Deliver. UNIQA Group at a Glance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Safer Better Longer Patient-Driven Healthcare Opportunities for Start-Ups a Look Into the Future: the World in 2030 Interview with Peter Eichler

safer better longer Patient-driven healthcare Opportunities for start-ups A look into the future: the world in 2030 Interview with Peter Eichler. Page 25 Impact Hub Vienna launches Mission 120. Page 37 Urbanisation, climate change and more. Page 49 UNIQA Group 2017 Sustainability Report Dear Readers, Our future My colleagues on the board and I belong to a generation that, Thirty-six-year-old Silvana Darda has been working at UNIQA in its youth, was very critical of the political views held by our for 13 years. She just recently became the mother of Emilia. parents and grandparents: we were concerned with issues such as nuclear energy, equal education opportunities for all, the im- She explained to us what sustainability means to her and how she portance of protecting the environment – think: the occupation of the would like to pass these values on to her child. Hainburger Au wetlands – or how the majority of the political parties and population dealt with Austria’s role before, during and after the Nazi regime – keyword: the Wald- Sometimes when Emilia is asleep in my arms, I lean down and gently inhale, and heim Affair. The stubbornness that we saw in the self-righteous establishment made us then thoughts come up that probably go through every mother’s mind: What will furious. We knew we were going to be totally different when we were adults. the world be like when my baby is 60 years old? When I am no longer there to pro- tect her. When she might already have grandchildren of her own. -

UNIQA Annual Financial Report 2018

At the forefront. Annual Financial Report 2018 according to section 124(1) of the Austrian Stock Exchange Act UNIQA Insurance Group AG 2 Contents 3 Contents Consolidated Corporate Governance Report 4 Report of the Supervisory Board 16 Group Management Report 22 Consolidated Financial Statements 42 Segment Reporting 51 Notes to the Consolidated Financial Statements 62 Risk Report 120 Approval for publication 137 Declaration of the legal representatives 138 Audit Opinion 139 4 Consolidated Corporate Governance Report CORPORATE GOVERNANCE 5 UNIQA has been committed to compliance with the UNIQA also declares its continued willingness to comply Austrian Code of Corporate Governance since 2004 and with the Austrian Code of Corporate Governance as cur- publishes the declaration of conformity both in the Group rently amended. However, UNIQA deviates from the provi- report and on www.uniqagroup.com in the Investor Rela- sions of the Code as amended with regard to the following tions section. The Austrian Code of Corporate Governance C rules (comply or explain rules), and the explanations are is also publicly available at www.uniqagroup.com and set out below. www.corporate-governance.at. Rule 49 of the Austrian Code The Corporate Governance Report and the Consolidated of Corporate Governance Corporate Governance Report of UNIQA Insurance Group AG are summarised in this report in accordance with Sec- Due to the growth of UNIQA’s shareholder structure and tion 267b in conjunction with Section 251(3) of the Austri- the special nature of the insurance business with regard an Commercial Code. to the investment of assets, there are a number of con- tracts with individual members of the Supervisory Boards Implementation and compliance with the individual rules of related companies in which these Supervisory Board in the Austrian Code of Corporate Governance, with the members discharge duties as members of governing bodies. -

Winter in Prague Tuesday 5 December to Friday 8 December 2017

emerging europe conference Winter in Prague Tuesday 5 December to Friday 8 December 2017 Our 2017 event held over 4 informative and jam-packed days, will continue the success of the previous five years and host almost 3,000 investor meetings, with over 160 companies representing 17 countries, covering multiple sectors. For more information please contact your WOOD sales representative: WOOD & Company Save Warsaw +48 222 22 1530 the Date! Prague +420 222 096 452 conferences 2017 London +44 20 3530 0611 [email protected] Participating companies in 2016 - by country Participating companies in 2016 - by sector Austria Hungary Romania Turkey Consumer Financials Healthcare TMT Atrium ANY Banca Transilvania Anadolu Efes Aegean Airlines Alior Bank Georgia Healthcare Group Asseco Poland AT&S Budapest Stock Exchange Bucharest Stock Exchange Arcelik AmRest Alpha Bank Krka AT&S CA Immobilien Magyar Telekom Conpet Bizim Toptan Anadolu Efes Athex Group (Hellenic Exchanges) Lokman Hekim CME Conwert MOL Group Electrica Cimsa Arcelik Banca Transilvania Cyfrowy Polsat S.A. Erste Bank OTP Bank Fondul Proprietatea Coca-Cola Icecek Astarta Bank Millennium Industrials Luxoft Immofinanz Wizz Air Hidroelectrica Dogan Holding Atlantic Grupa BGEO Aeroflot Magyar Telekom PORR Nuclearelectrica Dogus Otomotiv Bizim Toptan Bank Zachodni WBK Cimsa O2 Czech Republic RHI Kazakhstan OMV Petrom Ford Otosan CCC Bucharest Stock Exchange Ciech Orange Polska Uniqa Insurance Group Steppe Cement Romgaz Garanti Coca-Cola Icecek Budapest Stock Exchange Dogus Otomotiv OTE Vienna -

