RCI-09.30.2019-Exhibit 99.3

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Alberta Government Services ______Corporate Registry ______

Alberta Government Services ____________________ Corporate Registry ____________________ Registrar’s Periodical REGISTRAR’S PERIODICAL, MAY 31, 2006 ALBERTA GOVERNMENT SERVICES Corporate Registrations, Incorporations, and Continuations (Business Corporations Act, Cemetery Companies Act, Companies Act, Cooperatives Act, Credit Union Act, Loan and Trust Corporations Act, Religious Societies’ Land Act, Rural Utilities Act, Societies Act, Partnership Act) 101078775 SASKATCHEWAN LTD. Other 1230732 ALBERTA INC. Numbered Alberta Prov/Territory Corps Registered 2006 APR 19 Corporation Incorporated 2006 APR 24 Registered Registered Address: #203, 5101 - 48 STREET, Address: 420 MACLEOD TRAIL S. E., MEDICINE LLOYDMINSTER ALBERTA, T9V 0H9. No: HAT ALBERTA, T1A 2M9. No: 2012307324. 2112369844. 1230987 ALBERTA INC. Numbered Alberta 101081848 SASKATCHEWAN LTD. Other Corporation Incorporated 2006 APR 18 Registered Prov/Territory Corps Registered 2006 APR 26 Address: THIRD FLOOR, 14505 BANNISTER ROAD Registered Address: 5016 - 52 STREET, CAMROSE SE, CALGARY ALBERTA, T2X 3J3. No: ALBERTA, T4V 1V7. No: 2112385964. 2012309874. 1172789 ONTARIO INC. Other Prov/Territory Corps 1231123 ALBERTA LTD. Numbered Alberta Registered 2006 APR 24 Registered Address: 11135 - 84 Corporation Incorporated 2006 APR 20 Registered AVENUE, EDMONTON ALBERTA, T6G 0V9. No: Address: 213-3515-17 AVE SW, CALGARY 2112374687. ALBERTA, T3E 0B7. No: 2012311235. 1201 GLENMORE GP INC. Other Prov/Territory Corps 1231148 ALBERTA LTD. Numbered Alberta Registered 2006 APR 18 Registered Address: 1400, 350 Corporation Incorporated 2006 APR 25 Registered - 7 AVENUE SW, CALGARY ALBERTA, T2P 3N9. Address: 500-444-5 AVE SW, CALGARY ALBERTA, No: 2112364001. T2P 2T8. No: 2012311482. 1228093 ALBERTA LTD. Numbered Alberta 1232700 ALBERTA LTD. Numbered Alberta Corporation Incorporated 2006 APR 17 Registered Corporation Incorporated 2006 APR 18 Registered Address: 4004 14 ST SE, CALGARY ALBERTA, T2G Address: 1003-4TH AVENUE SOUTH, LETHBRIDGE 3K5. -

NS Royal Gazette Part I

Nova Scotia Published by Authority PART 1 VOLUME 222, NO. 28 HALIFAX, NOVA SCOTIA, WEDNESDAY, JULY 10, 2013 IN THE MATTER OF: The Companies Act, IN THE MATTER OF: The Companies Act, Chapter 81, R.S.N.S. 1989, as amended Chapter 81, R.S.N.S., 1989, as amended; - and - - and - IN THE MATTER OF: The Application of IN THE MATTER OF: An Application of Jubida 3095155 Nova Scotia Company for Leave to Consulting Inc. (the “Company”) for Leave to Surrender its Certificate of Incorporation Surrender its Certificate of Incorporation and its Certificate of Name Change NOTICE IS HEREBY GIVEN that Jubida Consulting 3095155 NOVA SCOTIA COMPANY hereby gives Inc. intends to make application to the Registrar of Joint notice pursuant to the provisions of Section 137 of the Stock Companies for leave to surrender its Certificate of Companies Act that it intends to make application to the Incorporation pursuant to Section 137 of the Companies Nova Scotia Registrar of Joint Stock Companies for leave Act of Nova Scotia. to surrender its Certificate of Incorporation and its Certificate of Name Change. DATED at Halifax, Nova Scotia, this 10th day of July, 2013. DATED the 9th day of July, 2013. W. Richard Legge Barry D. Horne President and Secretary McInnes Cooper Jubida Consulting Inc. Purdy’s Wharf Tower II 130 Solutions Drive, Apt. 605 1300-1969 Upper Water Street Halifax NS B3S 0B8 Halifax NS B3J 3R7 Solicitor for 3095155 Nova Scotia Company 1400 July 10-2013 1414 July 10-2013 IN THE MATTER OF: The Nova Scotia Companies Act, R.S.N.S. -

