Broadridge Financial Solutions Annual Report 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

IFDS Insurance Solutions Brochure

Insurance Solutions ,, \ - 1!, A. ,, N /{I Supporting Your Guaranteed Wealth & Income Products In an era of volatile markets and historically low interest rates; baby boomers, small business owners and cautious investors are considering guaranteed products such as Segregated Funds with Life Time Annual Withdrawal Guarantee features, Guaranteed Minimum Withdrawal Benefit (GMWB), Guaranteed Interest Annuities (GIA) and Daily Interest Funds. The insurance industry is under increased pressure to quickly respond to the changing needs of investors. Insurance organizations need a robust yet flexible solution that can support the unique complexities of their business. Faster time to market Adaptable one contract solution At a Glance Insurance products are more complex than Our solution is structured to allow a single many other kinds of investment products, contract to hold multiple versions of Supports Segregated Funds, with a multitude of features and benefits. products – Segregated Funds, GIA and GIA and Daily Interest Funds The IFDS solution lets you easily build Daily Interest Funds – providing quick and product, make changes, and automate easy adaptability to changing customer many common activities, allowing you to demands and market conditions. One Multiple insurance products get to market more quickly. And when you contract also supports the efficient offered in a single system can get to market faster, you have a consolidation of activity between solution competitive advantage and more these products for call centre inquiries, opportunity -

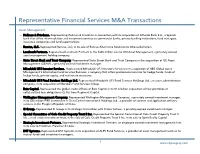

Representative Financial Services M&A Transactions

Representative Financial Services M&A Transactions Asset Management • Hellman & Friedman. Representing Hellman & Friedman in connection with its acquisition of Allfunds Bank S.A., a Spanish bank that offers intermediation and investment services to commercial banks, private banking institutions, fund managers, insurance companies and fund supermarkets. • Ramius, LLC. Represented Ramius, LLC, in its sale of Ramius Alternative Solutions to AllianceBernstein. • Landmark Partners. Represented Landmark Partners in the $465 million sale to OM Asset Management, a privately owned asset management holding company. • State Street Bank and Trust Company. Represented State Street Bank and Trust Company in the acquisition of GE Asset Management (GEAM), a privately owned investment manager. • Mitsubishi UFJ Investor Services. Represented Mitsubishi UFJ Investors Services in its acquisition of UBS Global Asset Management’s Alternative Fund Services Business, a company that offers professional services for hedge funds, funds of hedge funds, private equity, and real estate structures. • Mitsubishi UFJ Fund Services Holdings Ltd. Represented Mitsubishi UFJ Fund Services Holdings Ltd., an asset administration company, in its acquisition of Meridian Fund Services Group. • Bain Capital. Represented the global credit affiliate of Bain Capital in its $1.6 billion acquisition of four portfolios of collateralized loan obligations (CLOs) from Regiment Capital. • Wellington Management Company. Represented Wellington Management Company, a privately owned investment manager, in its $85 million PIPE investment in ChinaCache International Holdings Ltd., a provider of content and application delivery services in the People’s Republic of China. • 3i Group. Represented 3i Group in its strategic transaction with Fraser Sullivan, a privately owned investment manager. • Special Committee of Cole Credit Property Trust II Inc. -

Big Data at DST Bill Nixon, Matt Crouch

Big Data at DST Bill Nixon, Matt Crouch © 2013 DST Systems, Inc.© 2013 All rights DST Systems, reserved. Inc. All rights reserved. The enclosed materials are highly sensitive, proprietary and confidential. Please use every effort to safeguard the confidentiality of these materials. Please do not copy, distribute, use, share or otherwise provide access to these materials to any person inside or outside DST Systems, Inc. without prior written approval. This proprietary, confidential presentation is for general informational purposes only and does not constitute an agreement. By making this presentation available to you, we are not granting any express or implied rights or licenses under any intellectual property right. If we permit your printing, copying or transmitting of content in this presentation, it is under a non-exclusive, non-transferable, limited license, and you must include or refer to the copyright notice contained in this document. You may not create derivative works of this presentation or its content without our prior written permission. Any reference in this presentation to another entity or its products or services is provided for convenience only and does not constitute an offer to sell, or the solicitation of an offer to buy, any products or services offered by such entity, nor does such reference constitute our endorsement, referral, or recommendation. Our trademarks and service marks and those of third parties used in this presentation are the property of their respective owners. © 2013 DST Systems, Inc. All rights -

