There Were Responses from 19,974 out of All 52,560 Shareholders

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PUBLIC SUBMISSION Posted: November 20, 2020 Tracking No

Page 1 of 2 As of: 11/23/20 10:03 AM Received: November 18, 2020 Status: Posted PUBLIC SUBMISSION Posted: November 20, 2020 Tracking No. 1k4-9k60-8cjw Comments Due: December 03, 2020 Submission Type: Web Docket: PTO-C-2020-0055 Request for Comments on Discretion to Institute Trials Before the Patent Trial and Appeal Board Comment On: PTO-C-2020-0055-0001 Discretion to Institute Trials Before the Patent Trial and Appeal Board Document: PTO-C-2020-0055-0452 Comment from Japan Business Machine and Information System Industries Association Submitter Information Name: Hideaki Chishima Address: Lila Hijirizaka 7FL 3-4-10, Mita Minato-ku, Tokyo, Japan, 1080073 Email: [email protected] Phone: +81-3-6809-5495 Fax: +81-3-3451-1770 Submitter's Representative: Hideki Sanatake Organization: Japan Business Machine and Information System Industries Association General Comment Dear Sir, This post is for Japan Business Machine and Information System Industries Association (JBMIA) to submit its comments in response to solicitation of public comments by USPTO as announced in Federal Register / Docket No. PTO-C-2020-0055. The comments are attached hereto. JBMIA is a Japanese incorporated association which was renamed in 2002 from Japan Business Machine Makers Association established originally in 1960. JBMIA consists of 40 member companies engaged in business machine and information system and 5 supporting companies. Almost all of the member companies have actively filed patent applications in the USA. https://www.fdms.gov/fdms/getcontent?objectId=0900006484967b2a&format=xml&sho... 11/23/2020 Page 2 of 2 Sincerely, Hideaki Chishima (Mr) Intellectual Property Committee Secretariat Attachments JBMIA Comment (finnal) https://www.fdms.gov/fdms/getcontent?objectId=0900006484967b2a&format=xml&sho.. -

Quick Print Station (ASK-300)

Tentative The Best All-in-one System! You can start a photo business easily with this affordable, all-in-one solution. Small Initial Investment Compact Size Variety of Photo Finishing Formats Small Initial Investment Variety of Photo Finishing Formats All-in-one solution at an affordable price. Standard, ID and template The kiosk includes: ready photo formats available. Printer Photo formatting selection is Order terminal easy for everyone, using the Fujifilm software on-screen step-by-step guide. Compact Size & Easy Maintenance High Quality Prints Increase Shop’s Efficiency Outstanding image quality is realized by matching our This compact system is suitable for any retail environment. Image IntelligenceTM processing technology* with Easy loading of paper and replacing of ink ribbons in less than FUJIFILM Quality Thermal Photo Paper. 3 minutes. Adjustable display angle FUJIFILM Dye-sublimation Compact Kiosk System "Quick Print Station" Specifications Display 10.4 inch Touch Panel Display (800 x 600 pixel) OS: Windows XP Embedded (English) PC Unit CPU: Intel Atom N455 (1.6GHz) Memory: DDR3 SO-DIMM (1GB) HDD: 160GB (SATA) 275 mm Wireless LAN: Option Wireless BlueTooth (IEEE 802.15.1) : Option 445 mm Device (LAN port) Option Optical External Device (CD/DVD) Option (USB Connection) 170 mm PC Dimensions (W x D x H) 275 x 295 x 70-275 mm/10.8 x 11.6 x 2.8-10.8 inch (DPC Portable) Weight (approx.) 3.5 kg/7.7 lb Input media SD Memory Card, MicroSD Card, Memory Stick, 275 mm 446 mm Memory Stick Micro, xD-Picture Card, CompactFlash, USB Flash Memory Power Consumption 100-240V AC50/60 Hz Consumables Lineup Interface USB 2.0 x 4 ports (Type A) Print size Description Number of prints per Box Printing speed (approx) Standard Print 3.5 x 5 inch T RL-CF900 900 prints 11.2 seconds/print ID Photo 4 x 6 inch T RK-CF800 800 prints 12.3 seconds/print Frame photo 5 x 7 inch T R2L-CF460 460 prints 19.0 seconds/print Service & Function Edit (Crop, Rotate) 6 x 8 inch T R68-CF400 400 prints · Not include data transfering time. -

