Building a Network to Share and Discuss

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

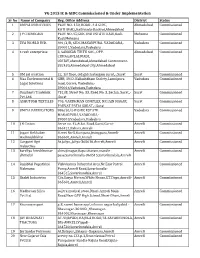

PETROLEUM DEALERS to BE GOVERNED by STATE TAX OFFICE Sl No

ANNEXURE - V - PETROLEUM DEALERS TO BE GOVERNED BY STATE TAX OFFICE Sl No. GSTIN TAXPAYER'S NAME 1 24AQRPP7312H1ZL 99 99 PETROLEUM 2 24AAEFA0023F1ZD A B PATEL AND CO 3 24AQNPM8975B1ZH A K MORI PETROLEUM 4 24AFCPC9369M1Z4 A M PETROLEUM 5 24AADFA2780N1ZD A. G. SHAH 6 24AAMFA4010E1Z4 A. K. ROADWAYS 7 24APBPK7429M1ZN A. N. AND SONS PETROLEUM SERVICE 8 24AAFFA8650H1ZJ A.K. BHAVSAR AND SONS 9 24ATOPP1482A1ZT AADARSH PETROLEUM 10 24ABBFA9252C1ZV AADESH PETROLEUM 11 24BARPJ8339R1ZP AADESH PETROLEUM 12 24AJHPD5419Q1ZY AADITYA PETROLEUM 13 24AUAPP3218R1ZC AADITYA PETROLIUM 14 24AFRPR6052H2Z2 AAGMAN PETROLEUM 15 24ABGFA1894B1ZS AAI JAMAD PETROLEUM 16 24AGIPK9146M1ZX AAI SHREE KHODIYAR PETROLEUM 17 24BCBPD5153K1ZV AAI SHREE KHODIYAR PETROLIUM 18 24BDWPM8984K1ZE AAI SHREE KHODIYAR PETROLIUM 19 24ABFFA0016J1Z0 AAI SHREE LIRBAI PETROLEUM 20 24BEVPB0384L1Z8 AAI SHRI KHODIYAR PETROLEUM 21 24ABBFA5940R1Z5 AAMI PETROLEUM 22 24AGOPC0187G1ZL AARA PETROLEUM 23 24AOLPJ1680G1Z0 AARADHANA PETROLEUM 24 24ABEFA1759R1Z1 Aarav Petroleum 25 24AAVFA1979R1ZG AARSHI PETROLEUM 26 24ABCFA3978J1ZA AARTI PETROLEUM 27 24AJEPG8595K1ZR AARTI PETROLIUM 28 24ACDPD8518K1ZN AASHIRVAD QUARY WORKS 29 24AAWFA2866J1ZZ AASHISH PETROLIUM SERVICE. 30 24ALPPD8204K1Z1 AASHRAY PETROLIUM 31 24ALBPP8913D1ZA AASHTHA PETROLEUM 32 24AMPPM0033J1Z5 AASOO PETROLEUM 33 24AOCPP1634F1ZB AASOPALAV PETROLEUM 34 24ADOPJ0447P1Z6 AASTHA PETROLEUM 35 24ADUPP4322M1Z2 AASTHA PETROLIUM 36 24AIAPP6620R1ZW AASTHA ENERGY 37 24AKNPK0690D1ZB AAYUSHI PETROLEUM 38 24AQPPC0315F1ZF AAZAL PETROLEUM 39 24AAKFA7404J2ZI -