Presentation Uniqa 8.17

UNIQA Insurance Group AG – at a glance The UNIQA Group is one of the leading insurance groups in its core markets in Austria and Central and Eastern Europe. UNIQA has around 40 companies in 18 countries and serves about 10,1 million customers. With UNIQA and Raiffeisen Versicherung, the Group has the two strongest insurance brands in Austria and is well positioned in the CEE markets. The history of UNIQA dates back more than 200 years to the establishment of Salzburger LandesVersicherung AG in 1811. Since then, business has developed into a Europe-wide insurance provider. The first steps towards becoming an insurer outside of Austria were made in 1991. UNIQA Österreich Versicherungen AG is the largest insurance company in the Austrian market with a market share of more than 21.per cent. Around 37 percent of the customers come from the home market and more than two thirds of the premiums are generated in Austria. We are the undisputed market leader in health insurance in Austria, with a 47 per cent market share. UNIQA operates in 15 markets in the CEE growth region: Albania, Bosnia and Herzegovina, Bulgaria, Croatia, Czechia, Hungary, Kosovo, Northern Macedonia, Montenegro, Poland, Romania, Russia, Serbia, Slovakia and Ukraine. The UNIQA Group also includes insurance companies in Switzerland and Liechtenstein. Already 63 per cent of the customers and more than 28 percent of the premiums arise out of the international business of the UNIQA Group. Through the partnership with the Raiffeisen banks in Austria and the CEE region, UNIQA also have access to a dense sales network in our core markets, which gives us an edge over the competition. -

GROUP REPORT 2015 / UNIQA GROUP 2015 Th Group Re FUTU in Po Rt K 20 15 /UNIQ a Gr RE Th Ou in P K

UNIQA Group is one of the leading insurance groups in its two core markets: Group Report 2015 / UNIQA Group Austria and Central and Eastern Europe (CEE). 2015 About 21,000 employees and exclusive sales partners serve about 10 million customers across 19 countries. Commanding a market share of more than 21 per cent, UNIQA is the second largest insurance group in Austria. In the growth region CEE, UNIQA is present in 15 markets: Albania, Bosnia and Herzegovina, Bulgaria, Croatia, Czech Republic, Hungary, Kosovo, Macedonia, Montenegro, Poland, Romania, Russia, Serbia, Slovakia and Ukraine. In addition, insurance companies in Italy, Switzerland, and Liechtenstein are also part of the UNIQA Group. Think Balanced portfolio FUTURE. 42% 42% Life insurance Property and casualty insurance 16% Health insurance Think GROUP REPORT 2015 / UNIQA GROUPGROUP REPORT 2015 UNIQA Group is one of the leading insurance groups in its two core markets: Austria and Central and Eastern Europe (CEE). About 21,000 employees and exclusive sales partners serve about 10 million customers across 19 countries. Commanding a market share of more than 21 per cent, UNIQA is the second largest insurance group in Austria. In the growth region CEE, UNIQA is present in 15 markets: Albania, Bosnia and Herzegovina, Bulgaria, Croatia, Czech Republic, Hungary, Kosovo, Macedonia, Montenegro, Poland, Romania, Russia, Serbia, Slovakia and Ukraine. In addition, insurance companies in Italy, Switzerland, and Liechtenstein are also part of the UNIQA Group. Balanced portfolio 42% 42% Life -

