Three Doors Anomaly, “Should I Stay, Or Should I Go”: an Artefactual Field

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1 Sequential Games

1 Sequential Games We call games where players take turns moving “sequential games”. Sequential games consist of the same elements as normal form games –there are players, rules, outcomes, and payo¤s. However, sequential games have the added element that history of play is now important as players can make decisions conditional on what other players have done. Thus, if two people are playing a game of Chess the second mover is able to observe the …rst mover’s initial move prior to making his initial move. While it is possible to represent sequential games using the strategic (or matrix) form representation of the game it is more instructive at …rst to represent sequential games using a game tree. In addition to the players, actions, outcomes, and payo¤s, the game tree will provide a history of play or a path of play. A very basic example of a sequential game is the Entrant-Incumbent game. The game is described as follows: Consider a game where there is an entrant and an incumbent. The entrant moves …rst and the incumbent observes the entrant’sdecision. The entrant can choose to either enter the market or remain out of the market. If the entrant remains out of the market then the game ends and the entrant receives a payo¤ of 0 while the incumbent receives a payo¤ of 2. If the entrant chooses to enter the market then the incumbent gets to make a choice. The incumbent chooses between …ghting entry or accommodating entry. If the incumbent …ghts the entrant receives a payo¤ of 3 while the incumbent receives a payo¤ of 1. -

Notes on Sequential and Repeated Games

Notes on sequential and repeated games 1 Sequential Move Games Thus far we have examined games in which players make moves simultaneously (or without observing what the other player has done). Using the normal (strategic) form representation of a game we can identify sets of strategies that are best responses to each other (Nash Equilibria). We now focus on sequential games of complete information. We can still use the normal form representation to identify NE but sequential games are richer than that because some players observe other players’decisions before they take action. The fact that some actions are observable may cause some NE of the normal form representation to be inconsistent with what one might think a player would do. Here’sa simple game between an Entrant and an Incumbent. The Entrant moves …rst and the Incumbent observes the Entrant’s action and then gets to make a choice. The Entrant has to decide whether or not he will enter a market or not. Thus, the Entrant’s two strategies are “Enter” or “Stay Out”. If the Entrant chooses “Stay Out” then the game ends. The payo¤s for the Entrant and Incumbent will be 0 and 2 respectively. If the Entrant chooses “Enter” then the Incumbent gets to choose whether or not he will “Fight”or “Accommodate”entry. If the Incumbent chooses “Fight”then the Entrant receives 3 and the Incumbent receives 1. If the Incumbent chooses “Accommodate”then the Entrant receives 2 and the Incumbent receives 1. This game in normal form is Incumbent Fight if Enter Accommodate if Enter . -

SEQUENTIAL GAMES with PERFECT INFORMATION Example

SEQUENTIAL GAMES WITH PERFECT INFORMATION Example 4.9 (page 105) Consider the sequential game given in Figure 4.9. We want to apply backward induction to the tree. 0 Vertex B is owned by player two, P2. The payoffs for P2 are 1 and 3, with 3 > 1, so the player picks R . Thus, the payoffs at B become (0, 3). 00 Next, vertex C is also owned by P2 with payoffs 1 and 0. Since 1 > 0, P2 picks L , and the payoffs are (4, 1). Player one, P1, owns A; the choice of L gives a payoff of 0 and R gives a payoff of 4; 4 > 0, so P1 chooses R. The final payoffs are (4, 1). 0 00 We claim that this strategy profile, { R } for P1 and { R ,L } is a Nash equilibrium. Notice that the 0 00 strategy profile gives a choice at each vertex. For the strategy { R ,L } fixed for P2, P1 has a maximal payoff by choosing { R }, ( 0 00 0 00 π1(R, { R ,L }) = 4 π1(R, { R ,L }) = 4 ≥ 0 00 π1(L, { R ,L }) = 0. 0 00 In the same way, for the strategy { R } fixed for P1, P2 has a maximal payoff by choosing { R ,L }, ( 00 0 00 π2(R, {∗,L }) = 1 π2(R, { R ,L }) = 1 ≥ 00 π2(R, {∗,R }) = 0, where ∗ means choose either L0 or R0. Since no change of choice by a player can increase that players own payoff, the strategy profile is called a Nash equilibrium. Notice that the above strategy profile is also a Nash equilibrium on each branch of the game tree, mainly starting at either B or starting at C. -