Annual Report

ROGERS COMMUNICATIONS INC. 2011 ANNUAL REPORT CONNECTIONS COME ALIVE ROGERS COMMUNICATIONS INC. AT A GLANCE DELIVERING RESULTS IN 2011 FREE CASH FLOW DIVIDEND SHARE TOP-LINE GENERATION INCREASES BUYBACKS GROWTH WHAT WE SAID: Deliver another year WHAT WE SAID: Increase cash WHAT WE SAID: Return WHAT WE SAID: Leverage of significant consolidated pre-tax returns to shareholders consistently additional cash to shareholders networks, channels and brands free cash flow. over time. by repurchasing Rogers shares to deliver continued revenue on open market. growth. WHAT WE DID: Generated $2 billion WHAT WE DID: Increased of pre-tax free cash flow in 2011, annualized dividend per share WHAT WE DID: Repurchased WHAT WE DID: Delivered 2% supporting the significant cash we 11% from $1.28 to $1.42 in 2011. 31 million Rogers Class B shares consolidated top-line growth returned to shareholders during for $1.1 billion. with 2% growth in adjusted the year. operating profit. CAPTURE OPERATING FAST AND RELIABLE GROW WIRELESS DATA GAIN HIGHER VALUE EFFICIENCIES NETWORKS REVENUE WIRELESS SUBSCRIBERS WHAT WE SAID: Implement cost WHAT WE SAID: Maintain Rogers’ WHAT WE SAID: Strong double-digit WHAT WE SAID: Continued rapid containment initiatives to capture leadership in network technology wireless data growth to support growth in smartphone subscriber efficiencies. and innovation. continued ARPU leadership. base to drive wireless data revenue and ARPU. WHAT WE DID: Reduced operating WHAT WE DID: Deployed Canada’s first, WHAT WE DID: 27% wireless expenses for the combined Wireless largest and fastest 4G LTE wireless net- data revenue growth with data WHAT WE DID: Activated nearly and Cable segments, excluding the work and completed the deployment of as a percent of network revenue 2.5 million smartphones helping cost of wireless equipment sales, by DOCSIS 3.0 Internet capabilities across expanding to 35% from 28% bring smartphone penetration to approximately 2% from 2010 levels. -