Stk7rocmumbai 28122018.Pdf

Sr No CIN Company Name 1 U70100MH1988PTC047470 ATAN DWEEP PROPERTIES AND RESORTSPRIVATE LIMITED 2 U99999MH1986PTC039423 0HRI SWAMI SAMARTHAICE PRODUCTS PRIVATE LTD 3 U65990MH1990PLC058141 20TH CENTURY CAPITAL VENTURE CORPORATION LIMITED 4 U99999MH1981PTC024821 20TH CENTURY-ORIENTLEASING PVT LTD 5 U65990MH1993PTC075614 3RIYESHA LEASING AND FINANCE P.LTD. 6 U74990MH2012PTC227156 5 GEN INTERNATIONALPRIVATE LIMITED 7 U40101MH2010PTC201852 A B J POWER GEN PRIVATE LIMITED 8 U45208MH2009PTC197088 A C BUSINESS PRIVATE LIMITED 9 U99999MH1955PTC009548 A ISMAIL AND COMPAYPRIVATE LIMITED 10 U92200MH1959PTC011358 A J PRIVATE LIMITED 11 U74140MH2003PTC138956 A M PROJECTS AND SERVICES PRIVATELIMITED 12 U99999MH1953PTC008983 A RAMSON AND CO PVTLTD 13 U99999MH1951PTC008623 A SHANKARLAL AND COPVT LTD 14 U74140PN1989PTC052484 A V BHAT MANAGEMENTAND CONSULTANCYSERVICES PVT LTD. 15 U74900MH2010PTC209161 A. J. BEAUTY AND HEALTH PRIVATE LIMITED 16 U92120MH2007PTC168557 A. J. ENTERTAINMENTPRIVATE LIMITED 17 U70102MH2012PTC229595 A. S. A. R. PROPERTIES & ESTATES PRIVATE LIMITED 18 U26260MH1960PLC011560 A. T. E. LIMITED 19 U99999MH1997PTC106970 A.B.V. EXIM (INDIA)PRIVATE LIMITED 20 U45400MH2012PTC229003 A.D REALTY PRIVATE LIMITED 21 U51216MH1995PTC092639 A.DANIF AND COMPANYLEATHERS PRIVATELIMITED 22 U50100MH1997PTC109748 A.G. MOTORS PRIVATELIMITED 23 U51900MH1995PTC093677 A.K.MERCANTILE PRIVATE LIMITED 24 U24132MH1983PLC031623 A.K.STRUCTURAL FOAMLIMITED 25 U99999MH1997PTC109211 A.M.FINCONS PRIVATELIMITED 26 U51396MH1941PTC003382 A.MACRACE AND COMPANY PRIVATE LIMITED -

Sr. No DP-ID CL-ID Beneficiary Name Amount Of

UNCLAIMED DIVIDEND FOR THE FINANCIAL YEAR 2017-18 Shareholders who wish to claim the unclamied dividend amount may send an email to our Registrar and Share Transfet Agent (RTA) Karvy Fintech Private Limited on [email protected] Proposed Date of transfer Amount of to IEPF (DD-MON-YYYY) Sr. No DP-ID CL-ID Beneficiary Name Unclaimed Last known Address Dividend (in Rs.) 1 19101 1201910101749944 NARENDER KUMAR GUPTA HUF 5332.50 H NO - 4 GYAN LOK COLONY BULANSAHAR UTTAR PRADESH 203001 . 09-09-2025 2 41400 1304140006719735 DIPIKA MUNDHRA 4950.00 SHREE BHAWAN OUTSIDE NATHUSAR GATE BIKANER RAJASTHAN 334001 . 09-09-2025 3 IN300214 12256998 RISHIKESH S THAKUR 15750.00 408 ASHIRWAD BUNGLOW VASNA ROAD BARODA GUJARAT 390015 . 09-09-2025 4 IN300513 11866665 SWATI S SHAH 1687.50 B/5 SHIVAM ENCLAVE NEAR CITIZEN SOC ELLORA PARK VADODARA GUJARAT 390023 . 09-09-2025 5 IN300214 10462133 NIRAJ BHATT 2250.00 17-18,BLDG 46- C ,CST ROAD OPP SINDHI SOC BUS STOP CHEMBUR MUMBAI 400071 . 09-09-2025 6 IN300476 10230703 K J ANDREW 2250.00 201, GLEN HEIGHT HIRANANDANI GARDEN POWAI MUMBAI 400076 . 09-09-2025 7 36000 1203600000780102 SUMEDH D DABHADE 2250.00 C/O SUNDRABAI LONDHE CHAWL DR AMBEDKAR NGR GAONDEVI TEKDI GAONDEVI ROAD BHANDUP WEST MUMBAI MAHARASHTRA 400078 09-09-2025 8 IN301604 11015177 KANTI DIPCHAND SHAH 4500.00 FLAT NO 9 MANGAL DEEP BLDG NEAR SAI BABA MANDIR VEER SAVARKAR MARG VIRAR EAST THANE 401305 . 09-09-2025 9 IN300450 12644609 GAUTAM CHAND LOONAWAT 2479.50 C-1/6 VALLABH NAGAR NR SANT GANESHWAR SCHOOL BEHIND ARIHANT COMPLEX RAIPUR (C G) 492006 . -

