List of Aluminium Industries S

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Vedanta Interim Results & Capital Market's Day Conference Call

“Vedanta Interim Results & Capital Market’s Day Conference Call” November 10, 2017 MANAGEMENT: MR. ANIL AGARWAL – CHAIRMAN, VEDANTA MR. KULDIP KAURA – CHIEF EXECUTIVE OFFICER, VEDANTA MR. SCOTT CAITHNESS – HEAD, EXPLORATION, VEDANTA MR. STEVEN DIN – CEO, KCM MR. SUDHIR MATHUR – CEO, OIL & GAS MR. SUNIL DUGGAL – CEO, ZINC INDIA MS. DESHNEE NAIDOO – CEO, ZINC INTERNATIONAL MR. SAMIR CAIRAE – CEO, INDIA DIVERSIFIED METALS MR. KISHORE KUMAR – CEO, IRON ORE MR. ABHIJIT PATI – CEO, ALUMINUM, JHARSUGUDA MR. AJAY DIXIT -- ALUMINA & TSPL POWER, VEDANTA MR. ASHWIN BAJAJ, HEAD, INVESTOR RELATIONS, VEDANTA Page 1 of 39 Vedanta Resources November 10, 2017 Moderator: Good day, ladies and gentlemen and welcome to the Vedanta Interim Results and Capital Markets Day Conference Call. As a reminder, all participant lines will be in the listen-only mode, and there will be an opportunity for you to ask questions after the presentation concludes. Should you need assistance during the conference call, please signal an operator by pressing ‘*’ and then ‘0’ on your touchtone telephone. Please note that this conference is being recorded. Ashwin Bajaj: Ladies and gentlemen, very good morning. I am Ashwin Bajaj, Head of Investor Relations of Vedanta. Thank you for joining us today for our H1 FY 2018 Results and Capital Markets Day. Let me introduce our speakers and go over the agenda for today. Our Chairman -- Anil Agarwal will give an “Overview” followed by “Strategy Update” by our CEO -- Kuldip Kaura; this will be followed by Scott Caithness -- our Head of Exploration who is here on video. Our CFO -- Arun Kumar is unable to join us today for medical reasons, so I will cover the “Financial Update;” Mr. -

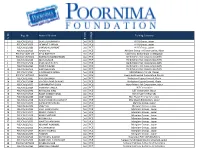

Internship Data Batch 2017 Till 27-05-16 (2)

Reg. No. Name of Student Training Company S. S. No. Branch College 1 PCE/CIV/13/013 DEVI LAL KUMAWAT Civil PCE A R G Group, jaipur 2 PCE/CIV/13/059 HEMANT SHARMA Civil PCE A R G Group, jaipur 3 PCE/CIV/13/069 SHARAD KUMAWAT Civil PCE A R G Group, jaipur 4 PCE/CIV/13/503 APURV RAJ Civil PCE Abhijeet Group of Construction, Bihar 5 PCE/CV/14/711/D KEYA BANERJEE Civil PCE Coal India, Baikunthpur Chattisgargh 6 PCE/CV/14/703/D KANHAIYA MAHESHWARI Civil PCE Delhi Metro Rail Corporation,Delhi 7 PCE/CIV/13/033 NITIN KUMAR Civil PCE Delhi Metro Rail Corporation,Delhi 8 PCE/CIV/13/508 PRASHANT DUBEY Civil PCE Delhi Metro Rail Corporation,Delhi 9 PCE/CIV/13/065 PRERIT KUMAR Civil PCE Delhi Metro Rail Corporation,Delhi 10 PCE/CIV/13/072 SHRAYESH JAIN Civil PCE Delhi Metro Rail Corporation,Delhi 11 PCE/CIV/13/041 SHUBHAM SHARMA Civil PCE DRA Infracom Pvt Ltd ,Tejpur 12 PCE/CV/14/709/D RAVI RAJ Civil PCE Heavy Engineering Corporation,Ranchi 13 PCE/CIV/13/061 KAILASH SINGH Civil PCE Hindustan Copper Limited, Khetri 14 PCE/CIV/13/044 VINOD KUMAR DHAKAD Civil PCE Hindustan Copper Limited, Khetri 15 PCE/CIV/13/075 SURYAPRATAP SINGH Civil PCE Jaipur Metro Rail Corporation,Jaipur 16 PCE/CIV/13/064 PRAKHAR TANEJA Civil PCE L&T Constrution 17 PCE/CIV/13/052 MONALISA JENA Civil PCE L&T Constrution,Jaipur 18 PCE/CIV/13/509 RAJAT KUMAR YADAV Civil PCE M/s Shyam Enterprises 19 PCE/CIV/13/055 AMIT YADAV Civil PCE M/s Shyam Enterprises Jaipur 20 PCE/CIV/13/038 RAJESH KUMAR KUMAWAT Civil PCE M/s Shyam Enterprises, jaipur 21 PCE/CIV/13/070 SHESHADRI MISHRA Civil PCE -

