Rating Rationale 22 Jan 2021 Goodwatts Solar Modasa 2 MW Pvt Ltd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Press Release DBL Nadiad Modasa Tollways Limited

Press Release DBL Nadiad Modasa Tollways Limited December 30, 2020 Ratings Facilities Amount (Rs. crore) Ratings1 Rating Action 74.01 CARE A; Stable Long term Bank Facilities Reaffirmed (Reduced from Rs. 79.74 Crore) (Single A ; Outlook: Stable) 74.01 Total Facilities (Rupees Seventy Four Crore and One Lakh only) Details of facilities in Annexure-1 Detailed Rationale & Key Rating Drivers The rating assigned to the bank facilities of DBL Nadiad Modasa Tollways Limited (DNMTL) continue to derive strength from its assured cash flow stream in the form of annuity receivable from Roads and Building Department (R&BD), Government of Gujarat (GoG) along with the operational status of its road project with established track record of receipt of annuities and creation of debt service reserve account (DSRA). Further, the annuity receipts of DNMTL adequately cover its debt servicing requirements. The rating of DNMTL also continue to take into account divestment of the controlling stake in DNMTL by DBL to Shrem Roadways Private Limited (SRPL; part of Chhatwal Group Trust) and responsibility of DBL for undertaking the requisite operation and maintenance (O&M) and major maintenance (MM) activity of DNMTL without any consideration for the same from DNMTL as per the agreement entered between SRPL and DBL. The above rating strengths, however, continue to be tempered by inherent interest rate risk and performance risk attached with the O&M contractor (i.e. DBL). Rating Sensitivities Positive Factors: Improvement in the credit profile of counter party Negative -

1 April 2011 POISONOUS PLANTS of MODASA TALUKA, DISTRICT SABARKANTHA

Life sciences Leaflets 14:462 – 465, 2011. FREE DOWNLOAD ISSN 0976 - 1098 st Published on: 1 April 2011 POISONOUS PLANTS OF MODASA TALUKA, DISTRICT SABARKANTHA (GUJARAT) INDIA M.S.JANGID AND 1S.S.SHARMA DEPARTMENT OF BOTANY, SIR P T SCIENCE COLLEGE, MODASA-383315. (GUJARAT)INDIA 1MD (AYURVED) AYURVEDIC PHYCIAN, AHEMDABAD-382424 (GUJARAT) INDIA [email protected] ABSTRACT: In this present work, a brief account of poisonous plants of taluka Modasa, district Sabarkantha (Gujarat) have been given. Total 34 poisonous plant species belonging to 27 genera and 19 families. Poisonous plants enumerated here were arranged alphabetically in their scientific name followed by family’s name, local name and poisonous part. KEY WORDS: Poisonous plants, Taluka Modasa. INTRODUCTION: The taluka of Modasa is situated on 230 28'N latitude and 730 18'E longitude on the bank of river Mazum. The region of Modasa is flat and consists of mostly sandy plains, although north and north eastern parts near Modasa are covered by the range of Aravalli hills. The total area of the taluka is 862.16 sq.km, total forest area is 6583.51 and total population is 2, 22,791. There are some poisonous plants that occur in this region. People of this region where not able to identify that which plants are poisonous. Perticularly children’s are prone to be victimized by eating poisonous plants accidentlly. The poisonous parts may be root,l atex, bark, seeds or even whole plant(Chopra(1949), Chopra,et al.(1965) and Fowler(1980). The floristic and ethnobotanical studies of Gujarat state have been carried out by Thaker (1910), Saxton and Sedgwick (1918), Nadkarni (1926), Santapau ( 1954), Patel (1971), Shah (1978), Jain (1991), Dastur (1996), Shashtri (1996), Punjani (1997), Patel (2001), Bhatt,et al. -

