Barramundi Monthly Update

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ASX Announcement (All Currency Figures Are in Australian Dollars Unless Otherwise Stated)

Afterpay Limited ASX: APT ASX Announcement (all currency figures are in Australian dollars unless otherwise stated) 7 July 2020 NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES TRADING UPDATE, CAPITAL RAISING AND CO-FOUNDER SELL-DOWN1 Afterpay Limited (Afterpay or the Company) is pleased to provide a trading update for the three month period ended 30 June 2020 (Q4 FY20) and the financial year ended 30 June 2020 (FY20). Afterpay also announces a capital raising of approximately $800m that includes a fully underwritten institutional Placement to raise $650m, followed by a non-underwritten Share Purchase Plan that aims to raise approximately $150m. KEY HIGHLIGHTS ● Strong performance across the business has delivered underlying sales of $11.1b in FY20, more than doubling the prior corresponding period (pcp) (up 112%). ● Underlying sales in Q4 FY20 was $3.8b, 127% above Q4 FY19. ● Q4 FY20 sales performance represented the highest quarterly performance ever, reflecting the accelerating shift to e-commerce spending since the impacts of COVID-19 emerged globally. ● Merchant revenue margins for FY20 are expected to be in line with or better than H1 FY20 and FY19. ● Net Transaction Loss (NTL) for FY20 is expected to be up to 55 basis points. ANZ NTL has remained at historically low levels and NTL within the US and UK regions has improved in 2H FY20 compared to 1H FY20 as a result of improving risk performance and historically high payment recovery rates. ● Net Transaction Margin (NTM) for FY20 is expected to be approximately 2%, underpinning a pathway to longer term profitability for the overall business. -

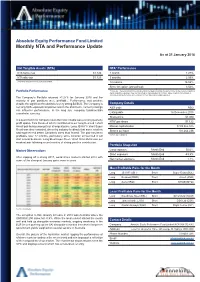

Monthly NTA and Performance Update

Absolute Equity Performance Fund Limited Monthly NTA and Performance Update As at 31 January 2018 Net Tangible Assets (NTA) NTA* Performance NTA before tax $1.122 1 month 1.27% NTA after tax $1.123 3 months 2.59% $ currency notation refers to Australian Dollars. 12 months 16.02% Since inception (annualised) 3.52% Portfolio Performance *Before tax. These calculations are unaudited and intended to illustrate the performance of the investment portfolio minus corporate expenses. They are calculated on a pre-dividend NTA basis. ‘Since inception (annualised)’ is annualised NTA performance since listing at $1.065 after listing related expenses The Company’s Portfolio returned +1.27% for January 2018 and the majority of pair positions were profitable. Performance was positive despite the significant headwind of a very strong $A/$US. The Company is Company Details net long $US-exposed companies and in the short term, currency swings ASX code AEG can influence performance. In the long run, company fundamentals overwhelm currency. Listing date 16 December 2015 Share price $1.080 In a quiet month for company news the most notable was a strong quarterly NTA* per share $1.122 profit update from Resmed which contributed to our long Resmed / short Ansell pair being amongst our strongest pairs. Long JB Hi-Fi / short Super Market capitalisation $109,365,375 Retail was also rewarded, driven by industry feedback that some retailers Shares on Issue 101,264,236 had experienced better Christmas sales than feared. The pair has been profitable over 12 months, particularly since Amazon announced it will *Before tax ex-dividend start a local business. -

