Market Wrap February 22, 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

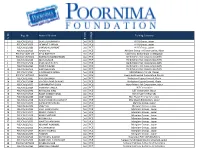

Internship Data Batch 2017 Till 27-05-16 (2)

Reg. No. Name of Student Training Company S. S. No. Branch College 1 PCE/CIV/13/013 DEVI LAL KUMAWAT Civil PCE A R G Group, jaipur 2 PCE/CIV/13/059 HEMANT SHARMA Civil PCE A R G Group, jaipur 3 PCE/CIV/13/069 SHARAD KUMAWAT Civil PCE A R G Group, jaipur 4 PCE/CIV/13/503 APURV RAJ Civil PCE Abhijeet Group of Construction, Bihar 5 PCE/CV/14/711/D KEYA BANERJEE Civil PCE Coal India, Baikunthpur Chattisgargh 6 PCE/CV/14/703/D KANHAIYA MAHESHWARI Civil PCE Delhi Metro Rail Corporation,Delhi 7 PCE/CIV/13/033 NITIN KUMAR Civil PCE Delhi Metro Rail Corporation,Delhi 8 PCE/CIV/13/508 PRASHANT DUBEY Civil PCE Delhi Metro Rail Corporation,Delhi 9 PCE/CIV/13/065 PRERIT KUMAR Civil PCE Delhi Metro Rail Corporation,Delhi 10 PCE/CIV/13/072 SHRAYESH JAIN Civil PCE Delhi Metro Rail Corporation,Delhi 11 PCE/CIV/13/041 SHUBHAM SHARMA Civil PCE DRA Infracom Pvt Ltd ,Tejpur 12 PCE/CV/14/709/D RAVI RAJ Civil PCE Heavy Engineering Corporation,Ranchi 13 PCE/CIV/13/061 KAILASH SINGH Civil PCE Hindustan Copper Limited, Khetri 14 PCE/CIV/13/044 VINOD KUMAR DHAKAD Civil PCE Hindustan Copper Limited, Khetri 15 PCE/CIV/13/075 SURYAPRATAP SINGH Civil PCE Jaipur Metro Rail Corporation,Jaipur 16 PCE/CIV/13/064 PRAKHAR TANEJA Civil PCE L&T Constrution 17 PCE/CIV/13/052 MONALISA JENA Civil PCE L&T Constrution,Jaipur 18 PCE/CIV/13/509 RAJAT KUMAR YADAV Civil PCE M/s Shyam Enterprises 19 PCE/CIV/13/055 AMIT YADAV Civil PCE M/s Shyam Enterprises Jaipur 20 PCE/CIV/13/038 RAJESH KUMAR KUMAWAT Civil PCE M/s Shyam Enterprises, jaipur 21 PCE/CIV/13/070 SHESHADRI MISHRA Civil PCE -

The Mineral Industry of India in 2006

2006 Minerals Yearbook INDIA U.S. Department of the Interior March 2008 U.S. Geological Survey THE MINERAL INDUSTRY OF INDIA By Chin S. Kuo India is endowed with a modest variety of mineral resources, 10%. The duty on imported copper ore and concentrates also although deposits of specific resources—barite, bauxite, was reduced to 2% from 5%. The customs duty on steel melting chromite, coal, iron ore, and manganese—were among the scrap was increased to 5% from 0%, however, owing to lower 10 largest in the world. The mineral industry produced many steel prices (Platts, 2006c). industrial minerals and several metals, but a limited number The Indian Government’s Department of Atomic Energy of mineral fuels. Overall, India was a major mineral producer. announced on January 20, 2006, that “titanium ores and The country’s production of mica sheet was ranked first in concentrates (ilmenite, rutile, and leucoxene) shall remain world output; barite, second; chromite, third: iron ore, talc and prescribed substances only till such time [as] the Policy on pyrophyllite, fourth; bauxite, sixth; crude steel and manganese, Exploration of Beach Sand Minerals notified vide Resolution seventh; and aluminum, eighth (U.S. Geological Survey, 2007). Number 8/1(1)97-PSU/1422 dated the 6th of October, 1998 is adopted/revised/modified by the Ministry of Mines or till the 1st Minerals in the National Economy of January 2007, whichever occurs earlier and shall cease to be so thereafter” (WGI Heavy Minerals Inc., 2006a, p. 1). The mining and quarrying sector contributed 2% to the country’s gross domestic product in 2005, which was the Production latest year for which data were available. -

MARKET LENS 11537 Intraday Pic MARICO Resistance 11878 Intraday Pick SIEMENS 12026 Intraday Pick UPL

