United Bermuda Party's Reply to the Budget Speech Delivered by Mr

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

General Assembly 1 June 1998

United Nations A/AC.109/2109 Distr.: General General Assembly 1 June 1998 Original: English Special Committee on the Situation with regard to the Implementation of the Declaration on the Granting of Independence to Colonial Countries and Peoples Bermuda Working paper prepared by the Secretariat Contents Paragraphs Page I. General .................................................................. 1–3 3 II. Constitutional and political developments .................................... 4–11 3 A. General ............................................................. 4–9 3 B. Political parties and elections ......................................... 10–11 3 III. Activities related to the withdrawal of military bases .......................... 12–15 3 IV. Economic conditions ...................................................... 16–47 4 A. General ............................................................. 16–21 4 B. Public finance ....................................................... 22–27 5 C. Banking ............................................................ 28–30 5 D. International business ................................................ 31–36 5 E. Transport and communications ........................................ 37–39 6 F. Tourism ............................................................ 40–47 6 V. Social conditions .......................................................... 48–56 7 A. Race relations ....................................................... 48–49 7 B. Labour ............................................................ -

Budget Statement in Support of the Estimates of Revenue and Expenditure 2006-2007. Presented By

BUDGET STATEMENT IN SUPPORT OF THE ESTIMATES OF REVENUE AND EXPENDITURE 2006/07 Presented by The Hon. Paula A. Cox, J.P., M.P. Minister of Finance To His Honour the Speaker and Members of the Honourable House of Assembly Mr. Speaker, Our objective is to build a strong economy and a fair society where there is opportunity and security for all. Our goal is to make the economy work for the people of Bermuda – consumers and business alike in a way that operates fairly and that benefits our young people and seniors. The National Budget 2006/07 ushers in a new wave – an ‘Age of Empowerment’, as we look to a better future. In every single year between 1998 and 2005, the Progressive Labour Party Government has framed economic and financial policies that have delivered positive GDP growth to the Bermuda economy for the benefit of Bermudians and residents alike. While we do not have final data for 2005, the signals from strategic sectors of the economy indicate a seventh successive year of economic growth in 2005. The National Budget 2006/07 builds upon the firm economic foundation that has been developed and fortified by successive Progressive Labour Party administrations. It will provide resources for programmes and initiatives that seek the following key objectives: 1. Strengthening social cohesion in our community; 2. Developing and training our Bermuda’s youth; 3. Improving the quality of life of our senior citizens; 4. Putting good quality homes within the economic reach of more Bermudian families; and 5. Stabilising, rejuvenating and encouraging business activity in all economic sectors. -

Racism, Oligarchy and Contentious Politics in Bermuda Andrea Dean [email protected]

Western University Scholarship@Western MA Research Paper Sociology Department September 2017 Racism, Oligarchy and Contentious Politics in Bermuda Andrea Dean [email protected] Follow this and additional works at: https://ir.lib.uwo.ca/sociology_masrp Part of the Politics and Social Change Commons Recommended Citation Dean, Andrea, "Racism, Oligarchy and Contentious Politics in Bermuda" (2017). MA Research Paper. 16. https://ir.lib.uwo.ca/sociology_masrp/16 This Dissertation/Thesis is brought to you for free and open access by the Sociology Department at Scholarship@Western. It has been accepted for inclusion in MA Research Paper by an authorized administrator of Scholarship@Western. For more information, please contact [email protected], [email protected]. Racism, Oligarchy and Contentious Politics in Bermuda by Andrea S. Dean A research paper accepted in partial fulfilment of the requirements for the degree of Master of Arts Department of Sociology The University of Western Ontario London, Ontario, Canada Supervisor: Dr. Anton Allahar 2017 ABSTRACT In 1959, ‘blacks’ in Bermuda boycotted the island’s movie theatres and held nightly protests over segregated seating practices. By all accounts the 1959 Theatre Boycott was one of the most significant episodes of contentious politics in contemporary Bermuda, challenging social norms that had been in existence for 350 years. While the trajectory and outcomes of ‘black’ Bermudians’ transgressive social protests could not have been predicted, this analysis uses racism, oligarchy and contentious politics as conceptual tools to illuminate the social mechanisms and processes that eventually led to the end of formal racial segregation in Bermuda after less than three weeks of limited and non-violent collective action. -

