Flex Ltd. (FLEX) Investor & Analyst Day

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2019 Annual Report

Toppan Merrill - Flex LTD Annual Report Combo Book - FYE 3.31.19 ED | 105212 | 09-Jul-19 16:19 | 19-11297-1.aa | Sequence: 1 CHKSUM Content: 45264 Layout: 60155 Graphics: 0 CLEAN Our Shareholders, Employees, Customers and Partners: In 1969, Joe and Barbara Ann McKenzie started a family business hand soldering electronic parts onto printed circuit boards to help Silicon Valley startups meet their dynamic capacity needs. These “board stuffers,” as they were known back then, decided to name their small company Flextronics. The McKenzies dreamed of revolutionizing the way electronic products were manufactured, not only in Silicon Valley, but all around the world. Fifty years later, we may have shortened the company name from Flextronics to Flex, but our list of achievements and milestones over the past five decades is nothing short of remarkable. Today, we have a broad portfolio of diverse customers, including some of the best-known global brands such as Cisco, Ford, IBM, Johnson & Johnson and Microsoft. From manufacturing early networking equipment and mobile devices for companies like Motorola, Nokia, Juniper and Ericsson to making Palm Pilots, Xboxes, Blackberrys, and HP printers, Flex led the transition from contract manufacturing to value-added Electronic Manufacturing Services (EMS). Our top customers come from more than a dozen different industries, providing us with a unique perspective on many of the fastest growing companies, by industry and by geography. Flex was one of the first American service manufacturers to go offshore by setting up a manufacturing facility in Singapore. The company was one of the first to innovate with full service industrial parks across Asia and eventually other geographies, to bring suppliers closer to the manufacturing line, and to support emerging “just in time” supply chain needs. -

Qualcomm® Quick Charge™ Technology Device List

One charging solution is all you need. Waiting for your phone to charge is a thing of the past. Quick Charge technology is ® designed to deliver lightning-fast charging Qualcomm in phones and smart devices featuring Qualcomm® Snapdragon™ mobile platforms ™ and processors, giving you the power—and Quick Charge the time—to do more. Technology TABLE OF CONTENTS Quick Charge 5 Device List Quick Charge 4/4+ Quick Charge 3.0/3+ Updated 09/2021 Quick Charge 2.0 Other Quick Charge Devices Qualcomm Quick Charge and Qualcomm Snapdragon are products of Qualcomm Technologies, Inc. and/or its subsidiaries. Devices • RedMagic 6 • RedMagic 6Pro Chargers • Baseus wall charger (CCGAN100) Controllers* Cypress • CCG3PA-NFET Injoinic-Technology Co Ltd • IP2726S Ismartware • SW2303 Leadtrend • LD6612 Sonix Technology • SNPD1683FJG To learn more visit www.qualcomm.com/quickcharge *Manufacturers may configure power controllers to support Quick Charge 5 with backwards compatibility. Power controllers have been certified by UL and/or Granite River Labs (GRL) to meet compatibility and interoperability requirements. These devices contain the hardware necessary to achieve Quick Charge 5. It is at the device manufacturer’s discretion to fully enable this feature. A Quick Charge 5 certified power adapter is required. Different Quick Charge 5 implementations may result in different charging times. Devices • AGM X3 • Redmi K20 Pro • ASUS ZenFone 6* • Redmi Note 7* • Black Shark 2 • Redmi Note 7 Pro* • BQ Aquaris X2 • Redmi Note 9 Pro • BQ Aquaris X2 Pro • Samsung Galaxy -

