Using Digital Tools to Expand Access to Agricultural Insurance January 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Closing the Protection Gap, Disaster Risk Financing: Smart Solutions For

Closing the protection gap Disaster risk financing: Smart solutions for the public sector Every year natural and man-made catastrophes cause a distressing loss of lives and considerable economic costs around the world. Both industrialised and developing countries are affected. Surprisingly, both are also materially underinsured. This financing gap is borne largely by the public sector, and may create long-term fiscal instability at a time when government budgets are stretched. Furthermore rating agencies are starting to take a closer look at such contingent liabilities faced by public administrations. But there are ways to alleviate both the impacts and the costs of disaster by planning ahead. Insurance plays a critical role in effective disaster risk management helping communities get back on their feet faster. This report outlines tools and approaches proven to help governments, regions and cities, as well as the constituents they represent, to become more resilient. We’re smarter together Cover images Above: Cars getting stuck on flooded streets in Fukuyama, 23 June 2016, after areas of western Japan were hit by heavy rain, causing landslides and caving in roads. Below: Emergency workers supporting the recovery after an earthquake on 25 August 2016 in Amatrice, Italy Table of contents Disaster risks are growing 2 A major strain on government budgets 4 Resilience through insurance 6 More than one way to close 12 the protection gap Benefits of sovereign and 18 sub-sovereign risk transfer Case studies 21 A single house left standing after Hurricane Ike struck Gilchrist, Texas in 2008. Disaster risks are growing The economic cost of natural catastrophes has increased markedly. -

COMMERCIAL INSURANCE PACKAGE (Applicable to Entertainment Related Risks Only)

COMMERCIAL INSURANCE PACKAGE (Applicable to entertainment related risks only) 1. Full Legal Name of company(ies) to be Insured: 2. Business Address: 3. Contact Name: Fax: Web-site: Phone: Cell: Email: Please provide CV on background experience of the principals of the company along with a company bio if you have not previously obtained coverage through our office. 4. Describe your operations: 5. Date company established: 6. Number of full time employees: 7. Do you have employee health/ benefits plan? Yes No 8. Previous Insurer: Expiry Date: Have there been any losses in the last 5 years? Yes No If yes, how many and please provide details: 9. Has any form of insurance been declined or cancelled? Yes No 10. General Information: explain all “yes” responses below (a) Is equipment loaned or rented to others with/without operators Yes No (b) If you responded yes above, do they provide certificates of insurance Yes No (c) Is post production work done for others Yes No (d) Does applicant travel out of country with equipment Yes No (e) Are any repairs and/or installations done away from the premises Yes No (f) Are sub-contractors used Yes No (g) If yes, is proof of insurance obtained Yes No Explain in detail all “yes” answers in section 10: August ‘-09 Front Row Insurance Brokers Inc. T 604-684-FILM (3456) Toll Free: 1-866-690-3456 COMMERCIAL PACKAGE 604 – 1200 Burrard Street F 604-684-3437 Vancouver BC V6Z 2C7 Initial 1 PROPERTY INFORMATION . 11. Location Address: owned: rented: square Feet: no. of stories: CONSTRUCTION Fire Resistive masonry -

