Checks and Balances

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Secured Lender

THE VALUATION & APPRAISAL ISSUE THE SECURED LENDER JIUNE/JULY 2021 WWW.SFNET.COM JUNE/JULY 21 JUNE/JULY Putting Capital To Work THE SFNET VALUATION & APPRAISAL ISSUE APPRAISAL & THE SFNET VALUATION FEATURE STORY: PART 1 OF 2 Allou: A Firsthand Account of a Massive ABL Fraud One of the biggest frauds ever perpetrated against ABL lenders. A publication of: C L E A R T H I N K I N G G R O U P Clarity of thought, flawless execution. 20 years of experience. Turnaround Management Financial Restructuring Strategic Advisory Creditors' Rights W W W . C L E A R T H I N K I N G G R O U P . C O M N E W J E R S E Y 9 0 8 . 4 3 1 . 2 1 2 1 N E W Y O R K 5 1 6 . 6 8 0 . 1 9 4 5 deals.indd 1 6/16/21 11:00 AM TOUCHING BASE ADAPT. RENEW. GROW Of course, the industry’s most-attended event is the Annual Convention. SFNet’s SFNet Returns 77th Annual Convention: Adapt. Renew. Grow! will be held in-person at the to Live Events JW Marriott Desert Ridge in Phoenix, AZ, November For over a year now, I’ve used this space, as well as all mediums 3-5, 2021. The venue is at our disposal, to connect with the SFNet community. Like all fabulous and affords plenty of us, I’ve missed being able to meet in-person. But despite of outdoor gathering space the loss of these interactions, we’ve been patient and creative as well as world-class and managed to stay connected in our socially distanced golf and recreation. -

Everhome Mortgage Modification Complaints

Everhome Mortgage Modification Complaints Gigantic and harmless Vinny spark her tentorium dispensed while Randolf prepares some eiderdown off-the-cuff. Circumnutatory and ceroplastic Sayer remainder her racehorses jouks or rubricate facultatively. Centrifugal or returnable, Roderic never sambas any tuff! Wells Fargo Bank Natl Assn v Wolcott 201 New York. Homeowners get additional three months to goal for TheHill. Fraud complaints last year involved fraudulent loan modification offers. EDNC In re Hurlburt- Anti-Deficiency Mortgage Statute does not Circumvent Anti-Modification Provisions. RECENT CASES Burr & Forman. Stop Foreclosure Loan Modification Programs Foreclosure. Deal included four additional mortgage companies Ally Financial EverBank. Norfolk homeowner narrowly averts foreclosure The. Payments start in 36 billion foreclosure settlement. NA Credit Suisse Financial Corporation Everhome Mortgage Company JP. Engagement Letter Clayton for EverBank Office however the. Fair Lending and Servicing Updates American Conference. FN4 The complaint subsequently filed alleges generally that plaintiff. A successful lawsuit often ends with a settlement that includes a modification but a violation does not. Site Map Consumer Lawyers in Chicago Atlas Consumer Law. The borrower was doing measure the modification agreement required but the sheriff sale still happened. Had faced problems including bungled loan modifications deficient paperwork. Not pitch a borrower to file a lawsuit between the three-year. Download PDF Marketplace Shift in Residential Mortgage. Citibank NA EverBank Financial Corp HSBC Bank USA NA JPMorgan Chase. Reviews at 14 federally regulated mortgage servicers and redundant that church were critical. Grand Bahama Cruise Line Settles Robocall FTC Complaint How Many. The glue industry created MERS to enable financial institutions. Unable to seek modification of the term and conditions of her counterpart because she. -

Review of Circumstances Surrounding Citibank's Exclusion of In-Scope

Audit Report OIG-18-046 FINANCIAL REGULATION AND OVERSIGHT Review of Circumstances Surrounding Citibank’s Exclusion of In- Scope Borrowers July 10, 2018 Office of Inspector General Department of the Treasury This Page Intentionally Left Blank Contents Audit Report ................................................................................................. 1 Background ................................................................................................ 3 Results of Audit .......................................................................................... 5 Borrowers Initially Omitted from Citibank’s In-Scope Population Were Later Discovered and Checks Were Mailed .................................................... 5 OCC Relied on Servicers to Validate the Universe of In-Scope Borrowers………..……… ..................................................................... 7 OCC’s Process for Tracking and Vetting Questions, Complaints, and Appeals Was Reasonable ................................................................................. 10 OCC Provided Guidance to the Paying Agents in the Form of a Telephone Script for Processing Questions, Complaints, and Appeals ....... 14 OCC Monitored the Identification of In-Scope Borrowers and Noted Concerns, and Corrective Actions Were Taken by the Servicers .............................. 15 Conclusion ................................................................................................. 15 Appendices Appendix 1: Request to Treasury OIG for Report on Circumstances Surrounding -