Highlights 2008

Group Report 2008 UNIQA Versicherungen AG Highlights 2008 Premium volume again exceeds previous year: ` 5,825 million (+10,4%) Flexibility Number of insurance policies further increased: Imprint 14.7 million (+12.0%) Processes Owner and publisher UNIQA grows ahead of the market in operational business UNIQA Versicherungen AG and Products Untere Donaustrasse 21 (UNIQA Tower) Eastern expansion remains on track – solid organic growth 1029 Vienna Austria Respect Market position in Romania considerably strengthened Commercial registry no.: 92933t by the acquisition of UNITA – the sixth-largest property Data processing register: 0055506 Customers insurer in the country Investor Relations and Markets UNIQA Versicherungen AG UNIQA Versicherungen UNIQA Versicherungen AG Result diminished by financial market crisis: Stefan Glinz Profit on ordinary activities `90 million Untere Donaustrasse 21 1029 Vienna Dividend: 40 cents per share Austria Tel.: (+43) 1 211 75 3773 Group Fax: (+43) 1 211 75 793773 and Profit E-mail: [email protected] Quality Staff The insurance of a Contents www.uniqagroup.com Integrity and Partners new generation 2 Forewords The UNIQA Group Austria is one of the leading insurance 4 Strategy Information groups in Central Europe. It unites Austrian identity with a Profitable International Growth UNIQA’s Group Report is published in German and English and can be European format. 10 Customers & Markets downloaded as a PDF file from the investor relations area on our Group website. A Cut Above in Service Quality Group Report 2008 Solid Values The annual reports of the UNIQA Group’s Austrian insurance companies can Under the umbrella of the publicly listed company UNIQA 14 Processes & Products also be downloaded at this address. -

UNIQA Insurance Group AG Company Presentation

UNIQA Insurance Group AG Company presentation September 2013 Proposed Offering Structure Issuer • UNIQA Insurance Group AG • Offering comprises primary shares from a capital increase Type of offer and • The core shareholders will waive their subscription rights distribution • Public offering in Austria and private placement to qualified institutional investors outside Austria including Rule 144A in the US Offer structure • Approximately €700 - 800m in primary shares Listing location • Official Market on the Vienna Stock Exchange • Strengthening of balance sheet and Economic Capital ratio Use of proceeds • Continue implementing strategic plans under the UNIQA 2.0 program • Retain strategic flexibility for mid to long-term growth Lock-up • Customary 6 month lock-up for company and core shareholders • Joint Global Coordinators: Deutsche Bank, Morgan Stanley, Raiffeisen Centrobank Syndicate • Co-Bookrunners: Barclays, Berenberg, UBS 08/09/2013 14:25 12dld0274_Client Pitchbook template_New.pptx 1 Experienced and dedicated management team with a new approach since 2011 Andreas Brandstetter CEO, 44 • 16 years in insurance • CEO since 2011 • Education: Political science, business administration Hannes Bogner Wolfgang Kindl CFO, 54 CEO UNIQA International, 47 • 19 years in insurance • 17 years in insurance • CFO since 1998 • Board member since 2011 • Education: Business administration, • Education: Business administration, certified accountant focus on insurance Hands-on management style Kurt Svoboda Thomas Münkel CRO, 46 COO, 53 • 17 years in -

AXA Has Completed the Sale of Its Operations in Central and Eastern

Paris, October 15, 2020 AXA has completed the sale of its operations1 in Central and Eastern Europe for Euro 1.0 billion AXA announced today that it has completed the sale of its Life & Savings, Property & Casualty and Pension businesses in Poland, Czech Republic and Slovakia to UNIQA Insurance Group AG (“UNIQA”), for a total cash consideration of Euro 1.0 billion. The completion of the transaction is expected to result in a positive impact of +2 points on AXA Group’s Solvency II ratio in 4Q20. ABOUT THE AXA GROUP FOR MORE INFORMATION: The AXA Group is a worldwide leader in insurance and asset management, with 160,000 empl oyees Investor Relations: +33.1.40.75.48.42 serving 108 million clients in 57 countries. In 2019, IFRS revenues amounted to Euro 103.5 billion and Andrew Wallace-Barnett: +33.1.40.75.46.85 underlying earnings to Euro 6.5 billion. AXA had Euro 969 billion in assets under managemen t as of François Boissin: +33.1.40.75.39.82 December 31, 2019. Aayush Poddar: +33.1.40.75.59.17 The AXA ordinary share is listed on compartment A of Euronext Paris under the ticker symbol CS Mikaël Malaganne: +33.1.40.75.73.07 (ISN FR 0000120628 – Bloomberg: CS FP – Reuters: AXAF.PA). AXA’s American Depository Share is Mathias Schvallinger: +33.1.40.75.39.20 also quoted on the OTC QX platform under the ticker symbol AXAHY. Shuqi Ye: +33.1.40.75.58.44 The AXA Group is included in the main international SRI indexes, such as Dow Jones Sustainability Index (DJSI) and FTSE4GOOD. -