Perceptions of Bermudian Leaders About the Philosophies, Major

East Tennessee State University Digital Commons @ East Tennessee State University Electronic Theses and Dissertations Student Works 5-2011 Perceptions of Bermudian Leaders About the Philosophies, Major Purposes, and Effectiveness of the Public School System in Bermuda Since 1987 Vincent Sinclair Williams Jr. East Tennessee State University Follow this and additional works at: https://dc.etsu.edu/etd Part of the Educational Leadership Commons Recommended Citation Williams, Vincent Sinclair Jr., "Perceptions of Bermudian Leaders About the Philosophies, Major Purposes, and Effectiveness of the Public School System in Bermuda Since 1987" (2011). Electronic Theses and Dissertations. Paper 1220. https://dc.etsu.edu/etd/1220 This Dissertation - Open Access is brought to you for free and open access by the Student Works at Digital Commons @ East Tennessee State University. It has been accepted for inclusion in Electronic Theses and Dissertations by an authorized administrator of Digital Commons @ East Tennessee State University. For more information, please contact [email protected]. Perceptions of Bermudian Leaders About the Philosophies, Major Purposes, and Effectiveness of the Public School System in Bermuda Since 1987 __________________ A dissertation presented to the faculty of the Department of Educational Leadership and Policy Analysis East Tennessee State University In partial fulfillment of the requirements for the degree Doctor of Education in Educational Leadership __________________ by Vincent Sinclair Williams, Jr. August 2011 __________________ Dr. Terrence Tollefson, Chair Dr. William Douglas Burgess, Jr. Dr. Eric Glover Dr. Pamela Scott Keywords: Bermuda public education, Bermuda private education, Bermuda education reform, Bermuda philosophy of education, Bermuda secondary school graduation rates, Education and Bermuda ABSTRACT Perceptions of Bermudian Leaders About the Philosophies, Major Purposes, and Effectiveness of the Public School System in Bermuda Since 1987 by Vincent Sinclair Williams, Jr. -

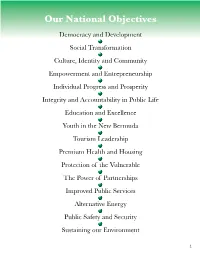

PLP 2007 Platform

Our National Objectives Democracy and Development Social Transformation Culture, Identity and Community Empowerment and Entrepreneurship Individual Progress and Prosperity Integrity and Accountability in Public Life Education and Excellence Youth in the New Bermuda Tourism Leadership Premium Health and Housing Protection of the Vulnerable The Power of Partnerships Improved Public Services Alternative Energy Public Safety and Security Sustaining our Environment 1 Message from the Leader Dr. The Hon. Ewart Brown “We have learnt the art and science of government and we conscientiously practice it to the greatest good of the greatest number of the Bermudian people. Bermuda is on the right track and heading in the right direction under the PLP. We intend to increase the momentum, and that we shall do.” Fellow Bermudians, Bermuda goes to the polls on in the right direction under the 1998 print advertisement with Tuesday, December 18 in an PLP. We intend to increase the a dreadlocked PLP officer and election that will be pivotal to momentum, and that we shall. candidate lined up in the cross our country’s future. Patterns hairs of a sniper’s rifle, wins the of Progress, the PLP Election The choices facing the electorate Piety Award when compared to Manifesto, offers ample bases are to continue to progress with the editorial assault of this cam- on which to decide your choice the PLP or to go back to the past paign of 2007; and the savage in the General Election. Our under the UBP. Because of the smut that is circulated by viral platform has emerged from the horror of forgetfulness, there are email. -