THE FLEX SYNDROME Working Conditions in the Hungarian Electronics Sector

THE FLEX SYNDROME Working conditions in the Hungarian electronics sector ACC and SOMO December 2012 COLOPHON THE FLEX SYNDROME Working conditions in the Hungarian electronics sector December 2012 AUTHORS: Zsófia Perényi (ACC), Kristóf Rácz & Irene Schipper (SOMO) RESEARCH: TÁRKI & SOMO & ACC PUBLISHED BY: SOMO – Centre for Research on Multinational Corporations COVER DESIGN: Justar.nl ISBN: 978-94-6207-014-1 This report is published as part of the makeITfair campaign, a European-wide project on consumer electronics. makeITfair aims to inform young consumers about human rights, social and environmental issues along the supply chain. It also addresses consumer electronics companies to contribute to change. makeITfair is coordinated by the Dutch organisation SOMO (Centre for Research on Multinational Corporations). Project partners are: SwedWatch and Fair Trade Center from Sweden; FinnWatch and Pro Ethical Trade Finland from Finland; DanWatch from Denmark; Germanwatch from Germany; Association of Conscious Consumers (ACC) from Hungary; ACIDH from the DR Congo; CIVIDEP from India; Workers Assistance Center (WAC) from the Philippines; and Civil Society Research and Support Collective (CSRSC) from South Africa. FUNDING: This publication has been produced with the assistance of the European Union. The content of this publication is the sole responsibility of SOMO and can in no way be taken to reflect the views of the European Union. CONTACT DETAILS: SOMO, Coordinator makeITfair Sarphatistraat 30, 1018 GL Amsterdam, The Netherlands Tel: +31 (0)20 639 12 91, [email protected], www.makeitfair.org SOMO: The Centre for Research on Multinational Corporations (SOMO) is a non-profit Dutch research and advisory bureau. SOMO investigates the policies of multinational enterprises and the internationalisation of business worldwide. -

Virtus Allianzgi Artificial Intelligence & Technology Opportunities Fund

Virtus AllianzGI Artificial Intelligence & Technology Opportunities Fund as of : 05/28/2021 (Unaudited) SECURITY SHARES TRADED MARKET VALUE % OF PORTFOLIO NXP Semiconductors NV 89,880 $19,002,430 1.89 % Microsoft Corp 76,095 $18,999,400 1.89 % Deere & Co 52,235 $18,862,059 1.87 % UnitedHealth Group Inc 40,120 $16,526,230 1.64 % IQVIA Holdings Inc 63,895 $15,345,023 1.52 % ON Semiconductor Corp 14,000,000 $14,665,000 1.46 % Mastercard Inc 40,120 $14,466,470 1.44 % Citigroup Inc 182,535 $14,367,330 1.43 % Square, Inc. 0.25% 01-NOV-2027 12,500,000 $14,054,688 1.40 % Morgan Stanley 151,625 $13,790,294 1.37 % Broadcom Inc 8.00 % Cum Conv Pfd Registered Shs 2019-30.09.22 Series A 8,965 $13,634,689 1.35 % JPMorgan Chase & Co 82,100 $13,484,104 1.34 % Anthem Inc 33,835 $13,473,774 1.34 % Marvell Technology Inc 268,390 $12,963,237 1.29 % Snap Inc 12,425,000 $12,782,219 1.27 % Visa Inc 56,215 $12,777,670 1.27 % Flex Ltd 656,100 $11,986,947 1.19 % Alphabet, Inc.- Cl A 5,080 $11,972,798 1.19 % Microchip Technology Incorporated 0.125% 15-NOV-2024 10,457,000 $11,966,729 1.19 % Royal Caribbean Cruises Ltd. /Subsidiaries (2)/ 2.875% 15-NOV-2023 9,000,000 $11,920,500 1.18 % First Republic Bank/CA 61,770 $11,825,249 1.17 % 1 SECURITY SHARES TRADED MARKET VALUE % OF PORTFOLIO Micron Technology Inc 137,890 $11,602,065 1.15 % 2020 Cash Mandatory Exchangeable Trust 9,330 $11,503,703 1.14 % Applied Materials Inc 83,190 $11,491,035 1.14 % Hilton Worldwide Holdings Inc 90,830 $11,378,274 1.13 % Honeywell International Inc 49,100 $11,337,681 1.13 % Ford Motor Company 0.0% 15-MAR-2026 10,000,000 $10,995,227 1.09 % Okta, Inc. -