Gujarat Cotton Crop Estimate 2019 - 2020

GUJARAT COTTON CROP ESTIMATE 2019 - 2020 GUJARAT - COTTON AREA PRODUCTION YIELD 2018 - 2019 2019-2020 Area in Yield per Yield Crop in 170 Area in lakh Crop in 170 Kgs Zone lakh hectare in Kg/Ha Kgs Bales hectare Bales hectare kgs Kutch 0.563 825.00 2,73,221 0.605 1008.21 3,58,804 Saurashtra 19.298 447.88 50,84,224 18.890 703.55 78,17,700 North Gujarat 3.768 575.84 12,76,340 3.538 429.20 8,93,249 Main Line 3.492 749.92 15,40,429 3.651 756.43 16,24,549 Total 27.121 512.38 81,74,214 26.684 681.32 1,06,94,302 Note: Average GOT (Lint outturn) is taken as 34% Changes from Previous Year ZONE Area Yield Crop Lakh Hectare % Kgs/Ha % 170 kg Bales % Kutch 0.042 7.46% 183.21 22.21% 85,583 31.32% Saurashtra -0.408 -2.11% 255.67 57.08% 27,33,476 53.76% North Gujarat -0.23 -6.10% -146.64 -25.47% -3,83,091 -30.01% Main Line 0.159 4.55% 6.51 0.87% 84,120 5.46% Total -0.437 -1.61% 168.94 32.97% 25,20,088 30.83% Gujarat cotton crop yield is expected to rise by 32.97% and crop is expected to increase by 30.83% Inspite of excess and untimely rains at many places,Gujarat is poised to produce a very large cotton crop SAURASHTRA Area in Yield Crop in District Hectare Kapas 170 Kgs Bales Lint Kg/Ha Maund/Bigha Surendranagar 3,55,100 546.312 13.00 11,41,149 Rajkot 2,64,400 714.408 17.00 11,11,115 Jamnagar 1,66,500 756.432 18.00 7,40,858 Porbandar 9,400 756.432 18.00 41,826 Junagadh 74,900 756.432 18.00 3,33,275 Amreli 4,02,900 756.432 18.00 17,92,744 Bhavnagar 2,37,800 756.432 18.00 10,58,115 Morbi 1,86,200 630.360 15.00 6,90,430 Botad 1,63,900 798.456 19.00 7,69,806 Gir Somnath 17,100 924.528 22.00 92,997 Devbhumi Dwarka 10,800 714.408 17.00 45,386 TOTAL 18,89,000 703.552 16.74 78,17,700 1 Bigha = 16 Guntha, 1 Hectare= 6.18 Bigha, 1 Maund= 20 Kg Saurashtra sowing area reduced by 2.11%, estimated yield increase 57.08%, estimated Crop increase by 53.76%. -

Rainfall in Mm) Sr

State Emergency Operation Centre,Revenue Department, Gandhinagar Rainfall Report 31/10/2018 (Rainfall in mm) Sr. District/ Avg Rain Rains till Rain During Total % Against Avg Rain Rains till Rain During Total % Against No Sr.No. District/ Taluka Taluka (1988-2017) Yesterday last 24 Hrs. Rainfall Avg Rain (1988-2017) Yesterday last 24 Hrs. Rainfall Avg Rain . 1 2 3 4 5 6 7 1 2 3 4 5 6 7 KUTCH NORTH GUJARAT 1 Kutch 4 Mahesana 1 Abdasa 390 53 0 53 13.61 1 Becharaji 659 294 0 294 44.64 2 Anjar 434 231 0 231 53.28 2 Jotana 753 139 0 139 18.45 3 Bhachau 441 103 0 103 23.36 3 Kadi 814 258 0 258 31.71 4 Bhuj 376 83 0 83 22.08 4 Kheralu 727 207 0 207 28.47 5 Gandhidham 403 264 0 264 65.54 5 Mahesana 760 288 0 288 37.90 6 Lakhpat 349 12 0 12 3.44 6 Satlasana 769 504 0 504 65.55 7 Mandvi(K) 434 118 0 118 27.22 7 Unjha 743 239 0 239 32.18 8 Mundra 477 145 0 145 30.40 8 Vadnagar 694 307 0 307 44.21 9 Nakhatrana 406 70 0 70 17.22 9 Vijapur 826 370 0 370 44.80 10 Rapar 460 26 0 26 5.65 10 Visnagar 689 195 0 195 28.32 Dist. Avg. 417 111 0 111 26.51 Dist. Avg. 743 280 0 280 37.70 KUTCH REGION 417 111 0 111 26.51 5 Sabarkantha 1 Himatanagar 838 902 0 902 107.60 NORTH GUJARAT 2 Idar 960 763 0 763 79.45 2 Patan 3 Khedbrahma 843 502 0 502 59.56 1 Chanasma 525 103 0 103 19.60 4 Posina 833 503 0 503 60.38 2 Harij 577 173 0 173 29.97 5 Prantij 832 415 0 415 49.86 3 Patan 685 164 0 164 23.93 6 Talod 804 418 0 418 51.97 4 Radhanpur 626 190 0 190 30.36 7 Vadali 877 556 0 556 63.38 5 Sami 537 168 0 168 31.26 8 Vijaynagar 835 673 0 673 80.58 6 Santalpur 478 154 0 154 32.22 Dist. -

