Bangalore City Cluster Development Project

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

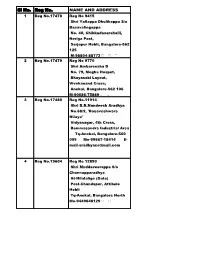

Sl No. Reg No. NAME and ADDRESS 1 Reg No.17478 Reg No 9415 Shri Yallappa Dhulikoppa S/O Basavalingappa No

Sl No. Reg No. NAME AND ADDRESS 1 Reg No.17478 Reg No 9415 Shri Yallappa Dhulikoppa S/o Basavalingappa No. 40, Chikkadasarahalli, Neriga Post, Sarjapur Hobli, Bangalore-562 125 M-98804-88772 2 Reg No.17479 Reg No 9770 Shri Ambareesha D No. 79, Megha Hospet, Bhayasabi Layout, Vivekanand Cross, Anekal, Bangalore-562 106 M-90086-75889 3 Reg No.17480 Reg No.11914 Shri B.R.Nandeesh Aradhya No.68/2, 'Basaveshwara Nilaya' Vidyanagar, 4th Cross, Bommasandra Industrial Area Tq-Anekal, Bangalore-560 099 Mo-99867-18414 E- [email protected] 4 Reg No.19604 Reg No 12890 Shri Muddaveerappa S/o Channapparadhya At-Hilalalige (Gate) Post-Chandapur, Attibele Hobli Tq-Anekal, Bangalore North Mo-9449648129 5 Reg No.24386 Reg No 12930 Shri Purushotham Y.R. S/o H.N.Rudramuniyappa Mahadeshwara Stores, H.N.R. Comples, Yadavanahalli Gate Attibele Hobli, Tq-Anekal Bangalore-562107 Mo- 9916970059 6 Reg No.24388 Reg No 12931 Shri Arun Aradhya M S/o Mallikarjuna At & Post-Yadavanahalli-562 107 Attibele Hobli, Tq-Anekal, Bangalore Mo- 9900776813 7 Reg No.27985 Reg No.13438 Shri Sharanabasava Hiremath S/o H.M.Siddaiah S.M.M.Enterprises, Gopalareddy Building Near Canara Computer, Vinayakanagar, Tirupalya Road, Hebbagodi Bangalore-560 099 Mo- 9880545450 8 Reg No.2360 Reg No.13439 Shri Basavaraja Moke S/o Jambanna Moke Sharma Building, Gollahalli Road, Near S.B.I.(ATM) Hebbagodi Bangalore-560 099 Mo-9945975209 9 Reg No.2361 Reg No.13440 Shri Ravi Chandra E S/o Eshwarappa Susheelamma Building, Vinayakanagar Hebbagodi Bangalore-560 099 Mo-9880610078 10 Reg No.11711 Reg No.13441 Shri Veeresh Lalasangi S/o Shivaputrappa NO.52, Balappa Reddy Building Vinayakanagar Hebbagodi Bangalore-560 099 Mo-9739476464 11 Reg No.11712 Reg No.13442 Smt Dhakshayini L.K. -

![Nelamangala Devihalli Expressway Private Limited: Provisional [ICRA]AA-(Stable) Assigned](https://docslib.b-cdn.net/cover/6928/nelamangala-devihalli-expressway-private-limited-provisional-icra-aa-stable-assigned-176928.webp)

Nelamangala Devihalli Expressway Private Limited: Provisional [ICRA]AA-(Stable) Assigned

