Hindustan Zinc Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Vedanta Interim Results & Capital Market's Day Conference Call

“Vedanta Interim Results & Capital Market’s Day Conference Call” November 10, 2017 MANAGEMENT: MR. ANIL AGARWAL – CHAIRMAN, VEDANTA MR. KULDIP KAURA – CHIEF EXECUTIVE OFFICER, VEDANTA MR. SCOTT CAITHNESS – HEAD, EXPLORATION, VEDANTA MR. STEVEN DIN – CEO, KCM MR. SUDHIR MATHUR – CEO, OIL & GAS MR. SUNIL DUGGAL – CEO, ZINC INDIA MS. DESHNEE NAIDOO – CEO, ZINC INTERNATIONAL MR. SAMIR CAIRAE – CEO, INDIA DIVERSIFIED METALS MR. KISHORE KUMAR – CEO, IRON ORE MR. ABHIJIT PATI – CEO, ALUMINUM, JHARSUGUDA MR. AJAY DIXIT -- ALUMINA & TSPL POWER, VEDANTA MR. ASHWIN BAJAJ, HEAD, INVESTOR RELATIONS, VEDANTA Page 1 of 39 Vedanta Resources November 10, 2017 Moderator: Good day, ladies and gentlemen and welcome to the Vedanta Interim Results and Capital Markets Day Conference Call. As a reminder, all participant lines will be in the listen-only mode, and there will be an opportunity for you to ask questions after the presentation concludes. Should you need assistance during the conference call, please signal an operator by pressing ‘*’ and then ‘0’ on your touchtone telephone. Please note that this conference is being recorded. Ashwin Bajaj: Ladies and gentlemen, very good morning. I am Ashwin Bajaj, Head of Investor Relations of Vedanta. Thank you for joining us today for our H1 FY 2018 Results and Capital Markets Day. Let me introduce our speakers and go over the agenda for today. Our Chairman -- Anil Agarwal will give an “Overview” followed by “Strategy Update” by our CEO -- Kuldip Kaura; this will be followed by Scott Caithness -- our Head of Exploration who is here on video. Our CFO -- Arun Kumar is unable to join us today for medical reasons, so I will cover the “Financial Update;” Mr. -

The Halting Progress of Privatization in India. Nandini Gupta* Current

From Commanding Heights to Family Silver: The Halting Progress of Privatization in India. Nandini Gupta* Current status of the privatization program In February 2010, India’s United Progressive Alliance (UPA) government, led by the Congress party, resurrected its stalled privatization program with a secondary offering of shares in National Thermal Power Corporation Ltd (NTPC), one of India’s best performing government-owned firms, which owns 20% of India’s power generation capacity. The sale of the $1.8 billion block of shares reduced the government’s existing stake in the company by an additional 5%, leaving 85% still under government control. However, the poor performance of the offering has raised alarm bells for the government’s future privatization plans. NTPC was subscribed just 1.2 times for the secondary offering, mainly with the help of government-owned financial institutions (“NTPC issue scrapes through with support from SBI, LIC,” The Economic Times, February 6, 2010). Although two foreign investment banks, Citigroup and J.P. Morgan were advising the company, the secondary offering did not attract any foreign institutional investment. The poor performance of the offering has also raised questions regarding the growth prospects of this company, which is a “navratna”, one of the nine “jewels” in the government’s crown. In a recent speech, the top ranking bureaucrat in the power ministry, HS Brahma, pointed out the company’s low employee productivity (“Power secretary censures NTPC for low productivity,” Daily News and Analysis India, February 15, 2010). The lackluster performance may also be due to investor skepticism regarding the company’s ability to compete effectively with a rapidly growing private sector. -

Hindustan Zinc (HINZIN)

