THE COST of CASH in INDIA INSTITUTE for BUSINESS in the GLOBAL CONTEXT Ii

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Punjab National Bank: Ratings Assigned and Reaffirmed; Stable Outlook Assigned

August 14, 2020 Punjab National Bank: Ratings assigned and reaffirmed; Stable outlook assigned Summary of rating action Previous Rated Current Rated Instrument* Amount Amount Rating Action (Rs. crore) (Rs. crore) [ICRA]AA-(hyb) (Stable); Reaffirmed, removed Basel III Compliant Tier II Bonds 1,000.00 1,000.00 from ‘rating watch with positive implications’ and Stable outlook assigned [ICRA]AA- (Stable); Reaffirmed, removed from Infrastructure Bonds 3,000.00 3,000.00 ‘rating watch with positive implications’ and Stable outlook assigned MAA (Stable); Reaffirmed, removed from Fixed Deposits Programme - - ‘rating watch with positive implications’ and Stable outlook assigned Certificates of Deposit [ICRA]A1+; Reaffirmed 60,000.00 60,000.00 Programme Basel III Compliant Tier II Bonds^ NA 3,000.00 [ICRA]AA-(hyb) (Stable); Assigned Basel II Compliant Lower Tier II [ICRA]AA- (Stable); Assigned NA 1,200.00 Bonds^ Total 64,000.00 68,200.00 *Instrument details are provided in Annexure-1 ^ These instruments were originally issued by erstwhile Oriental Bank of Commerce (e-OBC), now merged with Punjab National Bank Rationale The rating reaffirmation takes into account the conclusion of the merger between Punjab National Bank (PNB), erstwhile Oriental Bank of Commerce (e-OBC) and erstwhile United Bank of India (e-UBI), with the merger being effective from April 1, 2020 (the merged entity is hereafter referred to as PNB-M). With the conclusion of the merger, PNB-M’s systemic importance has increased further as it accounts for a share of ~7.2% in the net advances and 8.2% in the total deposits of the banking system as on April 1, 2020 compared to ~4.8% and ~5.4%, respectively, on a standalone basis. -

Everything on BHIM App for UPI-Based Payments

Everything on BHIM app for UPI-based payments BHIM UPI app - From linking bank accounts to sending payments. BHIM is based on UPI, which is the Universal Payments Interface and thus linked directly to a bank account. The new digital payments app calledBHIM is based on the Unified Payments Interface (UPI). The app is currently available only on Android; so iOS, Windows mobile users etc are left out. BHIM is also supposed to support Aadhaar-based payments, where transactions will bepossible just with a fingerprint impression, but that facility is yet to roll out. What can BHIM app do? BHIM is a digital payments solution app based on Unified Payments Interface (UPI) from the National Payments Corporation of India (NPCI). If you have signed up for UPI based payments on your respective bank account, which is also linked to your mobile number, then you’ll be able to use the BHIM app to conduct digital transactions. BHIM app will let you send and receive money to other non-UPI accounts or addresses. You can also send money via IFSC and MMID code to users, who don’t have a UPI-based bank account. Additionally, there’s the option of scanning a QR code and making a direct payment. Users can create their own QR code for a certain fixed amount of money, and then the merchant can scan it and the deduction will be made. BHIM app is like another mobile wallet? No, BHIM app is not a mobile wallet. In case of mobile wallets like Paytm or MobiKwik you store a limited amount of money on the app, that can only be sent to someone who is using the same wallet. -