Owner's Manual

Owner’s Manual BL00004970-200 EN Introduction Thank you for your purchase of this product. Be sure that you have read this manual and understood its contents be- fore using the camera. Keep the manual where it will be read by all who use the product. For the Latest Information The latest versions of the manuals are available from: http://fujifilm-dsc.com/en/manual/ The site can be accessed not only from your computer but also from smartphones and tablets. It also contains information on the software license. For information on fi rmware updates, visit: http://www.fujifilm.com/support/digital_cameras/software/ ii P Chapter Index Menu List iv 1 Before You Begin 1 2 First Steps 27 3 Basic Photography and Playback 45 4 Movie Recording and Playback 51 5 Taking Photographs 57 6 The Shooting Menus 101 7 Playback and the Playback Menu 159 8 The Setup Menus 185 9 Shortcuts 221 10 Peripherals and Optional Accessories 233 11 Connections 251 12 Technical Notes 265 iii Menu List Camera menu options are listed below. Shooting Menus Menu List Adjust settings when shooting photos or movies. N See page 101 for details. H IMAGE QUALITY SETTING P G AF/MF SETTING P IMAGE SIZE 102 FOCUS AREA 114 IMAGE QUALITY 103 AF MODE 115 RAW RECORDING 103 AF-C CUSTOM SETTINGS 116 FILM SIMULATION 104 STORE AF MODE BY ORIENTATION 119 1⁄3 1⁄3 B & W ADJ. ab(Warm/Cool) 105 AF POINT DISPLAYyz 119 GRAIN EFFECT 105 NUMBER OF FOCUS POINTS 120 COLOR CHROME EFFECT 105 PRE-AF 120 WHITE BALANCE 106 AF ILLUMINATOR 120 DYNAMIC RANGE 108 FACE/EYE DETECTION SETTING 121 D RANGE PRIORITY -

NOTICE of FISCAL YEAR 2018 (The 55Th FY) ANNUAL GENERAL MEETING of SHAREHOLDERS

㻝㻌 World Headquarters 3-1 Akasaka 5-chome, Minato-ku Tokyo 107-6325, Japan ISIN JP3571400005 Tel:+81-3-5561-7000 SEDOL 6895675 TSE 8035 May 28, 2018 NOTICE OF FISCAL YEAR 2018 (the 55th FY) ANNUAL GENERAL MEETING OF SHAREHOLDERS To Our Shareholders: We are pleased to announce that the 55th Annual General Meeting of Shareholders (the “AGM”) of Tokyo Electron Ltd. (“TEL”) will be held on Tuesday, June 19, 2018, at 10:00 a.m. Japan standard time, at PALACE HOTEL TOKYO, located at 1-1 Marunouchi 1-chome, Chiyoda-ku, Tokyo. Shareholders will also be asked to vote upon the following Agenda: 1: Election of Twelve Corporate Directors 2: Payment of Bonuses to Corporate Directors for the 55th Fiscal Year 3: Issuance of Share Subscription Rights as Stock-Based Compensation to Corporate Directors 4: Issuance of Share Subscription Rights as Stock-Based Compensation to Executives of the Company and its Subsidiaries 5: Introduction of a Stock Compensation System as Medium-term Performance-linked Compensation for Corporate Directors of the Company As part of our ongoing effort to improve the quality of communications with our foreign investors and to increase the participation of those investors and to exercise your voting rights at the AGM, Tokyo Electron Ltd. has appointed IR Japan, Inc. as our Global Information Agent in connection with the shareholder meeting. We realize that many shareholders do not vote at Japanese Shareholders Meeting due to the volume of meetings and timing concerns. Therefore, we attach special importance to your vote, and hope that you will continue to distinguish yourselves from many institutions, who, unfortunately, do not participate. -