The Extensive Form Representation of a Game

The extensive form representation of a game Nodes, information sets Perfect and imperfect information Addition of random moves of nature (to model uncertainty not related with decisions of other players). Mas-Colell, pp. 221-227, full description in page 227. 1 The Prisoner's dilemma Player 2 confess don't confess Player 1 confess 2.2 10.0 don't confess 0.10 6.6 One extensive form representation of this normal form game is: 2 Player 1 confess don't confess Player 2 Player 2 confessdon't confess confess don't confess 2 10 0 6 payoffs 2 0 10 6 3 Both players decide whether to confess simultaneously (or more exactly, each player decides without any information about the decision of the other player). This is a game of imperfect information: The information set of player 2 contains more than one decision node. 4 The following extensive form represents the same normal form: Player 2 confess don't confess Player 1 Player 1 confessdon't confess confess don't confess 5 Consider now the following extensive form game: Player 1 confess don't confess Player 2 Player 2 confessdon't confess confess don't confess 2 10 6 0 6 payoffs 2 0 10 6 Now player 2 observes the behavior of player 1. This is a game of perfect information. Strategies of player 2: For instance "If player 1 confesses, I…; if he does not confess, then I…" Player 2 has 4 strategies: (c, c), (c, d), (d, c), (d, d) The normal form of this game is: Player 2 c, c c, d d, c d, d Player 1 confess 2.2 2.2 10.0 10.0 don't confess 0.10 6.6 0.10 6.6 There is only one NE, - strategy confess for player 1 and - strategy (c, c) for player 2. -

What Is Local Optimality in Nonconvex-Nonconcave Minimax Optimization?

What is Local Optimality in Nonconvex-Nonconcave Minimax Optimization? Chi Jin Praneeth Netrapalli University of California, Berkeley Microsoft Research, India [email protected] [email protected] Michael I. Jordan University of California, Berkeley [email protected] August 18, 2020 Abstract Minimax optimization has found extensive application in modern machine learning, in settings such as generative adversarial networks (GANs), adversarial training and multi-agent reinforcement learning. As most of these applications involve continuous nonconvex-nonconcave formulations, a very basic question arises—“what is a proper definition of local optima?” Most previous work answers this question using classical notions of equilibria from simultaneous games, where the min-player and the max-player act simultaneously. In contrast, most applications in machine learning, including GANs and adversarial training, correspond to sequential games, where the order of which player acts first is crucial (since minimax is in general not equal to maximin due to the nonconvex-nonconcave nature of the problems). The main contribution of this paper is to propose a proper mathematical definition of local optimality for this sequential setting—local minimax—as well as to present its properties and existence results. Finally, we establish a strong connection to a basic local search algorithm—gradient descent ascent (GDA)—under mild conditions, all stable limit points of GDA are exactly local minimax points up to some degenerate points. 1 Introduction arXiv:1902.00618v3 [cs.LG] 15 Aug 2020 Minimax optimization refers to problems of two agents—one agent tries to minimize the payoff function f : X × Y ! R while the other agent tries to maximize it. -

Extensive Form Games and Backward Induction

Recap Perfect-Information Extensive-Form Games Extensive Form Games and Backward Induction ISCI 330 Lecture 11 February 13, 2007 Extensive Form Games and Backward Induction ISCI 330 Lecture 11, Slide 1 Recap Perfect-Information Extensive-Form Games Lecture Overview Recap Perfect-Information Extensive-Form Games Extensive Form Games and Backward Induction ISCI 330 Lecture 11, Slide 2 I The extensive form is an alternative representation that makes the temporal structure explicit. I Two variants: I perfect information extensive-form games I imperfect-information extensive-form games Recap Perfect-Information Extensive-Form Games Introduction I The normal form game representation does not incorporate any notion of sequence, or time, of the actions of the players Extensive Form Games and Backward Induction ISCI 330 Lecture 11, Slide 3 I Two variants: I perfect information extensive-form games I imperfect-information extensive-form games Recap Perfect-Information Extensive-Form Games Introduction I The normal form game representation does not incorporate any notion of sequence, or time, of the actions of the players I The extensive form is an alternative representation that makes the temporal structure explicit. Extensive Form Games and Backward Induction ISCI 330 Lecture 11, Slide 3 Recap Perfect-Information Extensive-Form Games Introduction I The normal form game representation does not incorporate any notion of sequence, or time, of the actions of the players I The extensive form is an alternative representation that makes the temporal -

