Holdings KL Allocation Fund, As of 6/30/20

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Japan Market Outlook- 4 August 2021

Japan Market Outlook - 4 August 2021 The Japanese stock market is notably lower on Tuesday, On Tuesday, the US dollar is trading in the lower 109 giving up some of the previous session's sharp gains, with yen region in the currency market. the benchmark Nikkei index just above the 27,500 marks, as traders are spooked after more prefectures declared a The main exporters are mostly down, with Sony down state of emergency until the end of the month amid a over 1%, Panasonic down almost 1%, and Mitsubishi surge in the coronavirus's delta variant infections. Electric down 0.5 percent, while Canon is up over 1%. After touching a low of 27,492.40 earlier, the Nikkei 225 Consumer prices in the Tokyo region fell 0.1 percent Index is down 239.51 points, or 0.86 percent, to year over year in July, according to economic data. 27,541.51. On Monday, Japanese stocks finished significantly higher. The core CPI, which excludes volatile food prices, increased by 0.1 percent on an annual basis, beating SoftBank Group has lost nearly 1% of its value, while forecasts for a flat figure that would have remained Uniqlo operator Fast Retailing has lost more than 1%. constant. Honda has lost about 1% of its market value, while Toyota has remained unchanged. Overall inflation increased by 0.1 percent in a seasonally adjusted monthly basis, while core CPI increased by 0.3 In the technology sector, Advantest is up more than 1% percent. and Screen Holdings is up almost 1%, while Tokyo Electron is down 0.4 percent. -

FTSE Japan ESG Low Carbon Select

2 FTSE Russell Publications 19 August 2021 FTSE Japan ESG Low Carbon Select Indicative Index Weight Data as at Closing on 30 June 2021 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country ABC-Mart 0.01 JAPAN Ebara 0.17 JAPAN JFE Holdings 0.04 JAPAN Acom 0.02 JAPAN Eisai 1.03 JAPAN JGC Corp 0.02 JAPAN Activia Properties 0.01 JAPAN Eneos Holdings 0.05 JAPAN JSR Corp 0.11 JAPAN Advance Residence Investment 0.01 JAPAN Ezaki Glico 0.01 JAPAN JTEKT 0.07 JAPAN Advantest Corp 0.53 JAPAN Fancl Corp 0.03 JAPAN Justsystems 0.01 JAPAN Aeon 0.61 JAPAN Fanuc 0.87 JAPAN Kagome 0.02 JAPAN AEON Financial Service 0.01 JAPAN Fast Retailing 3.13 JAPAN Kajima Corp 0.1 JAPAN Aeon Mall 0.01 JAPAN FP Corporation 0.04 JAPAN Kakaku.com Inc. 0.05 JAPAN AGC 0.06 JAPAN Fuji Electric 0.18 JAPAN Kaken Pharmaceutical 0.01 JAPAN Aica Kogyo 0.07 JAPAN Fuji Oil Holdings 0.01 JAPAN Kamigumi 0.01 JAPAN Ain Pharmaciez <0.005 JAPAN FUJIFILM Holdings 1.05 JAPAN Kaneka Corp 0.01 JAPAN Air Water 0.01 JAPAN Fujitsu 2.04 JAPAN Kansai Paint 0.05 JAPAN Aisin Seiki Co 0.31 JAPAN Fujitsu General 0.01 JAPAN Kao 1.38 JAPAN Ajinomoto Co 0.27 JAPAN Fukuoka Financial Group 0.01 JAPAN KDDI Corp 2.22 JAPAN Alfresa Holdings 0.01 JAPAN Fukuyama Transporting 0.01 JAPAN Keihan Holdings 0.02 JAPAN Alps Alpine 0.04 JAPAN Furukawa Electric 0.03 JAPAN Keikyu Corporation 0.02 JAPAN Amada 0.01 JAPAN Fuyo General Lease 0.08 JAPAN Keio Corp 0.04 JAPAN Amano Corp 0.01 JAPAN GLP J-REIT 0.02 JAPAN Keisei Electric Railway 0.03 JAPAN ANA Holdings 0.02 JAPAN GMO Internet 0.01 JAPAN Kenedix Office Investment Corporation 0.01 JAPAN Anritsu 0.15 JAPAN GMO Payment Gateway 0.01 JAPAN KEWPIE Corporation 0.03 JAPAN Aozora Bank 0.02 JAPAN Goldwin 0.01 JAPAN Keyence Corp 0.42 JAPAN As One 0.01 JAPAN GS Yuasa Corp 0.03 JAPAN Kikkoman 0.25 JAPAN Asahi Group Holdings 0.5 JAPAN GungHo Online Entertainment 0.01 JAPAN Kinden <0.005 JAPAN Asahi Intecc 0.01 JAPAN Gunma Bank 0.01 JAPAN Kintetsu 0.03 JAPAN Asahi Kasei Corporation 0.26 JAPAN H.U. -