CL King Market Maker List

CL King Market Maker List AAXN Axon Enterprise, Inc. CRMT America's Car-Mart, Inc. HAIN The Hain Celestial Group, Inc. MRVL Marvell Technology Group Ltd. SBAC SBA Communications Corporation ADBE Adobe Inc. CRNT Ceragon Networks Ltd. HCSG Healthcare Services Group, Inc. MSFT Microsoft Corporation SBUX Starbucks Corporation ADSK Autodesk, Inc. CROX Crocs, Inc. HELE Helen of Troy Limited MU Micron Technology, Inc. SCVL Shoe Carnival, Inc. ADTN ADTRAN, Inc. CSCO Cisco Systems, Inc. HIBB Hibbett Sports, Inc. NDLS Noodles & Company SGMS Scientific Games Corp AGNC AGNC Investment Corp. CSOD Cornerstone OnDemand, Inc. HLIT Harmonic Inc. NEOG Neogen Corporation SHOO Steven Madden, Ltd. AIMC Altra Industrial Motion Corp. CTAS Cintas Corporation HSIC Henry Schein, Inc. NLOK NortonLifeLock Inc. SMPL The Simply Good Foods Company ALGT Allegiant Travel Company CTSH Cognizant Technology Solutions Corporation HSII Heidrick & Struggles International, Inc. NTUS Natus Medical Incorporated SMSI Smith Micro Software, Inc. AMZN Amazon.com, Inc. CVLT Commvault Systems, Inc. HSKA Heska Corporation ON ON Semiconductor Corporation SNBR Sleep Number Corporation ANDE The Andersons, Inc. DAKT Daktronics, Inc. HSON Hudson Global, Inc. OSUR OraSure Technologies, Inc. SQBG Sequential Brands Group, Inc. ANGO AngioDynamics, Inc. DECK Deckers Outdoor Corporation IART Integra LifeSciences Holdings Corporation PACB Pacific Biosciences of California, Inc. SWBI Smith & Wesson Brands, Inc. ANSS ANSYS, Inc. DENN Denny's Corporation ICON Iconix Brand Group, Inc. PATK Patrick Industries, Inc. SRDX Surmodics, Inc. AOSL Alpha and Omega Semiconductor Limited DIOD Diodes Incorporated IDXX IDEXX Laboratories, Inc. Holdings PDCO Patterson Companies, Inc. STAF Staffing 360 Solutions, Inc. ATRO Astronics Corporation DISCA Discovery, Inc. ILMN Illumina, Inc. -

FLEX 5I (14", 15")

FLEX 5i (14", 15") ACCESSORIZE YOUR LIFESTYLE. The new Lenovo™ IdeaPad™ Flex 5i offers more ways to connect, interact, and immerse yourself making it a powerful combination of performance, connectivity, and entertainment with up to a 10th generation Intel® Core™ i7 processor. Enjoy crisp visuals on the FHD display along with the rich sound of user-facing, Dolby Audio™ speakers all while connecting with up to Intel® WiFi 6. WHY YOU SHOULD BUY THE LENOVO IDEAPAD FLEX 5i (14", 15") Reduce the Peek-proof privacy clutter at your fingertips A narrow bezel on Today’s world is not a 4 sides gives you more simple place, but that viewing area and less doesn’t mean we can’t clutter to interfere with build a simple solution the task at hand, whether to a complex problem. that’s at work, or play, A physical shutter on the enjoy the most out of webcam ensures you keep your screen with IPS panel out unwanted attention technology and up to Full when you are concerned High Definition screens on about your privacy. the IdeaPad Flex 5i. Create till your From zero to heart's content 360° in a flash With an optional digital The IdeaPad Flex 5i pen on select models, is designed for you to the IdeaPad Flex 5i lets keep your ideas flowing, you capture moments anywhere, anytime with of inspiration or take the ability to multi-mode notes on the fly. This your laptop and use it versatility gives you in ‘Laptop’ mode for the option to use your everyday computing, computer the way you ‘Tent’ mode for sharing want to use it with the things, ‘Stand’ mode REDEFINING WHAT'S POSSIBLE. -