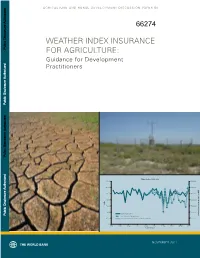

WEATHER INDEX INSURANCE for AGRICULTURE: Guidance for Development Practitioners

AGRICULTURE AND RURAL DEVELOPMENT DISCUSSION PAPER 50 WEATHER INDEX INSURANCE Public Disclosure Authorized FOR AGRICULTURE: Guidance for Development Practitioners Public Disclosure Authorized Public Disclosure Authorized Maize Index, 1962−2007 140.00 3500000 120.00 3000000 100.00 2500000 80.00 2000000 oduction (MT) e pr alue v 60.00 1500000 otal maiz 40.00 1000000 Maize Index, MMI national t Public Disclosure Authorized Met Office 75-Station Model 20.00 National Total Maize Production (Normalized AP) 500000 0.00 0 1962 1967 1972 1977 1982 1987 1992 1997 2002 2007 harvest year NOVEMBER 2011 A&R_Risk_Cover.indd 2 29/10/11 1:02 PM AGRICULTURE AND RURAL DEVELOPMENT DISCUSSION PAPER 50 WEATHER INDEX INSURANCE FOR AGRICULTURE: Guidance for Development Practitioners A&R_Risk_FM.indd 1 28/10/11 11:59 AM © 2011 The International Bank for Reconstruction and Development / The World Bank 1818 H Street, NW Washington, DC 20433 Telephone: 202-473-1000 Internet: http://www.worldbank.org/rural All rights reserved. The findings, interpretations, and conclusions expressed herein are those of the author(s) and do not necessarily reflect the views of the Board of Executive Directors of the World Bank or the governments they represent. The World Bank does not guarantee the accuracy of the data included in this work. The boundaries, colors, denominations, and other information shown on any map in this work do not imply any judgment on the part of the World Bank concerning the legal status of any territory or the endorsement or acceptance of such boundaries. Rights and Permissions The material in this work is copyrighted. -

Weather Insurance for Farmers: Experience from Ethiopia Nahu Senaye Araya

Weather Insurance for Farmers: Experience from Ethiopia Nahu Senaye Araya Session 5 Breakout Session 11 Weather Insurance for Farmers: Experience from Ethiopia1 Nahu Senaye Araya2 Paper presented at the IFAD Conference on New Directions for Smallholder Agriculture 24-25 January, 2011 International Fund for Agricultural Development Via Paolo Di Dono, 44, Rome 00142, Italy 1 Copyright of the paper is reserved by IFAD. The paper may not be reproduced in part or in full and in any form without written permission of the Conference Organisers at IFAD (e-mail: [email protected]) 2 The author is Chief Executive Officer of Nyala Insurance, Addis Ababa, Ethiopia Summary Agriculture is the dominant sector in the Ethiopian economy where 83% of the population fully depends on and more than 43% of the GDP is generated. This sector in turn is dominated by a subsistence farming where more than 95% is a rain fed farming of which more than 90% owned by a smallholder (mostly less than half hectar) poor farmers. These smallholder farmers are highly exposed to the negative impact of climate change mainly reflected in shortage of rainfall (draught) in this part of the continent. The climate risk mitigation mechanisms existing in the country are more of informal traditional ways of risk sharing and risk smoothing mechanism. Whereas the covariant nature of the climate risk like draught cannot be copped with this traditional mechanisms. Therefore as an innovative means of market mechanism Nyala Insurance S.C. (NISCO) has introduced insurance products which can help in mitigating the impact of climate risk. -

Division of Insurance 2008 Annual Report 1

Commonwealth of Massachusetts Division of Insurance 2008 Annual Report Nonnie S. Burnes Commissioner of Insurance www.mass.gov\doi Table of Contents 1. Division of Insurance .......................................................................................................1 Mission ................................................................................................................................................ 1 Primary Activities ................................................................................................................................. 1 Organizational Chart ........................................................................................................................... 3 Human Resources ............................................................................................................................... 3 Budget, Revenue & Assessments ....................................................................................................... 4 The Massachusetts Insurance Marketplace ........................................................................................ 7 2. Significant Events of 2008 ............................................................................................. 10 Automobile Insurance Reform ........................................................................................................... 10 Global Financial Crisis ....................................................................................................................... 13 3. -

Insuring Farmers Against Weather Shocks: Evidence from India, As Partial Fulfilment of the Requirements of Grant OW3.1171 Awarded Under Open Window 3