Institutional Equity Research NIFTY 11730 IN FOCUS October 29, 2020 Support 11633 Stock in Focus Aarti Industries MARKET LENS 11537 Intraday Pic MARICO Resistance 11878 Intraday Pick SIEMENS 12026 Intraday Pick UPL EQUITY INDICES Indices Absolute Change Percentage Change Domestic Last Trade Change 1-D 1-Mth YTD BSE Sensex 39,922 (600) (1.5%) 4.9% (3.2%) CNX Nifty 11,730 (160) (1.3%) 4.3% (3.6%) S&P CNX 500 9,632 (116) (1.2%) 3.1% (2.4%) SENSEX 50 12,285 (174) (1.4%) 3.9% (3.6%) International Last Trade Change 1-D 1-Mth YTD DJIA 26,520 (943) (3.4%) (4.5%) (7.1%) NASDAQ 11,005 (426) (3.7%) (1.5%) 22.7% NIKKEI 23,242 (177) (0.8%) 0.2% (1.8%) HANGSENG 24,354 (355) (1.4%) 3.9% (13.6%)) ADRs / GDRs Last Trade Change 1-D 1-Mth YTD Dr. Reddy’s Lab (ADR) 64.9 (3.1) (4.6%) (6.7%) 59.9% Tata Motors (ADR) 8.9 (0.6) (6.7%) (2.6%) (31.6%) STOCK IN FOCUS Infosys (ADR) 14.4 (0.5) (3.2%) 4.1% 39.3% f Aarti Industries’ revenue is likely to increase by ~8% YoY due to ICICI Bank (ADR) 10.6 (0.6) (5.4%) 7.4% (30.0%) demand revival and higher capacity utilization in Q2FY21. Its operating HDFC Bank (ADR) 58.6 (1.3) (2.2%) 17.2% (7.6%) capacity is expected to be >80%. Within the specialty chemicals Axis Bank (GDR) 33.2 (1.4) (3.9%) 12.9% (37.5%) segment, higher demand from the automobile sector is expected to Reliance Ind (GDR) 54.4 (0.8) (1.5%) (10.5%) 27.9% boost its volume. -

Government of India Ministry of Heavy Industries and Public Enterprises Department of Public Enterprises

GOVERNMENT OF INDIA MINISTRY OF HEAVY INDUSTRIES AND PUBLIC ENTERPRISES DEPARTMENT OF PUBLIC ENTERPRISES LOK SABHA UNSTARRED QUESTION NO. 1428 TO BE ANSWERED ON THE 11th FEBRUARY, 2020 ‘Job Reservation for SCs, STs and OBCs in PSUs’ 1428. SHRI A.K.P. CHINRAJ : SHRI A. GANESHAMURTHI : Will the Minister of HEAVY INDUSTRIES AND PUBLIC ENTERPRISES be pleased to state:- (a) whether the Government is planning to revamp job reservations issue for Scheduled Castes (SCs), Scheduled Tribes (STs) and Other Backward Classes (OBCs) in State-run companies following sharp fall of employment opportunities to them consequent upon disinvestment in all the Public Sector Enterprises (PSEs); (b) if so, the details thereof; (c) whether it is true that the Department of Investment and Public Asset Management (DIPAM) is examining the issue of job reservations for SCs, STs and OBCs in State run companies following disinvestment and if so, the details thereof; (d) the total disinvestment made in various PSEs company and category-wise during the last three years along with the reasons for disinvestment; (e) the total number of SCs, STs and OBCs presently working in various PSEs company and category-wise; and (f) the total number of SCs, STs and OBCs who lost their jobs in these companies during the said period? ANSWER THE MINISTER FOR HEAVY INDUSTRIES & PUBLIC ENTERPRISES (SHRI PRAKASH JAVADEKAR) (a to d): Job reservation is available to Scheduled Castes (SCs), Scheduled Tribes (STs) and Other Backward Classes (OBCs) in Central Public Sector Enterprises (CPSEs) as per the extant Government policy. The Government follows a policy of disinvestment in CPSEs through Strategic Disinvestment and Minority Stake sale. -