June 26, 2020 Nelamangala Devihalli Expressway Private Limited: Provisional [ICRA]AA-(Stable) assigned Summary of rating action Instrument* Current Rated Amount Rating Action (Rs. crore) Fund Based – Term Loan 275.00 Provisional [ICRA]AA-(Stable); Assigned Total 275.00 *Instrument details are provided in Annexure-1 Rationale ICRA has assigned Provisional [ICRA]AA- (pronounced as Provisional ICRA double A minus) rating to the Rs. 275.00 crore proposed term loan facilities of Nelamangala Devihalli Expressway Private Limited (NDEPL). The outlook on the rating is Stable. The rating assigned is provisional as of now (as denoted by the prefix ‘Provisional’ before the rating symbol) and is subject to the fulfilment and review of all pending actions/documentation pertaining to the facility rated by ICRA. The final rating may differ from the provisional rating in case the completed actions/documentation are not in line with ICRA’s expectations. The rating takes into account the importance of the project stretch for which NDEPL is proposing to acquire the toll concession rights under the substitution scheme from the NHAI. The project stretch provides connectivity between Bengaluru and Mangaluru, and also to important places such as pilgrim sites like Shiradi, Dharmasthala, Kukke Subramanya, Bellur Udupi and tourist destinations such as Coorg (Madikeri), Udupi, etc. The project has a long track record of toll collection (under the existing SPV/concessionaire) and has recorded healthy traffic growth over the years. The rating also takes into account the proposed transaction (acquisition deal) structure that ensures availability of sufficient funds for the completion of the pending major maintenance (MM) exercise and provision for payment of the applicable penalty to the authority for delay in completion of maintenance. -

Self Study Report 2010-2015 Government Arts College

!# Government of Karnataka Department of Collegiate Education SELF STUDY REPORT 2010-2015 (For 3rd Cycle Re-accreditation) OF GOVERNMENT ARTS COLLEGE DR. AMBEDKAR VEEDHI, BENGALURU-560 001 SUBMITTED TO NATIONAL ASSESSMENT AND ACCREDITATION COUNCIL (NAAC), NAGARABHAVI, BENGALURU-560 056 " !! !# " !! !# CONTENTS PAGE NO. 1 5 Part- I Preface 2 A. Profile 6 Executive Summary B. Criteria 11 C. SWOC 15 17 3 Profile of the Institution Part- II Criteria wise Inputs I Curricular Aspects 29 II Teaching-Learning and Evaluation 42 III Research, Consultancy and Extension 75 IV Infrastructure and Learning Resources 104 V Student Support and Progression 122 VI Governance, Leadership and Management 167 VII Innovations and Best Practices 193 Evaluation Report of the Departments 210 Compliance Report 331 Master Plan 332 Annexures NAAC Certificate 334 Part- III Review Report 335 Affiliation Letter 343 UGC 2(f) 12 (b) 345 Declaration 348 " !! !# PART – I 1. Preface 2. Executive Summary 3. Profile of the Institution " !! !# Government of Karnataka Department of Collegiate Education Office of the Principal Government Arts College, Dr Ambedkar Veedhi, Bengaluru-560 001 PHONE: 080-22211115 Email: [email protected] PREFACE It is a delightful experience to prepare and present the third cycle Self Study Report (SSR) of glorious Government Arts College, Bengaluru, to the National Assessment and Accreditation Council, Bengaluru for re-accreditation in compliance with our Letter of Intent for further quality enhancement of the college. This exercise has provided us an opportunity to review and analyze the institutional progress after the second accreditation and strengthened us in our quest for quality in the times to come. -

Panel Advocate List – Bangalore Co

PANEL ADVOCATE LIST – BANGALORE CO SL No Name of the Advocate Address Contact No E mail id 1. 5Ananthamurthy K R 3/3, Near STD English School, Prashanthanagar, T Dasarahalli, Bengaluru – 560040, III Floor, Dr. Ismail Building, Sardar Patrappa Road, Bengaluru - 560002 2. 6Ananthamurthy T K Off : 159/2, Rangaswamy Temple 3386640 (R) Street, Balepet, Bengaluru – 560003 Res : 598, II Cross, 7th Main, Vijayanagar, Bengaluru - 560040 3. 7Ananthanarayana B N Res : 7/48, 4th Cross, Lingarajapuram, Bengaluru – 560084 Off : 3/8, Karnic Road, Shankarapuram, Bengaluru 4. 8Annapurna Bevinje No. 4, Kodagi Building, Gundopanth Street, (Behind City Market) Bengaluru 5. 1Arakeshwara T N 232, Kadri nivas, 68th Cross, 3353431 / 0 Rajajinagar 5th Block, Bengaluru – 9845126875 560010 6. 1Arun Ponnappa M 702, Silver Lake Terrace, 167, 5583063 1 Richmond Road, Bengaluru - 560025 7. 1C K Annice Res : No.22, Prateeksha Unity Lane, 5714828 (R) 2 9th Cross, Ejipura Vivekanagar, Bengaluru – 560047 5550967 (O) Off : No.35, Lubbay Masjid Road, Bengaluru - 560001 8. 1Ashok N Nayak 105, III Cross, Gandhinagar, 2267332 (O) 4 Bengaluru - 560009 5252909 (R) 9. 1N H Ananthanarasimha No. 19, 10th Main, 27th Cross, 6715453 5Shastri Banashankari II Stage, Bengaluru - 560070 10. 1Ashwathaiah B 15, (I Floor), Link Road, 6 Seshadripuram, Bengaluru - 560020 11. 1Ashwatharanayana K Off : 21/1, Vasavi Vhambers, No. 14, I 6700521, 7 Floor, Kanya Kalyana Mantapa, 9448258115 Lalbagh Fort Road, Near Minerva Circle, Bengaluru – 560004 Res : 1034, 12th A Cross, J P Nagar I Phase, Bengaluru - 560078 12. 1D Ashwathappa 101/226, 25th Cross, 6th Block, 6548552 8 Jayanagar, Bengaluru - 560082 13. 1Ashwin Haladi Off : No. -

