Jersey Companies Law: a Guide

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CHAPTER# 1 Define Joint Stock Company?

CHAPTER# 1 Define Joint Stock Company? It may be defined as an artificial person recognized by laws, with a distinctive name, a common seal, a common capital comprising transferable shares carrying limited liability and having a perpetual succession. Define Separate Legal Entity? A joint stock company is the creation of law. It has a separate legal entity of its own which is recognized by law as distinctive from persons forming it. It can sue or be sued in its name. It can own and transfer the title to property. Explain Perpetual Existence? A joint stock company has long life compared to other forms of business organizations. When company is formed and commence business, it has then a continuous life. The shareholders can come or go. It can be wound up through compliance with the provisions of companies ordinance 1984. Define Common Seal? Joint Stock company is an artificial person created by law, it therefore cannot sign documents for itself. The common seal with the name of the company engraved on it is, therefore used as a substitute for its signature. What is Company Limited by Shares? This is the principal from of company which is registered with the registrar of joint stock company under the companies ordinance 1984. Its capital is divided into number of shares. The shares can be freely transferred and sold. The liability of members is limited to the amount if any, unpaid on the shares held by them. Define Private Limited Company? It can be formed (a) at least by two persons and its total membership cannot exceed 50 (b) the company by its articles also restricts the right to transfer it shares (c) it also prohibits any invitation to the public for investment. -

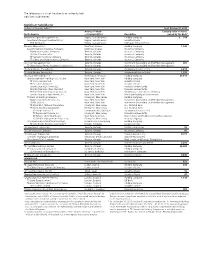

TD 2019 Annual Report Principal Subsidiaries

The following is a list of the directly or indirectly held significant subsidiaries. Significant Subsidiaries1 (millions of Canadian dollars) As at October 31, 2019 Address of Head Carrying value of shares North America or Principal Office2 Description owned by the Bank3 Greystone Capital Management Inc. Regina, Saskatchewan Holding Company $ 714 Greystone Managed Investments Inc. Regina, Saskatchewan Securities Dealer GMI Serving Inc. Regina, Saskatchewan Mortgage Servicing Entity Meloche Monnex Inc. Montreal, Québec Holding Company 1,595 Security National Insurance Company Montreal, Québec Insurance Company Primmum Insurance Company Toronto, Ontario Insurance Company TD Direct Insurance Inc. Toronto, Ontario Insurance Company TD General Insurance Company Toronto, Ontario Insurance Company TD Home and Auto Insurance Company Toronto, Ontario Insurance Company TD Asset Management Inc. Toronto, Ontario Investment Counselling and Portfolio Management 365 TD Waterhouse Private Investment Counsel Inc. Toronto, Ontario Investment Counselling and Portfolio Management TD Auto Finance (Canada) Inc. Toronto, Ontario Automotive Finance Entity 2,619 TD Auto Finance Services Inc. Toronto, Ontario Automotive Finance Entity 1,370 TD Group US Holdings LLC Wilmington, Delaware Holding Company 67,117 Toronto Dominion Holdings (U.S.A.), Inc. New York, New York Holding Company TD Prime Services LLC New York, New York Securities Dealer TD Securities (USA) LLC New York, New York Securities Dealer Toronto Dominion (Texas) LLC New York, New York Financial Services Entity Toronto Dominion (New York) LLC New York, New York Financial Services Entity Toronto Dominion Capital (U.S.A.), Inc. New York, New York Small Business Investment Company Toronto Dominion Investments, Inc. New York, New York Merchant Banking and Investments TD Bank US Holding Company Cherry Hill, New Jersey Holding Company Epoch Investment Partners, Inc. -

Limited Liability (S 9, 112) Limited by Shares (Public Or Proprietary)

TOPIC 1: INTRODUCTION – Types of Companies ‘Companies’ formed by registration under the Corporations Act as either public or proprietary companies; s 9 A company is EITHER a proprietary or a public company Proprietary (Pty Ltd) Public (Ltd) Shareholders Minimum 1 shareholder Minimum 1 shareholder s 45A(1); s 113 Maximum 50 non-employee No maximum shareholder Members Minimum 1 member Minimum 1 member s 114 No maximum Directors Minimum 1 director (resident) Minimum 3 directors (2 resident) + s 201A 1 company secretary Finance Cannot obtain funds from the public Can obtain funds from public s 45A(1); s 113 (w/disclosure document) Listing Cannot be listed Can be listed or unlisted s 45A(1); s 113 BUT not all public companies can be listed on the stock exchange (ASX) Type Limited by shares Limited by shares s 45A(1); s 112 Unlimited with share capital Limited by Guarantee Unlimited with share capital No Liability Company Registration ASIC Unlisted – ASIC, APRA Listed – ASIC, ASX, APRA • A public company, which adopts a constitution MUST lodge a copy with ASIC together with a copy of any special resolutions altering its provisions (ss 117(3), 136(5)). It is then publicly available. • A proprietary company, which adopts a constitution, need not lodge with ASIC but must send a copy to a member of the company upon request (s 139) Liability Limited Liability Unlimited Liability (s 9, 112) (s 9, 112) Limited by Shares Unlimited Limited by Guarantee No Liability (Public or proprietary) (Public or proprietary) (Public Companies) (Only public mining e.g. commercial e.g. -