Hindustan Zinc (HINZIN) CMP: | 223 Target: | 230 (3%) Target Period: 12 months HOLD October 21, 2020 Maintains volume guidance... Hindustan Zinc reported a mixed performance for Q2FY21. The topline came in line with our estimate while EBITDA and PAT were lower than our estimate. For the quarter, zinc sales volumes came in at ~181000 tonnes (up 8% YoY, 11% QoQ, marginally lower than our estimate: 185419 tonnes), lead sales volume came in at ~57000 tonnes (up 30% YoY, 27% QoQ, lower than our estimate: 60125 tonnes) while silver sales volume came in at Particulars ~203000 kg (up 50% YoY, 39% QoQ, higher than our estimate: 195000 kg). | Crore Topline came in at | 5660 crore (up 25% YoY, 42% QoQ), in line with our Market Capitalization 94,218 Update Result estimate of | 5668 crore. EBITDA came in at | 2952 crore (up 39% YoY, 87% Total Debt (FY20) 611 QoQ), lower than our estimate of | 3031 crore. EBITDA margin came in at Cash and Investments (FY20) 22,247 52.2%, marginally lower than our estimate of 53.5%. Ensuing PAT was at | EV 72,581 1940 crore (up 43% QoQ but down 7% YoY). HZL has announced an interim 52 week H/L (|) 258 / 122 dividend of | 21.3/equity share with a record date of October 28, 2020. Equity capital 845.1 Face value (|) | 2 Healthy reserve base provide earnings visibility over long term Price Chart HZL has a huge reserve base, which provides strong earnings visibility. During the year, total ore reserves increased from 92.6 million tonnes (MT) 300 15000 at the end of FY19 to 114.7 MT at the end of FY20 while mineral resources totalled 288.3 MT. -

3& ,Qwhuqdwlrqdo /Lplwhg

5DXQDT(3&,QWHUQDWLRQDO/LPLWHG 5DXQDT(3&,QWHUQDWLRQDO/LPLWHG Our Valued Clients "Raunaq EPC International Limited", an Engineering Contract dedicated team of professionals at various levels in dif CLIENTS Company Porfile "Raunaq EPCXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX International Limited" engaged in turnkey execution of Engineering Projects, is a group companyXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX of the "Surinder P. Kanwar Group", having well established companies like Bharat XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX Gears Limited, Clip-Lok Simpak (India) Pvt. Limited and Raunaq EPC International Limited. All these XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX companiesXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX have been meeting the escalating demands of national and international clients, with their qualityXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX manufactured products and engineering services for the core sector of industries and have provenXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX track record in the field of manufacturing Automobile Gear Boxes and Project works. "Raunaq EPC InternationalDATA Limited", REQUIRED an Engineering Contracting Organization managed by a dedicated team of professionals at various levels in different disciplines, is engaged primarily in the service of core infrastructural and industrial sectors in India, namely Power, Chemical, Hydro- carbon, Metal and Automobile sectors. Besides separate departments for Design & Engineering, Quality Assurance & Inspection etc., the company has a sufficient in-house resources in terms of Engineering -

Hpmg Shares & Sec

Your best guide to financial markets Weekly Research Reports GROWING TOGETHER www.hpmgshares.com HPMG Wealth (weekly) Top Sectors for the Week CONTENTS Title Page No. HPMG Wealth (Weekly) 03-04 Top Sectors for the Week 05-14 Weekly Pivot Table (Equities) 15 Weekly Pivot Table (Commodities) 16 Disclaimer 17 HPMG WEALTH WEEKLY Let Your Money Grow Confidently ! Stock ideas backed by strong research HPMG Wealth Weekly… Getting rich is easy with help of HPMG Wealth Weekly. This weekly research report helps you to identify the best five momentum stocks for the week. ‘Pick of the week’ is best among the mentioned five and is always with detailed ‘Technical & Macro outlook’. The trick to “Get Rich quickly and to Stay Rich forever” is a combination of alertness and awareness. With the right information on stocks from HPMG Wealth Weekly, your money is likely to grow confidently and living the “rich” life, is achievable. GROWING TOGETHER www.hpmgshares.com HPMG WEALTH WEEKLY Monday Let Your Money Grow Confidently ! 21st December, 2020 STOCKS CMP BIAS TRADING/ INVESTMENT STRATEGY Avanti Feeds is the leading manufacturer of shrimp feeds and Shrimp Processor with 45% market share in domestic shrimp feed market. The firm was incorporated in the year 1993 and is now having a market cap of Rs AVANTI FEEDS 550 Positive 7417 Crores. Technically, downside seen well supported at 453-469 zone. Look to buy at CMP, and on dips between 491-495 zone, targeting 587.50/601 and then aggressive targets at 621 mark. Stop below 447. Holding Period: 2-3 Months. -

