Return of Organization Exempt from Income Tax

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Profile 2020-21 975 Westtown Road West Chester, PA 19382-5700 (610) 399-7935 CEEB Code: 395230

Profile 2020-21 975 Westtown Road West Chester, PA 19382-5700 (610) 399-7935 CEEB Code: 395230 Founded in 1799 by the Religious Society of Friends, to their inner selves. Westtown expects students to be Westtown School continues to be one of the nation’s critical, independent thinkers who can work with a spirit best-known Quaker schools. Situated on 600 acres in of cooperation, understanding, and tolerance of the Chester County, Pennsylvania, Westtown is accredited views of others. by the Pennsylvania Association of Independent Schools. The Westtown experience is defined by rigorous Students at Westtown are challenged to realize their academic preparation for college, community living in intellectual, physical, emotional, and spiritual potential. a diverse environment, weekly Meeting for Worship, Truth, openness, and honesty are values which undergird and participation in the school’s unique Work Program the school community. A spirit of inquiry reigns in (detailed below). These shared events reflect and teach the classroom and students are encouraged to think the fundamental Quaker values of consensus, nonviolent creatively, to feel the condition of others, and to listen resolution of conflict, and the dignity of physical work. Victoria H. Jueds, Head of School Joaquim M. Hamilton, Associate Director of College Counseling Veda R. Robinson, Upper School Principal Marjorie T. Ireland, Associate Director of College Counseling Jessica K. Smith, Director of College Counseling Debra A. Weaver, Registrar, College Counseling Coordinator ENROLLMENT — Coeducational since the school’s founding, Westtown’s student body consists of 732 students in grades Pre-K through 12. — Students come from 19 states and 18 countries. -

Faith Voices Letter

In Support Of Keeping Houses Of Worship Nonpartisan August 16, 2017 Dear Senator: As a leader in my religious community, I am strongly opposed to any effort to repeal or weaken current law that protects houses of worship from becoming centers of partisan politics. Changing the law would threaten the integrity and independence of houses of worship. We must not allow our sacred spaces to be transformed into spaces used to endorse or oppose political candidates. Faith leaders are called to speak truth to power, and we cannot do so if we are merely cogs in partisan political machines. The prophetic role of faith communities necessitates that we retain our independent voice. Current law respects this independence and strikes the right balance: houses of worship that enjoy favored tax-exempt status may engage in advocacy to address moral and political issues, but they cannot tell people who to vote for or against. Nothing in current law, however, prohibits me from endorsing or opposing political candidates in my own personal capacity. Changing the law to repeal or weaken the “Johnson Amendment” – the section of the tax code that prevents tax-exempt nonprofit organizations from endorsing or opposing candidates – would harm houses of worship, which are not identified or divided by partisan lines. Particularly in today’s political climate, engaging in partisan politics and issuing endorsements would be highly divisive and have a detrimental impact on congregational unity and civil discourse. I therefore urge you to oppose any repeal or weakening of the Johnson Amendment, thereby protecting the independence and integrity of houses of worship and other religious organizations in the charitable sector. -