PDF Download [1

Annual Report 2002 TOKYO ELECTRON Profile Established in 1963, Tokyo Electron (TEL) is a world-leading supplier of semiconductor production equipment (SPE) and related services for the semiconductor industry. The Company develops, manufactures and markets a broad lineup of products, including oxidation/diffusion/LP-CVD systems, single wafer CVD and PVD systems, coater/developers, spin-on dielectric (SOD) coaters, etch systems, cleaning systems, wafer probers, and others. Tokyo Electron also uses its accumulated expertise in SPE to develop, manufacture and market coater/developers and etch/ash systems for the manufacture of Flat Panel Display (FPD). Most of the Company’s semiconductor and FPD production systems hold the leading share in their respective markets. Tokyo Electron also maintains a strong presence as a distributor, providing a wide array of semiconductor production systems, storage Disclaimer regarding area network and Internet related products for broadband solutions, and Forward-looking Statements electronic components in Japan from other leading suppliers. With a Matters discussed in this annual report, including network spanning 16 countries on three continents, Tokyo Electron forecasts of future business performance of Tokyo Electron, management strategies, beliefs provides superior products and services to its customers, and superior and other statements are based on the returns to its shareholders. Company’s assumption in light of information that is currently available. These forward-looking statements involve known -

Facilitation of Information Transfer on Chemicals in Products

Facilitation of Information Transfer on Chemicals in Products The Ministry of Economy, Trade and Industry (METI) developed ‘chemSHERPA’ [kémʃéərpə] as a new information transfer scheme for chemicals in products throughout their supply chains. METI hopes that the dissemination of chemSHERPA may contribute to reduce the workload of both providers and recipients of the information. From the beginning of the development of chemSHERPA, METI has been in communication with international bodies such as the IEC and the IPC, etc., with the aim of developing chemSHERPA into not only a Japanese standard but also an International standard. To make it a de-facto standard, METI has introduced this scheme to international organizations and governments of other countries for their active use. The Joint Article Management Promotion Consortium (JAMP) is a governing body for chemSHERPA from April 2016 and see a shift to chemSHERPA. We believe many companies are preparing towards implementing chemSHERPA. Based on the efforts mentioned above, the following companies and company groups have agreed with the dissemination of chemSHERPA, and METI will continue to work with JAMP and companies to spread the use of chemSHERPA to internal as well as external supply chains as needed.(Please contact us if any company or company group has interest in putting its name below.) It should be noted, the use of the provision of data entry support tools is free of charge in principle with the aim of promoting wider use of chemSHERPA. [Contact information] Chemical Management Policy Division Manufacturing Industries Bureau Ministry of Economy, Trade and Industry [email protected] 03-3501-0080 (direct) 03-3501-1511 (ex. -

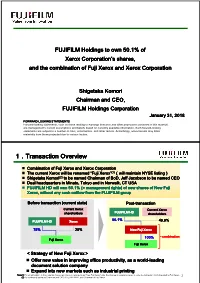

1.Transaction Overview Transaction Overview

FUJIFILM Holdings to own 50.1% of Xerox Corporation’s shares, and the combination of Fuji Xerox and Xerox Corporation Shigetaka Komori Chairman and CEO, FUJIFILM Holdings Corporation January 31, 2018 FORWARDFORWARD----LOOKINGLOOKING STATEMENTS Forward-looking statements, such as those relating to earnings forecasts and other projections contained in this material, are management’s current assumptions and beliefs based on currently available information. Such forward-looking statements are subject to a number of risks, uncertainties, and other factors. Accordingly, actual results may differ materially from those projected due to various factors. 111.1..TransactionTransaction Overview Combination of Fuji Xerox and Xerox Corporation The current Xerox will be renamed “Fuji Xerox” (1)(1)(1) (((will(will maintain NYSE listinglisting)))) Shigetaka Komori (2)(2)(2) to be named Chairman of BoDBoDBoD,BoD , Jeff Jacobson to be named CEO Dual headquarters in Minato, Tokyo and in NorwalkNorwalk,, CT USA FUJIFILM HD will own 50.1% (= management rights) of new sharesharess of New Fuji Xerox, without any cash outflow from the FUJIFILM group Before transaction (current state) PostPost----transactiontransaction Current Xerox Current Xerox FUJIFILM HD shareholders shareholders 50.1% FUJIFILM HD Xerox 50.1% 49.9% 757575%75 %%% 252525%25 %%% New Fuji Xerox 100% combination Fuji Xerox Fuji Xerox <<<Strategy<Strategy of New Fuji XeroxXerox>>>> Offer new value in improving office productivity, as a worldworld----leadingleading document solution company Expand intointointo newnewnew markets such asasas industrial printing Note(1) For simplification, in this material, the current Xerox is referred to as “New Fuji Xerox” after the change in company name, in order to distinguish it with the existing Fuji Xerox. -