Richcore Enzymes Pvt. Ltd. Plot No

SAFETY DATA SHEET CELLULASE I. Product Name and Company Identification Product Name : Cellulase CAS No. : 9012-54-8 Relevant identified uses Of the substance or mixture : Laboratory chemicals, Manufacture of substances Company Identification : Richcore Enzymes Pvt. Ltd. Plot no. 204 & 237, KIADB Industrial area Bommasandra-Jigani link road Bangalore-560105, Karnataka, India. Phone: +91-81-1041 9777 Fax: +91-80-27839574 http://www.richcoreenzymes.com II. Hazardous identification Physical hazards : Not classified. Health hazards : Respiratory sensitization Category 1 Classification according to EU Directives 67/548/EEC or 1999/45/EC May cause sensitisation by inhalation. Label elements : Labelling according Regulation (EC) No 1272/2008 Pictogram : Signal word : Danger Hazard statement: May cause allergy or asthma symptoms or breathing difficulties if inhaled. Avoid breathing dust/ fume/ gas/ mist/ vapours/ spray. If experiencing respiratory symptoms: Call a POISON CENTER or doctor/physician Precautionary statements: Avoid breathing vapours. Avoid contact with skin. Wear suitable protective clothing and gloves. Supplemental Hazard Statements: No data available III. Composition/information on ingredients Chemical Name Common name or CAS number Purity (%) Synonym Cellulase ----- 9012-54-8 -- MSDS/CE80/00 Page 1 of 6 Richcore Enzymes Pvt. Ltd. Plot No.204 & 237,Bommasandra Jigani Link Road, KIADB industrial area, Bangalore-560105, Karnataka,India Tel: +91 8110419777 |Fax: +91 80 2783 9574|www.richcoreenzymes.com| CIN: U24100KA2012PTC067211 IV. First aid measures Description of first aid measures General advice : Consult a physician. Show this safety data sheet to the doctor in attendance. If inhaled : If breathed in, move person into fresh air. If not breathing, give artificial respiration. Consult a physician. -

Study of Small Schools in Karnataka. Final Report.Pdf

Study of Small Schools in Karnataka – Final Draft Report Study of SMALL SCHOOLS IN KARNATAKA FFiinnaall RReeppoorrtt Submitted to: O/o State Project Director, Sarva Shiksha Abhiyan, Karnataka 15th September 2010 Catalyst Management Services Pvt. Ltd. #19, 1st Main, 1st Cross, Ashwathnagar RMV 2nd Stage, Bangalore – 560 094, India SSA Mission, Karnataka CMS, Bangalore Ph.: +91 (080) 23419616 Fax: +91 (080) 23417714 Email: raghu@cms -india.org: [email protected]; Website: http://www.catalysts.org Study of Small Schools in Karnataka – Final Draft Report Acknowledgement We thank Smt. Sandhya Venugopal Sharma,IAS, State Project Director, SSA Karnataka, Mr.Kulkarni, Director (Programmes), Mr.Hanumantharayappa - Joint Director (Quality), Mr. Bailanjaneya, Programme Officer, Prof. A. S Seetharamu, Consultant and all the staff of SSA at the head quarters for their whole hearted support extended for successfully completing the study on time. We also acknowledge Mr. R. G Nadadur, IAS, Secretary (Primary& Secondary Education), Mr.Shashidhar, IAS, Commissioner of Public Instruction and Mr. Sanjeev Kumar, IAS, Secretary (Planning) for their support and encouragement provided during the presentation on the final report. We thank all the field level functionaries specifically the BEOs, BRCs and the CRCs who despite their busy schedule could able to support the field staff in getting information from the schools. We are grateful to all the teachers of the small schools visited without whose cooperation we could not have completed this study on time. We thank the SDMC members and parents who despite their daily activities were able to spend time with our field team and provide useful feedback about their schools. -

