 20 “...a throwback to a simpler time. If Norman Rockwell were Consolidated Financial Statements 21 to design a corporation, this would be it.” This year’s cover Notes to Consolidated Financial Statements 26 represents what our “Family of Brands” is all about… Management’s Report on Responsibility for bringing generations of friends and families together to Financial Reporting 47 celebrate the goodness of homemade meals. -

The J.M. Smucker Company

K_\A%D%JdlZb\i:fdgXep )''08eelXcI\gfik FINANCIAL HIGHLIGHTS The J.M. Smucker Company Year Ended April 30, (Dollars in thousands, except per share data) 2009 2008 Net sales $3,757,933 $2,524,774 Net income and net income per common share: Net income $ 265,953 $ 170,379 Net income per common share – assuming dilution $ 3.12 $ 3.00 Income and income per common share before restructuring and merger and integration costs:(1) Income $ 321,617 $ 178,881 Income per common share – assuming dilution $ 3.77 $ 3.15 Common shares outstanding at year end 118,422,123 54,622,612 Number of employees 4,700 3,250 (1) Reconciliation to net income: Income before income taxes $ 396,065 $ 254,788 Merger and integration costs 72,666 7,967 Cost of products sold – restructuring — 1,510 Other restructuring costs 10,229 3,237 Income before income taxes, restructuring, and merger and integration costs $ 478,960 $ 267,502 Income taxes 157,343 88,621 Income before restructuring and merger and integration costs $ 321,617 $ 178,881 CONTENTS Our Culture 1 Letter to Shareholders 2 Business Overview 4 Our Commitment to Sustainability 11 Our Store and Café 12 Recipes 13 Five-Year Summary of Selected Financial Data 15 Summary of Quarterly Results of Operations 16 Stock Price Data 16 Comparison of Five-Year Cumulative Total Shareholder Return 17 Management’s Discussion and Analysis 18 Report of Management on Internal Control Over Financial Reporting 28 Report of Management on Responsibility for Financial Reporting 28 Report of Independent Registered Public Accounting Firm on Internal Control Over Financial Reporting 29 Report of Independent Registered Public Accounting Firm on the Consolidated Financial Statements 30 Consolidated Financial Statements 31 Notes to Consolidated Financial Statements 36 Directors and Officers 62 Properties 62 Corporate and Shareholder Information 63 Why We Are, Who We Are ® ...Our Culture A culture of dotting the i’s and crossing the t’s… Of doing the right things and doing things right… ® A culture of growth — individual and as a company. -

View Annual Report

2014 Annual Report OUR PURPOSE We have always defined success by more than financial performance. We believe how we do things is as important as what we do. Our Purpose aims to Helping to bring families together to further articulate why we are in business and the impact we aspire to have on society. share memorable meals and moments. Being together with the ones we love isn’t just a pleasant way to spend time — it’s vital to a healthy, happy, fulfilling life. In fact, the more time family and friends spend with each other, the richer their lives become. We believe that nothing brings people closer together than the meals and memories they share. And the stronger families are today, the stronger our society will be tomorrow. Quite simply, life tastes better together. WHY WE ARE, WHO WE ARE... OUR CULTURE A culture of dotting the i’s and crossing the t’s… Of doing the right things and doing things right… A culture of growth – individual and as a company. It’s who we are. It’s because of who we are. It’s a result of living our Basic Beliefs… Our Commitment to Each Other. To our consumers and to our customers. As we look to the future of unlimited possibilities, we recognize the principles that are instrumental to our success… A culture deeply rooted in our Basic Beliefs… Guideposts for decisions at every level… Why we are who we are. A culture that encourages commitment to each other… Clear communication and collaboration… Vision…A culture of appreciation. -

A Guide to Companies, Products and Services That Support Lesbian, Gay, Transgender, Bisexual and Queer Workplace Inclusion

4 5 A Guide To Companies, Products And Services That Support Lesbian, Gay, Transgender, Bisexual And Queer Workplace Inclusion 1640 Rhode Island Ave., N.W. Washington, D.C. 20036 800-777-4723 www.hrc.org/buyersguide TTY: 202-216-1572 BUYING FOR WORKPLACE EQUALITY 2018 A FEW WAYS YOU CAN HELP FIGHT DEAR FOR EQUALITY EVERY DAY: FRIENDS,TAKE ACTION FOR EQUALITY Share this information with your friends, family and co-workers. Help them become supporters of workplace equality by factoring the information from this guide into 1 purchasing decisions. Advocate for equality in the work- place. If your company isn’t on this list or you think it can do better, go to www.hrc.org/cei to find out how to 2 engage your employer. Get active about equality. Sign up for newsletters and Action Alerts at 3 www.hrc.org/workplace. 1 The maxim that the customer is always right has never been truer in today’s hyper- connected global market. Consumers can publicly praise or criticize businesses they patronize with the click of a button and influence friends’ and strangers’ purchasing behaviors. Businesses cannot afford to ignore the increasingly savvy and engaged consumer. As consumers, you know that you have a choice. And with this Buying for Workplace Equality guide, providing the most accurate review of a business’s workplace policies toward lesbian, gay, bisexual, transgender and queer employees, we hope that you feel empowered to make those purchasing decisions that are most important to you. This year’s guide includes results from the 2018 Corporate Equality Index, which features 609 businesses that scored a perfect 100 percent.