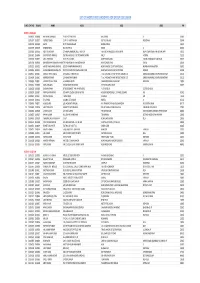

List of Shortlisted Candidates for Group Discussion

LIST OF SHORTLISTED CANDIDATES FOR GROUP DISCUSSION SL NO CONT NO ROLL NO NAME ADD1 ADD2 ADD3 PIN BATCH I: 09.00 A.M. 1 21000332 11000088 HIMANSHU BANSWAL E-126 PATEL NAGAR II GHAZIABAD UP 201001 2 21001297 11000271 JASPREET SINGH C 147 II A KHETRI NAGAR DIST JHUNJHUNU RAJASTHAN 333504 3 21001943 11000386 SIMMY RD 72 RAVIDAS NAGAR NEARELA DELHI 110040 4 21003879 11000798 DHARMENDRA B 46 SECTOR 55 NOIDA UP 201301 5 21002385 21000563 ROHIT CHAUDHARY C/O KAMAL MANDAL SWEET FACTORY FLAT NO 04 MAHISGOTE KRISHNAPUR NEW TOWN KOLKATA NR MOHINI APPT 700102 6 21003872 21000896 SOUMYAJYOTI MANDAL FLAT NO 402 BLOCK 1 42 SRICHARAN SARANI BALLY HOWRAH 711201 7 21002640 31000171 ARUL VENTHANS D.CO 159, 14WARD AMBEDKAR NAGAR, HARUR, DHARMAUR, TAMILNADU 636903 8 21001708 51000104 DNYANESHWAR SHANKAR KHARATMAL73F VAKHAR BHAG MAHAVEER NAGAR HIGH SCHOOL ROAD SANGIJ 416416 9 21002332 51000132 ANIKET PANDURANG GAIKWAD 261/01 KANNAMWAR NAGAR 02 NEAR VIKHROLI COURT VIKHROLI EAST MUMBAI MAHARASHTRA 400083 10 21002656 51000151 ASHISH BABURAO MUNGHATE PLOT NO 42 MAITREE KAMAL ARJUN PARK NEAR SHIV HEIGHTS BEL TARODI ROAD NAGPUR 440034 11 21000054 11000013 JASMEET SINGH BHATIA C/O JASMEET SINGH BHATIA TC 6/12 VEDANTA VIHAR HINDUSTAN ZINC LTD DARIBA RAJSAMAND UDAIPUR RAJASTHAN 313211 12 21000058 11000015 AKANKSHA KUMARI C/O AKANKSHA KUMARI TC 9/14 VEDANTA VIHAR HINDUSTAN ZINC LTD DARIBA RAJSAMAND UDAIPUR RAJASTHAN 313211 13 21000060 11000016 SANDEEP KUMAR YADAV A-5 AAKASH HOSTEL SHAKARPUR NEAR SANJAY PARK NEW DELHI 110092 14 21000234 11000061 KAPIL AGRAWAL 267/643 -

