Trump Empire Totters, with Banks Not Far Behind

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Donald Trump 72 for Further Research 74 Index 76 Picture Credits 80 Introduction

Contents Introduction 4 A Bet Th at Paid Off Chapter One 8 Born Into a Wealthy Family Chapter Two 20 Winning and Losing in Business Chapter Th ree 31 Celebrity and Politics Chapter Four 43 An Unconventional Candidate Chapter Five 55 Trump Wins Source Notes 67 Timeline: Important Events in the Life of Donald Trump 72 For Further Research 74 Index 76 Picture Credits 80 Introduction A Bet That Paid Off n June 16, 2015, reporters, television cameras, and several hun- Odred people gathered in the lobby of Trump Tower, a fi fty-eight- story skyscraper in Manhattan. A podium on a stage held a banner with the slogan “Make America Great Again!” All heads turned as sixty-nine-year-old Donald John Trump made a grand entrance, rid- ing down a multistory escalator with his wife, Melania. Trump biogra- pher Gwenda Blair describes the scene: “Gazing out, they seemed for a moment like a royal couple viewing subjects from the balcony of the palace.”1 Trump fl ashed two thumbs up and took his place on the stage to proclaim his intention to campaign for the Republican nomination for president. Unlike the other politicians hoping to be elected president in No- vember 2016, Trump was a billionaire and international celebrity who had been in the public eye for decades. Trump was known as a negotia- tor, salesman, television personality, and builder of glittering skyscrap- ers. He was involved in high-end real estate transactions, casinos, golf courses, beauty pageants, and the reality show Th e Apprentice. Trump’s name was spelled out in shiny gold letters on luxury skyscrapers, golf courses, resorts, and other properties throughout the world. -

Donald Had Started Branding All of His Buildings in Manhattan, My Feelings About My Name Became More Complicated

Thank you for downloading this Simon & Schuster ebook. Join our mailing list to get updates on new releases, deals, recommended reads, and more from Simon & Schuster. CLICK HERE TO SIGN UP Already a subscriber? Provide your email again so we can register this ebook and send you more of what you like to read. You will continue to receive exclusive offers in your inbox. For my daughter, Avary, and my dad If the soul is left in darkness, sins will be committed. The guilty one is not he who commits the sin, but the one who causes the darkness. —Victor Hugo, Les Misérables Author’s Note Much of this book comes from my own memory. For events during which I was not present, I relied on conversations and interviews, many of which are recorded, with members of my family, family friends, neighbors, and associates. I’ve reconstructed some dialogue according to what I personally remember and what others have told me. Where dialogue appears, my intention was to re-create the essence of conversations rather than provide verbatim quotes. I have also relied on legal documents, bank statements, tax returns, private journals, family documents, correspondence, emails, texts, photographs, and other records. For general background, I relied on the New York Times, in particular the investigative article by David Barstow, Susanne Craig, and Russ Buettner that was published on October 2, 2018; the Washington Post; Vanity Fair; Politico; the TWA Museum website; and Norman Vincent Peale’s The Power of Positive Thinking. For background on Steeplechase Park, I thank the Coney Island History Project website, Brooklyn Paper, and a May 14, 2018, article on 6sqft.com by Dana Schulz. -

Trump Entertainment Resorts: Three Bankruptcies and the Failure to Make Atlantic City Great Again

University of Tennessee, Knoxville TRACE: Tennessee Research and Creative Exchange Chapter 11 Bankruptcy Case Studies College of Law Student Work June 2017 Trump Entertainment Resorts: Three Bankruptcies and the Failure to Make Atlantic City Great Again Ryan Gallagher Andrew Hale Follow this and additional works at: https://trace.tennessee.edu/utk_studlawbankruptcy Part of the Bankruptcy Law Commons Recommended Citation Gallagher, Ryan and Hale, Andrew, "Trump Entertainment Resorts: Three Bankruptcies and the Failure to Make Atlantic City Great Again" (2017). Chapter 11 Bankruptcy Case Studies. https://trace.tennessee.edu/utk_studlawbankruptcy/47 This Article is brought to you for free and open access by the College of Law Student Work at TRACE: Tennessee Research and Creative Exchange. It has been accepted for inclusion in Chapter 11 Bankruptcy Case Studies by an authorized administrator of TRACE: Tennessee Research and Creative Exchange. For more information, please contact [email protected]. Trump Entertainment Resorts: Three Bankruptcies and the Failure to Make Atlantic City Great Again Workouts and Reorganizations – Professor George Kuney Spring 2017 Ryan Gallagher and Andrew Hale 1 Table of Contents 1 Introduction and Overview: The Gamble on Atlantic City and a History of Trump Entertainment Resorts ..................................................................................................................... 5 1.1 Background ..................................................................................................................... -