Westonian Magazine in THIS ISSUE: BEHIND the NUMBERS Annual Report for 2016–2017

WINTER 2018 The Westonian Magazine IN THIS ISSUE: BEHIND THE NUMBERS Annual Report for 2016–2017 The [R]evolution of Science at Westtown FIG. 1 Mission-Based Science Meets the 21st Century The Westonian, a magazine for alumni, parents, and friends, is published by Westtown School. Its mission is “to capture the life of the school, to celebrate the impact that our students, faculty, and alumni have on our world, and to serve as a forum for connection, exploration, and conversation.” We publish issues in Winter and Summer. We welcome letters to the editor. You may send them to our home address or to [email protected]. HEAD OF SCHOOL Jeff DeVuono James Perkins ’56 Victoria H. Jueds Jacob Dresden ’62, Keith Reeves ’84 Co-Associate Clerk Anne Roche CONNECT BOARD OF TRUSTEES Diana Evans ’95 Kevin Roose ’05 Amy Taylor Brooks ’88 Jonathan W. Evans ’73, Daryl Shore ’99 Martha Brown Clerk Michael Sicoli ’88 Bryans ’68 Susan Carney Fahey Danielle Toaltoan ’03 Beah Burger- Davis Henderson ’62 Charlotte Triefus facebook.com/westtownschool Lenehan ’02 Gary M. Holloway, Jr. Kristen Waterfield twitter.com/westtownschool Luis Castillo ’80 Sydney Howe-Barksdale Robert McLear Edward C. Winslow III ’64 vimeo.com/westtownschool Michelle B. Caughey ’71, Ann Hutton Brenda Perkins ’75, Maximillian Yeh ’87 instagram.com/westtownschool Co-Associate Clerk Jess Lord ’90 Recording Clerk WINTER 2018 The Westonian Magazine Editor Lynette Assarsson, Associate Director FEATURES of Communications Manager of The (R)evolution of Web Features Greg Cross, 16 Science at -

Westtown School

Upper School Principal West Chester, PA Westtown School, an independent, PK-12, day and boarding Quaker school in West Chester, Pennsylvania, seeks an experienced, dynamic educational leader to serve as Upper School Principal. The principal will provide strategic guidance for the Upper School, support its faculty, oversee its daily operations, and guide the division through both joys and challenges with skill, sensitivity and grace. The principal will partner with other senior administrators to develop and implement school- wide strategic priorities that further the school’s mission, and will ensure the alignment of Upper School initiatives with those priorities. The School: Westtown is a spirit-led school where students are empowered to discover their unique gifts and guiding purpose in a values-based community, while acquiring the skills and knowledge they will need to impact — and to better — the world they will inherit. Founded in 1799 by members of the Philadelphia Yearly Meeting of the Religious Society of Friends, Westtown educates not just for the sake of college preparation, but for an engaged and reflective life. The school’s academic program is rigorous, and its college admissions record is impressive. At the same time, the school places a strong emphasis on reflection and mindfulness, both in weekly Meeting for Worship and in students’ everyday lives. Westtown’s beautiful 600-acre campus, located just 25 miles west of Philadelphia, encourages investigation, relaxation, and play, as well as illustrating the school’s commitment to sustainability. Quaker values and practices pervade the curriculum and culture, encouraging each community member to value diversity, to seek peace and justice, and to demonstrate respect for self and others. -

List of AOIME Institutions

List of AOIME Institutions CEEB School City State Zip Code 1001510 Calgary Olympic Math School Calgary AB T2X2E5 1001804 ICUC Academy Calgary AB T3A3W2 820138 Renert School Calgary AB T3R0K4 820225 Western Canada High School Calgary AB T2S0B5 996056 WESTMOUNT CHARTER SCHOOL CALGARY AB T2N 4Y3 820388 Old Scona Academic Edmonton AB T6E 2H5 C10384 University of Alberta Edmonton AB T6G 2R3 1001184 Vernon Barford School Edmonton AB T6J 2C1 10326 ALABAMA SCHOOL OF FINE ARTS BIRMINGHAM AL 35203-2203 10335 ALTAMONT SCHOOL BIRMINGHAM AL 35222-4445 C12963 University of Alabama at Birmingham Birmingham AL 35294 10328 Hoover High School Hoover AL 35244 11697 BOB JONES HIGH SCHOOL MADISON AL 35758-8737 11701 James Clemens High School Madison AL 35756 11793 ALABAMA SCHOOL OF MATH/SCIENCE MOBILE AL 36604-2519 11896 Loveless Academic Magnet Program High School Montgomery AL 36111 11440 Indian Springs School Pelham AL 35124 996060 LOUIS PIZITZ MS VESTAVIA HILLS AL 35216 12768 VESTAVIA HILLS HS VESTAVIA HILLS AL 35216-3314 C07813 University of Arkansas - Fayetteville Fayetteville AR 72701 41148 ASMSA Hot Springs AR 71901 41422 Central High School Little Rock AR 72202 30072 BASIS Chandler Chandler AZ 85248-4598 30045 CHANDLER HIGH SCHOOL CHANDLER AZ 85225-4578 30711 ERIE SCHOOL CAMPUS CHANDLER AZ 85224-4316 30062 Hamilton High School Chandler AZ 85248 997449 GCA - Gilbert Classical Academy Gilbert AZ 85234 30157 MESQUITE HS GILBERT AZ 85233-6506 30668 Perry High School Gilbert AZ 85297 30153 Mountain Ridge High School Glendale AZ 85310 30750 BASIS Mesa -

