Textron: Action & Results

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Citation X+ There Is Nothing Faster

CITATION X+ THERE IS NOTHING FASTER Period. Fly the uncontested speed leader up to Mach 0.935 (717 mph) to a max altitude of 51,000 feet, way ahead of your competition. Combining cross-continental range, a technologically advanced flight deck and cabin, and legendary performance makes the Citation X®+ unmatched in more than just speed. Max Range Max Cruise Speed Max Passengers 3,460 nm 528 ktas 12 Useful Load Takeoff Distance 14,769 lb 5,250 ft HIGH-PERFORMANCE BOARDROOM Relax in the wide, reclining seats with plenty of legroom, and enjoy the view through 13 large windows. Exceptional leathers and fabrics, hand-finished hardwoods, and a contemporary vanity and lavatory complete the fit and finish of the Citation X+ cabin. STAY CONNECTED IN FLIGHT Manage cabin lighting, window shades, temperature and entertainment with simple touch-screen commands, and stay connected with in-cabin high-speed Internet and Wi-Fi. AN INTERIOR DESIGNED FOR YOUR NEEDS Thirteen large windows Standard belted Executive tables Additional storage Class-leading Fully tracking, Large galley with flushing lavatory stow neatly between seats legroom berthable room for food swing-out seats preparation CUSTOMIZED COMFORT Choose customized interior finishes and personalized touches throughout to make the Citation X+ your own. Multiple cabin compartments and additional storage space are just a few of the available options. Standard Seating Optional Seating LEADING-EDGE AVIONICS The Garmin™ G5000™ avionics suite allows pilots to individualize their layouts, providing such features as full-dimensional renderings of terrain and precise weather pattern and traffic monitoring, all from a touch-screen, intuitive interface. -

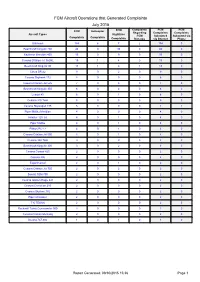

FCM Aircraft Operations That Generated Complaints July 2015

FCM Aircraft Operations that Generated Complaints July 2015 Complaints FCM FCM FCM Helicopter FCM Regarding Complaints Complaints Aircraft Types Nighttime FCM Submitted Submitted via Complaints Complaints Complaints Run-ups via Internet Phone Unknown 184 6 7 2 184 0 Beechcraft King Air 200 46 0 30 0 46 0 Raytheon Beechjet 400 15 0 9 0 15 0 Cessna Citation Jet 560XL 15 1 4 0 15 0 Beechcraft King Air 90 13 1 6 1 13 0 Cirrus SR-22 9 0 2 0 9 0 Cessna Skyhawk 172 8 0 0 0 8 0 Cessna Citation Jet 525 7 0 3 0 7 0 Beechcraft King Air 350 6 0 2 0 6 0 Learjet 45 6 0 1 0 6 0 Cessna 310 Twin 5 0 0 0 5 0 Cessna Skywagon 185 5 0 0 0 4 1 Piper Malibu Meridian 4 0 0 0 4 0 Hawker 125 Jet 4 0 1 0 4 0 Piper Malibu 4 0 1 0 4 0 Pilatus PC-12 4 0 1 0 4 0 Cessna Citation Jet 560 4 0 1 0 4 0 Cessna 340 Twin 3 0 0 0 3 0 Beechcraft King Air 300 3 0 2 0 3 0 Cessna Corsair 425 2 0 0 0 2 0 Cessna 206 2 0 0 0 2 0 Experimental 2 0 1 0 2 0 Cessna Citation Jet 750 2 0 2 0 2 0 Socata TBM 700 2 0 0 0 2 0 Cessna Golden Eagle 421 2 0 0 0 2 0 Cessna Centurion 210 2 0 0 0 2 0 Cessna Skylane 182 2 0 0 0 2 0 Piper Cherokee 2 0 0 0 2 0 T-6 TEXAN 2 0 0 0 2 0 Rockwell Turbo Commander 900 2 0 0 0 2 0 Cessna Citation Mustang 2 0 0 0 2 0 Boeing 737-900 1 0 1 0 1 0 Report Generated: 09/30/2015 15:36 Page 1 Complaints FCM FCM FCM Helicopter FCM Regarding Complaints Complaints Aircraft Types Nighttime FCM Submitted Submitted via Complaints Complaints Complaints Run-ups via Internet Phone Piper Navajo Twin 1 0 0 0 1 0 Mitsubishi MU-2 1 0 0 0 1 0 Beechcraft Debonair/Bonanza 1 0 1 0 1 0 -