Trends in Integrated Reporting That Support Sustainable Growth In

At the Council on Investments for the Future, held by the Japanese government in June 2018, there was debate concerning how to make Japan an environmental, social, and governance (ESG) investing power as part of future growth strategies. One major point taken from the debate was that the rules of the game are changing one after another worldwide. In response to revisions to the Stewardship Code in May 2017, several invest- ment management companies have positioned the individual disclosure of voting results as a form of “public report card.” In addition, constructive dialogue contin- ues to grow, with the external survey showing that roughly one-quarter to one-third of companies listed in the First Section of the Tokyo Stock Exchange have engaged in substantial discussion. On the other hand, a succession of corporate scandals have led to a desire to advance corporate governance reform. In order for compa- nies to set their long-term visions into motion, they must take serious consideration of their stakeholders and raise corporate value. Corporate Value Reporting Lab One of the investment principles of the Government Pension Investment Fund (GPIF) states: “By fulfilling our stewardship responsibilities (including the consider- ation of ESG factors), we shall continue to maximize medium- to long-term invest- ment returns for the benefit of pension recipients.” This, and other philosophies Trends in Integrated held by asset owners worldwide have led to significant game changing events occurring in the investment chain. Consequently, with Japan beginning its foray into ESG investing, integrated reports are also becoming more commonplace. Investee Reporting that companies and asset managers engaged in stewardship activities are also influ- enced by the annual list of “Excellent Integrated Reports” and “Most-improved Inte- grated Reports” selected by GPIF’s asset managers entrusted with domestic equity Support Sustainable investment. -

TOBAM Maximum Diversification All World Developed Ex North America USD

TOBAM Maximum Diversification All World Developed ex North America USD 31/12/2019 Instrument Weight BP PLC 0.10% IDEMITSU KOSAN CO LTD 0.21% INPEX HOLDINGS INC 0.07% JX HOLDINGS INC 0.09% NESTE OIL OYJ 1.16% OMV AG 0.08% SANTOS LTD 0.02% SBM OFFSHORE NV 0.05% TGS NOPEC GEOPHYSICAL CO ASA 0.02% VOPAK 0.02% WOOD GROUP (JOHN) PLC 0.02% AIR LIQUIDE 0.23% AIR WATER INC 0.02% AKZO NOBEL 0.12% ALUMINA LTD 0.03% AMCOR PLC-CDI 0.08% AVON RESOURCES LTD 0.53% BORAL LTD 0.02% CHR HANSEN HOLDING A/S 0.08% DAICEL CHEMICAL INDUSTRIES 0.02% DOWA HOLDINGS CO LTD 0.01% EMS-CHEMIE HOLDING AG-REG 0.03% FLETCHER BUILDING LTD 0.02% FORTESCUE METALS GROUP LTD 0.60% GIVAUDAN-REG 0.16% HITACHI CHEMICAL CO LTD 0.03% HUHTAMAKI OYJ 0.03% ISRAEL CHEMICALS LTD 0.02% JAMES HARDIE INDUSTRIES-CDI 0.07% JFE HOLDINGS INC 0.02% KANSAI PAINT CO LTD 0.03% KURARAY CO LTD 0.03% MITSUBISHI MATERIALS CORP 0.02% NEWCREST MINING LTD 1.35% TOBAM Maximum Diversification All World Developed ex North America USD 31/12/2019 Instrument Weight NIPPON PAINT CO LTD 0.05% NIPPON PAPER INDUSTRIES CO L 0.04% NIPPON SHOKUBAI CO LTD 0.01% NISSAN CHEMICAL INDUSTRIES 0.04% NOF CORP 0.02% NORTHERN STAR RESOURCES LTD 0.66% NOVOZYMES A/S-B SHARES 0.07% OJI PAPER CO LTD 0.03% ORICA LTD 0.02% ORORA LTD 0.02% SARACEN MINERAL HOLDINGS LTD 0.32% SMURFIT KAPPA GROUP PLC 0.04% SYMRISE AG 0.04% TAIHEIYO CEMENT CORP 0.02% TAIYO NIPPON SANSO CORP 0.02% TEIJIN LTD 0.02% THYSSENKRUPP AG 0.04% TORAY INDUSTRIES INC 0.02% WIENERBERGER AG 0.02% ADP 0.04% AENA SA 0.09% ALFA LAVAL AB 0.04% ALL NIPPON AIRWAYS CO LTD -