Positioning of Imaging Solutions

Business Presentation for Imaging Solutions Businesses FUJIFILM Holdings Corporation Mar. 22, 2018 FORWARD-LOOKING STATEMENTS Forward-looking statements, such as those relating to earnings forecasts and other projections contained in this material, are management’s current assumptions and beliefs based on currently available information. Such forward-looking statements are subject to a number of risks, uncertainties, and other factors. Accordingly, actual results may differ materially from those projected due to various factors. 1 Positioning of Imaging Solutions 2 Imaging Solutions Business Overview 3 History of Imaging Solutions 4 Total World Demand Trend of Color Film 5 Responding to Changes in the Business Environment 6 Producing New Value 7 Changes in the Imaging Solutions Business Large improvements in profitability across the Imaging Solutions business as a whole (Billions of yen) 391.6 374.9 373.6 380.0 360.3 346.0 352.9 341.8 14% 10.8% 9.1% 5.6% 54.0 36.8 1.0% 20.3 32.0 3.6 -0.2% -8.4 -0.8 -12.9 -2.2% -3.3% FY2011/3 FY2012/3 FY2013/3 FY2014/3 FY2015/3 FY2016/3 FY2017/3 FY2018/3 Revenue Operation Operation (forecast) income income margin 8 Imaging Solutions Medium-Term Management Plan “VISION2016” 9 Expand the Instant Photo System Business Globally Digital Instant Printing Lens Camera Camera 10 Expand the Instant Photo System Business Globally Instant Digital Printing Lens Camera Camera 11 Expand the Printing Business Instant Digital Printing Lens Camera Camera 12 Expand the Printing Business Fujifilm shipment basis in Japan, -

Dicelab Process Development Printer

DICElab Process Development Printer Precision Process Development with Inkjet Technology Single pass inkjet printing is ideal for a wide variety of high-volume manufacturing applications. The DICElab Process Development Printer is a modular print system that uses the proven DICEblade inkjet sub-system to deposit inks and other fluids onto a variety of substrates. This enables manufacturers to quickly bring new inkjet applications from concept to production, using real-world production printheads. Applications include:. The DICElab is built up from a series of highly configureable • Materials and process development (“from lab and expandable modules. A basic configuration includes the to fab”) following: • Ink & functional fluid performance testing with 1. DICEblade, one per color or printhead style, with ink supply, different substrates drive electronics, printbar and automated head tending. • Printhead performance testing 2. Client specified printhead types from manufacturer’s like Fujifilm, Kyocera, Konica Minolta, Ricoh, and Xaar. • Cure lamp and pinning lamp testing 3. Two Core Chuck Servo Blocks • Visual inspection of roll-fed products 4. Web Extension Block • Narrow web product printing (e.g. labels, tickets, 5. Machine base tags) with fixed or variable data and barcodes 6. Motorized Printbar Mount (X-Z stage with theta cams) • Printing on 3D objects (with conveyor option) 7. Integrated Power distribution, PC & Software The DICElab printer uses a user-configurable Additional material user-exchangeable transport options: material handling system that is flexible enough • Conveyor for most process development work – and is • Slide-table readily scalable to production volumes. Users can The DICEblade can be easily and quickly removed for service, easily add to the basic configuration to provide This allows complete access to both sides of each printhead, for: increased web path length, multiple heads, UV drive electronics and ink supply. -

