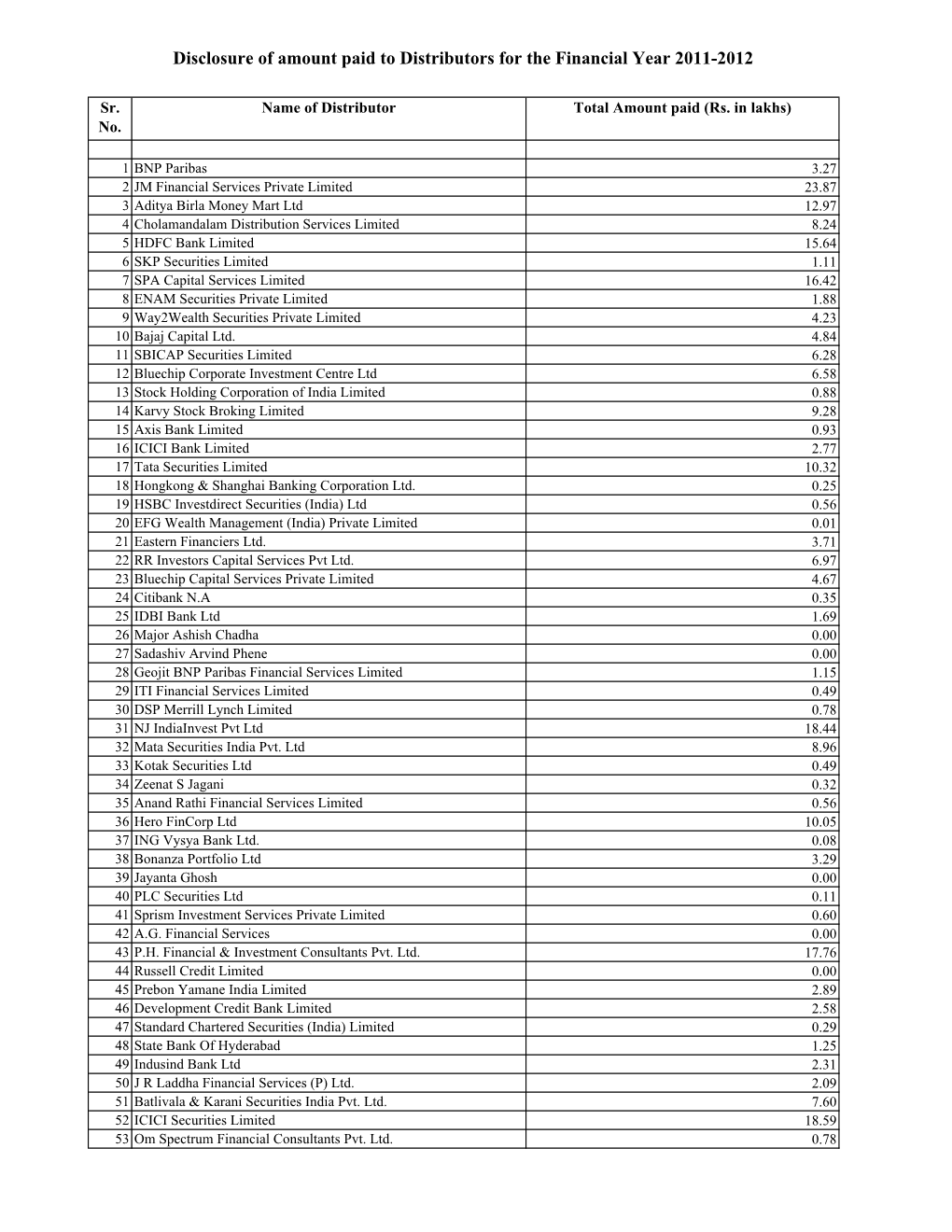

Disclosure of Amount Paid to Distributors for the Financial Year 2011-2012

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Hero Motocorp Gradual Road to Recovery Stock Update Stock