Stoxx® Japan 600 Esg-X Index

STOXX® JAPAN 600 ESG-X INDEX Components1 Company Supersector Country Weight (%) Toyota Motor Corp. Automobiles & Parts Japan 3.87 Sony Corp. Consumer Products & Services Japan 2.55 Softbank Group Corp. Telecommunications Japan 2.44 Keyence Corp. Industrial Goods & Services Japan 1.77 RECRUIT HOLDINGS Industrial Goods & Services Japan 1.54 Mitsubishi UFJ Financial Group Banks Japan 1.48 Shin-Etsu Chemical Co. Ltd. Chemicals Japan 1.36 Nippon Telegraph & Telephone C Telecommunications Japan 1.36 Nintendo Co. Ltd. Consumer Products & Services Japan 1.30 Nidec Corp. Technology Japan 1.30 Fast Retailing Co. Ltd. Retail Japan 1.25 Daikin Industries Ltd. Construction & Materials Japan 1.19 Takeda Pharmaceutical Co. Ltd. Health Care Japan 1.18 Tokyo Electron Ltd. Technology Japan 1.16 Honda Motor Co. Ltd. Automobiles & Parts Japan 1.10 Daiichi Sankyo Co. Ltd. Health Care Japan 1.08 Sumitomo Mitsui Financial Grou Banks Japan 1.04 Murata Manufacturing Co. Ltd. Technology Japan 1.03 KDDI Corp. Telecommunications Japan 1.02 Hitachi Ltd. Industrial Goods & Services Japan 0.92 Itochu Corp. Industrial Goods & Services Japan 0.92 Fanuc Ltd. Industrial Goods & Services Japan 0.90 Hoya Corp. Health Care Japan 0.84 Mitsubishi Corp. Industrial Goods & Services Japan 0.83 Mizuho Financial Group Inc. Banks Japan 0.76 SOFTBANK Telecommunications Japan 0.75 Denso Corp. Automobiles & Parts Japan 0.72 Mitsui & Co. Ltd. Industrial Goods & Services Japan 0.71 Tokio Marine Holdings Inc. Insurance Japan 0.70 Oriental Land Co. Ltd. Travel & Leisure Japan 0.68 SMC Corp. Industrial Goods & Services Japan 0.68 Mitsubishi Electric Corp. Industrial Goods & Services Japan 0.67 Seven & I Holdings Co. -

NIKKEI JAPAN 1000 Constituents (As of March 25, 2005)