The Halting Progress of Privatization in India. Nandini Gupta* Current

From Commanding Heights to Family Silver: The Halting Progress of Privatization in India. Nandini Gupta* Current status of the privatization program In February 2010, India’s United Progressive Alliance (UPA) government, led by the Congress party, resurrected its stalled privatization program with a secondary offering of shares in National Thermal Power Corporation Ltd (NTPC), one of India’s best performing government-owned firms, which owns 20% of India’s power generation capacity. The sale of the $1.8 billion block of shares reduced the government’s existing stake in the company by an additional 5%, leaving 85% still under government control. However, the poor performance of the offering has raised alarm bells for the government’s future privatization plans. NTPC was subscribed just 1.2 times for the secondary offering, mainly with the help of government-owned financial institutions (“NTPC issue scrapes through with support from SBI, LIC,” The Economic Times, February 6, 2010). Although two foreign investment banks, Citigroup and J.P. Morgan were advising the company, the secondary offering did not attract any foreign institutional investment. The poor performance of the offering has also raised questions regarding the growth prospects of this company, which is a “navratna”, one of the nine “jewels” in the government’s crown. In a recent speech, the top ranking bureaucrat in the power ministry, HS Brahma, pointed out the company’s low employee productivity (“Power secretary censures NTPC for low productivity,” Daily News and Analysis India, February 15, 2010). The lackluster performance may also be due to investor skepticism regarding the company’s ability to compete effectively with a rapidly growing private sector. -

Second Report

STANDING COMMITTEE ON COAL AND STEEL 2 (2004-2005) FOURTEENTH LOK SABHA DEPARTMENT OF MINES DEMANDS FOR GRANTS (2004-2005) SECOND REPORT LOK SABHA SECRETARIAT NEW DELHI August, 2004/Bhadrapada, 1926 (Saka) SECOND REPORT STANDING COMMITTEE ON COAL & STEEL (2004-2005) (FOURTEENTH LOK SABHA) DEPARTMENT OF MINES DEMANDS FOR GRANTS (2004-2005) Presented to Lok Sabha on 25.8.2004 Laid in Rajya Sabha on 25.8.2004 LOK SABHA SECRETARIAT NEW DELHI August, 2004/Bhadrapada, 1926 (Saka) CONTENTS PAGE COMPOSITION OF THE STANDING COMMITTEE ON COAL & STEEL ....... (iii) INTRODUCTION ............................................................................................ (v) PART I CHAPTER I Introductory ............................................................................................ 1 CHAPTER II Analysis of Demands for Grants (2004-2005) of the Department of Mines ................................................................................................... 4 A. Plan Outlay .............................................................................. 4 B. Geological Survey of India (GSI)....................................... 13 C. National Aluminium Company Limited (NALCO) ....... 23 D. Hindustan Copper Limited (HCL) .................................... 32 E. Mineral Exploration Corporation Limited (MECL) ....... 37 F. Bharat Gold Mines Limited (BGML) ................................ 41 G. Science and Technology (S&T) ........................................... 46 Statement of Conclusion/recommendations of the Standing Committee -

Communication on Progress for FY 2018-19 of Hindustan Copper Limited

.' , Communication on Progress for FY 2018-19 of Hindustan Copper Limited 1, ASHUTOSH CHOWDHURY AVENUE KOLKATA - 700 019 miAlJ1tt f~"S>WH <t>'i"R f<.o1f'"12:-s HINDUSTAN COPPER LIMITED _l('tR'l~ ('lI«I mom ~ ~) SANTOSH SHARMA (A GOVT. OF INDIA ENTERPRISE) Chairman and Managing Director <1111~AMRA BHAVAN 1,~~~ 1, ASHUTOSH CHOWDHURY AVENUE ~IKOLKATA - 700 019 ~/Phone : (033) 2283-2725/2281-6222 mlFax: (033) 2283-2862 { >ffitE-ma~ : [email protected], CIN : No. : L27201WB1967GOI028825 Date: 30.09.2019 Dear Stakeholders, In September 2015, the United Nations launched a new agenda for sustainable global development towards 2030 with a set of Global Goals intended to eradicate poverty and improve lives. HCLhas been committed to the UN Global Compact corporate responsibility initiative and its ten principles in the areas of Human Rights, Labour, Environment and Anti-Corruption. We firmly agree that these principles need reinforcement on a global scale, and in partnership with a spectrum of stakeholders engaged in the UNGlobal Compact Network. In this first annual Communication on Progress we describe our actions to continually improve the integration of the ten principles into our business strategy, culture and operations. We also commit to sharing this information with our stakeholders using our primary channels of communication. In step with societal developments and the company's growth, HCLis committed to being a responsible business leader in a globalised world. The Global Goals are ambitious, as they should be. It is a tall task to safeguard the world's global health and development challenges. To succeed, governments, civilsociety organisations and the Industry need to work together as partners in the implementation, as we have done in the framing of the goals. -