Cost of Land in Industrialareas 05.07.2019

KARNATAKA INDUSTRIAL AREAS DEVELOPMENT BOARD INDUSTRIAL AREA/WISE TENTATIVE PRICE OF LAND Sl. INDUSTRIAL AREA Date of PREVAILING No. Revision PRICE/ACRE (B.M.Date) (RS. IN LAKHS) 1 2 3 4 1 BENGALURU URBAN DIST. 1 Attibele 13-03-2012 100.00 2 Bommasandra 13-03-2012 200.00 3 Bommasandra IV Phase 13-03-2012 200.00 4 Bommasandra/Jigani Link Road 13-03-2012 200.00 5 DDK/Dyavasandra I & II 06-09-2007 200.00 6 Electronic City Phase II 06-09-2007 200.00 7 Electronic City Phase III 06-09-2007 200.00 8 EOIZ 06-09-2007 200.00 9 EPIP I & II Phase 06-09-2007 200.00 10 Jigani I & II Phase 13-03-2012 150.00 11 Kadugodi/Sadaramangala 06-09-2007 200.00 12 Kumbalagudu I & II Phase 13-03-2012 100.00 13 Peenya 06-09-2007 200.00 14 Veerasandra 13-03-2012 200.00 15 Kachanayakanahally 13-03-2012 200.00 16 Yarandahalli 13-03-2012 200.00 2 BENGALURU RURAL DIST. 1 Bengaluru Aerospace Park 17-01-2019 250.00 2 Bengaluru Aerospace /SEZ 17-01-2019 250.00 3 Bengaluru IT Park 17-01-2019 250.00 4 Bengaluru Hardware Park 17-01-2019 250.00 5 D.B.Pura Apparel Park I Phase 13-03-2012 80.00 6 D.B.Pura Apparel Park II Phase 13-03-2012 80.00 7 Dobaspet 13-03-2012 70.00 8 Dobaspet II Phase 13-03-2012 70.00 9 Doddaballapura 13-03-2012 60.00 10 Obhadenahally 27-12-2012 129.00 Obednahalli I.A Residential Layout 17-01-2019 Rs.9378 Per Sqmtr 11 Hoskote 13-03-2012 75.00 12 Sompura I & II Phases 11-03-2013 150.00 13 Avverahalli (Dobaspet IV Phase) 11-03-2013 150.00 Avverahalli Sub Layout in Plot no.28 & 29-A 05-03-2019 150.00 Dabaspete IV Phase (Avverahalli) I.A/Sub Layout 06-12-2018 150.00 in plot No. -

No.145 Mulbagal Assembly Constituency Blo Cantact

NO.145 MULBAGAL ASSEMBLY CONSTITUENCY BLO CANTACT LIST District Name : Kolar Polling AC PS Category - Teacher/Non Sl Station Numbe AC Name PS Name Location PS Location Name Name of the BLO Desgn. Teacher (Revenue/Others- Mobile No. Contact address of the BLO No ( PS ) r No. PL Specify ) No. 1 2 3 4 5 6 7 8 9 10 11 12 Government Higher Primary School, East wing, 1 145 Mulbagal 1 V SATHYA Anganawadi Worker Non-Teacher 9886549804 Agara Agara-1 Government Higher Primary 1 School,Agara. Government Higher Primary School, West 2 145 Mulbagal 2 Malashree Anganawadi Worker Non-Teacher 9620159202 Agara wing, Agara-2 Government Higher Primary School, S. Government Higher Primary 3 145 Mulbagal 3 2 V SUMALATHA Anganawadi Worker Non-Teacher 7259977857 S Bissanahalli Bisanahalli School, S. Bisanahalli Government Lower Primary School, Government Lower Primary 4 145 Mulbagal 4 3 AYEESHA Anganawadi Worker Non-Teacher 8105464975 Kondenahalli Kondenahalli School, Kondenahalli Government Lower Primary School, Government Lower Primary 5 145 Mulbagal 5 4 M V VENKATALAKSHMAMMA Anganawadi Worker Non-Teacher 8861576209 Murakanakunte Murakanakunte School, Murakanakunte St. Anne's Higher Primary 6 145 Mulbagal 6 St. Ann's Higher Primary School,Gukunte. 5 V SUJATHA Anganawadi Worker Non-Teacher 8105487056 Gukunte School, Gukunte Government Higher Primary School, V. Government Higher Primary 7 145 Mulbagal 7 6 V GATTAPPA Assitant Master Non-Teacher 9449398978 Muthyalapet Mulbagal Town Hosahalli School, V. Hosahalli Government Lower Primary 8 145 Mulbagal 8 Government -