The Mineral Industry of India in 2006

2006 Minerals Yearbook INDIA U.S. Department of the Interior March 2008 U.S. Geological Survey THE MINERAL INDUSTRY OF INDIA By Chin S. Kuo India is endowed with a modest variety of mineral resources, 10%. The duty on imported copper ore and concentrates also although deposits of specific resources—barite, bauxite, was reduced to 2% from 5%. The customs duty on steel melting chromite, coal, iron ore, and manganese—were among the scrap was increased to 5% from 0%, however, owing to lower 10 largest in the world. The mineral industry produced many steel prices (Platts, 2006c). industrial minerals and several metals, but a limited number The Indian Government’s Department of Atomic Energy of mineral fuels. Overall, India was a major mineral producer. announced on January 20, 2006, that “titanium ores and The country’s production of mica sheet was ranked first in concentrates (ilmenite, rutile, and leucoxene) shall remain world output; barite, second; chromite, third: iron ore, talc and prescribed substances only till such time [as] the Policy on pyrophyllite, fourth; bauxite, sixth; crude steel and manganese, Exploration of Beach Sand Minerals notified vide Resolution seventh; and aluminum, eighth (U.S. Geological Survey, 2007). Number 8/1(1)97-PSU/1422 dated the 6th of October, 1998 is adopted/revised/modified by the Ministry of Mines or till the 1st Minerals in the National Economy of January 2007, whichever occurs earlier and shall cease to be so thereafter” (WGI Heavy Minerals Inc., 2006a, p. 1). The mining and quarrying sector contributed 2% to the country’s gross domestic product in 2005, which was the Production latest year for which data were available. -

Hindustan Zinc Limited

Hindustan Zinc Limited INVESTOR PRESENTATION AUGUST 2019 Cautionary Statement and Disclaimer The views expressed here may contain information derived from publicly available sources that have not been independently verified. No representation or warranty is made as to the accuracy, completeness, reasonableness or reliability of this information. Any forward looking information in this presentation including, without limitation, any tables, charts and/or graphs, has been prepared on the basis of a number of assumptions which may prove to be incorrect. This presentation should not be relied upon as a recommendation or forecast by Hindustan Zinc Limited. Past performance of Hindustan Zinc cannot be relied upon as a guide to future performance. This presentation contains 'forward-looking statements' – that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance, and often contain words such as 'expects,' 'anticipates,' 'intends,' 'plans,' 'believes,' 'seeks,' or 'will.' Forward–looking statements by their nature address matters that are, to different degrees, uncertain. For us, uncertainties arise from the behaviour of financial and metals markets including the London Metal Exchange, fluctuations in interest and or exchange rates and metal prices; from future integration of acquired businesses; and from numerous other matters of national, regional and global scale, including those of a environmental, climatic, natural, political, economic, -

MARKET LENS 11537 Intraday Pic MARICO Resistance 11878 Intraday Pick SIEMENS 12026 Intraday Pick UPL