The Royal Gazette Index 2012

The Royal Gazette Gazette royale Fredericton Fredericton New Brunswick Nouveau-Brunswick ISSN 0703-8623 Index 2012 Volume 170 Table of Contents / Table des matières Page Proclamations . 2 Orders in Council / Décrets en conseil . 2 Legislative Assembly / Assemblée législative. 7 Elections NB / Élections Nouveau-Brunswick . 7 Departmental Notices / Avis ministériels . 7 NB Energy and Utilities Board / Commission de l’énergie et des services publics du N.-B. 11 New Brunswick Securities Commission / Commission des valeurs mobilières du Nouveau-Brunswick . 12 Notices Under Various Acts and General Notices / Avis en vertu de diverses lois et avis divers . 12 Sheriff’s Sales / Ventes par exécution forcée . 13 Notices of Sale / Avis de vente . 13 Regulations / Règlements . 15 Corporate Affairs Notices / Avis relatifs aux entreprises . 17 Business Corporations Act / Loi sur les corporations commerciales . 17 Companies Act / Loi sur les compagnies . 55 Partnerships and Business Names Registration Act / Loi sur l’enregistrement des sociétés en nom collectif et des appellations commerciales . 58 Limited Partnership Act / Loi sur les sociétés en commandite . 88 2012 Index Proclamations Atlantic Provinces Special Education Authority / Office de l’éducation spéciale pour les provinces de l’Atlantique Acts / Lois McLaughlin, John—OIC/DC 2012-277—p. 1456 (September 26 septembre) Apprenticeship and Occupational Certification Act / Apprentissage et la certification professionnelle, Loi sur l’—OIC/DC 2012-225—p. 1381 Board of Management / Conseil de gestion (September 5 septembre) Fitch, Bruce—OIC/DC 2012-318—p. 1602 (October 31 octobre) Electricity Act, An Act to Amend the / Électricité, Loi modifiant la Loi sur l’— Holder, Trevor—OIC/DC 2012-318—p. -

Telus Communications Inc

TELUS COMMUNICATIONS INC. Comments for CONSULTATION on a TECHNICAL, POLICY and LICENSING FRAMEWORK for SPECTRUM in the 600 MHz BAND SLPB-005-17 August 2017 Spectrum Management and Telecommunications October 2, 2017 i Table of Contents Executive Summary ....................................................................................................................................... 2 Introduction .................................................................................................................................................. 7 TELUS’ Comments on Specific Questions Posed by ISED ............................................................................ 10 1 Executive Summary 1. TELUS appreciates the opportunity to provide its comments. 2. TELUS fully supports the steps initiated by the Department to make valuable 600 MHz spectrum available for the benefit of all Canadians. Combined with 3.5 GHz and mmWave bands, the allocation of this spectrum in a timely manner will be instrumental in securing Canada’s position as a global leader in 5G. 3. TELUS firmly believes that 5G networks will act as a stimulus for disruption in modern digital economies. 5G networks will serve as a platform for innovation and will drive digital development in vertical industries such as health care, transportation, agriculture, manufacturing, automation, and smart cities. As such, 5G will become a central technological pillar in the realisation of the Government’s Innovation Agenda: Empowering Canada’s digital society, building a highly talented -

Application Form

Abridged Page 1 of 17 Application to Renew a Broadcasting Licence for an INDIVIDUAL Cable Distribution Undertaking OR Application to Obtain a REGIONAL Broadcasting Licence for Cable Distribution Undertakings GENERAL INSTRUCTIONS 1. Filing File electronically via Access Key by attaching the application to the Cover page. Access Key allows secure transmissions to the Commission and also authenticates your identity. Therefore, a signature is not required when using Access Key. Applicants who file their application in this manner are not required to submit a hard copy of the application and its related documents. Applicants who cannot send their application electronically with the Access Key service can contact the Commission at 1-877-249-CRTC (2782). Applicants who need further information relative to the CRTC processes can contact a Commission specialist at 1-866-781-1911. 2. Confidentiality requests At your request, portions of the application may be treated as confidential, pursuant to section 20 of the CRTC Rules of Procedure. The onus is on the applicant to request confidentiality for the information or material and to clearly demonstrate that the public interest will best be served by treating the information as confidential. For further information, refer to Circular No. 429 dated 19 August 1998. Applicants must ensure that documents that they request be treated as confidential are submitted in a separate electronic file and must indicate confidential in the name of the file. It is incumbent upon applicants to clearly identify the confidential documents by indicating confidential on each page and, in such cases, to file an abridged version of the document for the public file. -