Elderberries 2020 Winter

www.uurmapa.org E lderberries Volume 36 Number 1 WINTER, 2020 Nationally Known UU Authors Step Out TWO RETIRED COLLEAGUES’ NEW ISSUES STIR READERSHIP Mystery and ministry: Insightful, compassionate a natural evolution of slices of life the power of the word? A new Skinner House book (Oct., 2019) In Time’s Shadow: Stories About JUDITH CAMPBELL, UU community minister, talked to Impermanence, offers a collection of Elderberries about her MARILYN SEWELL’s very short fiction longtime (12 books) Olympia (each about a page or less) on Brown and newer (2018, right) themes of loss and change. Viridienne Greene mysteries, her career(s), and the ongoing Marilyn is Minister Emerita of the First Unitarian ministry of her writing. Church of Portland, OR, where she served as Senior Minister for 17 years before she retired. Judith also presents writing workshops and ‘Writing as Through these compelling readings Spiritual Practice” sessions Marilyn reveals the cultural incongruities both nationally & internation- and inanities that crowd our lives. ally. When she's not traveling We love, we lose, we die, and we and teaching, she makes her might ask, “What’s it all about?” home in Plymouth, MA. “Ministry and murder are CONTINUED, PAGE 8 JUDITH: “Write what you know” is unlikely bedfellows,” said Judith time-honored advice for writers. It is the only way to speak in an authentic (in a Boston Globe interview). MARILYN SEWELL voice. So, what do I know? “But put them together and they From 30 years of college make for a good story and a professing, I know people. And good teaching tool.” Her self- from 20+ years in active ministry, I know the ins and outs and ups and given nicknames include sinister downs of this curious craft, including minister, irreverent reverend, the darker side of human nature. -

The Official Boarding Prep School Directory Schools a to Z

2020-2021 DIRECTORY THE OFFICIAL BOARDING PREP SCHOOL DIRECTORY SCHOOLS A TO Z Albert College ON .................................................23 Fay School MA ......................................................... 12 Appleby College ON ..............................................23 Forest Ridge School WA ......................................... 21 Archbishop Riordan High School CA ..................... 4 Fork Union Military Academy VA ..........................20 Ashbury College ON ..............................................23 Fountain Valley School of Colorado CO ................ 6 Asheville School NC ................................................ 16 Foxcroft School VA ..................................................20 Asia Pacific International School HI ......................... 9 Garrison Forest School MD ................................... 10 The Athenian School CA .......................................... 4 George School PA ................................................... 17 Avon Old Farms School CT ...................................... 6 Georgetown Preparatory School MD ................... 10 Balmoral Hall School MB .......................................22 The Governor’s Academy MA ................................ 12 Bard Academy at Simon's Rock MA ...................... 11 Groton School MA ................................................... 12 Baylor School TN ..................................................... 18 The Gunnery CT ........................................................ 7 Bement School MA................................................. -