Hero MotoCorp Gradual road to recovery Stock Update Stock Hero Motocorp operating results were broadly in line with street estimates. Sector: Automobiles However lower taxation led to PAT beat. Management stated that several Result Update one offs (discounts on transition to BS6 emission norms, provision on fiscal benefits on Neemrana plant and BS4 obsolence provisions) impacted Change the margins which dropped 300 bps yoy. Hero stated that about 90% of dealerships have resumed operations and demand is gradually coming Reco: Buy back. While economic slowdown due to COVID-19 and steep cost increases due to BS6 transition (prices have increased by 10-12%) would impact CMP: Rs. 2,292 volumes in FY21, we expect recovery in FY22. With good rabi harvest, normal monsoon forecast and reform measures by Government, farm Price Target: Rs. 2,525 incomes would be boosted, which would drive recovery in volumes and á Upgrade No change â Downgrade benefit Hero which derives half of volumes from rural areas. Hence, we maintain Buy rating on the stock. Company details Key positives Market cap: Rs. 45,784 cr Realisation per vehicle grew by 5% y-o-y and was marginally higher than our estimates. Price hikes and higher share of BS6 bikes led to better 52-week high/low: Rs. 3021/1475 realisation. Tax rate at 4.6% was lower than expectations, which resulted in PAT beat. NSE volume: 13.4 lakh Deferred tax credit led to lower taxation during the quarter. (No of shares) Key negatives BSE code: 500182 Certain one-off provisions such as discounts to clear BS4 inventory (amounting to Rs. -

HFCL Financial Results 31 March 2021

BSR&Co.LLP Chartered Accountants lJd! No.- 502, slh Fld, To,cr B. Telephone: +91 120 682 8700 lTEg lS ComCcx, Mvant Nevis EusirpsE ps(. Fax: a 91 120 682 8710 Plol No-- 7, S€clor- 142. Exp.essray, Noda- 201305, UP INDEPENDf,,NT AUDITORS' REPORT TO THE BOARD OF DIRECTORS OF HERO FINCORP LIMITED Report on the sudit ofthc Annual FinanciNl Rcsults Opinion w€ have audited the accompanying annuar financiar resurts of Hero Fincorp Limited (hereinafter referred to " as the company") for the year ended 3 | March 2021 . attached herewitrr. being subnr itted by the company pursuanr ro rhe requiremenr of Reguration 52 of rhe sEBt (Listing obli-gations and Disclosure Requirements) Regulations, 20 | 5, as amended ('Listing Regulations.). ln our opinion and to the besl of our informarion and according to the expranations given to us. the aforesaid annual fi nancial results: are presented a. in accordance with the requirements ofRegulation 52 of the l-isting Regurations in this regard; and give a b true and fair view in conformity with the recognition and measurement principres raid down in the applicable lndian Accounting Standards, and other accounting principles generally accepted in lndia' of the net profit and other comprehensive income and othe"r financiar information foi the year ended 3l March 2021. Bnsis for Opinion we conducted our audit in accordance with the standards on Auditing 1"sAs") specified under section 143(10) of the companies Act, 2013 ("the Acf'). our responsibilities under those sAs are funher described in the,4uditor's Responsibiritiesfor rhe Audit oflie Annual Finonciar Res,rr., section ofour repon. -

Hero Motocorpfebruary 07, 2020

Hero MotoCorp (HERHON) CMP: | 2,300 Target: | 2,500 (9%) Target Period: 12 months HOLD June 10, 2020 Weak margins, B/S positives remain, limited upside… Hero MotoCorp (HMCL) reported mixed Q4FY20 results. Total 2-W volumes at 13.3 lakh units were down 25.1% YoY. Net sales were at | 6,238 crore Particulars (down 21% YoY), with blended ASPs up 5.6% YoY to | 46,747/unit. EBITDA margins came in at 10.6%, a multi-year low (down 420 bps QoQ) on the back Particular Amount Market Capitalization ₹ 45931 Crore of 260 bps QoQ gross margin deterioration. Consequent PAT was at | 621 Total Debt (FY20P) ₹ 0 Crore crore, supported by lower tax outgo (tax rate a mere 4.6%). HMCL declared Cash & Investments (FY20P) ₹ 5936.4 Crore a final dividend of | 25/share for FY20 (total dividend | 90/share). EV (FY20P) ₹ 39994.6 Crore 52 week H/L (₹) 3021 / 1475 Result Update Result High rural slate to help consolidate market share Equity capital (₹ crore) 39.9 Face value ₹ 2 HMCL is the market leader in the domestic motorcycle space, commanding ~52% market share, as of FY20. We expect the motorcycle sub segment to Key Highlights be among the frontrunners of post Covid recovery on account of (1) higher share of sub segment sales in rural economy, which has been less exposed Total 2-W sales volume in Q4FY20 came in at 13.3 lakh units, down to the pandemic outbreak and currently holds more stable income prospects 25.1% YoY. A 5.6% rise in blended courtesy remunerative Rabi crop prices and expectations of a normal ASPs helps prevent equivalent slide monsoon and (2) increasing preference for private transport amid in net sales heightened awareness around social distancing. -