Safe Harbor Statement

1 2 Safe Harbor Statement This presentation contains forward-looking statements, as defined by federal and state securities laws, which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements concerning plans, objectives, goals, strategies, expectations, intentions, projections, developments, future events, performance or products, underlying assumptions, and other statements which are other than statements of historical facts. In some cases, you can identify forward-looking statements by terminology such as ''may,'' ''will,'' ''should,'' “hope,'' "expects,'' ''intends,'' ''plans,'' ''anticipates,'' "contemplates," ''believes,'' ''estimates,'' ''predicts,'' ''projects,'' ''potential,'' ''continue,'' and other similar terminology or the negative of these terms. From time to time, we may publish or otherwise make available forward-looking statements of this nature. All such forward- looking statements, whether written or oral, and whether made by us or on our behalf, are expressly qualified by the cautionary statements described on this message including those set forth below. All statements contained in this presentation are made only as of the date of this presentation. In addition, except to the extent required by applicable securities laws, we undertake no obligation to update or revise any forward-looking statements to reflect events, circumstances, or new information after the date of the information or to reflect the occurrence or likelihood -

SECTORWATCH: January 2018

SECTORWATCH: BPO January 2018 SECTORWATCH: 7 Mile Advisors appreciates the opportunity to present this confidential information to the Company. This document is meant to be delivered only in conjunction with a verbal presentation, and is not authorized for distribution. Please see the Confidentiality Notice & Disclaimer at the end of the BPO document. All data cited in this document was believed to be accurate at the time of authorship and came from publicly available sources. Neither 7 Mile Advisors nor 7M Securities make warranties or representations as to the accuracy or completeness of third-party data contained herein. This document should be treated as confidential and for the use of the intended recipient only. Please January 2018 notify 7 Mile Advisors if it was distributed in error. Sector Dashboard . Public Basket Performance . Operational Metrics . Valuation Comparison . Recent Deals . Appendix OVERVIEW Dashboard About Us 7MA provides Investment Banking & Advisory Services to the summary metrics on the sector, with commentary on Business Services and Technology Industries globally. market momentum by comparing the most recent 12- month performance against the last 3-year averages We advise on M&A and private capital transactions, and provide market assessments and benchmarking. As a close knit team with a long history together and a laser focus on our target markets, we help our clients sell their companies, raise capital, grow through acquisitions, and evaluate new markets. Public Basket Performance summary valuation and operating metrics for a basket of comparable public companies Sectorwatch We publish sectorwatch, a review of M&A and operational trends in the industries we focus. -

Our Commitment and Focus to TA Globally and Strategically Is Unrivalled

Our commitment and focus to TA globally and strategically is unrivalled. Our solutions have been designed to increase value for our clients through a globally aligned service and technical model and a consultative approach to meet your business requirements, day-in, day-out. Our knowledge of transfer agency operations is built on 40 years of experience. The skills we have developed during this time have allowed us to become a central point of knowledge for our •Single global existing clients in all their core markets. relationship model As a market leader we actively provide support and thought •Access to significant leadership to assist in the further development of our industry market expertise and and our client’s businesses. thought leadership worldwide Through our joint venture partners we have access to the best in information technology and range of ancillary services, together •Combined technology with some of the most innovative thinking in the outsourcing model industry. •Single contract, tariff and invoicing process Our footprint spans the globe with harmonised operations across the Asia-Pacific, Europe and North American regions. This coverage means we have a deep understanding of different markets, regulations and end-user environments across multiple jurisdictions, allowing us to support the international aspirations of our clients. IFDS takes a proactive role in developing flexible and tailored solutions to greater Our global support capabilities are benefit our client’s business. With a designed to help you overcome any global relationship framework we work complexities inherent with the full life with you to implement the most suitable cycle of distribution and administration solutions for your business requirements. -