Corporate Governance of Non-Listed Companies in Emerging Markets

Corporate Governance of Non-Listed Companies in Emerging Markets While the corporate governance debate has mostly focused on listed companies with dispersed shareholdings, issues such as financial transparency, the role of access to outside capital and conflict resolution are just as important for non-listed and family controlled companies which play a major role in many economies. Participants in OECD’s global corporate governance dialogue have started to address the different aspects of corporate governance in these companies. This publication provides policy makers, board members, managers, equity providers, creditors and other stakeholders an overview of the issues to be addressed in establishing good corporate governance of non-listed companies. Corporate Contributors to this publication are policy makers, regulators and practitioners, Governance mostly from emerging markets and developing countries including Brazil, China, India, Lebanon and Mexico. Drawing on their varied experiences, the contributors address key corporate governance issues such as the role of of Non-Listed professional managers, the implications of specific control and ownership structures; the unique characteristics of corporate governance of non-listed Companies companies, the adequate transparency requirements in non-listed companies, and how policy makers should inform themselves in order to facilitate better Markets Emerging in Companies Non-Listed of Governance Corporate in Emerging corporate governance and business performance in non-listed companies. Markets -

(2) Business Structures.Pdf

CA BUSINESS SCHOOL EXECUTIVE DIPLOMA IN BUSINESS AND ACCOUNTING SEMESTER 1: Preparation of Financial Statements Business Structures M B G Wimalarathna (ACA, ACMA, ACIM, SAT, ACPM)(MBA–PIM/USJ) Introduction As we discussed in chapter 01, every entity must identify & record business transactions for the given period and importantly such transaction (which are identified and recorded) should belongs to the given entity. An entity refers collection (pool) of interrelated group of people acting towards achieving common goal(s) and will be either one of the following; Sole Trader Partnership Company Non-profit motive organization Trust Period should be either a calendar year or an assessment year for local company. Sole Trader/Sole Proprietorship A Sole trader is a business owned by a person/an individual and control/manage by himself. Key features: Owner & controller is a same individual. Not a legal entity. Formation is not complex. Need to obtain BRN & TIN. For tax purpose, entity’s income is treated as individual’s income (owner) Advantages Disadvantages - Easy & inexpensive to form. - Unlimited liability since not - Not govern under strict rules & treated as separate legal entity. regulations. - Limited skills & capabilities. - Total autonomy over business - Cease the business when owner decisions. experience incapability. - Enjoy entire benefits. - Bear entire loss and liabilities. - Not charge tax on business profit. Partnership A Partnership is an association of two or more persons or entities that carry on business as partners with the common motive of earning profit. (how partnership differs from JV) A partnership could be form verbally, impliedly or in writing. Most of the partnerships carry on business in line with the provisions made in Partnership Agreement. -

An Introductory Guide to the Conversion of Your Existing Private Limited Company

THE LAW FOR IRISH COMPANIES IS CHANGING! YOU WILL NEED TO ACT SOON An Introductory Guide to the Conversion of your existing Private Limited Company February 2015 1 M-19926455-8 Soon, the law governing Irish companies will be changing. This means you will have decisions to take, and choices to make, but we are here to help you make the decisions and choices that are best for your company, its directors and shareholders. The Companies Bill 2012 was signed into law on 23 December 2014 and is now the Companies Act 2014. When the new Act enters into force (currently expected to be on 1 June 2015), all existing Irish private limited companies will have to make a decision:- To convert to the new simplified type of private company – Company Limited by Shares ("CLS" or "LTD") or To convert to the new more traditional company type – Designated Activity Company ("DAC") or To convert to another company type. There is another option – to do nothing, but we do not recommend this for reasons which we explain below. The CLS A CLS (or "LTD", which is the term preferred by the Companies Registration Office) can have just one director and one shareholder. Its internal rules will be set out in one document, with no requirement to include an objects clause, since a CLS will have full and unlimited corporate capacity, and no requirement to have an authorised share capital. A CLS will also be able to dispense with holding a physical AGM, irrespective of the number of shareholders. It may however be desirable in certain cases to continue with two directors and to keep holding meetings having regard to requirements necessary to maintain residence for Irish tax purposes. -