Ramanagara District

Details of Respective area engineers of BESCOM (Row 2 - District name) (Column 10 - Alphabetical order of Areas) District: Ramanagar Sl Zone Circle Division Sub Division O&M Unit Areas No 1 2 3 4 5 6 7 8 9 10 11 12 Assistant Assistant Superintending Executive Engineer / Name Chief Engineer Name Name Name Executive Name Engineer Engineer Junior Engineer Engineer BRAZ Sri. Siddaraju ramanagara "Sri. Nagarajan chandapura "(EE) 9448234567 94498 41655 Thimmegowda 080-23500117 080-28488780 9448279027 (eechandapura [email protected] [email protected] [email protected] n .in" .in) muniswamy layout Kammasandra ( F-14 Feeder, Electronic city MUSS) bommasandra industrial are 3rd phase bommasandra industrial area 3rd stage near Smt. Jamuna acharya ITI collage padmapriya industrial estate --NPS fa bommasandra village, Concord Wind Rass Appt Ramsagar village heelalige Heelalige Main Road Near "(AEE) 9449865127 BCET Engineering College Chandapura RK Lake Viw, Thimmareddy industrial area old chandapura Vidyanagar, Heelalige grama royal gardenia RS Gardenium Shashidhar M.K aochandapura@gma decathlon Varthur main road Ananthnagar Phase-1 SFS Enclave, Dady's Garden, Golden nest rk city 4th lane neraluru..Dady's Garden, Golden nest ( HT ) VEERA 8277892574 il.com AE Suresh munireddy industrial area, near A2B hotel MR Layout (old chandapura) Banglapete , fortune city noorani masjid Tranquil city Opposite Hebbagodi police SANDRA 8310502355 ANANTHA 1 9449872371, station Infosys colony reliable levendulla house huskur gate hellalige gate royal mist apartment -

355D Bus Time Schedule & Line Route

355D bus time schedule & line map 355D Jigani Apc Cricle View In Website Mode The 355D bus line (Jigani Apc Cricle) has 2 routes. For regular weekdays, their operation hours are: (1) Jigani Apc Cricle: 8:45 AM - 12:50 PM (2) K R Puram: 7:00 AM - 11:00 AM Use the Moovit App to ƒnd the closest 355D bus station near you and ƒnd out when is the next 355D bus arriving. Direction: Jigani Apc Cricle 355D bus Time Schedule 41 stops Jigani Apc Cricle Route Timetable: VIEW LINE SCHEDULE Sunday 8:45 AM - 12:50 PM Monday 8:45 AM - 12:50 PM K.R.Puram Market Tuesday 8:45 AM - 12:50 PM I.T.I.Colony Gate Wednesday 8:45 AM - 12:50 PM K.R.Puram Railway Station Thursday 8:45 AM - 12:50 PM Tin Factory Friday 8:45 AM - 12:50 PM Swamy Vivekananda Road, Bangalore Saturday 8:45 AM - 12:50 PM Mahadevapura Emc 2 Doddanekkundi 355D bus Info Direction: Jigani Apc Cricle Karthiknagara Stops: 41 Trip Duration: 73 min Service Road, Bangalore Line Summary: K.R.Puram Market, I.T.I.Colony Gate, Marathhalli Bridge K.R.Puram Railway Station, Tin Factory, Mahadevapura, Emc 2, Doddanekkundi, Karthiknagara, Marathhalli Bridge, Kadabisanahalli, Kadabisanahalli Devarabisanahalli, Cs-Accenture B7 Eco Space, Bellanduru Junction City Light Apartment, Jn Of Devarabisanahalli Sarjapura Ring Road, Ibbaluru, Agara Junction, Agara/H.S.R, H.S.R B.D.A Complex, Hsr Apartment, Cs-Accenture B7 Eco Space Central Silk Board, Rupena Agrahara, Bommanahalli, Garvebhavi Palya, Kudlu Gate, Singasandra, Hosa Bellanduru Junction City Light Apartment Road, P.E.S.I.T. -