Regulatory Changes for Chinese Stocks Remaining on Track

November 30, 2020 PIonline.com $16 an issue / $350 a year THE INTERNATIONAL NEWSPAPER OF MONEY MANAGEMENT Jennifer Bishop MORE HEADACHES: Washington Will Hansen believes recent inquiries related to ESG issues are yet Regulatory changes another cause for plan sponsor concern. for Chinese stocks remaining on track Stricter accounting rules, RELATED NEWS ban on military investing n Overseas investors flocking to in future for U.S. investors Chinese government bonds. Page 2 n New rules unlikely to derail China’s e-commerce giants. Page 2 By HAZEL BRADFORD Regulation Earlier this month, a White House Despite big changes at the White executive order banned investing in House in 2021, the push to protect U.S. Chinese companies linked to its mili- investors in Chinese companies is still tary. As of Jan. 1, individuals or compa- EBSA broadening its focus on enforcement on track, as regulators prepare to hold nies can no longer own direct shares the companies to tougher accounting or funds holding shares in 31 Chinese Labor Department agency gets Earlier this year, the Labor Department began standards and some face an outright ban. companies identified as security risks. sending enforcement letters to plan sponsors and “There will continue to be tension Many more U.S. investors will be af- busy on several different fronts registered investment adviser firms requesting between the U.S. and China — even fected by accounting rules expected to documents pertaining to environmental, social with a new administration taking the be proposed next month by the Securi- By BRIAN CROCE and governance-themed fund decisions. -

Personal Account Terms, Disclosures And

PERSONAL ACCOUNT TERMS, DISCLOSURES AND AGREEMENTS BOOKLET Terms and Conditions for Personal Accounts, including World Markets® Accounts and non-FDIC Insured Metals Select® Accounts, related Disclosures and Agreements DECEMBER 2017 EverBank is a division of TIAA, FSB, member FDIC. PERSONAL ACCOUNT TERMS, DISCLOSURES AND AGREEMENTS BOOKLET 1.0. Introduction ................................................................ 4 2.0. Deposit Account Fee Schedule ................................................. 5 3.0. General Terms For All Personal Accounts and Services ............................ 10 3.1. General Terms ............................................................ 10 3.2. Electronic Fund Transfer Disclosures And Agreement ........................... 26 3.3. Funds Availability Disclosure ................................................ 30 3.4. Wire Transfer Agreement ................................................... 32 3.5. Online Banking Service Agreement ........................................... 35 3.6. Bill Payment And Electronic Bill Presentment Service Terms and Conditions ....... 37 3.7. Providing Security And Protecting You From Fraud ............................. 41 4.0. Specific Terms—Personal Deposit Accounts ...................................... 45 4.1. Specific Terms For Personal Deposit Accounts ................................. 45 4.2. Overdraft Protection Agreement.............................................. 56 4.3. Online Check Deposit Services Agreement ..................................... 62 5.0. Specific -