NIKKEI JAPAN 1000 Constituents (as of March 25, 2005) Tokyo Stock Exchange 1st 2580 COCA-COLA CENTRAL JAPAN 1332 NIPPON SUISAN 2590 DYDO DRINCO 1334 MARUHA GROUP 2591 CALPIS 1377 SAKATA SEED 2593 ITO EN 1379 HOKUTO 2594 KEY COFFEE 1601 TEIKOKU OIL 2595 KIRIN BEVERAGE 1662 JAPAN PETROLEUM EXPLORATION 2602 NISSHIN OILLIO GROUP 1720 TOKYU CONSTRUCTION 2607 FUJI OIL 1721 COMSYS HOLDINGS 2613 J-OIL MILLS 1722 MISAWA HOMES HOLDINGS 2651 LAWSON 1801 TAISEI 2664 CAWACHI 1802 OBAYASHI 2670 ABC-MART 1803 SHIMIZU 2678 ASKUL 1808 HASEKO 2681 GEO 1812 KAJIMA 2685 POINT 1820 NISHIMATSU CONSTRUCTION 2692 ITOCHU-SHOKUHIN 1821 SUMITOMO MITSUI CONSTRUCTION 2730 EDION 1824 MAEDA 2731 NIWS 1833 OKUMURA 2768 SOJITZ HOLDINGS 1860 TODA 2779 MITSUKOSHI 1878 DAITO TRUST CONSTRUCTION 2784 ALFRESA HOLDINGS 1881 NIPPO 2801 KIKKOMAN 1883 MAEDA ROAD CONSTRUCTION 2802 AJINOMOTO 1885 TOA 2809 Q.P. 1893 PENTA-OCEAN CONSTRUCTION 2810 HOUSE FOODS 1924 PANAHOME 2811 KAGOME 1925 DAIWA HOUSE INDUSTRY 2815 ARIAKE JAPAN 1928 SEKISUI HOUSE 2871 NICHIREI 1941 CHUDENKO 2873 KATOKICHI 1942 KANDENKO 2874 YOKOHAMA REITO 1946 TOENEC 2875 TOYO SUISAN 1951 KYOWA EXEO 2897 NISSIN FOOD PRODUCTS 1959 KYUDENKO 2908 FUJICCO 1961 SANKI ENGINEERING 2914 JAPAN TOBACCO 1963 JGC 3001 KATAKURA INDUSTRIES 1969 TAKASAGO THERMAL ENGINEERING 3002 GUNZE 1970 HITACHI PLANT ENGINEERING 3101 TOYOBO 1973 NEC SYS. INTEGRA. & CONST. 3103 UNITIKA 1979 TAIKISHA 3105 NISSHINBO INDUSTRIES 1982 HIBIYA ENGINEERING 3106 KURABO INDUSTRIES 2001 NIPPON FLOUR MILLS 3110 NITTO BOSEKI 2002 NISSHIN SEIFUN GROUP 3116 TOYOTA -

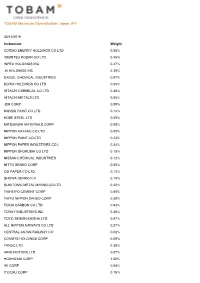

TOBAM Maximum Diversification Japan JPY

TOBAM Maximum Diversification Japan JPY 30/12/2019 Instrument Weight COSMO ENERGY HOLDINGS CO LTD 0.05% IDEMITSU KOSAN CO LTD 0.46% INPEX HOLDINGS INC 0.47% JX HOLDINGS INC 0.35% DAICEL CHEMICAL INDUSTRIES 0.07% DOWA HOLDINGS CO LTD 0.05% HITACHI CHEMICAL CO LTD 0.38% HITACHI METALS LTD 0.05% JSR CORP 0.09% KANSAI PAINT CO LTD 0.14% KOBE STEEL LTD 0.05% MITSUBISHI MATERIALS CORP 0.08% NIPPON KAYAKU CO LTD 0.05% NIPPON PAINT CO LTD 0.23% NIPPON PAPER INDUSTRIES CO L 0.24% NIPPON SHOKUBAI CO LTD 0.18% NISSAN CHEMICAL INDUSTRIES 0.12% NITTO DENKO CORP 0.05% OJI PAPER CO LTD 0.13% SHOWA DENKO K K 0.10% SUMITOMO METAL MINING CO LTD 0.20% TAIHEIYO CEMENT CORP 0.05% TAIYO NIPPON SANSO CORP 0.30% TOKAI CARBON CO LTD 0.93% TORAY INDUSTRIES INC 0.26% TOYO SEIKAN KAISHA LTD 0.07% ALL NIPPON AIRWAYS CO LTD 0.27% CENTRAL JAPAN RAILWAY CO 0.02% COMSYS HOLDINGS CORP 0.09% FANUC LTD 0.38% HINO MOTORS LTD 0.07% HOSHIZAKI CORP 1.50% IHI CORP 0.08% ITOCHU CORP 0.16% TOBAM Maximum Diversification Japan JPY 30/12/2019 Instrument Weight JAPAN AIRLINES CO LTD 0.49% JGC HOLDINGS CORP 0.09% JS GROUP CORP 0.85% KEIHAN ELECTRIC RAILWAY CO 0.13% KEIO CORP 0.18% KINTETSU CORP 0.26% KOMATSU LTD 0.07% KYOWA EXEO CORP 0.06% KYUSHU RAILWAY COMPANY 0.13% MAKITA CORP 0.22% MITSUBISHI CORP 0.69% MITSUBISHI HEAVY INDUSTRIES 0.31% NAGOYA RAILROAD CO LTD 0.14% NANKAI ELECTRIC RAILWAY CO 0.08% OBAYASHI CORP 0.13% ODAKYU ELECTRIC RAILWAY CO 0.20% PARK24 CO LTD 1.15% RECRUIT HOLDINGS CO LTD 0.10% SANKYU INC 0.07% SECOM CO LTD 0.06% SEIBU HOLDINGS INC 0.09% SEINO HOLDINGS CO LTD -