Bound in Bermuda and Virginia: the First Century of Slave Laws and Customs

Central Washington University ScholarWorks@CWU All Master's Theses Master's Theses Winter 2017 Bound in Bermuda and Virginia: the First Century of Slave Laws and Customs Max Tiffany Central Washington University, [email protected] Follow this and additional works at: https://digitalcommons.cwu.edu/etd Part of the African History Commons, and the United States History Commons Recommended Citation Tiffany, Max, "Bound in Bermuda and Virginia: the First Century of Slave Laws and Customs" (2017). All Master's Theses. 600. https://digitalcommons.cwu.edu/etd/600 This Thesis is brought to you for free and open access by the Master's Theses at ScholarWorks@CWU. It has been accepted for inclusion in All Master's Theses by an authorized administrator of ScholarWorks@CWU. For more information, please contact [email protected]. BOUND IN BERMUDA AND VIRGINIA: THE FIRST CENTURY OF SLAVE LAWS AND CUSTOMS A Thesis Presented to The Graduate Faculty Central Washington University In Partial Fulfillment of the Requirement for the Degree Master of Arts History by Max Loren Tiffany February 2017 CENTRAL WASHINGTON UNIVERSITY Graduate Studies We hereby approve the thesis of Max Loren Tiffany Candidate for the degree of Master of Arts APPROVED FOR THE GRADUATE FACULTY ______________ _________________________________________ Dr. Brian Carroll, Committee Chair ______________ _________________________________________ Dr. Jason Knirck ______________ _________________________________________ Dr. Daniel Herman ______________ _________________________________________ Dean of Graduate Studies ii ABSTRACT BOUND IN BERMUDA AND VIRGINIA: THE FIRST CENTURY OF SLAVE LAW AND CUSTOMS by Max Loren Tiffany February 2017 This study looks at the differing early slave societies of colonial Virginia and Bermuda. Specifically, this study looks at how the first century of slave laws and customs in the respective colonies varied so greatly. -

Approved Estimates of Revenue and Expenditure for the Year 2018/19

GOVERNMENT OF BERMUDA APPROVED ESTIMATES OF REVENUE AND EXPENDITURE FOR THE YEAR 2018/19 Printed in Bermuda by The Bermuda Press Ltd. TABLE OF CONTENTS SECTION A - SUMMARY ANALYSIS SUMMARY OF CONSOLIDATED FUND ESTIMATES...................................................A 1 SUMMARY BY DEPARTMENT OF -CURRENT ACCOUNT REVENUE....................................................A 2 -CURRENT ACCOUNT EXPENDITURE...........................................A 5 -CAPITAL ACCOUNT EXPENDITURE...............................................A 9 -EMPLOYMENT ...............………......................................…….. A 11 ANALYSIS OF CURRENT ACCOUNT REVENUE...........................................................A 4 ANALYSIS OF CURRENT ACCOUNT EXPENDITURE.................................................A 8 SECTION B - CURRENT ACCOUNT ESTIMATES EXPLANATORY NOTES...............................................................................................................................B 1 NON-MINISTRY DEPARTMENTS B 6 HEAD 01 GOVERNOR & STAFF.......................................................................B 7 02 LEGISLATURE……………………………………………………………B 10 05 OFFICE OF THE AUDITOR GENERAL.............................................................................................................B 14 56 HUMAN RIGHTS COMMISSION……………………………………….B 17 63 PARLIAMENTARY REGISTRAR…………….…………………………B 20 85 OMBUDSMAN'S OFFICE…………………………………………………B 24 92 INTERNAL AUDIT………..……………………………………………….B 29 98 INFORMATION COMMISSIONER'S OFFICE…………………………B 32 101 PRIVACY COMMISSIONER'S -

Bermuda Consists of a Group of Islands Approximately 650 Miles from the American Mainland, with a Total Area of 19 L/2 Square Miles

Bermuda consists of a group of islands approximately 650 miles from the American mainland, with a total area of 19 l/2 square miles. The present population is about 32,000, or more than 1,600 to the square mile. The islands were colonized by Britain in the early 17th century and have remained British since. Bermuda enjoys a large measure of self government and takes pride in the fact that the elected House of Assembly is the second oldest Parliament in the British Empire, being preceded in seniority only by Westminster. The franchise is not universal, but is based upon a property qualification. Unquestionably this restricted franchise has led to conservative government, as legislators are elected by those who, through possession of property, have a stake in the community. The Government has always pursued policies which have tended to pre serve the peace, charm and amenities of the Islands, not only for the purpose of attracting visitors from Canada and the United States, but because the preservation of such amenities is essential to the Bermuda way of life* It may be noted, as a case in point, that automobiles have been banned since a brief experience prior to the World War and it is certain that no responsible opinion would sponsor an attempt to reintroduce mechanical road transport. Large areas of the islands, in recent years, have been devoted to recreational purposes as the development of the tourist industry has required. Golf courses, especially at Riddell* s Bay and in the Tucker1 s Town Development, have removed substantial acreage which formerly supported considerable numbers of people, and many large land holdings and estates, purchased by Canadians and Americans, have further contributed to population congestion in areas which remain available for habita tion. -