Socially Conscious Australian Equity Holdings

Socially Conscious Australian Equity Holdings As at 30 June 2021 Country of Company domicile Weight COMMONWEALTH BANK OF AUSTRALIA AUSTRALIA 10.56% CSL LTD AUSTRALIA 8.46% AUST AND NZ BANKING GROUP AUSTRALIA 5.68% NATIONAL AUSTRALIA BANK LTD AUSTRALIA 5.32% WESTPAC BANKING CORP AUSTRALIA 5.08% TELSTRA CORP LTD AUSTRALIA 3.31% WOOLWORTHS GROUP LTD AUSTRALIA 2.93% FORTESCUE METALS GROUP LTD AUSTRALIA 2.80% TRANSURBAN GROUP AUSTRALIA 2.55% GOODMAN GROUP AUSTRALIA 2.34% WESFARMERS LTD AUSTRALIA 2.29% BRAMBLES LTD AUSTRALIA 1.85% COLES GROUP LTD AUSTRALIA 1.80% SUNCORP GROUP LTD AUSTRALIA 1.62% MACQUARIE GROUP LTD AUSTRALIA 1.54% JAMES HARDIE INDUSTRIES IRELAND 1.51% NEWCREST MINING LTD AUSTRALIA 1.45% SONIC HEALTHCARE LTD AUSTRALIA 1.44% MIRVAC GROUP AUSTRALIA 1.43% MAGELLAN FINANCIAL GROUP LTD AUSTRALIA 1.13% STOCKLAND AUSTRALIA 1.11% DEXUS AUSTRALIA 1.11% COMPUTERSHARE LTD AUSTRALIA 1.09% AMCOR PLC AUSTRALIA 1.02% ILUKA RESOURCES LTD AUSTRALIA 1.01% XERO LTD NEW ZEALAND 0.97% WISETECH GLOBAL LTD AUSTRALIA 0.92% SEEK LTD AUSTRALIA 0.88% SYDNEY AIRPORT AUSTRALIA 0.83% NINE ENTERTAINMENT CO HOLDINGS LIMITED AUSTRALIA 0.82% EAGERS AUTOMOTIVE LTD AUSTRALIA 0.82% RELIANCE WORLDWIDE CORP LTD UNITED STATES 0.80% SANDFIRE RESOURCES LTD AUSTRALIA 0.79% AFTERPAY LTD AUSTRALIA 0.79% CHARTER HALL GROUP AUSTRALIA 0.79% SCENTRE GROUP AUSTRALIA 0.79% ORORA LTD AUSTRALIA 0.75% ANSELL LTD AUSTRALIA 0.75% OZ MINERALS LTD AUSTRALIA 0.74% IGO LTD AUSTRALIA 0.71% GPT GROUP AUSTRALIA 0.69% Issued by Aware Super Pty Ltd (ABN 11 118 202 672, AFSL 293340) the trustee of Aware Super (ABN 53 226 460 365). -

Takeovers + Schemes Review

TAKEOVERS + SCHEMES REVIEW 2018 GTLAW.COM.AU 1 THE GILBERT + TOBIN 2018 TAKEOVERS AND SCHEMES REVIEW 2017 demonstrated a distinct uptick in activity for Australian public company mergers and acquisitions. Some key themes were: + The number of transactions announced increased by 37% over 2016 and aggregate transaction values were among the highest in recent years. + The energy & resources sector staged a recovery in M&A activity, perhaps signalling an end to the downwards trend observed over the last six years. The real estate sector made the greatest contribution to overall transaction value, followed closely by utilities/infrastructure. + Despite perceived foreign investment headwinds, foreign interest in Australian assets remained strong, with Asian, North American and French acquirers featuring prominently. Four of the five largest transactions in 2017 (including two valued at over $5 billion) involved a foreign bidder. + There was a material decline in success rates, except for high value deals greater than $500 million. Cash transactions continued to be more successful than transactions offering scrip. Average premiums paid fell slightly. + Regulators continue to closely scrutinise public M&A transactions, with the attendant lengthening of deal timetables. This Review examines 2017’s public company transactions valued over $50 million and provides our perspective on the trends for Australian M&A in 2017 and what that might mean for 2018. We trust you will find this Review to be an interesting read and a useful resource for 2018. 2 -