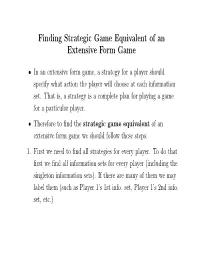

Finding Strategic Game Equivalent of an Extensive Form Game

Finding Strategic Game Equivalent of an Extensive Form Game • In an extensive form game, a strategy for a player should specify what action the player will choose at each information set. That is, a strategy is a complete plan for playing a game for a particular player. • Therefore to find the strategic game equivalent of an extensive form game we should follow these steps: 1. First we need to find all strategies for every player. To do that first we find all information sets for every player (including the singleton information sets). If there are many of them we may label them (such as Player 1’s 1st info. set, Player 1’s 2nd info. set, etc.) 2. A strategy should specify what action the player will take in every information set which belongs to him/her. We find all combinations of actions the player can take at these information sets. For example if a player has 3 information sets where • the first one has 2 actions, • the second one has 2 actions, and • the third one has 3 actions then there will be a total of 2 × 2 × 3 = 12 strategies for this player. 3. Once the strategies are obtained for every player the next step is finding the payoffs. For every strategy profile we find the payoff vector that would be obtained in case these strategies are played in the extensive form game. Example: Let’s find the strategic game equivalent of the following 3-level centipede game. (3,1)r (2,3)r (6,2)r (4,6)r (12,4)r (8,12)r S S S S S S r 1 2 1 2 1 2 (24,8) C C C C C C 1. -

Revealed Preferences of Individual Players in Sequential Games

Revealed Preferences of Individual Players in Sequential Games Hiroki Nishimura∗ January 14, 2021 Abstract This paper studies rational choice behavior of a player in sequential games of perfect and complete information without an assumption that the other players who join the same games are rational. The model of individually rational choice is defined through a decomposition of the behavioral norm assumed in the subgame perfect equilibria, and we propose a set of axioms on collective choice behavior that characterize the individual rationality obtained as such. As the choice of subgame perfect equilibrium paths is a special case where all players involved in the choice environment are each individually rational, the paper offers testable characterizations of both individual rationality and collective rationality in sequential games. JEL Classification: C72, D70. Keywords: Revealed preference, individual rationality, subgame perfect equilibrium. 1 Introduction A game is a description of strategic interactions among players. The players involved in a game simultaneously or dynamically choose their actions, and their payoffs are determined by a profile of chosen actions. A number of solution concepts for games, such as the Nash equilibrium or the subgame perfect equilibrium, have been developed in the literature in order to study collective choice of actions made by the players. In turn, these solution concepts are widely applied in economic analysis to provide credible predictions for the choice of economic agents who reside in situations approximated by games. ∗Department of Economics, University of California Riverside. Email: [email protected]. I am indebted to Efe A. Ok for his continuous support and encouragement. I would also like to thank Indrajit Ray, anonymous referees, and an associate editor for their thoughtful suggestions. -

Lecture Notes Part 2

Claudia Vogel Mathematics for IBA Winter Term 2009/2010 Outline 5. Game Theory • Introduction & General Techniques • Sequential Move Games • Simultaneous Move Games with Pure Strategies • Combining Sequential & Simultaneous Moves • Simultaneous Move Games with Mixed Strategies • Discussion Claudia Vogel: Game Theory and Applications 2 Motivation: Why study Game Theory? • Games are played in many situation of every days life – Roomates and Families – Professors and Students – Dating • Other fields of application – Politics, Economics, Business – Conflict Resolution – Evolutionary Biology – Sports Claudia Vogel: Game Theory and Applications 3 The beginnings of Game Theory 1944 “Theory of Games and Economic Behavior“ Oskar Morgenstern & John Neumann Claudia Vogel: Game Theory and Applications 4 Decisions vs Games • Decision: a situation in which a person chooses from different alternatives without concerning reactions from others • Game: interaction between mutually aware players – Mutual awareness: The actions of person A affect person B, B knows this and reacts or takes advance actions; A includes this into his decision process Claudia Vogel: Game Theory and Applications 5 Sequential vs Simultaneous Move Games • Sequential Move Game: player move one after the other – Example: chess • Simultaneous Move Game: Players act at the same time and without knowing, what action the other player chose – Example: race to develop a new medicine Claudia Vogel: Game Theory and Applications 6 Conflict in Players‘ Interests • Zero Sum Game: one player’s gain is the other player’s loss – Total available gain: Zero – Complete conflict of players’ interests • Constant Sum Game: The total available gain is not exactly zero, but constant. • Games in trade or other economic activities usually offer benefits for everyone and are not zero-sum. -