Zinc News – Issue January 2019

Naughty Sohan made 10 differences while copying the Picture - 1, he missed some and added some in the new Picture - 2. Let's find those 10 differences in Picture - 2. ZINC NEWS Kid's JANUARY 2019 03 Column !! esjh lqj{kk esjh ft+Eesnkjh Oops !!! e - 1 Sohan missed some, added some... e : Pictur Other Stories 12 Mr. Sunil Duggal CEO, HZL - The Zinc Man of India 06 er Pictur 18 Hindustan Zinc ranked 9th under Responsible Business Achievements & Mast Rankings-2018 by IIM Udaipur Recognitions 19 We @ Zinc - Silver by Mr. Tarun Arora 20 Humko Mann Ki Shakti Dena 21 Hindustan Zinc's Zinc in the Statue of Unity - Sardar Vallabhbhai Patel 22 Be Safe Zindagi... 23 Hindustan Zinc received CII - ITC 16 Sustainability Award Steel Your Car With Zinc Coat e - 2 26 Mining Data for Mining - Mr. Sunil - Mr. Arindam Mukharjee Duggal - CEO, HZL 28 New Norms to Turn Popular Cars Vintage e : Pictur 29 Mine Environment and Mineral Conservation Week - 2018 celebrated at HZL 32 Training Session on POSH at PMP, CSC, RDC & Zawar Mines 18 Copied Pictur Hindustan Zinc tops Metal & Mining 40 Hindustan Zinc hosts 1st All India Mines Safety, Cleanliness & Sector Globally in the 'Environment Category' Silicosis Awareness Week 2018 in Dow Jones Sustainability Index - 2018 43 ek:rh esa nks o"khZ; Vsªfuax gsrq ny jokuk 1 0. A line is remo is line A 0. v ed fr ed om bridge. om 44 53 Villages to get Free Primary Health Facilities mountain. the of colour the in Change 9. 8. Hole is remo is Hole 8. -

Optimizing Stock Market Returns During Global Pandemic Using Regression in the Context of Indian Stock Market

Journal of Risk and Financial Management Article Optimizing Stock Market Returns during Global Pandemic Using Regression in the Context of Indian Stock Market Pradip Debnath 1,* and Hari Mohan Srivastava 2,3,4,5,* 1 Department of Applied Science and Humanities, Assam University, Cachar, Assam, Silchar 788011, India 2 Department of Mathematics and Statistics, University of Victoria, Victoria, BC V8W 3R4, Canada 3 Department of Medical Research, China Medical University Hospital, China Medical University, Taichung 40402, Taiwan 4 Department of Mathematics and Informatics, AzerbaiJanuary University, 71 Jeyhun Hajibeyli Street, Baku AZ1007, Azerbaijan 5 Section of Mathematics, International Telematic University Uninettuno, I-00186 Rome, Italy * Correspondence: [email protected] (P.D.); [email protected] (H.M.S.) Abstract: Stock markets around the world experienced a massive collapse during the first wave of COVID-19. Roughly in the month of January 2021, the second wave of COVID-19 struck in India, reaching its peak in May, and by the end of May, the active cases started to decline. A third wave is again predicted by the end of 2021, and as such, the COVID-19 pandemic seems to have become a periodic phenomenon over the last couple of years. Therefore, the study of the behavior of the stock market as well as that of the investors becomes very interesting and crucial in this highly volatile and vulnerable market trend. Motivated by these facts, in the present paper, the researcher develops a model for portfolio management, using curve-fitting techniques and shows that this model can encounter the market volatility efficiently in the context of the Indian stock market. -