FTSE World Asia Pacific

2 FTSE Russell Publications 19 August 2021 FTSE World Asia Pacific Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) a2 Milk 0.04 NEW Asustek Computer Inc 0.1 TAIWAN Cheil Worldwide 0.02 KOREA ZEALAND ASX 0.12 AUSTRALIA Cheng Shin Rubber Industry 0.03 TAIWAN AAC Technologies Holdings 0.05 HONG KONG Atlas Arteria 0.05 AUSTRALIA Chiba Bank 0.04 JAPAN ABC-Mart 0.02 JAPAN AU Optronics 0.08 TAIWAN Chicony Electronics 0.02 TAIWAN Accton Technology 0.07 TAIWAN Auckland International Airport 0.06 NEW China Airlines 0.02 TAIWAN Acer 0.03 TAIWAN ZEALAND China Development Financial Holdings 0.07 TAIWAN Acom 0.02 JAPAN Aurizon Holdings 0.05 AUSTRALIA China Life Insurance 0.02 TAIWAN Activia Properties 0.03 JAPAN Ausnet Services 0.03 AUSTRALIA China Motor 0.01 TAIWAN ADBRI 0.01 AUSTRALIA Australia & New Zealand Banking Group 0.64 AUSTRALIA China Steel 0.19 TAIWAN Advance Residence Investment 0.05 JAPAN Axiata Group Bhd 0.04 MALAYSIA China Travel International Investment <0.005 HONG KONG ADVANCED INFO SERVICE 0.06 THAILAND Azbil Corp. 0.06 JAPAN Hong Kong Advantech 0.05 TAIWAN B.Grimm Power 0.01 THAILAND Chow Tai Fook Jewellery Group 0.04 HONG KONG Advantest Corp 0.19 JAPAN Bandai Namco Holdings 0.14 JAPAN Chubu Elec Power 0.09 JAPAN Aeon 0.2 JAPAN Bangkok Bank (F) 0.02 THAILAND Chugai Seiyaku 0.27 JAPAN AEON Financial Service 0.01 JAPAN Bangkok Bank PCL (NVDR) 0.01 THAILAND Chugoku Bank 0.01 JAPAN Aeon Mall 0.02 JAPAN Bangkok Dusit Medical Services PCL 0.07 THAILAND Chugoku Electric Power 0.03 JAPAN Afterpay Touch Group 0.21 AUSTRALIA Bangkok Expressway and Metro 0.02 THAILAND Chunghwa Telecom 0.17 TAIWAN AGC 0.08 JAPAN Bangkok Life Assurance PCL 0.01 THAILAND CIMB Group Holdings 0.08 MALAYSIA AGL Energy 0.04 AUSTRALIA Bank of East Asia 0.03 HONG KONG CIMIC Group 0.01 AUSTRALIA AIA Group Ltd. -

(ASX100) Women on Boards Analysis

Australia/NZ | Australia Thematic Investing (Citi) Equities 18 August 2011 │ 32 pages ESG: ASX100 Women on Board Analysis Increasing Focus on Board Diversity Women on Boards of ASX100 Companies — The ASX Corporate Governance Council’s new principles and recommendations on diversity commenced on 1 January Elaine Prior 2011. This is likely to lead to increasing focus on companies’ approaches to diversity +61-2-8225-4891 issues, including female representation on company boards. This report looks at data [email protected] on women directors on ASX100 company boards. The number of women directors has Felipe Faria increased, particularly in recent months (Figure 5 to Figure 8). Board diversity may [email protected] enhance effectiveness, by providing a wider range of perspectives and knowledge. Women on Boards Data — We collected and analysed data on female board directors of S&P/ASX100 companies from FY08 to 8 August 2011 (Figure 5 to Figure 9). At 8 August 2011 there were 134 women on ASX100 boards, a 46% increase from FY08. ASX100 companies with no female board directors were AQP, CQO, EGP, FMG, IPL, JHX, LEI, LYC, OSH, PDN, PRY, RHC, RMD, SGM and SWM. Companies with three female directors (the highest number identified) are AMP, BEN, CBA, MQG, QAN, QBE and WBC. Seven female directors each currently hold three ASX100 directorships. Business Case for Gender Diversity — Reibey Institute research found that those ASX500 companies with women directors on 30 June 2010 had a 3-year return on equity (ROE) 10.7% higher than those without any women directors. The 5-year ROE was 11.1% higher. -

Stoxx® Pacific Total Market Index

STOXX® PACIFIC TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) CSL Ltd. Health Care AU 7.79 Commonwealth Bank of Australia Banks AU 7.24 BHP GROUP LTD. Basic Resources AU 6.14 Westpac Banking Corp. Banks AU 3.91 National Australia Bank Ltd. Banks AU 3.28 Australia & New Zealand Bankin Banks AU 3.17 Wesfarmers Ltd. Retail AU 2.91 WOOLWORTHS GROUP Retail AU 2.75 Macquarie Group Ltd. Financial Services AU 2.57 Transurban Group Industrial Goods & Services AU 2.47 Telstra Corp. Ltd. Telecommunications AU 2.26 Rio Tinto Ltd. Basic Resources AU 2.13 Goodman Group Real Estate AU 1.51 Fortescue Metals Group Ltd. Basic Resources AU 1.39 Newcrest Mining Ltd. Basic Resources AU 1.37 Woodside Petroleum Ltd. Oil & Gas AU 1.23 Coles Group Retail AU 1.19 Aristocrat Leisure Ltd. Travel & Leisure AU 1.02 Brambles Ltd. Industrial Goods & Services AU 1.01 ASX Ltd. Financial Services AU 0.99 FISHER & PAYKEL HLTHCR. Health Care NZ 0.92 AMCOR Industrial Goods & Services AU 0.91 A2 MILK Food & Beverage NZ 0.84 Insurance Australia Group Ltd. Insurance AU 0.82 Sonic Healthcare Ltd. Health Care AU 0.82 SYDNEY AIRPORT Industrial Goods & Services AU 0.81 AFTERPAY Financial Services AU 0.78 SUNCORP GROUP LTD. Insurance AU 0.71 QBE Insurance Group Ltd. Insurance AU 0.70 SCENTRE GROUP Real Estate AU 0.69 AUSTRALIAN PIPELINE Oil & Gas AU 0.68 Cochlear Ltd. Health Care AU 0.67 AGL Energy Ltd. Utilities AU 0.66 DEXUS Real Estate AU 0.66 Origin Energy Ltd. -