Royal Gazette of Prince Edward Island

Postage paid in cash at First Class Rates PUBLISHED BY AUTHORITY VOL. CXXXII - NO. 07 Charlottetown, Prince Edward Island, February 18, 2006 CANADA PROVINCE OF PRINCE EDWARD ISLAND IN THE SUPREME COURT - ESTATES DIVISION TAKE NOTICE that all persons indebted to the following estates must make payment to the personal representative of the estates noted below, and that all persons having any demands upon the following estates must present such demands to the representative within six months of the date of the advertisement: Estate of: Personal Representative: Date of Executor/Executrix (Ex) Place of the Advertisement Administrator/Administratrix (Ad) Payment ORNAWKA, Walter Henry David Anthony Ornawka Carr Stevenson & MacKay Vernon Bridge RR#2 Irene Brenda Arbing (EX.) PO Box 522 Queens Co., PE Charlottetown, PE February 18th, 2006 (07-20)* BAKER, Florence May Muriel Grigg Ramsay & Clark Tyne Valley Edgar Ellis (EX.) PO Box 96 Prince Co., PE Summerside, PE February 11th, 2006 (06-19) CURRAN, Jennie Mae Martin Kenny (EX.) Law Office of Alfred K. Fraser, QC St. Teresa PO Box 516 Kings Co., PE Montague, PE February 11th, 2006 (06-19) GALLANT, Joseph Theodore Leroy Gallant McLellan Brennan Summerside Melvin Gallant (EX.) PO Box 35 Prince Co., PE Summerside, PE February 11th, 2006 (06-19) CARRIER, Judith Alberta Carol McInnis (AD.) Carr Stevenson & MacKay Montreal PO Box 522 Quebec Charlottetown, PE February 11th, 2006 (06-19) JOHNSTON, Barbara Allan Arthur Johnston (EX.) E. W. Scott Dickieson Law Office Charlottetown PO Box 1453 *Indicates date of first publication in the Royal Gazette. This is the official version of the Royal Gazette. -

Broadcasting and Telecom Notice of Consultation CRTC 2010 406-2

Broadcasting and Telecom Notice of Consultation CRTC 2010-406-2 PDF version Additional references: 2010-406 and 2010-406-1 Ottawa, 23 July 2010 Call for comments on the customer transfer process and related competitive issues – Extension of deadline and scope Deadline for comments: 23 August 2010 File numbers: 8622-C12-201010595 and 8622-B54-201008566 1. The Commission has received a request from Rogers Communications Inc. to amend Call for comments on the customer transfer process and related competitive issues, Broadcasting and Telecom Notice of Consultation CRTC 2010-406, 23 June 2010, as amended by Broadcasting and Telecom Notice of Consultation CRTC 2010-406-1, 5 July 2010, to include the handling of wireless customer cancellation and transfer requests. 2. Given that it is common practice for service providers to offer discounts or other incentives for bundled services, including telephone, television, Internet and wireless services, the Commission considers that it would be appropriate to include wireless service offerings as part of the Commission’s larger examination of customer transfer processes. 3. Considering the broadened scope of the proceeding, the Commission extends the deadline for comments to 23 August 2010. Parties may file reply comments by 9 September 2010. 4. Parties who have not previously registered in this proceeding and who wish to receive copies of all submissions must notify the Commission by 6 August 2010 (the registration date) of their intention to do so by filling out the online form; by writing to the Secretary General, CRTC, Ottawa, Ontario, K1A 0N2; or by faxing to 819-994-0218. Parties are to provide their email addresses, where available. -