Modi: Two Years On

Modi: Two Years On Hudson Institute September 2016 South Asia Program Research Report Modi: Two Years On Aparna Pande, Director, India Initiative Husain Haqqani, Director, South and Central Asia South Asia Program © 2016 Hudson Institute, Inc. All rights reserved. For more information about obtaining additional copies of this or other Hudson Institute publications, please visit Hudson’s website, www.hudson.org ABOUT HUDSON INSTITUTE Hudson Institute is a research organization promoting American leadership and global engagement for a secure, free, and prosperous future. Founded in 1961 by strategist Herman Kahn, Hudson Institute challenges conventional thinking and helps manage strategic transitions to the future through interdisciplinary studies in defense, international relations, economics, health care, technology, culture, and law. Hudson seeks to guide public policy makers and global leaders in government and business through a vigorous program of publications, conferences, policy briefings and recommendations. Visit www.hudson.org for more information. Hudson Institute 1201 Pennsylvania Avenue, N.W. Suite 400 Washington, D.C. 20004 P: 202.974.2400 [email protected] www.hudson.org Table of Contents Overview 5 Defense 13 Self-Sufficiency 14 Challenges and Opportunities 15 Education and Skill Development 18 Background 18 Modi Administration on Education 20 Prime Minister Modi’s Interventions in Skill Development 20 Challenges and Opportunities 21 India’s Energy Challenge 23 Coal 23 Petroleum 24 Natural Gas 25 Nuclear 27 Renewables 28 Challenges -

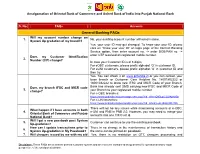

Faqs Answers

Amalgamation of Oriental Bank of Commerce and United Bank of India into Punjab National Bank S. No. FAQs Answers General Banking FAQs Will my account number change on 1. No, your existing account number will remain same. System Up gradation of my branch? Yes, your user ID may get changed. To know your user ID, please click on “Know your user ID” on login page of the Internet Banking Service option, then enter account no. -> enter DOB/PAN no. -> enter OTP received on registered mobile number. Does my Customer Identification 2. Number (CIF) change? In case your Customer ID is of 8 digits, For eOBC customers, please prefix alphabet „O‟ in customer ID. For eUNI customers, please prefix alphabet „U‟ in customer ID and then try. Yes. You can check it on www.pnbindia.in or you can contact your base branch or Customer Care Helpline No. 18001802222 or 18001032222 to know new IFSC and MICR Code of your Branch. Does my branch IFSC and MICR code Bank has already sent SMS carrying new IFSC and MICR Code of 3. change? your Branch to your registered mobile number. For e-OBC branches: https://www.pnbindia.in/downloadprocess.aspx?fid=dYhntQN3LqL12L04pr6fGg== For e-UNI branches: https://www.pnbindia.in/downloadprocess.aspx?fid=8dvm/Lo2L15cQp3DtJJIlA== There will not be any issues while maintaining accounts of e-OBC, What happen if I have accounts in both 4. e-UNI and PNB in PNB 2.0. However, you may need to merge your Oriental Bank of Commerce and Punjab accounts into one CIF/Cust Id. -

India Policy Forum July 12–13, 2016

Programme, Authors, Chairs, Discussant and IPF Panel Members India Policy Forum July 12–13, 2016 NCAER | National Council of Applied Economic Research 11 IP Estate, New Delhi 110002 Tel: +91-11-23379861–63, www.ncaer.org NCAER | Quality . Relevance . Impact NCAER is celebrating its 60th Anniversary in 2016-17 Tuesday, July 12, 2016 Seminar Hall, 1st Floor, India International Centre, New Wing, New Delhi 8:30 am Registration, coffee and light breakfast 9:00–9:30 am Introduction and welcome Shekhar Shah, NCAER Keynote Remarks Amitabh Kant, CEO, NITI Aayog 9:30–11:00 am The Indian Household Savings Landscape [Paper] [Presentation] Cristian Badarinza, National University of Singapore Vimal Balasubramaniam & Tarun Ramadorai, Saïd Business School, Oxford & NCAER Chair Barry Bosworth, Brookings Institution Discussants Rajnish Mehra, University of Luxembourg, NCAER & NBER [Presentation] Nirvikar Singh, University of California, Santa Cruz & NCAER [Presentation] 11:00–11:30 am Tea 11:30 am–1:00 pm Measuring India’s GDP growth: Unpacking the Analytics & Data Issues behind a Controversy that Refuses to Go Away [Paper] [Presentation] R Nagaraj, Indira Gandhi Institute of Development Research T N Srinivasan, Yale University Chair Indira Rajaraman, Member, 13th Finance Commission Discussants Pronab Sen, Former Chairman, National Statistical Commission & Chief Statistician, Govt. of India; India Growth Centre B N Goldar, Institute of Economic Growth [Presentation] 1:00–2:00 pm Lunch 2:00–3:30 pm Early Childhood Development in India: Assessment & Policy -