Measuring the Assurances of Female Political Leaders: Hillary Clinton On

“Measuring the Assurances of Female Political Leaders: Hillary Clinton on the Campaign Trail” Paper presented to panel B10: “Responsiveness and Representation” May 31, 201, 10:30-12 pm, CL 305 Annual meeting of the Canadian Political Science Association Regina Saskatchewan, May 30-June 1, 2018 Abstract: A well-established maxim within the political leadership literature holds that most leaders, most of the time, seek to assure citizens in their public communications. The provision of such certainty is thought to be integral to the exercise of leadership: uncertain citizens seek advice and reassurance, and so they turn to political leaders who can provide such goods (Downs, 1957). This understanding has been studied empirically mainly with respect to male leaders (de Clercy, 2005). This study asks: do female political leader also communicate certainty and uncertainty to citizens and, if so, how may such messages compare with those of male leaders? The study focuses on Hillary Clinton, the first woman to campaign for the American presidency. Leader communications are evaluated by analysing the content of Clinton’s three televised 2016 presidential debate performances using Atlas.ti, a qualitative content analysis program. These findings are compared with the same speech sets for her opponent, Donald Trump. Then, these values are compared with similar data for a sample of two other male presidential candidates. The study finds Clinton fits the role of a classic transactional leader and given the small number of cases under study here, there seems to be no systematic difference in how she communicated assurances to citizens based on her gender. Copyright Cristine de Clercy, 2018. -

Trump, Trump, Trump by Paul H

Clio’s Psyche Understanding the “Why” of Culture, Current Events, History, and Society The Trump Symposium with Commentaries Trump as a Symptom Trump Studies European and Student Reactions to Trump Why Hillary Lost Ethical Issues Volume 24 Number 1 Summer 2017 Clio’s Psyche Vol. 24 No. 1 Summer 2017 ISSN 1080-2622 Published by the Psychohistory Forum 627 Dakota Trail, Franklin Lakes, NJ 07417 Telephone: (201) 891-7486 E-mail: [email protected] Editor: Paul H. Elovitz Editorial Board C. Fred Alford, PhD University of Maryland • James W. Anderson, PhD Northwestern University • David Beisel, PhD RCC-SUNY • Donald L. Carveth, PhD York University • Lawrence J. Friedman, PhD Harvard University • Ken Fuchsman, EdD University of Connecticut • Bob Lentz • Peter Loewenberg, PhD UCLA • Peter Petschauer, PhD Appalachian State University Subscription Rate: Free to members of the Psychohistory Forum $82 two-year subscription to non-members $75 yearly to institutions (Add $60 per year outside U.S.A. & Canada) Single issue price: $29 We welcome articles of psychohistorical interest of 500-2,000 words and some up to 3,500 words that have deeper scholarship. INSTRUCTIONS FOR CONTRIBUTORS: Clio’s Psyche welcomes original manuscripts that address individual or group issues from a psychological perspective. We are interested in contemporary and historical events. Childhood, family, group trauma, mechanisms of defense, personality, political psychology, psychic trauma, and psychobiography are of special interest. Our readers come from many fields so we avoid technical terminology. All manuscripts must include 6-10 keywords that stress the psychohistorical aspects of the article and an abstract of a maximum of 100 words. -

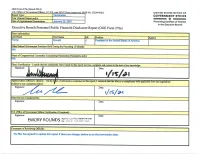

Financial Disclosure Report (OGE Form 278E)

OGE Form 278e (March 2014) U.S. Office of Government Ethics· 5 C.F.R. art 2634 Form A roved: 0MB No. (3209-0001) UNIT£0 STATES O FflCE O F R rt T Tennination GOVERNM ENT ETHICS Date of Appointment/Termination: January 20, 2021 Preventing Confli* cts of lntere,t in the Execu:ive Bran<:h Executive Branch Personnel Public Financial Disclosure Report (OGE Form 278e) Filer's Information •L . Last Name First Name MI Position Agency Trump Donald J President of the United States of America Other Federal Government Positions Held During the Preceding 12 Months: N/A Name of Congressional Committee Considering Nomination (Nominees only): N/A Filer's Certification - I certify that the statements I have made in this report are true, complete and correct to the best of my knowledge: Signature: Date: JJMi •/•'r/- • Agency Ethics Otticial's upwon - Ori the i1.1s of mtormation contained m llllS report, I conclude that the filer 1s in compliance with applicable laws and regulations (subject to any comments be]ow) - Signature: Date: ~ 1/ ,s/ ;;-c Other Review Conducted By: Signature: Date: U.S. Office ofGovernment Ethics Certification (if required): Signature: Date: Comments of Reviewing Officials: The filer has agreed to update this report if there are changes before or on the termination date. OGE Form 278e (March 2014) Instructions for Part 1 Note: This is a public form. Do not include account numbers, street addresses, or family member names. See instructions for required information. Filer's Name Page Number Donald J. Trump 2 of 37 Part 1: Filer's Positions Held Outside United States Government # Organization Name City/State Organization Type Position Held From To 1. -