Institutional Equity Research NIFTY 11730 IN FOCUS October 29, 2020 Support 11633 Stock in Focus Aarti Industries MARKET LENS 11537 Intraday Pic MARICO Resistance 11878 Intraday Pick SIEMENS 12026 Intraday Pick UPL EQUITY INDICES Indices Absolute Change Percentage Change Domestic Last Trade Change 1-D 1-Mth YTD BSE Sensex 39,922 (600) (1.5%) 4.9% (3.2%) CNX Nifty 11,730 (160) (1.3%) 4.3% (3.6%) S&P CNX 500 9,632 (116) (1.2%) 3.1% (2.4%) SENSEX 50 12,285 (174) (1.4%) 3.9% (3.6%) International Last Trade Change 1-D 1-Mth YTD DJIA 26,520 (943) (3.4%) (4.5%) (7.1%) NASDAQ 11,005 (426) (3.7%) (1.5%) 22.7% NIKKEI 23,242 (177) (0.8%) 0.2% (1.8%) HANGSENG 24,354 (355) (1.4%) 3.9% (13.6%)) ADRs / GDRs Last Trade Change 1-D 1-Mth YTD Dr. Reddy’s Lab (ADR) 64.9 (3.1) (4.6%) (6.7%) 59.9% Tata Motors (ADR) 8.9 (0.6) (6.7%) (2.6%) (31.6%) STOCK IN FOCUS Infosys (ADR) 14.4 (0.5) (3.2%) 4.1% 39.3% f Aarti Industries’ revenue is likely to increase by ~8% YoY due to ICICI Bank (ADR) 10.6 (0.6) (5.4%) 7.4% (30.0%) demand revival and higher capacity utilization in Q2FY21. Its operating HDFC Bank (ADR) 58.6 (1.3) (2.2%) 17.2% (7.6%) capacity is expected to be >80%. Within the specialty chemicals Axis Bank (GDR) 33.2 (1.4) (3.9%) 12.9% (37.5%) segment, higher demand from the automobile sector is expected to Reliance Ind (GDR) 54.4 (0.8) (1.5%) (10.5%) 27.9% boost its volume. -

Government of India Ministry of Heavy Industries and Public Enterprises Department of Public Enterprises

GOVERNMENT OF INDIA MINISTRY OF HEAVY INDUSTRIES AND PUBLIC ENTERPRISES DEPARTMENT OF PUBLIC ENTERPRISES LOK SABHA UNSTARRED QUESTION NO. 1428 TO BE ANSWERED ON THE 11th FEBRUARY, 2020 ‘Job Reservation for SCs, STs and OBCs in PSUs’ 1428. SHRI A.K.P. CHINRAJ : SHRI A. GANESHAMURTHI : Will the Minister of HEAVY INDUSTRIES AND PUBLIC ENTERPRISES be pleased to state:- (a) whether the Government is planning to revamp job reservations issue for Scheduled Castes (SCs), Scheduled Tribes (STs) and Other Backward Classes (OBCs) in State-run companies following sharp fall of employment opportunities to them consequent upon disinvestment in all the Public Sector Enterprises (PSEs); (b) if so, the details thereof; (c) whether it is true that the Department of Investment and Public Asset Management (DIPAM) is examining the issue of job reservations for SCs, STs and OBCs in State run companies following disinvestment and if so, the details thereof; (d) the total disinvestment made in various PSEs company and category-wise during the last three years along with the reasons for disinvestment; (e) the total number of SCs, STs and OBCs presently working in various PSEs company and category-wise; and (f) the total number of SCs, STs and OBCs who lost their jobs in these companies during the said period? ANSWER THE MINISTER FOR HEAVY INDUSTRIES & PUBLIC ENTERPRISES (SHRI PRAKASH JAVADEKAR) (a to d): Job reservation is available to Scheduled Castes (SCs), Scheduled Tribes (STs) and Other Backward Classes (OBCs) in Central Public Sector Enterprises (CPSEs) as per the extant Government policy. The Government follows a policy of disinvestment in CPSEs through Strategic Disinvestment and Minority Stake sale. -

The Halting Progress of Privatization in India. Nandini Gupta* Current

From Commanding Heights to Family Silver: The Halting Progress of Privatization in India. Nandini Gupta* Current status of the privatization program In February 2010, India’s United Progressive Alliance (UPA) government, led by the Congress party, resurrected its stalled privatization program with a secondary offering of shares in National Thermal Power Corporation Ltd (NTPC), one of India’s best performing government-owned firms, which owns 20% of India’s power generation capacity. The sale of the $1.8 billion block of shares reduced the government’s existing stake in the company by an additional 5%, leaving 85% still under government control. However, the poor performance of the offering has raised alarm bells for the government’s future privatization plans. NTPC was subscribed just 1.2 times for the secondary offering, mainly with the help of government-owned financial institutions (“NTPC issue scrapes through with support from SBI, LIC,” The Economic Times, February 6, 2010). Although two foreign investment banks, Citigroup and J.P. Morgan were advising the company, the secondary offering did not attract any foreign institutional investment. The poor performance of the offering has also raised questions regarding the growth prospects of this company, which is a “navratna”, one of the nine “jewels” in the government’s crown. In a recent speech, the top ranking bureaucrat in the power ministry, HS Brahma, pointed out the company’s low employee productivity (“Power secretary censures NTPC for low productivity,” Daily News and Analysis India, February 15, 2010). The lackluster performance may also be due to investor skepticism regarding the company’s ability to compete effectively with a rapidly growing private sector. -