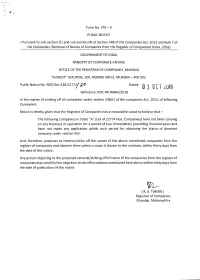

Form No. STK - 5

Form No. STK - 5 PUBLIC IVOTICE ( Pursuant to sub-section (1) and sub-section (4) of section 248 of the Companies Act, 2013 and Rule 7 of the Companies (Removal of Names of Companies from the Register of Companies) Rules, 2016) GOVERNMENT OF INDIA MINISTRY OF CORPORATE AFFAIRS OFFICE OF THE REGISTRAR OF COMPANIES, MUMBAI "EVEREST" BUILDING, 100, MARINE DRIVE, MUMBAI -400 002. Public Notice No. ROC/Sec.248/22774/@ Reference: ROC-MUMBAI/2018 In the matter of striking off of companies under section 248(1) of the companies Act, 2013, of following Companies: Notice is hereby given that the Registrar of Companies has a reasonable cause to believe that - The following companies in Table "A" (List of 22774 Nos. Companies) have not been carrying on any business or operation for a period of two immediately preceding financial years and have not made any application within such period for obtaining the status of dormant company under section 455. And, therefore, proposes to remove/strike off the names of the above mentioned companies from the register of companies and dissolve them unless a cause is shown to the contrary, within thirty days from the date of this notice. Any person objecting to the proposed removaI/striking off of name of the companies from the register of companies may send his/her objection to the office address mentioned here above within thirty days from the date of publication of this notice. ( R. K. TIWARI ) Registrar of Companies Mumbai, Maharashtra Sr No Company Name CIN 1 ATAN DWEEP PROPERTIES AND U70100MH1988PTC047470 RESORTSPRIVATE -

Provisional Gradation List of Medical Officers As on 01.04.2018

PROVISIONAL GRADATION LIST OF MEDICAL OFFICERS AS ON 01.04.2018 Gradation SEX PG PG HOME_ PSC PSC CONFIRM DISTRICT OF NAME CASTE DOB DOJ_SERV Present Pay Scale PLACE OF POSTING Remarks No. 2018 M/F QUALIFICATION YEAR DISTRICT Year NUMBER DATE POSTING 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 ON DEPUTATION IN 1 DR. ANUPAM RAY M GEN 8-Jul-1955 MS(Surgery) 1982 HOSHANGABAD 17-Aug-1979 1980 23 01/01/1980 37400-67000+8700 JABALPUR MEDICAL COLLEGE, JABALPUR ON DEPUTATION IN DR. SMT. KIRAN BALA Dip(Gynea&Obst) & 2 F GEN 15-Apr-1953 1991 JABALPUR 22-Oct-1977 1980 36 01/01/1983 37400-67000+8700 JABALPUR MEDICAL COLLEGE, MISHRA MD(Gynea&Obst) JABALPUR DR. NAVAL KISHORE ON DEPUTATION IN 3 M GEN 11-Aug-1954 Dip(Ortho) 1979 SATNA 21-Aug-1979 1980 161 01/01/1983 37400-67000+8700 SATNA NEMA CENTRAL JAIN, SATNA ON DEPUTATION IN J.A. 4 DR. VIJAY KUMAR JAIN M GEN 31-May-1953 MS(Surgery) GWALIOR 9-Jun-1980 1980 515 01/01/1983 15600-39100+7600 GWALIOR HOSPITAL, GWALIOR ON DEPUTATION IN J.A. 5 DR. V.K.D. JAIN M GEN 9-May-1953 MD(Anaesthesia) 1985 SAGAR 29-Jul-1981 1980 174 R 01/01/1983 37400-67000+8700 GWALIOR HOSPITAL, GWALIOR ON DEPUTATION IN G.R. 6 DR. YOGENDRA PRADHAN M GEN 1-Jun-1953 Dip(Ortho) 1988 GWALIOR 3-Sep-1979 1980 178 R 01/01/1983 37400-67000+8700 GWALIOR MEDICAL COLLEGE, GWALIOR ON DEPUTATION IN HAMIDIA 7 DR. -