As Its Stock Collapsed, Trump's Firm Gave Him Huge Bonuses and Paid

As its stock collapsed, Trump’s firm gave him huge bonuses and paid for his jet The Washington Post By Drew Harwell // June 12, 2016 https://www.washingtonpost.com/business/economy/as-its-stock-collapsed-trumps-firm-gave- him-huge-bonuses-and-paid-for-his-jet/2016/06/12/58458918-2766-11e6-b989- 4e5479715b54_story.html It was promoted as the chance of a lifetime: Mom-and-pop investors could buy shares in celebrity businessman Donald Trump’s first public company, Trump Hotels and Casino Resorts. Their investments were quickly depleted. The company known by Trump’s initials, DJT, crumbled into a penny stock and filed for bankruptcy after less than a decade, costing shareholders millions of dollars, even as other casino companies soared. In its short life, Trump the company greatly enriched Trump the businessman, paying to have his personal jet piloted and buying heaps of Trump-brand merchandise. Despite losing money every year under Trump’s leadership, the company paid Trump handsomely, including a $5 million bonus in the year the company’s stock plummeted 70 percent. Many of those who lost money were Main Street shareholders who believed in the Trump brand, such as Sebastian Pignatello, a retired private investor in Queens. By the time of the 2004 bankruptcy, Pignatello’s 150,000 shares were worth pennies on the dollar. “He had been pillaging the company all along,” said Pignatello, who joined shareholders in a lawsuit against Trump that has since been settled. “Even his business allies, they were all fair game. He has no qualms about screwing anybody. -

October-2017.Pdf

Inside stories of how activist staffers countered corporate lobbies “A wonderful read.” — ROBERT REICH “ Witty and penetrating…” — NORMAN ORNSTEIN “ This book is the story of a public servant … and his fellow activist staffers, whose valiant work on consumer protection has helped millions of Americans.” — RALPH NADER “A lively and thought- provoking book…” — JAMES A. THURBER “ This may be the most important political book written about our current political dysfunction…” — MATT MYERS Available now in jacketed cloth & ebook formats. Visit us at www.vanderbiltuniversitypress.com. contents OCTOBER 2017 UP FRONT 6 The New Fight for Labor Rights 18 To survive, the labor movement needs to rethink its strategy. BY RACHEL M. COHEN 8 Losing Hearts and Minds How Trump quietly gutted a program to combat extremism. BY BENJAMIN POWERS 9 The Trump Tweetometer A look inside the president’s mind, based on his first seven months of tweets. 10 The Next Standing Rock Why is Canada green-lighting a pipeline that could kill the climate? BY BEN ADLER 12 Art of the Steal How Trump’s self-dealing helped make his book a best-seller. BY ALEX SHEPHARD COLUMNS 14 Deadbeat Democrats How Bill Clinton set the stage for the GOP’s war on the poor. BY BRYCE COVERT Lauren Underwood, 16 a nurse from Illinois, Redoing the Electoral Math is a candidate for Congress. It will take more than demographics to save the Democrats. BY JOHN B. JUDIS Running on Hope REVIEW 46 Rules for Radicals A new group of Obama aides aims to take down Trump. The right-wing economist who rigged But can Democrats win without a unified message? democracy for the rich. -

Nathan J. Robinson Anatomy of a Monstrosity

“[Robinson] perfectly predicted what would happen in a Clinton-Trump race... He was one of the few pundits who did.” — FORTUNE TRUMP ANATOMY OF A MONSTROSITY NATHAN J. ROBINSON ANATOMY OF A MONSTROSITY TRUMP ANATOMY OF A MONSTROSITY By NATHAN J. ROBINSON Published by: Current Affairs Press P.O. Box 441394 W. Somerville, MA 02144 currentafairs.org Copyright © 2017 by Nathan J. Robinson All Rights Reserved First U.S. Edition Distributed on the West Coast by Waters & Smith, Ltd Monster City, CA ISBN 978-0997844771 No portion of this text may be reprinted without the express permission of Current Afairs, LLC. Cover photo copyright © Getty Images, reprinted with permission. Library of Congress Catalog-in-Publication Data Robinson, Nathan J. Trump: Anatomy of a Monstrosity / Nathan J. Robinson p. cm Includes bibliographical references and index ISBN 978-0997844771 1. Trump, Donald J. 2. Political science 3. Elections 4. Social Philosophy 1. Title To all those who have had the misfortune of sharing a planet with Donald J. Trump, and to those who shall someday get rid of him and everything for which he stands. “We are here to help each other through this thing, whatever it is.” —Kurt Vonnegut “What kind of son have I created?” —Mary Trump, mother of Donald Trump1 CONTENTS Preface 13 Introduction: Trump U 19 I. Who He Is Te Life of Trump 37 Trump & Women 54 What Trump Stands For 69 Who Made Trump 97 II. How It Happened Trump the Candidate 111 Clinton v. Trump 127 What Caused It To Happen? 141 III. What It Means Despair Lingers 177 Orthodox Liberalism Has Been Repudiated 183 Te Press is Discredited Forever 199 Calamity Looms, or Possibly Doesn’t 211 Why Trump Must Be Defeated 217 IV. -