Second Report

STANDING COMMITTEE ON COAL AND STEEL 2 (2004-2005) FOURTEENTH LOK SABHA DEPARTMENT OF MINES DEMANDS FOR GRANTS (2004-2005) SECOND REPORT LOK SABHA SECRETARIAT NEW DELHI August, 2004/Bhadrapada, 1926 (Saka) SECOND REPORT STANDING COMMITTEE ON COAL & STEEL (2004-2005) (FOURTEENTH LOK SABHA) DEPARTMENT OF MINES DEMANDS FOR GRANTS (2004-2005) Presented to Lok Sabha on 25.8.2004 Laid in Rajya Sabha on 25.8.2004 LOK SABHA SECRETARIAT NEW DELHI August, 2004/Bhadrapada, 1926 (Saka) CONTENTS PAGE COMPOSITION OF THE STANDING COMMITTEE ON COAL & STEEL ....... (iii) INTRODUCTION ............................................................................................ (v) PART I CHAPTER I Introductory ............................................................................................ 1 CHAPTER II Analysis of Demands for Grants (2004-2005) of the Department of Mines ................................................................................................... 4 A. Plan Outlay .............................................................................. 4 B. Geological Survey of India (GSI)....................................... 13 C. National Aluminium Company Limited (NALCO) ....... 23 D. Hindustan Copper Limited (HCL) .................................... 32 E. Mineral Exploration Corporation Limited (MECL) ....... 37 F. Bharat Gold Mines Limited (BGML) ................................ 41 G. Science and Technology (S&T) ........................................... 46 Statement of Conclusion/recommendations of the Standing Committee -

Hindustan Zinc (HINZIN)

Hindustan Zinc (HINZIN) CMP: | 223 Target: | 230 (3%) Target Period: 12 months HOLD October 21, 2020 Maintains volume guidance... Hindustan Zinc reported a mixed performance for Q2FY21. The topline came in line with our estimate while EBITDA and PAT were lower than our estimate. For the quarter, zinc sales volumes came in at ~181000 tonnes (up 8% YoY, 11% QoQ, marginally lower than our estimate: 185419 tonnes), lead sales volume came in at ~57000 tonnes (up 30% YoY, 27% QoQ, lower than our estimate: 60125 tonnes) while silver sales volume came in at Particulars ~203000 kg (up 50% YoY, 39% QoQ, higher than our estimate: 195000 kg). | Crore Topline came in at | 5660 crore (up 25% YoY, 42% QoQ), in line with our Market Capitalization 94,218 Update Result estimate of | 5668 crore. EBITDA came in at | 2952 crore (up 39% YoY, 87% Total Debt (FY20) 611 QoQ), lower than our estimate of | 3031 crore. EBITDA margin came in at Cash and Investments (FY20) 22,247 52.2%, marginally lower than our estimate of 53.5%. Ensuing PAT was at | EV 72,581 1940 crore (up 43% QoQ but down 7% YoY). HZL has announced an interim 52 week H/L (|) 258 / 122 dividend of | 21.3/equity share with a record date of October 28, 2020. Equity capital 845.1 Face value (|) | 2 Healthy reserve base provide earnings visibility over long term Price Chart HZL has a huge reserve base, which provides strong earnings visibility. During the year, total ore reserves increased from 92.6 million tonnes (MT) 300 15000 at the end of FY19 to 114.7 MT at the end of FY20 while mineral resources totalled 288.3 MT. -