Csr Company Related Letter 17.07.2019

CSR Companies Contact Details S.No. District Company Name Concerned Name Mobile/Email 1 Ajmer R.K.Marble Pvt. Ltd., Makrana Road, Sh. Subhash C. Agarwal [email protected] Madanganj- Kishangarh- Mr. Suresh Patni 305801Ajmer 9829071401 2 Ajmer Shree Cement Ltd, Bangur Nagar, Sh. Bhawani Singh 9251037546 Beawar, Ajmer [email protected] 3 Ajmer Property Ventures (India) Pvt. Ltd., Sh. Vikas Patni [email protected] Makrana Road, Madanganj- Sh. Hemant Rathi, [email protected] Kishangarh, Ajmer Director [email protected] Sh. Namita Jain, CS 9829071401 4 Alwar Vintage Distillers Ltd., 117, M.I.A. Sh. Saurabh Jain 7665779000 Alwar-301030 Sh. Prakash Narang, 7073709112 Manager Personnel 7073709111 [email protected] [email protected] 5 Alwar United Breweries Ltd., UB Tower, Ms. Tushara Shankar (91-80) 39855000, Direct 39855 Level 3-5, UB City, #24 Vittal Maliya [email protected] Road, Bengaluru-560001 6 Alwar Eicher Engines ( A unit of TAFE Sh. R.N.Sahai [email protected] Motors and Tractors Limited), Sr. DGM 9414017928 Itarana Road, Alwar- 301001 Sh. Nageshwar Dutt [email protected] Lakhawat 7 Alwar Carlsberg India Pvt. Ltd., Plot No. SP- Sh. Ananad Shrivastava [email protected] 1-4& 5-8, Agro Food Park, MIA Ext. [email protected] Alwar 9785107507 8 Alwar Ashok Leyland Ltd., SPL-298, MIA, Sh. Gopinath [email protected] Alwar- 301 030 Asst. Manager-HR 9414020361 9 Alwar Metso India Pvt. Ltd., SP 1-1 to 1-13, Sh. Sanjay Sehgal [email protected] MIA Industrial Area, South East Sr. Manager 8094019207 Zone, Alwar- 301030 10 Alwar Havells India Ltd. -

Iot Opportunities for Industry 4.0

EMPOWER YOUR ANALYTICS WITH OPERATIONAL DATA 2019 OSISOFT MUMBAI SEMINAR IoT opportunities for industry 4.0 Neelesh Chawda 14th October, 2019 Head Milling Excellence, HZL one vision . one vedanta . Industry opportunities and challenges one vision . one vedanta . Opportunity to scale up Mining Autonomous Vehicles Estimated worldwide 88,000 110Mn uber users across the mining equipment in use world Data volume are up 500 folds Handles 3Mn drivers around over past 10 years different parts and timelines of world Only 20% of network capacity With 110Mn uber users, only industry need in 2020 exist today caters 69% of US market 62% of workforce think having Completely mobile access to application helps App and IoT to do better job based operations Working mine or cluster might be Operates in 80 countries and next door or halfway across 400 cities across globe world one vision . one vedanta . Industry challenges We are mature and proactive org, but We want to be data-driven, but… We need to cut costs, but… UNNECESSARY EXCESSIVE Loss time are of the UNPLANNED MAINTENANCE don’t know which cuts DOWNTIME COST 89% not time based 85% effort push us over our risk tolerance is in gathering and aggregating the data Operational Silos Average in a week Less Innovation and working investment as compared to other 40% hours are lost Reactive or Break / Fix due to inefficient communication sectors Maintenance Culture Organizational Working hazards and Care for Environment and Knowledge Loss mitigation of safety risks natural resources Data Not Accessible or Proactively Analyzed We know asset failure is often IT & OT data sources are diverse We don’t know where to cut random; however, we don’t have a and siloed, resulting in limited or where the point of diminishing better set of diagnostic tools visibility across an enterprise returns resides LOST LOWER REVENUE PROFITABILITY PEOPLE PROCESS TECHNOLOGY one vision . -

Hindustan Zinc (HINZIN)