12. Existing Mergers and Acquisitions in Banking Sector

1.Executive Summary Merger - It's the most talked about term today creating lot of excitement and speculative activity in the markets. But before Mergers & Acquisitions (M&A) activity speeds up, it has to actually pass through a long chain of procedures (both legal and financial), which at times delays the deal. With the liberalization of the Indian economy in 1991, restrictions on Mergers and Acquisitions have been lowered. The numbers of Mergers and Acquisitions have increased many times in the last decade compared to the slack period of 1970-80s when legal hurdles trimmed the M&A growth. To put things in perspective, from 15 mergers in 1998, the number crossed to over 280 in FY01. With a downturn in the capital markets, valuations have come down to historic lows. It's high time that the consolidation game speeds up. In simple terms, a merger means blending of two or more existing undertakings into one, consequent to which each undertaking would lose their separate identity. The most common reasons for mergers are, operating synergies, market expansion, diversification, growth, consolidation of production capacities and tax savings. However, these are just some of the illustrations and not the exhaustive benefits. However, before the idea of Merger and Acquisition crystallizes, the firm needs to understand its own capabilities and industry position. It also needs to know the same about the other firms it seeks to tie up with, to get a real benefit from a merger. Globalization has increased the competitive pressure in the markets. In a highly challenging environment a strong reason for merger and acquisition is a desire 1 to survive. -

Technology Financials

Sector UpdateSector | 22 Update November | Financials 2020 Financials Technology RBI releases the Report of the Internal Working Group to Review RBI report on private sector banks’ ownership Extant Ownership Guidelines and Market share gains to accelerate for private sector banks Corporate Structure for Indian Private Sector Banks We view the RBI’s Internal Working Group (IWG) report related to the ownership of private sector banks as progressive in nature. a) Suggestions for corporate/industrial houses on how to get a banking license and b) allowing NBFCs (even belonging to industrial houses) above asset sizes of INR500b to get banking licenses would increase healthy competition, making the banking system more efficient, reducing intermediation cost, and ultimately increasing credit penetration in the system. Over the last five years, private sector banks have rapidly gained market share to ~30% (2020) from ~18% (2015), and we see this trend accelerating at a faster pace now. M&A opportunities may also increase in the system as corporates with deep pockets may adopt this route rather than building from scratch. Fit and proper criteria, increased surveillance on group entities, the maximum allowed promoter shareholding, and regulatory cost of CRR, SLR, etc. have been the key considerations thus far for applying and granting banking licenses. It remains to be seen how corporate India, NBFCs, and the RBI would approach the matter this time around, once final guidelines are out. Prima facie, we see IDFC Ltd, Bajaj Finance, L&TFH, Equitas, and Ujjivan to be key beneficiaries. Long-awaited opportunity for corporate/industrial houses One of the key suggestions in the report is to provide an opportunity for NBFCs with greater than INR500b corporate/industrial houses to get a share of the growing banking system pie. -