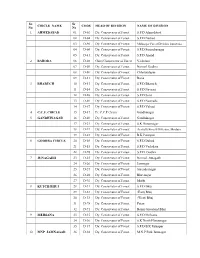

List of Forest Divisions with Code

Sr. Sr CIRCLE NAME CODE HEAD OF DIVISION NAME OF DIVISION No. No 1 AHMEDABAD 01 D-02 Dy. Conservator of Forest S.F.D Ahmedabad 02 D-04 Dy. Conservator of Forest S.F.D Nadiad 03 D-96 Dy. Conservator of Forest Mahisagar Forest Division, Lunavada. 04 D-06 Dy. Conservator of Forest S.F.D Surendranagar 05 D-81 Dy. Conservator of Forest S.F.D Anand 2 BARODA 06 D-08 Chief Conservator of Forest Vadodara 07 D-09 Dy. Conservator of Forest Normal Godhra 08 D-10 Dy. Conservator of Forest Chhotaudepur 09 D-11 Dy. Conservator of Forest Baria 3 BHARUCH 10 D-13 Dy. Conservator of Forest S.F.D Bharuch 11 D-14 Dy. Conservator of Forest S.F.D Navsari 12 D-16 Dy. Conservator of Forest S.F.D Surat 13 D-80 Dy. Conservator of Forest S.F.D Narmada 14 D-87 Dy. Conservator of Forest S.F.D Valsad 4 C.C.F. CIRCLE 15 D-17 Pr. C.C.F (A/cs) Gandhinagar 5 GANDHINAGAR 16 D-20 Dy. Conservator of Forest Gandhinagar 17 D-21 Dy. Conservator of Forest S.K Himatnagar 18 D-97 Dy. Conservator of Forest Aravalli Forest Division, Modasa 19 D-23 Dy. Conservator of Forest B.K Palanpur 6 GODHRA CIRCLE 20 D-03 Dy. Conservator of Forest S.F.D Dahod 21 D-15 Dy. Conservator of Forest S.F.D Vadodara 22 D-98 Dy. Conservator of Forest S.F.D. Godhra 7 JUNAGADH 23 D-25 Dy. -