Hindustan Zinc (HINZIN) CMP: | 308 Target: | 340 (10%) Target Period: 12 months HOLD April 29, 2021 Performs well…. Hindustan Zinc (HZL) reported a healthy Q4FY21 performance, primarily on account of higher-than-expected sales volume. For the quarter, zinc sales volumes came in at ~198000 tonnes (up 14% YoY, 9% QoQ, higher than our estimate: 191813 tonnes), lead sales volume came in at ~62000 tonnes (up 29% YoY, 17% QoQ, higher than our estimate: 54575 tonnes) while silver sales volume came in at ~203000 kg (up 41% YoY, 11% QoQ, higher Particulars than our estimate: 187500 kg). Topline came in at | 6947 crore (up 58% YoY, | Crore 15% QoQ), higher than our estimate of | 6435 crore. EBITDA came in at Market Capitalization 1,30,182 Result Update Result | 3875 crore (up 97% YoY, 19% QoQ), higher than our estimate of | 3594 Total Debt (FY21) 7,178 crore. EBITDA margin came in at 55.8%, in line with our estimate (EBITDA Gross Cash and Eq. (FY21) 22,308 margin of 54.2% in Q3FY21, 44.7% in Q4FY20). HZL’s zinc cost of production EV 1,15,052 (CoP) before royalty during quarter was at US$945/tonne per tonne 52 week H/L (|) 334 / 164 (| 68969/tonne), down 5%YoY both in rupee, US dollar terms and flat QoQ Equity capital 845.1 (down 1% in rupee terms). Ensuing PAT for Q4FY21 was at | 2481 crore (up Face value (|) | 2 13% QoQ, 85% YoY), higher than our estimate of | 2353 crore. Price Performance Healthy reserve base provides earnings visibility over long term 400 15000 HZL has a huge reserve base, which provides strong earnings visibility. -

Cr-V OXIDES from the RAMPURA AGUCHA Pb-Zn

745 The Canadian M inc ralo g ist Vol. 33, pp. 745-752 (1995) Cr-V OXIDESFROM THE RAMPURA AGUCHA Pb-Zn-(Ag) DEPoSll RAJASTHAN,INDIA WOLFRAM HOLLER ANDEUGEN F. STIIMPFL Institute of Geological Sciences, Mining University Leoben, Peter-Twmer-Strasse 5, 8700 Leobea Austria Arsrrasr Two new compositionalvarieties of rme oxide minerals have been studiedby ore microscopyand electron-microprobe analysis in samplesfrom the high-grademetamorphic, stratiform RampuraAgucha Pb--Zn{Ag) deposit, Rajasthan,India- We haveestablished the presenceof a Cr-V-Fe spineland a Cr-V rhombohedraloxide. The compositionsof the two minerals, Vs.s-1.15Cr9.6a_1.15Fej.6_n.67Mn6.12+.y.Mgo.A4zrzno.os-o.ozOaand V1.111.6Crs.36_4.sFe6.62_n.17O3, respectively, differ from known end-membersbecause of considerablesubstitution of Cr for V. Similar solid-solution seriesof spinels in the system FeCrrO. - FeVrOo- MnCrrOa- MnV2O4,such as manganochromite,worelainenite and coulsonite,as well as relatively pure karelianite and eskolaite, have been reported from several high-grademetamorphic deposis and areas.The rare V-oxide schreyerite,V2Ti3O9, also occursas exsolution lamellae in rutile at RampuraAgucha. These unusual compositions are arcributed to locally high concentrationsof V in the precursorsediments; they further underscorethe isochemicalnature of regional metamorphismof the orebody. Keryord*: coulsonite, ma:rganochromite,vuorelainenite, rutile, eskolaite, karelianite, schreyerite,Cr-V spinel, Rampura Agucha,Rajasthan, India. SoMraans Deux groupesd'oxydes rares ont 6t6mis en 6videnceau coursde notre dtudep6trographique et nos analysespar microsonde 6lectroniqued'6chantillons de rochesfortement m6urnorphisdes du gisementstrattforme n Pb--Zn-(Ag) de RampuraAguch4 au Rajasthan,en Inde. tr s'agit d'un spinelle I Cr-V-Fe et d'un oxyde rhombo€driquede Cr-V.