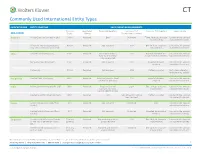

Commonly Used International Entity Types

Commonly Used International Entity Types COUNTRY/REGION ENTITY STRUCTURE BASIC FORMATION REQUIREMENTS Minimum Registered Corporate Secretary Minimum # of Minimum # of Directors Legal Liability ASIA-PACIFIC Capital Address Shareholders/Partners Australia Public Company (Limited or Ltd.) AUD 0 Required One Unlimited Three. At least 2 must be Limited to the amount local residents subscribed for shares Private or Proprietary Company AUD 0 Required Not required 1-50 One. At least 1 must be Limited to the amount (Pty. Ltd. or Proprietary Limited) local resident subscribed for shares China Limited Liability Company CNY 0 Required Not required. But a 1-50 Board of directors or a Limited to the amount local representative single executive director subscribed for shares may be required. Company Limited by Shares CNY 0 Required Not required 2-200 Board of directors Limited to the amount required subscribed for shares Partnership CNY 0 Required Not required 2-50 Partner managed Not a separate legal entity from its parent Hong Kong Limited Private Company HKD 0 Required Required, must be local 1-50 Board of directors Limited to the amount resident or company required subscribed for shares India Private Limited Company (Pvt Ltd) INR 0 Required Required if initial 2-200 Two. At least 1 must be Limited to the amount capital investment local resident subscribed for shares exceeds INR100 million Limited Liability Partnership (LLP) INR 0 Required N/A Two. At least 1 must be Partner managed Limited to the amount local resident subscribed for shares Japan General Corporation (Kabushiki JPY 1 Required Not required Unlimited One Limited to the amount Kaisha) subscribed for shares Limited Liability Company (Godo- JPY 1 Required Not required Unlimited Managed by managing Limited to the amount Kaisha) members subscribed for shares Singapore Private Limited Company (Private $1 in any Required Required and must be 1-50 One. -

GOVERNANCE ISSUES in PRIVATE COMPANIES Article

ownerdirectorchallenge.com.au GOVERNANCEEmbargoed until 12.30pm, ISSUES Monday 17 September 2012. IN PRIVATE COMPANIES Article Embargoed until 12.30pm, Monday 17 September 2012. Discover what you know, and don’t know about being an owner director. Test yourself today at ownerdirectorchallenge.com.au ownerdirectorchallenge.com.au GOVERNANCE ISSUES IN PRIVATE COMPANIES Embargoed until 12.30pm, Monday 17 September 2012. THE ASX CORPORATE GOVERNANCE COUNCIL CORPORATE GOVERNANCE PRINCIPLES AND RECOMMENDATIONS ARE ONLY REQUIRED TO BE FOLLOWED BY LISTED COMPANIES (ON AN ‘IF NOT, WHY NOT’ BASIS FOR THE MOST PART). NEVERTHELESS, THEY SET OUT GOVERNANCE PRACTICES AND ISSUES WHICH CAN BE VERY HELPFUL TO PRIVATE COMPANIES AND SERVE AS A BENCHMARK FOR GOOD GOVERNANCE. THE IMPORTANCE OF GOOD GOVERNANCE IS JUST AS GREAT FOR PRIVATE COMPANIES - IT IS JUST THE IMPLEMENTATION WHICH WILL USUALLY BE LESS COMPLEX. The basic precepts of good governance are fundamental to What is the Nature of Private Companies? all organisations – having a board charter, well defined roles A private company is a company that is registered and responsibilities for board members, appropriate financial as, or converts to, a proprietary company under knowledge, accountability and transparency to members, the Corporations Act 2001. Directors of proprietary shareholders and stakeholders. companies have legal duties and responsibilities A survey of the regulation of corporate governance in SMEs under the Corporations Act 2001. Under that Act, highlights a number of policy conclusions -