At the Speed of Life Rogers Communications Inc

At the speed Rogers Communications Inc. of life 2016 Annual Report At home, across the country and around the world – that’s the speed of life, and it’s never been faster. About Rogers Rogers is a leading diversified Canadian communications and media company that’s working to deliver a great experience to our customers every day. We are Canada’s largest provider of wireless communications services and one of Canada’s leading providers of cable television, high-speed Internet, information technology, and telephony services to consumers and businesses. Through Rogers Media, we are engaged in radio and television broadcasting, sports, televised and online shopping, magazines and digital media. Our shares are publicly traded on the Toronto Stock Exchange (TSX: RCI.A and RCI.B) and on the New York Stock Exchange (NYSE: RCI). Page 3 Page 4 Page 5 Pages 7–15 Delivering on our 2016 financial and Segment Letter from strategy in 2016 operating results overview the CEO Page 15 Pages 16–17 Page 18 Page 19 Looking Corporate Senior executive Directors ahead governance officers Pages 20–21 Page 22 Page 23 Page 152 Corporate social Our vision 2016 financial Shareholder responsibility and values report information 2016 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 1 2 ROGERS COMMUNICATIONS INC. 2016 ANNUAL REPORT Delivering on our strategy in 2016 Total revenue Adjusted Free cash flow (In billions of dollars) operating profit (In billions of dollars) (In billions of dollars) 13.7 5.1 1.7 1.7 13.4 5.0 5.0 1.4 12.9 2014 2015 2016 2014 2015 2016 2014 2015 2016 5% 4bps 286k Wireless decrease Wireless service revenue in Wireless postpaid net growth postpaid churn additions compared to a churn rate 180k or 170% to 2% of 1.23% increase in 2015 in 2016 from 2015 11% 97k 56% Internet Internet increase in revenue growth net additions self-serve the growth 60k or 162% transactions engine of our increase on the Cable segment from 2015 Rogers brand from 2015 2016 ANNUAL REPORT ROGERS COMMUNICATIONS INC. -

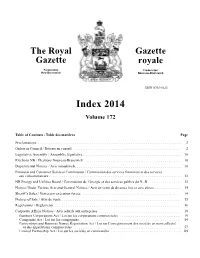

The Royal Gazette Index 2014

The Royal Gazette Gazette royale Fredericton Fredericton New Brunswick Nouveau-Brunswick ISSN 0703-8623 Index 2014 Volume 172 Table of Contents / Table des matières Page Proclamations . 2 Orders in Council / Décrets en conseil . 2 Legislative Assembly / Assemblée législative. 10 Elections NB / Élections Nouveau-Brunswick . 10 Departmental Notices / Avis ministériels. 10 Financial and Consumer Services Commission / Commission des services financiers et des services aux consommateurs . 13 NB Energy and Utilities Board / Commission de l’énergie et des services publics du N.-B. 13 Notices Under Various Acts and General Notices / Avis en vertu de diverses lois et avis divers . 14 Sheriff’s Sales / Ventes par exécution forcée. 14 Notices of Sale / Avis de vente . 15 Regulations / Règlements . 16 Corporate Affairs Notices / Avis relatifs aux entreprises . 19 Business Corporations Act / Loi sur les corporations commerciales . 19 Companies Act / Loi sur les compagnies . 54 Partnerships and Business Names Registration Act / Loi sur l’enregistrement des sociétés en nom collectif et des appellations commerciales . 57 Limited Partnership Act / Loi sur les sociétés en commandite . 89 2014 Index Proclamations Order in Council 2013-372 corrected / Décret en conseil 2013-372 corrigée— OIC/DC 2013-391—p. 166 (February 5 février), OIC/DC 2014-33—p. 288 Acts / Lois (February 26 février) Order in Council 2014-77 corrected / Décret en conseil 2014-77 corrigée— Accountability and Continuous Improvement Act / Reddition de comptes et OIC/DC 2014-173—p. 951 (June 25 juin) l’amélioration continue, Loi sur la—OIC/DC 2014-282—p. 1437 (August Order in Council 2014-147 corrected / Décret en conseil 2014-147 modifiée— 27 août) OIC/DC 2014-184—p. -