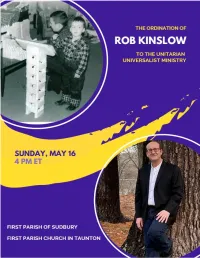

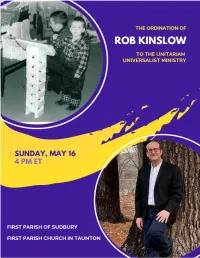

Robk Ordination OOS FINAL Rev2

ORDER OF SERVICE Processional All Creatures of the Earth and Sky Words: Attributed to St. Francis of Assisi Music: Ralph Vaughan Williams Performed by the First Parish of Sudbury Choir Welcome Rev. Dr. Marjorie Matty Call to Worship Rev. Christana Wille McKnight Chalice Lighting Jay Kinslow Dan Kinslow Stephanie Deerwester Invitation to Generosity Rev. Tera Klein Offertory Sure on This Shining Night Words: James Agee Music: Morten Lauridsen Performed by the First Parish of Sudbury Choir Prayer Sarah Donnell Emily Drummond Li Kynvi Lauren Levwood Amanda Schuber Reading Rev. Beverly Waring Musical Response The River Words and music: Coco Love Alcorn Performed by the First Parish Church in Taunton Ensemble Homily Rev. Andrea Greenwood and Rev. Mark W. Harris Musical Response Swimming to the Other Side Words and music: Pat Humphries Performed by the First Parish Church in Taunton Ensemble Act of Ordination Valerie Tratnyek Mary Vaeni ACT OF ORDINATION With microphones remaining muted, please join in these words as directed: Members of First Parish of Sudbury: We, the members of First Parish of Sudbury, of Sudbury, Massachusetts … Members of First Parish Church in Taunton: We, the members of the First Parish Church in Taunton, of Taunton, Massachusetts … All members of both congregations: By the authority of our living tradition, we joyfully ordain you, Reverend Robert Patrick Kinslow, to the Unitarian Universalist ministry. Live into this call. May you minister from your whole self: heart and mind, body and spirit. May you always speak the truth as you know it with courage and wisdom, demonstrate grace, gentleness and good humor, celebrate the mystery and wonder of life, share in the joys and sorrows of our human condition, embody the living tradition of our faith, and above all, serve the world with compassion and love. -

Health Matters Loose Ends

18B A Packet Publication The Week of Friday, December 14, 2018The Week of Friday, December 14, 2018 A Packet Publication 19B Health Matters Loose Ends Continued from Page 18B Continued from Page 15B attacks, the American Academy of Pediat- parents, siblings and other caregivers or • Noticeable contracting of the chest, angry for the next two years.” rics offers the following tips: close relatives should also receive the flu ribs or belly when breathing. “I was ready to do something more than • Do not smoke or let anyone else smoke vaccine. • Unusual anxiety or restlessness. just knitting pink hats for the Pussyhat in your home or car. If asthma is well managed, a child should • Change in skin color. Project,” said Susie. • Reduce exposure to dust mites by cov- not experience symptoms more than once or • Increased pulse. Princetonian, Joel Schwartz, became ering your child’s mattress and pillows with twice per week, symptoms should not wake • Sweating. Barbara’s partner in the goal of flipping special allergy-proof casing, washing bed- a child at night more than twice per month, • Decreased level of alertness. the 7th Congressional District from Re- ding in hot water every 1 to 2 weeks, and and a child should be able to play sports and At Penn Medicine Princeton Medical publican to Democratic. “Joel was great at vacuuming and dusting regularly. participate in physical education activities. Center, pediatricians from Children’s Hos- the data analysis, and I was a networking • Avoid pets or at least keep pets out of When Asthma Becomes an Emergen- pital of Philadelphia are on-site 24/7 to con- machine. -