SS&C Technologies Holdings, Inc. 2020 Annual Report on 10-K

SS&C Technologies Holdings, Inc. 2020 Annual Report on 10-K My Fellow Shareholders, In 2020, we navigated the global COVID pandemic by safely and effectively moving 99% of our workforce to a work from home environment. We renewed our focus on serving our customers and maintained a very high service level. Financially, we paid down $738 million in debt, bought back $228 million in stock, generated $1.185 billion in operating cash flow, and earned $4.30 in adjusted earnings per share and our stock advanced 19.5% from $60.87 to $72.75. We ended the year with 95.8% revenue retention, and received broad-ranging, constructive and positive client feedback. The value of our products, services, and capabilities, via technology at scale was undeniable. Our businesses received increased inbound interest for cloud hosting and outsourced services as firms look to SS&C to provide access to production systems, and augment their staff and processing capability. We believe this will be a long term trend, and a catalyst for firms to adopt a digitized and outsourced services model. We continued to invest in our business and spent $471.0 million on research & development and capitalized software. We are seeing success with Eze Eclipse, our digital trading platform, which doubled its client base. We have leveraged Algorithmics capabilities and developed a scenario as a service, a pandemic-specific analytical tool incorporating health risk factors. SS&C Health developed a flu vaccine campaign to increase flu vaccine penetration within the market. SS&C Intralinks used their virtual data room technology to support a large multinational bank with the payment protection plan during the height of the pandemic. -

M-18-013 SSC DST Systems Public

DETERMINATION OF MERGER NOTIFICATION M/18/013 – SS&C TECHNOLOGIES/DST SYSTEMS INC Section 21 of the Competition Act 2002 Proposed acquisition by SS&C Technologies Holdings, Inc. of DST Systems, Inc. Dated 15 March 2018 Introduction 1. On 7 February 2018, in accordance with section 18(1)(a) of the Competition Act 2002, as amended (“the Act”), the Competition and Consumer Protection Commission (the “Commission”) received a notification of a proposed transaction whereby SS&C Technologies Holdings, Inc. (“SS&C”) would acquire all of the issued shares of common stock of DST Systems, Inc. (“DST”) (“the Proposed Transaction”). The Proposed Transaction will be implemented pursuant to a merger agreement dated 11 January 2018 between SS&C, DST and Diamond Merger Sub, Inc.1 The Undertakings Involved The Acquirer – SS&C 2. SS&C provides software products and software-enabled services to financial service providers in North America, Europe, Asia, Australia and Africa. SS&C is based in Connecticut, USA and is publicly listed on the NASDAQ Stock Market. 3. SS&C's products and services allow its clients to automate and integrate front-office functions (such as trading and modelling); middle-office functions (comprising portfolio management and reporting); and back-office functions (including accounting, performance measurement, reconciliation, reporting, processing, and clearing). 1 Diamond Merger Sub, Inc. is an indirect wholly-owned subsidiary of SS&C. In the notification, the parties state that Diamond Merger Sub, Inc. will be merged with and into DST, with DST continuing as the surviving corporation. SS&C will then acquire all of the issued shares of common stock of DST. -

Proof of Claim in Any Insolvency Proceeding Or Take Any Similar Action

THE ADVISORS’ INNER CIRCLE FUND III Rayliant Quantamental China Equity ETF (the “Fund”) Supplement, dated January 21, 2021, to the Fund’s Prospectus and Statement of Additional Information (the “SAI”), each dated December 30, 2020 This supplement provides new and additional information beyond that contained in the Prospectus and SAI and should be read in conjunction with the Prospectus and SAI. Effective immediately, all references to the Fund’s address are changed to the following: Rayliant Quantamental China Equity ETF c/o SEI Investments Distribution Co. One Freedom Valley Drive Oaks, Pennsylvania 19456 Please retain this supplement for future reference. RAY-SK-001-0100 STATEMENT OF ADDITIONAL INFORMATION RAYLIANT QUANTAMENTAL CHINA EQUITY ETF TICKER SYMBOL: RAYC Principal Listing Exchange: NYSE Arca, Inc. a series of THE ADVISORS’ INNER CIRCLE FUND III December 30, 2020 Investment Adviser: RAYLIANT INVESTMENT RESEARCH doing business as RAYLIANT ASSET MANAGEMENT This Statement of Additional Information (“SAI”) is not a prospectus. This SAI is intended to provide additional information regarding the activities and operations of The Advisors’ Inner Circle Fund III (the “Trust”) and the Rayliant Quantamental China Equity ETF (the “Fund”). This SAI is incorporated by reference into and should be read in conjunction with the Fund’s prospectus dated December 30, 2020, as it may be amended from time to time (the “Prospectus”). Capitalized terms not defined herein are defined in the Prospectus. Shareholders may obtain copies of the Prospectus or the Fund’s annual or semi-annual report, when available, free of charge by writing to the Fund at Rayliant Quantamental China Equity ETF, P.O. -