Model 162 SERIAL NUMBER

Model 162 SERIAL NUMBER Serials 16200001 and On REGISTRATION NUMBER This publication includes the material required to be furnished to the pilot by ASTM F2245. COPYRIGHT © 2009 ORIGINAL ISSUE - 22 JULY 2009 CESSNA AIRCRAFT COMPANY WICHITA, KANSAS, USA REVISION 3 - 28 SEPTEMBER 2010 162PHUS-03 U.S. CESSNA INTRODUCTION MODEL 162 GARMIN G300 PILOT’S OPERATING HANDBOOK AND FLIGHT TRAINING SUPPLEMENT CESSNA MODEL 162 SERIALS 16200001 AND ON ORIGINAL ISSUE - 22 JULY 2009 REVISION 3 - 28 SEPTEMBER 2010 PART NUMBER: 162PHUS-03 162PHUS-03 U.S. i/ii CESSNA INTRODUCTION MODEL 162 GARMIN G300 CONGRATULATIONS Congratulations on your purchase and welcome to Cessna ownership! Your Cessna has been designed and constructed to give you the most in performance, value and comfort. This Pilot’s Operating Handbook has been prepared as a guide to help you get the most utility from your airplane. It contains information about your airplane’s equipment, operating procedures, performance and suggested service and care. Please study it carefully and use it as a reference. The worldwide Cessna Organization and Cessna Customer Service are prepared to serve you. The following services are offered by each Cessna Service Station: • THE CESSNA AIRPLANE WARRANTIES, which provide coverage for parts and labor, are upheld through Cessna Service Stations worldwide. Warranty provisions and other important information are contained in the Customer Care Handbook supplied with your airplane. The Customer Care Card assigned to you at delivery will establish your eligibility under warranty and should be presented to your local Cessna Service Station at the time of warranty service. • FACTORY TRAINED PERSONNEL to provide you with courteous, expert service. -

Technical Addendum to the Guidance for Noise Screening of Air Traffic Actions

MP130001 MITRE PRODUCT Technical Addendum to the Guidance for Noise Screening of Air Traffic Actions Koffi A. Amefia February 2013 The contents of this material reflect the views of the author and/or the Director of the Center for Advanced Aviation System Development (CAASD), and do not necessarily reflect the views of the Federal Aviation Administration (FAA) or the Department of Transportation (DOT). Neither the FAA nor the DOT makes any warranty or guarantee, or promise, expressed or implied, concerning the content or accuracy of the views expressed herein. This is the copyright work of The MITRE Corporation and was produced for the U.S. Government under Contract Number DTFAWA-10-C-00080 and is subject to Federal Aviation Administration Acquisition Management System Clause 3.5-13, Rights in Data-General, Alt. III and Alt. IV (Oct. 1996). No other use other than that granted to the U.S. Government, or to those acting on behalf of the U.S. Government, under that Clause is authorized without the express written permission of The MITRE Corporation. For further information, please contact The MITRE Corporation, Contract Office, 7515 Colshire Drive, McLean, VA 22102 (703) 983-6000. 2013 The MITRE Corporation. The Government retains a nonexclusive, royalty-free right to publish or reproduce this document, or to allow others to do so, for “Government Purposes Only.” MP130001 MITRE PRODUCT Technical Addendum to the Guidance for Noise Screening of Air Traffic Actions Sponsor: The Federal Aviation Administration Koffi A. Amefia Dept. No.: F072 Project No.: 0213BB03-2B Outcome No.: 3 PBWP Reference: 3-2.1-2 February 2013 “Wind Farm and Environmental Assessment Processes” For Release to all FAA This document was prepared for authorized distribution only. -