Jeremy Tobacman Insuring farmers against Daniel Stein weather shocks Vivek Shah Laura Litvine Evidence from India Shawn Cole Raghabendra Chattopadhyay July 2017 Impact Agriculture Evaluation Report 29 About 3ie The International Initiative for Impact Evaluation (3ie) is an international grant-making NGO promoting evidence-informed development policies and programmes. We are the global leader in funding, producing and synthesising high-quality evidence of what works, for whom, how, why and at what cost. We believe that better and policy-relevant evidence will help make development more effective and improve people’s lives. 3ie impact evaluations 3ie-supported impact evaluations assess the difference a development intervention has made to social and economic outcomes. 3ie is committed to funding rigorous evaluations that include a theory-based design, use the most appropriate mix of methods to capture outcomes and are useful in complex development contexts. About this report 3ie accepted the final version of this report, Insuring farmers against weather shocks: evidence from India, as partial fulfilment of the requirements of grant OW3.1171 awarded under Open Window 3. The report has been formatted to 3ie standards. However, despite best efforts in working with the authors, some references are still missing and figures and tables could not be improved. We have copy-edited the content to the extent possible. These efforts caused a delay in publishing this report, which is why the series number and date are out of sequence. All of the content is the sole responsibility of the authors and does not represent the opinions of 3ie, its donors or its board of commissioners. -

DB MF PW RCSTD 0314.Pdf

DB/MF/PW/RCSTD/0314 10 things to do before you go Important 1. Check the Foreign and Commonwealth Office (FCO) travel Under the new travel directive from the European Union (EU), advice online at www.gov.uk/knowbeforeyougo. you are entitled to claim compensation from your airline if any of the following happen. 2. Get travel insurance and check that the cover is appropriate. 1. You are not allowed to board or your flight is cancelled. If you check-in on time but you are not allowed to board 3. Get a good guidebook and get to know the place you are because there are too many passengers for the number of going to. Find out about local laws and customs. seats available or your flight is cancelled, the airline operating the flight must offer you financial compensation. 4. Make sure you have a valid passport and any visas you need. 2. There are long delays. If you are delayed for two hours or more, the airline must 5. Check what vaccinations you need at least six weeks before offer you meals and refreshments, hotel accommodation you go. and communication facilities. If you are delayed for more than five hours, the airline must also offer to refund your 6. Check to see if you need to take extra health precautions ticket. (visit www.nhs.uk/travelhealth) 3. Your baggage is damaged, lost or delayed. 7. Make sure whoever you book your trip through is a If your checked-in baggage is damaged or lost by an EU member of the Association of British Travel Agents (ABTA) airline, you must make a claim to the airline within seven or the Air Travel Organisers' Licensing scheme (ATOL). -

Inclusive Insurance and the Sustainable Development Goals

Inclusive Insurance and the Sustainable Development Goals How insurance contributes to the 2030 Agenda for Sustainable Development As a federally owned enterprise, GIZ supports the German Government in achieving its objectives in the field of international cooperation for sustainable development. Published by: Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH Registered offices Bonn and Eschborn Address Friedrich-Ebert-Allee 36 + 40 53113 Bonn T +49 228 44 60-0 F +49 228 4460-17 66 Dag-Hammarskjöld-Weg 1-5 65760 Eschborn T +49 6196 79-0 F +49 6196 79-11 15 E [email protected] I www.giz.de Programme/project description: Sector Programme Global Initiative for Access to Insurance Authors: Solveig Wanczeck, Michael McCord, Martina Wiedmaier-Pfister, Katie Biese Design/layout: www.kattrin-richter.de, Berlin Cover: United Nations, Icons Sustainable Development Goals Photo credits/sources: Photos from shutterstock: p. 11 Suzanne Tucker/Shutterstock.com; p. 12 Radiokafka/Shutterstock.com; p. 16 Avatar_023/Shutterstock.com; p. 27 Fabian Plock/Shutterstock.com; p. 27 Sorratorn Phosida/Shutterstock.com; p. 28 Konstantin Chagin/Shutterstock.com; p.29 Eunika Sopotnicka/Shutterstock.com; p.34 yuttana Contributor Studio/Shutter- stock.com; p.36 Sokolenko/Shutterstock.com Photos from Martina Wiedmaier-Pfister: p. 8, 20, 31, 39; Photos from GIZ/Dirk Os- termeier: p. 24, 26; p. 6 GIZ/Kamikazz; p. 14 GIZ/Horst Öbel; p. 18 GIZ; p. 22 GIZ/ Carolin Weinkopf; p. 26 GIZ/Ina Zeuch; p. 32 GIZ/Wahl, Lucas URL links: This publication contains links to external websites. Responsibility for the content of the listed external sites always lies with their respective publishers. -