CDP Japan Water Security Report 2019

CDP Japan Water Security Report 2019 On behalf of 525 institutional investors with assets of USD 96 trillion CDP Japan Water Security Report 2019 | 2020 March Report writer Contents CDP Foreword 3 Report Writer Foreword 4 Water Security A List 2019 6 Scoring 7 Stories of Change 8 - Kao Corporation - Japan Tobacco Inc. Executive Summary 12 Response to CDP’s Water Security Questionnaire 14 Appendix 22 - CDP Water Security 2019 Japanese companies Please note that the names of companies in the text do not indicate their corporate status. Important Notice The contents of this report may be used by anyone providing acknowledgment is given to CDP. This does not represent a license to repackage or resell any of the data reported to CDP or the contributing authors and presented in this report. If you intend to repackage or resell any of the contents of this report, you need to obtain express permission from CDP before doing so. CDP has prepared the data and analysis in this report based on responses to the CDP 2019 information request. No representation or warranty (express or implied) is given by CDP as to the accuracy or completeness of the information and opinions contained in this report. You should not act upon the information contained in this publication without obtaining specific professional advice. To the extent permitted by law, CDP does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this report or for any decision based on it. -

Published on 7 October 2015 1. Constituents Change the Result Of

The result of periodic review and component stocks of TOPIX Composite 1500(effective 30 October 2015) Published on 7 October 2015 1. Constituents Change Addition( 80 ) Deletion( 72 ) Code Issue Code Issue 1712 Daiseki Eco.Solution Co.,Ltd. 1972 SANKO METAL INDUSTRIAL CO.,LTD. 1930 HOKURIKU ELECTRICAL CONSTRUCTION CO.,LTD. 2410 CAREER DESIGN CENTER CO.,LTD. 2183 Linical Co.,Ltd. 2692 ITOCHU-SHOKUHIN Co.,Ltd. 2198 IKK Inc. 2733 ARATA CORPORATION 2266 ROKKO BUTTER CO.,LTD. 2735 WATTS CO.,LTD. 2372 I'rom Group Co.,Ltd. 3004 SHINYEI KAISHA 2428 WELLNET CORPORATION 3159 Maruzen CHI Holdings Co.,Ltd. 2445 SRG TAKAMIYA CO.,LTD. 3204 Toabo Corporation 2475 WDB HOLDINGS CO.,LTD. 3361 Toell Co.,Ltd. 2729 JALUX Inc. 3371 SOFTCREATE HOLDINGS CORP. 2767 FIELDS CORPORATION 3396 FELISSIMO CORPORATION 2931 euglena Co.,Ltd. 3580 KOMATSU SEIREN CO.,LTD. 3079 DVx Inc. 3636 Mitsubishi Research Institute,Inc. 3093 Treasure Factory Co.,LTD. 3639 Voltage Incorporation 3194 KIRINDO HOLDINGS CO.,LTD. 3669 Mobile Create Co.,Ltd. 3197 SKYLARK CO.,LTD 3770 ZAPPALLAS,INC. 3232 Mie Kotsu Group Holdings,Inc. 4007 Nippon Kasei Chemical Company Limited 3252 Nippon Commercial Development Co.,Ltd. 4097 KOATSU GAS KOGYO CO.,LTD. 3276 Japan Property Management Center Co.,Ltd. 4098 Titan Kogyo Kabushiki Kaisha 3385 YAKUODO.Co.,Ltd. 4275 Carlit Holdings Co.,Ltd. 3553 KYOWA LEATHER CLOTH CO.,LTD. 4295 Faith, Inc. 3649 FINDEX Inc. 4326 INTAGE HOLDINGS Inc. 3660 istyle Inc. 4344 SOURCENEXT CORPORATION 3681 V-cube,Inc. 4671 FALCO HOLDINGS Co.,Ltd. 3751 Japan Asia Group Limited 4779 SOFTBRAIN Co.,Ltd. 3844 COMTURE CORPORATION 4801 CENTRAL SPORTS Co.,LTD. -