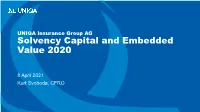

UNIQA Insurance Group AG Solvency Capital and Embedded Value 2019

UNIQA Insurance Group AG Solvency Capital and Embedded Value 2020 8 April 2021 Kurt Svoboda, CFRO EXECUTIVE SUMMARY Solvency Capital Embedded Value New Business Life, Health & Solvency Unrestricted Value Pension Fund Capital Ratio1 Tier 1 Capital MCEV2 EUR 170% 74% -5.3% 111m Impact ex-AXA Free Surplus Standard & 3 New Business on Solvency Generation Poor’s rating Margin Capital Ratio EUR A- -26% 126m 3.6% ▪ Significant impacts on MCEV and NBV values as a result of ▪ Decrease of capital position driven by ex-AXA acquisition adding ex-AXA entities and interest rate environment in 2020 ▪ Inclusion of the ex-AXA entities leads to the following uplifts as at 2020 Q4: MCEV +862m, NBV +46m ▪ Solvency position stays in internal ambition zone of minimum 170% ▪ Downward pressure on MCEV and NBV from a decline in interest rates in 2020 and COVID-19 environment ▪ Quality of capital in own funds remains strong ▪ Higher Free Surplus Generation mainly due to acquired ex- AXA business 1 Audit on Solvency & Financial Condition Report (SFCR) ongoing 2 As % of adjusted opening Life, Health & Pension Fund MCEV. The purchased ex-AXA entities are included in the adjusted opening MCEV 2 3 Annualized ex-AXA contribution for 2020 CONTENT I. Group Solvency Capital ▪ Risk Strategy ▪ Results ▪ Sensitivities and other analysis II. Market Consistent Embedded Value ▪ Results ▪ Sensitivities and other analysis III. Appendix ▪ SCR Methodology ▪ MCEV Methodology ▪ Assumptions ▪ Glossary & Disclaimer 3 I. GROUP CAPITAL REQUIREMENT Risk Strategy Key Elements of our Risk Ambition Strategy 170% ▪ Ambition is to have SCR Ratio above 170% Action ▪ We focus on underwriting risks and take Take measures to market/credit risks only to the extent reduce risk necessary 135% ▪ Target market risk share of total SCR is below 65% Recovery ▪ The target rating for UNIQA Group is Immediately increase category “A” by Standard & Poor’s solvency 100% Regulatory plan 4 I. -

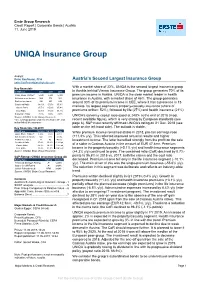

Credit Report UNIQA

Erste Group Research Erste Group Research Credit Report | Corporate Bonds | Austria 11. June 2019 UNIQA Insurance Group Analyst: Peter Kaufmann, CFA Austria’s Second Largest Insurance Group [email protected] With a market share of 22%, UNIQA is the second largest insurance group Key financials in EUR mn 2016 2017 2018 in Austria behind Vienna Insurance Group. The group generates 70% of its Gross Prem. Written* 5,048 5,293 5,309 premium income in Austria. UNIQA is the clear market leader in health Net investment income 589 572 581 insurance in Austria, with a market share of 46%. The group generates Profit before taxes 226 265 295 around 30% of its premium income in CEE, where it has a presence in 15 Combined Ratio 98.1% 97.5% 96.8% Claims Ratio 65.7% 65.9% 65.4% markets. Its largest segment is property-casualty insurance (share of Cost Ratio 32.4% 31.6% 31.4% premiums written: 52%), followed by life (27%) and health insurance (21%). Solvency II Ratio 202% 250% 248% UNIQA's solvency capital ratio stood at 248% at the end of 2018 (most Source: UNIQA, Erste Group Research *incl. savings portion of premiums from unit- and recent available figure), which is very strong by European standards (see index-linked life insurance page 6). S&P most recently affirmed UNIQA's rating on 21 Dec. 2018 (see Key financials 1Q 2019 table on the left hand side). The outlook is stable. in EUR mn 1Q 2018 1Q 2019 Delta While premium income remained stable in 2018, pre-tax earnings rose Gross Prem. -