The Assessment of Bermuda's National Money Laundering

THE ASSESSMENT OF BERMUDA’S NATIONAL MONEY LAUNDERING AND TERRORIST FINANCING RISK Report Table of Contents Foreword ....................................................................................................................................................... 4 Executive Summary ................................................................................................................................... 5 Chapter 1: Introduction and Context ............................................................................................................. 7 Relevant FATF requirements ............................................................................................................................................ 7 Bermuda’s Geographical Context ..................................................................................................................................... 8 Bermuda’s Political and Juridical Context ......................................................................................................................... 8 Bermuda’s Economic and Social Context .......................................................................................................................... 8 Chapter 2: Bermuda’s AML/ATF Legislative Framework and Key Agencies ............................................... 10 Legislative Framework ................................................................................................................................................... 10 Core Legislation ................................................................................................................................................ -

A Heritage Ethnography with Museum Implications

Community uses of maritime heritage in Bermuda: A heritage ethnography with museum implications Charlotte Andrews University of Cambridge 2010 COMMUNITY USES OF MARITIME HERITAGE IN BERMUDA: A HERITAGE ETHNOGRAPHY WITH MUSEUM IMPLICATIONS This dissertation is submitted for the degree of Doctor of Philosophy CHARLOTTE ANDREWS HUGHES HALL UNIVERSITY OF CAMBRIDGE 2010 Declaration This dissertation was written for the sole purpose of fulfilment of the requirements for the degree of Doctor of Philosophy. It is based on original and independent research undertaken while a doctoral candidate in the Department of Archaeology at the University of Cambridge. This dissertation is the result of my own work and includes nothing which is the outcome of work done in collaboration except where specifically indicated in the text. Statement of Length This dissertation does not exceed the limit of 80,000 words (or 350 pages) plus a 20,000 word extension, stipulated and approved by the Archaeology and Anthropology Degree Committee and the Board of Graduate Studies at the University of Cambridge. ii Acknowledgments Although positioned in this preface, it is preferable for the acknowledgments that follow to be read after the dissertation. I say this as a spoiler warning for forthcoming discussions of my positioning and because it is the research itself that, I hope, reflects all that has been so generously given to me by those acknowledged below. These gifts include significant time and effort on the part of many people as well as their trust, flexibility and patience. For me, this project was not simply about ‘getting a PhD’ but about making the most of my graduate and research experiences, optimising the opportunity to listen, think and explore. -

General Assembly Distr.: General 6 February 2015

United Nations A/AC.109/2015/6 General Assembly Distr.: General 6 February 2015 Original: English Special Committee on the Situation with regard to the Implementation of the Declaration on the Granting of Independence to Colonial Countries and Peoples Bermuda Working paper prepared by the Secretariat Contents Page The Territory at a glance ......................................................... 3 I. Constitutional, legal and political issues ............................................ 4 II. Budget ....................................................................... 5 III. Economic conditions ............................................................ 5 A. General ................................................................... 5 B. Financial services .......................................................... 5 C. Tourism .................................................................. 7 D. Construction .............................................................. 7 E. Transport and communications ............................................... 7 IV. Social conditions ............................................................... 8 A. General ................................................................... 8 B. Labour ................................................................... 8 C. Education ................................................................. 9 D. Public health .............................................................. 9 Note: The information contained in the present paper has been derived from -

Economic Benefits from Air Transport in the Caribbean Islands

pro Economic Benefits from Air Transport in the Caribbean Islands Caribbean report Acknowledgements Oxford Economics gratefully acknowledge the help that we received from the International Air Transport Association (IATA) in preparation of this report. Through a survey conducted by IATA many organisations across the aviation industry supplied us with data that has formed an integral part of our analysis. In addition, the Airports Council International (ACI) very kindly provided us data on the economic activities at airports. We would like to thank all these organisations for their generosity in supplying this data, without which this report could not have been written. A note on the data reported in the report Unless otherwise stated, the numbers reported in this report relate to the calendar year 2009. Oxford Economics 2011 v1.1 2 Caribbean report Contents Facts & figures .......................................................................................... 5 1 Enabling long-term economic growth ............................................ 7 1.1 Connectivity ................................................................................................ 7 1.2 Catalytic effects – tourism .......................................................................... 8 1.2.1 The Bahamas ..................................................................................... 9 1.2.2 Cuba ................................................................................................... 9 1.2.3 Grenada ..........................................................................................