Tamralipihouse Journal of Hindustan Copper Limited | Vol

TAMRALIPIHouse Journal of Hindustan Copper Limited | Vol. 72 | July 2015-Feb 2016 From the Chairman's Desk My dear Colleagues, The current financial year 2015-16 is drawing to a close. During the year, on production front, we have recovered the ground lost in FY 2014-15. However, gains in production have been offset due to sharp decline in LME prices of Copper and the year has been a tough one for all of us. The fiscal 2015-16 will go down in the annals of HCL's history for acquisition of Jhagadia Copper Ltd. (now named as Gujarat Copper Project) as our fifth Unit and for initiating Malanjkhand Underground Expansion Project which is flagship expansion project of the Company. Both of these measures are vital for the long term sustenance of the Company. As you are already aware, our bottom line and our earnings are greatly influenced by the LME Copper prices and Exchange Rates. In the next fiscal, the global market will continue to remain sluggish, therefore the need of the hour is to reduce our cost of production by all possible means. To help tide over the crisis all are welcome to come up with suggestions, innovations for improvement of systems/ procedure/process etc. particularly in the areas focused on reducing cost of production, reducing wastages, maximizing revenue and generating fund. As they say, a chain is as strong as its weakest link. Hence, the need of the hour is to improve upon each of our operational processes and to plug all the gaps that may make the Company bleed. -

Contractor Registration

HINDUSTAN COPPER LIMITED (A Government of India Enterprise) NOTICE INVITING APPLICATIONS FOR REGISTRATION OF CONTRACTORS Applications in the prescribed forms are invited from experienced and resourceful contractors for their registration in various categories and class of work involving major excavation, construction, repair and maintenance works pertaining to Mining, Civil, Electrical, Mechanical etc. at HCL’s different Units, i.e. Indian Copper Complex (Jharkhand State), Khetri Copper Complex (Rajasthan State), Malanjkhand Copper Project (Madhya Pradesh State) & Taloja Copper Project (Maharashtra State). Application Form for Registration of Contractors is available in HCL’s website www.hindustancopper.com (For Civil Contracts Ref. ‘Part - A’ and other than Civil Works Ref. ‘Part – B’). Interested parties/firms are requested to download the Form and submit the same, duly filled in, to the respective Unit Head (address given below). This would be entirely for the purpose of HCL’s information only. Filling up of the form does not mean that HCL is liable to register the contractor. The normal registration procedure of HCL shall be followed. Address of the Unit Heads Executive Director, Malanjkhand Copper Project Po: Malanjkhand Dist.: Balaghat (MP) 481116 General Manager Khetri Copper Complex Po: Khetri Nagar Dist. Jhunjhunu (Rajasthan) 333504 General Manager Indian Copper Complex PO: Moubhandar, Ghatsila Dist: East Singbhum (Jharkhand) 832303 Asst. General Manager Taloja Copper Project Plot No. E-33 to E-36, MIDC Area Po: Taloja Dist: Raigad (Maharashtra) 410208 PART – ‘A’ (CIVIL WORKS) RULES AND CONDITIONS FOR REGISTRATION OF CIVIL CONTRACTORS/FIRMS IN HINDUSTAN COPPER LTD. 1. The classification of the contractor/firms shall be against the following categories of works :- i) Heavy Industrial reinforced cement concrete and/or steel structurals. -

Report 2019-2020

A Miniratna Category-I CPSE www.hindustancopper.com ´ÉÉ̹ÉEò |ÉÊiÉ´ÉänùxÉ näù¶É EòÉ iÉÉ©É JÉÊxÉEò ANNUAL THE COPPER MINER TO THE NATION REPORT 2019-2020 If undelivered please return to: HINDUSTAN COPPER LIMITED A Miniratna Category - I Central Public Sector Enterprise 'Tamra Bhavan', 1, Ashutosh Chowdhury Avenue, Kolkata-700 019 CIN: L27201WB1967GOIO28825 Website: www.hindustancopper.com E-mail: [email protected] Contact No.: (033) 2283 2226 Fax: (033) 2283 2676 cygnusadvertising.in Vision To strive to be a leading metal mining company and maximize total shareholder return by sustainably finding, developing and mining Copper ore and such other geologically associated minerals. Mission To achieve sustainable growth in business through optimum & efficient use of existing resources and assets. To achieve rapid expansion of mining capacity through expansion of existing mines, re-opening of closed mines and Greenfield projects. Detailed exploration of existing mines and new mining leases to expand mining capacity. To enhance the value of the Company by focusing on performance improvement. To assimilate state-of-the art technology in exploration, mining and beneficiation of ores for competitive advantage. To strive for continuous improvement in productivity and energy to bring at par with the best internationally. To continue innovation through research & development. Hindustan Copper Limited (A Government of India Enterprise) Auditors Contents Page No. M/s. Chaturvedi & Co., Kolkata Board of Directors 2 Bankers Notice to the Members 3 State Bank of India United Bank of India Report of the Board of Directors 11 Indian Overseas Bank Punjab National Bank Corporate Governance Report 38 ICICI Bank Axis Bank Secretarial Audit Report 49 HDFC Bank Certificate on Corporate Governance 52 Registrar and Transfer Agent M/s. -