Citation Sovereign+ Redraw Your Range Map

CITATION SOVEREIGN+ REDRAW YOUR RANGE MAP Range-enhancing winglets combined with powerful engines allow the CESSNA CITATION SOVEREIGN+ aircraft to land on smaller runways and at airports surrounded by obstacles. This reduces travel time and grants access to popular destinations such as Aspen, Hilton Head and Ocean Reef. The sizable cabin makes every business trip a pleasure. Maximum Range Maximum Cruise Speed Maximum Passengers Useful Payload Takeoff Distance 3,200 nm 460 ktas 12 12,794 lb 3,530 ft UNMATCHED INGENUITY CITATION SOVEREIGN+ SPECIFICATIONS INTERIOR Cabin Height 68 in 1.73 m Cabin Width 66 in 1 .68 m Cabin Length 25 ft 3 in 7.70 m TOUCH-SCREEN SPACIOUS CABIN HEATED BAGGAGE AVIONICS The spacious, versatile cabin features COMPARTMENT BAGGAGE CAPACITY electrically operated windows and a Weight 1,435 lb 651 kg NextGen-capable GARMIN double-club seating configuration. The heated baggage compartment can G5000 avionics streamline the hold up to 1,000 pounds and 100 cubic Volume 135 cu ft 3.82 cu m pilot experience with advanced feet of cargo. autothrottles and touch-screen WEIGHTS simplicity. Max Takeoff 30,775 lb 1 3,959 kg Basic Operating Weight 1 8,235 lb 8,27 1 kg Useful Load 12,790 lb 5,801 kg MAX PASSENGERS 12 ENGINES Manufacturer Pratt & Whitney Canada Model (2) PW306D Thrust 5,907 lb 26.28 kN ea PERFORMANCE Takeoff Field Length (MTOW) 3,530 ft 1,076 m Max Range 3,200 nm 5,926 km Max Cruise Speed 460 ktas 852 km/h FUEL-EFFICIENT ENGINES Time to Climb FL 450 in 27 min POWERFUL CLASS-LEADING Pratt & Whitney Canada engines deliver low-cost ELECTRICAL SYSTEM TAKEOFF FIELD LENGTH maintenance, high reliability and fuel efficiency for Performance data is based on standard conditions with zero wind. -

PILOT REPORT Grand Caravan EX Cessna’S Big Utility Turboprop Single Is a Capable and All-Around Solid Performer

PILOT REPORT Grand Caravan EX Cessna’s big utility turboprop single is a capable and all-around solid performer. by Matt Thurber The Cessna Caravan has been in production since of the big single-engine turboprop. 1984, and earlier this year I had my first opportu- While it’s common to be told the Caravan “flies nity to fly the single-engine utility turboprop from just like a heavy 172,” the airplane is not simply Textron Aviation’s private airport—Beech Factory a stretched and beefed-up version of any Cessna Airport—in Wichita. single. The configuration may be similar—there www.ainonline.com My demo pilot was Terry Allenbaugh, the per- aren’t many options when it comes to designing fect pilot to show me the Caravan’s capabili- a tricycle-gear single-engine turboprop for rough- ties. During his early flying career, Allenbaugh field operations—but the Caravan employs many flew one of the first Caravans, Serial Number features found on larger airplanes. 8, for Mission Aviation Fellowship in Ethio- The strut-braced wing has massive flaps that pia. Although he has flown all the Citations extend to 70 percent of each wing’s length. Spoil- and King Airs, Allenbaugh returned to flying ers mounted inboard of the ailerons improve the Caravan as a sales demonstration pilot two low-speed handling. Elevator trim tabs have dual years ago, and he is an enthusiastic proponent actuators. A pressure fuel system is optional and © 2017 AIN Publications. All Rights Reserved. For Reprints go to AVIATION INTERNATIONAL NEWS • OCTOBER 2017 PILOT REPORT typically installed on float-equipped Caravans. -

CHAMPION AEROSPACE LLC AVIATION CATALOG AV-14 Spark

® CHAMPION AEROSPACE LLC AVIATION CATALOG AV-14 REVISED AUGUST 2014 Spark Plugs Oil Filters Slick by Champion Exciters Leads Igniters ® Table of Contents SECTION PAGE Spark Plugs ........................................................................................................................................... 1 Product Features ....................................................................................................................................... 1 Spark Plug Type Designation System ............................................................................................................. 2 Spark Plug Types and Specifications ............................................................................................................. 3 Spark Plug by Popular Aircraft and Engines ................................................................................................ 4-12 Spark Plug Application by Engine Manufacturer .........................................................................................13-16 Other U. S. Aircraft and Piston Engines ....................................................................................................17-18 U. S. Helicopter and Piston Engines ........................................................................................................18-19 International Aircraft Using U. S. Piston Engines ........................................................................................ 19-22 Slick by Champion ............................................................................................................................. -