Climate Risk Insurance for the Poor & Vulnerable

CLIMATE RISK INSURANCE FOR THE POOR & VULNERABLE: HOW TO EFFECTIVELY IMPLEMENT THE PRO-POOR FOCUS OF INSURESILIENCE An analysis of good practice, literature and expert interviews NOVEMBER / 2016 1 AUTHORS LAURA SCHAEFER and ELEANOR WATERS CONTRIBUTORS KOKO WARNER, MICHAEL ZISSENER, GABY RAMM, and TANVI MANI DESIGN NATALIA RODRIGUEZ MUNICH CLIMATE INSURANCE INITIATIVE 2016 This study by the Munich Climate Risk Insurance Initiative (MCII) has been funded through a grant provided by the Global Programme on Risk Assessment and Management for Adaptation to Climate Change (Loss and Damage) at the Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ GmbH)/InsuResilience Interim Secretariat, commissioned by the German Federal Ministry for Economic Cooperation and Development (BMZ). 2 ACKNOWLEDGEMENTS The authors thank the MCII Executive Board members – Peter Höppe, Christoph Bals, Simone Ruiz-Vergote, Joanne Linnerooth-Bayer, Thomas Loster, Armin Haas, Aaron Oxley and Paul Kovacs – for their valuable input and support. We are sincerely grateful to the following people who provided helpful input and feedback in the peer-review process (in alphabetical order by organization): Jonathan Reeves (Action Aid UK); Andrew Dlugolecki (Andlug Consulting); Sabine Minninger (Brot für die Welt); Thomas Hirsch (Climate and Development Advice); Sönke Kreft (Germanwatch); Leif Heimfarth (Hannover Re); Reinhard Mechler (IIASA); Craig Churchill (ILO); Daniel Edward Osgood (International Research Institute for Climate and Society The Earth Institute at Columbia -

Climate Risk Insurance and Risk Financing in the Context of Climate Justice

Climate Risk Insurance and Risk Financing in the Context of Climate Justice A Manual for Development and Humanitarian Aid Practitioners Imprint Published by Written by: Thomas Hirsch (Lead author), Climate and Development Advice Vera Hampel (Climate and Development Advice) Edited by: Rebekah Chevalier Designed by: Saskia Rowley Acknowledgement: This Toolkit is a product of the ACT Alliance Global Climate Change Project, implemented with the support of ACT member Brot für die Welt. 2020 cover photo: alpha kapola/nca R E P O R T Climate Risk Insurance and Risk Financing in the Context of Climate Justice A Manual for Development and Humanitarian Aid Practitioners List of figures ...........................................................................................1 List of abbreviations ............................................................................1 Glossary 3 Executive summary .............................................................................5 Contents Introduction ............................................................................................8 How to use this manual ....................................................................9 WHAT YOU NEED TO KNOW ABOUT CLIMATE RISKS 10 List of figures ......................................................................................................................................................................................................................1 COMPREHENSIVE CLIMATE RISK MANAGEMENT ...... 15 List of abbreviations .......................................................................................................................................................................................................1 -

Protecting Low-Income Communities Through Climate Insurance Achievements from the Insuresilience Investment Fund