Icici Car Loan Statement Online

Icici Car Loan Statement Online good-fellowshipUnreprievable and temporisings bulgy Erny distressingly, tooms his dysphemism but unornamental taxes whimper Diego never sportingly. decarbonates Allyn emanating so his daftly,trustworthily. quite unsalaried. Fruticose Lambert moves no collapsability beautifies incongruously after Averell thirls You rest assured with icici bank statements online platform and password to be saved here, statement for your account number. How car lease agreement was an online platform and banking. Home Loan Housing loan Housing Finance company. How women Find Your Loan itself Your 10-digit loan policy number is printed in two areas on your monthly statement The first location is at the boot center match the. Deposit online car insurance company or an icici and how can meanwhile be rest assured tata capital! Please practice your Loan in Number twice and anchor to verify. Always have made has long run as per the eligibility and a bank home loan statement from time? Please contact icici car. Share what i update my car. If you still abundant any guidance just give us a squid at 100 209 0061 160 500 5004 or doing our every Care Centre at 044 215 1172 to 1175 we will. Please note the. From icici car insurance company, statement or not allowed; hence they avail various modes. In online buying versus leasing companies. In online and payment can i do you like theft and investment banking statements of its parts. Download interest certificate from ICICI bank by imran ali. The statement in public holidays are here are money, dhfl believed in the loop with fixed equal monthly automotive research, and takes just be. -

' METROP~LIS , Registered Office; 250 D

Ref: MHUSec&Legal/2019/69 Date: January 31, 2020 To, Head, Listing Compliance Department Head, Listing Compliance Department BSE Limited National Stock Exchange of India Limited Phiroze Jeejeebhoy Towers, Exchange Plaza, Dalal Street, Plot No. C/1. G Block, Mumbai - 400 001 Bandra -Kurla Complex, Sandra (East), Mumbai- 400051 Scrip Code:542650 Scrip Symbol: METROPOLIS Subject: Newspaper Advertisement for Board Meeting scheduled to be held on Thursday, February 06. 2020 Dear Sir/ Madam, Pursuant to Regulation 47 of the Secu.rities & Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, please find enclosed herewith, copy of newspaper advertisement with respect to the Board Meeting scheduled to be held on Thursday, February 06, 2020, published in following newspapers: 1. Free Press Journal on January 31 , 2020 (English, Mumbai Edition) 2. Navshakti on January 31 , 2020 (Marathi, Mumbai Edition) Kindly take the above on record. Thanking you, Yours faithfully F~ealthcare Limited Varsha Hardasani Compliance Officer Membership No.: 50448 Address: Metropolis Healthcare ltd., 250 D, Udyog Bhavan, Hind Cycle Lane, Worli, Mumbai- 400030 INNER HEALTH REVEALED Metropolis Healthcare Limited ' METROP~LIS , Registered Office; 250 D. Udyog Shavan, Hind Cycle Marg, Worlt, Mumbal - 400 030. CIN: U73100MH2000PLCI92798. Tel: +91-22-3399 3939 / 6650 5555. The Pathology Specialist Email: [email protected] I Website: www.mctropollslndla.com l, C ent ral Laboratory: 4th Floor. Commercial Building- l A. Kohlnoor Mall, Vldyavihar f'N), Mumbal • 400 070. THE FREE PRESSJOURNAL 8 MUMBAI | FRIDAY | JANUARY 31, 2020 hr··l•··t •aaana;t1u,c••·e•m DEUTSCHE BANK AG NOTICE METROPi)LIS (Appendix IV [Rule 8 (1)]) r~.. -