2020 Environmental Progress Report Apple.Com/Environment Introduction Climate Change Resources Smarter Chemistry Appendix 3

Environmental Progress Report. Covering fiscal year 2019 Introduction Climate Change Resources Smarter Chemistry Appendix 2 Contents Introduction 3 Letter from Lisa Jackson 5 Our responsibility 3 6 Our environmental strategy 7 Our environmental vision Climate Change 10 Our approach 14 Low-carbon design 8 16 Energy efficiency 18 Renewable electricity 24 Direct emissions abatement 25 Carbon removal Resources 30 Our approach 31 Materials 28 44 Water stewardship 48 Zero waste to landfill Smarter Chemistry 53 Our approach 54 Mapping and engagement 51 56 Assessment 58 Innovation Appendix 62 Appendix A: Apple’s environmental data 68 Appendix B: Facilities renewable energy supplement 61 78 Appendix C: Assurance and review statements 94 Appendix D: Environmental health and safety policy statement 95 Appendix E: ISO 14001 certification Cover: An Apple-protected forest in Maine, United States. Image Credit: EcoPhotography 2020 Environmental Progress Report apple.com/environment Introduction Climate Change Resources Smarter Chemistry Appendix 3 Our year in review The responsibility to protect our shared planet intersects every aspect of our lives. This year has offered humbling reminders that nature is bigger and more powerful than any one of us—and that our ability to solve worldwide challenges depends on historic innovation and collaboration. That’s why Apple has dedicated our resources—and our best thinking—to considering the environment in everything we do: the energy that powers our operations, the materials in our devices, the companies we do business with, and the health and safety of those who make and use our products. We’ve led our industry in reducing our environmental footprint for years, but we know there is more to do. -

HP Engage Flex Pro Retail System Do More in Your Store and Beyond

Datasheet HP Engage Flex Pro Retail System Do more in your store and beyond Efficiently manage your retail business from the store floor to the back office with the HP Engage Flex Pro, our stable, secure, and highest- performing retail platform that delivers maximum flexibility for a range of deployments. Build your best solution HP recommends Windows 10 Pro for business Configure the perfect fit for your users and environment, whether it’s point of sale, video surveillance, processing/controlling, digital Windows 10 Pro1 signage or OEM with flexible connectivity, graphics, and networking options and a suite of retail peripherals.2 Poised to perform and expand with your business Tackle every retail challenge with a powerful 8th Gen Intel® processor3 and Intel® Optane™ memory.4 Adjust capacity as your needs change with endless storage options like an Intel® Optane™ SSD, SATA or M.2—up to five total drives per system.2 Secure, manageable, and reliable out of the box Reduce the cost and complexity of managing your platforms and secure your critical assets with innovative, integrated, and proactive security and manageability features for your system and its data. Featuring Stick with an OS you know with your choice of Windows 10 Pro, Windows IoT or FreeDOS. Get hardware-enforced self-healing protection from HP Sure Start Gen4, manage your system across the OS with HP Manageability Integration Kit, maintain critical OS processes with HP Sure Run, and restore your image over a network with HP Sure Recover. Minimize downtime with a design that goes the distance. It passes HP’s Total Test Process and has a steel chassis and gold-plated connectors that are tested to withstand temperatures up to 40° C. -

