Refueling Assessment of a Zero-Emission Container Corridor Between China and the United States: Could Hydrogen Replace Fossil Fuels?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Container Ship Size and Port Relocation Discussion Paper 169 Roundtable

CPB Corporate Partnership Board Container Ship Size and Port Relocation Discussion Paper 169 Roundtable Olaf Merk International Transport Forum CPB Corporate Partnership Board Container Ship Size and Port Relocation Discussion Paper 169 Roundtable Olaf Merk International Transport Forum The International Transport Forum The International Transport Forum is an intergovernmental organisation with 59 member countries. It acts as a think tank for transport policy and organises the Annual Summit of transport ministers. ITF is the only global body that covers all transport modes. The ITF is politically autonomous and administratively integrated with the OECD. The ITF works for transport policies that improve peoples’ lives. Our mission is to foster a deeper understanding of the role of transport in economic growth, environmental sustainability and social inclusion and to raise the public profile of transport policy. The ITF organises global dialogue for better transport. We act as a platform for discussion and pre- negotiation of policy issues across all transport modes. We analyse trends, share knowledge and promote exchange among transport decision-makers and civil society. The ITF’s Annual Summit is the world’s largest gathering of transport ministers and the leading global platform for dialogue on transport policy. The Members of the Forum are: Albania, Armenia, Argentina, Australia, Austria, Azerbaijan, Belarus, Belgium, Bosnia and Herzegovina, Bulgaria, Canada, Chile, China (People’s Republic of), Croatia, Czech Republic, Denmark, Estonia, Finland, France, Former Yugoslav Republic of Macedonia, Georgia, Germany, Greece, Hungary, Iceland, India, Ireland, Israel, Italy, Japan, Kazakhstan, Korea, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Mexico, Republic of Moldova, Montenegro, Morocco, the Netherlands, New Zealand, Norway, Poland, Portugal, Romania, Russian Federation, Serbia, Slovak Republic, Slovenia, Spain, Sweden, Switzerland, Turkey, Ukraine, the United Arab Emirates, the United Kingdom and the United States. -

Downloaded, Is Consistently the Same and Their Facilities Are Accessible Only to the Types of Goods in Which They Manage (Roa Et Al, 2013)

Running head: THE IMPACT OF VESSEL BUNCHING 1 The Impact of Vessel Bunching: Managing Roll-on-Roll-off Terminal Operations Jonathan E. Gurr California State University Maritime Academy THE IMPACT OF VESSEL BUNCHING 2 Abstract The operations at port terminals are under consent examination, consistently investigating the various operational challenges effecting efficiency and performance. In a study to identify the consequences of vessel bunching, vessels that arrive within a short amount of time between each vessel, this paper presents an approach to forecast Ro-Ro terminal capacity while referencing the various input factors: vessel arrival schedule, inbound cargo volume, and rail or truck out-gate volume. Using a quantitative analysis derived using actual historical data from a Ro-Ro terminal at the Port of Long Beach, California, the proposed approach applied an additional probability factor that vessel bunching would occur. The analysis highlights the effectiveness of using actual historical data when examining a Ro-Ro terminal’s capacity and how the resulting information could be communicated inclusively with all stakeholders involved in port operations as means of performance improvement. Keywords: vessel bunching, ro-ro, terminal, forecast, capacity, risk assessment THE IMPACT OF VESSEL BUNCHING 3 The Impact of Vessel Bunching Seaports remain the most common way to transfer goods from one form of transportation to another. Global ports are responsible for handling over 80 per cent of global merchandise trade in volume and more than two thirds of its value (UNCTAD, 2017). As key nodes in the supply chain, ports are under continual pressure to implement efficiency improvements and cost saving measures. -