A Brief Guide to Forming a Company

A brief guide to forming a company 1. Incorporating a Company A Designated Activity Company (“DAC”): A Types of Company private company, a DAC’s activities are limited to its objects as set out in its memorandum of The most common forms of business organisations association and it must have at least two directors. operating in Ireland are: Suitable for joint ventures and special purposes A Limited Company vehicles or where there is a corporate governance requirement for a restriction on its activities. An Unlimited Company A Company Limited by Guarantee having a Share Investment Funds Capital (“DAC limited by guarantee”): A private Irish registered companies can be formed having company, whereby the shareholders have liability public or private status and with limited or unlimited under two headings; firstly, the amount, if any, that liability. is unpaid on the shares they hold, and secondly, the amount they have undertaken to contribute to Irish company law also provides for the use of the the assets of the company, in the event that it is Societas Europaea or “SE’s” which is a European wound up, being not less than €1. Its activities are public limited company. limited to its objects as set out in its memorandum Limited Companies of association and it must have at least two In a limited company, the liability of the shareholder directors. is limited to the amount(s) agreed to be paid on the A Company Limited by Guarantee not having issue of share(s) or the nominal value of the share, a Share Capital (“CLG”): A public company, whichever is greater and/or is limited to the amount whereby the shareholders’ liability is limited to guaranteed by the shareholder. -

TELFA Country-By-Country Compendium Of

Country by country guide 2 telfacountrybycountryguide Table of contents 1. Introduction ............................................................................................................................................. 4 2. Austria ....................................................................................................................................................... 7 3. Belgium ..................................................................................................................................................... 9 4. Cyprus ........................................................................................................................................................ 14 5. Czech Republic ......................................................................................................................................... 17 6. Denmark ................................................................................................................................................... 23 7. Estonia ....................................................................................................................................................... 26 8. France ......................................................................................................................................................... 30 9. Finland ....................................................................................................................................................... 34 10. Germany ................................................................................................................................................... -

Choices of Business Organisation

REVIST@ e – Mercatoria Volumen 3, Número 2. (2004) PARTNERSHIPS AND COMPANIES A COMPARATIVE APPROACH TO UK BUSINESS ORGANISATIONS∗ By David Ricardo Sotomonte Mujica∗∗ INTRODUCTION This paper does not pretend to cover all the different aspects of partnerships and companies as forms of organising business, but to be a guide for the reader in his approach to the two most spread and important types of business associations provided by law for today’s businessman. Therefore, the essay is divided in two basic parts: the first one is dedicated to an independent and separate analysis of partnerships and companies within the UK; and the second one, which is a comparison between both business associations. PARTNERSHIPS & COMPANIES, THE BRITISH TREATMENT. The first step in order to achieve a logical and complete comparison between partnerships and companies from UK’s Law point of view is to understand the main characteristics of both figures and the different subtypes within them. Consequently, this section starts with the essential aspects of every type of partnerships and companies, and finalises with the comparative examination. A. Essential Characteristics i. Companies. As in many other jurisdictions, UK’s Company Law does not define clearly what a company is but describes its formation1 and the different types of companies that may exist. The process or mechanism by which companies are created or formed is called incorporation. As a result of incorporation, the company acquires separate personality becoming an independent legal person distinct from its members and/or directors (this is one of the essential characteristics of companies and is discussed further on this paper). -

The Unlimited Company Companiescompanies Billact 2014 2012

The Unlimited Company companiescompanies billact 2014 2012 The Companies Act 2014 (the “Act”) came into effect on 1 June 2015 and has introduced significant reforms in company law in Ireland. Although some of the law relating to an unlimited company is unchanged by the Act, there are some notable reforms. Key Features • unless specifically exempted, the name of an unlimited company must end with either “unlimited company” or “cuideachta neamhtheoranta”; • no restriction on a company previously re-registered from limited to unlimited (or vice versa) subsequently reverting to its previous status; • new rules with respect to the capacity of an unlimited company, mirroring those applying with respect to a designated activity company and a public limited company; • unlimited company permitted to be a single-member company; • statutory distribution rules disapplied with respect to an unlimited company (although insolvency rules will remain); • a reserve arising from a reduction of capital of a ULC or a PUC treated as a realised profit; • new provisions facilitating reorganisations, mergers and divisions of companies apply to an unlimited company in the same way as to a private company limited by shares (however, in the case of a merger or division, one of the companies involved must be a private company limited by shares). Companies Act 2014 Preliminary Constitution The Unlimited The Act provides for three types of As in the case of other types of company, unlimited company: the provisions with respect to the Company constitution of an unlimited company (a) a private unlimited company (“ULC”); (continued) reflect changes from the previous law. (b) a public unlimited company (with a Like a designated activity company share capital) (“PUC”); and (“DAC”), the constitution of an unlimited company must be in the form of a (c) a public unlimited company (without a memorandum and articles of association.