20062006 Civil Air Patrol Annual Report to Congress

Annual Report 07 2/9/07 3:34 PM Page i 20062006 Civil Air Patrol Annual Report to Congress th year of National Service 6655 Annual Report 07 2/9/07 3:34 PM Page ii On Our Cover: From its early anti-sub days of World War II and the Fairchild 24 to the glass cockpit-equipped Cessna Skylanes of this century, Civil Air Patrol's 65-year history is rich. The glass-cockpit technology, bottom photos, allows CAP members to fly homeland security missions more efficiently and safely than they did during World War II, when volunteer pilots like CAP 1st Lt. Henry "Ed" Phipps, above, defended America's East and Gulf coasts from German submarines. Discover more about CAP's illustrious history and its Missions for America inside this 2006 Report to Congress and Annual Performance Report. Annual Report 07 2/9/07 3:34 PM Page 1 Civil Air Patrol Keeps U.S. Safe n behalf of our 56,000 members, I am pleased to present the Civil Air Patrol's first joint 2006 Annual Report to Congress and Annual Performance Report. In CAP, it is all about our Missions for America, which are unselfishly carried out by private citizens providing professional Ovolunteer service. Whatever their mission, these Everyday Heroes proudly step up and perform their assigned tasks in an efficient, cost-effective manner. In fact, the cost to taxpayers for CAP missions is less than $100 per aircraft hour flown. CAP members' 2006 accomplishments were numerous. They: • Helped rescue lost and stranded pilots, motorists, children, Alzheimer's patients, hikers, hunters and Boy Scouts throughout America. -

IN the UNITED STATES DISTRICT COURT for the EASTERN DISTRICT of PENNSYLVANIA CHARLES POWERS, on His Own : CIVIL ACTION Behalf An

Case 2:06-cv-02993-TJS Document 152 Filed 02/09/11 Page 1 of 31 IN THE UNITED STATES DISTRICT COURT FOR THE EASTERN DISTRICT OF PENNSYLVANIA CHARLES POWERS, on his own : CIVIL ACTION behalf and on behalf of the : class defined herein : NO. 06-2993 : v. : : LYCOMING ENGINES, a Division of : AVCO CORPORATION; AVCO : CORPORATION; and TEXTRON, INC. : PLANE TIME, LLC, on its own behalf and : CIVIL ACTION on behalf of others similarly situated : : NO. 06-4228 v. : : LYCOMING ENGINES, a Division of : AVCO CORPORATION; AVCO : CORPORATION; and TEXTRON, INC. : MEMORANDUM OPINION Savage, J. February 9, 2011 In these two consolidated putative nationwide class actions, we conduct a choice-of- law analysis and then re-evaluation of whether the plaintiffs have satisfied Rule 23's requirements for class certification. Moving for class certification under Fed. R. Civ. P. 23(b)(3), the plaintiffs seek to represent a class of owners or previous owners of aircraft equipped with engines designed and built by Lycoming Engines.1 They claim that the engines were manufactured with defective crankshafts that can cause a total loss of engine power and in-flight engine 1 The plaintiffs named three defendants, Lycoming Engines, Avco Corporation (“Avco”) and Textron, Inc. Since the motion for certification was filed, Textron has been dismissed. The two remaining defendants are referred to collectively as “Lycoming.” Case 2:06-cv-02993-TJS Document 152 Filed 02/09/11 Page 2 of 31 failures, and that Lycoming knew of and concealed the defect that prevents the crankshafts from functioning as intended. They seek damages for the cost to replace the defective crankshafts, which includes parts, labor, transportation, storage, insurance, the loss of the use of the aircraft while the crankshafts are being replaced and the diminished value of the aircraft. -