UNIQA Group Report 2018

Group Report 2018 / UNIQA Group 2018 At the forefront. Think GROUP / UNIQA REPORT GROUP 2018 Think safer, better, longer living. UNIQA Group is one of the leading insurance groups in its two core markets: Austria and Central and Eastern Europe (CEE). Around 19,000 employees and exclusive sales partners serve 10.1 million customers across 16 countries. Commanding a market share of around 22 per cent, UNIQA is the second largest insurance group in Austria. In the CEE growth region, UNIQA is present in 15 markets: Albania, Bosnia and Herzegovina, Bulgaria, Croatia, the Czech Republic, Hungary, Kosovo, Montenegro, North Macedonia, Poland, Romania, Russia, Serbia, Slovakia and Ukraine. Balanced … in the core markets of Austria portfolio … and CEE 27% 71% Life insurance UNIQA 52% Austria Property and casualty insurance 29% UNIQA 21% International Health insurance Premium distribution Think UNIQA Group at a glance Consolidated key figures In € million 2018 2017 Change Premiums written 4,989.0 4,811.7 +3.7% Savings portions from unit-linked and index-linked life insurance (before reinsurance) 320.5 481.6 –33.5% Premiums written including savings portions from unit-linked and index-linked life insurance 5,309.5 5,293.3 +0.3% of which property and casualty insurance 2,774.4 2,639.7 +5.1% of which health insurance 1,086.4 1,042.0 +4.3% of which life insurance 1,448.6 1,611.6 –10.1% of which recurring premiums 1,335.8 1,357.7 –1.6% of which single premiums 112.7 254.0 –55.6% Premiums written including savings portions from unit-linked and index-linked -

Network Member Fact Sheet

Network Member Fact Sheet Insurable Poolable Capabilities Minimum lives to offer Minimum lives to offer Country Network Member Parent Primary Contact a local group contract pooling A D L M P A D L M P A D L M P Albania SIGAL UNIQA Group AUSTRIA (Albania) Uniqa Insurance Group AG Merjemaj , Milena 12 12 x x x x x x x x Anguilla Sagicor Anguilla Sagicor Life Inc. Kellman, Sandra 5 5 x x x x x x x x x Antigua Sagicor Antigua Sagicor Life Inc. Kellman, Sandra 5 5 x x x x x x x x x Argentina HSBC Seguros de Vida Argentina S.A. HSBC Fuentes, Matias 10 10 x x x x x x Aruba Sagicor Aruba Sagicor Life Inc. Kellman, Sandra 5 5 x x x x x x x x x Australia AMP Australia AMP Limited Georges, Harry 200 200 x x x x Austria UNIQA Österreich Versicherungen AG Uniqa Insurance Group AG Huger , Robert 10 10 and min. 20k € x x x x x x x x x Barbados Sagicor Barbados Sagicor Life Inc. Kellman, Sandra 5 5 x x x x x x x x x Belgium AG Insurance Ageas N.V./S.A. Moreau, Michel 10 (review per case) 50 x x x x x x x x x Belize Sagicor Belize Sagicor Life Inc. Kellman, Sandra 5 5 x x x x x x x x x Bosnia and Herzegovina UNIQA Bosnia / Herzegovina Uniqa Insurance Group AG Fazlibegović, Faris 5 5 x x x x x x x x Brazil Care Plus The British United Provident Association Limited Abdalla, Caio 3 200 x x Brazil Icatu Seguros Icatu Seguros Rodrigues, Cibelle 2 2 x x x x x x x Bulgaria UNIQA Bulgaria Uniqa Insurance Group AG Vezev , Martin 5 5 x x x x x x x x Canada Manulife The Manufacturers Life Insurance Company Wilson, Randy 2 35 x x x x x x x Caribbean Nations Sagicor Life Inc.