District Development Officer

District Development Officer District District Development Officer Phone No. Email Ahmedabad Shri V. A. Vaghela (O) 079 - 25506487 District Development Officer, (F) 079 - 25511359 District Panchayat, Ahmedabad. Amreli Shri Nirgude Yogesh Babanro (O) 02792 - 222313 District Development Officer, (F) 02792 - 222378 District Panchayat, Amreli. Anand Shri Amit Prakash Yadav (O) 02692 - 241110 District Development Officer, (F) 02692 - 243895 District Panchayat, Anand. Kheda Shri Sudhir B. Patel (O) 0268 - 257262 ( Nadiad) District Development Officer, (F) 0268 - 257851 District Panchayat, Kheda. Banaskantha Shri Amit Arora (O) 02742 - 254060 (Palanpur) District Development Officer, (F) 02742 - 252063 District Panchayat, Banaskatha. Bharuch Ms. Agre Kshipra (O) 02642 - 240603 Suryakantarao (F) 02642 - 240951 District Development Officer, District Panchayat, Bharuch. Bhavnagar Shri Oak Aayush Sanjeev (O) 0278 - 2426810 District Development Officer, (F) 0278 - 2430295 District Panchayat, Bhavnagar. Dahod Shri Sujal Mayatra (O) 02673 - 247066 District Development Officer, (F) 02673 - 247438 District Panchayat, Dahod. Dangs Shri H. K. Vadhvaniya (O) 02631 - 220254 (Ahwa) District Development Officer, (F) 02631 - 220444 District Panchayat, Dangs. Gandhinagar Shri D. P. Desai (O) 079 - 23222618 District Development Officer, (F) 079 - 23223266 District Panchayat, Gandhinagar. Jamnagar Shri M. A. Pandya District Development Officer, (O) 0288 - 2553901 District Panchayat, 0288 - 2553901 Jamnagar. (F) 0288 - 2552394 Junagadh Shri Ajay Prakash (O) 0285 - 2651001 District Development Officer, (F) 0285 - 2651222 District Panchayat, Junagadh. Kutch - Bhuj Shri C. J. Patel (O) 02832 - 250080 District Development Officer, (F) 02832 - 250355 District Panchayat, Kachchh. Mehsana Shri J. B. Patel (O) 02762 - 222301 District Development Officer, (F) 02762 - 221447 District Panchayat, Mehsana. Navsari Shri Tushar D. Sumera (O) 02637 - 244299 District Development Officer, (F) 02637 - 230475 District Panchayat, Navsari. -

Socio-Political Condition of Gujarat Daring the Fifteenth Century

Socio-Political Condition of Gujarat Daring the Fifteenth Century Thesis submitted for the dc^ee fif DOCTOR OF PHILOSOPHY IN HISTORY By AJAZ BANG Under the supervision of PROF. IQTIDAR ALAM KHAN Department of History Aligarh Muslim University, Aligarb- 1983 T388S 3 0 JAH 1392 ?'0A/ CHE':l!r,D-2002 CENTRE OF ADVANCED STUDY TELEPHONE SS46 DEPARTMENT OF HISTORY ALIGARH MUSLIM UNIVERSITY ALIGARH-202002 TO WHOM IT MAY CONCERN This is to certify that the thesis entitled 'Soci•-Political Condition Ml VB Wtmmimt of Gujarat / during the fifteenth Century' is an original research work carried out by Aijaz Bano under my Supervision, I permit its submission for the award of the Degree of the Doctor of Philosophy.. /-'/'-ji^'-^- (Proi . Jrqiaao;r: Al«fAXamn Khan) tc ?;- . '^^•^\ Contents Chapters Page No. I Introduction 1-13 II The Population of Gujarat Dxiring the Sixteenth Century 14 - 22 III Gujarat's External Trade 1407-1572 23 - 46 IV The Trading Cotnmxinities and their Role in the Sultanate of Gujarat 47 - 75 V The Zamindars in the Sultanate of Gujarat, 1407-1572 76 - 91 VI Composition of the Nobility Under the Sultans of Gujarat 92 - 111 VII Institutional Featvires of the Gujarati Nobility 112 - 134 VIII Conclusion 135 - 140 IX Appendix 141 - 225 X Bibliography 226 - 238 The abljreviations used in the foot notes are f ollov.'ing;- Ain Ain-i-Akbarl JiFiG Arabic History of Gujarat ARIE Annual Reports of Indian Epigraphy SIAPS Epiqraphia Indica •r'g-acic and Persian Supplement EIM Epigraphia Indo i^oslemica FS Futuh-^ffi^Salatin lESHR The Indian Economy and Social History Review JRAS Journal of Asiatic Society ot Bengal MA Mi'rat-i-Ahmadi MS Mirat~i-Sikandari hlRG Merchants and Rulers in Giijarat MF Microfilm. -