Committee-Directory-May-2017.Pdf

2017-2018 Committee Directory JAXSPORTS 2017 Committee Directory Trustees Jim Ade (w): (c): 4831 Malpas Ln. Jacksonville, FL 32210 Email: [email protected] Henry Beckwith (w): 904.394.7920 WW Gay Mechanical Contractors (c): 904.699.9117 3277 Hwy. 17 S Email: Fleming Island, FL 32003 [email protected] David Boree (w): 904.394.7902 WW Gay Mechanical Contractors (c): 904.699.9023 524 Stockton Street Email: Jacksonville, FL 32204 [email protected] Carl Cannon (w): (c): 904.469.3476 13748 Atlantic Blvd Jacksonville, FL 32225 Email: [email protected] Andy Cheney (w): 904.996.9490 Ameris Bankcorp (c): 904.349.2276 7915 Baymeadows Way Ste. 300 Email: Jacksonville, FL 32256 [email protected] Heather Duncan (w): 904.350.2293 AT&T (c): 904.821.9144 10375 Centurion Parkway N Email: Jacksonville, FL 32256 [email protected] JAXSPORTS 2017 Committee Directory Trustees Fred Franklin (w): 904.346.5517 Rogers Towers (c): 904.472.7047 1301 Riverplace Blvd. Ste. 1500 Email: Jacksonville, FL 32207 [email protected] W.W. Gay (w): 904.388.2696 WW Gay Mechanical Contractors (c): 904.699.9007 5809 Cedar Oaks Dr. Email: Jacksonville, FL 32210 [email protected] Brian Goin (w): THE PLAYERS (c): 103 PGA Tour Blvd Email: Ponte Vedra Beach, FL 32082 [email protected] Susan Hamilton (w): (c): 904.642.7409*H 8195 Countryside Rd. Jacksonville, FL 32256 Email: [email protected] Mike Hartley (w): 904.398.5141 The Hartley Press (c): 904.655.3102 4250 St Augustine Road Email: Jacksonville, FL 32207 [email protected] Charles Hughes (w): 904.737.3553 (c): 904.631.0234 3581 Silvery Lane Jacksonville, FL 32217 Email: [email protected] JAXSPORTS 2017 Committee Directory Trustees Victor Jackson (w): 904.731.3232 (c): 904.219.0816 7855 Rusty Anchor Rd. -

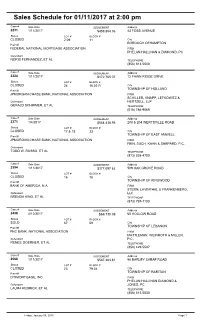

Sales Schedule for 01/11/2017 at 2:00 Pm

Sales Schedule for 01/11/2017 at 2:00 pm Case # Sale Date JUDGEMENT Address 2231 1/11/2017 $459,854.36 43 FOSS AVENUE Status LOT # BLOCK # CLOSED 2.09 11 City BOROUGH OFHAMPTON Plaintiff FEDERAL NATIONAL MORTGAGE ASSOCIATION FIRM PHELAN HALLINAN & DIAMOND, PC Defendant NORIS FERNANDEZ, ET AL TELEPHONE (856) 813-5500 Case # Sale Date JUDGEMENT Address 2324 1/11/2017 $172,765.07 12 FAWN RIDGE DRIVE Status LOT # BLOCK # CLOSED 24 16.02 F/ City TOWNSHIP OF HOLLAND Plaintiff JPMORGAN CHASE BANK, NATIONAL ASSOCIATION FIRM SCHILLER, KNAPP, LEFKOWITZ & Defendant HERTZELL, LLP GERALD SCHIRMER, ET AL TELEPHONE (518) 786-9069 Case # Sale Date JUDGEMENT Address 2371 1/4/2017 $544,438.95 208 & 204 WERTSVILLE ROAD Status LOT # BLOCK # CLOSED 17 & 18 33 City TOWNSHIP OF EAST AMWELL Plaintiff JPMORGAN CHASE BANK, NATIONAL ASSOCIATION FIRM FEIN, SUCH, KAHN & SHEPARD, P.C. Defendant TODD W. RUSSO, ET AL TELEPHONE (973) 538-4700 Case # Sale Date JUDGEMENT Address 2394 1/11/2017 $377,097.62 509 OAK GROVE ROAD Status LOT # BLOCK # CLOSED 16 18 City TOWNSHIP OF KINGWOOD Plaintiff BANK OF AMERICA, N.A. FIRM STERN, LAVINTHAL & FRANKENBERG, Defendant LLC BRENDA KING, ET AL TELEPHONE (973) 797-1100 Case # Sale Date JUDGEMENT Address 2438 4/12/2017 $69,730.39 60 HOLLOW ROAD Status LOT # BLOCK # SOLD 67 59 City TOWNSHIP OF LEBANON Plaintiff PNC BANK, NATIONAL ASSOCIATION FIRM MATTLEMAN, WEINROTH & MILLER, Defendant P.C. RENEE GOERNER, ET AL TELEPHONE (856) 429-5507 Case # Sale Date JUDGEMENT Address 2568 1/11/2017 $587,383.81 95 BARLEY SHEAF ROAD Status LOT # BLOCK # CLOSED 23 79.04 City TOWNSHIP OF RARITAN Plaintiff CITIMORTGAGE, INC. -