Part 4: Game Theory II Sequential Games

Part 4: Game Theory II Sequential Games Games in Extensive Form, Backward Induction, Subgame Perfect Equilibrium, Commitment June 2016 Games in Extensive Form, Backward Induction, SubgamePart 4: Perfect Game Equilibrium, Theory IISequential Commitment Games () June 2016 1 / 17 Introduction Games in Extensive Form, Backward Induction, SubgamePart 4: Perfect Game Equilibrium, Theory IISequential Commitment Games () June 2016 2 / 17 Sequential Games games in matrix (normal) form can only represent situations where people move simultaneously ! sequential nature of decision making is suppressed ! concept of ‘time’ plays no role but many situations involve player choosing actions sequentially (over time), rather than simultaneously ) need games in extensive form = sequential games example Harry Local Latte Starbucks Local Latte 1; 2 0; 0 Sally Starbucks 0; 0 2; 1 Battle of the Sexes (BS) Games in Extensive Form, Backward Induction, SubgamePart 4: Perfect Game Equilibrium, Theory IISequential Commitment Games () June 2016 3 / 17 Battle of the Sexes Reconsidered suppose Sally moves first (and leaves Harry a text-message where he can find her) Harry moves second (after reading Sally’s message) ) extensive form game (game tree): game still has two Nash equilibria: (LL,LL) and (SB,SB) but (LL,LL) is no longer plausible... Games in Extensive Form, Backward Induction, SubgamePart 4: Perfect Game Equilibrium, Theory IISequential Commitment Games () June 2016 4 / 17 Sequential Games a sequential game involves: a list of players for each player, a set -

Section Note 3

Section Note 3 Ariella Kahn-Lang and Guthrie Gray-Lobe∗ February 13th 2013 Agenda 1. Game Trees 2. Writing out Strategies and the Strategy Space 3. Backwards Induction 1 Game Trees Let's review the basic elements of game trees (extensive form games). Remember, we can write any game in either its normal (matrix) form or its extensive (tree) form - which representation we use is mainly a question of which solution concept we want to implement. Game trees are particularly useful for representing dynamic (sequential) games, primarily be- cause they easily allow us to implement the simple solution concept of backwards induction (see later). 1.1 Dynamic Games vs. Simultaneous Games Many important economic applications in game theory cannot be described by a simultaneous move game. Recall that a simultaneous game is one where all players were choosing their actions without any information about actions chosen by other players. A dynamic game, in contrast, is one where at least one player at some point of the game is choosing his action with some information about actions chosen previously. While dynamic games are often sequential over time, what matters is not the timing, but the information a player holds about previous moves in the game, because this is what enables them to condition their strategy on previous moves. For this reason, the `order' in which we draw a game tree matters only in getting the flow of information correctly. In simultaneous games, we can draw the game tree either way round and it represents the same game. ∗Thanks to previous years' TF's for making their section materials available for adaptation. -

Sequential Games Sequential Games

Sequential games Sequential games A sequential game is a game where one player chooses his action before the others choose their. We say that a game has perfect information if all players know all moves that have taken place. Sequential games Sequential games We may play the dating game as a sequential game. In this case, one player, say Connie, makes a choice before the other. Connie Football Drink Football (20,5) (0,0) Roy Drink (0,0) (5,20) Game tree Connie Football Drink Roy Roy Football Drink Football Drink (20,5) (0,0) (0,0) (5,20) Payoffs to: (Roy,Connie) Backward induction Connie Football Drink (20,5) (5,20) Football Drink Football Drink (20,5) (0,0) (0,0) (5,20) Payoffs to: (Roy,Connie) Backward induction Connie Football Drink (20,5) (5,20) Football Drink Football Drink (20,5) (0,0) (0,0) (5,20) Payoffs: (5,20) Game tree Suppose Roy chooses first. Roy Football Drink Connie Connie Football Drink Football Drink (20,5) (0,0) (0,0) (5,20) Payoffs to: (Roy,Connie) Game tree Roy Football Drink (20,5) (5,20) Football Drink Football Drink (20,5) (0,0) (0,0) (5,20) Payoffs: (20,5) Game tree Connie Roy Football Drink Football Drink (20,5) (5,20) (20,5) (5,20) Football Drink Football Drink Football Drink Football Drink (20,5) (0,0) (0,0) (5,20) (20,5) (0,0) (0,0) (5,20) Payoffs: (5,20) Payoffs: (20,5) In dating game, the first player to choose has an advantage.