Mizuho BK Custody and Proxy Board Lot Size List JUN 22 , 2021

Mizuho BK Custody and Proxy Board Lot Size List JUN 22 , 2021 Board Lot Stock Name (in Alphabetical Order) ISIN Code QUICK Code Size 21LADY CO.,LTD. 100 JP3560550000 3346 3-D MATRIX,LTD. 100 JP3410730000 7777 4CS HOLDINGS CO.,LTD. 100 JP3163300001 3726 A-ONE SEIMITSU INC. 100 JP3160660001 6156 A.D.WORKS GROUP CO.,LTD. 100 JP3160560003 2982 A&A MATERIAL CORPORATION 100 JP3119800005 5391 A&D COMPANY,LIMITED 100 JP3160130005 7745 ABALANCE CORPORATION 100 JP3969530009 3856 ABC-MART,INC. 100 JP3152740001 2670 ABHOTEL CO.,LTD. 100 JP3160610006 6565 ABIST CO.,LTD. 100 JP3122480001 6087 ACCESS CO.,LTD. 100 JP3108060009 4813 ACCESS GROUP HOLDINGS CO.,LTD. 100 JP3108190004 7042 ACCRETE INC. 100 JP3108180005 4395 ACHILLES CORPORATION 100 JP3108000005 5142 ACMOS INC. 100 JP3108100003 6888 ACOM CO.,LTD. 100 JP3108600002 8572 ACRODEA,INC. 100 JP3108120001 3823 ACTIVIA PROPERTIES INC. 1 JP3047490002 3279 AD-SOL NISSIN CORPORATION 100 JP3122030004 3837 ADASTRIA CO.,LTD. 100 JP3856000009 2685 ADEKA CORPORATION 100 JP3114800000 4401 ADISH CO.,LTD. 100 JP3121500007 7093 ADJUVANT COSME JAPAN CO.,LTD. 100 JP3119620007 4929 ADTEC PLASMA TECHNOLOGY CO.,LTD. 100 JP3122010006 6668 ADVAN CO.,LTD. 100 JP3121950004 7463 ADVANCE CREATE CO.,LTD. 100 JP3122100005 8798 ADVANCE RESIDENCE INVESTMENT CORPORATION 1 JP3047160001 3269 ADVANCED MEDIA,INC. 100 JP3122150000 3773 ADVANEX INC. 100 JP3213400009 5998 ADVANTAGE RISK MANAGEMENT CO.,LTD. 100 JP3122410008 8769 ADVANTEST CORPORATION 100 JP3122400009 6857 ADVENTURE,INC. 100 JP3122380003 6030 ADWAYS INC. 100 JP3121970002 2489 AEON CO.,LTD. 100 JP3388200002 8267 AEON DELIGHT CO.,LTD. 100 JP3389700000 9787 AEON FANTASY CO.,LTD. 100 JP3131420006 4343 AEON FINANCIAL SERVICE CO.,LTD. -