Oil and Gas News Briefs, December 28, 2020

Oil and Gas News Briefs Compiled by Larry Persily December 28, 2020 LNG producers risk overinvesting in too much new supply (The Wall Street Journal; Dec. 24) - As a cleaner fossil fuel, natural gas will play a role for years to come. It is less certain, however, that it will be a profitable one. Exuberant investment in new reserves and liquefaction facilities in recent years helped globalize the LNG market but also created a supply glut. Any sustained recovery in prices and profits will require producers to resist the temptation to overinvest once again. Future profitability will depend on how well supply and demand match up. Natural gas will likely play two key roles in the upcoming green transition: replacing coal-fired power plants until sufficient renewables production can be built; and fueling backup peak plants to bridge the gaps in intermittent wind and solar generation. Gas demand is expected to peak sometime in the next decade or two and then taper off slowly, though advances in carbon capture and storage could extend its role. On the other hand, gas demand could be reduced by a faster-than-expected fall in costs for renewable energy and storage, or an accelerated development of green hydrogen. The uncertainty makes it tricky to estimate what supply will be needed in the future, particularly as projects can take years to come online. This raises the risk of overproduction, which can cause prices to languish. Decisions to invest during the next two years could lead to another “wave of supplies” coming online in 2027, prompting another downward price cycle, said Carlos Torres Diaz, gas and power analyst at energy consultancy Rystad Energy. -

The Need for Speed

DEO VOLENTE Deo Volente The Need for Speed BUILDERS Hartman Marine B.V. OWNERS Hartman Seatrade B.V. DEO VOLENTE YARD NUMBER 001 IMO NUMBER 9391658 12 | ShipBuilding Industry | Volume 1 | No. 2 Deo Volente.indd 12 07-06-2007 11:42:59 COMO Hartman Seatrade is a modern shipping company specializing in the carriage of all kind of dry cargoes with special emphasis on voluminous project cargoes and heavy lift transports. With a vast experience in deep Deo Volente sea shipping for more than two centuries the Urk based company recently inaugurated its new ‘mini’ heavy lift vessel – Deo Volente. The new build vessel is a surpass of the previous Deo Volente with an accent on operating terms as speed and heavy lift capabilities. Photo courtesy of Flying Focus ight from the beginning the two Hartman brothers MARIN and Wolfards. Construction of the hull was Rhad a pretty good idea of how their new vessel ordered from CIG group who built her on her Polish should look like and be able to. They designed a novel location, and was transferred to the Netherlands for concept for a small and fast heavy lift vessel which outfitting under management of Hartman Marine BV. would fall just in the 3000 gross tonnage and 3000 kW installed power category. These criteria are of High Service Speed significant effect on the operating costs with regard to The Deo Volente is proof of nowadays need for the required number of crew and manning speed. She is the fastest heavy lift cargo ship in the certification. -

Glossary of Port Industry Terminology

Glossary of Port Industry Terminology Berth: 1) The area allotted to accommodate a vessel alongside a wharf, or the area in which a vessel swings when at anchor. 2) Or in “cruise terminology ” a bed. Berthage: A tariff charged to a vessel occupying a berth. It is calculated by applying the current tariff rate per GT for each of the first 2 twelve-hour periods. Each additional hour is charged at a lower published rate per GT. Bollard: Is a short vertical post used on a ship or a quay, principally for mooring. Breakbulk: Non-containerized general cargo. Examples include iron, steel, machinery, linerboard, woodpulp and yachts. Cabin: A passenger room onboard the cruise ship – sometimes called a stateroom or a berth. CBSA: Canada Border Services Agency (occasionally referred to as Canada Customs). Coastal Trading Act: An Act respecting the use of foreign ships and non-duty paid ships in the coasting trade. (Canadian version of American “Jones Act” see cabotage below). Cabotage Water transportation term applicable to shipments between ports of a nation; commonly refers to coastwise or intercoastal navigation or trade. Many nations, including the United States, have cabotage laws which require national flag vessels to provide domestic interport service. (In US this is referred to as the “Jones Act”). Chart Datum: A plan below which the tide will seldom fall. The Canadian Hydrographic Service has adopted the plane of Lowest Normal Tides (LNT) as chart datum. To find the depth of water, the height of tide must be added to the depth shown on the chart. Tidal heights preceded by a (-) must be subtracted from the charted depth. -