Sanmina Corporation (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K (Mark One) [x] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended September 29, 2018 or [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to . Commission File Number 0-21272 Sanmina Corporation (Exact name of registrant as specified in its charter) Delaware 77-0228183 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification Number) 2700 N. First St., San Jose, CA 95134 (Address of principal executive offices) (Zip Code) Registrant's telephone number, including area code: (408) 964-3500 Securities registered pursuant to Section 12(b) of the Act: Common Stock, $0.01 Par Value Securities registered pursuant to Section 12(g) of the Act: None (Title of Class) Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ x ] No [ ] Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Act. Yes [ ] No [ x ] Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Rd5 Web Holdings.Indd

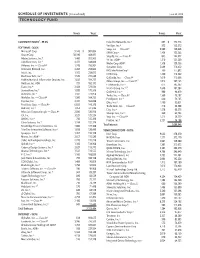

SCHEDULE OF INVESTMENTS (Unaudited) June 30, 2018 TECHNOLOGY FUND SHARES VALUE SHARES VALUE COMMON STOCKS† - 99.5% Palo Alto Networks, Inc.* 697 $ 143,213 VeriSign, Inc.* 972 133,572 SOFTWARE - 26.6% Snap, Inc. — Class A*,1 9,980 130,638 Microsoft Corp. 9,148 $ 902,084 SINA Corp.* 1,459 123,563 Oracle Corp. 10,190 448,971 Shopify, Inc. — Class A* 845 123,277 Adobe Systems, Inc.* 1,460 355,963 YY, Inc. ADR* 1,210 121,569 salesforce.com, Inc.* 2,411 328,860 Weibo Corp. ADR* 1,358 120,536 VMware, Inc. — Class A* 1,748 256,904 Symantec Corp. 5,649 116,652 Activision Blizzard, Inc. 3,287 250,864 IAC/InterActiveCorp* 760 115,892 Intuit, Inc. 1,165 238,015 CDW Corp. 1,420 114,722 Electronic Arts, Inc.* 1,529 215,620 GoDaddy, Inc. — Class A* 1,610 113,666 Fidelity National Information Services, Inc. 1,837 194,777 Zillow Group, Inc. — Class C*,1 1,814 107,135 NetEase, Inc. ADR 721 182,175 F5 Networks, Inc.* 611 105,367 Fiserv, Inc.* 2,424 179,594 Match Group, Inc.*,1 2,648 102,584 ServiceNow, Inc.* 1,020 175,919 GrubHub, Inc.* 900 94,419 Autodesk, Inc.* 1,327 173,956 Twilio, Inc. — Class A* 1,360 76,187 Workday, Inc. — Class A* 1,360 164,723 Proofpoint, Inc.* 660 76,105 Paychex, Inc. 2,395 163,698 Okta, Inc.* 1,490 75,051 First Data Corp. — Class A* 6,850 143,370 Trade Desk, Inc. — Class A* 710 66,598 Red Hat, Inc.* 1,054 141,626 Etsy, Inc.* 1,578 66,576 Atlassian Corporation plc — Class A* 2,030 126,916 Stamps.com, Inc.* 260 65,793 CA, Inc. -