Ordination Order of Service.Pdf

ORDER OF SERVICE Processional All Creatures of the Earth and Sky Words: Attributed to St. Francis of Assisi Music: Ralph Vaughan Williams Performed by the First Parish of Sudbury Choir Welcome Rev. Dr. Marjorie Matty Call to Worship Rev. Christana Wille McKnight Chalice Lighting Jay Kinslow Dan Kinslow Stephanie Deerwester Invitation to Generosity Rev. Tera Klein Offertory Sure on This Shining Night Words: James Agee Music: Morten Lauridsen Performed by the First Parish of Sudbury Choir Prayer Sarah Donnell Emily Drummond Li Kynvi Lauren Levwood Amanda Schuber Reading Rev. Beverly Waring Musical Response The River Words and music: Coco Love Alcorn Performed by the First Parish Church in Taunton Ensemble Homily Rev. Andrea Greenwood and Rev. Mark W. Harris Musical Response Swimming to the Other Side Words and music: Pat Humphries Performed by the First Parish Church in Taunton Ensemble Act of Ordination Valerie Tratnyek Mary Vaeni ACT OF ORDINATION With microphones remaining muted, please join in these words as directed: Members of First Parish of Sudbury: We, the members of First Parish of Sudbury, of Sudbury, Massachusetts … Members of First Parish Church in Taunton: We, the members of the First Parish Church in Taunton, of Taunton, Massachusetts … All members of both congregations: By the authority of our living tradition, we joyfully ordain you, Reverend Robert Patrick Kinslow, to the Unitarian Universalist ministry. Live into this call. May you minister from your whole self: heart and mind, body and spirit. May you always speak the truth as you know it with courage and wisdom, demonstrate grace, gentleness and good humor, celebrate the mystery and wonder of life, share in the joys and sorrows of our human condition, embody the living tradition of our faith, and above all, serve the world with compassion and love. -

UUMA News the Newsletter of the Unitarian Universalist Ministers’ Association

UUMA News The Newsletter of the Unitarian Universalist Ministers’ Association November 2005—February 2006 From the President Inside this Issue: he ten members of your UUMA Executive Ministry Days/PLCC 2 T Committee (the Exec) are eager to let you know From the Editor 3 what we’ve been up to, and to learn of any concerns, From Good Offices 3 questions, or opinions you may have. And so we have a website, the UUMA chat, an email list for sending out And We Remember . 4 important news, and a quarterly newsletter. We offer each Administrator Column 7 Chapter a visit from an Exec member who will give a Sermon Awards 8 report and respond to questions and concerns. At this New UUMA Focus Group 8 year’s GA we will return to having Ministry Days (after several years of Professional Days in conjunction with The Power of Effects 9 LREDA), featuring – in addition to the CENTER presentation and worship, 50 year Address 10 including remarks by the 25- and 50-year ministers – more chances for interaction: CENTER-Fold 12 CENTER workshops; collegial conversations: a conversation with Bill Sinkford; and our annual meeting, which we expect to make more interesting starting this year. News from the Dept. of 14 Ministry & Professional Leadership And the minutes of Exec meetings are posted on our website. This only happens, though, after they have been approved at the next meeting about three months later. 25 year Address 16 To keep you more up to date, Executive Notes are now posted on the UUMA News from the UUA 17 Members’ website. -

A Brief History of Westtown School

A Brief History of Westtown School Westtown School has been part of Westtown Township 1797 near the mill. Th e sawyer’s home still stands in the for over 200 years, situated with Street Road to the south, north woods of the campus as a faculty home. Th at same Westtown Road to the west, and Shady Grove Way and year a springhouse was erected; later it was enlarged to Walnut Hill Road to the east. Th e school was founded by house the dairy operation of the school’s farm. It remains members of the Philadelphia Yearly Meeting of the Reli- today along Westtown Road as a faculty home. A grist- gious Society of Friends as a boarding school for Quaker mill built in 1801 along Chester Creek no longer stands, children that would encourage spiritual formation and but the house built for the miller, also along Westtown provide a useful education. Th e school opened in 1799 Road, is still maintained by the school. Th ese are a few and is regarded as the oldest, continuously operating coed- of the many buildings on Westtown’s campus that tell the ucational boarding school in the country. Th e school took story of the school’s past and present. its name from its location in Chester County, the town- ship marked as “West Town” and “West-Towne” on two Westtown’s current main building was designed by Phila- early maps of Pennsylvania by surveyor Th omas Holme, delphia architect Addison Hutton and was completed in appointed by William Penn. Today, as an independent 1888.