Structural Design of a Container Ship Approximately 3100 TEU According to the Concept of General Ship Design B-178

Structural design of a container ship approximately 3100 TEU according to the concept of general ship design B-178 Wafaa Souadji Master Thesis presented in partial fulfillment of the requirements for the double degree: “Advanced Master in Naval Architecture” conferred by University of Liege "Master of Sciences in Applied Mechanics, specialization in Hydrodynamics, Energetics and Propulsion” conferred by Ecole Centrale de Nantes developed at West Pomeranian University of Technology, Szczecin in the framework of the “EMSHIP” Erasmus Mundus Master Course in “Integrated Advanced Ship Design” Ref. 159652-1-2009-1-BE-ERA MUNDUS-EMMC Supervisor: Dr. Zbigniew Sekulski, West Pomeranian University of Technology, Szczecin Reviewer: Prof. Robert Bronsart, University of Rostock Szczecin, February 2012 Structural design of a container ship approximately 3100 TEU 3 according to the concept of general ship design B-178 ABSTRACT Structural design of a container ship approximately 3100 TEU according to the concept of general ship design B-178 By Wafaa Souadji The initial design stage is crucial for the ship design, including the ship structural design, as the decisions are here taken fundamental to reach design objectives by establishing basic ship characteristics. Consequently, errors which may appear have the largest impact on the final design. Two main aspects related to the design of structures are typically addressed in the initial design: analysis of strength and cost estimation. The design developed in the dissertation is based on the conceptual design of general containership B-178 built in the Stocznia Szczecińska Nowa, providing its main particulars, hull form as well as the general arrangement. The general objective of the thesis is to carry out the hull structural design based on the functional requirements of the containership. -

Lighter Barges: an Alternative to Servicing Post- Panamax Vessels at the Port of Wilmington, NC

Lighter Barges: An Alternative to Servicing Post- Panamax Vessels at the Port of Wilmington, NC Jonathan E. Bingham1, Kathryn R. Cyr1, Lawrence B. Cahoon2 1- Marine and Coastal Ocean Policy Program* UNC Wilmington, Wilmington, NC 28403 2- Dept. of Biology and Marine Biology UNC Wilmington, Wilmington, NC 28403; [email protected] 1 INTRODUCTION The North Carolina State Ports Authority recently proposed a costly plan to deepen and widen the Port of Wilmington’s navigation channel in order to accommodate large post- Panamax vessels. This paper proposes that there is another, potentially more appealing and affordable alternative: shallow-draft lighter barges. Ports in areas like Hong Kong and the lower Mississippi River use variations of lighter barges to bring cargo to and from ships and ports. Wilmington’s unique location and navigational challenges make lighter barges a viable option that deserves consideration. American port facilities and channels have grown to accommodate Panamax sized vessels over the last century. The existing Panama Canal channels feature a depth of about 40 ft. The channel depth and the dimensions of the first two lock systems (106 ft. width) turned out to be the limiting factors for the Panamax vessel design and size. However, in June of 2016, the situation will change for U.S. harbors when the newly constructed Panama Canal expansion is completed. The project creates a new lane for ship traffic with larger locks than the original channels, allowing for wider ships with deeper drafts (Fig. 1). New construction is expected to double the canal’s current capacity of 300 million tons per year (Dervarics 2015). -