ATP® Libraries Catalog

2 ATP® Libraries Catalog Revision Date May 24 2016 ATP 101 South Hill Drive Brisbane, CA 94005 (+1) 415-330-9500 www.atp.com ATP® Policies and Legal www.atp.com/policy © Copyright 2016, ATP. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form by any means, electronic, mechanical, photocopying, recording or otherwise, without prior written permission of ATP. The information in this catalog is subject to change without notice.ATP, ATP Knowledge, ATP Aviation Hub, HubConnect, NavigatorV, and their respective logos, are among the registered trademarks or trademarks of ATP. All third-party trademarks used herein are the property of their respective owners and ATP asserts no ownership rights to these items. iPad and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. All original authorship of ATP is protected under U.S. and foreign copyrights and is subject to written license agreements between ATP and its subscribers. Visit www.atp.com/policy for more information ATP Customer Support Please visit www.atp.com/support for customer support information ATP® Libraries Catalog – Revision Date: May 24 2016 3 CONTENTS CONTENTS ...................................................................................................................................................................... 3 REGULATORY LIBRARIES ............................................................................................................................................. -

Aircraft Library

Interagency Aviation Training Aircraft Library Disclaimer: The information provided in the Aircraft Library is intended to provide basic information for mission planning purposes and should NOT be used for flight planning. Due to variances in Make and Model, along with aircraft configuration and performance variability, it is necessary acquire the specific technical information for an aircraft from the operator when planning a flight. Revised: June 2021 Interagency Aviation Training—Aircraft Library This document includes information on Fixed-Wing aircraft (small, large, air tankers) and Rotor-Wing aircraft/Helicopters (Type 1, 2, 3) to assist in aviation mission planning. Click on any Make/Model listed in the different categories to view information about that aircraft. Fixed-Wing Aircraft - SMALL Make /Model High Low Single Multi Fleet Vendor Passenger Wing Wing engine engine seats Aero Commander XX XX XX 5 500 / 680 FL Aero Commander XX XX XX 7 680V / 690 American Champion X XX XX 1 8GCBC Scout American Rockwell XX XX 0 OV-10 Bronco Aviat A1 Husky XX XX X XX 1 Beechcraft A36/A36TC XX XX XX 6 B36TC Bonanza Beechcraft C99 XX XX XX 19 Beechcraft XX XX XX 7 90/100 King Air Beechcraft 200 XX XX XX XX 7 Super King Air Britten-Norman X X X 9 BN-2 Islander Cessna 172 XX XX XX 3 Skyhawk Cessna 180 XX XX XX 3 Skywagon Cessna 182 XX XX XX XX 3 Skylane Cessna 185 XX XX XX XX 4 Skywagon Cessna 205/206 XX XX XX XX 5 Stationair Cessna 207 Skywagon/ XX XX XX 6 Stationair Cessna/Texron XX XX XX 7 - 10 208 Caravan Cessna 210 X X x 5 Centurion Fixed-Wing Aircraft - SMALL—cont’d. -

2017 SUN Baseline Noise Modeling Memo

To: CHRIS POMEROY, FRIEDMAN MEMORIAL AIRPORT From: Chris Sandfoss Cc: Rob Adams Date: 3/1/2017 Re: SUN Noise Modeling Methodology and Preliminary Results This memo summarizes the basic input data for, and the preliminary results of, the noise modeling of existing (2017) baseline conditions at Friedman Memorial Airport (SUN). Noise contours have been be prepared using the AEDT at levels of DNL 65, 70, and 75. The following sections describe the input data and results of the noise contour modeling. NOISE MODELING METHODOLOGY Number of Operations and Fleet Mix: The number of annual operations that were modeled for the existing (2017) conditions at SUN is based on a variety of sources, including ATCT operations counts, Airport landing fee reports, and FAA Aviation System Performance Metrics (ASPM) databases. There were 25,316 total operations at SUN from January 2016 through December 2016, which corresponds to 69.4 average-annual day operations. Table 1 provides a summary of the average daily operations and fleet mix at SUN, organized by aircraft type, operation type, and time of day. Several aircraft types use the same FAA-approved substitute in the noise database of the AEDT as indicated by the noise model ID in Table 1. Daytime/Nighttime Operations: Data on the ratio of daytime to nighttime operations is based on data from the Draft Environmental Impact Statement (DEIS) and data from FMAA staff. Approximately 98 percent of all operations occur during the daytime (7:00 am to 9:59 pm) and 2 percent of all operations occur during the nighttime (10:00 pm to 6:59 am).