3& ,Qwhuqdwlrqdo /Lplwhg

5DXQDT(3&,QWHUQDWLRQDO/LPLWHG 5DXQDT(3&,QWHUQDWLRQDO/LPLWHG Our Valued Clients "Raunaq EPC International Limited", an Engineering Contract dedicated team of professionals at various levels in dif CLIENTS Company Porfile "Raunaq EPCXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX International Limited" engaged in turnkey execution of Engineering Projects, is a group companyXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX of the "Surinder P. Kanwar Group", having well established companies like Bharat XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX Gears Limited, Clip-Lok Simpak (India) Pvt. Limited and Raunaq EPC International Limited. All these XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX companiesXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX have been meeting the escalating demands of national and international clients, with their qualityXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX manufactured products and engineering services for the core sector of industries and have provenXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX track record in the field of manufacturing Automobile Gear Boxes and Project works. "Raunaq EPC InternationalDATA Limited", REQUIRED an Engineering Contracting Organization managed by a dedicated team of professionals at various levels in different disciplines, is engaged primarily in the service of core infrastructural and industrial sectors in India, namely Power, Chemical, Hydro- carbon, Metal and Automobile sectors. Besides separate departments for Design & Engineering, Quality Assurance & Inspection etc., the company has a sufficient in-house resources in terms of Engineering -

Communication on Progress for FY 2018-19 of Hindustan Copper Limited

.' , Communication on Progress for FY 2018-19 of Hindustan Copper Limited 1, ASHUTOSH CHOWDHURY AVENUE KOLKATA - 700 019 miAlJ1tt f~"S>WH <t>'i"R f<.o1f'"12:-s HINDUSTAN COPPER LIMITED _l('tR'l~ ('lI«I mom ~ ~) SANTOSH SHARMA (A GOVT. OF INDIA ENTERPRISE) Chairman and Managing Director <1111~AMRA BHAVAN 1,~~~ 1, ASHUTOSH CHOWDHURY AVENUE ~IKOLKATA - 700 019 ~/Phone : (033) 2283-2725/2281-6222 mlFax: (033) 2283-2862 { >ffitE-ma~ : [email protected], CIN : No. : L27201WB1967GOI028825 Date: 30.09.2019 Dear Stakeholders, In September 2015, the United Nations launched a new agenda for sustainable global development towards 2030 with a set of Global Goals intended to eradicate poverty and improve lives. HCLhas been committed to the UN Global Compact corporate responsibility initiative and its ten principles in the areas of Human Rights, Labour, Environment and Anti-Corruption. We firmly agree that these principles need reinforcement on a global scale, and in partnership with a spectrum of stakeholders engaged in the UNGlobal Compact Network. In this first annual Communication on Progress we describe our actions to continually improve the integration of the ten principles into our business strategy, culture and operations. We also commit to sharing this information with our stakeholders using our primary channels of communication. In step with societal developments and the company's growth, HCLis committed to being a responsible business leader in a globalised world. The Global Goals are ambitious, as they should be. It is a tall task to safeguard the world's global health and development challenges. To succeed, governments, civilsociety organisations and the Industry need to work together as partners in the implementation, as we have done in the framing of the goals. -

Hpmg Shares & Sec

Your best guide to financial markets Weekly Research Reports GROWING TOGETHER www.hpmgshares.com HPMG Wealth (weekly) Top Sectors for the Week CONTENTS Title Page No. HPMG Wealth (Weekly) 03-04 Top Sectors for the Week 05-14 Weekly Pivot Table (Equities) 15 Weekly Pivot Table (Commodities) 16 Disclaimer 17 HPMG WEALTH WEEKLY Let Your Money Grow Confidently ! Stock ideas backed by strong research HPMG Wealth Weekly… Getting rich is easy with help of HPMG Wealth Weekly. This weekly research report helps you to identify the best five momentum stocks for the week. ‘Pick of the week’ is best among the mentioned five and is always with detailed ‘Technical & Macro outlook’. The trick to “Get Rich quickly and to Stay Rich forever” is a combination of alertness and awareness. With the right information on stocks from HPMG Wealth Weekly, your money is likely to grow confidently and living the “rich” life, is achievable. GROWING TOGETHER www.hpmgshares.com HPMG WEALTH WEEKLY Monday Let Your Money Grow Confidently ! 21st December, 2020 STOCKS CMP BIAS TRADING/ INVESTMENT STRATEGY Avanti Feeds is the leading manufacturer of shrimp feeds and Shrimp Processor with 45% market share in domestic shrimp feed market. The firm was incorporated in the year 1993 and is now having a market cap of Rs AVANTI FEEDS 550 Positive 7417 Crores. Technically, downside seen well supported at 453-469 zone. Look to buy at CMP, and on dips between 491-495 zone, targeting 587.50/601 and then aggressive targets at 621 mark. Stop below 447. Holding Period: 2-3 Months.