Annual Report December 31, 2020

ANNUAL REPORT DECEMBER 31, 2020 As of February 12, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports are no longer sent by mail, unless you have specifically requested paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports are made available on the Fund’s website (www.sequoiafund.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically through your financial intermediary, you will not be affected by this change andyou need not take any action. You may elect to receive shareholder reports and other communications electronically at any time by contacting your financial intermediary. You may elect to receive all future reports in paper form free of charge. If you invest through a financial intermediary, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you may inform the Fund that you wish to continue receiving paper copies of your shareholder reports by calling 1-800-686-6884. Sequoia Fund December 31, 2020 Table of Contents Page Illustration of an Assumed Investment of $10,000 . ................................................... 3 Shareholder Letter . ...................................................................... 4 Management’s Discussion of Fund Performance . ....................................................... 8 Annual Fund Operating Expenses . ..................................................................... 11 Fees and Expenses of the Fund . ....................................................................... 11 Schedule of Investments . .................................................................. 12 Statement of Assets and Liabilities. -

KRANE SHARES TRUST Krane-UBS China a Share Fund (The “Fund

KRANE SHARES TRUST Krane-UBS China A Share Fund (the “Fund”) Supplement dated June 10, 2021 to the currently effective Statutory Prospectus, as it may be supplemented, for the Fund This supplement provides new and additional information beyond that contained in the currently effective Statutory Prospectus for the Fund and should be read in conjunction with the Statutory Prospectus dated February 24, 2021. Prior Performance of Similar Accounts Managed by UBS Asset Management (Americas) Inc. UBS Asset Management (Americas), Inc. (“UBS”) and its affiliates also manage other accounts referred to as UBS Equity China A Opportunity Composite (the “Composite”) that comprises all accounts managed by UBS and its affiliates with investment objectives, policies and strategies that are substantially similar to the Fund. Below you will find information about the prior performance of the Composite. The total asset size of all the accounts comprising the Composite as of December 31, 2020 was approximately $2.93 billion. The performance information has been provided by UBS and relates to the historical performance of the Composite, as measured against a broad-based market index, the MSCI China A Onshore Index (Net). The performance of the Composite should not be considered a substitute for the performance of the Fund, does not represent the past performance of the Fund and is not an indication of the future performance of the Fund. You should not assume that the Fund will have the same performance as the Composite. The performance of the Fund may be better or worse than the performance of the Composite due to, among other things, differences in brokerage commissions, account expenses, including management fees, the size of positions taken in relation to account size and diversification of securities, timing of purchases and sales, and availability of cash for new investments between the Fund and the accounts in the Composite. -

January 2018 M&A and Investment Summary

January 2018 M&A and Investment Summary Table of Contents 1 Overview of Monthly M&A and Investment Activity 3 2 Monthly M&A and Investment Activity by Industry Segment 9 3 Additional Monthly M&A and Investment Activity Data 41 4 About Petsky Prunier 55 Securities offered through Petsky Prunier Securities, LLC, member of FINRA. This M&A and Investment Summary has been prepared by and is being distributed in the United States by Petsky Prunier, a broker dealer registered with the U.S. SEC and a member of FINRA. 2 | M&A and Investment Summary January 2018 M&A and Investment Summary for All Segments Transaction Distribution ▪ A total of 615 deals were announced in January 2018, of which 316 were worth $34.2 billion in aggregate reported value • January activity is highlighted by 316 investments across all the segments, the largest single month total over the past 24 months ▪ Software was the most active segment with 248 deals announced, the most reported in a single month to date — 142 of these transactions reported $5.9 billion in value ▪ Digital Media/Commerce was also active with 137 transactions announced, of which 91 were worth a reported $6.7 billion in value ▪ Strategic buyers announced 264 deals (44 reported $19.2 billion in value) ▪ VC/Growth Capital investors announced 316 transactions (265 reported $10.4 billion in value) ▪ Private Equity investors announced 35 deals during the month (six reported $4.7 billion in value) January 2018 BUYER/INVESTOR BREAKDOWN Transactions Reported Value Strategic Buyout Venture/Growth Capital # %