The Cruise Passengers' Rights & Remedies 2016

PANEL SIX ADMIRALTY LAW: THE CRUISE PASSENGERS’ RIGHTS & REMEDIES 2016 245 246 ADMIRALTY LAW THE CRUISE PASSENGERS’ RIGHTS & REMEDIES 2016 Submitted By: HON. THOMAS A. DICKERSON Appellate Division, Second Department Brooklyn, NY 247 248 ADMIRALTY LAW THE CRUISE PASSENGERS’ RIGHTS & REMEDIES 2016 By Thomas A. Dickerson1 Introduction Thank you for inviting me to present on the Cruise Passengers’ Rights And Remedies 2016. For the last 40 years I have been writing about the travel consumer’s rights and remedies against airlines, cruise lines, rental car companies, taxis and ride sharing companies, hotels and resorts, tour operators, travel agents, informal travel promoters, and destination ground operators providing tours and excursions. My treatise, Travel Law, now 2,000 pages and first published in 1981, has been revised and updated 65 times, now at the rate of every 6 months. I have written over 400 legal articles and my weekly article on Travel Law is available worldwide on www.eturbonews.com Litigator During this 40 years, I spent 18 years as a consumer advocate specializing in prosecuting individual and class action cases on behalf of injured and victimized 1 Thomas A. Dickerson is an Associate Justice of the Appellate Division, Second Department of the New York State Supreme Court. Justice Dickerson is the author of Travel Law, Law Journal Press, 2016; Class Actions: The Law of 50 States, Law Journal Press, 2016; Article 9 [New York State Class Actions] of Weinstein, Korn & Miller, New York Civil Practice CPLR, Lexis-Nexis (MB), 2016; Consumer Protection Chapter 111 in Commercial Litigation In New York State Courts: Fourth Edition (Robert L. -

Irish Maritime Directorate Strategy - Public Consultation Submissions by Recipient

Irish Maritime Directorate Strategy - Public Consultation Submissions by Recipient 1. Commander John Jordan Received 13 November 2020 Dear Sir, From 1952 to 2000 I served on Irish and British Merchant ships, including 32 years in the Irish naval Service, and finally 8 years mainly with Commissioners of Irish Lights and some with Dundalk shipping and British and Irish Containers on MV Wicklow. I would have entered and used all Irish Ports except Wicklow, Dundalk ,Drogheda and Sligo. In Naval days I was liaison officer to the Survey and charting for Burtonport Fishery harbour and served in command of 5 naval ships. Comments Core 1. In the overall our response to Maritime safety is reactive as we have NO hands on 24/7 view, or control of maritime traffic. With the loss of manned lighthouses and reliance only on Radio channels in competition with Cell and satellite phones there has been a loss of the Surface Picture and of discipline among users. Most busy sea traffic areas, other than Ireland, are now controlled and interrogated by VTS . Recent incidences offshore and over the years has shown our weaknesses in the event of ship breakdowns that culminate in towage and/or rescue. There are no dedicated Emergency Towage vessels. Regulations will not solve or provide a solution to an actual incident. Core 2. Some of our Ports are in planned disarray. There is a certain loss of control in that traditional town based berthage is being repurposed as development lands while linear losses of berthage, are not being met at down river sites. -

Cruise Shipping and Urban Development the Case of Dublin

CPB Corporate Partnership Board Cruise Shipping and Urban Development The Case of Dublin This report analyses Dublin’s attractiveness as a cruise port and assesses the impacts of cruise shipping on the city. It evaluates policies in place and provides recommendations to increase the positive impacts of cruise shipping for the city of Dublin. Over the last decade, Dublin has grown as an important port of call for cruises in Northern Europe. Cruise tourism generates significant economic benefits for the city of Dublin. The value cruise tourism brings could be further increased by developing Dublin into a cruise home port, that is a port from which cruises start and where they end. Under which conditions could this be achieved? Which policy measures would be needed? Which stakeholders would need to be involved? This report is part of the International Transport Forum’s Case-Specific Policy Analysis series. These are topical studies on specific issues carried out by the ITF in agreement with local institutions. Cruise Shipping and Urban Development The Case of Dublin Case-Specific Policy Analysis International Transport Forum 2 rue André Pascal F-75775 Paris Cedex 16 T +33 (0)1 45 24 97 10 F +33 (0)1 45 24 13 22 Email: [email protected] Web: www.itf-oecd.org 2016-12/Photo credit: Port of Dublin 2016-12/Photo Cruise Shipping and Urban Development The Case of Dublin Case-Specific Policy Analysis The International Transport Forum The International Transport Forum is an intergovernmental organisation with 57 member countries. It acts as a think tank for transport policy and organises the Annual Summit of transport ministers. -