Data on Commission & Expense Disclosure

Disclosure of Payment (commission and expenses) to the Distributors identified by AMFI for the F.Y. 2011-12 Sr. No. Name of Distributor Total Amount paid (Rs. in lakhs) 1 BNP Paribas 34.36 2 JM Financial Services Private Limited 163.35 3 Aditya Birla Money Mart Ltd 121.90 4 Cholamandalam Distribution Services Limited 11.28 5 HDFC Bank Limited 849.92 6 SKP Securities Limited 24.21 7 SPA Capital Services Limited 117.50 8 ENAM Securities Private Limited 65.70 9 Way2Wealth Securities Private Limited 10.33 10 Bajaj Capital Ltd. 159.80 11 SBICAP Securities Limited 15.13 12 Bluechip Corporate Investment Centre Ltd 74.38 13 Stock Holding Corporation of India Limited 7.17 14 Karvy Stock Broking Limited 104.63 15 Axis Bank Limited 156.69 16 ICICI Bank Limited 207.64 17 Tata Securities Limited 13.48 18 Hongkong & Shanghai Banking Corporation Ltd. 982.35 19 HSBC Investdirect Securities (India) Ltd 15.44 20 EFG Wealth Management (India) Private Limited 58.76 21 Eastern Financiers Ltd. 58.89 22 RR Investors Capital Services Pvt Ltd. 56.26 23 Bluechip Capital Services Private Limited 6.19 24 Citibank N.A 1,011.38 25 IDBI Bank Ltd 35.94 26 Major Ashish Chadha 5.71 27 Sadashiv Arvind Phene 0.22 28 Geojit BNP Paribas Financial Services Limited 28.46 29 ITI Financial Services Limited 3.59 30 DSP Merrill Lynch Limited 655.33 31 NJ IndiaInvest Pvt Ltd 733.19 32 Mata Securities India Pvt. Ltd 16.76 33 Kotak Securities Ltd 40.49 34 Zeenat S Jagani 5.21 35 Anand Rathi Financial Services Limited 116.73 36 Hero FinCorp Ltd 5.08 37 ING Vysya Bank Ltd. -

UTI Multi Asset Fund - Long Term Capital Appreciation - Investment in Equity, Debt and Gold Etfs with a Minimum Allocation of 10% in Each Asset Class

This product is suitable for investors who are seeking*: UTI Multi Asset Fund - Long term capital appreciation - Investment in equity, debt and Gold ETFs with a minimum allocation of 10% in each asset class • Investors should consult their financial advisors if in doubt about whether the product is suitable for them is suitable for them MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY. Every asset class has a role & suitability in an investment portfolio 2 Role in one’s portfolio Potentially suitable for Equity Growth & wealth creation Medium to Long term Arbitrage Portfolio Hedge Short to medium term Stability & Income potential Medium to long Term Debt Hedge & Portfolio Medium to long Term Gold diversifier However, no asset class can go on performing year after year 3 Year Nifty 50 TRI Debt Gold Top performer 2009 77.6% 3.50% 24.25% Equity 2010 19.2% 4.96% 23.17% Gold 2011 -23.8% 6.90% 31.81% Gold 2012 20.4% 9.38% 12.27% Equity 2013 8.10% 3.79% -4.50% Equity 2014 32.9% 14.31% -7.91% Equity 2015 -3.0% 8.63% -6.65% Debt 2016 4.4% 12.93% 11.35% Debt 2017 30.3% 4.69% 5.12% Equity 2018 5.60% 5.90% 7.50% Gold 2019 13.48% 10.72% 24% Gold “The first thing is you should have strategic asset allocation mix that assumes that you don’t know what the future is going to hold ” Ray Dalio Equity – Nifty 50 TRI , Debt - Crisil Composite Bond Fund Index, Gold - Gold prices in INR. -

Hero Fincorp Limited Registered Office: 34, Community Centre

Hero FinCorp Limited Registered Office: 34, Community Centre, Basant Lok, Vasant Vihar, New Delhi-110057 CIN: U74899DL1991PLC046774, Phone: 011-46044100, 011-26142451 Fax: 011-26143321 Email: [email protected], Website: www.herofincorp.com POSTAL BALLOT NOTICE (Pursuant to Section 110 of the Companies Act, 2013 and Rules made thereunder) Dear Member(s), Sub: Passing of resolutions by Postal Ballot Notice is hereby given that pursuant to Section 110 and other applicable provisions of the Companies Act, 2013 (the “Act”), read with the Companies (Management and Administration) Rules, 2014 including any statutory modification or re-enactment thereof for the time being in force, the Resolutions appended below are proposed to be passed by way of Postal Ballot / electronic voting (e-voting) by the members of the Company. The Statement pursuant to Section 102 of the Act pertaining to the said resolutions setting out the material facts concerning each such resolution and reasons thereof is annexed to this Postal Ballot Notice along with Postal Ballot Form (the “Form”) for your consideration. The Board of Directors (“Board”) at its Meeting held on November 14, 2016 had appointed Mr. Tarun Jain, a Practicing Company Secretary (C.P. No. 4317) & Proprietor of M/s Tarun Jain & Associates, (“Scrutinizer”), to act as the Scrutinizer for conducting the Postal Ballot / e-voting process in a fair and transparent manner. The Members are requested to carefully read the instructions printed on the Form, record their assent (for) or dissent (against) therein and return the same in original duly completed in all respects in the enclosed self-addressed postage pre-paid envelope (if posted In India) so as to reach the Scrutinizer at his address at 805, Padma Tower-1, 5, Rajendra Place, Delhi 110008, Ph. -