Unclaim Account Reportas on 31-03-2021

ACCT NAME ADDRESS NATRAJ CLOTH STORES 23, PATEL CLOTH MARKET BAPUNAGAR AHD BHOLANATH VASTRA BHANDAR 11/12, PATEL CLOTH MARKET AHD STUDENT WELFARE TRUST OPP. KALYAN KENDRA,NEW BAPUNAR Ah d VISWAS CORPARATION VISWANATH BANGLOWS BIH. SHIVDARSHAN ODHAV ROAD Ahmedabad CELLO PAINTS IND 5-P D CORPORATION NR. REVABHA REVABHAI ESTATE C.T.M Ahmedabad NEWMAC AIR PRODUCTS 7-AMAR ESTATE NR.KANTA ESTATE Ahmedabad SHALIGRAM MOTOR INDUSTRIES D-77, INDRAJIT,MAHAVIRSOCIETY THAKKARBAPANAGAR Ahmedabad GAJARA ONERS ASOCIATION 493-MAHAVIRNAGARSOCIETY THHKARBAPANAGAR Ahmedabad SWATI ENTERPRISES SHRIJEE COMPLEX , NEAR SUKHRAM CHAMBER S, BAPUNAGAR Ahmedabad MANOJ ELECTRONICS 30/3 VIRATNAGAR SOCIETY KHODIYARNAGAR Ahmedabad KINJAL SALES AGENCY 74/MAYURPARK SOC, BAPUNAGAR Ahmedabad MANPASAND SINTHITEC 23/ PATEL CLOTH MARKET Ahmedabad SURAJ PROVISION STORS D-8/ NARAYANNAGAR PART-2 KHODIYARNAGAR AHMEDABAD METALAB ENTERPRISE 25/26, NILKANTH AVENUE, B/H PALM HOTEL SARDAR PATEL RING ROAD AVAS DEVLOPERS RATANBA VIDHAVAL NR. TAHHAKARBAPANAGAR Ahmedabad SOMANTH CORPORATION B-207 SHIVPARK SOCIETY ODHAV Ahmedabad SUKHARAM BILLDERS A-1 TWIN BUNGLOJ SOCIETY NICOLGAM ROAD Ahmedabad SARTHI BUILDERS GHANSYAMNAGAR NR. SANKET VIDH. BAPUNAGAR Ahmedabad AKASH SPINNERS 8,MAMTA IND. ESTATE VASTRAL ROAD, AMRAIVADI Ahmedabad KRISHNA COMPUTER CENTER F/31-32 SARTHI COMPLEX JASODANAGAR CHOKDI Ahmedabad NEHA TEXTILES 12/ AVAKASH SOCIETY BAPUNAGAR Ahmedabad SHREEJI CORPORATION NR. PANCHVATI SOCIETY THAKKARBAPA NAGAR ROAD Ahmedabad SHREE AAMBESHWER MOLDAS 31/ CHANDRA DYAMAND CENTER BAPUNAGAR Ahmedabad KHODIYAR SALES CORPORATION SHAHAPURA TILES COMPOUND ODHAV ROAD Ahmedabad CHANDRAKANT BHAGVANBHAI PATEL 719, MAHAVIRNAGAR INDIA COLONY Ahmedabad KHODIYAR HANDLOOM HOUSE A-10, GOPINATH SOCIETY INDIA COLONY, BAPUNAGAR Ahmedabad SHRI UMIYA DECORETARS MANAHAR NAGAR PART-1, KHODIYAR NAGAR Ahmedabad PRAMUKH DEVLOPERS 703/4633 G.H. -