DDU-GKY PIA Wise Training Centre Details

DDU-GKY PIA wise Training Centre Details Active Center Center Current Sr Active Center Active Center Location Center Incharge PIA Name Type of Project Mobilisation District Trade Name Location Incharge Status of No. Location District Address Name Block/Taluka Contact No. Center Food & Beverage 3rd Floor, Devashish Arcade, Sabarkantha Service Ahmedabd Ahmedabd Opp.Gurudwara, Odhav BRTS Ms.Komal Ganava 9998279008 Active Kheda Electrical Technician Road, Odhav Ahmedabad 1 Quess Corp Ltd. Residential Technical Support Quess Skills Academy 64 Aravali Executive - non voice Shubh Avenue-Near Amravilla Vadodara Vadodara Mr.Salman Munshi 8238928664 Active Panchamahals Sales Associates Duplex new VIP Rd-Vadodara Vadodara Kichen Helper in Opp: Satyam Party Plot Banaskantha Banking Sales Sabarkantha Representative - Plot No.12, Survey No.154, Mehsana Sales Person Lapkaman Gam, Near AINS College & Karnavati Eye 2 Bonanza Human Resource Pvt. Ltd. Residential Patan (Retail) - RET101 Ahmedabd Ahmedabd Mr.Nitin mishra 8355855201 Active Hospital, S.P. Ring, Road Ognaj Circle, Lapkaman, Surendranagar Ahmedabad. Mahisagar Marutinandan Education Trust, Unarmed Security Nalanda Vidhya Sankul At- Mehsana Visnagar Ms.Ridhdhi Patel 8160609424 Active Mehsana Guard -SSS/Q0101 Umta Tal-Visnagar Dist.Mahesana B K Amin High School, Nr. Manund Primary School, At - Junagadh Patan Patan Mr.Viresh Barot 9512075410 Active 3 Orion Security Solutions Pvt. Ltd. Residential Manund, Ta - Patan, Dist - Housekeeping Patan Attendant (Manual Cleaning) - Sarvoday PTC collage, THC/Q0203 Patan Mahisagar Lunavada At.Salavada, Tal-Lunavada, Mr.Turi Mukeshkumar 9537930572 Active Mahisagar-388270 Valsad Customer Care Narmada Executive (Call Centre) Shivdeep Complex, 3rd Floor, Opp. Sardar Market, Beside Navsari Housekeeping Mr.Tusar Dineshbhai 4 Spiktel Technologies Pvt. -

Brickwork Ratings Reaffirms the Ratings for the Bank Loan Facilities of ₹

Rating Rationale Goodwatts Solar Modasa Pvt Ltd 16 May 2019 Brickwork Ratings reaffirms the ratings for the Bank Loan Facilities of ₹. 14.06 Crores of Goodwatts Solar Modasa Pvt Ltd. Particulars Amount (₹ Crs) Rating* Facility Tenure Previous** Previous Present Present (Dec, 2017) Fund based 0.00 10.06 BWR BBB-, SO BWR BBB-, (SO)*** Pronounced as BWR Pronounced as BWR Triple Triple B Minus, B Minus, Structured Long Term Structured Obligation Fund Based 15.60 4.00 (Proposed) Obligation Reaffirmed Outlook:Stable Outlook:Stable Total 15.60 14.06 INR Fourteen Crores and Six Lakhs Only *Please refer to BWR website www.brickworkratings.com/ for definition of the ratings Complete details of Bank facilities is provided in Annexure-I **Rating moved to rating not reviewed category in March 2019 ***The Suffix ‘Structured Obligation’ indicates the credit enhancement derived from the Corporate Guarantee provided by the parent – Abellon Cleanenergy Ltd. (Rated BWR BBB- (Stable) (ACEL) to the bank facilities of Goodwatts Solar Modasa Pvt. Ltd. (GSMPL). Ratings: Reaffirmed Rationale/Description of Key Rating Drivers/Rating sensitivities: BWR has essentially relied upon the financial results of ACEL and GSMPL up to FY19, projections of the company, publicly available information and information/clarification provided by the company. 16 May 2019 1 The rating has factored, inter alia, GSMPL being part of reputed Abellon Group of Ahmedabad - Gujarat, experienced & professional management team, revenue visibility for the next 20 years with 25 years PPA with GUVNL and creation of DSRA aiding timely servicing of debt. The rating is however constrained by, First generation entrepreneur to start the renewable energy business, inherent risk associated with solar power business and revenues being susceptible to delays, as the buyer is a State Government entity. -