Corporate Presentation

Corporate Presentation Feb 2019 Disclaimer THIS PRESENTATION (“PRESENTATION”) IS NOT AN OFFER TO SELL ANY SECURITIES OR A SOLICITATION TO BUY ANY SECURITIES OF HINDUSTAN COPPER LIMITED (THE “COMPANY”). The material that follows is a Presentation of general background information about the Company’s activities as at the date of the Presentation. It is information given in summary form and does not purport to be complete and it cannot be guaranteed that such information is true and accurate. This Presentation does not constitute a prospectus, offering circular or offering memorandum or an offer, or a solicitation of any offer, to purchase or sell, any shares and should not be considered as a recommendation that any investor should subscribe for or purchase any of the Company’s equity shares. Securities of the Company may not be offered or sold in the United States absent registration under the U.S. Securities Act of 1933, as amended, or an exemption from the registration requirements of that Act. Any public offering or sale of securities of the Company to be made in the United States will be made by means of a prospectus that may be obtained from the Company or the selling security holder and that will contain detailed information about the Company and its management, as well as financial statements. This Presentation includes statements that are, or may be deemed to be, “forward-looking statements”. These forward-looking statements can be identified by the use of forward-looking terminology, including the terms “believes”, “estimates”, “anticipates”, “projects”, “expects”, “intends”, “may”, “will”, “seeks” or “should” or, in each case, their negative or other variations or comparable terminology, or by discussions of strategy, plans, aims, objectives, goals, future events or intentions. -

Joindre Capital Services Ltd. Sebi Regn No

JOINDRE CAPITAL SERVICES LTD. SEBI REGN NO. INH000002061 / INZ000174034 DAILY REPORT 28th May 2019 RBI to hold state bonds, term repo auctions; Sun Pharmaceutical, Punjab National Bank, Aurobindo Pharma, NMDC, Pfizer India, SpiceJet, among companies reporting earnings. WHAT TO WATCH: India Shadow Lenders Face a Margin Squeeze From RBI Guidelines Jet Airways Creditors Set Two-Week Deadline: Mint Modi Election Sweep Could Help Rupee Buck Its May Curse: Chart Day After Modi Was Re-Elected, Foreign Funds Buy Indian Bonds Arcelor, Resurgent Said to Mull Joint Bid for Essar Power Plant Bharat Heavy Debt Risk Rises 5 Levels in Bloomberg Model Modi, Resist the Urge to Be India’s Xi Jinping: Andy Mukherjee India’s NTPC Studying Buying 700 MW Coal-Power Project: Official India’s April Crude Oil Output Declines 6.9% Y/y; Gas Dips 0.3% India Regulator Tightens Disclosure Rules for Listed Corp Bonds Anil Ambani to Sell Big FM Radio Unit for at Least $151 Million Billionaires Differ Over ‘One Issue’ at Top Asian Budget Airline o IndiGo CEO Dutta doesn’t elaborate on what the issue is IndiGo Sees Capacity Rising 30% After Profit Jumps Fivefold Gail Investing 550B Rupees in Pipelines, Petrochem, City Gas India Sugar Prices Seen Stable as State Support Seen Continuing Sell the Rally in India Stocks as Headwinds Persist: BofAML India Corp Bond Issuances Seen at INR7 Trillion in FY20: Care Siemens COO Sees No Impact From U.S. Ban on Huawei As of Now Global Funds Buy Net 4.61b of India Equity Derivatives Monday o Global Funds Buy Net INR12.2b India Stocks Monday: NSE o Foreign Investors Buy Net INR3.92B Indian Equities May 24 MEDIA REPORTS: Ficci demands stimulus package to pump-prime slowing economy: PTI India Ratings Expects India GDP Growth At 6.9% In FY19, Lower Than CSO Estimate: PTI RBI May Ease Voting Rules on Debt Workouts: Business Standard GOVERNMENT: 3pm: New Delhi.