Max Bergmann: on January 6, 2017 the US Intelligence Community Dropped a Bomb

The Asset Episode 2: Bankrupt Producer: Previously on The Asset: Max Bergmann: On January 6, 2017 the US intelligence community dropped a bomb. Newscast: Newscaster: US intelligence has concluded that Russian President Vladimir Putin ordered his military to help Donald Trump win the election. James Comey: The FBI, as part of our counterintelligence mission, is investigating the Russian government's efforts to interfere in the 2016 presidential election. Max Bergmann: And then… Newscast: Reporter: The president has fired James Comey. Max Bergmann: Trump drops the charade. Newscast: Donald Trump: Oh, I was going to fire regardless of recommendation. Lester Holt: So there was […] Donald Trump: He made a recommendation. He is highly respected. But regardless of recommendation, I was going to fire [Comey]. Max Bergmann: Trump fired the FBI director for investigating him. He admitted to obstruction of justice on national television. -BREAK- Max Bergmann: Episode 2: Bankrupt. The Trump Taj Mahal Casino in Atlantic City was supposed to be the eighth wonder of the world. When it opened in April 1990 it was the largest casino complex ever built, taking up 17 acres of prime real-estate on Atlantic City's famed boardwalk. It was also the most expensive casino ever built. Donald Trump shelled out $1.1 billion to get it operating. The Trump Taj Mahal was exactly what you'd expect from a Trump casino. It was bigger, more expensive, and it was tackier, decked out top to bottom in blinding neon lights and faux-Indian spires. It was an over-the-top effort to exude ostentatious wealth. -

Guide to the UNLV Libraries Collection of Trump Entertainment Resorts, Inc

Guide to the UNLV Libraries Collection of Trump Entertainment Resorts, Inc. Promotional Materials and Reports This finding aid was created by Kyle Gagnon. This copy was published on December 05, 2019. Persistent URL for this finding aid: http://n2t.net/ark:/62930/f1565m © 2019 The Regents of the University of Nevada. All rights reserved. University of Nevada, Las Vegas. University Libraries. Special Collections and Archives. Box 457010 4505 S. Maryland Parkway Las Vegas, Nevada 89154-7010 [email protected] Guide to the UNLV Libraries Collection of Trump Entertainment Resorts, Inc. Promotional Materials and Reports Table of Contents Summary Information ..................................................................................................................................... 3 Historical Background ..................................................................................................................................... 3 Scope and Contents Note ................................................................................................................................ 4 Arrangement .................................................................................................................................................... 4 Administrative Information ............................................................................................................................. 4 Names and Subjects ....................................................................................................................................... -

How to Get Rich

▼How to Get Rich ◄ 2 ► ▼How to Get Rich Contents Title Page Dedication Introduction Five Billion Reasons Why You Should Read This Book PART I The Donald J. Trump School of Business and Management PART II Your Personal Apprenticeship (Career Advice from The Donald) PART III Money, Money, Money, Money PART IV The Secrets of Negotiation PART V The Trump Lifestyle ◄ 3 ► ▼How to Get Rich PART VI Inside The Apprentice Acknowledgments Appendix Behind the Scenes at the Trump Organization About the Author Also by Donald J. Trump Copyright ◄ 4 ► ▼How to Get Rich To my parents, Mary and Fred Trump ◄ 5 ► ▼How to Get Rich The Mother of All Advice Trust in God and be true to yourself. —Mary Trump, my mother When I look back, that was great advice, concise and wise at once. I didn’t really get it at first, but because it sounded good, I stuck to it. Later I realized how comprehensive this is—how to keep your bases covered while thinking about the big picture. It’s good advice no matter what your business or lifestyle. —DJT ◄ 6 ► ▼How to Get Rich TRUMP How to Get Rich ◄ 7 ► ▼How to Get Rich Introduction Five Billion Reasons Why You Should Read This Book A lot has happened to us all since 1987. That’s the year The Art of the Deal was published and became the bestselling business book of the decade, with over three million copies in print. (Business Rule #1: If you don’t tell people about your success, they probably won’t know about it.) A few months ago, I picked up The Art of the Deal, skimmed a bit, and then read the first and last paragraphs.