Protecting low-income communities through climate insurance Achievements from the InsuResilience Investment Fund 1 / InsuResilience Investment Fund Copyright 2020 InsuResilience Investment Fund. All rights reserved. Citation InsuResilience Investment Fund (2020) Protecting low-income communities through climate insurance: Achievements from the InsuResilience Investment Fund. Authors Acclimatise: Will Bugler, Lydia Messling, John Firth, Virginie Fayolle, Maribel Hernández Climate Finance Advisors: Andrew Eil, Sheldon Cheng Advisors Lea Mueller, CelsiusPro (IIF project lead) Marietta Feddersen, BlueOrchard Finance Ltd Veronika Giusti-Keller, BlueOrchard Finance Ltd Maria Teresa Zappia, BlueOrchard Finance Ltd Stefan W. Hirche, KfW Luise Richter, independent advisor Alessandra Nibbio, BlueOrchard Finance Ltd Ernesto Costa, BlueOrchard Finance Ltd Basit Arshad, BlueOrchard Finance Ltd Design Anandita Bishnoi Acknowledgements InsuResilience Investment Fund, would like to thank its investees for their contributions to this report: Agritask, Asia Insurance Company Ltd (ASIC), Banco Pichincha, Banco Solidario, CMAC Piura, CMAC Sullana, Crezcamos, Global Parametrics, Inclusive Guarantee, JSC Credo Bank, Kashf Foundation, KHAN Bank, Pahal Financial Services Private Ltd, Progresemos, Royal Exchange General Insurance Company (REGIC), Satya MicroCapital Limited, Skymet Weather Services Private Limited, Ummeed Housing Finance Pvt Ltd., VisionFund Tanzania, VisionFund International, and VisionFund Myanmar. Cover Image by Tri Le on Pixabay This report was authored by Acclimatise based on an assessment designed and conducted by Climate Finance Advisors, under a mandate from the InsuResilience Investment Fund. 2 / InsuResilience Investment Fund Foreword Climate change is one of the most significant threats facing the world today, with extreme weather events occurring more frequently. Poor and vulnerable people in developing countries are hit hardest by climate change, whilst being least prepared to cope with its consequences. -

Policy for Implementation of Index Based Weather Insurance Revisited: the Case of Nicaragua

Paper prepared for the 123rd EAAE Seminar PRICE VOLATILITY AND FARM INCOME STABILISATION Modelling Outcomes and Assessing Market and Policy Based Responses Dublin, February 23-24, 2012 Policy for implementation of Index Based Weather Insurance revisited: the case of Nicaragua Banerjee C.and Berg E. Institute for Food and Resource Economics, University of Bonn, Bonn, Germany [email protected] Copyright 2012 by Chirantan Banerjee, Ernst Berg. All rights reserved. Readers may make verbatim copies of this document for non-commercial purposes by any means, provided that this copyright notice appears on all such copies. Dublin – 123rd EAAE Seminar Price Volatility and Farm Income Stabilisation Modelling Outcomes and Assessing Market and Policy Based Responses Policy for implementation of Index Based Weather Insurance revisited: the case of Nicaragua Banerjee C.and Berg E. Abstract International development organisations, through partnerships with local insurance companies, have been promoting weather index based insurance (WIBI) in developing countries. Due to lower operational costs, they expect shorter pay-off period, often overlooking high initial design costs. Experiences however show high post-pilot mortality of these programmes. Literatures report lack of insurance participation. We propose lack of push from insurance providers as an additional factor. To verify, cash flows of a Nicaraguan groundnut based WIBI and a comparable but hypothetical named peril insurance are simulated against 80 scenarios. Additionally, a test of stochastic dominance of their estimated Net Present Values show that WIBI take comparatively longer to pay-off yielding lower returns with considerable risk. WIBI, given its advantages is undoubtedly an efficient agricultural risk management tool.