VG 2015 IC & GIDC with Address.Xlsx

VG 2015 IC & GIDC Commissioned & Under Implementation Sr No Name of Company Reg. Office Address District Status 1 UMIYA INDUSTRIES PLOT NO- 150, ROAD -4 A GIDC, Ahmedabad Commissioned KATHWAD,,Kathwada-Daskroi,Ahmedabad 2 J P CHEMICALS PLOT NO-45,GIDC IND ESTATE KADI,Kadi- Mehsana Commissioned Kadi,Mehsana 3 EVA WORLD IND. 891/3/B, GIDC,MAKARPURA- VADODARA,- Vadodara Commissioned 390011,Vadodara,Vadodara 4 r-resh enterprisse 3, SANSKAR TIRTH SOC., OPP. Ahmedabad Commissioned CHHAGANLALWADI, ODHAV,ahemdabad,Ahmedabad Cantonment- 382430,Ahmedabad City,Ahmedabad 5 OM sai creation 22, 1st floor, old gidc katargam surat,,-,Surat Surat Commissioned 6 Maa Environmental & GHB, 1012-Kailashdham Society,Laxmipura Vadodara Commissioned Legal Solutions road, Gorwa, Vadodara,- 390016,Vadodara,Vadodara 7 Omshanti Tradelink 731/B, Street No. 33, Road No. 3, Sachin, Surat,,- Surat Commissioned Pvt. Ltd. ,Surat 8 ASHUTOSH TEXTILES 705, VARDHMAN COMPLEX, NR JAIN NAGAR, Surat Commissioned PARVAT PATIA SURAT,,-,Surat 9 UMIYA FABRICATORS 986/20/2-B GIDC ESTATE Vadodara Commissioned MAKARPURA,VADODARA,- 390010,Vadodara,Vadodara 10 J B Cotton Serve no. 42,Atkot Road,Garni,Garni- Amreli Commissioned 365421,Babara,Amreli 11 Jogani Rekhaben Street No-5,Rampara,Jesingpara,Amreli- Amreli Commissioned Hashmukhbhai 365601,Amreli,Amreli 12 Gangotri Agri At.Jaliya,,Jaliya-365610,Amreli,Amreli Amreli Commissioned Industries 13 kareliya hiteshkumar shivaji nagar,Bapa sitaram,mandir Amreli Commissioned dhirajlal pase,Savarkundla-364515,Savarkundala,Amreli 14 Rajubhai Popatbhai Vishvkarma Industrial Area,Nr.Esar Patrol Amreli Commissioned Makwana Pump,Amreli Road,Savarkundla- 364515,Savarkundala,Amreli 15 Shakti Industries C/o,Surya Motors,White House,S.T.Depo,Amreli- Amreli Commissioned 365601,Amreli,Amreli 16 Madhuvan Silica sojitra medical store,Dhari-Amreli Main Amreli Commissioned Pvt.Ltd. -

CULTURAL RESOURCES in PANCHKROSHI PARIKRAMA: PART of the NARMADA RIVER PARIKRAMA Author of the Paper: Ar

ST04- Culture-Nature Journey CULTURE-NATURE, RIVER, LAKES AND WATER Case Study Kiosk 1 IDENTIFYING AND SAFEGUARDING NATURAL - CULTURAL RESOURCES IN PANCHKROSHI PARIKRAMA: PART OF THE NARMADA RIVER PARIKRAMA Author of the Paper: Ar. Shubhashri Upasani Abstract While focusing on indigenous form of culture at India level, each and every aspect of ancient Hindu Culture ensures strong connectivity with nature. Intangible (E.g. rituals, traditions) & tangible (E.g. architectural manifestations of the intangible) forms of Hindu culture reflect inseparable role of nature associated with it. Tirthsthanas are the examples of combination of tangible and intangible forms in Hindu Culture closely connected with the surrounding environment. Among these Tirthsthanas, Rivers are awarded sublime existence as a cultural property and natural elements. These rivers as the lifeline have motherly place in the society with their own characteristics and importance. Among the most holy rivers, River Narmada has important place with reasons like sacred values, number of Tirthsthanas, separate Narmada Puraan and the unique way of tenacity, worshipping in its own kind – the complete Parikrama of River Narmada. River Narmada is explored by many scholars in different ways as the mysterious, spiritual, geological, geographical aspects and references from ancient scriptures. But the ‘Narmada Parikrama Path’ needs to be explored through the angle of cultural landscape also. The path of ~thirthy-six hundred km on both banks is full of natural (huge variety of flora-fauna) and man-made cultural properties with mythological, historical associations. Along the whole path, nature and culture are each other’s shadows. Hence considering the huge biodiversity, identifying cultural resources around Narmada Parikrama Path and safeguarding them by strategies, policies, guided development is my proposal. -