Priority Issues for India in External Trade

VIF REPORT Priority Issues for India in External Trade Vivekananda International Foundation Priority Issues for India in External Trade N/;H7=3@3@63"@F7D@3F;A@3>AG@63F;A@ /;H7=3@3@63"@F7D@3F;A@3>AG@63F;A@ ,3@&3DF;@&3D9 :3@3=K3BGD; '7I7>:;V. S. Seshadri -7> 3J ?3;>;@8AH;8;@6;3 AD9 074E;F7III H;8;@6;3 AD9 >>+;9:FE+7E7DH76 'AB3DFA8F:;EBG4>;53F;A@?3K47D7BDA6G576 EFAD76;@3D7FD;7H3> EKEF7? AD FD3@E?;FF76 ;@ 3@K 8AD? AD 4K 3@K ?73@E 7>75FDA@;5 ?75:3@;53> B:AFA5ABK;@9 D75AD6;@9ADAF:7DI;E7I;F:AGFF:7BD;AD B7D?;EE;A@A8F:7BG4>;E:7D )G4>;E:764K/;H7=3@3@63"@F7D@3F;A@3>AG@63F;A@ N/;H7=3@3@63"@F7D@3F;A@3>AG@63F;A@ /;H7=3@3@63"@F7D@3F;A@3>AG@63F;A@ © Vivekananda ,3@&3DF;@&3D9 :3@3=K3BGD; '7I7>:; International Foundation, 2019 -7> 3J Vivekananda International?3;>;@8AH;8;@6;3 AD9 Foundation 074E;F7III H;8;@6;3 AD9 3, San Martin Marg, Chanakyapuri, New Delhi - 110021 Tel: 011-24121764, Fax: 011-66173415 E-mail: [email protected],>>+;9:FE+7E7DH76 Website: www.vifindia.org All Rights Reserved.'AB3DFA8F:;EBG4>;53F;A@?3K47D7BDA6G576 EFAD76;@3D7FD;7H3> EKEF7? AD FD3@E?;FF76 ;@ 3@K 8AD? AD 4K 3@K ?73@E 7>75FDA@;5 No part of ?75:3@;53> B:AFA5ABK;@9 D75AD6;@9ADAF:7DI;E7I;F:AGFF:7BD;ADthis publication may be reproduced, stored in a retrieval system, or transmitted in any form, or by any means electronic, mechanical, photocopying, recording or otherwise without the prior permission of the publisher. -

India Knowledge@Wharton 1 Feb 2012.Cdr

February 01, 2012 Can YES Bank, India's Youngest and Fastest-Growing Bank, Be a Model for Newer Entrants? Published: February 01, 2012 in India Knowledge@Wharton In the first flush of liberalization post 1991, the Reserve Bank of other banks became more conservative. Kapoor, who did not have India (RBI) also imbibed some of the spirit of reform and opened up legacy issues to deal with, decided to press on the accelerator. He a trifle. New banking licenses were issued to several aspirants. But increased the number of branches, invested in the brand, continued many of those banks collapsed and ultimately had to be rescued by with hiring, intensified product management and customer the system. HDFC Bank (itself a new licensee) had to take over relationship. Most importantly in a money market that was almost Times Bank and Centurion Bank of Punjab. Global Trust Bank ran frozen, he showed risk appetite. into serious ethics issues and had to be merged with Oriental Bank of Commerce. And CRB Capital Markets, which was issued a “We were somewhat shaken and disturbed [by the crisis] because it banking license, never took off; the institution's chairman, C.R. was so early in the life [of the bank], but we also realized that it was a Bhansali, was arrested for various scams. great opportunity to acquire new customers and build confidence," Kapoor says. Jaideep Iyer, YES Bank's president of financial Currently, the RBI is set to issue a new set of licenses. The responses management, adds: "Given our scale and size we offered to the white paper on new guidelines are in. -

Do Bank Mergers, a Panacea for Indian Banking Ailment - an Empirical Study of World’S Experience

IOSR Journal of Business and Management (IOSR-JBM) e-ISSN: 2278-487X, p-ISSN: 2319-7668. Volume 21, Issue 10. Series. V (October. 2019), PP 01-08 www.iosrjournals.org Do Bank Mergers, A Panacea For Indian Banking Ailment - An Empirical Study Of World’s Experience G.V.L.Narasamamba Corresponding Author: G.V.L.Narasamamba ABSTRACT: In the changed scenario of world, with globalization, the need for strong financial systems in different countries, to compete with their global partners successfully, has become the need of the hour. It’s not an exception for India also. A strong financial system is possible for a country with its strong banking system only. But unfortunately the banking systems of many emerging economies are fragmented in terms of the number and size of institutions, ownership patterns, competitiveness, use of modern technology, and other structural features. Most of the Asian Banks are family owned whereas in Latin America and Central Europe, banks were historically owned by the government. Some commercial banks in emerging economies are at the cutting edge of technology and financial innovation, but many are struggling with management of credit and liquidity risks. Banking crises in many countries have weakened the financial systems. In this context, the natural alternative emerged was to improve the structure and efficiency of the banking industry through consolidation and mergers among other financial sector reforms. In India improvement of operational and distribution efficiency of commercial banks has always been an issue for discussion for the Indian policy makers. Government of India in consultation with RBI has, over the years, appointed several committees to suggest structural changes towards this objective. -