Press Release

Press Release Fujifilm Sericol India launches color+ KSO ink designed for Konica Minolta KM 512i print head color+ KSO print samples displayed at Media expo 2016, New Delhi New Delhi , 22 September 2016: Fujifilm Sericol india launched its new color+ KSO ink designed for Konica Minolta KM 512i print heads at Media Expo 2016. The ink is compatible with Allwin, Flora, Infinity, JHF, Colorjet and other brands of printers. Color+ KSO is a solvent based digital ink which offers CMYK colours and has a maximum of 24 month outdoor durability. Speaking on this occassion, Mr. Ganesh Krishnan, Executive Director, Marketing at Fujifilm Sericol said “the new color+ KSO ink which is designed for Konica Minolta KM 512i print head is capable of producing high quality output and delivers a wide gamut of vibrant colours. Color+ KSO has shown exceptional results on 30 picoliter drop size of KM 512i print head. “ The new color+ KSO ink is expected to attract a lot of attention from printer who have recently upgraded their machines to KM 512i print head. Press Release About Fujifilm Sericol India Pvt. Ltd. : Among the top ten printing ink suppliers globally, Fujifilm Sericol is widely recognized for its strong service ethics, innovation and product quality.With manufacturing facilities in three continents, distribution network in 80 countries and marketing units at all major global locations, Fujifilm Sericol has established itself as a major provider of robust ink solutions to the Screen, Digital and Narrow Web industries. For further information, Please Contact Mr. Baibhav Nath, Senior Executive- Marketing Mob: +91 9545550911, Email : [email protected]. -

L E N S E S & a C C E S S O R I

P. 4 P. 5 P. 6 P. 7 Scott Grant / Hai Tre / Jeff Carter / Gathot Subroto / Canada Vietnam UK Indonesia P. 8 P. 9 P.10 Matt Hart / Bert Stephani / Max De Martino / UK Belgium Italy P.11 P.12 P.13 P.14 Omar Z Robles / Simone Sbarglia / Pål Laukli / LS Trung / U.S.A. Italy Norway Vietnam P.15 P.16 P.17 Yonghui Wang / Supalerk Fabian De Backer / China Narubetkrausee / Belgium Thailand P.18 P.19 P.20 Taeyoung An / Joe Ng / Chalit Padoongcheep / Korea Canada Thailand P.21 P.21 Torwong Salwala / Giulia Torra / Thailand Italy Cover_P.2-3 Jonas Dyhr Rask / Denmark Specifications are subject to change without notice. LENSES & ACCESSORIES For more information, please visit our website: http://www.http://fujifilm-x.com/en/accessories/ c 2016 FUJIFILM Corporation P2-3/P36 The vision of the X Series, the choice for X Series owners A collection of creativity-oriented lenses, which complement the X-Trans CMOS sensor perfectly and eliminate the low-pass filter for ultimate sharpness. X Mount Lenses _ P.4-21 Accessories _ P.23-29 Technology _ P.30-33 Specifications _ P.34-35 2 3 P4-5/P36 XF14mmF2.8 R XF16mmF1.4 R WR X-T2 : F11 1/4 sec. ISO200 Scott Grant / Canada High resolving power across the frame from the centre to the edges. This ultra-wide-angle lens, which has a diagonal angle of view greater than 90°, produces extraordinary images. Distortion has been kept to a measured value of zero, with sharpness right across the frame, even when the subject is near the edges. -

Popular Storage Device with Fujifilm Quality the Xd-Picture Card™ Is A

Popular storage device with Fujifilm quality The xD-Picture Card™ is a newly- developed ultra-compact storage media that is set to be a standard in the future of digital imaging. Despite its tiny dimensions, it boasts incredible storage capacities. : : : 16MB - - - N072980A 32MB - - - N072990A 64MB - - - N073000A 128MB - - - N073010A 256MB - - - N073020A *Compressed image size varies depending on the subject being photographed, therefore the number of images that can be recorded on a card may vary. Development of the xD-Picture Card™ Ultra-Compact Digital Camera Memory Media Q: What does 'xD' actually mean? A: It was inspired by 'eXtreme digital', suggesting the excellence of this new memory media for recording, storing and transporting audiovisual information. Q: What is the rationale for this new format? A: There is a consumer demand for greater memory capacity, as well as the development of smaller and more innovative digital camera designs. Also, speed of storage is increasingly an issue as large image files and movie files become more and more common. Q: Which companies were involved in the development of the xD- Picture Card™? A: The card format was jointly developed by Fujifilm and Olympus. Q: Will Fujifilm cameras accept the Olympus xD-Picture Card™, and vice versa? A: Yes, but the use of the original equipment manufacturer's cards are recommended to ensure total support. Q: Who will manufacture the xD-Picture Card™? A: Initially, the production of the media will be by Toshiba Corporation. Q: What will be the availability of the media? A: xD-Picture Card™s will be available in all regions where Fujifilm and Olympus digital cameras are sold.