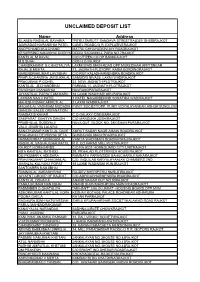

Unclaimed Deposit List

UNCLAIMED DEPOSIT LIST Name Address SILABEN RASIKLAL BAVARIA "PITRU SMRUTI" SANGAVA STREETRAJDEV SHERIRAJKOT JAMNADAS NARANBHAI PATEL CANEL ROADC/O R. EXPLASIVERAJKOT ANOPCHAND MULCHAND MATRU CHHAYADIGVIJAY ROADRAJKOT KESARISING NANJIBHAI DODIYA DODIA SADANMILL PARA NO.7RAJKOT KANTILAL M RAVAL C/O CITIZEN CO.OP.BANKRAJKOT M S SHAH CCB.H.O.RAJKOT CHANDRAKANT G CHHOTALIYA LAXMI WADI MAIN ROAD OPP MURLIDHAR APPTSNEAR RAJAL B MEHTA 13, JAGNATH PLOTOPP. KADIA BORDINGRAJKOT NARENDRAKUMAR LAVJIBHAI C/O RUP KALADHARMENDRA ROADRAJKOT PRAFULCHANDRA JAYSUKHLAL SAMUDRI NIVAS5, LAXMI WADIRAJKOT PRAGJIBHAI P GOHEL 22. NEW JAGNATH PLOTRAJKOT KANTILAL JECHANDBHAI PARIMAL11, JAGNATH PLOTRAJKOT RAYDHAN CHANABHAI NAVRANGPARARAJKOT JAYANTILAL PARSOTAM MARU 18 LAXMI WADIHARI KRUPARAJKOT LAXMAN NAGJI PATEL 1 PATEL NAGARBEHIND SORATHIA WADIRAJKOT MAHESHKUMAR AMRUTLAL 2 LAXMI WADIRAJKOT MAGANLAL VASHRAM MODASIA PUNIT SOCIETYOPP. PUNIT VIDYALAYANEAR ASHOK BUNGLOW GANESH SALES ORGANATION RAMDAS B KAHAR C.O GALAXY CINEMARAJKOT SAMPARAT SAHITYA SANGH C/O MANSUKH JOSHIRAJKOT PRABHULAL BUDDHAJI NAVA QUT. BLOCK NO. 28KISHAN PARARAJKOT VALJI JIVABHIA LALKIYA SANATKUMAR KANTILAL DAVE AMRUT SADAR NAGR AMAIN ROADRAJKOT BHAGWANJI DEVSIBHAI SETA GUNDAVADI MAIN ROADRAJKOT HASMUKHRAY CHHAGANLAL VANIYA WADI MAIN ROADNATRAJRAJKOT RASIKLAL VAGHAJIBHAI PATEL R.K. CO.KAPAD MILL PLOTRAJKOT RAJKOT HOMEGARDS C/O RAJKOT HOMEGUARD CITY UNITRAJKOT NITA KANTILAL RATHOD 29, PRHALAD PLOTTRIVEDI HOUSERAJKOT DILIPKUMAR K ADESARA RAMNATH PARAINSIDE BAHUCHARAJI NAKARAJKOT PRAVINKUMAR CHHAGANLAL -

NAME of DIVISION from to 1 Indore City North 33/11 KV LIG 11 KV 11

Planned shutdown Name of NAME OF Name of EHV S/s or Line KV Group (for 33KV) Date of Duration of Total Reason for Planned Shutdown (Maintenance/Erection Shutdown Approval Alternate Supply Demand in MW Location where S.No Name of 33 KV / 11 KV feeder Areas affected Circle DIVISION 33/11 KV S/s Capacity / Category (for 11 Planned Planned Shutdown Duration work/ FSP / Safety purpose etc.) Approved by - Granted to- Arrangements are affected due to tree cutting is to (33 or 11) KV) Shutdown From to available or not (Yes/No) Shutdown. be done FOR AB SWITCH RED HOT WORK AT UNIAN BANK LIG 1 Indore city North 33/11 KV LIG 11 KV 11 KV INDUSTRY HOUSE CHQ 26.04.2018 6:00:00 6:30:00 0:30:00 SE CITY AE(Maint.) NO 1 Behind LIG Gurudwara, Rohit Eye hospital, Madan book stationary, Ambedkar nagar, MAIN ROAD 2 Indore city North 33/11 KV MODERN 11 KV 11 KV CHOUTHA SANSAR CHQ 26.04.2018 8:00:00 10:00:00 2:00:00 FOR ME REPLACEMENT WORK OF 33 KV ZONAL 1ST SE CITY AE(Maint.) NO 0.85 Sector F Industrial Area 3 Indore city North 33/11 KV MODERN 11 KV 11 KV MARIMATA CHQ 26.04.2018 8:00:00 10:00:00 2:00:00 FOR ME REPLACEMENT WORK OF 33 KV ZONAL 1ST SE CITY AE(Maint.) NO 0.75 Ganeshdham colony, Sanwer main road, Orient wire, JP Papers 4 Indore city North 33/11 KV MODERN 11 KV 11 KV B-1 CHQ 26.04.2018 9:00:00 9:30:00 0:30:00 FOR ME WIRING CHECK WORK SE CITY AE(Maint.) NO 0.9 Sector F Industrial Area 5 Indore city North 33/11 KV VIJAY NAGAR 11 KV 11 KV MAIN NO. -