List of Government/Grant-In-Aid/Self Finance Iti with Iti Code in Gujarat State

LIST OF GOVERNMENT/GRANT‐IN‐AID/SELF FINANCE ITI WITH ITI CODE IN GUJARAT STATE DISTRICT TALUKA ITI TYPE ITI NAME ITI CODE Ahmedabad Ahmadabad City (West) Government Gota‐Ranip 173 Ahmedabad Ahmadabad City (West) Government Kubernagar 101 Ahmedabad Ahmadabad City (West) Government Maninagar 134 Ahmedabad Ahmadabad City (West) Government Maninagar (Mahila) 171 Ahmedabad Ahmadabad City (West) Government Saraspur 109 Ahmedabad Ahmadabad City (West) Grant In Aid Blind People Association ‐ Vastrapur 527 Ahmedabad Ahmadabad City (West) Grant In Aid Deaf & Dumb ‐ Navrangpura 533 Ahmedabad Ahmadabad City (West) Grant In Aid Nava Naroda 538 Ahmedabad Ahmadabad City (West) Grant In Aid Physically Handicapped ‐ Gomtipur 550 Ahmedabad Ahmadabad City (West) Grant In Aid Samarpan ‐ Motera 549 Ahmedabad Ahmadabad City (West) Grant In Aid Shahibaug (Mahila) 518 Ahmedabad Ahmadabad City (West) Grant In Aid Sola 524 Ahmedabad Ahmadabad City (West) Self Finance Ahmedabad Cantonment Board 5211 Ahmedabad Ahmadabad City (West) Self Finance Ashirvad Research Foundation 5257 Ahmedabad Ahmadabad City (West) Self Finance B M Institute Of Mental Health 5250 Ahmedabad Ahmadabad City (West) Self Finance City High School, Ahmedabad 5002 Ahmedabad Ahmadabad City (West) Self Finance Computer Vasana, Ahmedabad 5089 Ahmedabad Ahmadabad City (West) Self Finance Deaf & Dumb, Navrangpura 5010 Ahmedabad Ahmadabad City (West) Self Finance Gujarat Vidyapith Sf‐ Shahibaug 5013 Ahmedabad Ahmadabad City (West) Self Finance Hariom, Ahmedabad 5080 Ahmedabad Ahmadabad City (West) Self Finance Indo German, Ahmedabad 5006 Medi Planet Manav Sanvedana, Ahmedabad Ahmadabad City (West) Self Finance 5243 Maninagar Medi Planet Manav Sanvedana, Ahmedabad Ahmadabad City (West) Self Finance 5023 Naranpura Ahmedabad Ahmadabad City (West) Self Finance Navjivan High School Trust 5237 Sarvoday Charitable Trust Sanchalit Shrey Ahmedabad Ahmadabad City (West) Self Finance 5260 Hospital Pvt. -