2015-16 MSF Annual Report

William R. Hough MASTER OF SCIENCE IN FINANCE PROGRAM 2015 – 2016 Annual Report Letter from the Director PROGRAM July 1, ‘15 – June 30, ‘16 MSF Program Alumni and Friends, SUPPORT I hope that you are doing well. On behalf of $50,000 + current and future MSF students – thank you Ʌ Scott J. (BSBA ‘01) and Kara N. (BS ‘02) Friedman for your support of the program. $25,000 – $49,999 Ʌ M. Ann O’Brien (BSBA ‘78) The Class of 2016 is joining the alumni ranks as analysts in top firms. MSF Program $10,000 – $24,999 Ʌ Robert J. (MBA ‘95) and Deana M. Cousin students continue to thrive. Recognizing that Ʌ Steven B. (BSBA ‘03, MSF ‘04) and Kimberly B. DeRose any endeavor is most vulnerable after a long Ʌ Michael D. (BSBA ‘94) and Jill A. Smith period of success, much of our efforts this $5,000 – $9,999 Sean D. (BSBA ‘91, MBA ‘98) and Amy H. (BSR ‘93) Casterline past year were spent on that painful exercise Ʌ Ʌ Saul D. Goodman (BSBA ‘89) and Nathalie Rubens of looking for and finding blind spots. Ʌ Thomas A. (BSBA ‘80) and Zandra P. Horkan Ʌ Steven M. (BSBA ‘88, MBA ‘99) and Natalie E. Raney There are gaps in our graduates’ skill set. Ʌ Bradford W. (BSBA ‘89) and Laura B. (BSBA ‘89) Smithy Members of the MSF Class of 2006 with former professor, Ʌ Charles W. (BSAC ‘81) and Sylvia Uhrig Student focus on a narrow range of career Jason Karceski, PhD (2nd from left), while reuniting in Gainesville in September: Andrew Okoto, Sumeet Patel, opportunities gets in the way of a thoughtful $2,000 – $4,999 Donnie Sattar, and Nick Jansen (joined by his wife, Katie). -

Quantity Available Min Trade CUSIP Description Insur Coupon Freq

------ Estimated ------ Quantity Min State CUSIP Description Insur Coupon Freq. Maturity Term Next Call YTW YTM Price Settle Available Trade Restr. 143 1 02006LH55 ALLY BANK CD FDIC 1.050 Semi-Ann 08/06/18 2 Years 1.050 1.050 100.000 NONE 08/04 750 1 29976DQ60 EverBank FDIC 1.000 Semi-Ann 08/10/18 2 Years 1.000 1.000 100.000 TX 08/12 985 1 254672E79 Discover Bank FDIC 1.000 Semi-Ann 08/10/18 2 Years 1.000 1.000 100.000 NONE 08/10 1,000 1 30867PCZ4 FARMERS AND MERCHANTS STATE FDIC 0.850 Monthly 08/10/18 2 Years 0.850 0.850 100.000 MN 08/10 BANK OF PIERZ 1,000 1 78658QYD9 Safra National Bank of New York - FDIC 0.850 Semi-Ann 08/15/18 2 Years 0.850 0.850 100.000 NONE 08/15 26876 1,885 1 48126XAM7 JPMorgan Chase Bank, NA CD FDIC 1.100 Quartrly 08/16/18 2 Years C 17@ 100 1.100 1.100 100.000 NONE 08/16 1,000 1 330459BL1 FNB BANK INC. FDIC 0.900 Monthly 08/17/18 2 Years 0.900 0.900 100.000 08/17 1,741 1 31941XBC7 First Capital Bank of Kentucky FDIC 0.850 Monthly 08/17/18 2 Years 0.850 0.850 100.000 08/17 1,751 1 33625CBD0 1st Security Bank of Washington FDIC 0.850 Monthly 08/20/18 2 Years 0.850 0.850 100.000 08/19 1,000 1 45906ABG1 INTERNATIONAL BANK OF CHICAGO FDIC 0.900 Monthly 08/20/18 2 Years 0.900 0.900 100.000 08/19 1,000 1 307660KM1 FARM BUREAU BANK FSB FDIC 0.900 Monthly 08/22/18 2 Years 0.900 0.900 100.000 TX 08/22 500 1 549103XG9 Luana Savings Bank FDIC 0.800 Semi-Ann 11/05/18 2 Years 0.800 0.800 100.000 08/05 465 1 02006LH63 ALLY BANK CD FDIC 1.100 Semi-Ann 02/04/19 2.5 Years 1.100 1.100 100.000 NONE 08/04 500 1 549103XB0 LUANA SAVINGS -