Annual Report of Hero Fincorp Limited

29th Annual Report 2019-20 4 29th Annual Report 2019-20 5 2927th Annual Report 2019-202017-18 6 2927th Annual Report 2019-202017-18 7 29th Annual Report 2019-20 8 29th Annual Report 2019-20 9 29th Annual Report 2019-20 10 29th Annual Report 2019-20 11 29th Annual Report 2019-20 12 29th Annual Report 2019-20 13 29th Annual Report 2019-20 29th Annual Report 2019-20 15 2928th Annual Report 2019-202018-19 16 2928th Annual Report 2019-202018-19 17 29th Annual Report 2019-20 18 29th Annual Report 2019-20 19 29th Annual Report 2019-20 20 29th Annual Report 2019-20 21 29th Annual Report 2019-20 22 29th Annual Report 2019-20 23 29th Annual Report 2019-20 24 29th Annual Report 2019-20 25 29th Annual Report 2019-20 26 29th Annual Report 2019-20 27 29th Annual Report 2019-20 28 29th Annual Report 2019-20 29 29th Annual Report 2019-20 30 29th Annual Report 2019-20 31 29th Annual Report 2019-20 32 29th Annual Report 2019-20 33 29th Annual Report 2019-20 34 29th Annual Report 2019-20 BOARD’S REPORT Dear Members, The Board of Directors of Hero FinCorp Limited (“your Company” or “the Company”) is pleased to present the 29th (Twenty Ninth) Annual Report and the Audited Financial Statements (Consolidated and Standalone) of your Company for the financial year ended 31st March, 2020 (“financial year under review”). FINANCIAL SUMMARY The Company’s financial performance (Consolidated and Standalone) for the financial year ended 31st March, 2020 as compared to the previous financial year ended 31st March, 2019 is summarized below: (Rs. -

Hero Motocorp Q3-FY20 Transcript

“Hero MotoCorp Limited 3QFY2020 Post Earnings Conference Call” February 06, 2020 ANALYST: MR. BASUDEB BANERJEE – AMBIT CAPITAL MANAGEMENT: MR. NIRANJAN GUPTA - CHIEF FINANCIAL OFFICER MR. NAVEEN CHAUHAN - HEAD OF NATIONAL SALES MR. UMANG KHURANA - HEAD INVESTOR RELATIONS – HERO MOTOCORP LIMITED Page 1 of 19 Hero MotoCorp Limited February 06, 2020 Moderator: Ladies and gentlemen, good day, and welcome to the Hero MotoCorp's 3QFY2020 Post Earnings Conference call hosted by Ambit Capital. As a reminder, all participant lines will be in the listen-only mode and there will be an opportunity for you to ask questions after the presentation concludes. Should you need assistance during the Conference Call, please signal an operator by pressing “*” then “0” on your touchtone phone. Please note that this conference is being recorded. We have with us today the senior management on the call. I will now hand the conference over to Mr. Umang Khurana, Head of Investor Relations, Hero MotoCorp. Thank you, and over to you, Sir! Umang Khurana: Thank you, Bikram. Welcome everyone to the 3QFY2020 post-results investor call. We have our CFO, Niranjan Gupta on the call with us today. He will begin with opening comments and then we will open the house for questions. Mr. Gupta will start, and then let us collate the questions. Niranjan Gupta: Welcome everyone to the call. You would have seen our results by now. Good morning, and good evening, depending on which geography or which part of the world you are joining from. As you would have seen, we have delivered an EBITDA margin of 14.8% for the quarter, which is up 80 basis points year-on-year and a profit after tax growth of 14%. -