ESG Reporting by the ASX200

Australian Council of Superannuation Investors ESG Reporting by the ASX200 August 2019 ABOUT ACSI Established in 2001, the Australian Council of Superannuation Investors (ACSI) provides a strong, collective voice on environmental, social and governance (ESG) issues on behalf of our members. Our members include 38 Australian and international We undertake a year-round program of research, asset owners and institutional investors. Collectively, they engagement, advocacy and voting advice. These activities manage over $2.2 trillion in assets and own on average 10 provide a solid basis for our members to exercise their per cent of every ASX200 company. ownership rights. Our members believe that ESG risks and opportunities have We also offer additional consulting services a material impact on investment outcomes. As fiduciary including: ESG and related policy development; analysis investors, they have a responsibility to act to enhance the of service providers, fund managers and ESG data; and long-term value of the savings entrusted to them. disclosure advice. Through ACSI, our members collaborate to achieve genuine, measurable and permanent improvements in the ESG practices and performance of the companies they invest in. 6 INTERNATIONAL MEMBERS 32 AUSTRALIAN MEMBERS MANAGING $2.2 TRILLION IN ASSETS 2 ESG REPORTING BY THE ASX200: AUGUST 2019 FOREWORD We are currently operating in a low-trust environment Yet, safety data is material to our members. In 2018, 22 – for organisations generally but especially businesses. people from 13 ASX200 companies died in their workplaces. Transparency and accountability are crucial to rebuilding A majority of these involved contractors, suggesting that this trust deficit. workplace health and safety standards are not uniformly applied. -

Business Leadership: the Catalyst for Accelerating Change

BUSINESS LEADERSHIP: THE CATALYST FOR ACCELERATING CHANGE Follow us on twitter @30pctAustralia OUR OBJECTIVE is to achieve 30% of ASX 200 seats held by women by end 2018. Gender balance on boards does achieve better outcomes. GREATER DIVERSITY ON BOARDS IS VITAL TO THE GOOD GOVERNANCE OF AUSTRALIAN BUSINESSES. FROM THE PERSPECTIVE OF PERFORMANCE AS WELL AS EQUITY THE CASE IS CLEAR. AUSTRALIA HAS MORE THAN ENOUGH CAPABLE WOMEN TO EXCEED THE 30% TARGET. IF YOUR BOARD IS NOT INVESTING IN THE CAPABILITY THAT DIVERSITY BRINGS, IT’S NOW A MARKED DEPARTURE FROM THE WHAT THE INVESTOR AND BROADER COMMUNITY EXPECT. Angus Armour FAICD, Managing Director & Chief Executive Officer, Australian Institute of Company Directors BY BRINGING TOGETHER INFLUENTIAL COMPANY CHAIRS, DIRECTORS, INVESTORS, HEAD HUNTERS AND CEOs, WE WANT TO DRIVE A BUSINESS-LED APPROACH TO INCREASING GENDER BALANCE THAT CHANGES THE WAY “COMPANIES APPROACH DIVERSITY ISSUES. Patricia Cross, Australian Chair 30% Club WHO WE ARE LEADERS LEADING BY EXAMPLE We are a group of chairs, directors and business leaders taking action to increase gender diversity on Australian boards. The Australian chapter launched in May 2015 with a goal of achieving 30% women on ASX 200 boards by the end of 2018. AUSTRALIAN 30% CLUB MEMBERS Andrew Forrest Fortescue Metals Douglas McTaggart Spark Group Ltd Infrastructure Trust Samuel Weiss Altium Ltd Kenneth MacKenzie BHP Billiton Ltd John Mulcahy Mirvac Ltd Stephen Johns Brambles Ltd Mark Johnson G8 Education Ltd John Shine CSL Ltd Paul Brasher Incitec Pivot -