Edith Watson Good Afternoon, We Are in Receipt of Correspondence From

Edith Watson From: Marie Lapp <[email protected]> Sent: April 20, 2020 2:52 PM To: A. Hory, RDMW; Claire Moglove ([email protected]); G. Doubt; J McNabb, NI911 Chair ; L. Wallace, RDN; M. Swift, CVRD Cc: A. Radke, qRD; Brian Pearson; C. Morrison, RDN; David Leitch; D. Pearce, RDN; G. Fletcher, RDMW; H. Zenner, ACRD; Russell Dyson; Beth Dunlop; C. Loudon, RDN Adminisntration; Kevin Douville; Randy Zaleschuk; qathet Administration; RDMW Administration ([email protected]); S. Bremer, CRFD; Email - [email protected]; Teresa Warnes; W. Thomson, ACRD Subject: NI911 - CRTC Suspension of Next Generation 9-1-1 Deadline Attachments: Emergency_Services_-_Sec_Gen_Letter_re__suspension_of_NG9-1-1_deadlines.pdf Importance: High Good afternoon, We are in receipt of correspondence from the Canadian Radio-television and Telecommunications Commission (CRTC), advising that a result of COVID-19 they are suspending the deadlines for Next Generation 9-1-1, The date which the NG9-1-1 network providers must have their systems ready to support NG9-1-1 voice, has been extended from June 30, 2020 to March 30th, 2021. NI 9-1-1 Corp is continuing to move ahead with the commitments to Next Gen 911 within this budget year. We have attached the CRTC correspondence for your reference. This item will also be on the next NI 9-1-1 agenda for receipt and discussion. Regards, Marie Lapp Financial Services Assistant Comox Valley Regional District 770 Harmston Avenue, Courtenay, B.C. V9N 0G8 Tel: 250-334-6000; Toll free: 1-800-331-6007 Fax 250-334-4358 Email: [email protected] 1 April 08, 2020 Our reference: 8665-C12-201507008 BY EMAIL Distribution List RE: Suspension of Next-Generation 9-1-1 deadlines due to COVID-19 The COVID-19 pandemic and the resulting measures taken to contain it are having a significant impact on citizens and businesses across Canada, including Originating Network Providers (ONPs) and 9-1-1 network providers responsible for the implementation of Next Generation 9-1- 1 (NG9-1-1). -

A Strategic Analysis for Competing in the Canadian Consumer Wireless Telecommunications Market

A STRATEGIC ANALYSIS FOR COMPETING IN THE CANADIAN CONSUMER WIRELESS TELECOMMUNICATIONS MARKET Josef Alexander Pach M.Sc. (Earth Sciences), University of Waterloo, 1994 B.Sc. Eng. (Geological), University of New Brunswick, 1989 PROJECT SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF BUSINESS ADMINISTRATION In the Faculty of Business Administration Executive MBA O Josef A. Pach 2006 SIMON FRASER UNIVERSITY Summer 2006 All rights reserved. Thls work may not be reproduced in whole or in part, by photocopy or other means, without permission of the author. APPROVAL Name: Josef A. Pach Degree: Master of Business Administration Title of Project: A STRATEGIC ANALYSIS FOR COMPETING IN THE CANADIAN CONSUMER WIRELESS TELECOMMUNICATIONS MARKET Supervisory Committee: Dr. Neil Abramson Senior Supervisor Associate Professor of Strategy Dr. Ed Bukszar Second Reader Associate Professor Date Approved: SIMON FRASER UNlvERSlTYl ibra ry DECLARATION OF PARTIAL COPYRIGHT LICENCE The author, whose copyright is declared on the title page of this work, has granted to Simon Fraser University the right to lend this thesis, project or extended essay to users of the Simon Fraser University Library, and to make partial or single copies only for such users or in response to a request from the library of any other university, or other educational institution, on its own behalf or for one of its users. The author has further granted permission to Simon Fraser University to keep or make a digital copy for use in its circulating collection, and, without changing the content, to translate the thesislproject or extended essays, if technically possible, to any medium or format for the purpose of preservation of the digital work.