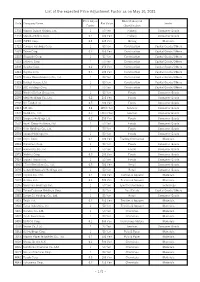

List of the Expected Price Adjustment Factor As on May 10, 2021

List of the expected Price Adjustment Factor as on May 10, 2021 Price Adjust Nikkei Industrial Code Company Name Par Value Sector Factor Classification 1332 Nippon Suisan Kaisha, Ltd. 1 50 Yen Fishery Consumer Goods 1333 Maruha Nichiro Corp. 0.1 500 Yen Fishery Consumer Goods 1605 INPEX Corp. 0.4 125 Yen Mining Materials 1721 Comsys Holdings Corp. 1 50 Yen Construction Capital Goods/Others 1801 Taisei Corp. 0.2 250 Yen Construction Capital Goods/Others 1802 Obayashi Corp. 1 50 Yen Construction Capital Goods/Others 1803 Shimizu Corp. 1 50 Yen Construction Capital Goods/Others 1808 Haseko Corp. 0.2 250 Yen Construction Capital Goods/Others 1812 Kajima Corp. 0.5 100 Yen Construction Capital Goods/Others 1925 Daiwa House Industry Co., Ltd. 1 50 Yen Construction Capital Goods/Others 1928 Sekisui House, Ltd. 1 50 Yen Construction Capital Goods/Others 1963 JGC Holdings Corp. 1 50 Yen Construction Capital Goods/Others 2002 Nisshin Seifun Group Inc. 1 50 Yen Foods Consumer Goods 2269 Meiji Holdings Co., Ltd. 0.2 250 Yen Foods Consumer Goods 2282 NH Foods Ltd. 0.5 100 Yen Foods Consumer Goods 2413 M3, Inc. 2.4 125/6 Yen Services Consumer Goods 2432 DeNA Co., Ltd. 0.3 500/3 Yen Services Consumer Goods 2501 Sapporo Holdings Ltd. 0.2 250 Yen Foods Consumer Goods 2502 Asahi Group Holdings, Ltd. 1 50 Yen Foods Consumer Goods 2503 Kirin Holdings Co., Ltd. 1 50 Yen Foods Consumer Goods 2531 Takara Holdings Inc. 1 50 Yen Foods Consumer Goods 2768 Sojitz Corp. 0.1 500 Yen Trading Companies Materials 2801 Kikkoman Corp. -

DAIWA Earnings Analysis of Major Banks–I

DAIWA DAIWA INSTITUTE OF RESEARCH LTD. 6 December 2007 (No of pages: 19) Earnings Analysis of Major Banks–I —1H FY07 Earnings Summary and Operating Environment— (Sumitomo Mitsui Banking Corp is affiliated with Daiwa Securities SMBC. See disclaimer below.) Equity Research Dept Akira Takai • Major banks’ aggregate 1H FY07 parent real net business profit (total sum of group banks) edged down 2.6% y/y to Y1,614.8 billion. Domestic net interest income expanded, mainly thanks to improvement in loan-deposit interest rate spreads. Treasury operations apparently improved overall, helped by lower overseas interest rates. Meanwhile, slow growth in net fee/commission income and an increase in overhead weighed on profit. • However, the main factor dragging down profit was aggregate credit costs net of recoveries, which reached Y366.1 billion, reversing course net credit recoveries of Y244.9 booked a year earlier. A number of banks took a hit from earnings deterioration at group non-banks and higher income taxes due to the realization of deferred tax assets during the year-earlier period. This capped aggregate consolidated net income at Y947.9 billion, 45.4% below the 1H FY06 figure, which was the highest in history. However, solid profitability prompted some banks to resume or raise common dividends in 1H. • The BOJ did not raise interest rates in 1H, after having lifted the unsecured overnight call rate 0.25% twice in FY06. The bond market retreated in 1Q but began to rebound in 2Q. Meanwhile, global equity markets pulled back in response to the deepening subprime loan crisis in August, causing Japanese equities to plummet.