Deal Flow Participation

Deal Flow Participation 3 September 2021 Security Code Issuer Offer Name Role Listing Date Country WIA070.NZ Wellington International Airport Wellington International Airport Fixed Rate Bond Distribution Aug-20 NZ FCL.AX FINEOS FINEOS (FCL) Institutional Placement Distribution Aug-20 AU SYD.AX Sydney Airport Sydney Airport (SYD) Shortfall Bookbuild Distribution Aug-20 AU TAH.AX Tabcorp Tabcorp (TAH) Shortfall Bookbuild Distribution Aug-20 AU IPL020.NZ Investore Property Investore Property Fixed Rate Bond Distribution Sep-20 NZ ORE.AX Orocobre Orocobre (ORE) Institutional Placement Distribution Sep-20 AU MCY030.NZ Mercury Energy Mercury Energy Green Bond Distribution Sep-20 NZ SUM030.NZ Summerset Summerset Fixed Rate Bonds Distribution Sep-20 NZ ABY.AX Adore Beauty Adore Beauty IPO Co-Manager Oct-20 AU VHP.NZ Vital Healthcare Vital Healthcare Placement Distribution Oct-20 NZ OCA010.NZ Oceania Oceania Bond Offer Distribution Oct-20 NZ ARG030.NZ Argosy Argosy Green Bond Distribution Oct-20 NZ CGFPC.AX Challenger Capital Challenger Capital Notes 3 IPO Distribution Oct-20 AU HPG.AX Hipages Group Holdings Hipages IPO Distribution Nov-20 NZ BOQPF.AX Bank of Queensland Limited Bank of Queensland Capital Notes 2 IPO Co-Manager Nov-20 AU BENPH.AX Bendigo and Adelaide Bank Ltd Bendigo and Adelaide Bank Capital Notes IPO Co-Manager Nov-20 AU SML.NZ Synlait Milk Limited Synlait Milk Placement Distribution Nov-20 NZ IAG.NZ Insurance Australia Group Limited IAG Placement Distribution Nov-20 NZ WBCPJ.AX Westpac Banking Corporation Westpac Capital Notes -

Vanguard Total World Stock Index Fund Annual Report October 31, 2020

Annual Report | October 31, 2020 Vanguard Total World Stock Index Fund See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports. Important information about access to shareholder reports Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com. You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. Your election to receive paper copies will apply to all the funds you hold through an intermediary or directly with Vanguard. -

DNR Capital Australian Equities Income Fund Monthly Report

DNR Capital Australian Equities Income Fund Performance Report – August 2021 Performance Fund overview The S&P/ASX 200 Industrials Accumulation Index was up APIR Code PIM8302AU 5.58% over the month. Investment bias Style neutral with a quality focus Information Technology (+16.8%) was the best performing sector, following Afterpay’s (APT +39.2%) takeover offer Designed for Investors who are seeking a from Square and Wisetech’s (WTC +57.0%) strong profit greater level of income and who result. Health Care (+6.8%) also outperformed as the can make use of franking credits. majority of the sector met expectations during reporting Investment objective To invest in a concentrated portfolio season. Utilities (+0.3%) was the worst performing sector, of Australian equities that aims to following poor performance in energy markets, evidenced outperform the Benchmark (net by results released during the recent reporting period. fees) and deliver higher levels of Industrials (+2.5%) also underperformed, as materials income relative to the benchmark and energy-linked industrials in particular underperformed over a rolling three-year period. alongside faltering commodity prices. The investment objective is not a The DNR Capital Australian Equities Income Fund forecast of the Fund’s performance. underperformed the Index for the month. Key stock Benchmark S&P/ASX 200 Industrials contributors were IPH (IPH), Commonwealth Bank of Accumulation Index Australia (CBA, no holding) and Suncorp Group (SUN). Key stock detractors were BHP Group (BHP), Afterpay (APT, no Investable universe Australian equities and cash holding) and Woodside Petroleum (WPL). Investment constraints The Fund will not invest in The Fund’s dividend yield expectation for 2021 is currently derivatives.