117397-BRI-PK-Easypaisa-Pakistan-Series-IFC-Mobile-Money-Toolkit-PUBLIC.Pdf

IN PARTNERSHIP WITH GENDER AND DIGITAL FINANCIAL SERVICES Public Disclosure Authorized CAMPING WITH OUR CUSTOMERS The Service EasyPaisa1 of Pakistan uses 75,000 agents and 6,000 plus 1-link enabled ATMs to facilitate 1.2 million Benazir Income Support Payments (BISP) to poor women every quarter. Utilizing an KEY FIGURES Public Disclosure Authorized innovative co-location tent for each client servicing, EasyPaisa has watched these women develop their financial literacy and share this learning in the community. 1.2 million transactions every quarter Innovations 75,000 agent locations The BISP recipients are not likely to own mobile phones. EasyPaisa and BISP opted for a debit card solution. These accounts can be transitioned to mobile phones when ownership and usage rates 75 percent of recipients increase. from the poorest 40 percent of the population To service these customers, BISP and EasyPaisa have set up 31 “campsites” strategically located approximately 5 kilometers from Public Disclosure Authorized All 1.2 million recipients any client’s home. These tents have BISP staff members to verify have a bank account, a eligibility. EasyPaisa personnel in turn issue and train customers in debit card, and are fully how to use the debit cards, making them a one-stop tent for customers. trained to use agents These service tents also manage lost cards or PINs, re-training and and ATMs queries about payments. 31 Co-location Service Adaptations campsites created EasyPaisa needed to ensure the cash-out points were ready for 1.2 million transactions of 5 billion Pakistani Rupee (PKR) (approximately US$47 million) per quarter through retailers and ATMs. -

JK Panchayat, Urban Body Elections Likely in October

3 Days’ Forecast Jammu www.thenorthlines.com www.epaper.northlines.com Date Min Temp Max Temp Weather July 12 24.0 30.0 Generally cloudy sky July 13 24.0 33.0 Generally cloudy sky July 14 24.0 33.0 Generally cloudy sky Srinagar July 12 18.0 30.0 Thunderstorm with rain July 13 18.0 30.0 Thunderstorm with rain July 13 18.0 30.0 Thunderstorm with rain Vol No: XXIII Issuethe No. 166 14.07.2018 (Saturday)northlines Daily Jammu Tawi Price 3/- Pages-12 Regd. No. JK|306|2017-19 BJP MLA’s wife accuses husband Civil secretariat Mehbooba warns of dangerous of having extra-marital affairs meets on July 13 consequences if New Delhi breaks in PDD SRINAGAR, JULY 13, CNS While talking to Raina said, "Our priority is NL CORRESPONDENT Omar questions working on "Martyrs' Day" reporters after paying not government formation. JAMMU, JULY 13 Former Chief Minister and floral tributes to July 13 We were in power in the NL CORRESPONDENT Abdullah said "the the PDP chief Mehbooba Martyrs, Mehbooba Mufti state and had it been our A BJP legislator's wife on SRINAGAR, JULY 13 conduct of the meeting at Mufti Friday said that if said: "If Delhi tries to priority we would not have Friday publicly accused the civil secretariat and BJP led New Delhi dismiss the voting rights of walked away from the her husband of having an The conduct of an official presence of top officials in Government split her people like in 1987, if it coalition government.