Residential Plot / Land for Sale in Nelamangala, Bangalore

https://www.propertywala.com/P8177991 Home » Bangalore Properties » Residential properties for sale in Bangalore » Residential Plots / Lands for sale in NelaMangala, Bangalore » Property P8177991 Residential Plot / Land for sale in NelaMangala, Bangalore 30 lakhs Vacant Site Advertiser Details Vishwanathnagar, Vajarahalli, NelaMangala, Bangalore -… Area: 1200 SqFeet ▾ Facing: North Transaction: Resale Property Price: 3,000,000 Rate: 2,500 per SqFeet +40% Possession: Immediate/Ready to move Scan QR code to get the contact info on your mobile Description The site measuring 30ft x 40 ft facing north, BMRDA approved, DC converted facing newly developing public park. Viswanathnagar, Vajarahalli, Bengaluru that falls in CMC limit of Nelamangala since recently. RAMKI LAYOUT Please mention that you found this ad on PropertyWala.com when you call. Features Land Features Clear Title Freehold Land Water Connection Electric Connection Close to School Location * Location may be approximate Landmarks Offices Grama Panchayath (<12km) Transportation Helipad (<13km), Helipad (<14km) Recreation Shanthala Theater (<1km), Roopa Theatre (<1km), Mnc (<3km), Maruthi theatre (<11km), SLN Theatre (<13km) Hospitals & Healthcare Sri Brahmi Dental Clinic (<5km), Golhalli Dental Clinic (<8km), Apoorva Dental Clinic (<9km), Sri Vinayaka Dental Clinic. Dr. Nivedi… Sri Surya Multi Speciality Dental Clini… Banks & ATMs HDFC Bank (<4km), ICICI Bank (<0.5km), ICICI BANK ATM (<0.5km), Karnataka Bank (<0.5km), Bank Of Baroda (<0.5km), IDBI (<0.5km), HDFC ATM (<0.5km), State -

Bangalore Rural District, Karnataka

GOVERNMENT OF INDIA MINISTRY OF WATER RESOURCES CENTRAL GROUND WATER BOARD GROUND WATER INFORMATION BOOKLET BANGALORE RURAL DISTRICT, KARNATAKA SOUTH WESTERN REGION BANGALORE NOVEMBER 2008 FOREWORD Ground water contributes to about eighty percent of the drinking water requirements in the rural areas, fifty percent of the urban water requirements and more than fifty percent of the irrigation requirements of the nation. Central Ground Water Board has decided to bring out district level ground water information booklets highlighting the ground water scenario, its resource potential, quality aspects, recharge – discharge relationship, etc., for all the districts of the country. As part of this, Central Ground Water Board, South Western Region, Bangalore, is preparing such booklets for all the 27 districts of Karnataka state, of which six of the districts fall under farmers’ distress category. The Bangalore Ruaral district Ground Water Information Booklet has been prepared based on the information available and data collected from various state and central government organisations by several hydro-scientists of Central Ground Water Board with utmost care and dedication. This booklet has been prepared by Shri A. Kannan, Scientist-B under the guidance of Dr. K. Md. Najeeb, Superintending Hydrogeologist, Central Ground Water Board, South Western Region, Bangalore. The figures were prepared by S/Sri. H.P.Jayaprakash, Scientist-C and K.Rajarajan, Assistant Hydrogeologist. The efforts of Report processing section in finalising and bringing out the report in this format are commendable. I take this opportunity to congratulate them for the diligent and careful compilation and observation in the form of this booklet, which will certainly serve as a guiding document for further work and help the planners, administrators, hydrogeologists and engineers to plan the water resources management in a better way in the district.