A History of the Cruise Ship Industry

Resources (/Resources/) // Blog (/Resources/Blog) November 19, 2018 A HISTORY OF THE CRUISE SHIP INDUSTRY Cruising has come a long way from the industry’s beginnings as a way for steamship companies to supplement their earnings from hauling cargo and mail across the ocean. In 2018, an estimated 27.2 million people (https://www.f-cca.com/downloads/2018-Cruise-Industry- Overview-and-Statistics.pdf) are expected to take a cruise vacation, making the $126 billion industry (https://www.f-cca.com/downloads/2018-Cruise-Industry-Overview-and-Statistics.pdf) one of the fastest growing in the leisure travel market. Today’s ships are more luxurious (https://www.royalcaribbean.com/cruise-ships/symphony-of-the- seas) than some land-based resorts, with spas, multiple bars, restaurants, lounges, and entertainment venues. Some even include onboard waterparks and ice-skating rinks. While many vacationing passengers enjoy these megaships and the over-the-top resort amenities— rock climbing, anyone? — they present special challenges for the crews hired to maneuver and manage these vessels while keeping all aboard safe, and require special training. Resolve Maritime Academy (https://www.resolveacademy.com/Training- Courses/Courses/Advanced-Shiphandling-Conventional) offers a ve-day course on advanced ship handling that covers the complex procedures involved in maneuvering large, conventionally powered vessels. The course uses Resolve Maritime Academy’s full-mission bridge and mini-bridge simulators to teach proper procedures for situations such as docking and undocking, propulsion loss, maneuvering in high winds and currents, and avoiding collisions. In addition to instruction on handling for cruise ships, the course can be customized for container, bulker, offshore, and oil and gas vessels. -

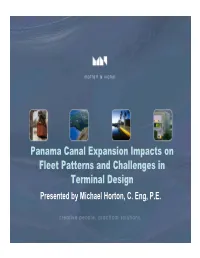

Panama Canal Expansion Impacts on Fleet Patterns and Challenges in Terminal Design Presented by Michael Horton, C

Panama Canal Expansion Impacts on Fleet Patterns and Challenges in Terminal Design Presented by Michael Horton, C. Eng, P.E. Agenda • Panama Canal Expansion, the Coming Fleet – Fleet Vessel size – Container Vessel Size • Design Criteria , Present & Future – Terminal Requirements for the Future – Options for Berth Construction • Challenges, Moving Forward – Time – Money • Conclusions The New Generation Source: ACP Ready or Not? In 1995 the Regina Maersk was big at 6,500 TEU – 5,800 trucks – 25 barges – 550 cargo planes Regina Maersk (1995) Now We Have the Emma Maersk at 11,000 or 13,000TEUs Emma Maersk (2006) But Still Not The Biggest Vessel On The Water Typical Maritime Transport Costs Source: Delft University, “Containerization International Charter Market Report”, Drewry Container Market Review 2006-2007. Container Ship Dimensions by Capacity (averages) Capacity Draft LOA Beam (TEUs) (m) (m) (m) 2,000-2,999 11.6 239 31.5 3,000-3,999 12.1 259 32.4 4,000-4,999 13.0 284 33.2 5,000-5,999 13.7 281 39.0 6,000-6,999 13.9 302 40.6 7,000-7,999 14.6 343 42.6 8,000-8,999 14.3 329 42.8 9,000-9,999 14.7 344 44.0 >10,000 15.5 398 56.4 Immediate Demand (ECSA carrier) • (2010) - 6,300 TEUS: – Length: 300 Meters – Beam: 40 Meters – Draft: 14.5 Meters – DWT: 76,000 • (2014) - 8,800 TEUS: – Length: 338 Meters – Beam: 46 Meters – Draft: 15.5 Meters – DWT: 116,000 Vessel Size: Conclusion • Panama Canal sets the new top end? • Vessel size will be a factor of route, market potential and facilities availability • With or without the Canal expansion, terminal