Traffic Pre-Feasibility Study for Indore Metro

TRAFFIC PRE-FEASIBILITY STUDY FOR INDORE METRO CLIENT: URBAN ADMINISTRATION AND DEVELOPMENT DEPARTMENT GOVERNMENT OF MADYAPRADESH PREPARED BY DELHI METRO RAIL CORPORATION LTD. Metro Bhawan, Fire Brigade Lane, Barakhamba Road, New Delhi-110 001 8TH APRIL, 2013 TRAFFIC PRE-FEASIBILITY STUDY FOR INDORE METRO CLIENT: URBAN ADMINISTRATION AND DEVELOPMENT DEPARTMENT GOVERNMENT OF MADYAPRADESH PREPARED BY DELHI METRO RAIL CORPORATION LTD. Metro Bhawan, Fire Brigade Lane, Barakhamba Road, New Delhi-110 001 8TH APRIL, 2013 Traffic pre feasibility study for Indore metro Contents 1.0 INRODUCTION ....................................................................................................................... 4 Table 1: Metro Alternative Networks considered in the study .................................................. 5 Figure 1: Alternative Metro Network considered for Indore ..................................................... 6 Figure 2: Tested Metro Alignment for Indore ............................................................................ 7 2.0 INDORE CITY .......................................................................................................................... 8 Figure 3 Overview of Indore and surrounding towns ................................................................. 8 3.0 Earlier Study .......................................................................................................................... 9 Figure 4: MRTS Corridors proposed in past study ................................................................... -

30. Index (3) Van Sanskritische Termen

Kies uw tekstdoc.nr.: 01 02 03 08 09 10 11 12 13 14 15 16 17 19 21 22 23 26 27 28 29 31 32 33 34 37 39 40 41 42 43 44 45 46 47 48 49 50 51 53 54 55 56 58 59 60 Afk. Laatste bewerking: 26-09-2020 ga naar > Index (1) van Chinese - Germaaanse termen > Index (2) van Griekse - Overige niet-IE termen > Index (4) van Sanskritische termen O - Y Dit document vormt een onderdeel van de website https://www.religies-overzichtelijk.nl Hier vindt u tevens de koppelingen naar de andere indexen en de teksten, de toelichtingen en de afkortingen Index (3) van Sanskritische termen A - N SANSK. TERMEN: ‘’ (spreuken, frasen, citaten) - Sansk. termen: ‘astu śrauṣaṭ’ ‘het zij zo; moge de goden het horen’, bepaalde 13 uitroep tijdens het ritueel [zie Taal: uitroep: ‘astu śrauṣaṭ’ (Ind.)] [astu shrausat, astu shraushat] Sansk. termen: ‘asya vāmasya’, de beginwoorden van een hymne in de Ṛg Veda 10 (I, 164), ook wel Asyavāmīya genoemd en gecomponeerd door de dichter Dīrghatamas. De hymne bestaat uit raadsels die de eenheid van de wereld en de goden uitdrukt [zie Literatuur: Veda, Ṛg: Asya Vāmasya-hymne (Ind.)] [asya vamasya, Asyavamiya] Sansk. termen: ‘Athāto brahma-jijñāsā’ ‘En dan nu een onderzoek naar het 34 Brahman’, openingszin van de Vedānta Sūtra (= Brahma Sūtra) (wrsch. door Bādarāyaṇa) [zie Filosofie: type: Vedānta: frase: ‘Athāto brahma-jijñāsā’ (openingszin van de Vedānta Sūtra) (Ind.)] [athato brahma jijnasa] Sansk. termen: ‘Athāto dharma-jijñāsā’ ‘En dan nu een onderzoek naar 34 dharma’, openingszin van de Mīmāṃsā Sūtra’s (door Jaimini) [zie Filosofie: type: Pūrva Mīmāṃsā: frase: ‘Athāto dharma-jijñāsā’ (openingszin van de Mīmāṃsā Sūtra’s (door Jaimini)) (Ind.)] [athato brahma jijnasa] Sansk.