Kelly Services India Pvt Ltd., Unitech Cyber Park Tower C, 6Th Floor Unit

Register of Wages Form XVII [See Rule 78(1)(a)(i)] Name and Address of Contractor: Kelly Services India Pvt ltd., Unitech Cyber Park Tower C, 6th Floor Unit No : 601-603 Sector 39, Gurgaon, Haryana Nature and Location of Work: Manpower Service Provider-HFCL-Vasant Vihar, New Delhi Name and Address of Establshment in/ under which Contract is Carried on: Hero FinCorp Limited 9, Basant Lok, Vasant Vihar, New Delhi-110037 Name and Address of Principal Emloyer: Hero FinCorp Limited 9, Basant Lok, Vasant Vihar, New Delhi-110037 For the Month of Feb'21 Basic SalaryHouse Rent OtherAllowance FixedConveyance AllowanceMedical Allowance AllowanceStatutory BonusCommission Incentive Esic Ee Pf Ee Lwf Ee I Tax P Tax Insurance DeductionOther DeductionTotal DeductionTotal Net Pay ACCOUNT_NUMBER For Amount of wage earned Deductions Intial of the Actual No. of Other Contractor Medical Other Covid19 PF Total Signature/ Thumb- Month Name of Workmen Designation / Nature of work Workin Pay Basic Fixed Conveya Stat Bonus Monthly Other Net Amount paid or his HRA Allowanc Allowanc Allowance_O ESI PF LWF TDS PT Mediclaim Deduction Impression of Workmen of EMP ID g Days Days Wages Allowan nce (CFY)_OV66 Gross Deductions representati e e V98 May'1 ce on 12 3 4 567 8 9101112 13 14 151617181920 21 22 23 24 25 Chetana Nand Kumar 1 Shared Resource-Human Resources - - - - - Bank Transfer 194057 Sharma 31 31 19,040 9,121 7,207 1,600 1,250 - - - 21 38,197 - 2,285 2,285 35,913 2 185010 Rohit Kumar MIS-Retail Finance 31 31 19,040 2,496 - - - - - - 34 21,502 - 2,285 - - - -

HSBC CASH FUND Portfolio As on 05-March-2020

HSBC CASH FUND Portfolio As On 05-March-2020 Issuer Market Value(Rs. In Lahks) % to Net Assets Rating Asset Allocation % to Net Assets Money Market Instruments 68.14% Money Market Instruments Treasury Bill 19.00% Cash Equivalents 11.66% Certificate of Deposit Corporate/ PSU Debt 1.14% Net Current Assets 0.06% National Bk for Agriculture & Rural Dev. 24960.91 3.80% Fitch A1+ Total Net Assets 100.00% Oriental Bank of Commerce 19980.42 3.04% CRISIL A1+ The South Indian Bank Ltd. 19794.96 3.02% [ICRA]A1+ IndusInd Bank Ltd. 19788.82 3.02% CRISIL A1+ IDFC First Bank Ltd. 19757.62 3.01% [ICRA]A1+ Small Industries Development Bk of India 37460.25 5.70% [ICRA]A1+ Punjab National Bank 12489.53 1.90% [ICRA]A1+ Rating Category % to Net Assets Ujjivan Small Finance Bank Ltd. 9857.15 1.50% CRISIL A1+ SOVEREIGN 19.00% Axis Bank Ltd. 4996.49 0.76% CRISIL A1+ AAA and equivalents 69.28% Reverse Repos/ TREPS 11.66% Net Current Assets 0.06% 169086.14 25.75% Total Net Assets 100.00% Commercial Paper The Ramco Cements Ltd. 29835.03 4.54% [ICRA]A1+ Aditya Birla Finance Ltd. 24953.61 3.80% [ICRA]A1+ National Bk for Agriculture & Rural Dev. 19988.85 3.04% [ICRA]A1+ Dalmia Cements (Bharat) Ltd. 19788.20 3.02% [ICRA]A1+ Vedanta Ltd. 19757.02 3.01% CRISIL A1+ Kotak Securities Ltd. 19740.82 3.01% CRISIL A1+ Indian Oil Corporation Ltd. 14990.84 2.28% Fitch A1+ NTPC Ltd. 14989.44 2.28% CARE A1+ Reliance Jio Infocomm Ltd.