Ocean Tomo 300 Patent Index 2015–2016 Constituents

OCEAN TOMO 300 PATENT INDEX 2015–2016 CONSTITUENTS CONSUMER DISCRETIONARY COMPANY NAME TICKER AMAZON.COM INC AMZN SCHLUMBERGER LTD SLB HALOZYME THERAPEUTICS INC HALO AMERICAN AXLE & MFG HOLDINGS AXL STATOIL ASA STO HOLOGIC INC HOLX CABELA’S INC CAB SUPERIOR ENERGY SERVICES INC SPN ILLUMINA INC ILMN CAESARS ENTERTAINMENT CORP CZR IMMUNOGEN INC IMGN DELPHI AUTOMOTIVE PLC DLPH FINANCIALS IMMUNOMEDICS INC IMMU FORD MOTOR CO F ALLSTATE CORP ALL INTREXON CORP XON GARMIN LTD GRMN AMERICAN CAPITAL LTD ACAS IRONWOOD PHARMACEUTICALS INC IRWD GENERAL MOTORS CO GM BGC PARTNERS INC BGCP ISIS PHARMACEUTICALS INC ISIS GOODYEAR TIRE & RUBBER CO GT CAPITAL ONE FINANCIAL CORP COF JOHNSON & JOHNSON JNJ GROUPON INC GRPN CIT GROUP INC CIT LABORATORY CRP OF AMER HLDGS LH HANESBRANDS INC HBI CITIGROUP INC C LEXICON PHARMACEUTICALS INC LXRX INTERNATIONAL GAME TECHNOLOGY IGT CME GROUP INC CME MANNKIND CORP MNKD JAKKS PACIFIC INC JAKK E*TRADE FINANCIAL CORP ETFC MEDICINES COMPANY MDCO JARDEN CORP JAH GENWORTH FINANCIAL INC GNW MEDTRONIC PLC MDT LIBERTY MEDIA CORP LMCA GOLDMAN SACHS GROUP INC GS MINDRAY MEDICAL INTL LTD MR MATTEL INC MAT HARTFORD FINANCIAL SVCS GRP HIG NEKTAR THERAPEUTICS NKTR NEWELL RUBBERMAID INC NWL JPMORGAN CHASE & CO JPM NOVO-NORDISK A/S NVO NEWS CORP NWSA KEYCORP KEY OMEROS CORP OMER PULTEGROUP INC PHM LEUCADIA NATIONAL CORP LUK PACIFIC BIOSCIENCES OF CALIF PACB SIRIUS XM HOLDINGS INC SIRI LINCOLN NATIONAL CORP LNC PDL BIOPHARMA INC PDLI SONY CORP SNE MITSUBISHI UFJ FINL MTU SPECTRANETICS CORP SPNC TATA MOTORS LTD TTM NASDAQ INC NDAQ ST JUDE -

Lenovo Manufacturing Sites and Suppliers

Lenovo Manufacturing Sites and Suppliers Following is the list of Lenovo manufacturing and suppliers as of August 2020. The list represents all our manufacturing sites, all our outsourced manufacturers and component suppliers that constitute 95% of our production spend. With respect to suppliers, all suppliers are required contractually to comply with the RBA Code of Conduct, Lenovo’s further and comprehensive Supplier Code of Conduct, all laws and regulations and many other Sustainability related concerns, the following suppliers receive direct validation of compliance. This includes formal agreements ensuring anti-corruption and anti-bribery, formal RBA annual self-assessments and independent biennial RBA approved third-party audits, receipt of audit reports, action plans and tracking closure of actions. Additionally these suppliers are formally tracked on environmental impact of GHG, water, waste renewable energy and responsible sourcing of materials. These efforts include critical Tier 2 and Tier 3 suppliers. Lenovo Manufacturing Sites MFG Sites Location # of employees WHP No. 19 Gaoxin 4th Road, Wuhan, Hubei, China 5000 CDP No. 88 Tianjian Road, Chengdu, China 400 HYP Lenovo Science & Technology Park, Huiyang, China 700 SZP No. 30 Tao Hua Road, Shenzhen, China 1400 Estrada Municipal Jose Costa de Mesquita, 200 — Chacara Alvorada — Brazil(IDU) Indaiatuba/SP, Brazil 300 Mexico No. 316 Boulevard Escobedo, Apodaca, NL, Mexico 2700 No. 3188-1, YunGu Road, Economic and Technological Development Zone, LCFC Hefei, Anhui, China. 3600 RS No. 19/1A & 2A Cuddalore Main Rd., Edayar Palayam Village, India Pondicherry, India 140 NECPC 6-80, Shimohanazawa 2-Chome, Yonezawa-shi, Yamagata, Japan 400 USFC 6540 Franz Warner Parkway, Whitsett, N.C., U.S.