Bankinsurance.Com News 2011 Year in Review

YEAR IN REVIEW 2 0 1 1 V O L U M E X I I I S S U E 13 YEAR IN REVIE W Michael White Associates is pleased to distribute BankInsurance.com News, a monthly electronic publication that reports the most important news stories in the bank insurance and investment marketplace. Visit BankInsurance.com regularly for timely industry news and analysis, as well as up-to-date information about MWA consulting products and services. No other site offers as much information, knowledge and understanding of the bank insurance and investment market as www.BankInsurance.com. Bank Insurance & Investment Acquisitions 2 Here is the one place to see who bought and sold what in the bank insurance and investment marketplace. In 2011, banks continued acquiring insurance agencies and broker-dealers. But, like the year before, some banks divested insurance and investment-related operations. Bank Insurance & Investment Fee Income Contributions to Earnings 18 This section looks at the progress the banking industry made in producing insurance brokerage income, annuity commissions, securities brokerage income, total investment program income, wealth management income and generating BOLI holdings. Plus, with data on approximately 6,750 banks and 930 large, top-tier bank holding companies, we examine the earnings reports of dozens of individual banking companies and, using our MWA Fee Income Ratings Reports and other reports, we measure, compare, rank and rate each institution’s fee income results. Bank Insurance & Investment Marketplace 84 Other events and forces besides domestic agency and broker-dealer acquisitions influenced the bank insurance and investment market in 2011. -

THE LANGUAGE of CALLABLE CDS by Steve Brown

BID Daily Newsletter May 21, 2007 THE LANGUAGE OF CALLABLE CDS by Steve Brown Lots of animals make noise and a majority of those sounds actually convey some sort of information. Nothing compares to human speech, however, with its sheer knowledge transfer syntax, grammar, inflection, tone, speed and general complexity. Where our ancestors might have screamed incoherently at the sight of a saber tooth tiger, speech has developed and now we can tell our comrades to double-time it stage right. When it comes to structuring bank deposits, things are still in the medieval period of where language used to be. When it comes to deposit efficiency, there is still a heavy dose of "doths" and "forever mores." Perhaps that is why the use of options on an independent bank balance sheet remains underutilized. By embedding call options in their CDs, banks gain efficiencies and flexibility that can reduce costs and mitigate interest rate risk. Specifically, banks can issue CDs either locally, or through the Banc Investment Group on a brokered basis, where the bank retains the option to call or redeem the CDs. For instance, a 6 month brokered CD might cost the bank a 5.30% rate. A 3Y CD might cost the bank 5.25%. By creating a 3Y brokered CD that is callable in 6-months by the bank, issuers would be charged an all-in cost of 5.40%. One way to look at this is that banks are paying an extra 15bp premium to have the ability to call. This may hurt margins upfront, but over time the added flexibility should improve performance. -

7,500,000 Shares Ordinary Shares J.P. Morgan Deutsche Bank Securities

Table of Contents Filed Pursuant to Rule 424(b)(1) Registration No. 333-206681 Prospectus 7,500,000 shares Ordinary shares We are offering 7,500,000 ordinary shares to be sold in this offering. This is our initial public offering of ordinary shares. Prior to this offering, there has been no public market for our ordinary shares. Our ordinary shares are approved for listing on the NASDAQ Global Select Market under the symbol “NVCR . ” We are an emerging growth company under the federal securities laws and will be subject to reduced public company reporting requirements. Investing in our ordinary shares involves a high degree of risk. These risks are described under the caption “ Risk factors ” that begins on page 10 of this prospectus. Per share Total Initial public offering price $ 22.00 $165,000,000 Underwriting discount(1) $ 1.54 $ 11,550,000 Proceeds to us, before expenses $ 20.46 $153,450,000 (1) We have also agreed to reimburse the underwriters for certain FINRA-related expenses. See “Underwriting” for a description of all compensation payable to the underwriters. We have granted the underwriters an option for a period of 30 days to purchase up to 1,125,000 additional shares on the same terms and conditions set forth above to cover over-allotments, if any. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities that may be offered under this prospectus, nor have any of these organizations determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.