List of Help Centers Courses-Technical

List of Help Centers Courses-Technical મ嫍ુ યમત્રં ી યવુ ા વાવલબં ન યોજના હ쫍ે પ સેꋍટર કો-ઓર્ડીનેટરનો કામકાજના દિવસે અને કચરે ી સમય િરમમયાન જ સપં કક કરવા માટે મવદ્યાર્થીઓ અને વાલીઓન ે નમ્ર મવનતં ી છે. SR. DISTRICT NAME OF HELP CENTERS 1 Ahmedabad R.C.Tech. Inst., Opp. Gujarat HighCourt, S.G.Highway, Ahmedabad. 2 Ahmedabad Govt. Polytechnic, Near Panjrapole,Ambavadi,Ahmedabad. 3 Ahmedabad L.D.College Of Engineering, Opp.Gujarat University,Ahmedabad 4 Ahmedabad Vishwakarma Government EngineeringCollege, Chandkheda 5 Ahmedabad Government Polytechnic for Girls,Navrangpura,Ahmedabad 6 Ahmedabad L.M.College of Pharmacy, Navrangpura 7 Ahmedabad CEPT University, Navragpura 8 Ahmedabad Gujarat Technological University,Chandkheda 9 Ahmedabad Helpdesk Raksha Shakti University 10 Ahmedabad Nirma University, Opp.S.G.V.P, S.GHighway,Ahmedabad 11 Ahmedabad Girls Ploytechnic, Ahmedabad 12 Ahmedabad Sal Institute of pharmacy 13 Ahmedabad A-One Pharmacy College 14 Ahmedabad R. C. Technical Institute, Opp.Gujarat High Court, S G Highway, Sola 15 Ahmedabad Indus University 16 Amreli Dr.J.N.Maheta Government Polytechnic,Bhavnagar Road, Amreli 17 Anand A.R.College of Pharmacy, V.V.NagarM.N.College of Pharmacy, Khambhat 18 Anand M.N.College of Pharmacy, KhambhatCharotar University of Science & 19 Anand Charotar University of Science &Technology, Changa 20 Anand B & B Institute of Technology, VallabhVidhyanagar 21 Anand Birla Vishvakarma Maha Vidhyalaya,Vallabh Vidyanagar 22 Anand Indukaka Ipcowala College of Pharmacy 23 Anand Sardar Vallabhbhai patel Institute of Technology 24 Anand A D Patel Institute of Technology 25 Anand Anand Pharmacy College 26 Anand G H Patel College of Engineering and Technology 27 Anand Madhuben & Bhanubhai Patel Institute of Technology- CVM Universit 28 Anand Indubhai Patel College of Pharmacy & Reserch Center 29 Anand Bhaikaka University 30 Aravali B.M.Shah College of Pharmacy, Modasa 31 Aravali Government EngineeringCollege,,Shamalaji Road, Modasa 32 Banaskantha Government Engg. -

ITI LIST.Xlsx

LIST OF GOVERNMENT/GRANT‐IN‐AID/SELF FINANCE ITI WITH ITI CODE IN GUJARAT STATE (ADMISSION‐2020) DISTRICT TALUKA ITI TYPE ITI NAME ITI CODE Ahmedabad Ahmadabad City Government Gota‐Ranip 173 Ahmedabad Ahmadabad City Government Kubernagar 101 Ahmedabad Ahmadabad City Government Mahila Iti Maninagar(Vastral) 171 Ahmedabad Ahmadabad City Government Maninagar 134 Ahmedabad Ahmadabad City Government Saraspur 109 Ahmedabad Ahmadabad City Grant In Aid Blind People Association ‐ Vastrapur 527 Ahmedabad Ahmadabad City Grant In Aid Deaf & Dumb ‐ Navrangpura 533 Ahmedabad Ahmadabad City Grant In Aid Nava Naroda 538 Ahmedabad Ahmadabad City Grant In Aid Physically Handicapped ‐ Gomtipur 550 Ahmedabad Ahmadabad City Grant In Aid Samarpan ‐ Motera 549 Ahmedabad Ahmadabad City Grant In Aid Shahibaug (Mahila) 518 Ahmedabad Ahmadabad City Grant In Aid Sola 524 Ahmedabad Ahmadabad City Self Finance Ahmedabad Cantonment Board 5211 Ahmedabad Ahmadabad City Self Finance Ashirvad Research Foundation 5257 Ahmedabad Ahmadabad City Self Finance B M Institute Of Mental Health 5250 Ahmedabad Ahmadabad City Self Finance City High School, Ahmedabad 5002 Ahmedabad Ahmadabad City Self Finance Computer Vasana, Ahmedabad 5089 Ahmedabad Ahmadabad City Self Finance Deaf & Dumb, Navrangpura 5010 Ahmedabad Ahmadabad City Self Finance Gujarat Vidyapith Sf‐ Shahibaug 5013 Ahmedabad Ahmadabad City Self Finance Hariom, Ahmedabad 5080 Ahmedabad Ahmadabad City Self Finance Indo German, Ahmedabad 5006 Ahmedabad Ahmadabad City Self Finance Medi Planet Manav Sanvedana, Maninagar